- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/JPY stuck into 189.00 but leaning into the upside

GBP/JPY stuck into 189.00 but leaning into the upside

- GBP/JPY trapped near 189.00 after a failed bid for 189.50.

- BoJ continues to flirt with hints about the end of negative rates.

- UK data provides little spark for chart moves this week.

GBP/JPY saw a thin rally on Wednesday, testing into 189.50 before wrapping up the midweek trading session near the 189.00 handle. The pair is cautiously recovering after an early-week dip into the 188.00 handle.

The Bank of Japan (BoJ) continues to wink at the possibility of ending the negative rate regime. BoJ Governor Kazuo Ueda nodded at “tweaking negative rates” early Wednesday, as the BoJ prepares to place the burden of the final decision on the shoulders of spring negotiations on wages between unions and management at large business organizations. The BoJ has been openly transparent that how hawkish or dovish the Japanese central bank will be in the near-term will hinge entirely on wage growth following the end and data collection of Japan’s spring negotiations.

UK data came in mixed early on Wednesday, but did little to move the needle. UK Industrial Production fell to -0.2% in January after December’s 0.6% print, missing the forecast flat print of 0.0%. UK MoM Manufacturing Production also declined, coming in at the expected 0.0% compared to the previous 0.8%. UK Gross Domestic Product (GDP) in January also met expectations, printing at 0.2% versus the previous -0.1%.

The rest of the trading week sees only thin data for both the Pound Sterling (GBP) and the Japanese Yen (JPY). Friday will round out the Guppy’s hits on the economic calendar with mid-tier UK Consumer Inflation Expectations for the next 12 months. UK consumer inflation forecasts last printed at 3.3%.

GBP/JPY technical outlook

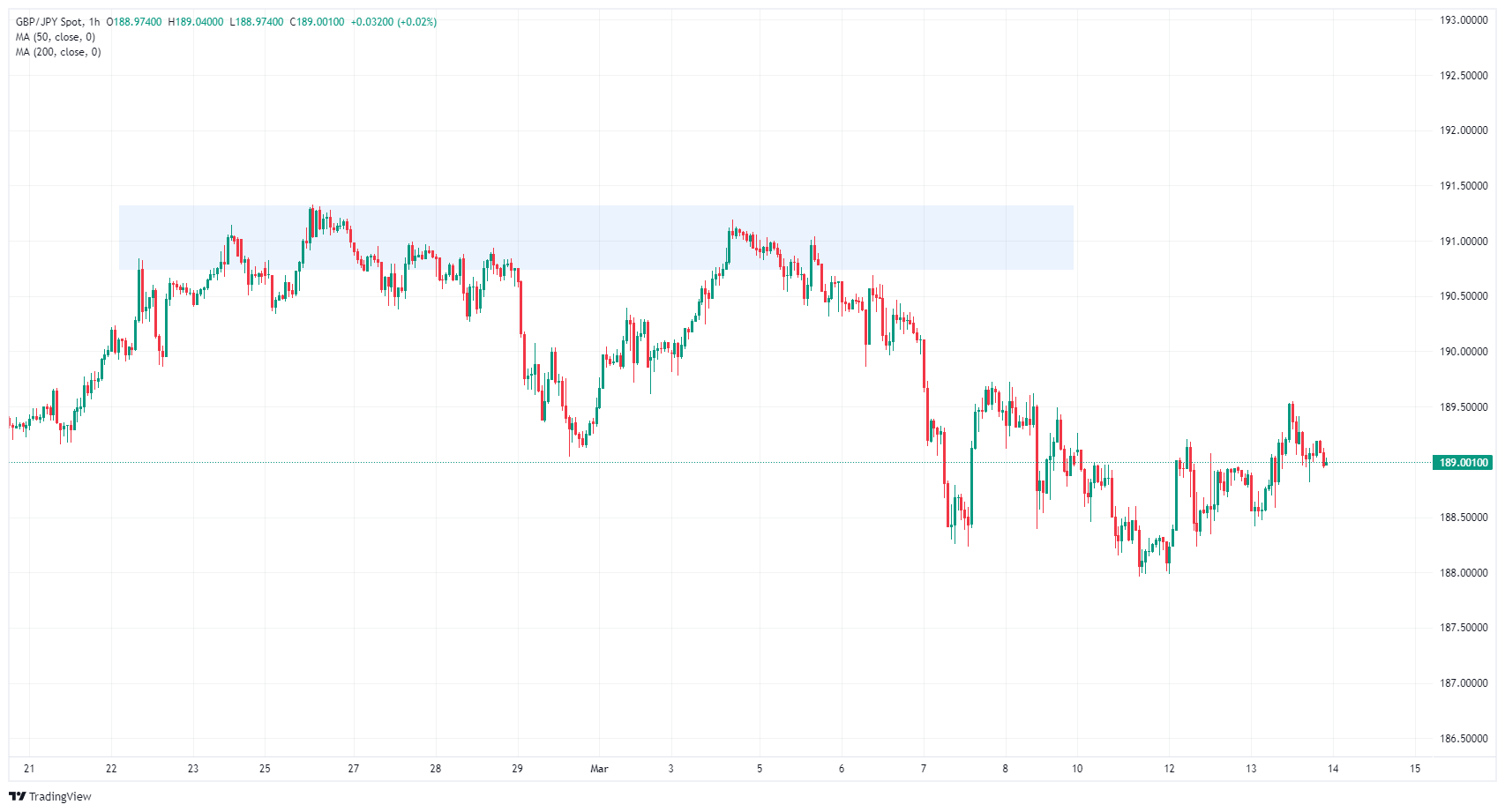

GBP/JPY is on a slow grind higher after Monday’s bounce from the 188.00 handle, facing intraday technical resistance from 189.50 as the pair drifts around 189.00. A stiff supply zone is built into the 191.00 region to capture any bullish pushes into the high end.

Despite the recent end of a five-day bear run in the GBP/JPY chart after the pair backslid from 191.00, the Guppy is barely down from its highest bids since 2015, and the pair remains well-bid above the 200-day Simple Moving Average (SMA) at 184.14.

GBP/JPY hourly chart

GBP/JPY daily chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.