- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD extends downside after negative Chinese data

AUD/USD extends downside after negative Chinese data

- The Australian Dollar is hit by negative Chinese House Price data on Friday.

- A fall in Chinese New Loans and M2 Money Supply add to the narrative of constraint.

- AUD/USD tumbled on Thursday after US data showed inflationary tendencies in the US economy.

AUD/USD is trading almost two tenths of a percent lower on Friday, extending Thursday’s sell-off into the weekend. The pair is feeling pressure from negative Chinese housing and lending data which indicates the property sector of the world’s second largest economy is still in the eye of the storm.

The weak Chinese data is a negative factor for the Australian Dollar which relies heavily on the Chinese market for its exports, particularly Iron Ore, which is Australia’s largest export commodity.

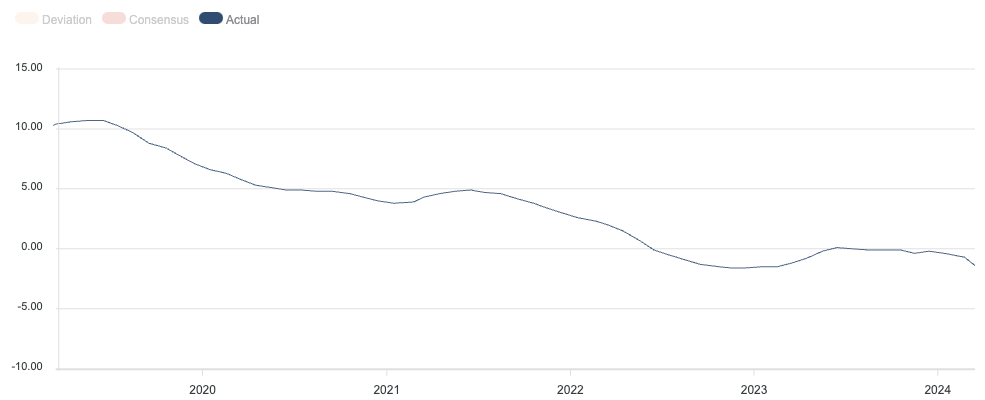

The Chinese House Price Index showed a decline in house prices of minus 1.4% in February from minus 0.7% in the previous month of January, according to data from the National Bureau of Statistics of China, released early Friday. This continues the down trend in Chinese house prices since 2019.

Chinese property market woes have had a direct impact on Iron Ore prices, because the country uses so much of the ore to make the steel girders it uses in its buildings. Iron Ore prices have registered a roughly 25% drop since the start of 2024 alone.

Other data out on Friday showed an unexpected fall in New Loans in China, in February. New Loans shrank to ㍐1,450 billion, according to data from The People’s Bank of China (Pboc). This was a decline from the 4,920 billion Yuan in January and below estimates of 1,500 billion. The data indicates less lending, which could be growth limiting, especially for the borrowing intensive property sector.

Data showing lower-than-expected Money Supply M2, which increased by 8.7% YoY in February versus the 8.8% forecast, suggests a brake on liquidity.

US factory gate inflation rises

AUD/USD fell over half a percent on Thursday after the release of US macroeconomic data indicated the US economy was hotter-than-expected.

The US Producer Price Index, which measures factory-gate price inflation, rose to 1.6%, easily beating the 1.1% expected and 1.0% previous, suggesting continued inflationary tendencies.

Core PPI also rose by more than estimated. The data suggests the inflation will be passed on to consumers and turn up later to bug shoppers in the Consumer Price Index.

The higher inflation makes it less likely the Federal Reserve (Fed) will be in a hurry to cut interest rates. Whilst market expectations continue to see the probabilities favor a rate cut in June, the chance of a reduction in May has dwindled to virtually zero.

Higher interest rates for longer are positive for USD because they attract more foreign capital inflows. They are negative for the AUD/USD which measures the number of Australian Dollars purchasable with one US Dollar. As such the data was negative for the pair, which declined substantially after the release on Thursday.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.

-638461042762640597.png)