- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD Price Analysis: Holds steady above mid-1.0800s, lacks follow-through ahead of Fed

EUR/USD Price Analysis: Holds steady above mid-1.0800s, lacks follow-through ahead of Fed

- EUR/USD attracts some buyers and moves away from a two-week low set on Tuesday.

- The technical setup warrants some caution for bullish trades ahead of the Fed decision.

- A sustained break below the 1.0835 confluence should pave the way for deeper losses.

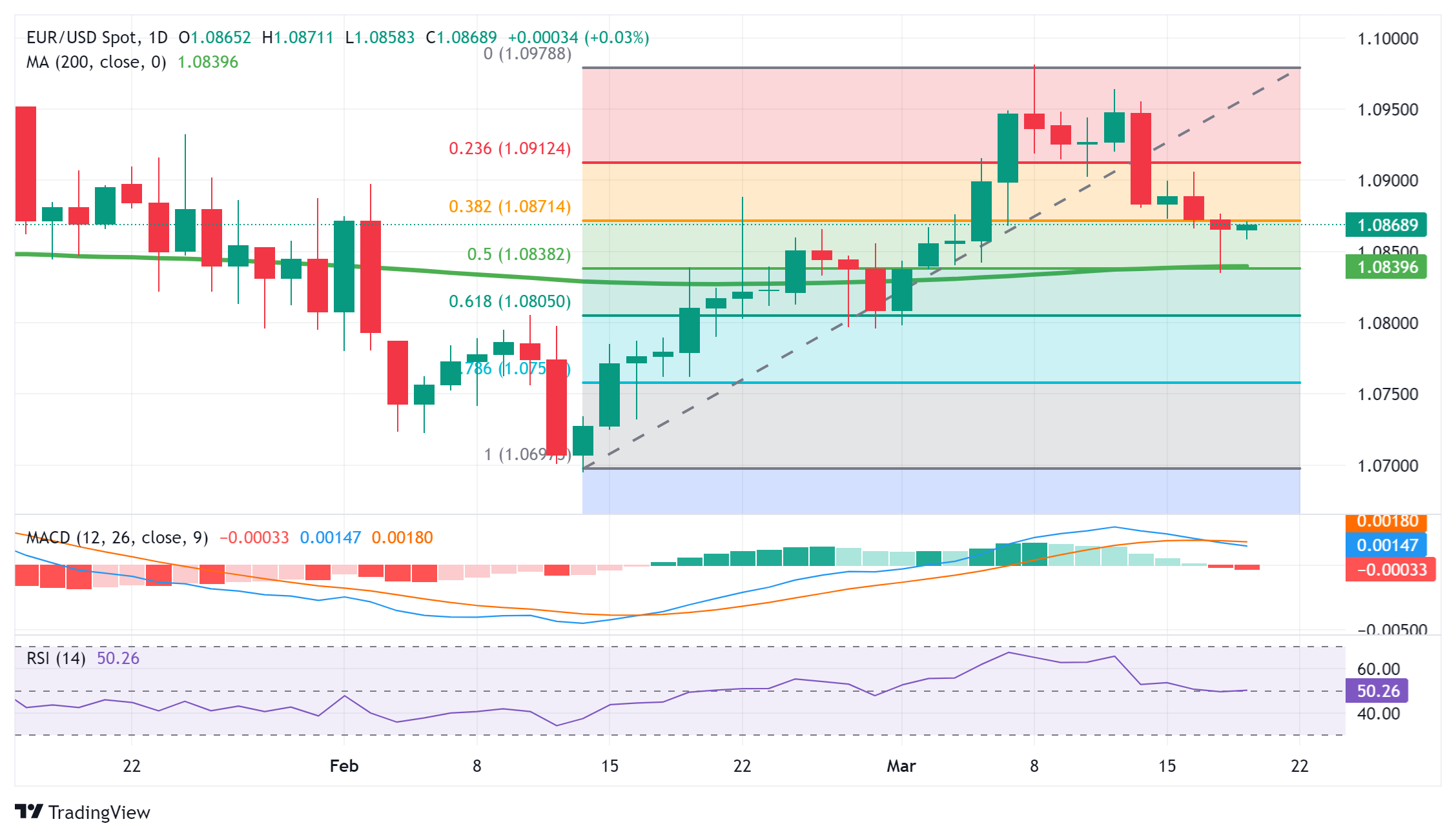

The EUR/USD pair edges higher during the Asian session on Wednesday and for now, seems to have snapped a two-day losing streak to a nearly two-week low, around the 1.0835 region touched the previous day. Spot prices, however, lack follow-through buying as traders seem reluctant to place aggressive bets and prefer to wait on the sidelines ahead of the outcome of the highly anticipated two-day FOMC policy meeting later today.

The Federal Reserve (Fed) is widely expected to keep rates at their historic highs, though might lower its projection for rate cuts in 2024 to two from three previously in the wake of still-sticky inflation. Hence, the focus will remain glued to the so-called "dot plot", which, along with Fed Chair Jerome Powell's remarks, will be scrutinized for cues about the future rate-cut path. This, in turn, will play a key role in influencing the US Dollar (USD) price dynamics and provide a fresh directional impetus to the EUR/USD pair.

From a technical perspective, the recent pullback from the 1.0980 region, or the highest level since January 12 touched earlier this month, stalled near the 1.0835 confluence support. The said area comprises the very important 200-day Simple Moving Average (SMA) and the 50% Fibonacci retracement level of the February-March positive move, which might continue to protect the immediate downside and act as a key pivotal point. A convincing break below will be seen as a fresh trigger for bears and drag the EUR/USD pair lower.

Given that oscillators on the daily chart have just started gaining negative traction, spot prices might then accelerate the fall to the 1.0800 mark, or the 61.8% Fibo. level, en route to the 1.0760-1.0755 region. Some follow-through selling could make the EUR/USD pair vulnerable to retesting sub-1.0700 levels, or the YTD low touched on February 14.

On the flip side, any subsequent move up is likely to confront stiff resistance near the 1.0900 round-figure mark, nearing the 23.6% Fibo. support breakpoint. A sustained strength beyond will suggest that the corrective pullback has run its course and lift the EUR/USD pair back to the monthly peak, around the 1.0980 region. The momentum could get extended further beyond the 1.1000 psychological mark, towards the next relevant hurdle near the 1.1040 zone.

EUR/USD daily chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.