- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- BoE Interest Rate Decision Preview: Dovish hold is on the cards as inflation cools more than expected

BoE Interest Rate Decision Preview: Dovish hold is on the cards as inflation cools more than expected

- The UK central bank is expected to keep its policy rate unchanged at 5.25%.

- The Bank of England is seen reducing its rates earlier than estimated after softer-than-expected inflation data.

- GBP/USD will closely follow the BoE’s decision as well as the Minutes.

The Bank of England (BoE) is set to hold its policy rate for a fifth meeting in a row on Thursday amidst some recent pick-up in speculation over interest rate cuts by the central bank.

Bank of England predicted keeping the “wait-and-see” mode

The Bank of England is expected to leave the benchmark interest rate unchanged at 5.25% following its policy meeting on Thursday at 12:00 GMT. The bank’s decision on the policy rate will come in tandem with the release of the Monetary Policy Minutes.

While market participants originally expected the BoE to lag both the Federal Reserve (Fed) and the European Central Bank (ECB) in kick-starting their easing cycles, the persistent disinflationary pressures not only accelerated in the UK in February, but also seem to have now underpinned the view of an earlier commencement of the interest rate reductions.

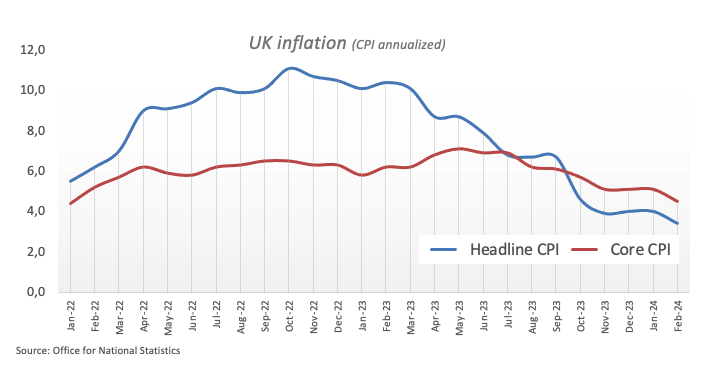

Speaking about inflation, the headline Consumer Price Index (CPI) in the UK rose by 3.4% in the year to February and 4.5% when it came to the Core CPI, that is, excluding food and energy costs.

In fact, these latest UK inflation figures appear to put to the test the insofar “higher for longer” narrative by the BoE. Looking at the upcoming event, a decision to maintain rates unchanged is anticipated to be a done deal, while the central bank is also expected to extend its “wait-and-see” stance and probably drop some cautious tone regarding its inflation outlook.

Still around inflation, the latest BoE’s Decision Maker Panel survey (DMP) indicated that businesses anticipate a decrease in their output price inflation over the upcoming year. Furthermore, one-year ahead CPI inflation expectations declined to 3.3% in February, down from 3.4% in January, while the expected year-ahead wage growth remained steady at 5.2%. In addition, three-year ahead CPI inflation expectations dropped to 2.8% from 2.9%.

BoE’s Governor Andrew Bailey emphasized on March 12 that the pivotal issue revolves around the restrictiveness of policy, adding that the central question is the duration for which this restrictive stance needs to be maintained. He expressed satisfaction with the effectiveness of monetary policy, noting that inflation expectations seem firmly anchored. Additionally, Bailey noted that there has been minimal evidence indicating a rise in unemployment as a prerequisite for inflation reduction, while concerns regarding the entrenchment of second-round effects have diminished.

Ahead of the BoE gathering, analysts at TD Securities said, “We expect the MPC to hold its Bank Rate at 5.25% and leave key guidance largely unchanged, with a wait-and-see message. There's scope to soften the language around underlying inflation, but little else should change”.

How will the BoE interest rate decision impact the GBP/USD?

In light of the latest inflation figures, the probability of a hawkish hold by the central bank now looks markedly dwindled. That said, an outcome in line with market expectations should leave the Pound Sterling (GBP) trading within its familiar ranges, or even spark some fresh bouts of weakness in the very near future.

In that case, GBP/USD could decisively break below the key 200-day SMA at 1.2592, allowing for extra selling pressure to kick in. “Further losses could see Cable revisit the 2024 low of 1.2518 recorded on February 5," notes FXStreet Senior Analyst Pablo Piovano. Pablo adds that “a sustained breach of the latter is not contemplated for the time being, as it would involve a bigger deterioration of the currency’s outlook.”

On the upside, Pablo points at “the initial resistance at the YTD peak of 1.2893 (March 8). The surpassing of this level could prompt GBP/USD to embark on a move to, initially, the psychological 1.3000 yardstick.”

Economic Indicator

United Kingdom BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Pound Sterling price today

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies today. Pound Sterling was the weakest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.11% | 0.07% | -0.03% | -0.06% | 0.40% | 0.21% | 0.31% | |

| EUR | -0.11% | -0.03% | -0.13% | -0.14% | 0.30% | 0.11% | 0.21% | |

| GBP | -0.07% | 0.03% | -0.11% | -0.12% | 0.32% | 0.13% | 0.25% | |

| CAD | 0.03% | 0.14% | 0.14% | -0.02% | 0.43% | 0.25% | 0.35% | |

| AUD | 0.04% | 0.15% | 0.13% | 0.01% | 0.44% | 0.26% | 0.35% | |

| JPY | -0.40% | -0.29% | -0.33% | -0.44% | -0.42% | -0.19% | -0.09% | |

| NZD | -0.22% | -0.11% | -0.14% | -0.25% | -0.27% | 0.18% | 0.10% | |

| CHF | -0.33% | -0.20% | -0.24% | -0.36% | -0.38% | 0.07% | -0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.