- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

- The Canadian Consumer Price Index is seen gathering some upside traction in March.

- The BoC deems risks to the inflation outlook to be balanced.

- The Canadian Dollar navigates five-month lows against the US Dollar.

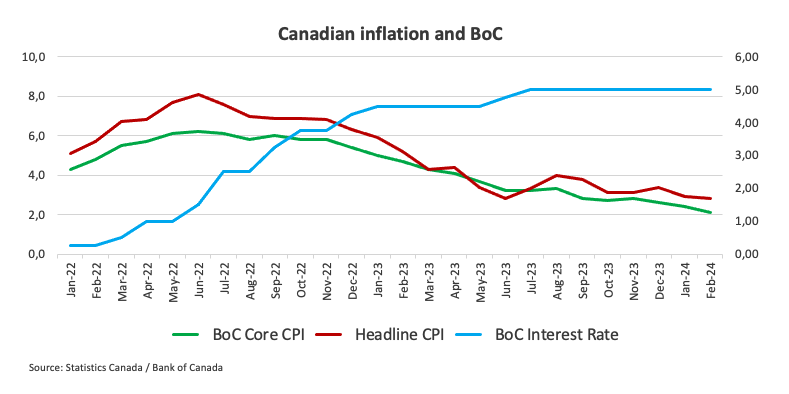

Canada is set to disclose the latest inflation figures on Tuesday, with Statistics Canada releasing the Consumer Price Index (CPI) for March. Forecasts suggest a 3.1% year-on-year increase in the headline figure, accelerating from February’s 2.8% rise. Projections for the month anticipate a 0.7% increase in the index compared to the previous month's 0.3% reading.

In addition to the CPI data, the Bank of Canada (BoC) will unveil its core Consumer Price Index measure, which omits volatile components such as food and energy expenses. February’s BoC core CPI showed a 0.1% monthly increase and a year-on-year uptick of 2.1%.

These figures will be closely watched as they have the potential to impact the direction of the Canadian Dollar (CAD) in the very near term and shape perspectives on the Bank of Canada's monetary policy. Regarding the Canadian Dollar (CAD), it has exhibited weakness against the US Dollar (USD) in recent sessions and currently remains near five-month lows significantly beyond the 1.3700 yardstick.

What to expect from Canada’s inflation rate?

Analysts anticipate price pressures across Canada remained sticky in March. Indeed, analysts predict that inflation, as measured by annual changes in the Consumer Price Index, will quicken to 3.1% from its previous reading of 2.8% on a yearly basis, reflecting patterns observed in several of Canada's G10 counterparts, particularly the US. Since August’s 4% inflation rate, price growth has generally trended downward, except for a rebound noted in the final month of the last year. Overall, inflation metrics continue to exceed the Bank of Canada's 2% target.

If the upcoming data validates the expected prints, investors may contemplate the central bank maintaining its current restrictive stance for a longer period than initially anticipated. However, further tightening of monetary conditions appears improbable, according to statements from the bank’s officials.

Such a scenario would require a sudden and sustained resurgence of price pressures and a rapid surge in consumer demand, both of which appear unlikely in the foreseeable future.

During his press conference following the latest BoC meeting, Governor Tiff Macklem noted that gas prices have a tendency to fluctuate, which is why they are paying close attention to core inflation. Macklem said the bank has not had the opportunity to thoroughly examine the latest US inflation data yet, while he did not see significant direct imported inflation effects from the US. Additionally, the BoC stated its intention to monitor whether this downward trend continues and is particularly attentive to the evolution of core inflation. The bank also noted that shelter price growth remains significantly high and predicts that overall inflation is expected to hover close to 3% during the first half of 2024, decline below 2.5% in the second half of 2024, and reach the 2% target in 2025.

Analysts at TD Securities argued that: “We look for headline CPI to bounce 0.2pp higher to 3.0% y/y in March as prices rise by 0.7% m/m, underpinned by another large increase for the energy component alongside a partial rebound in food prices and core goods after their muted performance over Jan/Feb”. Analysts added, “The expected move higher for headline CPI and a larger m/m increase for core measures stand in contrast to the Bank of Canada's desire for more evidence that recent progress will be sustained. Even though the Bank will have the April CPI report in hand for its next policy decision, we do not think it will have enough evidence of sustained deceleration until July.”

When is the Canada CPI data due and how could it affect USD/CAD?

On Tuesday at 12:30 GMT, Canada is scheduled to unveil the Consumer Price Index for March. The potential reaction of the Canadian Dollar hinges on shifts in monetary policy expectations by the Bank of Canada. Nonetheless, barring any significant surprises in either direction, the BoC is unlikely to alter its current cautious monetary policy stance, aligning with the approaches of other central banks like the Federal Reserve (Fed).

The USD/CAD has initiated the new trading year with a decent bullish trend, although this uptrend seems to have gathered extra pace since last week, largely surpassing the 1.3700 figure, an area last traded in mid-November 2023.

According to Pablo Piovano, Senior Analyst at FXStreet, there is a strong likelihood of the USD/CAD maintaining its positive bias as long as it remains above the crucial 200-day Simple Moving Average (SMA) at 1.3515. The bullish sentiment now faces the immediate hurdle at the round milestone of 1.3800. Conversely, breaching the 200-day SMA could lead to additional losses and a potential descent to the January 31 low of 1.3358. Beyond this point, notable support levels are scarce until the December 2023 bottom of 1.3177, recorded on December 27.

Pablo emphasizes that significant increases in CAD volatility would necessitate unexpected inflation figures. A below-expectation CPI could reinforce arguments for potential BoC interest rate cuts in the coming months, thereby further boosting USD/CAD. However, a CPI rebound, similar to trends observed in the US, might offer some backing to the Canadian Dollar, albeit to a limited extent. A higher-than-anticipated inflation reading would heighten pressure on the Bank of Canada to sustain elevated rates for an extended period, potentially leading to prolonged challenges for many Canadians grappling with higher interest rates, as highlighted by Bank of Canada Governor Macklem in past weeks.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.