- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Australian Dollar extends gains due to positive market sentiment

Australian Dollar extends gains due to positive market sentiment

- The Australian Dollar rises as positive market sentiment favors the risk-sensitive currencies.

- The Australian Dollar cheered the hawkish sentiment surrounding the RBA despite the weaker Aussie Trade Balance and Building Permits.

- The US Dollar faced a challenge as Fed Chair Powell dismissed the likelihood of a further rate hike.

The Australian Dollar (AUD) extends its gains on Thursday despite the weaker-than-expected Trade Balance and Building Permits data released by the Australian Bureau of Statistics. The AUD/USD pair receives support from the prevailing positive market sentiment after dovish remarks from the Federal Reserve Chairman Jerome Powell on Wednesday.

The Australian Dollar advances due to the hawkish sentiment surrounding the Reserve Bank of Australia’s (RBA) maintaining higher interest rates in 2024. The higher-than-expected domestic inflation data released last week has raised expectations that the RBA may delay interest rate cuts.

The US Dollar Index (DXY), which gauges the performance of the US Dollar (USD) against six major currencies, remains under pressure following the dovish remarks from Federal Reserve Chairman Jerome Powell after the interest rate decision on Wednesday. Powell dismissed the likelihood of a further rate hike, contributing to pressure for the US Dollar (USD). As expected, the US Federal Reserve (Fed) decided to maintain interest rates at 5.25%-5.50% in May’s meeting.

Traders are likely awaiting weekly Initial Jobless Claims, Nonfarm Productivity, and Factory Orders from the United States (US) on Thursday. These releases will likely provide further insights into the state of the United States (US) economy.

Daily Digest Market Movers: Australian Dollar appreciates due to improved risk appetite

- Australia’s Trade Balance (MoM) posted a surplus of 5,024 million in April, against the market anticipation of an increase to 7,370 million from the previous 7,370 million. Additionally, Australian Building Permits rose by 1.9%, falling short of the expected 3.0% in March. The February’s reading was -1.9%.

- The ASX 200 Index saw a modest increase on Thursday following the uptick in heavyweight financial firms, recovering some losses recorded Wednesday. This could be attributed to the positive market sentiment after Fed Chair Jerome Powell dismissed the chances of any further rate hike during the Federal Open Market Committee (FOMC) conference on Wednesday.

- Federal Reserve Chairman Jerome Powell highlighted that progress on inflation has recently stalled, suggesting that it would take more time than previously anticipated before the Fed could confidently expect inflation to approach its 2% target. Powell mentioned that if robust hiring persisted and inflation remained stagnant, it would justify delaying rate cuts.

- The ADP US Employment Change reported that private businesses added 192,000 workers to their payrolls in April, surpassing the expected increase of 175,000 and 208,000 prior.

- The ISM US Manufacturing PMI fell to 49.2 in April from March’s 50.3, against the market expectations of a stall. The data indicated a contraction in the US manufacturing sector, failing to sustain the momentum observed in the previous month, which marked the first expansion in 16 months.

- According to the Financial Review, ANZ predicts the Reserve Bank of Australia will start reducing interest rates in November, spurred by last week's inflation data surpassing expectations. Likewise, Commonwealth Bank, Australia's largest mortgage lender, has revised its forecast for the RBA's first interest rate cut timing, now projecting a single cut in November.

- According to the CME FedWatch Tool, the likelihood of the Federal Reserve maintaining interest rates at their current level during the June meeting has risen to 91.0%, climbing from 83.5% a week ago.

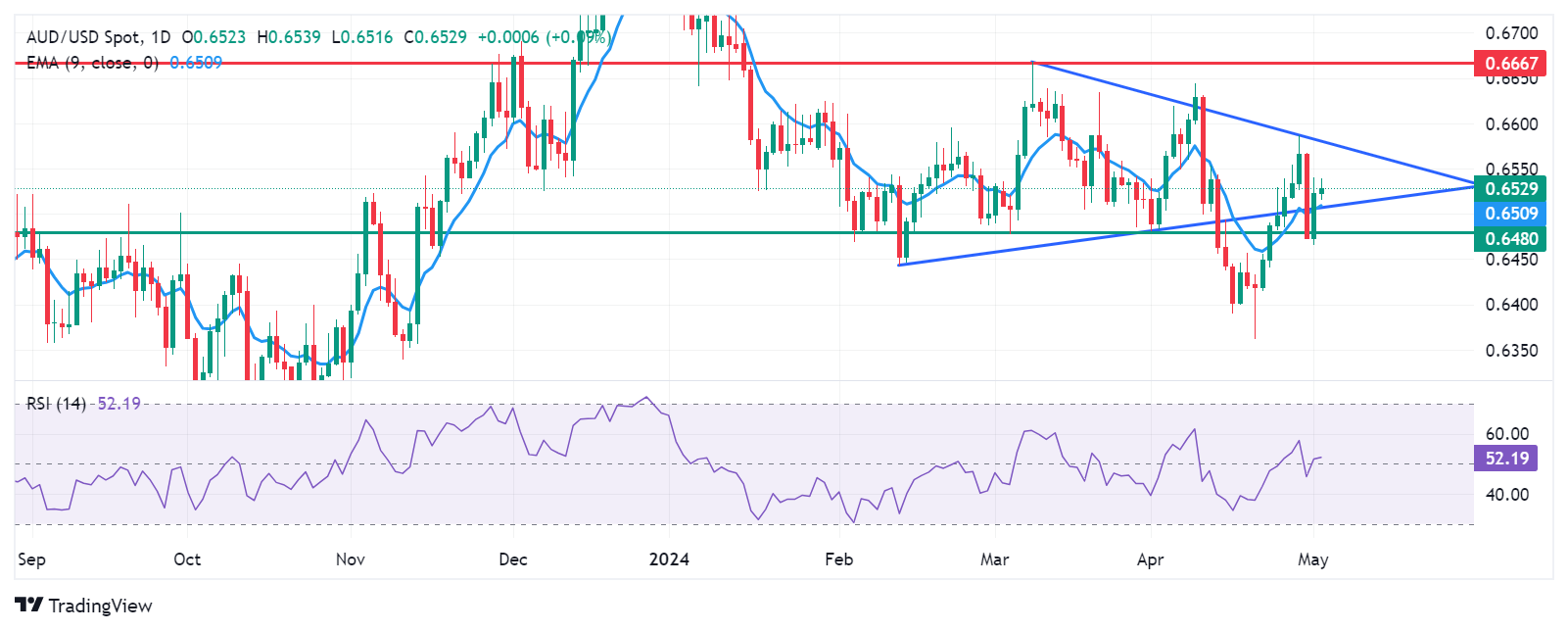

Technical Analysis: Australian Dollar moves above 0.6500 back into the triangle

The Australian Dollar trades around 0.6530 on Thursday. The pair has re-entered the symmetrical triangle pattern. Additionally, the 14-day Relative Strength Index (RSI) is above the 50-level, indicating a bullish bias.

The AUD/USD pair might challenge the upper boundary, situated around the level of 0.6580, followed by the psychological level of 0.6600. A breakthrough above this level could lead the pair to explore the region around March’s high of 0.6667.

On the downside, the AUD/USD pair could potentially move toward the lower boundary of the symmetrical triangle around the nine-day Exponential Moving Average (EMA) at 0.6509. A break below the latter could exert pressure on the pair to test the rebound support at the 0.6480 level.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of the Australian Dollar (AUD) against listed major currencies today. The Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.03% | 0.07% | 0.03% | 0.05% | 0.17% | 0.08% | 0.03% | |

| EUR | -0.02% | 0.04% | 0.00% | 0.02% | 0.13% | 0.05% | 0.00% | |

| GBP | -0.07% | -0.03% | -0.03% | -0.02% | 0.10% | -0.01% | -0.01% | |

| CAD | -0.03% | 0.00% | 0.04% | 0.01% | 0.12% | 0.03% | 0.00% | |

| AUD | -0.05% | 0.00% | 0.02% | 0.00% | 0.13% | 0.02% | 0.00% | |

| JPY | -0.20% | -0.16% | -0.14% | -0.15% | -0.16% | -0.14% | -0.15% | |

| NZD | -0.08% | -0.03% | 0.00% | -0.03% | -0.02% | 0.07% | -0.02% | |

| CHF | -0.04% | 0.00% | 0.04% | 0.00% | 0.02% | 0.10% | 0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.