- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY Price Forecast: Subdued around 157.50, eyes on US CPI data

USD/JPY Price Forecast: Subdued around 157.50, eyes on US CPI data

- USD/JPY hovers at the mid-range of the 157.00-158.00, set to finish in the red.

- Uptrend's extension lies above 158.00 and 158.88, but BoJ intervention fears loom.

- A drop below the Tenkan-sen, opens the door towards 157.00.

The US Dollar losses some ground against the Japanese Yen on Monday amid a bank holiday in Japan as the USD/JPY shrugged off a rise in the US 10-year T-note yield. At the time of writing, the pair trades at 157.54, down by 0.11%.

USD/JPY Price Forecast: Technical outlook

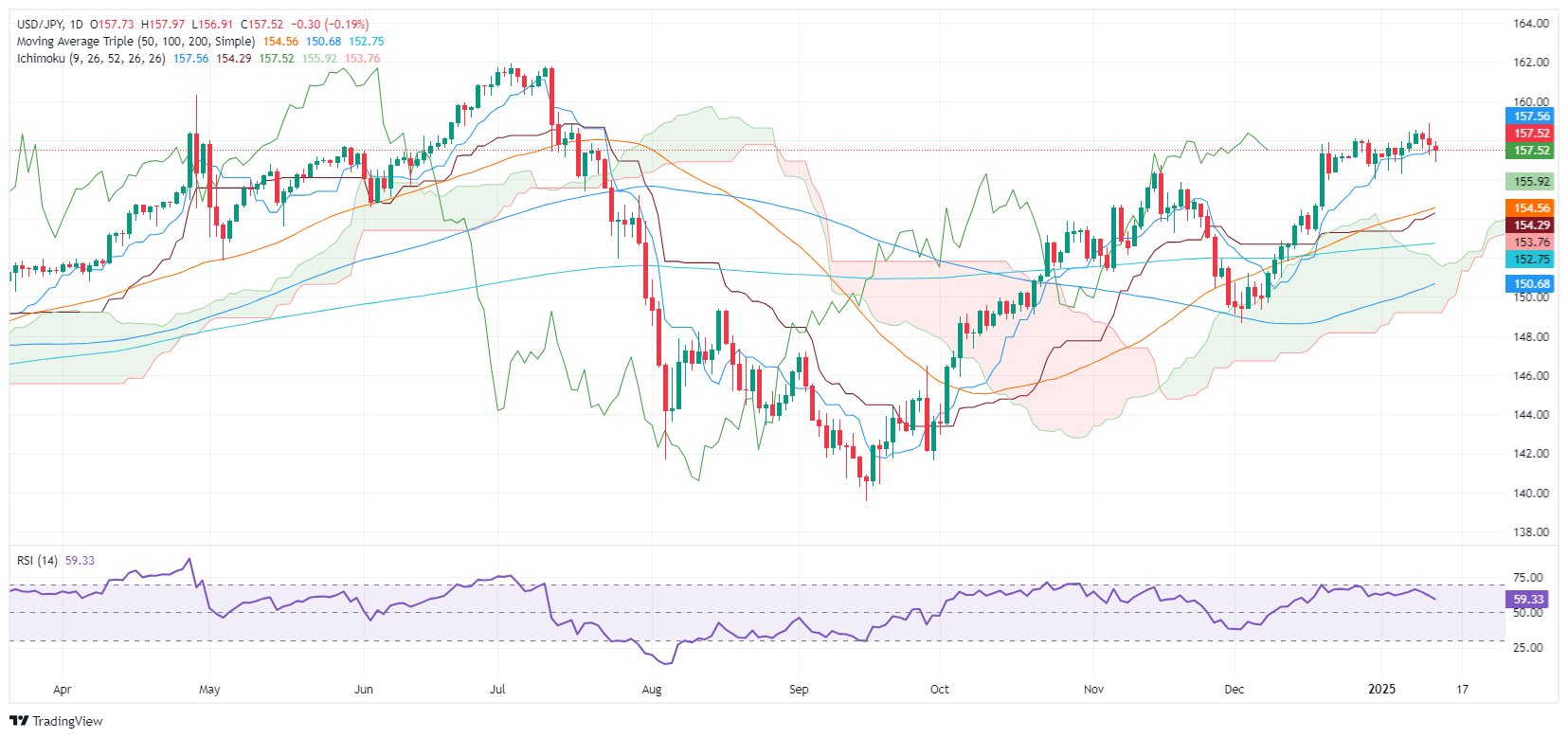

The USD/JPY daily chart remains upward biased, but faces strong resistance at 158.00, amid fears that the Bank of Japan (BoJ) might intervene in the Forex markets. Momentum favors further upside, after the 50-day Simple Moving Average (SMA) at 154.58 crossed above the 200-day SMA, forming a 'golden cross,' implying that further upside is seen.

For a bullish continuation, the USD/JPY first ceiling level would be the 158.00 figure followed by the January 10 peak hit following US NFP data on Friday at 158.88. A breach of the latter will expose 159.00.

If USD/JPY tumbles below Tenkan-sen, the next support would be the January 6 low of 156.24, followed by the December 31 pivot low of 156.02.

USD/JPY Price Chart - Daily

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | -0.20% | -0.11% | -0.13% | -0.23% | -0.31% | -0.16% | |

| EUR | 0.25% | 0.07% | 0.11% | 0.13% | 0.02% | -0.06% | 0.13% | |

| GBP | 0.20% | -0.07% | 0.10% | 0.07% | -0.04% | -0.13% | 0.04% | |

| JPY | 0.11% | -0.11% | -0.10% | 0.06% | -0.15% | -0.22% | -0.04% | |

| CAD | 0.13% | -0.13% | -0.07% | -0.06% | -0.14% | -0.17% | 0.01% | |

| AUD | 0.23% | -0.02% | 0.04% | 0.15% | 0.14% | -0.08% | 0.08% | |

| NZD | 0.31% | 0.06% | 0.13% | 0.22% | 0.17% | 0.08% | 0.17% | |

| CHF | 0.16% | -0.13% | -0.04% | 0.04% | -0.01% | -0.08% | -0.17% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.