- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD drops below 1.2400 after US CPI data

GBP/USD drops below 1.2400 after US CPI data

- GBP/USD hits a daily low of 1.2374 as US inflation jumps above 3%.

- The US Dollar strengthens as investors expect Fed's first rate cut until September 2025.

- If GBP/USD prints a daily close below 1.2400, sellers would target 1.2300.

The Pound Sterling slipped during the North American session after the latest United States (US) inflation report showed that prices continued to rise, pushing back expectations of a Federal Reserve rate cut in the first half of 2025. The GBP/USD trades at 1.2387, down 0.47%.

Pound dips as US inflation surges

Inflation reaccelerates in the US, as the US Bureau of Labor Statistics (BLS) reveals. The Consumer Price Index (CPI) rose above 3% YoY for the first time since June 2024. Month-over-month (MoM) figures jumped 0.5%, up from December’s 0.4%. In the meantime, excluding volatile items, CPI increased by 3.3% YoY from 3.2%, and MoM expanded by 0.4%, up from 0.2%, exceeding estimates of 0.3%.

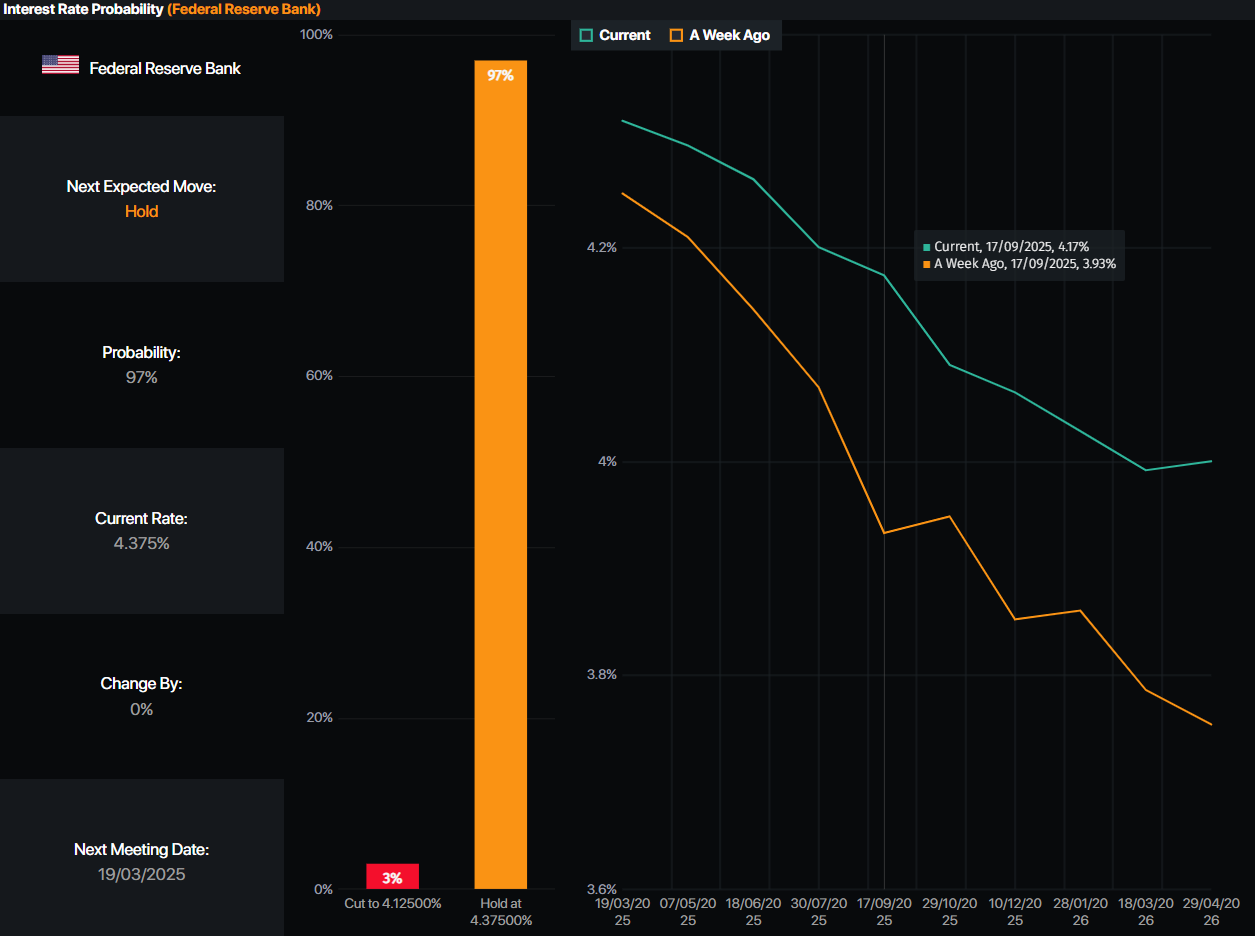

After the data, investors expect the first rate cut until September, according to data from Prime Market Terminal. The swaps market had priced in 20 basis points of easing toward the September 17 meeting, down from last week’s 45 bps.

Source: Prime Market Terminal

In the UK, the National Institute of Economic and Social Research (NIESR) predicts the Bank of England (BoE) has little room to cut rates further and predicts the BoE will cut rates once in 2025 and again in 2026.

This week, traders are eyeing Fed Chair Jerome Powell's testimony at the US House of Representatives. Besides him, Atlanta’s Fed Bostic and Governor Waller would cross the wires.

In the UK, the docket will feature Gross Domestic Product (GDP) figures for Q4 2024. Economists expect the economy to contract by -0.1% QoQ, yet on an annual basis, they estimate growth of 1.1%, up from Q3's 0.9%.

GBP/USD Price Forecast: Technical outlook

GBP/USD price action indicates the pair remains tilted to the downside but is set to consolidate within the 1.2330 - 1.2450 area. The Relative Strength Index (RSI) suggests that momentum remains bearish, opening the door for further selling pressure in the pair.

A daily close below 1.2400 could sponsor a leg toward the February 11 low of 1.2332, followed by the February 3 low of 1.2248. On further weakness, 1.22000 is up next. Conversely, if GBP/USD rises past 1.2400 and challenges the 50-day Simple Moving Average (SMA) at 1.2475, the exchange rate could aim towards 1.2500.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.16% | 0.40% | 1.24% | 0.25% | 0.68% | 0.69% | 0.14% | |

| EUR | -0.16% | 0.24% | 1.07% | 0.09% | 0.52% | 0.52% | -0.02% | |

| GBP | -0.40% | -0.24% | 0.80% | -0.14% | 0.28% | 0.29% | -0.26% | |

| JPY | -1.24% | -1.07% | -0.80% | -0.97% | -0.54% | -0.54% | -1.07% | |

| CAD | -0.25% | -0.09% | 0.14% | 0.97% | 0.43% | 0.43% | -0.11% | |

| AUD | -0.68% | -0.52% | -0.28% | 0.54% | -0.43% | 0.00% | -0.54% | |

| NZD | -0.69% | -0.52% | -0.29% | 0.54% | -0.43% | -0.00% | -0.54% | |

| CHF | -0.14% | 0.02% | 0.26% | 1.07% | 0.11% | 0.54% | 0.54% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.