- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 03-06-2014

EUR/USD $1,3626 +0,21%

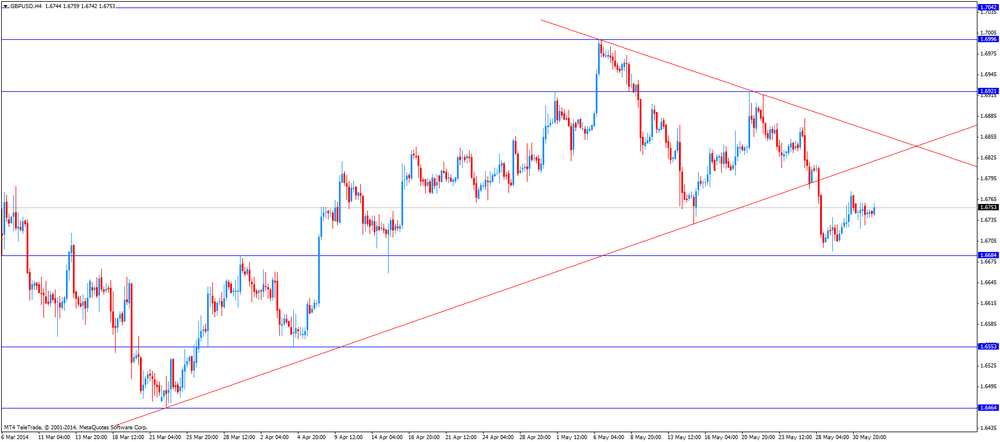

GBP/USD $1,6748 +0,01%

USD/CHF Chf0,8962 -0,23%

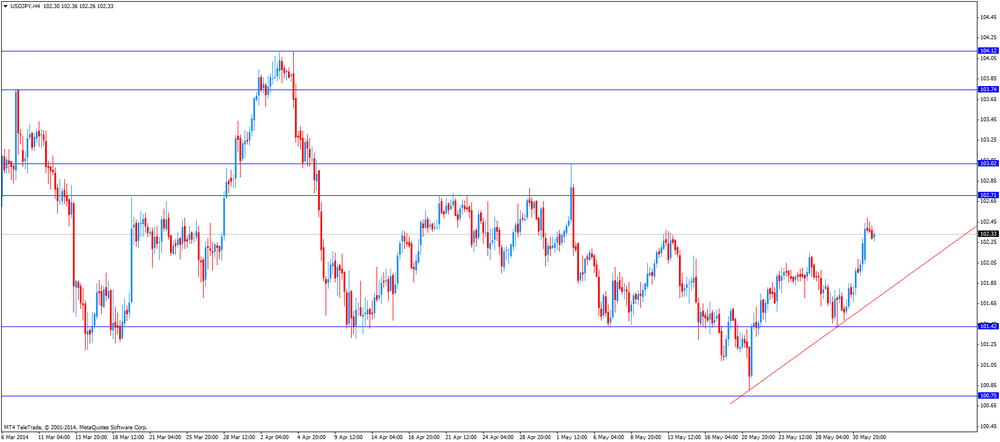

USD/JPY Y102,53 +0,16%

EUR/JPY Y139,71 +0,37%

GBP/JPY Y171,70 +0,16%

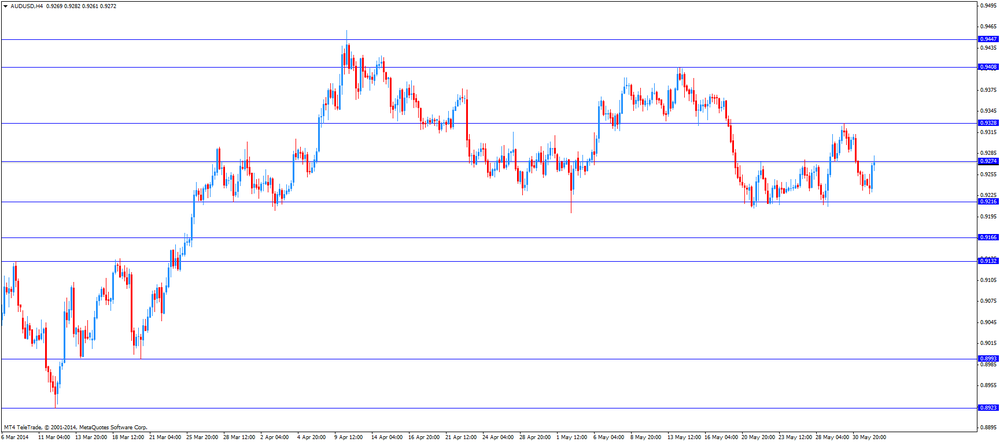

AUD/USD $0,9265 +0,27%

NZD/USD $0,8432 -0,20%

USD/CAD C$1,0907 +0,09%

The U.S.

dollar traded mixed against the most major currencies after the release of

factory orders in the U.S. The U.S. factory orders climbed 0.7% in April, beating

expectations for 0.6% increase, after a 1.1% gain in March.

The euro

rose against the U.S. dollar despite the weaker-than-expected inflation data in

the Eurozone. Eurozone’s inflation increased 0.5% in May, after a 0.7% gain in

March. Analysts had expected a 0.7% rise. Inflation target by the European

Central Bank (ECB) is 2%.

The

unemployment rate in the Eurozone fell to 11.7% in April from 11.8% in March.

Analysts had expected the unemployment rate remains unchanged.

The number

of unemployed people in Spain decreased by 111,900 in May, after a 111,600

decline in April. Analysts had forecasted a 112,300 drop.

Market

participants expect the European Central Bank will add further stimulus

measures on Thursday. Investors are awaiting the ECB will cut interest rates

and announce measures to boost lending to smaller businesses.

The British

pound traded mixed against the U.S. dollar. The U.K. construction purchasing

managers' index declined to 60.0 in May, from 60.8 in April. Analysts had

expected the index to increase to 61.2.

Nationwide

house price index for the U.K. climbed 0.7% in May, meeting analysts’

expectations, after a 1.2% rise in April. On a yearly basis, Nationwide house

price index for the U.K. rose 11.1% in May, after a 10.9% increase in April.

Analysts had expected the index remains unchanged.

In the

overnight trading session, the New Zealand dollar traded higher against the U.S

dollar due to speculation New Zealand’s currency will benefit along with the

Australian dollar. Market participants are awaiting the release of the

Australian economic growth tomorrow. Australia’s economy should expand 1.1% in

the first quarter.

In the

absence of any major economic reports, investors also remain concerned about

the impact of lower dairy prices on the economy and the interest rate.

In the day

trading session, the kiwi dropped against the U.S. dollar.

The

Australian dollar climbed against the U.S. dollar after the Reserve Bank of

Australia’s interest rate decision, but lost a part of its gains in the day

trading session. The Reserve Bank of Australia (RBA) kept interest rate

unchanged at a record low 2.5% as expected. The RBA decided to continue

accommodative monetary policy. Accommodative monetary policy should provide

support to demand and to economic growth.

Retail

sales in Australia increased 0.2% in April, missing expectations of a 0.3% gain

in March, after a 0.1% rise in March.

Australia’s

current account deficit declined to AUD5.67 billion in the first quarter from

AUD11.7 billion the previous quarter. The deficit of the previous quarter was

revised down to AUD11.7 billion from a deficit of AUD10.1 billion. Analysts had

expected a reduction of the deficit to AUD7.0 billion.

The

Japanese yen traded mixed against the U.S. dollar. Labour cash earning in Japan

rose 0.9% in April, exceeding expectations for a 0.6% gain, after a 0.7%

increase in March.

The Reserve

Bank of Australia released its interest rate decision. Interest rate remained

unchanged at a record low 2.5%. Market participants had expected this decision.

The RBA

decided to continue accommodative monetary policy. Accommodative monetary

policy should provide support to demand and to economic growth.

The Reserve

Bank of Australia governor Glenn Stevens said that exports were rising “strongly”

and the Australian dollar remained strong by historical standards.

Inflation

target by the RBA is 2-3% over the next two years.

Australia’s

central bank has reduced its interest rate by a cumulative 225 basis points

since November 2011.

EUR/USD $1.3500, $1.3550, $1.3600, $1.3650, $1.3700

USD/JPY Y101.10, Y101.50, Y102.65, Y103.00

USD/CAD Cad1.0850, Cad1.0875

AUD/USD $0.9200, $0.9240, $0.9245

EUR/GBP stg0.8050, stg0.8075

Economic

calendar (GMT0):

01:00 Australia Retail Sales Y/Y

April +5.7% +5.7%

01:00 China Non-Manufacturing PMI May 54.8 55.5

01:30 Australia Retail sales (MoM)

April +0.1% +0.3%

+0.2%

01:30 Australia Current Account, bln

Quarter I -10.1 -7.1

-5.7

01:30 Japan Labor Cash Earnings,

YoY

April +0.7% +0.6%

+0.9%

01:45 China HSBC Manufacturing PMI

(Finally)

May 49.7 49.7

49.4

04:30 Australia Announcement of the RBA

decision on the discount rate

2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

06:00 United Kingdom Nationwide house price index

May +1.2% +0.7%

+0.7%

06:00 United Kingdom Nationwide house price index, y/y May +10.9

+10.9% +11.1%

08:30 United Kingdom PMI Construction

May 60.8 61.2

60.0

09:00 Eurozone Harmonized CPI, Y/Y

(Preliminary) May +0.7%

+0.7% +0.5%

09:00 Eurozone Unemployment Rate

April 11.8% 11.8%

11.7%

The U.S.

dollar remained under pressure against the most major currencies ahead of the

release of factory orders in the U.S. The U.S. factory orders should climb 0.6%

in April, after a 1.1% gain in March.

The euro rose

against the U.S. dollar despite the weaker-than-expected inflation data in the

Eurozone. Eurozone’s inflation increased 0.5% in May, after a 0.7% gain in

March. Analysts had expected a 0.7% rise. Inflation target by the European

Central Bank (ECB) is 2%.

The

unemployment rate in the Eurozone fell to 11.7% in April from 11.8% in March.

Analysts had expected the unemployment rate remains unchanged.

The number

of unemployed people in Spain decreased by 111,900 in May, after a 111,600

decline in April. Analysts had forecasted a 112,300 drop.

Market

participants expect the European Central Bank will add further stimulus

measures on Thursday. Investors are awaiting the ECB will cut interest rates

and announce measures to boost lending to smaller businesses.

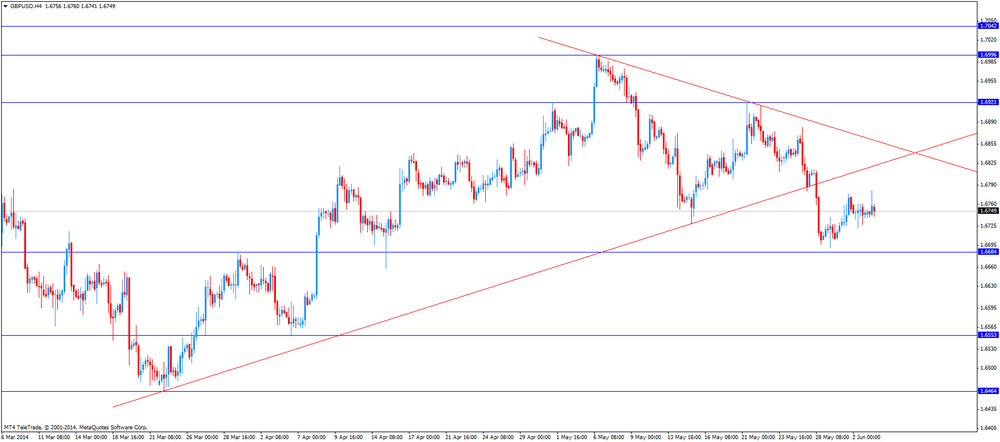

The British

pound traded mixed against the U.S. dollar. The U.K. construction purchasing

managers' index declined to 60.0 in May, from 60.8 in April. Analysts had

expected the index to increase to 61.2.

Nationwide

house price index for the U.K. climbed 0.7% in May, meeting analysts’ expectations,

after a 1.2% rise in April. On a yearly basis, Nationwide house price index for

the U.K. rose 11.1% in May, after a 10.9% increase in April. Analysts had

expected the index remains unchanged.

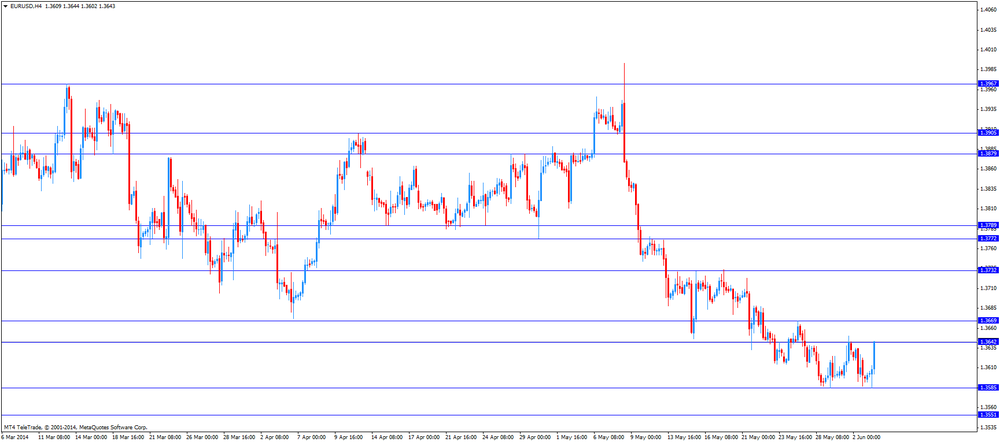

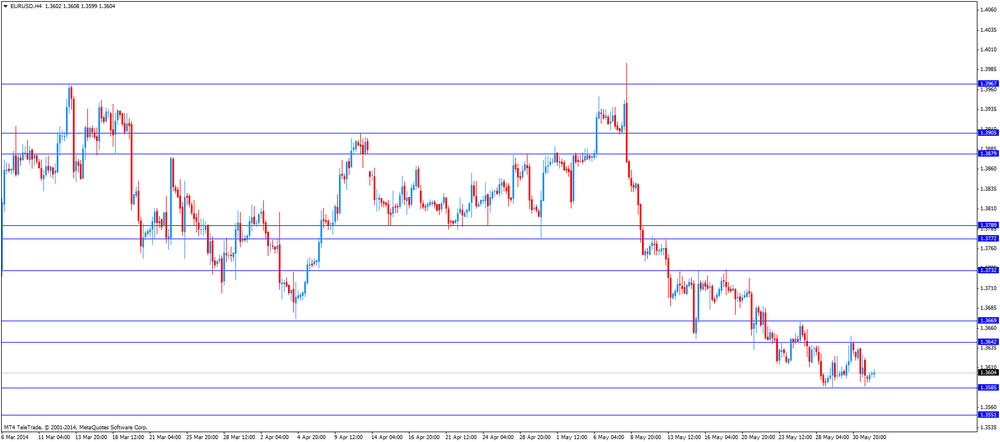

EUR/USD:

the currency pair declined to $1.3644

GBP/USD:

the currency pair traded mixed

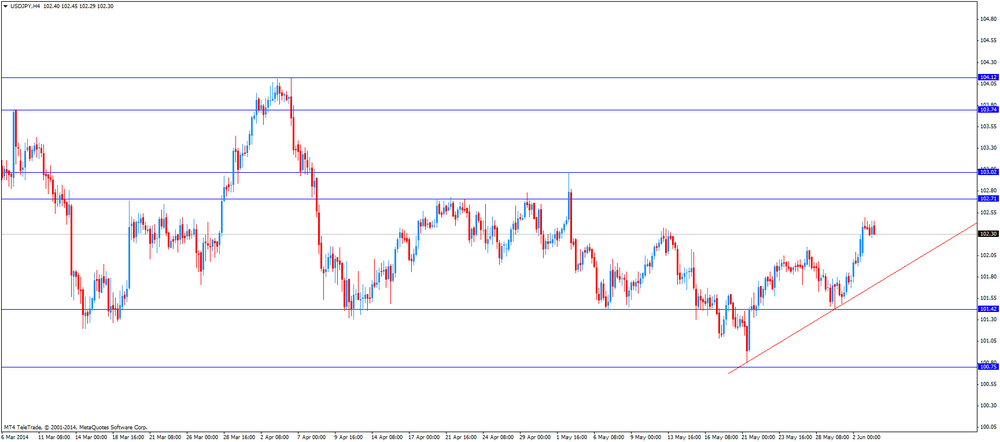

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

14:00

U.S. Factory Orders April +1.1%

+0.6%

EUR/USD

Offers $1.3695/700, $1.3688, $1.3670/80, $1.3655, $1.3615-30

Bids $1.3585/80, $1.3550

GBP/USD

Offers $1.6860, $1.6835/40

Bids $1.6725, $1.6690

AUD/USD

Offers $0.9350, $0.9330, $0.9300

Bids $0.9235/30, $0.9220, $0.9210/00, $0.9150

EUR/JPY

Offers Y140.50, Y140.00, Y139.75/80, Y139.45/50

Bids Y139.00, Y138.85/80, Y138.50, Y138.20

USD/JPY

Offers Y103.00, Y102.80, Y102.50

Bids Y102.00, Y101.60, Y101.05/00

EUR/GBP

Offers stg0.8195/205, stg0.8160/65

Bids stg0.8080, stg0.8050

Eurozone’s

inflation increased 0.5% in May, after a 0.7% gain in March. Analysts had

expected a 0.7% rise. Inflation target by the European Central Bank (ECB) is

2%.

German

inflation was released yesterday. Inflation in Germany also declined. German

preliminary consumer price index fell 0.1% in May, after a decline of 0.2% in

April. Analysts had expected a 0.1% rise. On a yearly basis, German preliminary

consumer price index rose 0.9% in May, after a 1.3% gain in April. Analysts had

forecasted a 1.1% increase.

All these

figures are feeding speculation the European Central Bank will add further

stimulus measures on Thursday. Investors are awaiting the ECB will cut interest

rates and announce measures to boost lending to smaller businesses.

The

unemployment rate in the Eurozone fell to 11.7% in April from 11.8% in March.

Analysts had expected the unemployment rate remains unchanged.

EUR/USD $1.3500, $1.3550, $1.3600, $1.3650, $1.3700

USD/JPY Y101.10, Y101.50, Y102.65, Y103.00

USD/CAD Cad1.0850, Cad1.0875

AUD/USD $0.9200, $0.9240, $0.9245

EUR/GBP stg0.8050, stg0.8075

Economic

calendar (GMT0):

01:00 Australia Retail Sales Y/Y April +5.7% +5.7%

01:00 China Non-Manufacturing PMI May 54.8 55.5

01:30 Australia Retail sales (MoM) April +0.1% +0.3% +0.2%

01:30 Australia Current Account, bln Quarter I -10.1 -7.1 -5.7

01:30 Japan Labor Cash Earnings, YoY April +0.7% +0.6% +0.9%

01:45 China HSBC Manufacturing PMI (Finally) May 49.7 49.7 49.4

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

06:00 United Kingdom Nationwide house price index May +1.2% +0.7% +0.7%

06:00 United Kingdom Nationwide house price index, y/y May +10.9 +10.9% +11.1%

08:30 United Kingdom PMI Construction May 60.8 61.2 60.0

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) May +0.7% +0.7% +0.5%

09:00 Eurozone Unemployment Rate April 11.8% 11.8% 11.7%

The U.S.

dollar traded lower against the most major currencies due to the disappointing

ISM manufacturing purchase managers’ index in the U.S. The Institute of Supply

Management released its manufacturing purchasing managers' index for the U.S.

The index dropped to 53.2 in May, from 54.9 in April. Analysts had expected a

gain to 55.5.

The New

Zealand dollar traded higher against the U.S dollar due to speculation New

Zealand’s currency will benefit along with the Australian dollar. Market

participants are awaiting the release of the Australian economic growth

tomorrow. Australia’s economy should expand 1.1% in the first quarter.

In the

absence of any major economic reports in New Zealand, investors also remain concerned about

the impact of lower dairy prices on the economy and the interest rate.

The

Australian dollar climbed against the U.S. dollar after the Reserve Bank of

Australia’s interest rate decision. The Reserve Bank of Australia (RBA) kept interest

rate unchanged at a record low 2.5% as expected. The RBA decided to continue

accommodative monetary policy. Accommodative monetary policy should provide

support to demand and to economic growth.

Earlier in

the trading session, Australian retail sales were released. Retail sales in

Australia increased 0.2% in April, missing expectations of a 0.3% gain in

March, after a 0.1% rise in March.

Australia’s

current account deficit declined to AUD5.67 billion in the first quarter from AUD11.7

billion the previous quarter. The deficit of the previous quarter was revised

down to AUD11.7 billion from a deficit of AUD10.1 billion. Analysts had

expected a reduction of the deficit to AUD7.0 billion.

The Japanese yen traded little changed against the U.S. dollar. Labor cash earning in Japan rose 0.9% in April, exceeding expectations for a 0.6% gain, after a 0.7% increase in March.

EUR/USD:

the currency pair increased to $1.3605

GBP/USD:

the currency pair traded mixed

USD/JPY:

the currency pair traded mixed

AUD/USD:

the currency pair increased to $0.9268

The most

important news that are expected (GMT0):

14:00 U.S. Factory Orders April +1.1% +0.6%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3762 (3649)

$1.3722 (3513)

$1.3659 (771)

Price at time of writing this review: $ 1.3604

Support levels (open interest**, contracts):

$1.3573 (3756)

$1.3536 (4923)

$1.3474 (8745)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 56909 contracts, with the maximum number of contracts with strike price $1,3850 (6024);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 77131 contracts, with the maximum number of contractswith strike price $1,3500 (8745);

- The ratio of PUT/CALL was 1.35 versus 1.31 from the previous trading day according to data from June, 2.

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (2741)

$1.6901 (2103)

$1.6802 (1309)

Price at time of writing this review: $1.6745

Support levels (open interest**, contracts):

$1.6697 (2601)

$1.6599 (2440)

$1.6500 (979)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 24582 contracts, with the maximum number of contracts with strike price $1,7000 (2741);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 26920 contracts, with the maximum number of contracts with strike price $1,6700 (2601);

- The ratio of PUT/CALL was 1.10 versus 1.11 from the previous trading day according to data from June, 2.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.