- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 04-07-2014

The U.S. dollar traded higher against the most major currencies. The U.S. currency was still supported by yesterday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

Markets in the U.S. are closed for the Independence Day holiday on Friday.

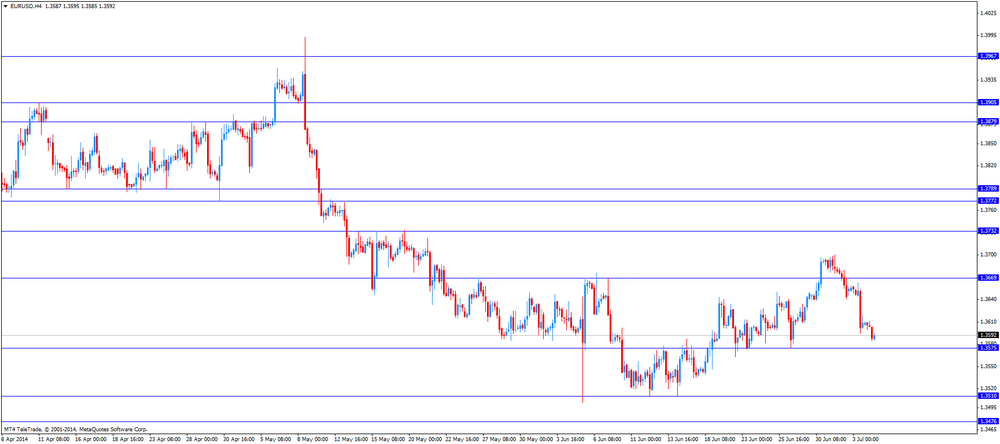

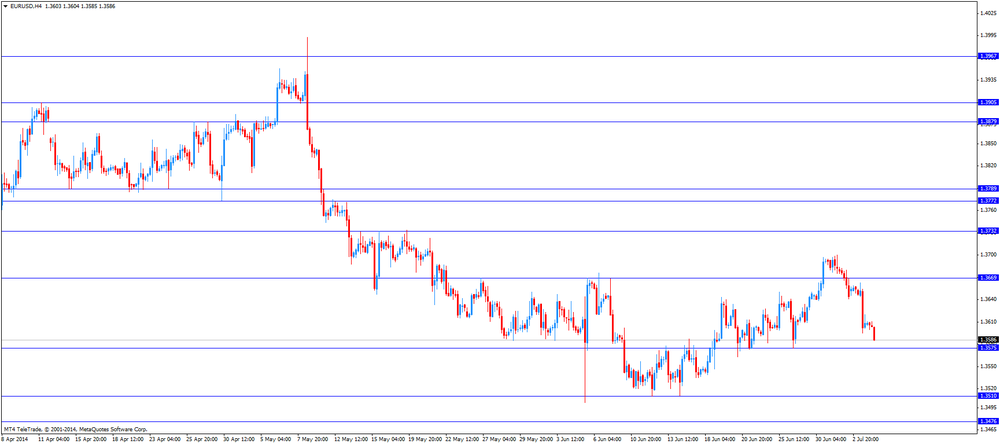

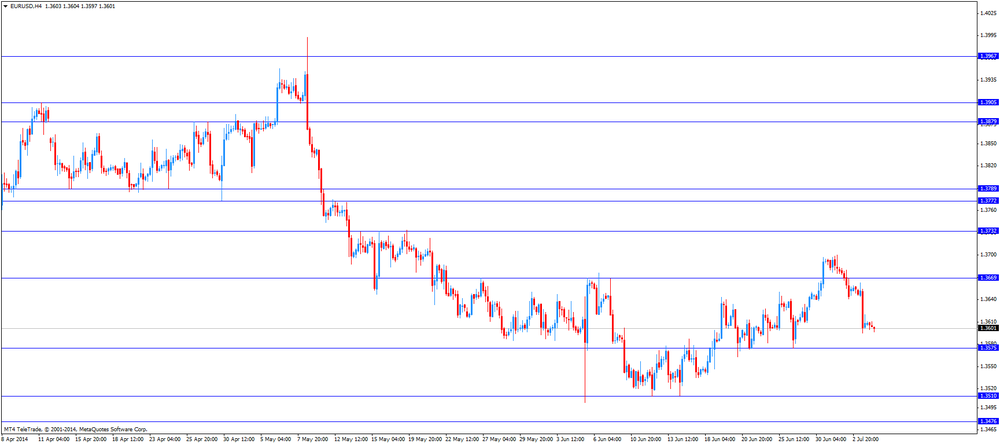

The euro traded lower against the U.S. dollar due to the weaker-than-expected German factory orders. German factory orders decreased 1.7% in May, missing expectations for a 0.8% fall, after a 3.4% gain in April. April's figure was revised up from a 3.1% increase.

On a yearly basis, German factory orders rose 5.5% in May, after a 6.3% increase in April.

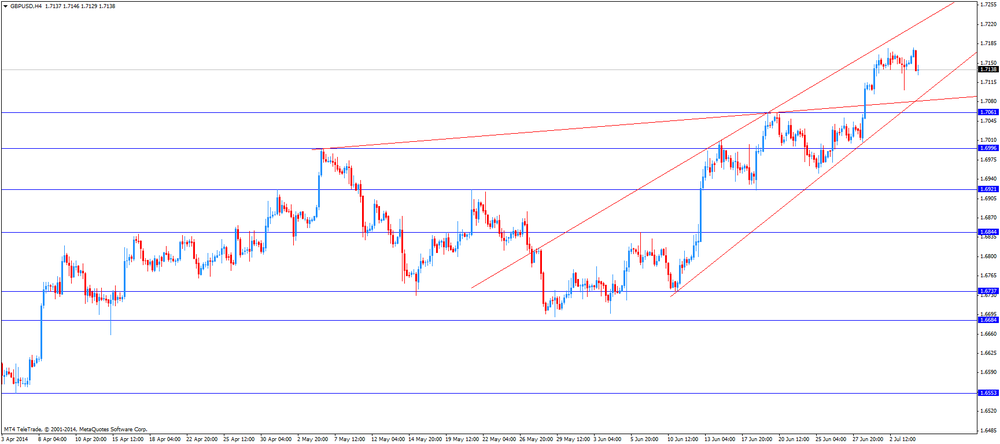

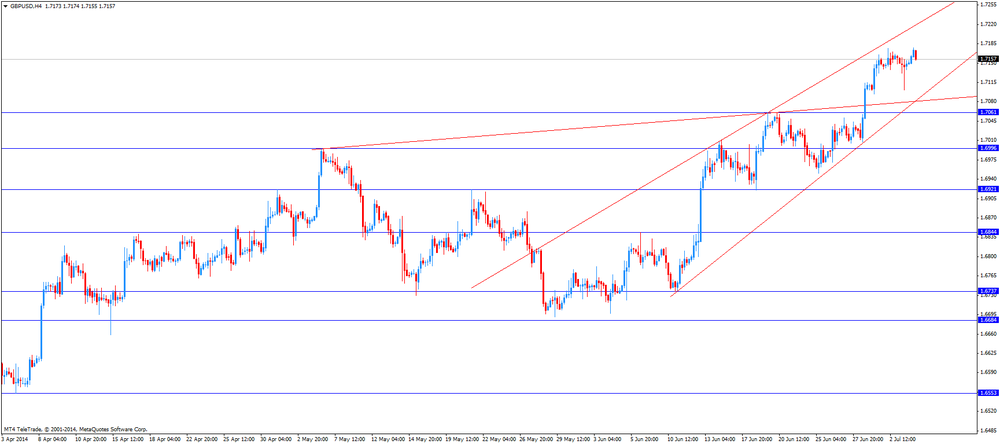

The British pound traded lower against the U.S. dollar in the absence of any major economic reports in the U.K.

The New Zealand dollar traded lower against the U.S dollar due to yesterday's strong U.S. labour market data. No economic reports were released in New Zealand.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports in Australia. Yesterday's strong U.S. labour market data and comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens still weighed on the Australian currency. The RBA Governor said that the Australian dollar remains high by historical standards and investors are underestimating the probability of a significant fall in the Australian dollar at some point.

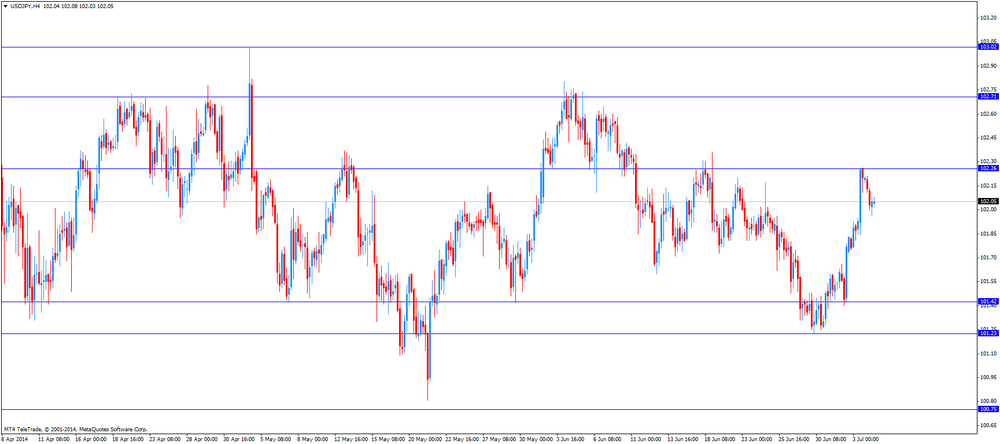

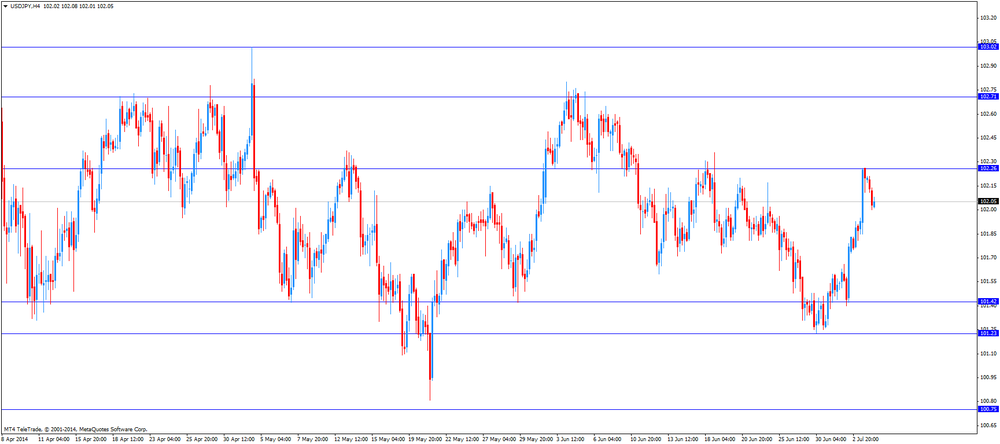

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports in Japan. Yesterday's strong U.S. labour market data still weighed on the yen.

EUR/USD $1.3600, $1.3620

USD/JPY Y101.70-75, Y101.90-95

EUR/JPY Y139.25

EUR/GBP 0.7970, stg0.8050

AUD/USD $0.9350, $0.9400

NZD/USD $0.8655

EUR/USD

Offers $1.3700-20, $1.3680/85, $1.3660, $1.3635

Bids $1.3576-74, $1.3565, $1.3550/40

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7095/90, $1.7065, $1.7035/30, $1.7010

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9420, $0.9400

Bids $0.9330, $0.9320, $0.9300

EUR/JPY

Offers Y140.50, Y140.00, Y139.50, Y139.30, Y139.00

Bids Y138.50, Y138.20, Y138.00

USD/JPY

Offers Y102.80, Y102.65, Y102.50, Y102.30

Bids Y101.70, Y101.40/30, Y101.20, Y101.10/00, Y100.80

EUR/GBP

Offers stg0.8030, stg0.8000, stg0.7970

Bids stg0.7915, stg0.7905-890, stg0.7800

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:40 Australia RBA Assist Gov Edey Speaks

06:00 Germany Factory Orders s.a. (MoM) May +3.4% Revised From +3.1% -0.8% -1.7%

06:00 Germany Factory Orders n.s.a. (YoY) May +6.3% +5.5%

The U.S. dollar traded higher against the most major currencies. The U.S. currency was supported by yesterday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

Markets in the U.S. are closed for the Independence Day holiday on Friday.

The euro declined against the U.S. dollar due to the weaker-than-expected German factory orders. German factory orders decreased 1.7% in May, missing expectations for a 0.8% fall, after a 3.4% gain in April. April's figure was revised up from a 3.1% increase.

On a yearly basis, German factory orders rose 5.5% in May, after a 6.3% increase in April.

The British pound decreased against the U.S. dollar in the absence of any major economic reports in the U.K.

EUR/USD: the currency pair fell to $1.3585

GBP/USD: the currency pair declined to $1.7129

USD/JPY: the currency pair traded mixed

EUR/USD $1.3600, $1.3620

USD/JPY Y101.70-75, Y101.90-95

EUR/JPY Y139.25

EUR/GBP 0.7970, stg0.8050

AUD/USD $0.9350, $0.9400

NZD/USD $0.8655

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:40 Australia RBA Assist Gov Edey Speaks

06:00 Germany Factory Orders s.a. (MoM) May +3.4% Revised From +3.1% -0.8% -1.7%

06:00 Germany Factory Orders n.s.a. (YoY) May +6.3% +5.5%

The U.S. dollar traded mixed against the most major currencies. The U.S. currency was supported by yesterday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

Markets in the U.S. are closed for the Independence Day holiday on Friday.

The New Zealand dollar declined against the U.S dollar due to yesterday's strong U.S. labour market data. No economic reports were released in New Zealand.

The Australian dollar traded slightly higher against the U.S. dollar in the absence of any major economic reports in Australia. Yesterday's strong U.S. labour market data and comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens still weighed on the Australian currency. The RBA Governor said that the Australian dollar remains high by historical standards and investors are underestimating the probability of a significant fall in the Australian dollar at some point.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports in Japan. Yesterday's strong U.S. labour market data still weighed on the yen.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.7175

USD/JPY: the currency pair declined to Y102.00

EUR / USD

Resistance levels (open interest**, contracts)

$1.3705 (2149)

$1.3679 (1595)

$1.3644 (275)

Price at time of writing this review: $ 1.3606

Support levels (open interest**, contracts):

$1.3570 (311)

$1.3551 (1747)

$1.3527 (1594)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 19043 contracts, with the maximum number of contracts with strike price $1,3800 (3163);

- Overall open interest on the PUT options with the expiration date August, 8 is 26370 contracts, with the maximum number of contracts with strike price $1,3500 (6253);

- The ratio of PUT/CALL was 1.38 versus 1.29 from the previous trading day according to data from July, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.7402 (975)

$1.7304 (1371)

$1.7207 (1360)

Price at time of writing this review: $1.7171

Support levels (open interest**, contracts):

$1.7092 (700)

$1.6996 (1288)

$1.6898 (1539)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 13361 contracts, with the maximum number of contracts with strike price $1,7100 (1584);

- Overall open interest on the PUT options with the expiration date August, 8 is 16701 contracts, with the maximum number of contracts with strike price $1,6900 (1539);

- The ratio of PUT/CALL was 1.25 versus 0.94 from the previous trading day according to data from Jule, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3609 -0,35%

GBP/USD $1,7152 -0,06%

USD/CHF Chf0,8933 +0,51%

USD/JPY Y102,21 +0,44%

EUR/JPY Y139,08 +0,08%

GBP/JPY Y175,27 +0,35%

AUD/USD $0,9344 -1,04%

NZD/USD $0,8747 -0,27%

USD/CAD C$1,0640 -0,24%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.