- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 11-02-2016

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1322 +0,28%

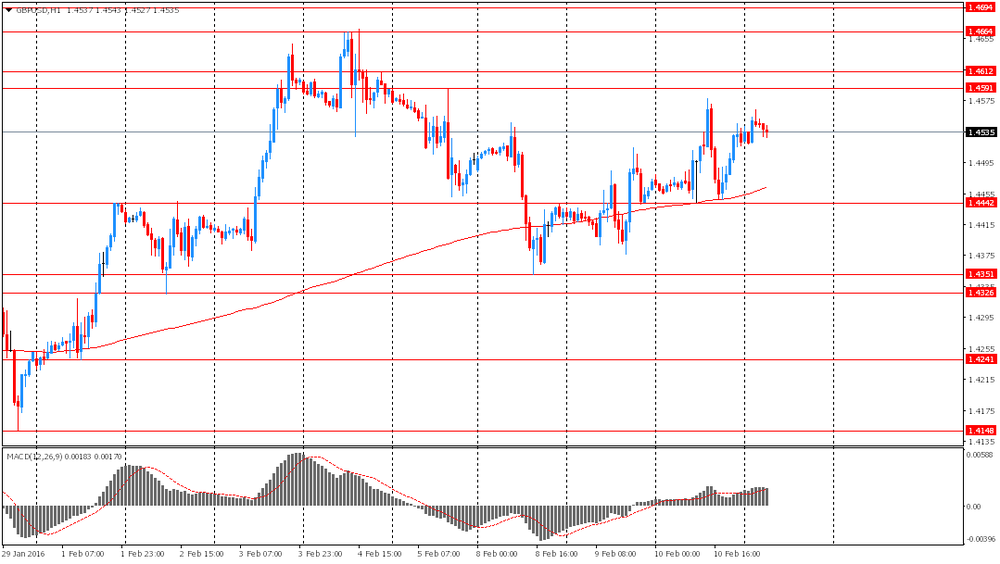

GBP/USD $1,4437 -0,58%

USD/CHF Chf0,9722 -0,12%

USD/JPY Y112,42 -0,81%

EUR/JPY Y127,27 -0,57%

GBP/JPY Y162,71 -1,14%

AUD/USD $0,7008 -1,21%

NZD/USD $0,6715 +0,45%

USD/CAD C$1,3935 +0,09%

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

00:30 Australia Home Loans December 1.8% 3%

07:00 Germany CPI, m/m (Finally) January -0.1% -0.8%

07:00 Germany CPI, y/y (Finally) January 0.3% 0.5%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV 0.3% 0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV 1.8% 2.3%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV 0%

10:00 Eurozone Industrial production, (MoM) December -0.7% 0.3%

10:00 Eurozone Industrial Production (YoY) December 1.1% 0.8%

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV 0.3% 0.3%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV 1.6% 1.5%

13:30 U.S. Retail sales January -0.1% 0.1%

13:30 U.S. Retail Sales YoY January 2.2%

13:30 U.S. Import Price Index January -1.2% -1.4%

13:30 U.S. Retail sales excluding auto January -0.1% 0%

15:00 U.S. Business inventories December -0.2% 0.1%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 92 92

15:00 U.S. FOMC Member Dudley Speak

The Swiss franc strengthened slightly against the dollar, retreating from session low. In the course of trading influenced by the general weakening of the US currency, growth in demand for safe-haven assets, as well as the comments the head of SNB Thomas Jordan. During the interview, Jordan said that the Swiss franc is still "overvalued" and added that he does not rule out further rate cuts. "We've come a long way on the issue of negative interest rates. At the moment, we are closely monitoring the situation and do not exclude any scenario. In order to weaken the franc, we used the negative rate and are ready to intervene in the currency market. Franc remains overvalued, but should eventually . loosen revalued now become a less important factor than a year ago ", - said the head of the Central Bank, adding that the turbulence in Europe could once again draw attention to the franc as a safe-haven, but it makes no sense to establish a new threshold level of the Swiss franc. In addition, Jordan commented on the situation with the prices. "Inflation is currently at negative values in the area and at levels lower than we would like, but our expansionary monetary policy is aimed at the return of inflation in the zone of growth in the medium term." - Jordan said.

Data previously presented today showed that consumer prices in Switzerland fell in a stable pace in January. The consumer price index fell by 1.3 per cent per annum in January, saying the same rate of decline as in December. This figure was also in line with the consensus forecast. Prices are falling in November, 2014. On a monthly basis, consumer prices also decreased in a stable pace of 0.4 percent in January, as expected by economists. The decrease was mainly due to sales in the clothing sector, as well as oil prices fall.

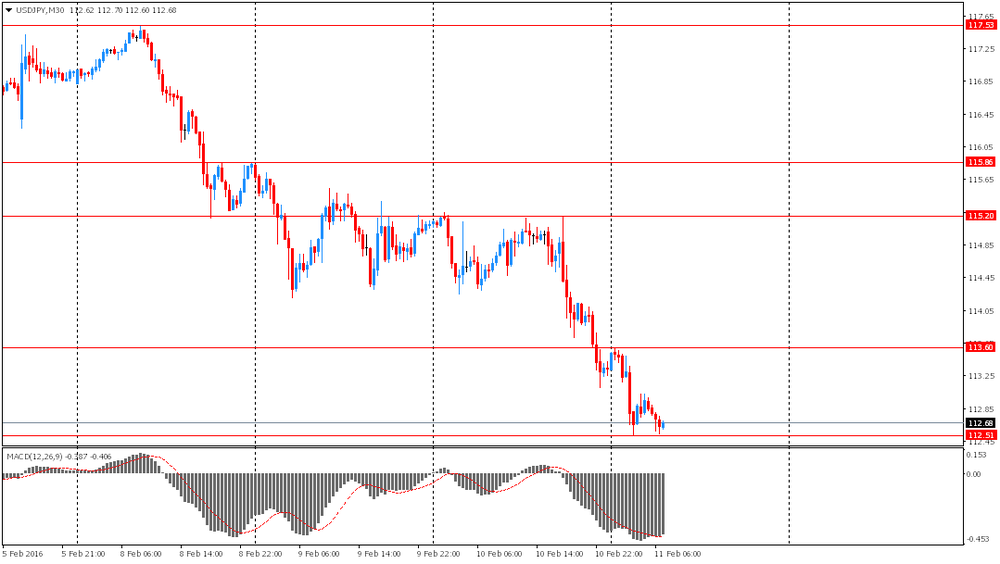

The Japanese yen fell sharply against the dollar, but then was able to regain some lost ground. The main reason for fell of the yen were unconfirmed rumors of intervention by the Bank of Japan. Once again, investors' attention has shifted the mood of the markets. Experts note that the concerns about the global economic outlook triggered the fall in stock markets, while increasing the demand for safe-haven assets, namely the yen and the euro.

In focus were also data on the US labor market. The Labor Department reported that the number of Americans who first applied for unemployment benefits fell last week, became another sign of the US labor market stability in times of economic crisis abroad. Primary treatment at 16,000 down for unemployment insurance and seasonally adjusted reached 269,000 for the week ending 6 February. Economists had expected 281,000 initial claims last week. Data for the previous week remained unchanged at 285 000. The report also showed that the number of repeated applications for unemployment benefits fell by 21,000 to 2.239 million in the week ended January 30th. Continuing claims are reported with a one-week lag. Some economists worry that low levels of initial claims signals the lack of dynamism in the labor market, or it may reflect the state of the population, which is long-term unemployed, and has no right to submit new applications for unemployment benefits.

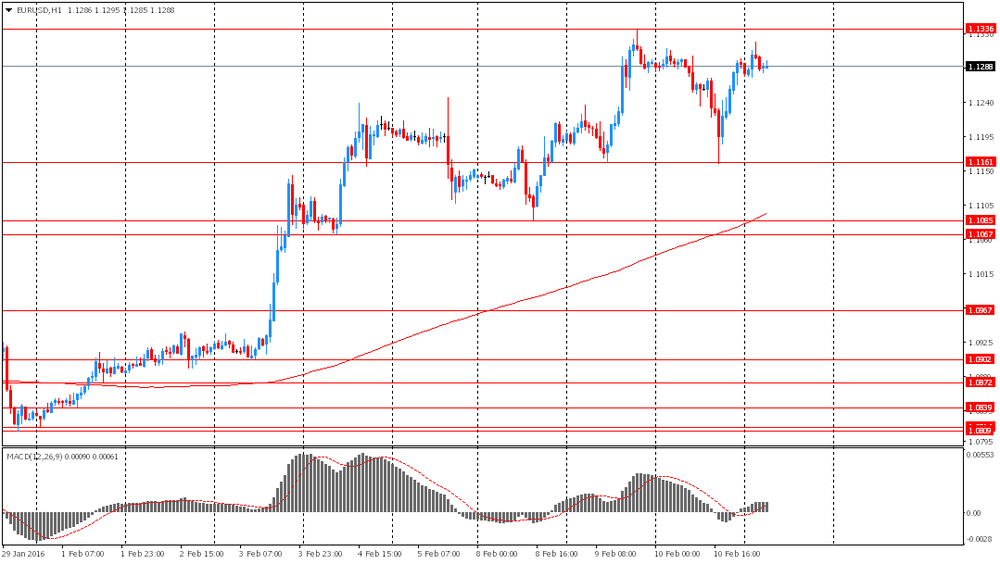

The euro rose against the US dollar, reaching a maximum of 21 October 2015, which was mainly due to an increase in demand for safe-haven assets in the face of increasing risk aversion. In the course of trading was also influenced by the situation in the bond market: the yield of British bonds fell to a record low, and the yield on German bonds reached their lowest level since April 2015. Negatively on the dollar also reflected the comments by the US Federal Reserve Chairman Janet Yellen on the introduction of negative interest rates. She also reiterated there are several threats to the country's economy from the volatility of world markets and the weakness of the international economy. Yellen said that the Central Bank is now trying to assess how much the market situation may impact on the economy, but so far to make any conclusions premature. In addition, she did not rule out further rate hikes in the coming months. According to a recent survey of Wall Street Journal, the Fed will not povyshatstavki during meetings in March and April, but is more likely to produce a policy tightening in June. Only 9% of respondents expect an increase in key interest rates at the meeting on March 15-16, the Central Bank, although this opinion was held by 66% of respondents in the last month. Approximately 60% of economists forecast a rate hike at the meeting of 14-15 June, which is 25% more than in the January survey. Approximately 13% of economists expect the Fed to raise rates at the meeting on April 26-27, which is 7% more than in the previous survey. On average, the economists estimated the probability of a Fed rate as follows: 19% in March and 22% in April and 49% in June.

The Fed Chairwoman Janet Yellen testified before the Senate Banking Committee on Thursday. She said that the Fed and markets were surprised by oil price movements.

"We have been quite surprised by movements in oil prices. I think in part they reflect supply influences, but demand may also play a role," she said.

Yellen pointed out that it is too earlier to decide on monetary policy actions in March.

The Fed chairwoman noted that the Fed discussed negative rates in 2010, and it ready to implement negative rates if needed.

"We wouldn't take those [negative interest rates] off the table, but we have work to do to judge whether they would be workable here," Yellen said.

The Swiss National Bank (SNB) Chairman Thomas Jordan said in an interview on Thursday that the central bank could cut its interest rates further.

"At present we are monitoring the situation closely. We do not rule out anything," he said.

Jordan pointed out that the SNB was ready to intervene in the foreign exchange market if needed.

He also said that Swiss currency was overvalued.

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.6% in November from 24.7% in October. October's figure was revised up from 24.5%.

The number of unemployed fell by 3,718 persons compared with October 2015.

The youth unemployment rate was 48.0% in November.

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.1% in December, missing expectations for a 0.2% gain, after a 0.2% increase in November.

The increase was mainly driven by a gain in Toronto and Vancouver region. New home prices in Toronto and Oshawa region rose 0.2% in December, while prices in Vancouver also climbed 0.2%.

On a yearly basis, new housing price index in Canada climbed 1.6% in December, after a 1.6% gain in November.

USD/JPY: 116.00 (USD 1.51bn) 117.50 (620m)

EUR/USD: 1.1000 (EUR 258m) 1.1050 (159m) 1.1205 (189m) 1.1300 (146m)

GBP/USD: 1.4600 (GBP 265m)

AUD/USD: 0.6950 (250m) 0.6975 (402m) 0.7025 (325m) 0.7100 (229mn) 0.7150 (458m)

USD/CAD: 1.3900 (445m)

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 06 in the U.S. declined by 16,000 to 269,000 from 285,000 in the previous week.

Analysts had expected jobless claims to fall to 281,000.

Jobless claims remained below 300,000 the 49th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 21,000 to 2,239,000 in the week ended January 30.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation February 3.6% 3.6%

00:00 China Bank holiday

00:00 Japan Bank holiday

08:15 Switzerland Consumer Price Index (MoM) January -0.4% -0.4% -0.4%

08:15 Switzerland Consumer Price Index (YoY) January -1.3% -1.3% -1.3%

The U.S. dollar traded mixed against the most major currencies ahead of the Fed Chairwoman Janet Yellen's testimony before the Senate Banking Committee at 15:00 GMT. It is likely that she will repeat her yesterday's remarks. But questions could differ.

The number of initial jobless claims in the U.S. is expected to decline by 4,000 to 281,000 last week.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

European Central Bank Governing Council member Ewald Nowotny said on Thursday that inflation in the Eurozone could turn into negative territory in the first half of 2016 but prices are expected to climb in the second half. He noted that there was no deflationary risk in the Eurozone.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian economic data. Canada's new housing price index is expected to rise 0.2% in December, after a 0.2% gain in November.

The Swiss franc traded mixed against the U.S. dollar. The Swiss Federal Statistics Office released its consumer inflation data on Thursday. Switzerland's consumer price index fell 0.4% in January, in line with expectations, after a 0.4% decrease in December.

The decline was mainly driven by lower prices for clothing and petroleum products.

On a yearly basis, Switzerland's consumer price index remained unchanged at -1.3% in January, in line with forecasts.

EUR/USD: the currency pair rose to $1.1368

GBP/USD: the currency pair fell to $1.4384

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index, MoM December 0.2% 0.2%

13:30 U.S. Initial Jobless Claims February 285 281

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

22:30 Australia RBA's Governor Glenn Stevens Speech

EUR/USD

Offers: 1.1350 1.1375-80 1.1400 1.1430 1.1450 1.1480 1.1500

Bids: 1.1320 1.1300 1.1285 1.1265 1.1250 1.1235 1.1220 1.1200

GBP/USD

Offers: 1.4485 1.4500 1.4525 1.4545-50 1.4575-80 1.4600 1.4630 1.4650

Bids: 1.4445-50 1.4425 1.4400 1.4385 1.4365 1.4350 1.4330 1.4300

EUR/JPY

Offers: 126.30 126.50 126.75 127.00 127.25 127.50 127.80 128.00

Bids: 125.50 125.00 124.75 124.50 124.50 124.00

EUR/GBP

Offers: 0.7875-80 0.7900 0.7925-30 0.7950 0.7975 0.8000

Bids: 0.7820 0.7800 0.7780 0.7765 0.7750 0.7725-30 0.7700

USD/JPY

Offers: 111.50 111.65 111.85 112.00 112.20 112.50

Bids: 111.00 110.85 110.65 110.50 110.30 110.00

AUD/USD

Offers: 0.7030 0.7050 0.7080 0.7100-05 0.7120 0.7150 0.7175-80 0.7200

Bids: 0.6980-85 0.6950 0.6930 0.6900 0.6880 0.6850

European Central Bank Governing Council member Ewald Nowotny said on Thursday that inflation in the Eurozone could turn into negative territory in the first half of 2016 but prices are expected to climb in the second half.

"In the second half, we could already see a clear increase in inflation because of the base effect from the previous year," he said.

Nowotny noted that there was no deflationary risk in the Eurozone.

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance remained unchanged at +49% in January. December's figure was revised down from +50%.

RICS Chief Economist, Simon Rubinsohn, said that the near-term pressure on house prices was intensifying despite a higher level of supply.

According to the Business NZ Survey published on late Wednesday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand rose to 57.9 in January from 57.0 in December. It was the highest level since October 2014.

December's figure was revised up from 56.7.

A reading above 50 indicates expansion in the manufacturing sector.

The rise was mainly driven by a faster expansion in new orders and production.

"Over two-thirds of manufacturers provided positive comments regarding their main influence on business activity, with increased sales both on a domestic and international basis. Other comments outlined the general positive sentiment occurring in the New Zealand economy," Business NZ's executive director for manufacturing, Catherine Beard, said.

The Swiss Federal Statistics Office released its consumer inflation data on Thursday. Switzerland's consumer price index fell 0.4% in January, in line with expectations, after a 0.4% decrease in December.

The decline was mainly driven by lower prices for clothing and petroleum products.

On a yearly basis, Switzerland's consumer price index remained unchanged at -1.3% in January, in line with forecasts.

The U.S. Treasury Department released its federal budget data on Wednesday. The budget deficit turned into a surplus of $55.2 billion in January, beating expectations for a surplus of $45.0 billion, after a deficit of $14.0 billion growth in December.

The budget surplus was driven by higher receipts of individual and social insurance taxes.

In the four months of the fiscal year 2016, which ends at September this year, the budget deficit totalled $160.4 billion, down from a deficit of $194.2 billion a year ago.

European Central Bank (ECB) Governing Council member and Bank of France Governor Francois Villeroy de Galhau said in an interview on Wednesday that the French economy was not affected by the recent market turmoil. He noted that the economy was driven by domestic demand.

"The French economy is driven by an internal engine, first and foremost by household consumption," Villeroy de Galhau said.

USD/JPY: 116.00 (USD 1.51bn) 117.50 (620m)

EUR/USD: 1.1000 (EUR 258m) 1.1050 (159m) 1.1205 (189m) 1.1300 (146m)

GBP/USD: 1.4600 (GBP 265m)

AUD/USD: 0.6950 (250m) 0.6975 (402m) 0.7025 (325m) 0.7100 (229mn) 0.7150 (458m)

USD/CAD: 1.3900 (445m)The German Chambers of Commerce (DIHK) noted on Wednesday that German companies said business conditions were better now and exports were improving.

The DIHK expect the German economy to expand 1.3% this year, lower than the government's forecast of a 1.7% growth.

Fed Vice Chairman Stanley Fischer said on Wednesday that he was worried that U.S. reforms implemented after the global financial crisis can handle a credit market panic.

"The new system has not undergone its own stress test," he said.

"The financial system will undergo its fundamental stress test only when we have to deal with the next potential financial crisis," Fischer added.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1427 (2325)

$1.1381 (4292)

$1.1347 (3013)

Price at time of writing this review: $1.1288

Support levels (open interest**, contracts):

$1.1205 (226)

$1.1163 (1278)

$1.1108 (4117)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 59935 contracts, with the maximum number of contracts with strike price $1,1000 (5067);

- Overall open interest on the PUT options with the expiration date March, 4 is 84446 contracts, with the maximum number of contracts with strike price $1,0900 (6762);

- The ratio of PUT/CALL was 1.41 versus 1.41 from the previous trading day according to data from February, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.4806 (1157)

$1.4709 (1221)

$1.4612 (1106)

Price at time of writing this review: $1.4534

Support levels (open interest**, contracts):

$1.4486 (705)

$1.4390 (866)

$1.4293 (1880)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 26044 contracts, with the maximum number of contracts with strike price $1,4650 (1652);

- Overall open interest on the PUT options with the expiration date March, 4 is 24174 contracts, with the maximum number of contracts with strike price $1,4350 (2911);

- The ratio of PUT/CALL was 0.93 versus 0.92 from the previous trading day according to data from February, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia Consumer Inflation Expectation February 3.6% 3.6%

Federal Reserve Chairwoman Janet Yellen was neither too hawkish nor too dovish speaking to the House Financial Services Committee on Wednesday. Yellen noted weakness in financial conditions, but left the door open for a rate hike this year. She added that low oil prices weighed on inflation, which is expected to remain low in the near future. Yellen also said that strong U.S. dollar will increase exports from advanced economies allowing central banks of Europe and Japan to tighten monetary policy sooner.

The yen continued its rally against the greenback amid strong demand for safe-haven assets. Weaker stocks support the yen.

The New Zealand dollar rose at the beginning of the session after data showed that manufacturing activity rose to a fifteen-month high. The BNZ-BusinessNZ performance of manufacturing index rose to a seasonally adjusted 57.9 in January from 57.0 in December. Three sub-indices out of five rose. The production sub-index advanced to a fourteen-month high of 60.3, up from December's 57.1.

EUR/USD: the pair fluctuated within $1.1375-20 in Asian trade

USD/JPY: the pair fell to Y112.15

GBP/USD: the pair traded within $1.4520-60

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Consumer Price Index (MoM) January -0.4% -0.4%

08:15 Switzerland Consumer Price Index (YoY) January -1.3% -1.3%

13:30 Canada New Housing Price Index, MoM December 0.2% 0.2%

13:30 U.S. Continuing Jobless Claims January 2255 2250

13:30 U.S. Initial Jobless Claims February 285 281

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

22:30 Australia RBA's Governor Glenn Stevens Speech

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.