- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 11-03-2014

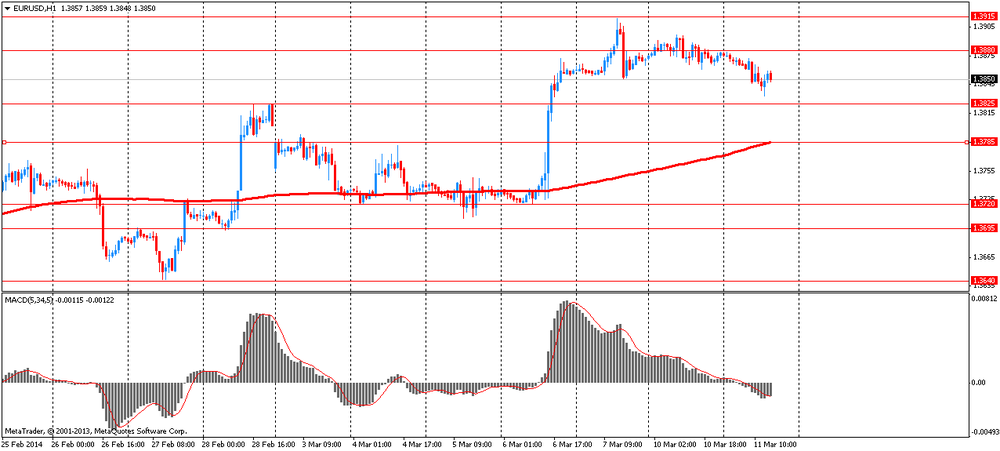

EUR/USD $1,3859 -0,14%

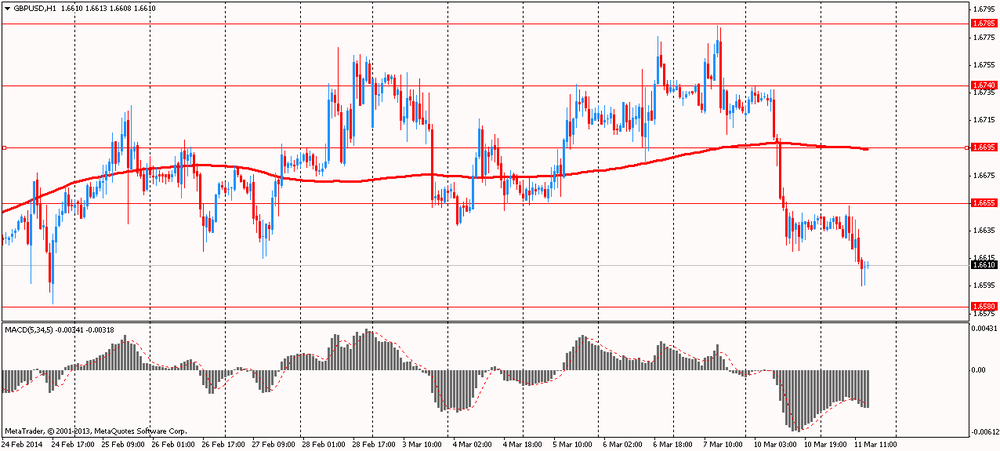

GBP/USD $1,6615 -0,17%

USD/CHF Chf0,8778 +0,03%

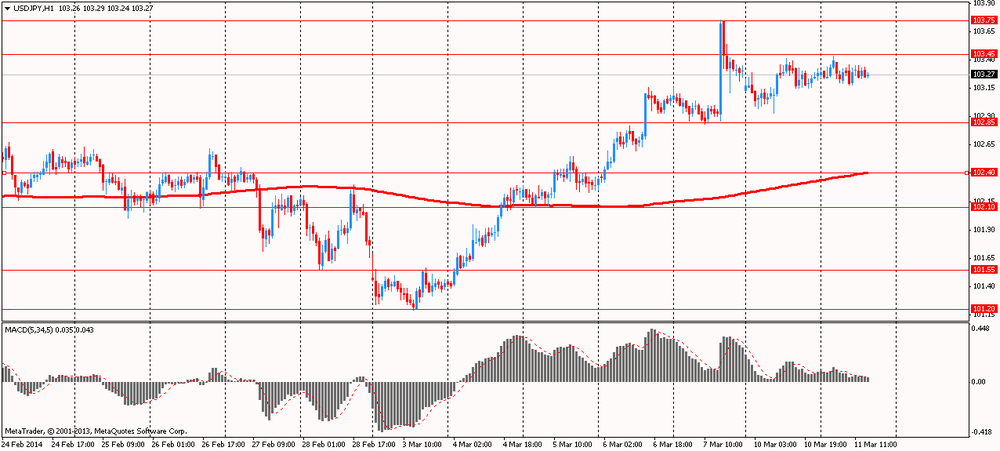

USD/JPY Y102,83 -0,44%

EUR/JPY Y142,72 -0,42%

GBP/JPY Y171,09 -0,47%

AUD/USD $0,8975 -0,50%

NZD/USD $0,8470 -0,01%

USD/CAD C$1,1104 -0,01%(time / country / index / period / previous value / forecast)

00:30 Australia Home Loans January -1.9% +0.8%

05:00 Japan BoJ monthly economic report March

05:00 Japan Consumer Confidence February 40.5 40.3

09:30 United Kingdom Trade in goods January -7.7 -8.7

10:00 Eurozone Industrial production, (MoM) January -0.7% +0.6%

10:00 Eurozone Industrial Production (YoY) January +0.5% +1.9%

14:30 U.S. Crude Oil Inventories March +1.4

18:00 U.S. Federal budget February -10.4 -223.2

18:00 U.S. Treasury Sec Lew Speaks

20:00 New Zealand RBNZ Interest Rate Decision 2.50% 2.75%

20:00 New Zealand RBNZ Press Conference

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Food Prices Index, m/m February +1.2% -0.2%

21:45 New Zealand Food Prices Index, y/y February +0.9%

23:50 Japan Core Machinery Orders January -15.7% +7.3%

23:50 Japan Core Machinery Orders, y/y January +6.7% +18.8%

The dollar traded lower against the euro , but was able to recover most of the previously lost positions . Impact on the dynamics of trade balance data and Germany on wholesale inventories SSCHA .

As it became known , in January German exports grew more than expected , after a decline in December. Exports rose 2.2 percent on a monthly measurement in January , recovering from the 0.9 percent drop in December. Exports are projected to grow had 1.5 percent . In addition , imports expanded by 4.1 percent after falling 1.4 percent a month earlier. Growth rate significantly higher than the increase of 1.4 per cent expected by economists. Due to the marked increase in import trade surplus fell to a seasonally adjusted to 17.2 billion euro in January from 18.3 billion euros in the previous month . In annualized export growth slowed to 2.9 percent from 4.5 percent in December. Similarly , imports increased by 1.5 percent , which is slower than the growth of 2.4 percent in December.

Another report showed that wholesale inventories in the U.S. rose more than expected in January. According to the data , wholesale inventories rose 0.6 percent in January after rising a revised 0.4 percent increase in December. Economists had expected an increase of 0.5 per cent of reserves compared with 0.3 percent growth , which was originally reported in the previous month. On the other hand, the Commerce Department reported : Wholesale sales fell 1.9 percent in January after rising 0.1 percent the previous month.

British pound retreated from the values against the dollar, but is still trading lower. The pair continues to lose ground in terms of risk aversion dominating the market earlier this week . Mixed data on industrial production in Britain did not have a pair of support , and it remained in the red zone . Note that the volume of industrial production increased by 0.1 percent compared with December . Issue , according to forecasts, had to expand 0.3 percent after 0.5 percent growth in December. Manufacturing output rose by 0.4 percent, the same as in December and remained above the 0.3 percent growth forecast by economists. The annual increase in industrial output accelerated to 2.9 percent from 1.9 percent ..

The course of trade also influenced words representatives of the Bank of England. Today in the British Parliament held a hearing at which the Bank of England and M. Carney MPC members P. Fisher , D. Miles and M. Weale commented on the February inflation report CB. Recall that last month the Bank has changed its policy of transparency, shifting the emphasis from the target threshold unemployment rate of 7% for a number of other factors that should also serve as guidelines in the decision to raise rates . In particular , we are talking about the spare capacity in the economy, productivity growth and wages. Carney noted that the state of the British economy is improving much faster than in the rest of the world . Carney also said that the Central Bank will start folding QE program only after several rate increases , while it does not require consultation with the Treasury on this issue.

The yen rose sharply against the dollar, while escaping with a narrow range , and reaching high yesterday . Currency appreciation can be explained by the reduced demand for safe-haven assets such as equities and commodities , amid concerns about instability in China's financial system . Besides growth of the yen helped drop in copper prices ( fixed for the third day in a row ) to the lowest level since 2010.

We add that the Japanese currency barely reacted to the decision to leave the Bank of Japan interest rates unchanged at 0.10%. Board members unanimously voted to keep monetary policy unchanged. By the end of next meeting confirmed the intention to maintain the policy of increasing the monetary base in the range of 60-70 trillion yen annually . The Bank of Japan also confirmed buyback of government bonds in the amount of government about 50 trillion yen and corporate bonds at 2.2-3.2 trillion .

USD/JPY Y101.00, Y102.25/30, Y102.80/90, Y103.00, Y103.30, Y103.50, Y104.00

EUR/USD $1.3600, $1.3625, $1.3650, $1.3670/80, $1.3700, $1.3770, $1.3800

AUD/USD $0.9070, $0.9075, $0.9200

EUR/GBP stg0.8200, stg0.8300, stg0.8415

USD/CAD Cad1.1000, Cad1.1025, Cad1.1055, Cad1.1120, Cad1.1195, Cad1.1200

GBP/USD $1.6550, $1.6600, $1.6750, $1.6800, $1.6850

USD/CHF Chf0.8780, Chf0.8950

07:00 Germany Current Account January 21.1 Revised From 23.5 13.0 16.2

07:00 Germany Trade Balance January 18.3 Revised From 18.5 19.3 17.2

07:30 Japan BOJ Press Conference

08:00 China New Loans February 1320

09:30 United Kingdom Industrial Production (MoM) January +0.5% Revised From +0.4% +0.3% +0.1%

09:30 United Kingdom Industrial Production (YoY) January +1.9% Revised From +1.8% +3.0% +2.9%

09:30 United Kingdom Manufacturing Production (MoM) January +0.4% Revised From +0.3% +0.3% +0.4%

09:30 United Kingdom Manufacturing Production (YoY) January +1.4% Revised From +1.5% +3.3% +3.3%

09:30 United Kingdom Inflation Report Hearings Quarter IV

10:00 Eurozone ECOFIN Meetings

Euro fell against the U.S. dollar on the background data on the trade balance of Germany. In January, German exports grew more than expected , after a decline in December showed Tuesday, official data agency Destatis.Eksport rose 2.2 percent on a monthly measurement in January , rebounding from the 0.9 percent drop in December. Exports are projected to grow had 1.5 percent . In addition , imports expanded by 4.1 percent after falling 1.4 percent a month earlier. Growth rate significantly higher than the increase of 1.4 per cent expected by economists.

Due to the marked increase in import trade surplus fell to a seasonally adjusted to 17.2 billion euro in January from 18.3 billion euros in the previous month . In annualized export growth slowed to 2.9 percent from 4.5 percent in December. Similarly , imports increased by 1.5 percent , which is slower than the growth of 2.4 percent in December.

On an unadjusted basis the current account surplus was 16.2 billion euros in January, compared with 10.6 billion euro surplus , which saw in the corresponding period last year.

The British pound was down against the U.S. dollar on a background of mixed data on industrial production . In the UK, industrial production growth slowed in January, more than expected , while growth in the manufacturing industry remained stable compared to December showed Tuesday, official data Office for National Statistics .

The volume of industrial production increased by 0.1 percent compared with December . Issue , according to forecasts, had to expand 0.3 percent after 0.5 percent growth in December. Manufacturing output rose by 0.4 percent, the same as in December and remained above the 0.3 percent growth forecast by economists.

The annual increase in industrial output accelerated to 2.9 percent from 1.9 percent. At the same time , growth in the manufacturing industry increased more than doubled to 3.3 percent from 1.4 percent.

Today in the British Parliament held a hearing at which the Bank of England and M. Carney MPC members P. Fisher , D. Miles and M. Weale commented on the February inflation report CB. Recall that last month the Bank has changed its policy of transparency, shifting the emphasis from the target threshold unemployment rate of 7% for a number of other factors that should also serve as guidelines in the decision to raise rates . In particular , we are talking about the spare capacity in the economy, productivity growth and wages.

Carney suggested today that the amount of spare capacity in the economy should be a little more than 1.5% of GDP , while Wil named a figure of less than 1 %. Carney noted that the state of the British economy is improving much faster than in the rest of the world . Over the past few months increased inflation expectations , he said , and suggested that in the next three years, the Bank may raise rates gradually to reach 3.5 %. Carney said that the Central Bank will start folding QE program only after several rate increases , while it does not require consultation with the Treasury on this issue.

EUR / USD: during the European session, the pair fell to $ 1.3833

GBP / USD: during the European session, the pair fell to $ 1.6595

USD / JPY: during the European session, the pair traded in the range Y103.18 - Y103.36

At 14:00 GMT the United States will vacancy rates and labor turnover from the Bureau of Labor Statistics in January . At 15:00 GMT Britain will publish data on the change in GDP from NIESR February . At 20:30 GMT the United States will change in the volume of crude oil , according to the API. At 23:30 GMT Australia will release the consumer confidence index from Westpac in March . At 23:50 GMT Japan will BSI index of business conditions for large manufacturers , business conditions index (BSI) for large enterprises in all sectors for the 1st quarter , the index of activity in the services sector in January .

EUR/USD

Offers $1.3950, $1.3920/25, $1.3900-15, $1.3890

Bids $1.3835/25, $1.3800, $1.3770, $1.3760/50, $1.3710/00, $1.3694

GBP/USD

Offers $1.6785/800, $1.6745/55, $1.6720/25, $1.6700/10, $1.6680/85, $1.6655

Bids $1.6585/80, $1.6555/50, $1.6450

AUD/USD

Offers $0.9150, $0.9100

Bids $0.9005/00, $0.8950, $0.8910/00

EUR/JPY

Offers Y144.50, Y144.00, Y143.75/80, Y143.45/50

Bids Y142.50, Y142.20, Y142.00

USD/JPY

Offers Y104.00, Y103.50

Bids Y103.00, Y102.50, Y102.20

EUR/GBP

Offers stg0.8370/80, stg0.8350/55

Bids stg0.8320, stg0.8280/75, stg0.8190-80

USD/JPY Y101.00, Y102.25/30, Y102.80/90, Y103.00, Y103.30, Y103.50, Y104.00

EUR/USD $1.3600, $1.3625, $1.3650, $1.3670/80, $1.3700, $1.3770, $1.3800

AUD/USD $0.9070, $0.9075, $0.9200

EUR/GBP stg0.8200, stg0.8300, stg0.8415

USD/CAD Cad1.1000, Cad1.1025, Cad1.1055, Cad1.1120, Cad1.1195, Cad1.1200

GBP/USD $1.6550, $1.6600, $1.6750, $1.6800, $1.6850

USD/CHF Chf0.8780, Chf0.8950

05:00 Japan Eco Watchers Survey: Current February 54.7 54.3 53.0

05:00 Japan Eco Watchers Survey: Outlook February 49.0 40.0

A gauge of expected future market swings was near the lowest in 15 months as traders assess the rising tension between Ukraine and Russia.

The Swiss franc was near the strongest level in more than two years as Ukraine began military drills while Russian forces tightened their hold on the Crimean peninsula. Ukraine’s armed forces are testing the combat-readiness of troops, the Defense Ministry said today on its website, reiterating the government’s desire for a peaceful end to the standoff in the former Soviet republic’s eastern provinces.

The yen was little changed after the Bank of Japan reiterated at the end of a two-day policy meeting that it will continue its unprecedented monetary stimulus to stoke inflation. The BOJ kept a pledge to expand the monetary base at a pace of 60 trillion to 70 trillion yen ($677 billion) per year, the central bank said in a statement in Tokyo today, in line with all but one of 34 forecasts in a Bloomberg News poll. The bank lowered its view of exports and lifted its assessments of industrial output and investment.

Australia’s dollar dropped against most major peers after China, the nation’s biggest trade partner, said March 8 exports slid. China’s exports unexpectedly fell 18.1 percent in February from a year earlier, customs data showed March 8, compared with a forecast for an increase of 7.5 percent in a Bloomberg News survey. Imports rose 10.1 percent, leaving a trade deficit of $23 billion, the report showed.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3860-80

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6635-45

USD / JPY: on Asian session the pair traded in the range of Y103.20-45

There is a full calendar on both sides of the Atlantic Tuesday, although data is largely second tier. There is also a meeting of the Ecofin Group, with EU finance ministers athering in Brussels for a breakfast meeting. The calendar gets underway at 0700GMT, with the release of the German January trade balance and the fourth quarter labour cost data. Overall exports are seen higher by 1.5% on month after a fall of 1% in December. At 0900GMT, the Italian fourth quarter GDP data will cross the wires, seen up 0.1% on quarter, down 0.8% on year.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.