- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 16-06-2014

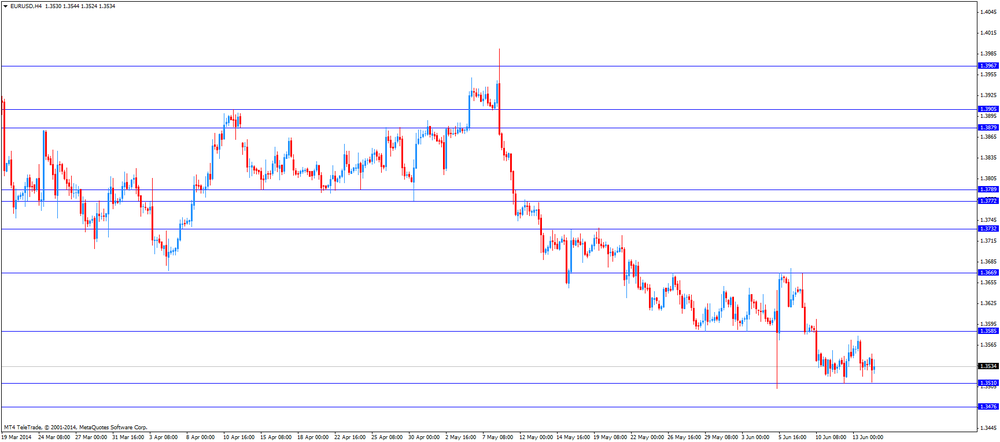

EUR/USD $1,3571 +0,22%

GBP/USD $1,6979 +0,08%

USD/CHF Chf0,8970 -0,31%

USD/JPY Y101,81 -0,21%

EUR/JPY Y138,17 +0,03%

GBP/JPY Y172,86 -0,13%

AUD/USD $0,9398 -0,02%

NZD/USD $0,8676 +0,12%

USD/CAD C$1,0841 -0,10%

01:30 Australia RBA Meeting's Minutes

01:30 Australia New Motor Vehicle Sales (MoM) May 0.0%

01:30 Australia New Motor Vehicle Sales (YoY) May -1.9%

05:45 Switzerland SECO Economic Forecasts Quarter III

07:15 Switzerland Producer & Import Prices, m/m May -0.3% 0.0%

07:15 Switzerland Producer & Import Prices, y/y May -1.2% -0.8%

08:30 United Kingdom Retail Price Index, m/m May +0.4% +0.2%

08:30 United Kingdom Retail prices, Y/Y May +2.5% +2.5%

08:30 United Kingdom RPI-X, Y/Y May +2.6%

08:30 United Kingdom Producer Price Index - Input (MoM) May -1.1% +0.1%

08:30 United Kingdom Producer Price Index - Input (YoY) May -5.5% -4.1%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.0% +0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) May +0.6% +0.8%

08:30 United Kingdom HICP, m/m May +0.4% +0.2%

08:30 United Kingdom HICP, Y/Y May +1.8% +1.7%

08:30 United Kingdom HICP ex EFAT, Y/Y May +2.0%

09:00 Eurozone ZEW Economic Sentiment June 55.2 59.6

09:00 Germany ZEW Survey - Economic Sentiment June 33.1 35.2

12:30 U.S. Building Permits, mln May 1.08 1.07

12:30 U.S. Housing Starts, mln May 1.07 1.04

12:30 U.S. CPI, m/m May +0.3% +0.2%

12:30 U.S. CPI, Y/Y May +2.0% +2.0%

12:30 U.S. CPI excluding food and energy, m/m May +0.2% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y May +1.8% +1.8%

20:30 U.S. API Crude Oil Inventories June +1.5

22:45 New Zealand Current Account Quarter I -1.43 1.42

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan Adjusted Merchandise Trade Balance, bln May -808.9 -1100

The U.S.

dollar traded mixed against the most major currencies after the economic

reports in the U.S. The lowering forecast of the U.S. economic growth by the International

Monetary Fund (IMF) weighed on the U.S. The IMF expects the U.S. economy to grow

2% in 2014, down from its forecast of 2.8% in April.

On the

other side, the U.S. currency was supported by concerns over escalating

violence in Iraq and the better-than-expected economic data.

The NAHB housing

market index in the U.S. increased to 49 in June from 45 in May, exceeding

expectations for a gain to 47.

The

capacity utilisation in U.S. climbed to 79.1% in May from 78.6% in April,

beating expectations for a rise to 78.9%.

The U.S. industrial

production rose a seasonally adjusted 0.6% in April, in line with forecasts,

after a 0.6% decline in March.

NY Fed

Empire State manufacturing index increased to 19.3 in June from 19.0 in May, exceeding

expectations from a decline to 15.2.

The euro increased

against the U.S. dollar due to speculation the European Central Bank will not

add further stimulus measures.

Eurozone’s

harmonized consumer price index declined 0.1% in May, meeting expectations,

after a 0.2% gain in April. On a yearly basis, harmonized consumer price index

in the Eurozone climbed 0.5%, as expected.

The core

inflation (excluding energy and food) in the Eurozone rose 0.7%, in line with

forecasts.

The British

pound traded lower against the U.S. dollar, but remained supported by the last

week’s comments of the Bank of England (BoE) Governor Mark Carney. He said the

BoE may raise its key interest rate earlier than investors expected.

The

Canadian dollar dropped against the U.S. dollar ahead of the foreign securities

purchases in Canada. The foreign securities purchases in Canada rose to 10.13

billion CAD in April, exceeding expectations for a gain to 4.27, after -1.41

billion CAD in March.

The New

Zealand dollar traded mixed against the U.S dollar. The Westpac index of

consumer sentiment for Q2 declined to 121.2 from 121.7 the previous quarter.

The

Australian dollar traded mixed against the U.S. dollar in the absence of any

economic reports in Australia.

The Reserve

Bank of Australia Assistant Governor Christopher Kent said today that the

unemployment rate in Australia will remain elevated for the next two years. He

added moderate wage growth and better productivity should help the economy. Mr.

Kent also pointed out “a decline in the real exchange rate is one important way

in which the economy can adjust to the decline in the terms of trade”.

The

Japanese yen mixed against the U.S. dollar. The yen was supported by the

increasing demand for safe-haven currency. The increasing demand for safe-haven

currency was driven by escalating violence in Iraq. No economic reports were

released in Japan.

The Bank of

Japan (BoJ) released its monthly economic report. The BoJ said Japan's economy

has continued to recover moderately as a trend, but there is a decline in

demand following caused by the consumption tax hike.

EUR/USD $1.3500, $1.3560, $1.3630, $1.3635

USD/JPY Y101.95, Y102.20/25, Y102.30/40, Y102.50, Y103.00

USD/CAD Cad1.0855

AUD/USD $0.9260, $0.9345, $0.9350, $0.9365

USD/CHF Chf0.9100

NZD/USD NZ$0.8575

Economic calendar (GMT0):

03:20 Australia

RBA Assist Gov Kent Speaks

05:00 Japan

BoJ monthly economic report June

09:00 Eurozone Harmonized CPI May +0.2% -0.1% -0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May +0.5% +0.5% +0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y May +0.7% +0.7% +0.7%

The U.S.

dollar traded higher against the most major currencies ahead of the release of

economic reports in the U.S. The U.S.

currency was supported by concerns over escalating violence in Iraq.

The euro traded

lower against the U.S. dollar. Eurozone’s harmonized consumer price index

declined 0.1% in May, meeting expectations, after a 0.2% gain in April. On a

yearly basis, harmonized consumer price index in the Eurozone climbed 0.5%, as

expected.

The core

inflation (excluding energy and food) in the Eurozone rose 0.7%, in line with

forecasts.

The British

pound traded lower against the U.S. dollar, but remained supported by the last

week’s comments of the Bank of England (BoE) Governor Mark Carney. He said the

BoE may raise its key interest rate earlier than investors expected.

The

Canadian dollar dropped against the U.S. dollar ahead of the foreign securities

purchases in Canada. The foreign securities purchases in Canada should rise to

4.27 billion CAD in April, after -1.23 billion CAD in March.

EUR/USD:

the currency pair declined to $1.3511

GBP/USD:

the currency pair decreased to $1.6958

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases April -1.23

4.27

12:30 U.S. NY Fed Empire State manufacturing

index June 19.0

15.2

13:00 U.S. Net Long-term TIC Flows April 4.0 41.3

13:00 U.S. Total Net TIC Flows

April -126.1

13:15 U.S.

Industrial Production

(MoM) May -0.6%

+0.6%

13:15 U.S. Capacity Utilization

May 78.6% 78.9%

14:00 U.S. NAHB Housing Market Index June 45 47

EUR/USD

Bids $1.3500, $1.3485/80, $1.3460/50

GBP/USD

Offers $1.7080/85, $1.7040/50, $1.7015-20, $1.6995/00

Bids $1.6950, $1.6930/20, $1.6910/00, $1.6885/80

AUD/USD

Offers $0.9500, $0.9450

Bids $0.9350, $0.9320, $0.9300

EUR/JPY

Offers Y139.20, Y139.00, Y138.80, Y138.50

Bids Y137.50, Y137.20, Y137.00, Y136.50

USD/JPY

Offers Y102.75/80, Y102.50

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900, stg0.7850

EUR/USD $1.3500, $1.3560, $1.3630, $1.3635

USD/JPY Y101.95, Y102.20/25, Y102.30/40, Y102.50, Y103.00

USD/CAD Cad1.0855

AUD/USD $0.9260, $0.9345, $0.9350, $0.9365

USD/CHF Chf0.9100

NZD/USD NZ$0.8575

Economic

calendar (GMT0):

03:20 Australia RBA Assist Gov Kent Speaks

05:00 Japan BoJ monthly economic report June

The U.S.

dollar traded mixed against the most major currencies. Friday’s

weaker-than-expected U.S. economic data and escalating violence in Iraq weighed

on markets. The U.S. producer price index decreased 0.2% in May, missing

expectations for a 0.1% increase, after a 0.6 rise in April. The U.S. producer price index excluding food

and energy declined 0.1% in May, missing expectation for a 0.2% rise, after a

0.5% gain in April.

Reuters/Michigan

consumer sentiment index for the U.S. fell to 81.2 in June from 81.9 in May,

missing expectations for a rise to 83.2.

The

violence in Iraq could lead to disruptions in the oil supplies in OPEC’s

second-biggest oil producer. U.S. president Barack Obama warned to use air

strikes to help the government in Baghdad.

The New

Zealand dollar traded higher against the U.S dollar due to the Friday’s weaker

economic data from U.S. The Westpac index of consumer sentiment for Q2 declined

to 121.2 from 121.7 the previous quarter.

The

Australian dollar traded higher against the U.S. dollar in the absence of any

economic reports in Australia.

The Reserve

Bank of Australia Assistant Governor Christopher Kent said today that the unemployment

rate in Australia will remain elevated for the next two years. He added moderate

wage growth and better productivity should help the economy. Mr. Kent also

pointed out “a decline in the real exchange rate is one important way in which

the economy can adjust to the decline in the terms of trade”.

The

Japanese yen increased against the U.S. dollar due to the increasing demand for

safe-haven currency. The increasing demand for safe-haven currency was driven

by escalating violence in Iraq. No economic reports were released in Japan.

The Bank of

Japan (BoJ) released its monthly economic report. The BoJ said Japan's economy

has continued to recover moderately as a trend, but there is a decline in

demand following caused by the consumption tax hike.

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair traded mixed

USD/JPY:

the currency pair declined to Y101.75

The most

important news that are expected (GMT0):

09:00 Eurozone Harmonized CPI May +0.2% -0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May +0.5% +0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y May +0.7% +0.7%

12:30 Canada Foreign Securities Purchases April -1.23 4.27

12:30 U.S. NY Fed Empire State manufacturing index June 19.0 15.2

13:00 U.S. Net Long-term TIC Flows April 4.0 41.3

13:00 U.S. Total Net TIC Flows April -126.1

13:15 U.S. Industrial Production (MoM) May -0.6% +0.6%

13:15 U.S. Capacity Utilization May 78.6% 78.9%

14:00 U.S. NAHB Housing Market Index June 45 47

EUR / USD

Resistance levels (open interest**, contracts)

$1.3643 (3003)

$1.3615 (1555)

$1.3575 (71)

Price at time of writing this review: $ 1.3543

Support levels (open interest**, contracts):

$1.3511 (1010)

$1.3495 (3712)

$1.3473 (4546)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 28378 contracts, with the maximum number of contracts with strike price $1,3700 (3448);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 40990 contracts, with the maximum number of contractswith strike price $1,3500 (4904);

- The ratio of PUT/CALL was 1.44 versus 1.46 from the previous trading day according to data from June, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.7201 (1215)

$1.7103 (1819)

$1.7006 (2050)

Price at time of writing this review: $1.6981

Support levels (open interest**, contracts):

$1.6894 (840)

$1.6797 (1385)

$1.6699 (1947)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 17332 contracts, with the maximum number of contracts with strike price $1,7000 (2050);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 20720 contracts, with the maximum number of contracts with strike price $1,6750 (2247);

- The ratio of PUT/CALL was 1.20 versus 1.12 from the previous trading day according to data from June, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.