- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 17-09-2015

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1415 +1,11%

GBP/USD $1,5582 +0,58%

USD/CHF Chf0,962 -0,91%

USD/JPY Y120,19 -0,32%

EUR/JPY Y137,21 +0,79%

GBP/JPY Y187,26 +0,25%

AUD/USD $0,7165 -0,33%

NZD/USD $0,6354 -0,28%

USD/CAD C$1,3179 +0,05%

(time / country / index / period / previous value / forecast)

08:00 Eurozone Current account, unadjusted, bln July 31.1

11:05 United Kingdom MPC Member Andy Haldane Speaks

12:30 Canada Consumer Price Index m / m August 0.1% 0%

12:30 Canada Consumer price index, y/y August 1.3% 1.3%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August 2.4% 2.1%

14:00 U.S. Leading Indicators August -0.2% 0.2%

The Italian statistical office Istat released its trade data for Italy on Thursday. Italy' trade surplus increased to a seasonally adjusted €8.0 billion in July from €6.9 billion in June.

Exports fell 0.4% in July, while imports decreased 3.7%.

On a yearly basis, exports climbed 6.3% in July, while imports rose 4.2%.

The trade surplus with the EU was €3 billion in July, while the trade surplus with non-EU countries was €5.0 billion.

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index slid to -6.0 in September from 8.3 in August, missing expectations for a decline to 6.0. It was the first negative reading since February 2014.

A reading above zero indicates expansion.

The shipments index was down 14.8 in September from 16.7 in August.

The new orders index increased to 9.4 in September from 5.8 in August.

The prices paid index slid to 0.5 in September from 6.2 in August, while the prices received index decreased to -5.0 from -4.9.

The number of employees index rose to 10.2 in September from 5.3 last month.

According to the report, the future general activity index rose to 44.0 in September from 43.1 in August.

The Eurostat released its construction production data for the Eurozone on Thursday. Construction production in the Eurozone increased 1.0% in July, after a 1.2% decline in June. It was the biggest rise since August 2014.

The rise was driven by higher output in civil engineering and in building. Civil engineering output climbed 1.0% in July, while production in the building sector was up 0.9%.

On a yearly basis, construction output increased 1.8% in July, after a 1.3% drop in June.

Civil engineering climbed by 3.9% year-on-year and building construction was up by 1.3%.

EUR/USD: $1.1100(E465mn), $1.1300(E330mn)

USD/JPY: Y120.00($500mn), Y120.25($450mn), Y121.00(2.8bn), Y121.10/15($800mn)

USD/CAD: Cad1.3125($300mn), Cad1.3300($600mn)

AUD/USD: $0.7195/00(A$1.8bn)

NZD/USD: $0.6275(NZ301mn)

EUR/JPY: Y133.00(E200mn), Y138.30(E275mn)

AUD/JPY: Y88.00(A$1.4bn)

AUD/NZD: $1.1335/40(A$460mn)

The Hellenic Statistical Authority released its labour market data for Greece on Thursday. The Greek unemployment rate declined to 24.6% in the second quarter from 26.6% in the previous quarter.

The number of unemployed people fell by 7.3% to 1.2 million in the second quarter.

The youth unemployment rate was down to 49.5% in the second quarter from 51.9% in the first quarter.

The U.S. Commerce Department released its current account data on Thursday. The U.S. current account deficit narrowed to $109.7 billion in the second quarter from $118.3 billion in the first quarter, beating expectations for a deficit of $111.3 billion. The first quarter's figure was revised up from a deficit of $113.3 billion.

The trade deficit decreased due to smaller deficits on goods and secondary income.

Exports of goods rose to $384.8 billion in second quarter from $382.8 billion in the first quarter, while goods imports fell to $573.1 billion from $575.0 billion.

The surplus on primary income climbed to $50.6 billion in the second quarter from $49.7 billion in the first quarter.

The U.S. Commerce Department released the housing market data on Thursday. Housing starts in the U.S. declined 3.0% to 1.126 million annualized rate in August from a 1,161 million pace in July, missing expectations for an increase to 1.170 million.

July's figure was revised down from 1.206 million units.

The decrease was driven by falls in starts of single-family and multifamily homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. rose 3.5% to 1.170 million annualized rate in August from a 1.130 million pace in July.

Analysts had expected building permits to climb to 1.160 million units.

Starts of single-family homes fell 3.0% in August. Building permits for single-family homes were up 2.8%.

Starts of multifamily buildings decreased 3.0% in August. Permits for multi-family housing jumped 4.7%.

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending September 12 in the U.S. declined by 11,000 to 264,000 from 275,000 in the previous week. Analysts had expected the initial jobless claims to remain unchanged at 275,000.

Jobless claims remained below 300,000 the 28th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 26,000 to 2,237,000 in the week ended September 5.

The European Central Bank (ECB) released its economic bulletin on Thursday. The central bank noted that the downside risk to the growth and inflation increased.

The economy in the Eurozone is expected to grow at a weaker pace than previously projected. The ECB pointed out that it could extend its asset-buying programme if needed.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Bulletin

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision -0.75% -0.75% -0.75%

07:30 Switzerland SNB Monetary Policy Assessment

08:30 United Kingdom Retail Sales (MoM) August 0.1% 0.2% 0.2%

08:30 United Kingdom Retail Sales (YoY) August 4.1% Revised From 4.2% 3.8% 3.7%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. Housing starts in the U.S. are expected to decline to 1.170 million units in August from 1.206 million units in July.

The number of building permits is expected to rise to 1.160 million units in August from 1.130 million units in July.

The number of initial jobless claims in the U.S. is expected to remain unchanged at 275,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to decrease to 6.0 in September from 8.3 in August.

The Fed will release its interest rate decision at 18:00 GMT.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded higher against the U.S. dollar after the mixed U.K. retail sales data. The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 0.2% in August, in line with expectations, after a 0.1% rise in July.

The higher growth was partly driven by higher sales of clothing and footwear, which climbed 2.3% in August.

Food sales fell 0.9% in August.

On a yearly basis, retail sales in the U.K. climbed 3.7% in August, missing forecasts of 3.8% increase, after a 4.1% rise in July. July's figure was revised down from a 4.2% gain.

The Swiss franc traded higher against the U.S. dollar after the release of the Swiss National Bank's (SNB) interest rate decision. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market as the Swiss franc is significantly overvalued and effects inflation and economic growth.

Inflation was downgraded to -1.2% in 2015 from the previous forecast of -1.0% and to be -0.5% in 2016, down from the previous forecast -0.4%. The SNB upgraded to 0.4% in 2017, up from the previous forecast of 0.3%.

The central bank noted that the Swiss economy rose slightly in the second quarter, while employment declined further.

The SNB expects the Swiss economy to return to positive growth in the second half of 2015. Real GDP for 2015 is expected to be about 1%.

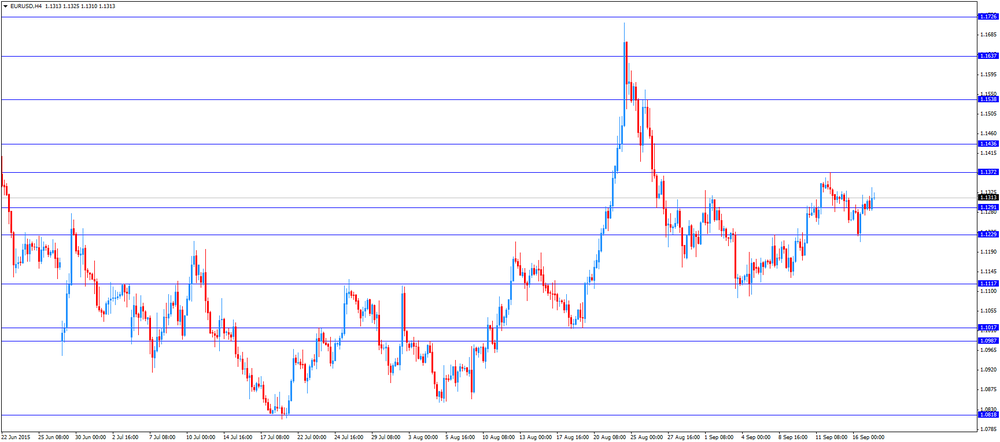

EUR/USD: the currency pair increased to $1.1337

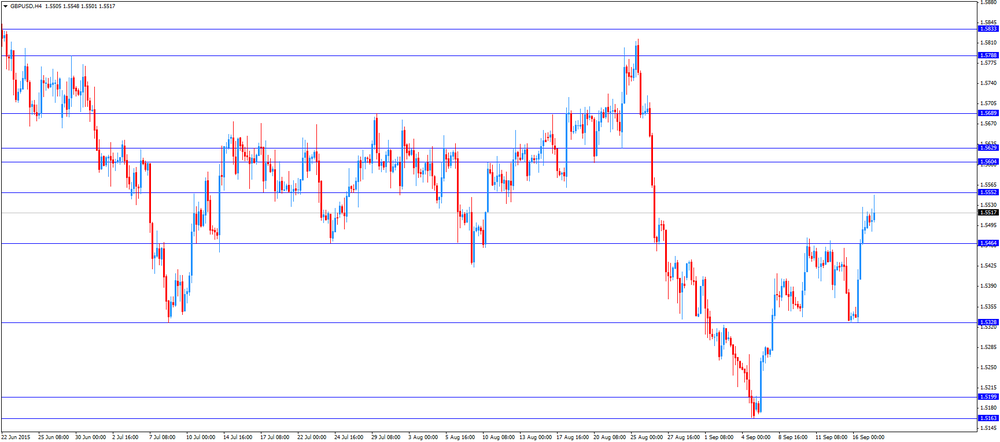

GBP/USD: the currency pair rose to $1.5548

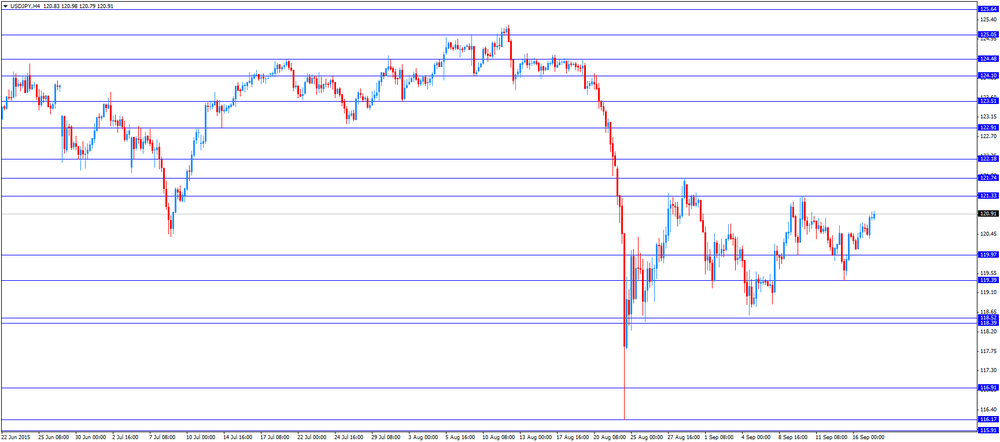

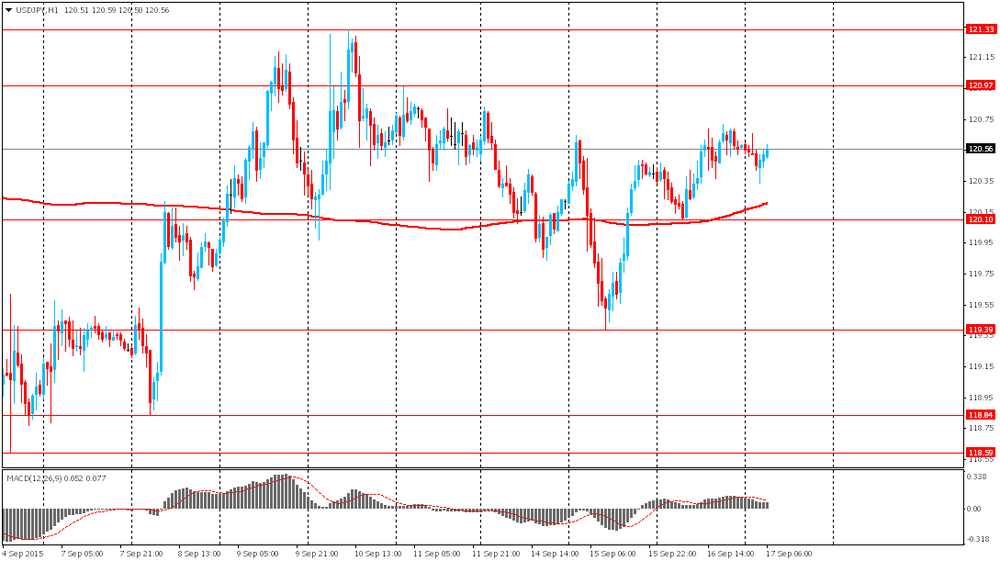

USD/JPY: the currency pair climbed to Y120.98

The most important news that are expected (GMT0):

12:30 U.S. Continuing Jobless Claims September 2260 2260

12:30 U.S. Current account, bln Quarter II -113.3 -111.3

12:30 U.S. Housing Starts August 1206 1170

12:30 U.S. Building Permits August 1130 1160

12:30 U.S. Initial Jobless Claims September 275 275

14:00 U.S. Philadelphia Fed Manufacturing Survey September 8.3 6.0

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

23:30 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Monetary Policy Meeting Minutes

EUR/USD

Offers 1.1320 1.1330-35 1.1355-60 1.1375 1.1390-1.1400 1.1420 1.1450

Bids 1.1285 1.1260 1.1245 1.1225 1.1200 1.1185 1.1165 1.1150 1.1130 1.1100

GBP/USD

Offers 1.5530 1.5550 1.5580-85 1.5600 1.5620 1.5650 1.5685 1.5700-10

Bids 1.5500 1.5485 1.5465 1.5450 1.5425-30 1.5400 1.5380 1.5350 1.5330 1.5300

:

EUR/GBP

Offers 0.7325-30 0.7355-60 0.7380-85 0.7400 0.7425 0.7450

Bids 0.7280-85 0.7260-65 0.7250 0.7230 0.7200

EUR/JPY

Offers 137.00 137.50 138.00

Bids 136.00-10 135.25 135.00 134.80-85 134.65 134.50 134.30 134.00

USD/JPY

Offers 121.00 121.15 121.25 121.50 121.80 122.00 122.30 122.50 122.75 123.00

Bids 120.65 120.50 120.25-30 120.00-10 119.85 119.65 119.50 119.30 119.00 118.85 118.50

AUD/USD

Offers 0.7200 -10 0.7225 0.7250 0.7265 0.7280 0.7300

Bids 0.7155-60 0.7125-30 0.7100 0.7085 0.7065 0.7045-50 0.7020 0.7000

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Thursday that the central bank will adjust its asset-buying programme if needed.

"The bank will make necessary adjustments on monetary policy, while examining both upside and downside risks on the economy and prices," he said.

Kuroda pointed out that the BoJ's 2% inflation target will be reached once the oil prices stabilise.

The BoJ governor also said that the global economy continued to grow moderately due to a strong growth in U.S. and other advanced economies.

The State Secretariat for Economic Affairs (SECO) released its GDP and inflation forecasts on Thursday. The agency upgraded its 2015 growth forecast to 0.9% from 0.8%. GDP for 2016 was downgraded to 1.5% from 1.6%.

"The economy will remain very subdued in the second half of the year and is likely to only start to strengthen again during the course of 2016," the SECO.

The agency noted that the downside risk to the Swiss economy increased since June due to the slowdown in emerging market.

The average annual unemployment rate is expected to be 3.3% this year and 3.6% next year.

The consumer price inflation is expected to be -1.1% in 2015 and +0.1% in 2016.

The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market as the Swiss franc is significantly overvalued and effects inflation and economic growth.

Inflation was downgraded to -1.2% in 2015 from the previous forecast of -1.0% and to be -0.5% in 2016, down from the previous forecast -0.4%. The SNB upgraded to 0.4% in 2017, up from the previous forecast of 0.3%.

The central bank noted that the Swiss economy rose slightly in the second quarter, while employment declined further.

The SNB expects the Swiss economy to return to positive growth in the second half of 2015. Real GDP for 2015 is expected to be about 1%.

Domestic demand should provide further support to the economy, according to the SNB.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 0.2% in August, in line with expectations, after a 0.1% rise in July.

The higher growth was partly driven by higher sales of clothing and footwear, which climbed 2.3% in August.

Food sales fell 0.9% in August.

On a yearly basis, retail sales in the U.K. climbed 3.7% in August, missing forecasts of 3.8% increase, after a 4.1% rise in July. July's figure was revised down from a 4.2% gain.

Statistics New Zealand released its GDP data on late Wednesday evening. New Zealand's GDP rose 0.4% in the second quarter, missing expectations for a 0.5% increase, after a 0.2% gain in the first quarter.

On a yearly basis, New Zealand's GDP climbed by 2.4% in the second quarter, missing expectations for a 2.5% gain, after a 2.7% rise in the first quarter. The first quarter's figure was revised up from a 2.6% rise.

The increase was driven by a rise in the service and primary industries.

The services sector rose 0.5% in the second quarter, while agriculture climbed 3.0% in Q2 as the meat and dairy production increased.

Bank of England (BoE) Governor Mark Carney repeated on Wednesday that it will become clearer "around the turn of this year" whether to start raising interest rates or not.

Carney pointed out that it is necessary that GDP and wages will to continue to rise and the inflation will start to firm up before start raising interest rates.

"Then the decision comes into sharper relief and it may become appropriate to begin to withdraw stimulus," he said.

French Finance Minister Michel Sapin said on Wednesday the government spending is falling, and the government will meet its budget target for the "first time in years."

The government forecasted the country's economy to expand 1% this year and 1.5% next year. The budget deficit is expected to be 3.8% of GDP in 2015, 3.3% in 2016 and below 3% in 2017.

The government debt is expected to below 100% of GDP in 2016, Sapin said.

The Ministry of Finance released its trade data for Japan on the late Wednesday evening. Japan's trade deficit widened to ¥569.7 billion in August from a deficit of ¥268.1 billion in July. Analysts had expected a deficit of ¥541.3 billion.

The adjusted trade deficit was ¥358.8 billion in August, down from a deficit of ¥375.1 billion in July. July's figure was revised up from a deficit of ¥368.8 billion.

Exports rose 3.1% year-on-year, while imports dropped 3.1%.

Exports to Asia climbed by 1.1% year-on-year, exports to the United States increased by 11.1%, exports to China dropped by 4.6%, while exports to the European Union were down 0.2%.

Imports from Asia climbed 7.4% year-on-year, imports from the United States jumped 5.4%, and imports from China gained 14.6%, while imports from the European Union rose 21.8%.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1458 (3232)

$1.1408 (1435)

$1.1354 (652)

Price at time of writing this review: $1.1291

Support levels (open interest**, contracts):

$1.1224 (441)

$1.1186 (934)

$1.1136 (2229)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 49391 contracts, with the maximum number of contracts with strike price $1,1600 (4733);

- Overall open interest on the PUT options with the expiration date October, 9 is 65940 contracts, with the maximum number of contracts with strike price $1,1000 (6711);

- The ratio of PUT/CALL was 1.34 versus 1.32 from the previous trading day according to data from September, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.5803 (1128)

$1.5705 (1391)

$1.5608 (1372)

Price at time of writing this review: $1.5502

Support levels (open interest**, contracts):

$1.5391 (861)

$1.5294 (1169)

$1.5196 (2742)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 22283 contracts, with the maximum number of contracts with strike price $1,5500 (1637);

- Overall open interest on the PUT options with the expiration date October, 9 is 20786 contracts, with the maximum number of contracts with strike price $1,5200 (2742);

- The ratio of PUT/CALL was 0.93 versus 0.99 from the previous trading day according to data from September, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia RBA Bulletin

The euro climbed slightly against the U.S. dollar amid a weak inflation report from the U.S. However the single currency was also weighed by euro zone inflation data. U.S. Bureau of Labor Statistics reported on Wednesday that consumer prices declined slightly in August marking their first decline since January. Prices were generally dragged down by low energy costs. The consumer price index fell by 0.1% in August after a 0.1% rise in July. The core index rose by 0.1%. Economists expected the CPI to stay unchanged, while the gain in the core CPI was in line with forecasts.

At the beginning of this session the New Zealand dollar declined against the greenback amid disappointing GDP data. New Zealand's GDP rose by 0.4% in the second quarter compared to +0.2% reported previously, but it fell short of expectations for a 0.5% rise. On an annualized basis the index came in at 2.4% vs 2.7% previous and 2.5% expected. However later on the NZD recovered amid the greenback's general weakness.

Investors are cautious ahead of the end of the FOMC's meeting. A survey by the Wall Street Journal showed that approximately 46% of the economists surveyed last week expect the Fed to raise rates in September. 35% of economists said the Fed would raise rates in December and 9.5% said they expect a liftoff in 2016. At the same time Barclays surveyed 700 investors last week and only 36% of the respondents believe that the central bank of the U.S. will raise rates in September.

EUR/USD: the pair fluctuated within $1.1285-15 in Asian trade

USD/JPY: the pair fluctuated around Y120.60

GBP/USD: the pair traded within $1.5495-15

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision -0.75% -0.75%

07:30 Switzerland SNB Monetary Policy Assessment

08:30 United Kingdom Retail Sales (MoM) August 0.1% 0.2%

08:30 United Kingdom Retail Sales (YoY) August 4.2% 3.8%

12:30 U.S. Continuing Jobless Claims September 2260 2260

12:30 U.S. Current account, bln Quarter II -113.3 -111.3

12:30 U.S. Housing Starts August 1206 1170

12:30 U.S. Building Permits August 1130 1160

12:30 U.S. Initial Jobless Claims September 275 275

14:00 U.S. Philadelphia Fed Manufacturing Survey September 8.3 6.0

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

23:30 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Monetary Policy Meeting Minutes

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.