- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 18-07-2013

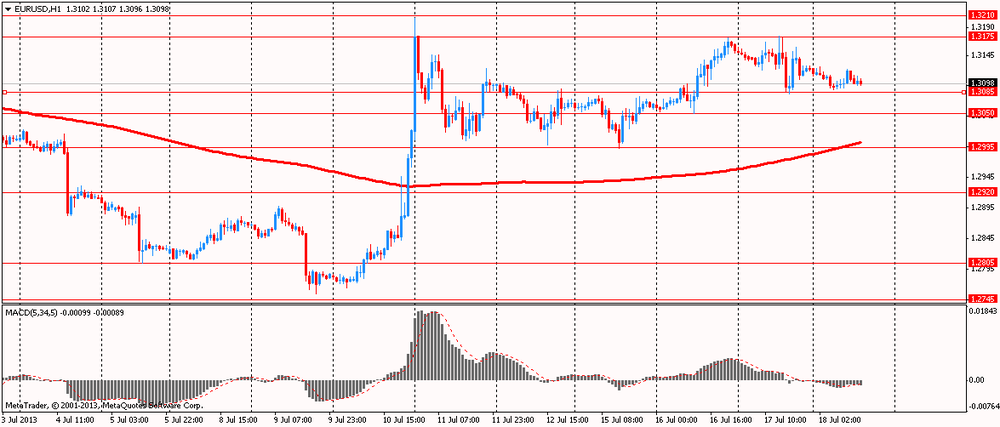

The euro rose sharply against the dollar, recovering with most of the previously lost positions. Note that the initial pressure on the currency has had a report which showed that the current account surplus euro zone fell in May compared with the previous month, mainly due to a higher deficit in current transfers and a reduction in income, according to the European Central Bank. The seasonally adjusted current account surplus fell to EUR19.6 billion in May from an upwardly revised EUR23.8 billion in April. In March, the balance amounted to EUR23.1 billion. The cause of the deterioration was the deficit in current transfers, which increased to EUR9.8 billion in May, compared with EUR7.5 billion in April. Account surplus revenues decreased to EUR4.9 billion from EUR5.2 billion.

Also contributed to the fall in the euro on U.S. data. After reporting a significant increase in initial claims for unemployment benefits in the U.S. last week, the Labor Department released a report that showed that last week the number of initial claims for unemployment benefits fell more than expected. The report states that the primary applications for unemployment benefits in the U.S. for the week July 7-13 fell by 24 thousand to 334 thousand, the consensus forecast of 349 thousand secondary applications for unemployment benefits in the U.S. for the week June 30 - July 6 rose 91 thousand to 3.114 million Initial Claims for unemployment benefits in the U.S. for the week June 30 - July 6 revised to 358 thousand from 360 thousand

An important event that turned the tide in favor of the euro currency trading, was the speech from Fed Chairman Ben Bernanke, who told the Senate that the decision had been taken that the central bank will cut its September meeting, the bond purchase program of $ 85 billion a month.

Many analysts on Wall Street have chosen a meeting mid-September as the most likely point when the Fed may make the first cut of the program, in part because after the meeting scheduled press conference. According to analysts, Fed officials will want to Bernanke explained the decision when it is taken, more than this, it may be done in an official statement.

Replying to questions in the Senate Banking Committee, Bernanke dismissed the date as something predestined. According to Bernanke, the decision to initiate folding of the program will depend on whether the Fed sees that the improvement in the economy, which it expects in the second half of the year. In the meantime, did not leave a lot of data since the last Fed meeting, held on June 18-19, after which he set out the approximate time to minimize the program. And the data that came out after the June meeting were "mixed," he said.

The pound rose against the dollar, which primarily was due to the release of data on retail sales in the UK, which rose sharply in the 2nd quarter. This is another indication that the economic recovery that began in the 1st quarter, gained momentum in April-June. According to the data of the National Bureau of Statistics (ONS), retail sales in the 2nd quarter, up 0.9%. This strong performance is similar to the dynamics of the third quarter of 2012, when sales benefited from the growth in consumer spending in the London Olympics. This growth is likely to add 0.1 percentage points to growth in gross domestic product in the 2nd quarter, said a spokesman for ONS. In the 1st quarter of the year, GDP grew by 0.3% after a similar reduction in the 4th quarter of 2012. Data on retail sales correspond to the polls, according to which the recovery is gaining momentum in the 2nd quarter. According to the report ONS, published on Thursday, retail sales rose in June by 0.2% compared with the previous month, slightly above economists' forecasts. Compared with the same period last year, sales were up 2.2%.

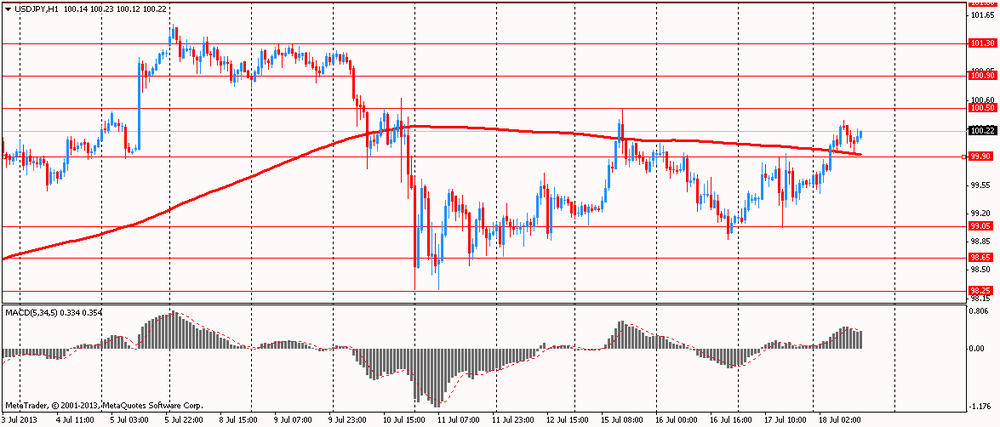

The yen weakened against most major currencies on expectations that the meeting of finance ministers and central bankers of Twenty (G-20), ultra loose monetary policy in Japan will not be condemned by the representatives of the G-20. So Russian Deputy Finance Minister Sergei Storchak said the policy will probably not encourage the Japanese authorities to reduce incentives designed to accelerate the rate of inflation to 2%. As stated in an interview with the Deputy Minister of Economy Nishimura: "The members of the G-20 well aware of the situation in Japan." Recall that since April, the Bank of Japan monthly buys bonds worth more than $ 70 billion, after Japanese Prime Minister Shinzo Abe has instructed the central bank to take steps to overcome deflation.

With leading U.S. economic indicators turning in a mixed performance in June, the Conference Board released a report on Thursday showing that its leading economic index came in unchanged for the month.

The Conference Board said its leading economic index was flat in June after edging up by 0.2 percent in May and jumping by 0.8 percent in April. Economists had expected the index to rise by 0.3 percent.

EUR/USD $1.3035, $1.3050, $1.3100, $1.3150, $1.3170, $1.3185, $1.3200, $1.3300

USD/JPY Y98.75, Y99.00, Y99.40, Y99.50, Y100.00, Y100.50, Y101.00

GBP/USD $1.4900, $1.5000, $1.5200, $1.5235, $1.5250, $1.5260

EUR/GBP stg0.8600, stg0.8630, stg0.8725

USD/CHF Chf0.9500, Chf0.9625

EUR/CHF Chf1.2325

AUD/USD $0.9000, $0.9100, $0.9200, $0.9210, $0.9250, $0.9280, $0.9300, $0.9200

NZD/USD $0.7995

USD/CAD C$1.0290, C$1.0375

Wholesale trade in Canada surged in May, recording the fastest one-month rate of growth in over two years, on strong sales of fertilizer and food, Statistics Canada said Thursday.

Month-over-month wholesale trade climbed 2.3% to 50.34 billion Canadian dollars ($48.34 billion), blowing away market expectations for a 0.3% advance, according to economists at Royal Bank of Canada.

The last time wholesale trade recorded a monthly gain this big was in January 2011, when it rose 2.4%.

The April data were also revised higher, indicating wholesale trade rose 0.4% in the month to C$49.23 billion versus the previous estimate of a 0.2% gain.

In volume terms, wholesale sales advanced 2.4%.

Wholesalers - which account for the largest portion of the service sector - generally act as an intermediary in the distribution of merchandise. As a result, many wholesalers tend to sell merchandise in large quantities to retailers, businesses and institutional clients.

Wholesale trade advanced in all categories tracked by Statistics Canada, but the data agency said two sectors stood out: sales of agricultural supplies, which advanced 19.6% on higher-than-usual demand for fertilizer; and food industry shipments, which climbed 4.2%.

On a year-over-year basis, wholesale sales gained 0.8%.

Inventories remained unchanged in May, at C$61.82 billion, after rising 0.5% in April.

The inventory-to-sales ratio -- which measures the time in months required to exhaust stockpiles if sales remain at present levels -- declined to 1.23:1 in May from 1.26:1 in April.

After reporting a notable increase in first-time claims for U.S. unemployment benefits in the previous week, the Labor Department released a report on Thursday showing that initial jobless claims pulled back by more than expected in the week ended July 13th.

The report said initial jobless claim fell to 334,000, a decrease of 24,000 from the previous week's revised figure of 358,000. Economists had been expecting jobless claims to dip to 345,000 from the 360,000 originally reported for the previous week.

06:00 Switzerland Trade Balance June 2.12 Revised From 2.22 2.41 2.73

08:00 Eurozone Current account, adjusted, bln May 23.8 Revised From 19.5 21.3 19.6

08:30 United Kingdom Retail Sales (MoM) June +2.1% +0.4% +0.2%

08:30 United Kingdom Retail Sales (YoY) June +2.1% Revised From +1.9% +1.8% +2.2%

The pound rose after the release of data on retail sales in the UK, which rose sharply in the 2nd quarter. This is another indication that the economic recovery that began in the 1st quarter, gained momentum in April-June. According to the data of the National Bureau of Statistics (ONS), retail sales in the 2nd quarter, up 0.9%. This strong performance is similar to the dynamics of the third quarter of 2012, when sales benefited from the growth in consumer spending in the London Olympics. This growth is likely to add 0.1 percentage points to growth in gross domestic product in the 2nd quarter, said a spokesman for ONS. In the 1st quarter of the year, GDP grew by 0.3% after a similar reduction in the 4th quarter of 2012. Data on retail sales correspond to the polls, according to which the recovery is gaining momentum in the 2nd quarter. According to the report ONS, published on Thursday, retail sales rose in June by 0.2% compared with the previous month, slightly above economists' forecasts. Compared with the same period last year, sales were up 2.2%.

The yen weakened against most major currencies on expectations that the meeting of finance ministers and central bankers of Twenty (G-20), ultra loose monetary policy in Japan will not be condemned by the representatives of the G-20. So Russian Deputy Finance Minister Sergei Storchak said the policy will probably not encourage the Japanese authorities to reduce incentives designed to accelerate the rate of inflation to 2%. As stated in an interview with the Deputy Minister of Economy Nishimura: "The members of the G-20 well aware of the situation in Japan." Recall that since April, the Bank of Japan monthly buys bonds worth more than $ 70 billion, after Japanese Prime Minister Shinzo Abe has instructed the central bank to take steps to overcome deflation.

Euro traded near a six-week high against the yen after the Greek parliament passed a package of laws on the reduction of the public sector is a prerequisite for the release of the next tranche of aid to the country from international lenders. The new rules require the dismissal of more than four thousand civil servants up to the end of the year. In addition, in the near future another 25 thousand people. Approval of a new package of laws was a prerequisite for Greece a loan of 6.8 billion euros from the EU and the International Monetary Fund.

It is worth noting that today, a one-day visit to Athens visited the German Finance Minister Wolfgang Schaeuble. During a joint press conference in Athens with Greek Finance Minister Schaeuble praised Greece's efforts to implement the austerity program, but stressed that more needs to be done. As expected, the German finance minister also announced the country's readiness to provide financial assistance in the amount of 100 million euros Greek companies through development bank KfW. Greek Finance Minister for his part called for greater "political and economic union" within the EU, which will help to overcome the crisis and to stimulate growth.

Demand for the dollar was limited after a speech by Federal Reserve Chairman Ben Bernanke before the lower house of the U.S. Senate. "If the outlook for the labor market will be less favorable if it turns out that inflation is not moving to the target level of 2%, or if the financial conditions that have tightened in recent years, will be challenging enough to allow us to achieve the goals set by the mandate of the Central Bank, the redemption of bonds the current level can be maintained longer, "- said Bernanke. If the situation in the economy will improve faster than expected, and inflation is "strongly" accelerate "the volume of redemption of bonds may be cut more quickly," he said.

EUR / USD: during the European session, the pair is trading in the range of $ 1.3089 - $ 1.3122

GBP / USD: during the European session, the pair rose to $ 1.5241

USD / JPY: during the European session, the pair rose to Y100.35

At 12:30 GMT Canada will release the change in the volume of wholesale trade for May. At 14:00 GMT the U.S. will release the manufacturing index, the Philadelphia Fed in July. At 14:00 GMT the chairman of Board of Governors of the Federal Reserve Ben Bernanke testifies.

EUR/USD

Offers $1.3250/60, $1.3225/30, $1.3170-90, $1.3150

Bids $1.3085/80, $1.3065, $1.3060/50, $1.3020

GBP/USD

Offers $1.5340/50, $1.5295/305, $1.5280/85, $1.5270, $1.5250

Bids $1.5150, $1.5145/40, $1.5130/20, $1.5100, $1.5080, $1.5060/45

AUD/USD

Offers $0.9300, $0.9240/50, $0.9215/20, $0.9180

Bids $0.9120, $0.9110/00, $0.9050, $0.9025/20

EUR/GBP

Offers stg0.8740/45, stg0.8700, stg0.8675/80, stg0.8665, stg0.8650/55

Bids stg0.8600, stg0.8595/90, stg0.8575/65

EUR/JPY

Offers Y132.50, Y132.20, Y132.00, Y131.60/80, Y131.45/50

Bids Y130.80/75, Y130.55/50, Y130.10/00, Y129.80

USD/JPY

Offers Y102.00, Y101.50, Y100.90/00, Y100.80, Y100.45/50,

Bids Y99.75/70, Y99..55/50, Y99.25/20, Y99.00, Y98.80

Switzerland's foreign trade surplus increased more than expected in June, the latest figures from the Federal Customs Administration showed Thursday.

The surplus was CHF 2.73 billion in June, up from CHF 2.2 billion in May. Economists expected a surplus of CHF 2.15 billion. Exports fell 5.5 percent year-on-year in real terms in June to CHF 16.7 billion and imports dropped 6.5 percent to CHF 14 billion.

In the second quarter, exports totaled CHF 51.2 billion, down 1.8 percent from a year earlier. Compared with the previous quarter, exports were down 3 percent.

During the period, Switzerland imported CHF 44.7 billion worth of goods. This was 0.8 percent higher than a year earlier and 0.4 percent higher than in the first quarter. The trade balance showed a surplus of CHF 6.5 billion compared with CHF 5.86 billion in the first quarter.

In the first half of the year, the trade balance showed a record surplus of CHF 12.3 billion, almost unchanged from the second half of 2012. Both exports and imports fell 2.9 percent each in real terms on an annual basis during the six months to June.

Eurozone's current account surplus decreased in May from the previous month, due mainly to higher deficit in current transfers and a decline in revenues, the European Central Bank said Friday.

The seasonally adjusted current account surplus dropped to EUR19.6 billion in May from an upwardly revised EUR23.8 billion in April. In March, the balance was a surplus of EUR23.1 billion.

Driving the deterioration, the shortfall in the current transfers account widened to EUR9.8 billion in May from EUR7.5 billion in April. The surplus in the income account dropped to EUR4.9 billion from EUR5.2 billion.

The services account showed a surplus of EUR6.4 billion during the month, which was lower than EUR8.1 billion recorded a month earlier. Meanwhile, the surplus in the goods trade account increased to EUR18.1 billion from EUR17.9 billion in April, data showed.

On an unadjusted basis, the current account showed a surplus of EUR9.5 billion in May, significantly lower than the revised EUR16.6 billion surplus seen in April.

U.K. retail sales volume, both excluding and including auto fuel, grew 0.2 percent each month-on-month in June, data from the Office for National Statistics showed Thursday.

Economists had forecast sales including auto fuel to grow 0.3 percent following a 2.1 percent rise in May. Sales, excluding auto fuel grew in line with economists' expectations, after expanding 2.1 percent a month ago.

Compared to June 2012, retail sales including auto fuel grew at a pace of 2.2 percent, faster than the 1.7 percent increase forecast by economists. Likewise, growth in sales excluding fuel rose 2.1 percent compared to the forecast of 1.6 percent rise.

EUR/USD $1.3035, $1.3050, $1.3100, $1.3150, $1.3170, $1.3185, $1.3200, $1.3300

EUR/JPY Y98.75, Y99.00, Y99.40, Y99.50, Y100.00, Y100.50, Y101.00

GBP/USD $1.4900, $1.5000, $1.5200, $1.5235, $1.5250, $1.5260

EUR/GBP stg0.8600, stg0.8630, stg0.8725

USD/CHF Chf0.9500, Chf0.9625

EUR/CHF Chf1.2325

AUD/USD $0.9000, $0.9100, $0.9200, $0.9210, $0.9250, $0.9280, $0.9300, $0.9200

NZD/USD $0.7995

USD/CAD C$1.0375

00:00 Australia Conference Board Australia Leading Index May +0.3% 0.0%

01:30 Australia NAB Quarterly Business Confidence Quarter II 2 -1

The yen weakened against most major peers on bets Group of 20 finance ministers and central bankers meeting this week will endorse the Bank of Japan’s monetary easing that aims to stoke 2 percent inflation. Russian Deputy Finance Minister Sergei Storchak said the G-20 probably won’t call for a tapering of stimulus in nations including Japan. The BOJ doubled monthly bond purchases to more than 7 trillion yen ($70 billion) in April, after Prime Minister Shinzo Abe urged the central bank to take steps to overcome deflation. Japan’s policies are well understood by G-20 members, Deputy Economy Minister Yasutoshi Nishimura said in a Bloomberg Television interview.

The euro traded near a six-week high versus the yen after Greek lawmakers approved austerity measures that clear the way for the next batch of bailout loans. In Europe, Greek lawmakers passed a bill that puts thousands of state workers on notice for possible dismissal, a victory for Prime Minister Antonis Samaras that clears the way for the country’s next bailout installment. The vote came hours before German Finance Minister Wolfgang Schaeuble arrives in Athens for a one-day visit.

Demand for the dollar was limited after Federal Reserve Chairman Ben S. Bernanke signaled the central bank’s asset purchases, which tend to debase the currency, hinge on economic performance. If the economy improved faster than expected, and inflation rose back “decisively” toward the central bank’s 2 percent target, “the pace of asset purchases could be reduced somewhat more quickly,” Bernanke said yesterday. The Fed would also be prepared to increase the pace of purchases “for a time, to promote a return to maximum employment in a context of price stability.”

EUR / USD: during the Asian session the pair fell to $ 1.3085

GBP / USD: during the Asian session the pair fell to $ 1.5170

USD / JPY: during the Asian session the pair rose to Y100.20

The European calendar gets underway when the ECB board gathers in Frankfurt for the regular mid-month council meeting. Executive Board member Joerg Asmussen is unlikely to be at the mid-month meet, as he and IMF Managing Director Christine Lagarde will appear on a panel in Vilnius from 0800GMT. The European data calendar kicks off at 0800GMT with the release of the EMU May current account data. German Finance Minister Wolfgang Schaeuble will make a statement at the German-Greek chamber of industry and commerce, in Athens, at 1000GMT. Schaeuble and Greek Finance Minister Giannis Stournaras will give a joint press conference in Athens at 1445GMT.

There is a full calendar on both sides of the Atlantic Thursday, with the second leg of Fed Chair Bernanke's semi-annual testimony to Congress again the stand out feature. There is a raft of UK data expected at 0830GMT, with the June Retail Sales numbers the main release. After a spike higher in retail sales volumes in May, up 2.1% on the month, retailers are expected to have small to non-existent gains in June, which would still result in firm Q2 sales growth, despite the 1.1% monthly fall in April. Analysts are looking for a hike of 0.2% on month. Other UK data expected at 0830GMT include the June CML Mortgage Lending data, the June BOE Capital Issuance, BOE Trends in Lending and the June SMMT Auto Production Data.

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3122 -0,24%

GBP/USD $1,5214 +0,44%

USD/CHF Chf0,9411 +0,15%

USD/JPY Y99,59 +0,44%

EUR/JPY Y130,67 +0,18%

GBP/JPY Y151,48 +0,86%

AUD/USD $0,9235 -0,05%

NZD/USD $0,7905 +0,23%

USD/CAD C$1,0405 +0,29%

00:00 Australia Conference Board Australia Leading Index May +0.3% 0.0%

01:30 Australia NAB Quarterly Business Confidence Quarter II 2

06:00 Switzerland Trade Balance June 2.22 2.41

08:00 Eurozone Current account, adjusted, bln May 19.5 21.3

08:30 United Kingdom Retail Sales (MoM) June +2.1% +0.4%

08:30 United Kingdom Retail Sales (YoY) June +1.9% +1.8%

12:30 Canada Wholesale Sales, m/m May +0.2% +0.4%

12:30 U.S. Initial Jobless Claims July 360 349

14:00 U.S. Leading Indicators June +0.1% +0.3%

14:00 U.S. Fed Chairman Bernanke Testifies

14:00 U.S. Philadelphia Fed Manufacturing Survey July 12.5 6.9

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.