- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 22-12-2015

(time / country / index / period / previous value / forecast)

07:45 France GDP, q/q (Finally) Quarter III 0.0% 0.3%

07:45 France GDP, Y/Y (Finally) Quarter III 1.1% 1.2%

08:00 Switzerland KOF Leading Indicator December 97.9 99.1

09:30 United Kingdom Current account, bln Quarter III -16.8 -21.5

09:30 United Kingdom GDP, q/q (Finally) Quarter III 0.7% 0.5%

09:30 United Kingdom GDP, y/y (Finally) Quarter III 2.4% 2.3%

12:00 U.S. MBA Mortgage Applications December -1.1%

13:30 Canada Retail Sales, m/m October -0.5% 0.5%

13:30 Canada Retail Sales YoY October 1.2%

13:30 Canada Retail Sales ex Autos, m/m October -0.5% 0.4%

13:30 Canada GDP (m/m) October -0.5% 0.3%

13:30 U.S. Durable Goods Orders November 3.0% -0.6%

13:30 U.S. Durable Goods Orders ex Transportation November 0.5% 0.0%

13:30 U.S. Durable goods orders ex defense 3.2% -0.2%

13:30 U.S. Personal Income, m/m November 0.4% 0.2%

13:30 U.S. Personal spending November 0.1% 0.3%

13:30 U.S. PCE price index ex food, energy, m/m November 0.0% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y November 1.3% 1.4%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) December 91.3 92

15:00 U.S. New Home Sales November 495 505

15:30 U.S. Crude Oil Inventories December 4.801

23:50 Japan Monetary Policy Meeting Minutes

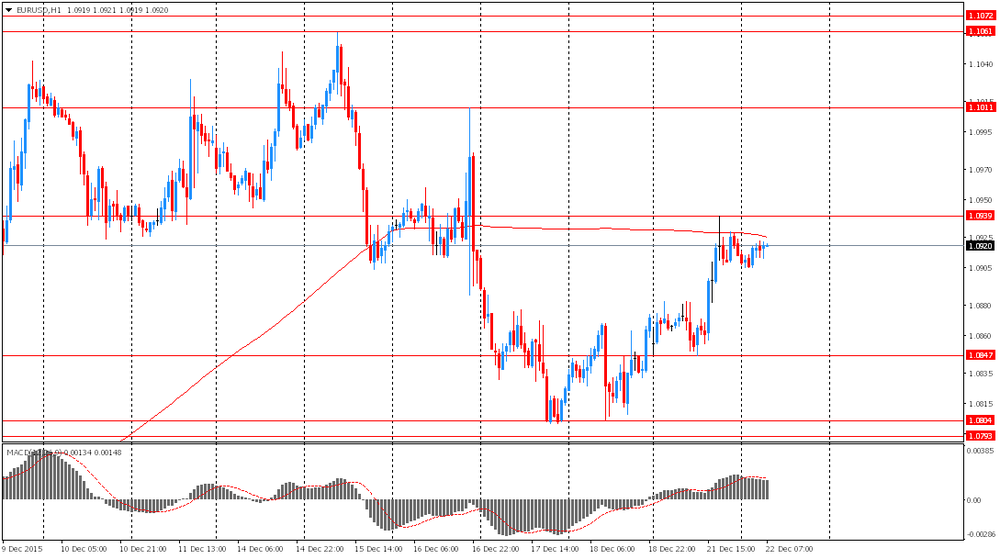

The euro rose against the dollar, as disappointing US data eased demand for the US currency, even though the losses are likely to be limited. Trading volumes are expected to remain low on the eve of the Christmas holidays. The dollar weakened after the National Association of Realtors said that sales in the secondary market fell last month by 10.5% to a 19-month low of 4.76 million units from 5.32 million in October. Analysts predicted a rise in November to 5.37 million units. The data came shortly after the US Commerce Department reported that gross domestic product grew at an annualized rate of 2.0% in the three months ended September 30, against the expected growth by 1.9%. Preliminary data originally showed an increase in the third quarter by 2.1%. In the second quarter, the US economy expanded by 3.9%. The euro kept as Spain faces a political crisis against the backdrop of controversial election results last weekend. On Monday, Spanish Prime Minister Mariano Rajoy said that his center-right People's Party (PP) intends to negotiate with competitors in an attempt to form a government, however, has reportedly left parties said they did not want to Rajoy remained in power.

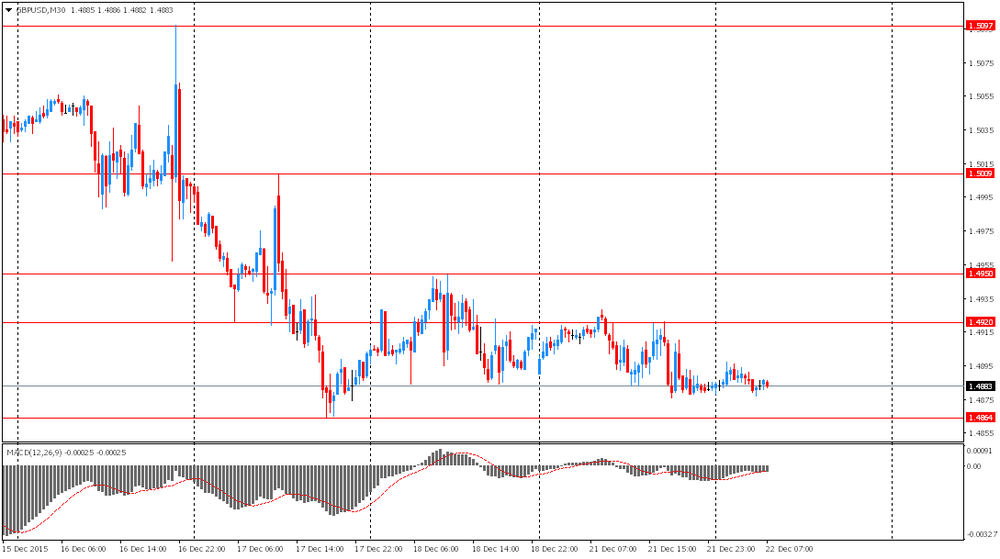

The pound fell against the dollar, dropping to the lowest level since April 15. Little impact on the currency had data showing that the situation in the sector of public finances of Britain worsened in November. Natsstatistiki Office (ONS) reported that net borrowing state. sector grew to 13.56 billion. pounds in November, compared to 6.45 billion. pounds in October (revised from 7.47 billion. lbs). Economists had forecast that the volume of loans will amount to 11 billion. Lbs. At the end of November, the net debt of state. sector, excluding state banks. sector amounted to 1536.4 bln. pounds, which is equivalent to 80.5 percent of gross domestic product. The ONS said that in November last year the budget was paid 1.1 billion. Pounds in fines for violations in Forex trading, but this year there was no such income. In the first eight months of fiscal year 2015/16, net borrowing of the public sector was 8.9 per cent less per annum. Their volume amounted to 66.9 billion. Pounds, which is close to the target value for the 2015/16 financial year.

The Swiss franc rose against the dollar, despite the publication of weak data on the trade balance. The Federal Customs Administration reported that the surplus in the trade in goods decreased to 3.14 billion Swiss francs compared with 4.08 billion. Francs in October (revised from 4.16 billion. Francs). The volume of exports fell by 2.1 percent after rising 6.2 percent in October. At the same time, import growth slowed to 0.2 percent from 4 percent. On an annual basis, exports increased by 4.7 percent, offsetting a 1.5 percent decline recorded in October. Similarly, the volume of imports rose by 8.3 percent after falling by 5 per cent in the previous month. In the period from January to November 2015 trade surplus amounted to 34.16 billion Swiss. Francs.

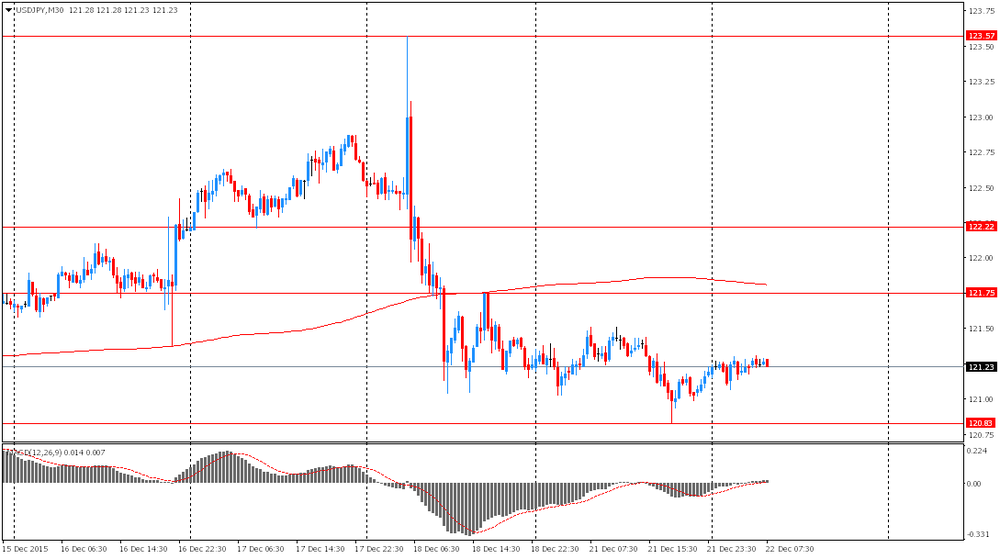

USDJPY 120.75 (USD 490m) 121.00 (USD 1.35bln) 123.00-05 (580m)

EURUSD 1.0700 (EUR 814m) 1.0800 (1.2bln) 1.0900 (3.1bln) 1.1000 (1.35bln)

AUDUSD 0.7100 (AUD 364m) 0.7125 (202m)

USDCHF 0.9860 (USD 200m) 0.9970 (200m)

EUR/USD

Offers 1.0930 1.0960 1.0985 1.1000 1.1025-30 1.1050 1.1080 1.1100

Bids 1.0900 1.0880-85 1.0850-55 1.0830 1.0800 1.0780-85 1.0750 1.0730 1.0700

GBP/USD

Offers 1.4900 1.4925-30 1.4950-55 1.4980-85 1.5000 1.5030 1.5050

Bids 1.4865-70 1.4850 1.4830 1.4800 1.4785 1.4765 1.4750 1.4730 1.4700

EUR/GBP

Offers 0.7350 0.7375 0.7400 0.7420 0.7450

Bids 0.7320 0.7300 0.7275-80 0.7250 0.7225-30 0.7200

EUR/JPY

Offers 132.50 132.80 133.00 133.20 133.50 133.85 134.00

Bids 132.00 131.80 131.50 131.00 130.80 130.50 130.30 130.00

USD/JPY

Offers 121.25-30 121.50-55 121.80 122.00 122.20 122.50

Bids 121.00 120.85 120.60-65 120.50 120.30 120.00

AUD/USD

Offers 0.7250-55 0.7280 0.7300 0.7320-25 0.7345-50

Bids 0.7220 0.7200 0.7180 0.7150 0.7120-25 0.7100

USD/JPY:121.00 (USD 1.35bln) 123.00-05 (580m)

EUR/USD:1.0700 (EUR 814m) 1.0800 (1.2bln) 1.0900 (2.6bln)

AUD/USD:0.7100 (AUD 364m) 0.7125 (202m

EUR / USD

Resistance levels (open interest**, contracts)

$1.1061 (4855)

$1.1012 (4828)

$1.0982 (2670)

Price at time of writing this review: $1.0905

Support levels (open interest**, contracts):

$1.0840 (3108)

$1.0770 (6030)

$1.0686 (5098)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 54708 contracts, with the maximum number of contracts with strike price $1,1100 (7419);

- Overall open interest on the PUT options with the expiration date January, 8 is 72904 contracts, with the maximum number of contracts with strike price $1,0450 (7928);

- The ratio of PUT/CALL was 1.33 versus 1.33 from the previous trading day according to data from December, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1155)

$1.5102 (2656)

$1.5005 (456)

Price at time of writing this review: $1.4892

Support levels (open interest**, contracts):

$1.4794 (1693)

$1.4697 (1054)

$1.4598 (529)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 18701 contracts, with the maximum number of contracts with strike price $1,5100 (2656);

- Overall open interest on the PUT options with the expiration date January, 8 is 18625 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from December, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:05 United Kingdom Gfk Consumer Confidence December 1 1 2

07:00 Germany Gfk Consumer Confidence Survey January 9.3 9.3 9.4

07:00 Switzerland Trade Balance November 4.16 3.82 3.14

The U.S. dollar traded range-bound against major currencies ahead of Christmas at the end of the current working week. Trading is not expected to be dynamic this week. At the same time many traders have already closed their positions ahead of the end of the year, which increases market volatility. On Thursday, December 24, markets in Germany and Italy will be closed. On December 25 markets in other European countries as well as in Canada, the U.S., Australia and New Zealand will be on holiday.

The U.S. National Association of Realtors will publish existing home sales data at 15:00 GMT. According to a median forecast sales rose to 5.4 million in November compared to 5.36 million in October. Final U.S. Q3 GDP data will be published today at 13:30 GMT.

The Australian dollar rose on China leading economic indicator data from the Conference Board. The index rose by 0.6% in November after a 0.3% increase in October and a 1.6% rise in September. Electricity production, retail sales of consumer goods and value-added industrial production rose.

EUR/USD: the pair fluctuated within $1.0900-25 in Asian trade

USD/JPY: the pair traded within Y121.10-30

GBP/USD: the pair traded within $1.4875-95

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom PSNB, bln November -7.47 -11

13:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter III 1.9% 1.3%

13:30 U.S. GDP, q/q (Finally) Quarter III 3.9% 1.9%

14:00 Belgium Business Climate December -3.9 -4

14:00 U.S. Housing Price Index, m/m October 0.8% 0.4%

15:00 U.S. Richmond Fed Manufacturing Index December -3 -1

15:00 U.S. Existing Home Sales November 5.36 5.37

21:45 New Zealand Trade Balance, mln November -963 -809.5

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.