- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 23-09-2015

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1187 +0,55%

GBP/USD $1,5248 -0,72%

USD/CHF Chf0,9789 +0,44%

USD/JPY Y120,20 +0,06%

EUR/JPY Y134,47 +0,61%

GBP/JPY Y183,28 -0,67%

AUD/USD $0,7003 -1,13%

NZD/USD $0,6269 -0,29%

USD/CAD C$1,3325 +0,41%

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Preliminary) September 51.7

04:30 Japan All Industry Activity Index, m/m July 0.3%

05:00 Japan Coincident Index (Finally) July 112.3 112.2

05:00 Japan Leading Economic Index (Finally) July 106.5 104.9

06:00 Germany Gfk Consumer Confidence Survey October 9.9 9.8

06:00 Switzerland UBS Consumption Indicator August 1.64

08:00 Germany IFO - Current Assessment September 114.8 114.7

08:00 Germany IFO - Expectations September 102.2 101.5

08:00 Germany IFO - Business Climate September 108.3 108

08:30 United Kingdom BBA Mortgage Approvals August 46.0

09:15 Eurozone Targeted LTRO 73.8

12:30 U.S. Chicago Federal National Activity Index August 0.34

12:30 U.S. Continuing Jobless Claims September 2237 2235

12:30 U.S. Initial Jobless Claims September 264 271

12:30 U.S. Durable Goods Orders August 2.2% -2%

12:30 U.S. Durable Goods Orders ex Transportation August 0.6% 0.1%

12:30 U.S. Durable goods orders ex defense 1.0% -1.2%

13:00 Belgium Business Climate September -5.1 -5.3

14:00 U.S. New Home Sales August 507 515

21:00 U.S. Fed Chairman Janet Yellen Speaks

23:30 Japan Tokyo Consumer Price Index, y/y September 0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September -0.1% -0.2%

23:30 Japan National Consumer Price Index, y/y August 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y August 0.0% -0.1%

European Central Bank (ECB) President Mario Draghi said before the Committee on Economic and Monetary Affairs of the European Parliament in Brussels on Wednesday that the central bank is ready to expand its asset-buying programme to boost the inflation in the Eurozone. He added that the downside risk to the inflation increased slower growth in emerging-market economies, a stronger euro and a decline in oil and commodity prices.

But Draghi pointed out that it is too early to say whether the recent turbulence in emerging markets and a fall in oil and commodity prices will lead to a lower inflation.

"More time is needed to determine in particular whether the loss of growth momentum in emerging markets is of a temporary or permanent nature and to assess the driving forces behind the drop in the international price of commodities and behind the recent episodes of severe financial turbulence," he said.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Wednesday. The U.S. preliminary manufacturing purchasing managers' index (PMI) remained unchanged at 53 in September, in line with expectations. It is the lowest level since October 2013.

A reading above 50 indicates expansion in economic activity.

Higher expansion in output was offset by slower pace of expansion in new orders and employment.

"Manufacturing remained stuck in crawler gear in September, fighting an uphill battle against the stronger dollar, slumping demand in many export markets and reduced capital spending, especially by the energy sector," Markit Chief Economist Chris Williamson.

"The sluggish growth, weaker forward-looking indicators and downturn in price pressures all point to the Fed holding off with rate hikes until next year," he added.

Greek Prime Minister Alexis Tsipras formed the new government. The new government was sworn into office on Wednesday. The cabinet is mostly unchanged. Euclid Tsakalotos was appointed as finance minister, while George Chouliarakis was appointed as deputy finance minister.

Yiannis Mouzalas was appointed as minister for migration.

EUR/USD: $1.1100(E682mn), $1.1100(E239mn), $1.1150, $1.1190($244mn), $1.1260($650mn)

USD/JPY: Y119.00($700mn), Y122.00($650mn)

USD/CAD: Cad1.3045, Cad1.3450($250mn)

USD/CHF: Chf1.0000($500mn)

European Central Bank Governing Council member Bostjan Jazbec said on Wednesday that the central bank was not discussing the extension of the asset-buying programme, adding that the monetary policy works with a delay.

"Monetary policy always works with a delay. At the moment there are no discussions on any other policies than QE. It seems that QE is bearing results, so now it's too early to talk about any new policies," he said.

European Central Bank Governing Council member Ewald Nowotny said in an interview with Bloomberg Television on Wednesday that he was wary of adding further stimulus measures.

"Monetary policy should be a steady-hand policy. We shouldn't act in a too-active way," he said.

Nowotny pointed out that the economy in the Eurozone is recovering, but slower than expected.

Statistics Canada released retail sales data on Friday. Canadian retail sales rose by 0.5% in July, in line with expectations, after a 0.4% increase in June. June's figure was revised down from a 0.6% gain.

The rise was driven by higher sales at motor vehicle and parts dealers and clothing and clothing accessories stores. Motor vehicle and parts sales rose 2.0% in July, while sales at clothing and clothing accessories stores climbed 2.5%.

Sales at gasoline stations declined 0.2% in July, while sales at electronics and appliance stores dropped 1.7%.

Sales at food and beverage stores were down 0.5% in July.

Sales rose in 6 of 11 subsectors.

Canadian retail sales excluding automobiles were flat in July, missing expectations for a 0.4% rise, after a 0.5% gain in June. June's figure was revised down from a 0.8% rise.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index July -0.3% Revised From -0.2% 0.3%

00:00 Japan Bank holiday

01:30 Australia RBA Financial Stability Review

01:45 China Markit/Caixin Manufacturing PMI (Preliminary) September 47.3 47.5 47.0

06:45 France GDP, Y/Y (Finally) Quarter II 0.8% 1.0% 1.1%

06:45 France GDP, q/q (Finally) Quarter II 0.7% Revised From 0.6% 0.0% 0.0%

07:00 France Services PMI (Preliminary) September 50.6 51 51.2

07:00 France Manufacturing PMI (Preliminary) September 48.3 48.5 50.4

07:30 Germany Services PMI (Preliminary) September 54.9 54.6 54.3

07:30 Germany Manufacturing PMI (Preliminary) September 53.3 52.8 52.5

08:00 Eurozone Services PMI (Preliminary) September 54.4 54.2 54

08:00 Eurozone Manufacturing PMI (Preliminary) September 52.3 52 52

11:00 U.S. MBA Mortgage Applications September -7% 13.9%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. preliminary manufacturing PMI data. The U.S. preliminary manufacturing PMI is expected to remain unchanged at 53.0 in September.

The FOMC member Dennis Lockhart will speak at 16:30 GMT.

The euro traded higher against the U.S. dollar after the release of the PMI data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's preliminary manufacturing PMI fell to 52.0 in September from 52.3 in August, in line with expectations.

Eurozone's preliminary services PMI declined to 54.0 in September from 54.4 in August. Analysts had expected the index to decrease to 54.2.

Markit's Chief Economist Chris Williamson said that Eurozone's economy expanded further, "but there remains a worrying failure of growth to accelerate to a pace sufficient to generate either higher inflation or strong job creation".

"The survey data indicate that the Eurozone economy expanded 0.4% in the third quarter, in line with the second quarter. This is, however, below what's generally regarded as its long-term potential growth rate and puts the economy on course to grow by just 1.6% this year," he added.

Germany's preliminary manufacturing PMI declined to 52.5 in September from 53.3 in August, missing forecasts of a decrease to 52.8.

Germany's preliminary services PMI was down to 54.3 in September from 54.9 in August. Analysts had expected index to decline to 54.6.

Markit's economist Oliver Kolodseike noted that the German economy was partly driven by higher output.

France's preliminary manufacturing PMI rose to 50.4 in September from 48.3 in August, beating forecasts of a rise to 48.5.

France's preliminary services PMI increased to 51.2 in September from 50.6 in August. Analysts had expected the index to climb to 51.0.

The French statistical office Insee released its final gross domestic product data for France on Wednesday. The French final GDP was stable in the second quarter, in line with the preliminary estimate, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% growth.

On a yearly basis, French final GDP climbed 1.1% in the second quarter, up from the preliminary estimate of 1.0% growth, after a 0.8% rise in the first quarter.

The European Central Bank President Mario Draghi will speak at 13:00 GMT.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The MPC member Ben Broadbrent will speak at 16:00 GMT.

The Canadian dollar traded higher against the U.S. dollar ahead the release of the Canadian retail sales data. Canadian retail sales are expected to increase 0.5% in July, after a 0.6% rise in June.

EUR/USD: the currency pair increased to $1.1175

GBP/USD: the currency pair fell to $1.5288

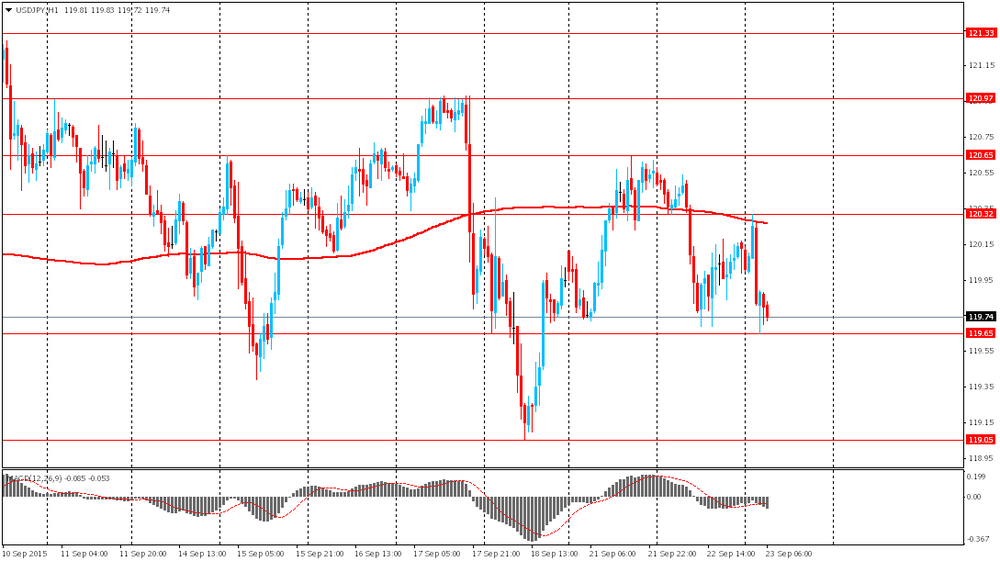

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m July 0.6% 0.5%

12:30 Canada Retail Sales YoY July 1.4%

12:30 Canada Retail Sales ex Autos, m/m July 0.8% 0.4%

13:00 Eurozone ECB President Mario Draghi Speaks

13:45 U.S. Manufacturing PMI (Preliminary) September 53 53

16:00 United Kingdom MPC Member Dr Ben Broadbent Speaks

16:30 U.S. FOMC Member Dennis Lockhart Speaks

22:45 New Zealand Trade Balance, mln August -649 -850

EUR/USD

Offers 1.1160 1.1185 1.1200 1.1225 1.1245 1.1275 1.1300

Bids 1.1120 1.1100 1.1085 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers 1.5360 1.5375 1.5400 1.5425 1.5450 1.5480 1.5500 1.5520

Bids 1.5330 1.5300 1.5285 1.5265 1.5250 1.5220 1.5200

EUR/GBP

Offers 0.7265-70 0.7285 0.7300 0.7325-30 0.7350-55

Bids 0.7225-30 0.7200 0.7185 0.7150 0.7130 0.7100

EUR/JPY

Offers 134.00 134.40 134.80 135.00 135.50 135.80 136.00

Bids 133.50 133.30 133.00 132.75 132.50 132.30 132.00

USD/JPY

Offers 120.20-25 120.40 120.60-65 120.85 121.00 121.30 121.50

Bids 119.75-80 119.50 119.30 119.10 119.00 118.85 118.50

AUD/USD

Offers 0.7050 0.7065 0.7080 0.7100 0.7130 0.7165-70 0.7185 0.7200

Bids 0.7020 0.7000 0.6985 0.6965 0.6950

The French statistical office Insee released its final gross domestic product data for France on Wednesday. The French final GDP was stable in the second quarter, in line with the preliminary estimate, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% growth.

Household spending was flat in the second quarter, after a 0.9% increase in the first quarter, while government spending rose 0.4%, after a 0.9% gain in the first quarter.

Exports climbed 2.0% in the second quarter, while imports rose 0.5%.

On a yearly basis, French final GDP climbed 1.1% in the second quarter, up from the preliminary estimate of 1.0% growth, after a 0.8% rise in the first quarter.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Wednesday. France's preliminary manufacturing PMI rose to 50.4 in September from 48.3 in August, beating forecasts of a rise to 48.5.

France's preliminary services PMI increased to 51.2 in September from 50.6 in August. Analysts had expected the index to climb to 51.0.

"The French private sector eked out another month of modest growth in September, with manufacturing making a meaningful contribution to expansion for the first time in well over a year. However, there was less positive news on the employment front, with jobs being shed at the sharpest rate since November 2014. A marked drop in service providers' business confidence further suggests that the general sluggishness in the economy is set to persist in the foreseeable future," the Senior Economist at Markit Jack Kennedy said.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Wednesday. Germany's preliminary manufacturing PMI declined to 52.5 in September from 53.3 in August, missing forecasts of a decrease to 52.8.

Germany's preliminary services PMI was down to 54.3 in September from 54.9 in August. Analysts had expected index to decline to 54.6.

Markit's economist Oliver Kolodseike noted that the German economy was partly driven by higher output.

"Digging a bit deeper into the data suggests that the German economy is set to grow further in the coming months. New orders rose at the strongest rate in almost two years, with companies benefitting from a positive economic environment and improved demand from both domestic and foreign clients," he noted.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's preliminary manufacturing PMI fell to 52.0 in September from 52.3 in August, in line with expectations.

Eurozone's preliminary services PMI declined to 54.0 in September from 54.4 in August. Analysts had expected the index to decrease to 54.2.

Markit's Chief Economist Chris Williamson said that Eurozone's economy expanded further, "but there remains a worrying failure of growth to accelerate to a pace sufficient to generate either higher inflation or strong job creation".

"The survey data indicate that the Eurozone economy expanded 0.4% in the third quarter, in line with the second quarter. This is, however, below what's generally regarded as its long-term potential growth rate and puts the economy on course to grow by just 1.6% this year," he added.

The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.0 in September from 47.3 in August, missing expectations for a rise to 47.5, and hitting a 78-month low.

A reading below 50 indicates contraction of activity.

The output index fell to 45.7 in September from 46.4 in August, reaching a 78-month low. New orders, new export orders, employment, output prices and input prices also declined.

Dr. He Fan, Chief Economist at Caixin Insight Group, said that the index indicates that China's manufacturing industry "has reached a crucial stage in the structural transformation process".

"Overall, the fundamentals are good. The principle reason for the weakening of manufacturing is tied to previous changes in factors related to external demand and prices. Fiscal expenditures surged in August, pointing to stronger government efforts on the fiscal policy front. Patience may be needed for policies designed to promote stabilization to demonstrate their effectiveness," he added.

According to the government think-tank Chinese Academy of Social Science, the Chinese economy is expected to expand 6.9% in 2015, down from the previous estimate of a 7.0% growth.

The think-tank noted that the slowdown was driven by a decline in investment by firms and individuals and growing debt pressures faced by local governments.

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Tuesday that downside risks to global growth increased due to lower commodity prices, a realignment of monetary policy and slower growth in China.

"The slowdown of Chinese growth was predictable, predicted, but has consequences and probably more spillover effects in the region in particular than was anticipated," she said.

The Conference Board released its leading economic index for Australia on Wednesday. The index rose 0.3% in July, after a 0.3% fall in June. June's figure was revised down from a 0.2% decline. It was the first increase in for months.

The coincident index increased 0.2% in July, after a 0.1% gain in June. June's figure was revised down from a 0.2% rise.

The index indicates the economy should continue to grow.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1257 (1186)

$1.1215 (540)

$1.1186 (560)

Price at time of writing this review: $1.1123

Support levels (open interest**, contracts):

$1.1083 (2426)

$1.1040 (2159)

$1.1013 (3761)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 52877 contracts, with the maximum number of contracts with strike price $1,1500 (4953);

- Overall open interest on the PUT options with the expiration date October, 9 is 68860 contracts, with the maximum number of contracts with strike price $1,1000 (7319);

- The ratio of PUT/CALL was 1.30 versus 1.34 from the previous trading day according to data from September, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.5603 (1335)

$1.5505 (1654)

$1.5409 (648)

Price at time of writing this review: $1.5337

Support levels (open interest**, contracts):

$1.5292 (1306)

$1.5195 (2741)

$1.5097 (1750)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 22317 contracts, with the maximum number of contracts with strike price $1,5500 (1654);

- Overall open interest on the PUT options with the expiration date October, 9 is 22370 contracts, with the maximum number of contracts with strike price $1,5200 (2741);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from September, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia Conference Board Australia Leading Index July -0.3% Revised From -0.2% 0.3%

01:30 Australia RBA Financial Stability Review

01:45 China Markit/Caixin Manufacturing PMI (Preliminary) September 47.3 47.5 47.0

The yen advanced against the U.S. dollar amid growing demand for this safe-haven currency due to declines in Asian stocks and weak data from China. Concerns over economic growth of the biggest consumer of commodities weigh on global markets. A preliminary report from Markit Economics and Caixin Media showed on Wednesday that China's manufacturing sector had fallen to a six-and-a-half-year low of 47.0 in September. Economists had expected a 47.5 reading after 47.3 reported previously. A reading below 50 suggests contraction. The Australian and New Zealand dollars fell amid this report as China is a key trading partner of these countries.

Meanwhile the dollar continued to weigh on the euro and the pound amid hawkish statements by several Fed officials. Earlier this week three policy makers said they expected a rate hike by the end of the current year.

EUR/USD: the pair fluctuated within $1.1105-35 in Asian trade

USD/JPY: the pair fell to Y119.65

GBP/USD: the pair fell to $1.5335

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France GDP, Y/Y (Finally) Quarter II 0.8% 1.0%

06:45 France GDP, q/q (Finally) Quarter II 0.6% 0.0%

07:00 France Services PMI (Preliminary) September 50.6 51

07:00 France Manufacturing PMI (Preliminary) September 48.3 48.5

07:30 Germany Services PMI (Preliminary) September 54.9 54.6

07:30 Germany Manufacturing PMI (Preliminary) September 53.3 52.8

08:00 Eurozone Services PMI (Preliminary) September 54.4 54.2

08:00 Eurozone Manufacturing PMI (Preliminary) September 52.3 52

11:00 U.S. MBA Mortgage Applications September -7%

12:30 Canada Retail Sales, m/m July 0.6% 0.5%

12:30 Canada Retail Sales YoY July 1.4%

12:30 Canada Retail Sales ex Autos, m/m July 0.8% 0.4%

13:00 Eurozone ECB President Mario Draghi Speaks

13:00 Switzerland SNB Quarterly Bulletin

13:45 U.S. Manufacturing PMI (Preliminary) September 53 53

14:30 U.S. Crude Oil Inventories September -2.104 -1.5

16:00 United Kingdom MPC Member Dr Ben Broadbent Speaks

16:30 U.S. FOMC Member Dennis Lockhart Speaks

22:45 New Zealand Trade Balance, mln August -649 -850

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.