- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 24-05-2013

The euro exchange rate fell sharply against the dollar, while otsupiv of the maximum values, and returning to the opening level. Note that initially helped by strong growth in the euro data for Germany. Leading indicator of consumer confidence in Germany rose in June GfK fifth consecutive month, up 6.5 points from 6.2 points in May, exceeding the forecast of economists, who had expected that he would remain at 6.2 points. The June index value - the highest since September 2007. German GDP rose in the 1st quarter by 0.1% compared with the previous quarter, and this growth corresponds to the previously published estimates. The economy has become stronger thanks to private consumption, while exports and investment companies declined.

Report Ifo, presented on Friday, reveals that the confidence of German business confidence recovered in May after two consecutive months of decline, pointing out that the growth of Europe's largest economy is gathering pace. The index of business sentiment in Germany Ifo index for May rose to 105.7 from 104.4 in April, beating the forecasts of economists who had expected the index to improve to 104.6.

However, the situation changed dramatically after the publication of the American dannyh.V report stated that orders for durable goods rose 3.3% in April after falling by a revised 5.9% in March. Economists had expected orders to rise by 1.1% compared to the 5.7% drop that have been reported for the previous month. Total orders for durable goods in April, adjusted for seasonal variation was 222.6 billion dollars.

Spending increased in almost all categories, with the growth leader orders for military aircraft and parts, which increased by 53.3%, as well as orders for civilian aircraft, which increased by 18.1%. With the exception of volatile orders for transportation equipment, orders for durable goods rose 1.3% in April, compared with 1.7% ethyl drop in March. Orders for durable goods excluding defense value of goods in April rose by 2.1% compared with 4.7% ethyl drop in March.

The yen extended its biggest weekly gain against the dollar since June, after the seminar on the economic future of Asia, Bank of Japan Haruhiko Kuroda said that the stability of the "highly desirable" for the debt market in the country, adding that the central bank will work over flexible market operations and strengthening ties with the market to prevent volatility in bond yields. He also said the markets concerned about the situation with long-term government securities, through which the Bank of Japan has taken a direct part in the markets, and it is highly desirable for these tools steady motion. We will conduct our operations in the market in a flexible manner, while maintaining as much as possible, the volatility of long-term interest rates, which temporarily grown in recent years - he added. Kuroda also said that the Bank of Japan will continue to strengthen communication between the market and bonds. However, Kuroda refused to comment on the "daily motion" in the Japanese stock and bond markets and exchange rates. He added that the central bank is committed to a specific level of stock prices and the yen.

The pound rose against the dollar after the data of the British Bankers' Association (BBA), published on Friday, showed that UK companies and households in April continued to pay off debts, as confidence remains subdued, despite a number of government initiatives to stimulate lending. According to the BBA, the net payment of loans by non-financial companies in April was 2.0 billion pounds ($ 3 billion) from 0.8 billion pounds in March. Household as a whole is also made more payments on the mortgage loans than done. As a result, net repayment of loans in April totaled 241 million pounds against 348 million pounds in March. In April 2012, net mortgage lending increased by 350 million pounds.

The total mortgage lending, which measures mortgage loans without deducting repayments on loans in April was 7.8 billion pounds, unchanged compared with March. Meanwhile, the number of mortgage approvals in April rose only slightly, to 32,153 from 31,401 in March.

The only sector which saw an increase - is unsecured consumer credit, which includes credit card loans. The index rose by 0.5 billion pounds after net repayment in March of 0.6 billion pounds.

EUR/USD

$1.2750, $1.2785, $1.2825, $1.2830, $1.2865, $1.2900, $1.2925,

$1.2935, $1.2970, $1.3000

USD/JPY Y101.00, Y101.50, Y101.60, Y102.00, Y102.25, Y104.00

EUR/JPY Y131.25

GBP/USD $1.5000, $1.5100, $1.5250

USD/CHF Chf0.9600, Chf0.9700

EUR/CHF Chf1.2375, Chf1.2400, Chf1.2450, Chf1.2550, Chf1.2705

AUD/USD $0.9605, $0.9650, $0.9850

After reporting a sharp in new orders

for manufactured durable goods in the previous month, the Commerce

Department released a report on Friday showing that durable goods

orders rebounded by more than anticipated in the month of

April.

The report said durable goods orders surged up by 3.3 percent in April after tumbling by a revised 5.9 percent in March. Economists had expected orders to climb 1.1 percent compared to the 5.7 percent drop that had been reported for the previous month.

Excluding a rebound in orders for transportation equipment, durable goods orders rose by 1.3 percent in April compared to a 1.7 percent drop in March.

06:00 Germany Gfk Consumer Confidence Survey June 6.2 6.2 6.5

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.1% +0.1% +0.1%

06:00 Germany GDP (YoY) (Finally) Quarter I -0.2% -0.2% -0.2%

07:15 United Kingdom MPC Member Fisher Speaks

08:00 Germany IFO - Business Climate May 104.4 104.6 105.7

08:00 Germany IFO - Current Assessment May 107.2 107.2 110.0

08:00 Germany IFO - Expectations May 101.6 101.6 101.6

08:30 United Kingdom BBA Mortgage Approvals April 31.2 32.7 32.2

10:00 Eurozone ECB's Jens Weidmann Speaks

The euro strengthened for a second day against the dollar after an industry report showed German business confidence unexpectedly increased in May, adding to optimism the region's biggest economy is improving.

The 17-nation currency extended its biggest weekly advance in seven weeks as a separate report forecast German consumer sentiment will improve in June.

The Ifo institute's German business climate index improved to 105.7 from 104.4 in April. Economists surveyed by Bloomberg News (GRIFPBUS) predicted it would remain unchanged. GfK AG said its consumer-sentiment index will increase to 6.5 next month from 6.2 in May. That would be the highest since September 2007.

While risks stemming from Europe's debt crisis persist, the German economy will gather pace in the current quarter, the Bundesbank said this week. Factory orders surged for a second month in March and exports increased.

The yen extended its biggest weekly gain versus the dollar since June after Bank of Japan Governor Haruhiko Kuroda said the central bank had announced sufficient monetary easing. The yen rose for a second day versus the dollar as Kuroda said the BOJ will implement flexible money-market operations and he wants to avoid increasing volatility in bond markets.

The pound rose against the dollar after the data of the British Bankers' Association (BBA), published on Friday, showed that UK companies and households in April continued to pay off debts, as confidence remains subdued, despite a number of government initiatives to stimulate lending. According to the BBA, the net payment of loans by non-financial companies in April was 2.0 billion pounds ($ 3 billion) from 0.8 billion pounds in March.

EUR / USD: during the European session, the pair rose to $ 1.2993 and retreated

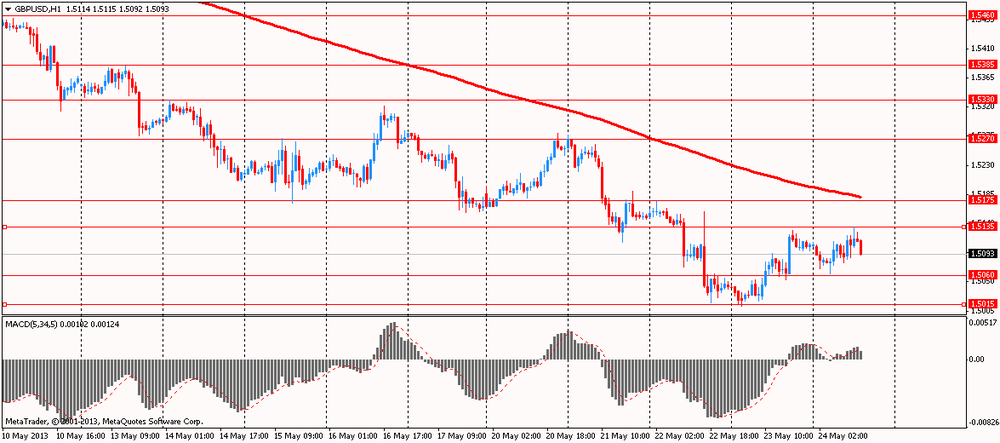

GBP / USD: during the European session, the pair rose to $ 1.5135

USD / JPY: during the European session, the pair fell to Y101.17

At 12:30 GMT the United States will publish the change in orders for durable goods, including excluding transportation equipment in April.

EUR/USD

Offers $1.3050, $1.3000

Bids $1.2960550, $1.2905/00, $1.2880, $1.2850, $1.2820/00, $1.2790

GBP/USD

Offers $1.5220/25, $1.5200, $1.5150/60, $1.5120/30

Bids $1.5060/50, $1.5040, $1.5000, $1.4985/80

AUD/USD

Offers $0.9800, $0.9780, $0.9760, $0.9735/40, $0.9700/10

Bids $0.9650/45, $0.9620/00, $0.9550, $0.9500

EUR/GBP

Offers stg0.8650/60, stg0.8620, stg0.8600

Bids stg0.8445/40, stg0.8430/20, stg0.8400

EUR/JPY

Offers Y133.50, Y133.20, Y133.00, Y132.20

Bids Y131.40, Y131.25/20, Y131.00, Y130.55/50, Y130.35/30

USD/JPY

Offers Y103.00, Y102.75/80, Y102.40, Y101.95/00

Bids Y101.20, Y101.05/00, Y100.85/80, Y100.50, Y100.20

EUR/USD

$1.2750, $1.2785, $1.2825, $1.2830, $1.2865, $1.2900, $1.2925,

$1.2935, $1.2970, $1.3000

USD/JPY Y101.00, Y101.50, Y101.60, Y102.00, Y102.25, Y104.00

EUR/JPY Y131.25

GBP/USD $1.5000, $1.5250

USD/CHF Chf0.9600, Chf0.9700

EUR/CHF Chf1.2375, Chf1.2400, Chf1.2450, Chf1.2550, Chf1.2705

AUD/USD $0.9605, $0.9650, $0.9850

02:55 Japan BOJ Governor Haruhiko Kuroda

Speaks

The yen rose against all major peers as stocks reversed an earlier advance and Bank of Japan Governor Haruhiko Kuroda said the central bank had announced sufficient monetary easing. "Investors have bought both Japanese stocks and dollar-yen, so when the equities are sold, the pair is susceptible to a drop," said Hiroshi Yoshida, a senior portfolio manager in Tokyo at MassMutual Life Insurance Co. "Position adjustments are more likely before the three-day holiday."

The dollar strengthened versus most of its counterparts before U.S. data that economists say will show durable goods orders and consumer confidence rose, backing the case for the Federal Reserve to slow stimulus.

German business confidence was probably unchanged in May after two monthly declines amid doubts over the economic recovery.

The Ifo institute's business climate index, based on a survey of 7,000 executives, will remain at 104.4, according to the median of 44 forecasts in a Bloomberg News survey. Ifo releases the report at 10 a.m. in Munich today.

EUR / USD: during the Asian session the pair fell to $ 1.2900

GBP / USD: during the Asian session the pair fell to $ 1.5060

USD / JPY: during the Asian session the pair fell below Y101.50

There is a full calendar on Friday for markets to concentrate on, with a raft of early data from the eurozone. At 0600GMT, the latest German fiscal and economic report is due, along with the detailed first quarter GDP data. At 0610GMT, the June GFK consumer sentiment indicator will be released. French data is expected at 0645GMT, with the release of the May business climate indicator, along with the May manufacturing and service sentiment indicators. At 0700 GMT, the Spanish April PPI numbers will cross the wires. At 0730GMT, German Finance Minister Wolfgang Schaeuble takes part in a conference with finance ministers of Germany's regional states, while at 0800GMT, German Economics Minister Philipp Roesler and IEA executive director Maria van der Hoeven deliver a joint press conference. Possibly the main Euro area release of the day will be the German May IfO release at 0800GMT. Also at 0800GMT, the Italian May ISTAT consumer confidence survey is out.

(pare/closed(00:00 GMT

+02:00)/change, %)

EUR/USD $1,2932 +0,62%

GBP/USD $1,5107 +0,42%

USD/CHF Chf0,9687 -1,06%

USD/JPY Y101,99 -1,11%

EUR/JPY Y131,89 -0,49%

GBP/JPY Y154,06 -0,68%

AUD/USD $0,9739 +0,51%

NZD/USD $0,8126 +0,86%

USD/CAD C$1,0301 -0,67%

02:55 Japan BOJ Governor Haruhiko Kuroda

Speaks

06:00 Germany Gfk Consumer Confidence Survey June 6.2 6.2

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.1% +0.1%

06:00 Germany GDP (wda) (YoY) (Finally) Quarter I -1.4% -1.4%

07:15 United Kingdom MPC Member Fisher Speaks

08:00 Germany IFO - Business Climate May 104.4 104.6

08:00 Germany IFO - Current Assessment May 107.2 107.2

08:00 Germany IFO - Expectations May 101.6 101.6

08:30 United Kingdom BBA Mortgage Approvals April 31.2 32.7

10:00 Eurozone ECB's Jens Weidmann Speaks

12:30 U.S. Durable Goods Orders April -5.7% +1.8%

12:30 U.S. Durable Goods Orders ex Transportation April -1.4% +0.6%

12:30 U.S. Durable goods orders ex defense April -4.7%

13:00 Belgium Business Climate May -14.7 -13.4

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.