- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 25-11-2015

The US dollar rose against most major currencies after the release of strong US economic data, contributed to the strengthening of optimism about the strength of the national economy.

The US Commerce Department reported that the volume of home sales in the primary market increased last month by 10.7% to 495,000 units compared with expectations for a 6.0% to 500,000.

The report came shortly after the US Labor Department reported that the number of initial applications for unemployment benefits for the week ending November 21 fell by 12,000 to 260,000 from a revised 272,000 the previous week.

In addition, the US Commerce Department said that orders for durable goods jumped last month by 3.0%, easily surpassing the forecast of growth of 1.5%.

Base orders for durable goods, excluding vehicles, rose in October by 0.5% compared to expectations of an increase by 0.3%.

The data also showed that personal spending in the US rose last month by 0.1% instead of the expected growth of 0.3%. In September personal spending rose 0.1%.

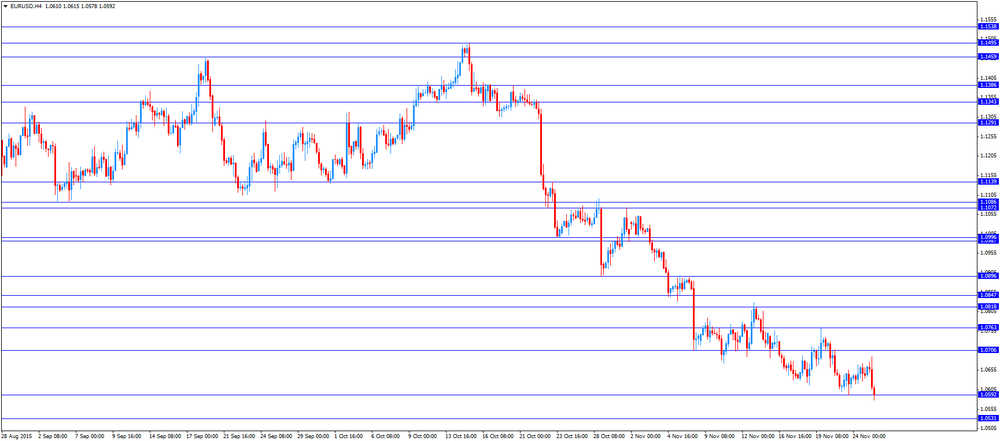

The euro has fallen sharply earlier against the dollar, dropping at the same level of $ 1.0600 below. The main reason there have been reports Reuters news agency that ECB officials are considering an increase in the size of the bond purchase program and the introduction of two-tier commission for banks that keep their cash at the ECB. Recall the ECB's next meeting is scheduled for December 3rd. Also today, the representative of the ECB's Constancio said that the change in volume of asset purchases (QE) will continue to depend on the new data, and reiterated that one of the objectives of the Central Bank does not include the foreign exchange market. He added that the euro zone can survive the rise in interest rates the US Federal Reserve, which is expected in December.

Focus has also been a report of the ECB on financial stability. It noted that the European financial system is threatened some of the risks associated with developing countries, particularly with China, although in the second half of 2015 the markets have overcome the effects of a series of upheavals. "Some volatility jumps finrynka indicate that the vulnerability of the problems in emerging markets has increased. Of particular concern are the prospects for China's view of its role in the world economy", - stated in the report of the ECB.

The ECB also announced that from December 22 to January 1, temporarily suspend purchases of bonds on the background of the projected decrease in market liquidity. From 27 November to 21 December bond purchases will be made more active, in a relatively more favorable market situation is expected in the 1st half of December. Currently, the ECB buys bonds for 60 billion euros a month. The program is valid from March 2015.

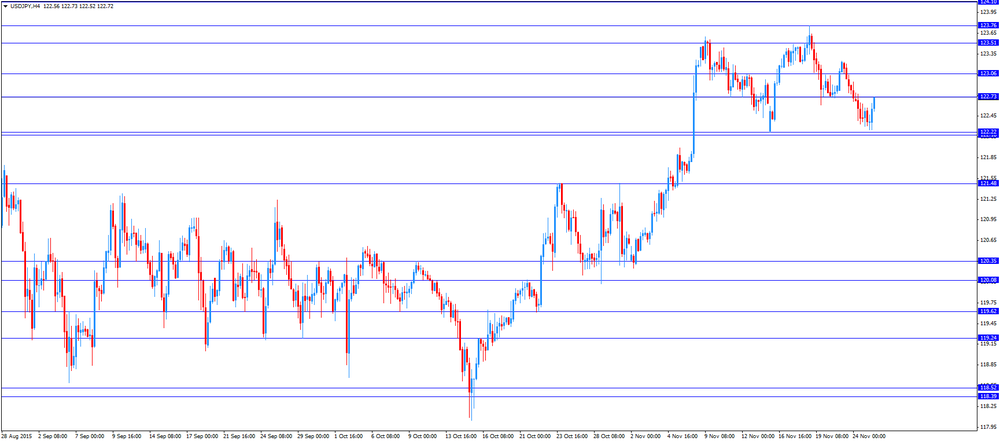

The yen weakened against the dollar after the minutes of the October meeting of the Bank of Japan showed that some members of the board of directors of the Japanese Central Bank considered that one of the reasons why the country can not be achieved in terms of inflation targets, became the decline in production. Concerns intensified lingering fear that the delay in achieving the 2% inflation target of the Bank of Japan indicates the inefficiency of central bank quantitative easing program. However, in accordance with the protocol, most responsible for the policy of the Bank of Japan officials said that the delay in achieving the inflation target due to low oil prices.

The pound regained the lost positions against the dollar after the Office for Budget Responsibility Britain revised its outlook on Britain's GDP upward. Management reports also pointed to an increase in labor demand in the labor market, for which the Bank of England drew increased attention when deciding on the rate. The Office for Budget Responsibility Britain raised its forecast for GDP in 2016 to 2.4% and announced that the government intends to achieve a budget surplus. Key messages speech Finance Minister Osborne: the next 5 years will create one million additional jobs; the British economy is still facing serious challenges; the weakness of the euro zone economy - a recurring problem; the debt level will decrease and will continue to decline every year; according to the estimates, in 2019-2020, the budget returns to surplus zone.

Little influenced by the report from the British Bankers' Association (BBA), which showed that the country's banks approved in October, more than mortgage loans than the month before, which made it possible to raise the annual growth rate to its highest level since April 2014. According to the data, in October, the Bank approved 45.437 mortgage loans for the purchase of housing compared to 44.825 in September. In annual terms, the figure rose to 21 percent. Net private loans and overdrafts rose by 228 million. Pounds in October, recording the biggest gain for October 2006. "Today's data suggest that housing market activity remained strong in October - said economist Richard BBA Vulhaus. - Consumers remain confident, and earnings growth." Net mortgage lending rose by 1.891 billion. Pounds in October, compared with an increase of 2.191 billion. Pounds in September, but Vulhaus said that gross lending, which excludes payments rose at the fastest pace in seven years. "Credit growth observed in the wholesale, retail and manufacturing sectors, while lending to construction and real estate sector continues to decline," - said Vulhaus.

The European Central Bank (ECB) will pause its asset-buying programme between December 22 and January 1. The central bank will resume its purchases on January 04.

"Purchases during the period 27 November to 21 December will be somewhat frontloaded to take advantage of the relatively better market conditions expected during the early part of the month," the ECB said.

The central bank will review its stimulus measures at its next meeting in December.

The Bank of Japan (BoJ) board member Sayuri Shirai said in a speech on Wednesday that there is no need for further stimulus measures.

"At present, further monetary policy action is unnecessary. A risk of returning to deflation is considered low given that prices of a wide range of consumption items, excluding energy, have been rising," she said.

Shirai forecasted the core inflation in Japan to rise to around 1.7% - 1.8% over the January-June period of 2017.

She pointed out that the low core inflation is temporary.

The U.K. Office for Budget Responsibility (OBR) released its Autumn Forecasts on Wednesday. The U.K. economy is expected to expand 2.4% in 2015, remained unchanged, and 2.4% in 2016, up from its previous forecast of 2.3% growth.

The U.K. economy is expected to grow at 2.5% in 2017, up from its previous forecast of 2.4%, at 2.4% in 2018, at 2.3% in 2019 and 2020.

The debt ratio for this year was downgraded to 82.5% of GDP from July forecast of 83.6%. The debt ratio is expected to be 79.9% in 2017-18, and 71.3% in 2020-21.

The U.K. budget deficit is expected to be 3.9% of GDP in 2015, 2.5% in 2016, 1.2% in 2017-18, declining to 0.2% in the year after, and turning into a surplus of 0.5% in 2019-20, while increasing to 0.6% in the following year.

The U.K. Chancellor George Osborne said in the Autumn Statement on Wednesday that global growth and global trade outlook were revised down.

"I can tell the House that in today's forecast, the expectations for world growth and world trade have been revised down again. The weakness of the euro zone remains a persistent problem; there are rising concerns about debt in emerging economies," he said.

Osborne noted that the government's debt will decline.

"We promised to bring our debts down. Today, the forecast I present shows that after the longest period of rising debt in our modern history, this year our debt will fall and keep falling in every year that follows," he said.

The Thomson Reuters/University of Michigan final consumer sentiment index increased to 91.3 in November from 90.0 in October, down from the preliminary estimate of 93.1.

"The data indicate that consumers have become increasingly aware of economic cross currents in the domestic as well as the global economy," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

The current economic conditions index rose to 104.3 in November 102.3 in October, down from a preliminary reading of 104.8.

The index of consumer expectations was up to 82.9 in November from 82.1 in October, down from a preliminary reading of 85.6.

The inflation expectations for the next year remained unchanged at 2.7% in November, up from a preliminary reading of 2.5%.

The U.S. Commerce Department released new home sales data on Wednesday. New home sales increased 10.7% to a seasonally adjusted annual rate of 495,000 units in October from 447,000 units in September. September's figure was revised down from 468,000 units.

Analysts had expected new home sales to reach 500,000 units.

The increase was mainly driven by higher sales in the Northeast. New home sales in the Northeast soared 135.3% in October.

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Wednesday. The U.S. preliminary services purchasing managers' index (PMI) climbed to 56.5 in November from 54.8 in October. It was the highest level since April.

Analysts had expected the index to rise to 55.0.

A reading above 50 indicates expansion in economic activity.

The increase was driven by a new business growth.

"The US economy is showing further robust economic growth in the fourth quarter, with the pace of expansion picking up in November. The upturn in the flash PMI brings the surveys up to a level indicative of 2.3% annualised GDP growth in November, up from 1.8% in October," Markit Chief Economist Chris Williamson.

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Wednesday. The U.S. house price index rose 0.8% on a seasonally adjusted basis in September, exceeding expectations for a 0.5% increase, after a 0.3% gain in August.

On a quarterly basis, U.S. house prices climbed 1.3% in the third quarter.

"The long-anticipated slowdown in home price appreciation did not occur in the third quarter. The factors that have contributed to extraordinary price growth over the last few years-low interest rates, tight inventories, strong buyer confidence, and improving income growth-continued to drive prices upward in much of the country. However, as prices continue to rise, reduced affordability will be a stronger market headwind," FHFA Principal Economist Andrew Leventis said.

The U.S. Commerce Department released personal spending and income figures on Wednesday. Personal spending rose 0.1% in October, missing expectations for a 0.3% gain, after a 0.1% increase in September.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 3.0% in the third quarter, after a 3.6% increase in the second quarter.

This data suggests that American consumers were cautious.

Spending on durable goods was flat in October, while spending on services increased by 0.1%.

The saving rate climbed was 5.6% in October, the highest level since December 2012, up from 5.3% in September.

Personal income increased 0.4% in October, in line with expectations, after a 0.2% gain in September. September's figure was revised up from a 0.1% increase.

Wages and salaries were up 0.6% in October.

The personal consumption expenditures (PCE) price index excluding food and energy was flat in October, missing forecasts of a 0.1% increase, after a 0.2% gain in September. September's figure was revised up from a 0.1% rise.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.3% in October, in line with expectations.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

The U.S. Commerce Department released durable goods orders data on Wednesday. The U.S. durable goods orders climbed 3.0% in October, exceeding expectations for a 1.5% rise, after a 0.8% drop in September. September's figure was revised up from a 1.2% fall.

The rise was partly driven by a strong demand for transportation equipment, which soared by 8.0% in October.

The U.S. durable goods orders excluding transportation increased 0.5% in October, beating expectations for a 0.3% gain, after a 0.1% decrease in September. September's figure was revised up from a 0.4% drop.

The U.S. durable goods orders excluding defence jumped 3.2 % in October, after a 1.6% decline in September. September's figure was revised up from a 2.0% decrease.

The U.S. Labor Department released its jobless claims figures on Wednesday. The number of initial jobless claims in the week ending November 21 in the U.S. fell by 12,000 to 260,000 from 272,000 in the previous week, exceeding expectations for a decline to 270,000. The previous week's figure was revised up from 271,000.

Jobless claims remained below 300,000 the 38th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 34,000 to 2,207,000 in the week ended November 14.

USDJPY 122.00 (USD 1.36bln) 123.00 (1.7bln) 123.50 (1.5bln)

EURUSD 1.0550 (EUR 1.5bln) 1.0600 (1.6bln) 1.0650 (702m) 1.0700 (1.5bln)

GBPUSD 1.4980 (GBP 523m)

USDCAD 1.3275-85 (USD 518m) 1.3500 (270m)

AUDUSD 0.7100 (AUD 239m) 0.7300 (788m)

EURGBP 0.7100 (EUR 280m) 0.7150 (200m)

EURJPY 131.50-60 (EUR 453m)

The Italian statistical office Istat released its industrial orders data for Italy on Wednesday. Industrial turnover in Italy dropped at a seasonally adjusted rate of 0.1% in September, after a 1.6% decrease in August.

Domestic market orders plunged 1.0% in September, while demand from non-domestic markets fell by 3.2%.

On a yearly basis, the seasonally adjusted industrial turnover in Italy slid 0.9% in September, after a 2.5% drop in August. August's figure was revised down from a 2.4% fall.

The seasonally adjusted industrial new orders index dropped by 2.0% month-on-month in September, after a 5.2% fall in August.

The Italian statistical office Istat released its retail sales data for Italy on Wednesday. Italian retail sales declined by 0.1% in September, after a 0.2% increase in August. July's figure was revised down from a 0.3% rise.

Sales of food products were down 0.1% in September, while sales of non-food products fell by 0.1%.

On a yearly basis, retail sales in Italy increased 1.5% in September, after a 1.3% rise in August.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Construction Work Done Quarter III 2.1% Revised From 1.6% -2.1% -3.6%

07:00 Switzerland UBS Consumption Indicator October 1.56 Revised From 1.65 1.6

09:30 United Kingdom BBA Mortgage Approvals October 44.8 Revised From 44.5 45.5 45.4

12:00 U.S. MBA Mortgage Applications November 6.2% -3.2%

12:30 United Kingdom Autumn Forecast Statement

The U.S. dollar traded higher against the most major currencies ahead of the release of the economic data from the U.S. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.1% in October, after a 0.1 rise in September.

Personal income in the U.S. is expected to rise 0.4% in October, after a 0.1% gain in September.

Personal spending in the U.S. is expected to gain 0.3% in October, after a 0.1% rise in September.

The U.S. durable goods orders are expected to increase 1.5% in October, after a 1.2% decline in September.

The U.S. durable goods orders excluding transportation are expected to rise 0.3% in October, after a 0.4% fall in September.

The number of initial jobless claims in the U.S. is expected to decline by 1,000 to 270,000 last week.

New home sales in the U.S. are expected to rise to 500,000 units in October from 468,000 units in September.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded lower against the U.S. dollar. The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 45,437 in October from 44,825 in September. September's figure was revised down from 44,489.

"These statistics show that housing market activity remained strong in October. Consumers remain confident and their incomes are growing. Mortgage rates are at multi-year lows and people are snapping up the very competitive deals being offered by banks," the chief economist at the BBA, Richard Woolhouse, said.

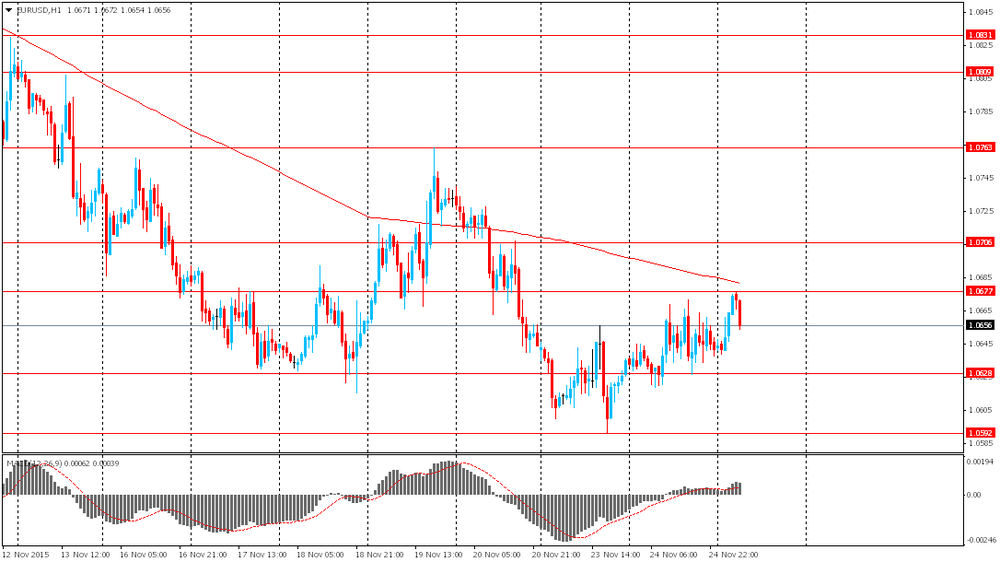

EUR/USD: the currency pair dropped to $1.0578

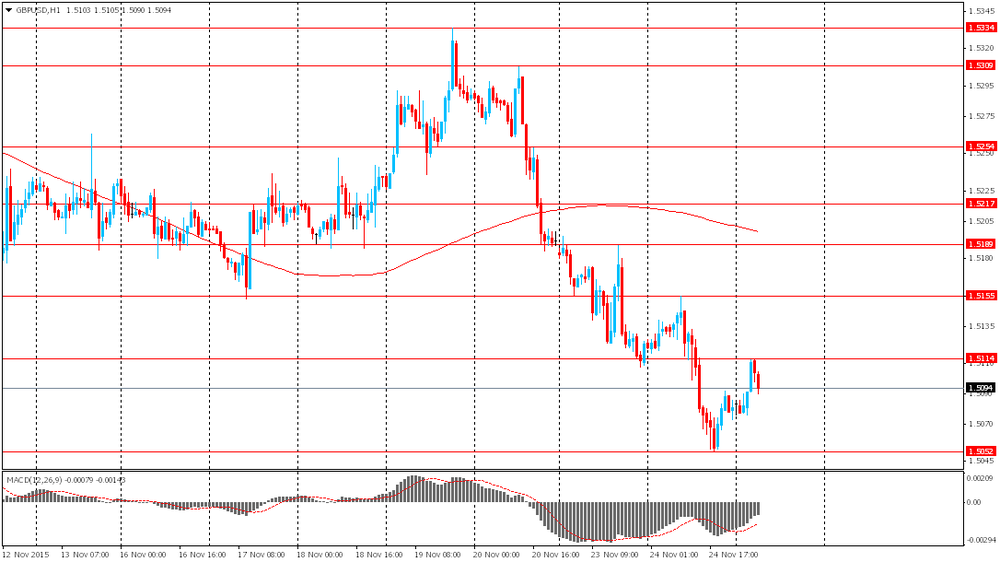

GBP/USD: the currency pair fell to $1.5054

USD/JPY: the currency pair increased to Y122.73

The most important news that are expected (GMT0):

13:30 U.S. Continuing Jobless Claims November 2175 2164

13:30 U.S. Durable Goods Orders October -1.2% 1.5%

13:30 U.S. Durable Goods Orders ex Transportation October -0.4% 0.3%

13:30 U.S. Durable goods orders ex defense -2%

13:30 U.S. Initial Jobless Claims November 271 270

13:30 U.S. Personal Income, m/m October 0.1% 0.4%

13:30 U.S. Personal spending October 0.1% 0.3%

13:30 U.S. PCE price index ex food, energy, m/m October 0.1% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y October 1.3% 1.3%

14:00 U.S. Housing Price Index, m/m September 0.3% 0.5%

14:45 U.S. Services PMI (Preliminary) November 54.8 55

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) November 90 93.1

15:00 U.S. New Home Sales October 468 500

15:30 U.S. Crude Oil Inventories November 0.252 1

21:45 New Zealand Trade Balance, mln October -1222 -937

EUR/USD

Offers 1.0685-90 1.0700 1.0720-25 1.0745 1.0760 1.0780-85 1.0800

Bids 1.0600 1.0580-85 1.0550 1.0525-30 1.0500

GBP/USD

Offers 1.5120-25 1.5135 1.5150-55 1.5170 1.5180-85 1.5200 1.5300

Bids 1.5075-80 1.5065 1.5050 1.5030 1.5000 1.4985 1.4965 1.4950

EUR/GBP

Offers 0.7075-80 0.7100 0.7125-30 0.7150

Bids 0.7035 0.7015-20 0.7000 0.6980-85 0.6965 0.6950

EUR/JPY

Offers 130.50 130.80 131.00131.20 131.50 131.85 132.00 132.50 132.75 133.00

Bids 130.00 129.85 129.50 129.35 129.00

USD/JPY

Offers 122.50 122.85 123.00 123.20-25 123.35 123.50 123.65.70 123.85 124.00

Bids 122.20-25 122.00 121.80 121.50-60 121.30 121.00

AUD/USD

Offers 0.7280-85 0.7300 0.7325-30 0.7350 0.7375 0.7400

Bids 0.7250 0.7235 0.7220 0.7200 0.7185 0.7165 0.7150 0.7130 0.7100-05

The European Central Bank (ECB) released its Financial Stability Review on Wednesday. The central bank said that the impact on the Eurozone's financial stability from interest rates hikes abroad is limited.

"Highly indebted foreign-currency borrowers may be vulnerable to a prospective normalisation of financial conditions in the United States and other advanced economies. Euro area banks have limited direct exposure to emerging market economies outside Europe," the report said.

But there are risks from a faster-than-expected interest rate hikes in the U.S.

"Risks to the growth outlook remain slightly on the downside and relate to a faster than expected normalisation of interest rates and a further appreciation of the US dollar," the report say.

The ECB Vice President Vitor Constancio said in a press conference today that a level of systemic risk in the Eurozone is low.

He noted that the ECB has not made a decision regarding further stimulus measures.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 45,437 in October from 44,825 in September. September's figure was revised down from 44,489.

"These statistics show that housing market activity remained strong in October. Consumers remain confident and their incomes are growing. Mortgage rates are at multi-year lows and people are snapping up the very competitive deals being offered by banks," the chief economist at the BBA, Richard Woolhouse, said.

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Wednesday. The Spanish producer prices dropped 0.7% in October, after a 0.9% fall in September.

On a yearly basis, producer price inflation in Spain fell 3.5% in October, after a 3.6% decline in September. Producer prices have been declining since July 2014.

Producer prices excluding energy were flat year-on-year in October, after a 0.3% rise in September.

Energy prices slid 13.2% year-on-year in October.

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.60 in October from 1.56 in September. September's figure was revised down from 1.65.

The increase was driven by a slight improvement in consumer confidence and expected business activity in the retail sector.

"Despite consumers' gloomy labour market expectations, this was outweighed slightly by the prospect of an economic upturn. At the same time, business activity in the retail sector seems to have improved recently," the bank said.

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index remained unchanged at 96 in November.

The index of the outlook on consumers' saving capacity rose to -4 in November from -5 in October.

The index of households' assessment of their financial situation in the past twelve months remained unchanged at -24 in October.

The index of the outlook on consumers' financial situation for next twelve months decreased to -11 in November from -10 in October.

The index of the outlook on unemployment rising in coming months dropped to 36 in November from 60 in October.

The index for future inflation expectations was up to -41 in November from -42 in October.

The Insee noted that the most responses were registered before the terrorist attacks of 13 November.

The Bank of Japan (BoJ) released its October 30 monetary policy meeting minutes on late Wednesday evening. According to minutes, a few board members noted that a slow improvement in the output gap is one of reasons why the central bank will miss its inflation target.

"A few members added that the projected delay in the timing of reaching 2 percent had also been partly attributable to a somewhat slow improvement in the output gap," the minutes said.

Many board members said that the delay of reaching 2% inflation targets was driven by low oil prices.

The BoJ decided to keep unchanged its monetary policy at its October meeting.

Moody's Japan K.K. said on Wednesday that weak domestic and global GDP growth will support stable earnings for non-financial corporates in Japan in 2016.

"Japan's corporates remain cautious under subdued domestic and global conditions, and will broadly focus on cutting costs, reducing leverage and maintaining credit quality and ratings," a Moody's Vice President and Senior Analyst, Masako Kuwahara, said.

The agency expects the Japanese economy to expand 0.5%-1.5% in 2016.

Moody's noted that it expects limited direct impact on Japanese corporates from the slowdown in the Chinese economy.

The European Commission proposed a euro-area wide insurance scheme for bank deposits on Tuesday. The scheme's name is the European Deposit Insurance Scheme (EDIS). This scheme should strengthen the Banking Union.

There will be 3 steps in implementing this scheme. The first step is a re-insurance approach which would last for 3 years until 2020. The second step is a progressively mutualised system ("co-insurance") in 2020. The third step is fully insure national Deposit Guarantee Schemes (DGS) as of 2024.

German Finance Minister Wolfgang Schaeuble said on Tuesday that the government's target is still a balanced budget next year, adding that the migration crisis is top priority.

"We can master this task next year without new debt, if possible," he said.

USD/JPY 122.00 (USD 1.36bln) 123.00 (1.7bln) 123.50 (1.5bln)

EUR/USD 1.0550 (EUR 1.5bln) 1.0600 (1.6bln) 1.0650 (702m) 1.0700 (1.5bln)

GBP/USD 1.4980 (GBP 523m)

USD/CAD 1.3275-85 (USD 518m) 1.3500 (270m)

AUD/USD 0.7100 (AUD 239m) 0.7300 (788m)

EUR/GBP 0.7100 (EUR 280m) 0.7150 (200m)

EUR/JPY 131.50-60 (EUR 453m)

EUR / USD

Resistance levels (open interest**, contracts)

$1.0852 (5332)

$1.0788 (2825)

$1.0738 (1240)

Price at time of writing this review: $1.0676

Support levels (open interest**, contracts):

$1.0630 (4452)

$1.0591 (5580)

$1.0571 (7490)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 95076 contracts, with the maximum number of contracts with strike price $1,1100 (6014);

- Overall open interest on the PUT options with the expiration date December, 4 is 120031 contracts, with the maximum number of contracts with strike price $1,0500 (9953);

- The ratio of PUT/CALL was 1.26 versus 1.27 from the previous trading day according to data from November, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5401 (1891)

$1.5301 (2666)

$1.5203 (1006)

Price at time of writing this review: $1.5095

Support levels (open interest**, contracts):

$1.4996 (2712)

$1.4898 (2568)

$1.4799 (649)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28446 contracts, with the maximum number of contracts with strike price $1,5600 (3574);

- Overall open interest on the PUT options with the expiration date December, 4 is 32448 contracts, with the maximum number of contracts with strike price $1,5050 (5038);

- The ratio of PUT/CALL was 1.14 versus 1.13 from the previous trading day according to data from November, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Construction Work Done Quarter III 2.1% Revised From 1.6% -2.1% -3.6%

07:00 Switzerland UBS Consumption Indicator October 1.65 1.6

The yen rose against the U.S. dollar on demand for safe-haven assets amid geopolitical tensions. Market participants grew cautious after Turkey downed a Russian warplane on the border of Syria. Turkey claims that the plane entered its airspace; however Russia insists it was in Syrian territory.

The minutes of the latest Bank of Japan meeting showed that Board members had not discussed additional stimulus measures on October 6-7. This news supported the yen too. Nevertheless many BOJ officials said the bank has to be ready to act at once if the inflation target is at risk.

Investors are also closing orders ahead of Thanksgiving Day.

The Australian dollar rose to a one-month high even after RBA Governor Glenn Steven said yesterday the central bank still favors a looser monetary policy. Stevens also noted that inflation was not an obstacle for further rate cuts. The AUD and other commodity-dependant currencies are supported by growing oil prices amid concerns that growing tensions in the Middle East might undermine supplies from this region. The Australian economy depends on the defense sector and it could benefit from geopolitical tensions. A higher economic activity could prevent the RBA from lowering its benchmark interest rate. This would be a good news for the Australian dollar.

EUR/USD: the pair rose to $1.0675 in Asian trade

USD/JPY: the pair fell to Y122.25

GBP/USD: the pair rose to $1.5115

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom BBA Mortgage Approvals October 44.5 45.5

12:00 U.S. MBA Mortgage Applications November 6.2%

12:30 United Kingdom Autumn Forecast Statement

13:30 U.S. Continuing Jobless Claims November 2175 2164

13:30 U.S. Durable Goods Orders October -1.2% 1.5%

13:30 U.S. Durable Goods Orders ex Transportation October -0.4% 0.3%

13:30 U.S. Durable goods orders ex defense -2%

13:30 U.S. Initial Jobless Claims November 271 270

13:30 U.S. Personal Income, m/m October 0.1% 0.4%

13:30 U.S. Personal spending October 0.1% 0.3%

13:30 U.S. PCE price index ex food, energy, m/m October 0.1% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y October 1.3% 1.3%

14:00 U.S. Housing Price Index, m/m September 0.3% 0.5%

14:45 U.S. Services PMI (Preliminary) November 54.8 55

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) November 90 93.1

15:00 U.S. New Home Sales October 468 500

15:30 U.S. Crude Oil Inventories November 0.252 1

21:45 New Zealand Trade Balance, mln October -1222 -937

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.