- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 01-12-2016

(raw materials / closing price /% change)

Oil 50.91 -0.29%

Gold 1,173.60 +0.36%

(index / closing price / change items /% change)

Nikkei 225 18,513.12 +204.64 +1.12%

Shanghai Composite 3,274.07 +24.04 +0.74%

S&P/ASX 200 5,500.24 0.00 0.00%

FTSE 100 6,752.93 -30.86 -0.45%

CAC 40 4,560.61 -17.73 -0.39%

Xetra DAX 10,534.05 -106.25 -1.00%

S&P 500 2,191.08 -7.73 -0.35%

Dow Jones Industrial Average 19,191.93 +68.35 +0.36%

S&P/TSX Composite 15,027.53 -55.32 -0.37%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0660 +0,68%

GBP/USD $1,2590 +0,68%

USD/CHF Chf1,0103 -0,67%

USD/JPY Y114,08 -0,32%

EUR/JPY Y121,61 +0,37%

GBP/JPY Y143,61 +0,36%

AUD/USD $0,7412 +0,39%

NZD/USD $0,7087 +0,07%

USD/CAD C$1,3316 -0,89%

00:30 Australia Retail Sales, M/M October 0.6% 0.3%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III 0.6% 0.3%

06:45 Switzerland Gross Domestic Product (YoY) Quarter III 2.0% 1.8%

09:30 United Kingdom PMI Construction November 52.6 52.2

10:00 Eurozone Producer Price Index, MoM October 0.1% 0.2%

10:00 Eurozone Producer Price Index (YoY) October -1.5% -1%

13:30 Canada Labor Productivity Quarter III -0.3% 1%

13:30 Canada Unemployment rate November 7% 7%

13:30 Canada Employment November 43.9 -20

13:30 U.S. Average workweek November 34.4 34.4

13:30 U.S. Average hourly earnings November 0.4% 0.2%

13:30 U.S. Unemployment Rate November 4.9% 4.9%

13:30 U.S. Nonfarm Payrolls November 161 175

Major U.S. stock-indexes mixed. Losses in technology stocks dragged down the Nasdaq and the S&P 500 on Thursday, while gains in bank and energy shares propped up the Dow. While Wall Street has rallied since the November election on hopes that President-elect Donald Trump's policies would be market friendly, technology stocks have barely budged, posting a mere 0.6% gain.

Most of Dow stocks in negative area (17 of 30). Top gainer - Chevron Corporation (CVX, +2.81%). Top loser - Microsoft Corporation (MSFT, -2.11%).

Most S&P sectors also in negative area. Top gainer - Basic Materials (+1.0%). Top loser - Technology (-2.1%).

At the moment:

Dow 19164.00 +32.00 +0.17%

S&P 500 2189.25 -9.50 -0.43%

Nasdaq 100 4732.00 -84.00 -1.74%

Oil 51.56 +2.12 +4.29%

Gold 1167.60 -6.30 -0.54%

U.S. 10yr 2.46 +0.09

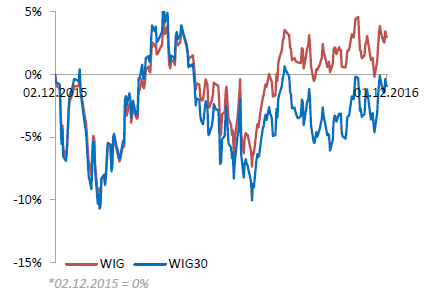

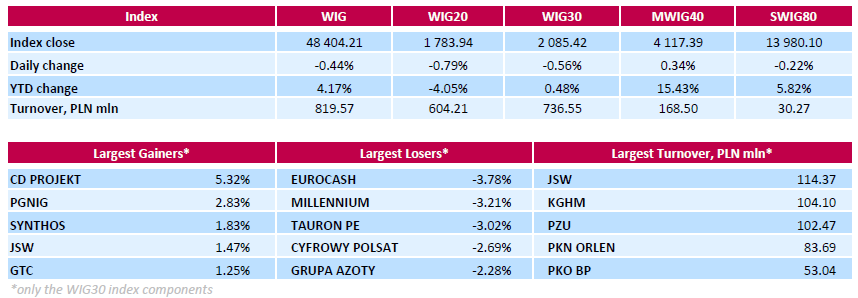

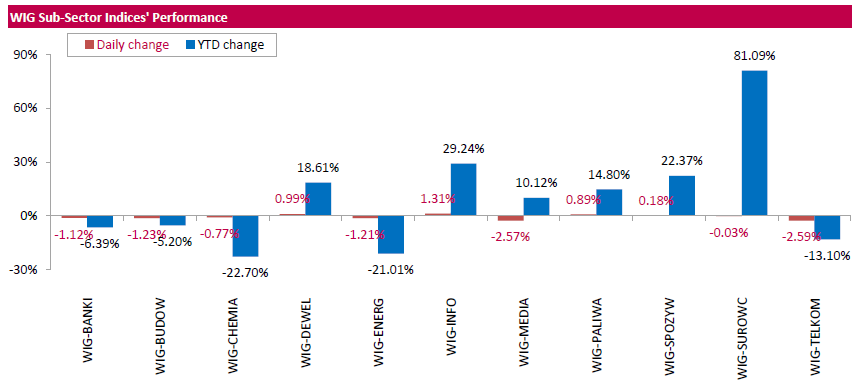

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, slumped by 0.44%. Sector performance within the WIG Index was mixed. Telecoms (-2.59%) tumbled the most, while information technology (+1.31%) fared the best.

The large-cap stocks fell by 0.56%, as measured by the WIG30 Index. In the index basket, FMCG-wholesaler EUROCASH (WSE: EUR) and bank MILLENNIUM (WSE: MIL) led the decliners, tumbling by 3.78% and 3.21% respectively. They were followed by genco TAURON PE (WSE: TPE), media group CYFROWY POLSAT (WSE: CPS), chemical producer GRUPA AZOTY (WSE: ATT) and telecommunication services provider ORANGE POLSKA (WSE: OPL), which lost between 2.23% and 3.02%. On the other side of the ledger, videogame developer CD PROJEKT (WSE: CDR) was the session's best performer, advancing 5.32%. Other major gainers were oil and gas producer PGNIG (WSE: PGN), chemical producer SYNTHOS (WSE: SNS) and coking coal producer JSW (WSE: JSW), which advanced 2.83%, 1.83% and 1.47% respectively.

In the afternoon we met the reading of weekly data on the number of applications for unemployment benefits USA. Today's data surprised slightly negative, but remain at a low level. There is still less than 300 thousand applications, what means that the labor market remains in good shape.

The main European indices remain under pressure, the German DAX and the French CAC40 lost 0.7% and 0.2% respectively. In Warsaw, after a morning decline, the market consolidates. Contracts on the S&P500 came out on the plus and herald a return to the lost yesterday, testing the level of 2200 points for the S&P500.

U.S. stock-index futures were flat, even as crude oil continued to surge, supported by the announcement that OPEC countries agreed on a deal to cut oil production at yesterday's meeting in Vienna. That was the first time the cartel cut supply in eight years. According to the approved agreement, OPEC countries will reduce oil output by 1.2 mln barrels daily to 32.5 mln barrels starting from January, 2017. Investors await the U.S. nonfarm payroll data, scheduled to be released tomorrow.

Global Stocks:

Nikkei 18,513.12 +204.64 +1.12%

Hang Seng 22,878.23 +88.46 +0.39%

Shanghai 3,274.07 +24.04 +0.74%

FTSE 6,704.58 -79.21 -1.17%

CAC 4,560.11 -18.23 -0.40%

DAX 10,553.87 -86.43 -0.81%

Crude $50.39 (+1.92%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 28.68 | -0.29(-1.001%) | 5602 |

| ALTRIA GROUP INC. | MO | 63.79 | -0.14(-0.219%) | 500 |

| Amazon.com Inc., NASDAQ | AMZN | 754 | 3.43(0.457%) | 14806 |

| Apple Inc. | AAPL | 110.3 | -0.22(-0.1991%) | 74623 |

| AT&T Inc | T | 38.55 | -0.08(-0.2071%) | 33045 |

| Barrick Gold Corporation, NYSE | ABX | 14.98 | -0.04(-0.2663%) | 34311 |

| Caterpillar Inc | CAT | 95.5 | -0.06(-0.0628%) | 4498 |

| Chevron Corp | CVX | 112.8 | 1.24(1.1115%) | 6050 |

| Citigroup Inc., NYSE | C | 56.63 | 0.24(0.4256%) | 7482 |

| Deere & Company, NYSE | DE | 101.58 | 1.38(1.3772%) | 6463 |

| E. I. du Pont de Nemours and Co | DD | 73.5 | -0.11(-0.1494%) | 1633 |

| Exxon Mobil Corp | XOM | 87.8 | 0.50(0.5727%) | 18803 |

| Facebook, Inc. | FB | 118.7 | 0.28(0.2364%) | 50463 |

| Ford Motor Co. | F | 12 | 0.04(0.3344%) | 13416 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.45 | 0.10(0.6515%) | 39144 |

| General Motors Company, NYSE | GM | 34.78 | 0.25(0.724%) | 4916 |

| Goldman Sachs | GS | 220.2 | 0.91(0.415%) | 15790 |

| Google Inc. | GOOG | 761 | 2.96(0.3905%) | 3355 |

| Intel Corp | INTC | 34.71 | 0.01(0.0288%) | 503 |

| International Business Machines Co... | IBM | 162 | -0.22(-0.1356%) | 165 |

| Johnson & Johnson | JNJ | 111.35 | 0.05(0.0449%) | 1332 |

| JPMorgan Chase and Co | JPM | 80.44 | 0.27(0.3368%) | 14813 |

| McDonald's Corp | MCD | 118.75 | -0.52(-0.436%) | 2857 |

| Microsoft Corp | MSFT | 60.21 | -0.05(-0.083%) | 5372 |

| Nike | NKE | 49.98 | 0.09(0.1804%) | 1895 |

| Pfizer Inc | PFE | 32.25 | 0.11(0.3423%) | 6138 |

| Procter & Gamble Co | PG | 82.42 | -0.04(-0.0485%) | 2547 |

| Starbucks Corporation, NASDAQ | SBUX | 57.82 | -0.15(-0.2588%) | 3302 |

| Tesla Motors, Inc., NASDAQ | TSLA | 189.01 | -0.39(-0.2059%) | 3948 |

| The Coca-Cola Co | KO | 40.4 | 0.05(0.1239%) | 16514 |

| Twitter, Inc., NYSE | TWTR | 18.58 | 0.09(0.4867%) | 21189 |

| Verizon Communications Inc | VZ | 49.79 | -0.11(-0.2204%) | 24300 |

| Visa | V | 77.99 | 0.67(0.8665%) | 4200 |

| Walt Disney Co | DIS | 99.75 | 0.63(0.6356%) | 1287 |

| Yandex N.V., NASDAQ | YNDX | 18.97 | -0.04(-0.2104%) | 1300 |

EURUSD 1.0500 (EUR 2.0bln) 1.0525 (879m) 1.0600 (EUR 4.86bln) 1.0650 (619m) 1.0750 (879m) 1.0800-10 (2.93bln)

GBPUSD 1.2400 (GBP 589m)

USDJPY 110.50 (1.06bln) 111.00 (1.79bln) 111.50 (942m) 112.00 (1.15bln) 114.30 (586m)

USDCHF 1.0060 (USD 1.18bln) 1.0200 (780m)

AUDUSD 0.7400 (AUD 559m) 0.7495-0.7500 (448m) 0.7640 (576m)

USDCAD 1.3500 )USD 745M)

EURJPY 118.50-55 (EUR 880m) 118.75 (EUR 1.59bln)

NZDUSD 0.7050 (NZD 834m)

USDCNY 6.8000 (USD 1.6bln) 6.8500 (1.78bln) 7.00 (1.36bln)

Upgrades:

Deere (DE) upgraded to Buy from Neutral at BofA/Merrill; target raised to $124 from $92

Travelers (TRV) upgraded to Buy from Neutral at Citigroup

Downgrades:

McDonald's (MCD) downgraded to Neutral from Buy at Guggenheim

Other:

Visa (V) reiterated with an Outperform rating at RBC Capital Mkts

MasterCard (MA) reiterated with an Outperform rating at RBC Capital Mkts

General Motors (GM) initiated with an Outperform at Macquarie; target $44

Ford Motor (F) initiated with a Neutral at Macquarie; target $13

EUR/USD

Offers 1.0630 1.0650 1.0670 1.0685 1.0700 1.0730 1.0750

Bids 1.0600 1.0580 1.0550-55 1.0530 1.0515 1.0500

GBP/USD

Offers 1.2650 1.2680 1.2700

Bids 1.2520 1.2500 1.2475-80 1.2455-60 1.2430 1.2400 1.2380 1.2360 1.2300

EUR/GBP

Offers 0.8480-85 0.8500 0.8525-30 0.8560 0.8575-80 0.8600

Bids 0.8450 0.8420 0.8400 0.8375-80 0.8350 0.8330 0.8300

EUR/JPY

Offers 121.55-60 121.80 122.00

Bids 121.00 120.45-50 120.00 119.60 119.30 119.00 118.80 118.50 118.00

USD/JPY

Offers 114.20 114.35 114.50 114.80-85 115.00 115.25 115.45-50

Bids 113.80 113.50 113.20 113.00 112.85 112.50 112.20 112.00 111.80 111.50 111.35 111.00

AUD/USD

Offers 0.7420-25 0.7450 0.7485 0.7500-05 0.7520 0.7545-50

Bids 0.7400 0.7380 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

During the first half of trading on the Warsaw parquet the stock market rebounded from the vicinity of the level of 1,800 points and it seems that the defeat of the next resistance will not be easy. Our market gave most of yesterday's gains and it was at a pretty decent turnover.

Shareholders of listed coking coal and coke group JSW voted in favor of moving the ailing KRUPIŃSKI mine to the state restructuring vehicle SRK, in line with the management's recommendation and creditor banks' opinion.

At 12.40 (Warsaw time) shares of JSW gained 4.70 percent and turnover in shares of the company were at that time PLN 71 million what was the highest result among all listed companies.

At the halfway point of today's session the WIG20 index was at the level of 1,787 points (-0,59%).

EUR/USD 1.0500 (EUR 2.0bln) 1.0525 (879m) 1.0600 (EUR 4.86bln) 1.0650 (619m) 1.0750 (879m) 1.0800-10 (2.93bln)

GBP/USD 1.2400 (GBP 589m)

USD/JPY 110.50 (1.06bln) 111.00 (1.79bln) 111.50 (942m) 112.00 (1.15bln) 114.30 (586m)

USD/CHF 1.0060 (USD 1.18bln) 1.0200 (780m)

AUD/USD 0.7400 (AUD 559m) 0.7495-0.7500 (448m) 0.7640 (576m)

USD/CAD 1.3500 )USD 745M)

EUR/JPY 118.50-55 (EUR 880m) 118.75 (EUR 1.59bln)

NZD/USD 0.7050 (NZD 834m)

USD/CNY 6.8000 (USD 1.6bln) 6.8500 (1.78bln) 7.00 (1.36bln)

Информационно-аналитический отдел TeleTrade

WIG20 index opened at 1802.89 points (+0.26%)*

WIG 48696.12 0.16%

WIG30 2100.51 0.16%

mWIG40 4111.67 0.20%

*/ - change to previous close

The cash market began trading with an increase of 0.26% and turnover focused in the companies of raw materials (KGHM, JSW, PKN Orlen). In the surrounding the German DAX was weaker and lose approx. 0.3%.

The Warsaw market is still refers to the stronger attitude of emerging markets, although after the first transaction market returns around yesterday's close. So, the beginning can be considered as neutral, but we clearly see that overcoming the psychological barrier of 1,800 points will not be easy, in particular, that the German DAX in the first few bars go down in relation to the opening and goes back to recent lows.

After fifteen minutes of trading the WIG20 index was at the level of 1,792 points (-0,29%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.0842 (4639)

$1.0773 (2818)

$1.0718 (1316)

Price at time of writing this review: $1.0616

Support levels (open interest**, contracts):

$1.0531 (3290)

$1.0487 (4540)

$1.0428 (6209)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 86195 contracts, with the maximum number of contracts with strike price $1,1400 (6421);

- Overall open interest on the PUT options with the expiration date December, 9 is 70507 contracts, with the maximum number of contracts with strike price $1,0500 (6209);

- The ratio of PUT/CALL was 0.82 versus 0.85 from the previous trading day according to data from November, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.2801 (1125)

$1.2702 (1917)

$1.2605 (1413)

Price at time of writing this review: $1.2538

Support levels (open interest**, contracts):

$1.2492 (2920)

$1.2396 (1476)

$1.2298 (2205)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 34873 contracts, with the maximum number of contracts with strike price $1,3400 (2561);

- Overall open interest on the PUT options with the expiration date December, 9 is 35042 contracts, with the maximum number of contracts with strike price $1,2500 (2920);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from November, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Yesterday's session on Wall Street a little disappointed and ended at the session minima. Today we begin a new month, which will bring a series of macro data in the form of PMI and ISM index

However, markets are still impressed by yesterday's agreement between OPEC and Russia, which raised the price of oil. Asian markets resulted in a substantial rise in share prices of commodity and energy.

OPEC's decision has strengthened the markets of raw materials, which are associated with the segment of emerging markets. It supported the MSCI Emerging Markets and caused capital inflows also on the Warsaw Stock Exchange.

Unfortunately, Poland is an importer of raw materials and for this reason will not be a beneficiary of the same increases as Russia and Brazil.

In the morning, futures on the US indices slightly lose. At the end of trading in Asia climate also somewhat spoiled relative to levels seen earlier in the session. This means that the start of trading in Europe promises to be without emotions.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.