- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 02-04-2015

The Federal Reserve Chairwoman Janet Yellen said on Thursday that the economic mobility strengthens the economy and more research is needed to understand what policies have impact on that economic mobility.

"Research could help us better understand how much mobility at the individual level matters for overall growth in productivity and economic output," Yellen noted.

Yellen didn't comment on monetary policy or the economic outlook.

Stock indices closed mixed as Greece's creditors said reform plan is not good enough to unblock a new tranche of loans.

The European Central Bank (ECB) released its minutes of March meeting. According to the minutes, the Governing Council reiterated to keep its monetary policy "for as long as needed".

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 57.8 in March from 60.1 in February, missing expectations for a rise to 60.4.

The decline was driven by slower rise of output and new orders.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,833.46 +23.96 +0.35 %

DAX 11,967.39 -33.99 -0.28 %

CAC 40 5,074.14 +11.92 +0.24 %

The U.S. dollar traded lower against the most major currencies despite the better-than-expected U.S. economic data. The U.S. trade deficit narrowed to $35.44 billion in February from a deficit of $42.7 billion in January. That was the lowest level since October 2009.

January's figure was revised down from a deficit of $41.8 billion.

Analysts had expected a trade deficit of $41.5 billion.

The decline of a deficit was driven by a stronger U.S. dollar and weaker global demand.

Factory orders in the U.S. rose 0.2% in February, exceeding expectations for a flat reading, after a 0.7% drop in January. It was the largest increase since July 2014.

January's figure was revised down from a 0.2% fall.

The increase was driven by higher orders for non-durable goods.

The number of initial jobless claims in the week ending March 28 in the U.S. fell by 20,000 to 260,000 from 288,000 in the previous week, beating expectations for a decline by 3,000. The previous week's figures was revised down from 282,000.

The euro rose against the U.S. dollar in the absence of any major economic reports from the Eurozone. Concerns over Greece's debt problems continue to weigh on the euro.

The European Central Bank (ECB) released its minutes of March meeting. According to the minutes, the Governing Council reiterated to keep its monetary policy "for as long as needed".

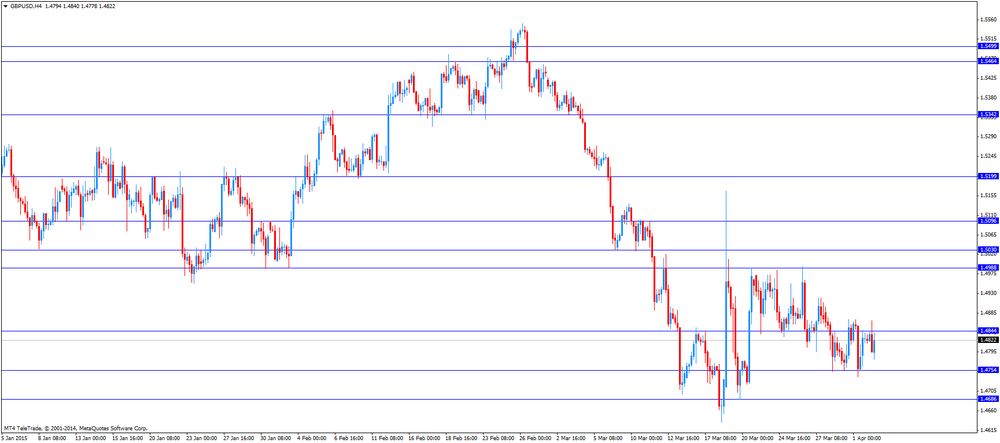

The British pound traded higher against the U.S. dollar. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 57.8 in March from 60.1 in February, missing expectations for a rise to 60.4.

The decline was driven by slower rise of output and new orders.

The Canadian dollar traded higher against the U.S. dollar after the better-than-expected Canadian trade data. Canada's trade deficit narrowed to C$0.98 billion in February from a deficit of C$1.5 billion in January. January's figure was revised up from a deficit of C$2.5 billion. Analysts had expected a trade deficit of C$1.8 billion.

The lower deficit was driven by stabilising oil prices.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback in the absence of any economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after the weaker-than-expected trade data from Australia. Australia's trade deficit widened to A$1.26 billion in February from A$1.03 billion in January. January's figure was revised down from a deficit of A$0.98 billion. Analysts had expected the trade deficit to rise to A$1.25 billion.

The increase of the deficit was driven by lower iron ore exports.

Exports rose 1.0% in February, while imports climbed 2.0%.

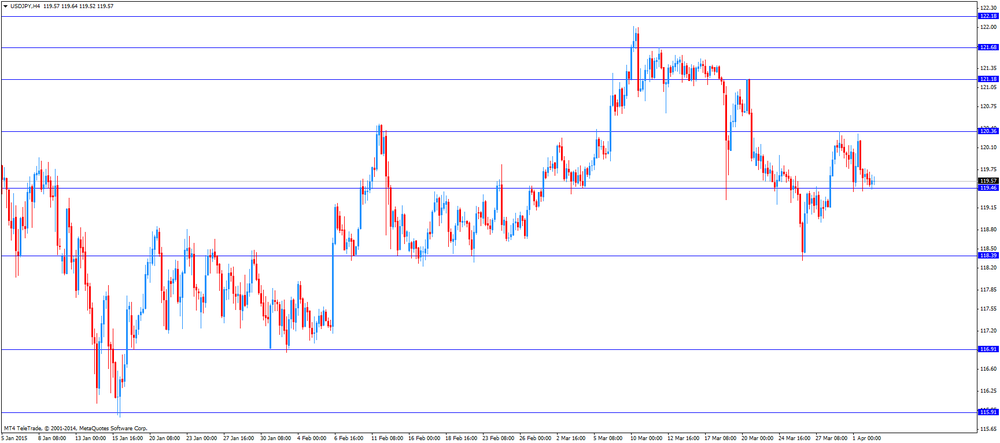

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback. Japan's monetary base increased 35.2% in March, missing expectations for 35.3% gain, after a 36.7% rise in February.

The Bank of Japan (BoJ) released its inflation expectations survey on Thursday. Japanese companies expect consumer price inflation to increase 1.4% in one year from now, unchanged from the December survey, the central bank said.

The European Central Bank Executive Board Member Sabine Lautenschlaeger expressed doubts that the quantitative easing programme by the central bank will have the desired effect.

"Given the current low level of interest rates in the euro zone, I have doubts whether the economic effects of the purchase programme will reach the desired magnitude," Lautenschlaeger told in an interview to the German weekly magazine WirtschaftsWoche.

She warned that low interest rate could lead to overheating or asset price bubbles.

Lautenschlaeger noted that quantitative leading may lead to refusal to implement reforms.

The European Central Bank's (ECB) its minutes of March meeting on Thursday. According to the minutes, the Governing Council reiterated to keep its monetary policy "for as long as needed".

The Governing Council members noted that quantitative easing by the central bank was adequate to reach the price stability.

The ECB officials pointed out that there is no need to implement further stimulus measures.

The deposit rate at -20 basis points is the effective lower bound, the Governing Council said.

Some of the Governing Council members expressed concerns that the growth in the Eurozone may be slower that forecasted. The ECB upgraded its growth estimate to 1.5% for 2015 on March 5, up from 1% in December last year. Gross domestic product (GDP) is expected to be 1.9% in 2016 and 2.1% in 2017.

The ECB decided on January 22 to launch an expanded asset purchase programme of 60 billion euro a month starting from March 2015 until September 2016.

The U.S. Commerce Department released factory orders data on Thursday. Factory orders in the U.S. rose 0.2% in February, exceeding expectations for a flat reading, after a 0.7% drop in January. It was the largest increase since July 2014.

January's figure was revised down from a 0.2% fall.

The increase was driven by higher orders for non-durable goods. Non-durable goods orders jumped by 1.8% in February.

Durable goods orders fell 0.2% in February.

The U.S. Commerce Department released the trade data on Thursday. The U.S. trade deficit narrowed to $35.44 billion in February from a deficit of $42.7 billion in January. That was the lowest level since October 2009.

January's figure was revised down from a deficit of $41.8 billion.

Analysts had expected a trade deficit of $41.5 billion.

The decline of a deficit was driven by a stronger U.S. dollar and weaker global demand.

Imports fell by 4.4% in February, while exports declined by 1.6%.

Exports to Canada and Mexico were up in February, exports to China dropped 8.9%, while exports to the European Union were unchanged.

Imports from China slid 18.1%.

EUR/USD: $1.0700 (E720M), $1.0800 (E625M), $1.0850 (E428M)

NZD/USD: $0.7450 (NZ$295M), $1.2600 (NZ$464M)

USD/CAD: C$1.2500-05 ($500M), C$1.2515 ($296M), C$1.2600 ($464M)

USD/JPY: Y120.00 ($2.8BLN), Y120.80 ($965M), Y121.00 ($526M)

U.S. equity-index futures dropped with the dollar amid signs economic growth is slowing before payrolls data on Friday.

Global markets:

Nikkei 19,312.79 +277.95 +1.46%

Hang Seng 25,275.64 +192.89 +0.77%

Shanghai Composite 3,826.69 +16.39 +0.43%

FTSE 6,817.21 +7.71 +0.11%

CAC 5,067.15 +4.93 +0.10%

DAX 11,992.59 -8.79 -0.07%

Crude oil $49.13 (-1.94%)

Gold $1201.60 (-0.52%)

Statistics Canada released the trade data on Thursday. Canada's trade deficit narrowed to C$0.98 billion in February from a deficit of C$1.5 billion in January. January's figure was revised up from a deficit of C$2.5 billion. Analysts had expected a trade deficit of C$1.8 billion.

The lower deficit was driven by stabilising oil prices.

Exports were up 0.4% in February. Exports of energy products soared by 14.9%.

Imports declined 0.7% in February. Imports of motor vehicles and parts slid by 4.7%, while imports of industrial machinery, equipment and parts declined 4.3%.

(company / ticker / price / change, % / volume)

| Travelers Companies Inc | TRV | 107.15 | +0.04% | 0.1K |

| Wal-Mart Stores Inc | WMT | 80.75 | +0.05% | 2.4K |

| Walt Disney Co | DIS | 105.50 | +0.06% | 0.8K |

| Ford Motor Co. | F | 15.92 | +0.06% | 9.7K |

| Yahoo! Inc., NASDAQ | YHOO | 44.20 | +0.16% | 0.3K |

| ALTRIA GROUP INC. | MO | 50.43 | +0.26% | 2.0K |

| Twitter, Inc., NYSE | TWTR | 50.68 | +0.42% | 92.2K |

| Apple Inc. | AAPL | 124.81 | +0.45% | 179.6K |

| Starbucks Corporation, NASDAQ | SBUX | 93.56 | +0.58% | 1.8K |

| Facebook, Inc. | FB | 82.30 | +0.78% | 81.3K |

| Yandex N.V., NASDAQ | YNDX | 15.95 | +1.14% | 2.5K |

| Tesla Motors, Inc., NASDAQ | TSLA | 190.62 | +1.62% | 63.7K |

| Intel Corp | INTC | 30.81 | 0.00% | 1.5K |

| Merck & Co Inc | MRK | 56.86 | 0.00% | 1.2K |

| United Technologies Corp | UTX | 115.92 | 0.00% | 0.4K |

| General Motors Company, NYSE | GM | 36.74 | 0.00% | 3.2K |

| Hewlett-Packard Co. | HPQ | 31.29 | 0.00% | 1.2K |

| Verizon Communications Inc | VZ | 48.90 | -0.04% | 4.0K |

| Pfizer Inc | PFE | 34.31 | -0.06% | 0.3K |

| Cisco Systems Inc | CSCO | 27.23 | -0.07% | 0.9K |

| Microsoft Corp | MSFT | 40.69 | -0.07% | 7.2K |

| Google Inc. | GOOG | 542.20 | -0.07% | 0.4K |

| Visa | V | 65.13 | -0.08% | 16.0K |

| ALCOA INC. | AA | 12.99 | -0.08% | 5.8K |

| AT&T Inc | T | 32.85 | -0.12% | 0.9K |

| Nike | NKE | 99.40 | -0.15% | 0.6K |

| Johnson & Johnson | JNJ | 99.00 | -0.15% | 0.6K |

| JPMorgan Chase and Co | JPM | 59.86 | -0.15% | 71.3K |

| Goldman Sachs | GS | 191.92 | -0.16% | 1.6K |

| International Business Machines Co... | IBM | 158.88 | -0.19% | 0.2K |

| Chevron Corp | CVX | 104.58 | -0.20% | 2.4K |

| American Express Co | AXP | 78.74 | -0.24% | 4.9K |

| Boeing Co | BA | 148.28 | -0.24% | 0.6K |

| Caterpillar Inc | CAT | 79.43 | -0.26% | 2.0K |

| Procter & Gamble Co | PG | 82.10 | -0.27% | 4.1K |

| Home Depot Inc | HD | 112.71 | -0.37% | 20.0K |

| E. I. du Pont de Nemours and Co | DD | 70.71 | -0.38% | 16.8K |

| McDonald's Corp | MCD | 95.72 | -0.59% | 0.1K |

| Barrick Gold Corporation, NYSE | ABX | 11.86 | -1.25% | 34.9K |

Upgrades:

Downgrades:

Other:

Starbucks (SBUX) target raised to $112 from $99 at Bernstein; Outperform

Facebook (FB) target raised to $97 from $91 at Citigroup; Buy

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Trade Balance February -1.03 Revised From -0.98 -1.25 -1.26

08:30 United Kingdom PMI Construction March 60.1 60.4 57.8

11:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. trade deficit is expected to narrow to $41.5 billion in February from $41.8 billion in January.

The number of initial jobless claims in the U.S. is expected to rise by 3,000 to 285,000.

Factory orders in the U.S. are expected to be flat in February, after a 0.2% decline in January.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone. Concerns over Greece's debt problems continue to weigh on the euro.

The European Central Bank (ECB) released its minutes of March meeting. According to the minutes, the Governing Council reiterated to keep its monetary policy "for as long as needed".

The British pound traded lower against the U.S. dollar after the weaker-than-expected construction PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 57.8 in March from 60.1 in February, missing expectations for a rise to 60.4.

The decline was driven by slower rise of output and new orders.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian trade data. The Canadian trade deficit is expected to narrow to C$1.8 billion in February from C$2.5 billion in January.

EUR/USD: the currency pair rose to $1.0843

GBP/USD: the currency pair decreased to $1.4778

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Trade balance, billions February -2.5 -1.8

12:30 U.S. International Trade, bln February -41.8 -41.5

12:30 U.S. Initial Jobless Claims March 282 285

12:30 U.S. Continuing Jobless Claims March 2416

14:00 U.S. Factory Orders February -0.2% 0.0%

EUR/USD

Offers 1.1100 1.1050 1.0100 1.0950 1.0900 1.0860/50

Bids 1.0700 1.0660/55 1.0600/10

GBP/USD

Offers 1.4995/500 1.4950 1.4920 1.4900

Bids 1.4725/20 1.4710/00 1.4685/80 1.4630

EUR/JPY

Offers 131.00 130.40/50 130.00

Bids 128.40 128.20/00 127.50

USD/JPY

Offers 122.05/00 121.70 121.20 121.00 120.50/45

Bids 119.00 118.90 118.65/60 118.35 118.00

EUR/GBP

Offers 0.7400 0.7385/90 0.7340 0.7300

Bids 0.7250 0.7220 0.7210/00 0.7150

AUD/USD

Offers 0.7850 0.7825 0.7800 0.7780 0.7700 0.7665

Bids 0.7500 0.7400

The Bank of Japan (BoJ) released its inflation expectations survey on Thursday. Japanese companies expect consumer price inflation to increase 1.4% in one year from now, unchanged from the December survey, the central bank said.

The consumer price inflation is expected to rise 1.6% in a three- year time frame and 1.6% in five-years, down from a previous estimate of 1.7%, according to the survey.

Companies' inflation expectations haven't been affected much by a slow recovery in consumer spending in Japan.

European stocks are trading steady close to their opening. Stalling negotiations between Greece and the E.U. weigh on the markets as the country is struggling to unlock more bailout funds. Greece failed to reach an agreement with the European Union and the IMF. The proposed reforms were rather seen as 'ideas' than concrete plans and therefor dismissed. Antonis Samaras announced yesterday that he would be willing to join a unity government if the government commits to stay in the Eurozone. Yesterday the ECB raised the cap on the Emergency Liquidity Assistance for Greek banks.

According to Markit the U.K. construction purchasing managers' index declined today to a 3 month low with a reading of 57.8 for the month of March. Analyst expected the PMI to rise from 60.1 to 60.4. U.K.'s construction output growth has lost some of its momentum this year although it has settled in at a strong pace, according to the author of the report.

The ECB Monetary Policy Meeting Accounts will be in the focus today. Later in day U.S. data on International Trade, Initial Jobless Claims and Factory orders will be reported.

The FTSE 100 index is currently trading +0.12% quoted at 6,817.66. Germany's DAX 30 lost -0.09% trading at 11,990.10. France's CAC 40 is currently trading at 5,065.09 points, +0.06%.

Oil is trading lower today after price skyrocketed yesterday as talks between western diplomats and officials from Iran are extended over the set deadline. If the talks will reach an agreement over Iran's atomic program could result in an end of the embargo which would add to the global supply glut.

Yesterday's data on U.S. Crude oil Inventories showed that inventories rose by 4.766 million barrels in the week ended March 27 - less than the build-up reported by the API a day earlier. U.S. output shrank for the first time since December. The number of active drilling rigs reach the lowest count since 4 years.

Brent Crude lost -0.75% currently trading at USD56.67 a barrel. On January 13th Crude set a low at USD45.19. West Texas Intermediate dropped -0.94% currently quoted at USD49.62.

Oil prices declined sharply in recent months as worldwide supply exceeds demand in a period of low global economic growth, pushing stockpiles to record highs and weighing on prices.

Gold is trading slightly lower today after yesterday's strong gains on weaker-than-expected U.S. data that dampened concerns over a rate hike in June. Manufacturing activity in March slowed to the lowest level in 14 months and the private sector in the U.S. added 189,000 jobs in March, according the ADP report on Wednesday. It was the slowest pace since January 2014. Now the focus will be on Friday's nonfarm payrolls and today's Initial Jobless Claims. A weaker U.S. dollar also supported the price of gold.

Gold is currently quoted at USD1,202.90, -0,07% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40. On Tuesday the 17th of march gold traded as low as USD1,142.50, a three-month low.

EUR/USD: $1.0700 (E720M), $1.0800 (E625M), $1.0850 (E428M)

NZD/USD: $0.7450 (NZ$295M), $1.2600 (NZ$464M)

USD/CAD: C$1.2500-05 ($500M), C$1.2515 ($296M), C$1.2600 ($464M)

USD/JPY: Y120.00 ($2.8BLN), Y120.80 ($965M), Y121.00 ($526M)

According to Markit the U.K. construction purchasing managers' index declined today to a 3 month low with a reading of 57.8 for the month of March. Analyst expected the PMI to rise from 60.1 to 60.4.

U.K.'s construction output growth has lost some of its momentum this year although it has settled in at a strong pace, according to the author of the report.

BLOOMBERG

BOE Gets New 'Unofficial Governor' as Mark Carney Appoints Aide

Mark Carney has just acquired a new set of eyes and ears at the Bank of England.

The governor appointed Iain de Weymarn as his private secretary, the aide in charge of his office at the central bank, a spokeswoman said by telephone. He replaced Alex Brazier, who left the job two weeks ago after his promotion to the Financial Policy Committee.

De Weymarn takes on a role described by a lawmaker last month as the organization's "unofficial governor," with a remit that offers insights into every corner of the 320-year-old institution. The post has often been a stepping stone to more senior positions within the central bank; prior holders include Deputy Governor Andrew Bailey and Paul Tucker, who lost out to Carney for the top job in 2012.

REUTERS

Oil retreats from large jump as focus returns to Iran talks

(Reuters) - Oil futures fell on Thursday, retreating from big gains in the previous session, as the prospect that any deal in nuclear talks with Tehran and a possible increase in its crude exports helped to keep pressure on prices.

Major powers and Iran have stretched talks on Tehran's nuclear program into a second day past an end-March deadline, with diplomats saying the chances for a preliminary deal were balanced between success and collapse.

Both Brent and U.S crude prices snapped three-session losing streaks on Wednesday, gaining $2 or more after data from the Energy Information Administration (EIA) showed a fall in rigs drilling for oil resulted in a drop in U.S. output last week for the first time since late-December.

Source: http://www.reuters.com/article/2015/04/02/us-markets-oil-idUSKBN0MT0AD20150402

BLOOMBERG

ECB Said to Raise ELA Limit for Greek Banks by 700 Million Euros

The European Central Bank approved an increase in the emergency funds available to Greek lenders that was smaller than the amount granted last week, two people familiar with the decision said.

At a meeting in Frankfurt on Wednesday, the Governing Council raised the cap on Emergency Liquidity Assistance provided by the Bank of Greece by 700 million euros ($754 million), the people said, asking not to be named because the decision is confidential. An ECB spokesman declined to comment.

As customers withdraw deposits on concern the Greek government is heading for a debt default and a banking crisis, the ECB is ensuring the country's lenders have sufficient liquidity to operate. At the same time, it's keeping them on a tight rein to prevent them from financing the state and so breaching European Union law.

European stocks are trading moderately higher today. Stalling negotiations between Greece and the E.U. weigh on the markets as the country is struggling to unlock more bailout funds. Greece failed to reach an agreement with the European Union and the IMF. The proposed reforms were rather seen as 'ideas' than concrete plans and therefor dismissed. Antonis Samaras announced yesterday that he would be willing to join a unity government if the government commits to stay in the Eurozone. Yesterday the ECB raised the cap on the Emergency Liquidity Assistance for Greek banks.

The commodity heavy FTSE 100 index is currently trading +0.22% quoted at 6,824.73 points. Germany's DAX 30 is trading at 12,007.55 points +0.05%. France's CAC 40 is currently trading at 5,072.01 points, +0.19%.

U.S. stocks fell on Wednesday, the first day of the new quarter, amid weaker-than expected U.S. economic data. The Institute for Supply Management's manufacturing purchasing managers' index for the U.S. declined to 51.5 in March from 52.9 in February, missing expectations for a decline to 52.5. It was the fifth consecutive decline. Private sector in the U.S. added 189,000 jobs in March, according the ADP report on Wednesday. The S&P 500 closed -0.40% with a final quote of 2,059.69 points. The DOW JONES index declined by -0.44%, closing at 17,698.18 points.

Chinese stocks were trading mixed. Hong Kong's Hang Seng is currently trading +0.51% at 25,209.42 points. China's Shanghai Composite declined to 3,801.52 points currently down -0.23%. The Chinese government announced that the social security fund, responsible for the Chinese pensions, will be allowed to invest in government debt, investment trust and shares.

The Nikkei rallied on Thursday rebounding from a three-week-low on short-coverings after the recent plunge and on speculations that the Bank of Japan will buy stocks. The index climbed +1.46% to close at 19,312.79.

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Trade Balance February -0.98 -1.25 -1.26

The U.S. dollar is trading broadly lower against its major peers on weaker-than-expected U.S. economic data reported yesterday, only booking gains against the aussie. The Institute for Supply Management's manufacturing purchasing managers' index for the U.S. declined to 51.5 in March from 52.9 in February, missing expectations for a decline to 52.5. It was the fifth consecutive decline. Private sector in the U.S. added 189,000 jobs in March, according the ADP report on Wednesday. It was the slowest pace since January 2014. Construction spending in the U.S. declined 0.1% in February.

The Australian dollar traded lower against the U.S. dollar. Data on the MI Inflation Gauge came in at 0.4% for March, compared to a previous reading of 0.0%. Year on year the reading rose from 1.3% to 1.5%. The Australian Trade Balance for February came in at a deficit of AUD1.26 billion, slightly higher than the expected AUD1.25 billion. The January reading was revised from a deficit of AUD980 million to AUD1.03 billion.

New Zealand's dollar rose against the greenback during the Asian after a seven day losing streak.

The Japaneseyen is trading higher against the greenback in the Asian session. Year on year the Japanese Monetary Base for March grew by 35.2, below expectations for an increase of 35.3%. The previous reading was 36.7%.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

(time / country / index / period / previous value / forecast)

07:00 United Kingdom Halifax house price index March -0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y March 8.3%

08:30 United Kingdom PMI Construction March 60.1 60.4

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada Trade balance, billions February -2.5 -1.8

12:30 U.S. International Trade, bln February -41.8 -41.5

12:30 U.S. Initial Jobless Claims March 282 285

12:30 U.S. Continuing Jobless Claims March 2416

14:00 U.S. Factory Orders February -0.2% 0.0%

EUR / USD

Resistance levels (open interest**, contracts)

$1.0904 (4382)

$1.0859 (2655)

$1.0823 (3723)

Price at time of writing this review: $1.0785

Support levels (open interest**, contracts):

$1.0727 (1741)

$1.0690 (4120)

$1.0646 (3064)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 71858 contracts, with the maximum number of contracts with strike price $1,1000 (5048);

- Overall open interest on the PUT options with the expiration date April, 2 is 81309 contracts, with the maximum number of contracts with strike price $1,0600 (7898);

- The ratio of PUT/CALL was 1.13 versus 1.16 from the previous trading day according to data from April, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.5100 (1656)

$1.5000 (1654)

$1.4901 (1015)

Price at time of writing this review: $1.4827

Support levels (open interest**, contracts):

$1.4797 (1052)

$1.4699 (2316)

$1.4600 (1261)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 27263 contracts, with the maximum number of contracts with strike price $1,5100 (1656);

- Overall open interest on the PUT options with the expiration date April, 2 is 28927 contracts, with the maximum number of contracts with strike price $1,5050 (2351);

- The ratio of PUT/CALL was 1.06 versus 1.07 from the previous trading day according to data from April, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.