- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 03-09-2018

| Raw materials | Closing price | % change |

| Oil | $70.10 | +0.43% |

| Gold | $1,207.00 | +0.02% |

| Index | Change items | Closing price | % change |

| Nikkei | -157.77 | 22707.38 | -0.69% |

| TOPIX | -15.04 | 1720.31 | -0.87% |

| Hang Seng | -176.01 | 27712.54 | -0.63% |

| KOSPI | -15.85 | 2307.03 | -0.68% |

| FTSE 100 | +72.18 | 7504.60 | +0.97% |

| DAX | -17.65 | 12346.41 | -0.14% |

| CAC 40 | +6.95 | 5413.80 | +0.13% |

| Pare | Closed | % change |

| EUR/USD | $1,1614 | +0,06% |

| GBP/USD | $1,2869 | -0,68% |

| USD/CHF | Chf0,96893 | +0,02% |

| USD/JPY | Y111,07 | -0,02% |

| EUR/JPY | Y129,00 | +0,03% |

| GBP/JPY | Y142,935 | -0,64% |

| AUD/USD | $0,7212 | +0,26% |

| NZD/USD | $0,6598 | -0,34% |

| USD/CAD | C$1,30909 | +0,37% |

Turnover in the retail sector rose by 0.3% in nominal terms in July 2018 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.9% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.3% in July 2018 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered a decline of 1.0%.

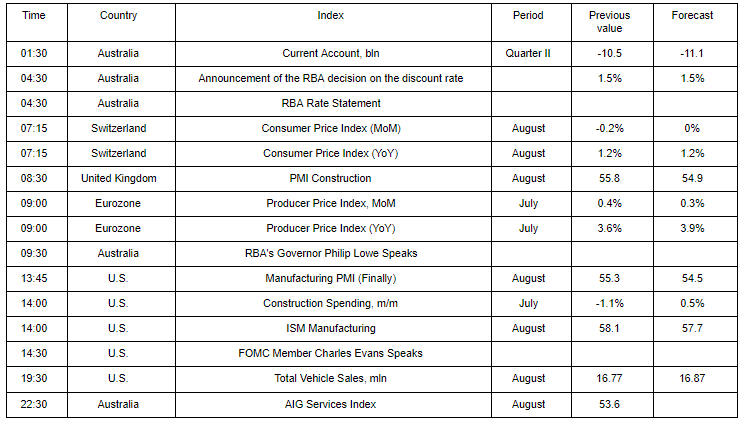

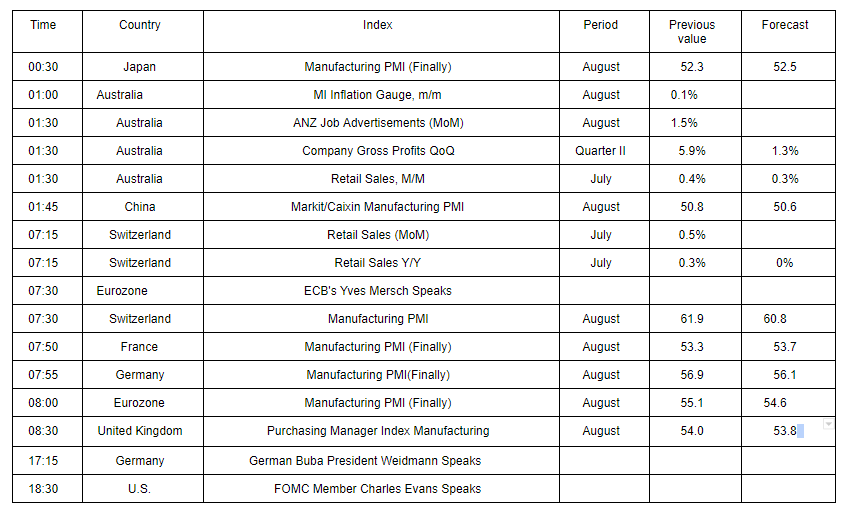

Rates of expansion in output and new orders eased following the first contraction in new export business for over two years. The subdued performance of the sector also transmitted itself to the labour market, with the pace of manufacturing job creation slumping to near-stagnation.

The seasonally adjusted IHS Markit/CIPS Purchasing Managers' Index (PMI) posted 52.8 in August, down from a revised reading of 53.8 in July (originally reported as 54.0). The PMI has posted above the neutral 50.0 mark for 25 successive months, although the latest reading is the lowest registered during that sequence.

Manufacturing operating conditions in the eurozone continued to strengthen during August, maintaining a run of expansion that now stretches to 62 months. However, posting 54.6, unchanged from the earlier flash-estimate, but down from July's 55.1, the final IHS Markit Eurozone PMI pointed to the slowest growth since November 2016.

Commenting on the final Manufacturing PMI data, Chris Williamson, Chief Business Economist at IHS Markit said: "Eurozone factories reported a further solid production gain in August, but prospects dimmed further as growth of new orders hit a two-year low and worries about the outlook deepened. "The slowdown in demand compared to the surging pace of expansion seen earlier in the year is being driven primarily by export orders rising at the slowest rate for nearly two years. Some of the slowdown in exports can be attributed to the appreciation of the euro since earlier in the year, but companies are also reporting signs of demand cooling and risk aversion intensifying".

The German manufacturing sector saw robust increases in both output and employment in August, though signs of weakness in new orders and concerns towards global geopolitics weighed on firms' expectations towards growth in the year ahead, according to the latest PMI survey data from IHS Markit. Notably, new export orders showed the weakest rise for over two years.

The headline IHS Markit/BME Germany Manufacturing PMI - a single-figure snapshot of the performance of the manufacturing economy - fell back to 55.9 in August, down from 56.9 in July and its joint-lowest reading in the past yearand-a-half (alongside that seen in June).

The following movements are compared with the March 2018 quarter. All prices are unadjusted: all volumes and values are seasonally adjusted unless otherwise stated:

-

The merchandise (goods) terms of trade rose 0.6 percent, following a 2.0 percent fall in the March 2018 quarter.

-

Export prices for goods rose 2.4 percent, while import prices for goods rose 1.7 percent.

-

Seasonally adjusted goods export volumes rose 1.1 percent, and goods import volumes rose 0.9 percent.

-

Seasonally adjusted goods export values rose 3.0 percent, and goods import values rose 1.7 percent.

In line with stronger inflows of new work, firms raised production and employment. However, business sentiment dipped amid uncertainty arising from global geopolitics. Meanwhile, cost pressures were sustained in August, leading firms to increase selling prices at the sharpest rate in almost ten years.

The headline Nikkei Japan Manufacturing Purchasing Managers' IndexTM (PMI) - a composite single-figure indicator of manufacturing performance - registered at 52.5 in August. This was compared to 52.3 in July.

Australian retail turnover was relatively unchanged (0.0 per cent) in July 2018, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

This follows a 0.4 per cent rise in June 2018.

"There were falls in three of the six industries," said Ben James, Director of Quarterly Economy Wide Surveys. "Household goods retailing (-1.2 per cent) led the falls, and there were also falls in Clothing, footwear and personal accessory retailing (-2.0 per cent) and Department stores (-1.9 per cent). The falls were offset by rises in Other retailing (1.7 per cent), Food (0.3 per cent) and Cafes, restaurants and takeaway food services (0.6 per cent)".

In seasonally adjusted terms, there were falls in Western Australia (-0.6 per cent), Victoria (-0.2 per cent), South Australia (-0.3 per cent), the Northern Territory (-1.6 per cent), the Australian Capital Territory (-0.6 per cent), and Tasmania (-0.3 per cent). New South Wales (0.0 per cent) was relatively unchanged, while Queensland rose (0.8 per cent).

Output continued to expand, and at a quicker pace than in July. However, new orders rose at the slowest rate since May 2017, while export sales declined for the fifth month in a row. At the same time, employment remained on a downward trend which, in turn, contributed to an increase in outstanding workloads. Inflationary pressures meanwhile picked up, with firms noting steeper increases in both input costs and output charges. Confidence towards future output remained stuck near June's six-month low, with a number of panellists citing concerns over the impact of the ongoing China-US trade war and relatively subdued market conditions.

The headline seasonally adjusted Purchasing Managers' Index (PMI) posted above the neutral 50.0 level at 50.6 in August. However, this was down from 50.8 in July and signalled the weakest improvement in the health of the sector since June 2017.

| Raw materials | Closing price | % change |

| Oil | $69.73 | -0.10% |

| Gold | $1,201.80 | -0.41% |

| Index | Change items | Closing price | % change |

| Nikkei | -4.35 | 22865.15 | -0.02% |

| ASX 200 | -32.30 | 6319.50 | -0.51% |

| Hang Seng | -275.50 | 27888.55 | -0.98% |

| KOSPI | +15.53 | 2322.88 | +0.67% |

| FTSE 100 | -83.61 | 7432.42 | -1.11% |

| DAX | -130.18 | 12364.06 | -1.04% |

| CAC 40 | -71.21 | 5406.85 | -1.30% |

| DJIA | -22.10 | 25964.82 | -0.09% |

| S&P 500 | +0.39 | 2901.52 | +0.01% |

| NASDAQ | +21.17 | 8109.54 | +0.26% |

| Pare | Closed | % change |

| EUR/USD | $1,1607 | -0,51% |

| GBP/USD | $1,2957 | -0,42% |

| USD/CHF | Chf0,96875 | +0,03% |

| USD/JPY | Y111,09 | +0,07% |

| EUR/JPY | Y128,95 | -0,44% |

| GBP/JPY | 143,854 | -0,41% |

| AUD/USD | $0,7193 | -0,99% |

| NZD/USD | $0,6621 | -1,40% |

| USD/CAD | C$1,30427 | +0,51% |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.