- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 04-07-2011

GBP/USD

Offers: $1.6100/05, $1.6120/25, $1.6150/55, $1.6180, $1.6200, $1.6220/30

Bids: $1.6050, $1.6025/20, $1.5970, $1.5940/30, $1.5915/00

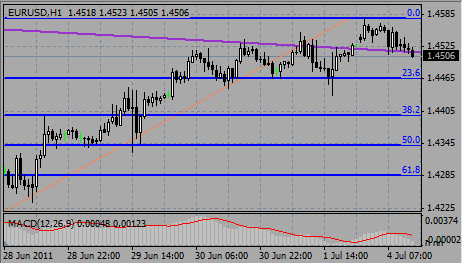

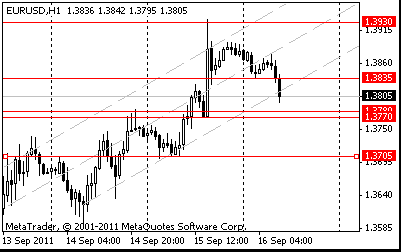

Offers: $1.4560, $1.4580, $1.4600, $1.4610, $1.4620/25, $1.4650/55, $1.4690/00

Bids: $1.4500, $1.4480, $1.4455/45, $1.4420/15, $1.4400, $1.4380/70

EUR/USD $1.4400, $1.4500

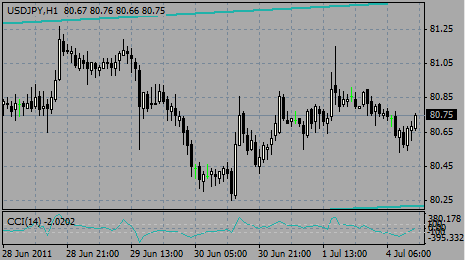

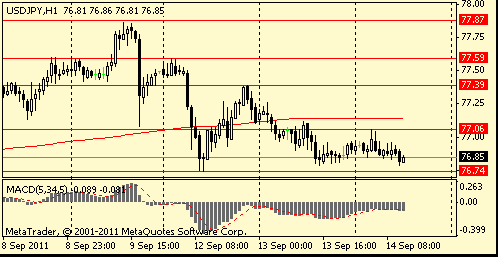

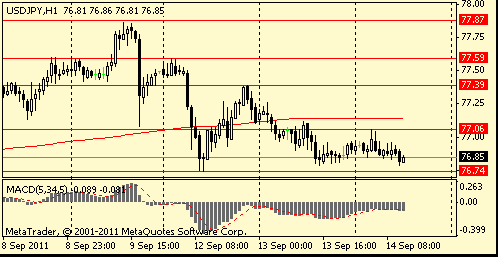

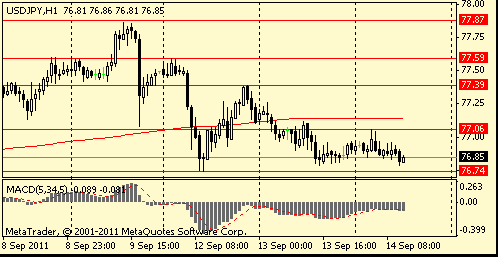

USD/JPY Y80.00, Y80.15, Y80.60, Y80.90

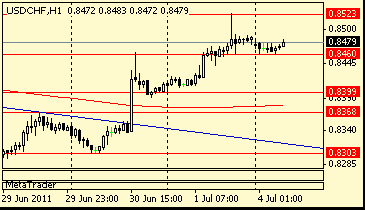

USD/CHF; Chf0.8400, Chf0.8420, Chf0.8450

СРА/ОЗН Y96.15

AUD/JPY Y86.75

GBP/USD extends its pullback to $1.6065, a bit higher an Asian lows on $1.6060. Earlier rate printed session highs on $1.6140 before retreated. Bids seen in place between $1.6060/50 with stops at $1.6045/40. Break under to open a deeper move toward $1.6025/20 ($1.6023 76.4% $1.5987/1.6140).

AUD/USD retreats to current $1.0718 ahead of US opening and tomorrow's RBA meeting. Offers remain at $1.0760/70 with stops above $1.0788/95. A break here opens the way up to $1.0950. Support at $1.0695/90 with corporate bids behind at $1.0655/50.

Data released:

09:00 EU(17) PPI (May) -0.2% -0.1% 0.9%

09:00 EU(17) PPI (May)Y/Y 6.2% 6.3% 6.7%

USA Independence Day

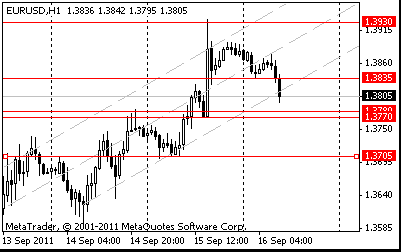

The euro weakened versus the yen after Standard & Poor’s said a debt-rollover plan for Greece may prompt a “selective default” rating for the country.

The euro earlier advanced on speculation the European Central Bank will increase interest rates this week. The ECB on July 7 will increase its benchmark rate to 1.5% from 1.25%, according to economists.

“Sentiment was undermined with those S&P comments,” said Jeremy Stretch at Canadian Imperial Bank of Commerce. “Markets are reluctant to aggressively sell the euro, though. We need to see what the other rating agencies are going to suggest.”

The Swiss franc declined after data showed retail sales fell 4.1% in May from a year earlier. The Swiss currency has advanced 9.3% versus the dollar this year as investors sought a haven amid the euro-area debt crisis.

“There is a response to domestic data, undoubtedly,” said Steve Barrow at Standard Bank Plc.

EUR/USD set stable around session lows after it earlier failed to go ahead the resistance at $1.4580. Rate holds at $1.4515/20.

GBP/USD fell under $1.6100from session highs on $1.6140 following the release of Construction PMI data.

USD/JPY recovered from session low on Y80.52 and currently holds around Y80.71.

Traders expect a low volume session, with US markets closed for the Independence Day holiday.

EUR/CHf holds around Chf1.2327 after it failed to break above the resistance area between Chf1.2345/50. Stops seen placed on a break of Chyf1.2360, a break to open a move toward Chf1.2400.

EUR/USD holds around $1.4520, challenging stops berween $1.4518/15. Offers remain around $1.4580/95, suggested to be linked to the reported option interest at $1.4600. Bids ahead of $1.4500.

GBP/USD holds below $1.6100 amid UK clearer sales. Rate fell to current $1.6095/90 from session highs on $1.6140 to $1.6095/90. Stops seen placed below $1.6090, a break to open a deeper move toward $1.6060/50.

- economy headed in expected direction;

- inflation pressure remains high;

- global economy recovering but faces many risks.

- economy headed in expected direction;

- inflation pressure remains high;

- global economy recovering but faces many risks.

The EU major indexes are narrowly mixed, although volumes remain very light due to US holiday. The FTSE was last 0.25% higher, with the CAC down 0.15%. The DAX is higher by 0.1%.

AUD/USD continues to recover, holding around $1.0750/55. Next level of resistance at $1.0770. Offers at $1.0815/20. On the downside bids at $1.0695/90 a break here to open $1.0625/20.

GBP/USD holds around $1.6123 following the construction PMI report as traders bought the rumour and sell the fact (53.6 versus the median 53.0). rate printed session high on $1.6140 with offers mentioned there.

EUR/USD: $1.4400, $1.4500

USD/JPY: Y80.00, Y80.15, Y80.60, Y80.90

USD/CHF: Chf0.8400, Chf0.8450

CHF/JPY: Y96.15

AUD/JPY: Y86.75

- 7 out of 9 Japan regions up economy from April;

- Japan spending shows signs of picking up in all regions;

- Japan output increasing or picking up in most regions;

- labor, income conditions remain severe in many regions.

Resistance 3: Y81.80 (May 31 high)

Resistance 3: Chf0.8610 (50.0 % FIBO CHF0,8950-Chf0,8275)

Resistance 3: $ 1.6150 (high of american session on Jun 22)

Resistance 3: $ 1.4700 (high of June)

01:30 Australia Retail Sales s.a. (MoM) (May) -0.6% 0.3% 1.2%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.