- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 05-10-2011

At 11:00 GMT it will know the decision on interest rates Bank of England (to be unchanged), and 11:45 GMT - ECB decision on the basic interest rate (expected to same level - 1.50%).

European stocks advanced for the first time in four days amid speculation policy makers are examining measures to shield banks from the region’s sovereign- debt crisis.

Benchmark indexes rose in all 18 western European markets, with the exception of Iceland. The DAX climbed 4.9 percent in Frankfurt. France’s CAC 40 rose 4.3 percent and the U.K.’s FTSE 100 advanced 3.2 percent.

FTSE 100 5,102 +157.73 +3.19%, CAC 40 2,974 +123.35 +4.33%, DAX 5,473 +256.32 +4.91%

Dexia SA snapped a four-day plunge after France and Belgium said a “bad bank” will be set up to hold its troubled assets. BNP Paribas SA and Societe Generale SA, France’s biggest lenders, climbed more than 8 percent. Rio Tinto Group led mining companies higher. European Aeronautic, Defence & Space Co. rose 5.7 percent after saying 2011 will be a “very good” year.

The euro fell against most of its major counterparts as concern the region’s debt crisis may spread led investors to shun the currency before a European Central Bank meeting tomorrow.

The 17-nation euro weakened to almost a decade low against the yen after a spokesman for European Union Economic and Monetary Commissioner Olli Rehn said there’s no concrete plan to recapitalize banks. Speculation about the effect of euro area bank holdings of Greek debt has helped weaken the euro 5.5 percent in the past month. The pound declined against the dollar and euro after a report showed U.K. economic growth slowed during the second quarter.

The euro depreciated 0.1 percent to 102.44 yen at 12:02 p.m. in New York, after dropping to 100.76 yen yesterday, the weakest level since June 2001. The currency declined 0.1 percent to $1.3330, after falling as much as 0.7 percent. The dollar was little changed at 76.86 yen.

The euro briefly pared its losses and the dollar strengthened against the yen after a report showed U.S. service industries expanded in September by more than forecast.

The U.K. economy expanded 0.1 percent from the first quarter, lower than the 0.2 percent previously published, the Office for National Statistics said today in London. Consumer spending plunged 0.8 percent, the most since the first quarter of 2009. The slow growth is adding pressure on the central bank to keep interest rates low. The Bank of England meets tomorrow.

The pound dropped 0.3 percent to $1.5438.

Gold prices rise, reducing losses after early fall, amid signs of improvement in the U.S. economy.

Gold (spot) trading in a range of $ 1597/1635. December futures traded in New York fell to $ 1596.6 per ounce, then rose to $ 1636.5, and is currently traded at around $ 1630 per troy ounce.

U.S. stocks rallied, sending the Standard & Poor’s 500 Index higher for a second straight day, as economic data topped estimates and investors speculated Europe will act to contain its debt crisis.

Dow 10,854 +45.64 +0.42%, Nasdaq 2,437.44 +32.62 +1.36%, S&P 500 1,131.53 +7.58 +0.67%

The S&P 500 rose 0.5 percent to 1,129.55 at 11:24 a.m. New York time. The index jumped 2.3 percent yesterday after plunging more than 20 percent intraday from an April peak, the threshold of a bear market. The Dow Jones Industrial Average added 38.15 points, or 0.4 percent, to 10,846.86 today.

Monsanto Co., the world’s largest seed company, rallied 3.6 percent after forecasting higher-than-expected profit. Halliburton Co. gained 1.5 percent, pacing gains in energy producers, as oil rose after the U.S. Energy Department reported an unexpected decline in inventories. Walt Disney Co. advanced 3.6 percent as Citigroup Inc. raised its recommendation for the shares. Apple Inc. slumped 0.7 percent, dropping for an eighth day for the longest decline since 1998.

Crude oil extended its gains after the U.S. Energy Department reported an unexpected decline in inventories. Supplies fell 4.68 million barrels to 336.3 million in the week ended Sept. 30, the Energy Department said today. Futures also rose as U.S. companies added more jobs than forecast last month. ADP Employer Services showed companies in the U.S. added 91,000 jobs in September.

Crude oil for November delivery rose $2.86, or 3.8 percent, to $78.53 a barrel at 10:37 a.m. on the New York Mercantile Exchange. Oil traded at $77.77 before the release of the inventory report at 10:30 a.m.

At the moment crude oil for November delivery traded at the level $78.39 a barrel.

new orders 56.5 vs in Aug 52.8

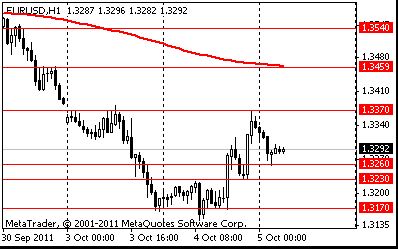

EUR/USD $1.3100, $1.3200, $1.3300, $1.3375, $1.3400, $1.3500

USD/JPY Y74.25, Y76.00, Y76.65, Y77.00, Y77.20, Y77.60, Y78.00

EUR/GBP stg0.8700

AUD/USD $0.9400, $0.9505, $0.9540

EUR/JPY Y101.50, Y104.80

EUR/CHF chf1.2250

U.S. stock futures gained as data showed companies added more jobs than estimated and investors speculated Europe will act to contain its crisis.

News that FMs are pondering a backstop for shaky eurozone banks sparked a late-day 400 point rally in the Dow. Details of the plan are sketchy, but markets were hungry for a sign that EU diplomats are taking the unstable capital positions of their banks seriously.

Company news:

Walt Disney Co. and Apollo Group Inc. rose at least 1.1 percent as analysts raised their recommendations

Data:

US data starts at 1100GMT with the weekly MBA Mortgage Application Index, which is later followed by the ADP National Employment Report, at 1215GMT. US data continues at 1400GMT when the ISM non-manufacturing index is expected to fall slightly to a reading of 53.2 in September. The weekly EIA Crude Oil Stocks then follows, at 1430GMT.

Challenger reports showed 115,730 planned layoffs in September, up sharply from 51,114 in August.

A 50,000 troop reduction from the US Army and a 30,000 planned reduction from Bank of America acct for most of the Sept spike.

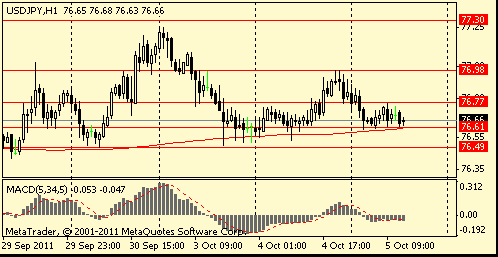

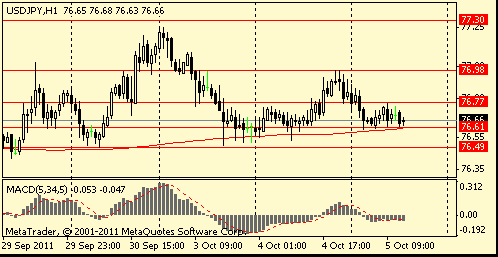

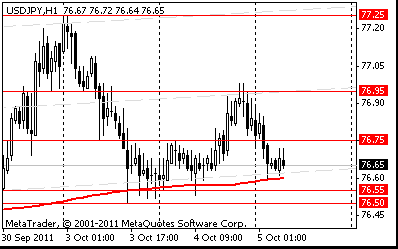

Resistance 3: Y77.30 (Sep 15 and Oct 3 high)

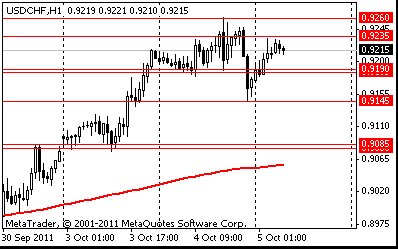

Resistance 3: Chf0.9500 (Feb 22 high)

Resistance 3: $ 1.5660 (Sep 30 high)

EMU debt crisis in larger, more acute phase;

Currently FTSE 5,010 +65.28 +1.32%, CAC 2,908 +57.68 +2.02%, DAX 5,300 +82.93 +1.59%.

European stocks advanced amid speculation policy makers are examining measures to shield banks from the sovereign-debt crisis.

Company news:

USD/JPY Y74.25, Y76.00, Y76.65, Y77.00, Y77.20, Y77.60, Y78.00

EUR/GBP stg0.8700

AUD/USD $0.9400, $0.9505, $0.9540

EUR/JPY Y101.50, Y104.80

EUR/CHF chf1.2250

00:30 Australia Retail sales (MoM) August +0,6%

00:30 Australia Retail Sales Y/Y August +1,6%

The euro fell against the dollar on speculation mounting debt concerns and signs of economic slowdown will compel the European Central Bank to increase monetary stimulus at its meeting tomorrow. The euro failed to extend its biggest jump in more than five months versus the yen as traders increased bets the ECB will lower borrowing costs and before a report today forecast to show the region’s retail sales declined in August. The greenback gained against most major peers after Federal Reserve Chairman Ben S. Bernanke signaled willingness to step up measures to spur U.S. growth.

Italy’s credit rating was cut by Moody’s Investors Service for the first time in almost two decades on concern that Prime Minister Silvio Berlusconi’s government will struggle to reduce the region’s second-largest debt amid chronically weak growth.

Moody’s lowered Italy’s rating three levels to A2 from Aa2, with a negative outlook, the New York-based company said in a statement yesterday. The action comes after Standard & Poor’s downgraded Italy on Sept. 20 for the first time in five years. Italy was last cut by Moody’s in May 1993.

The Australian dollar weakened as Asian stocks reversed an earlier gain.

EUR/USD: on asian session the pair fell

GBP/USD: the pair decreased on asian session

USD/JPY: the pair fell.During Wednesday the release of the final services PMIs from the main European states, leading up to the EMU data at 0758GMT. These

are expected to remain unrevised, although some analysts talk of upside risks following the recent manufacturing releases. This is shortly

followed at 0830GMT by the third estimate of Q2 GDP data, which is expected to remain unrevised. The third estimate of EMU Q2 GDP is also expected, at 0900GMT.

Hang Seng 16,250 -571.88 -3.40%

S&P/ASX 3,926 +54.38 +1.40%

Shanghai Composite closed

The euro rose from a eight-month low versus the dollar after Federal Reserve Chairman Ben S. Bernanke said he’s ready to take additional steps to boost the economy, increasing bets the central bank may introduce further easing.

The 17-nation currency rose for the first time in three days against the greenback on speculation that the U.S. central bank may implement a third round of quantitative easing, which would debase its currency. The euro extended its gains and higher-yielding currencies rose as U.S. stocks erased losses.

The Australian dollar declined to the least in more than a year versus the greenback after the Reserve Bank of Australia held its key rate at 4.75 percent.

The franc fell against the euro amid speculation that the Swiss National Bank may adjust the cap set last month to further weaken the currency.

EUR/USD: the pair is restored after falling.

GBP/USD: the pair is restored after three-day falling

USD/JPY: yesterday the pair is grown

During Wednesday the release of the final services PMIs from the main European states, leading up to the EMU data at 0758GMT. These

are expected to remain unrevised, although some analysts talk of upside risks following the recent manufacturing releases. This is shortly

followed at 0830GMT by the third estimate of Q2 GDP data, which is expected to remain unrevised. The third estimate of EMU Q2 GDP is also expected, at 0900GMT.

Resistance 2: Y76.95 (Oct 4 high)

Resistance 1: Y76.75 (high of the Asian session on Oct 4)

The current price: Y76.65

Support 1:Y76.50/55 (area of Oct 3-4 low)

Support 2:Y76.10/15 (area of Sep 21-22 low)

Support 3: Y75.90 (area of a historical low)

Comments: the pair remains in uptrend.

Asian stocks fell, driving a regional benchmark gauge toward its lowest close in more than two years, as disagreement among policy makers over how to resolve Europe’s debt crisis dimmed the outlook for exporters and banks. Japan’s Nikkei 225 (NKY) Stock Average fell 1.1 percent. South Korea’s Kospi Index slumped 3.6 percent. Australia’s S&P/ASX 200 dropped 0.6 percent after the Reserve Bank of Australia kept its benchmark interest rate unchanged. Hong Kong’s Hang Seng Index fell 3.4 percent.

Nikkei 225 8,456 -89.36 -1.05%, Hang Seng 16,250 -571.88 -3.40%, S&P/ASX 200 3,872 -24.91 -0.64%, Shanghai Composite 2,359 -6.12 -0.26%

The MSCI Asia Pacific Index fell 2.2 percent to 107.7 as of 5:31 p.m. in Mumbai, extending its biggest quarterly decline in almost three years. The measure closed at the lowest level since July 2009 as benchmark indexes worldwide have dropped more than 20 percent from their peaks, entering a so-called bear market. Asian stocks also fell after Goldman Sachs Group Inc. cut its forecast for earnings expansion in Asia excluding Japan. About two stocks fell for each that rose in the MSCI Index and all 10 industry groups declined, led by energy shares.

Esprit Holdings Ltd. (330), a clothier that counts Europe as its biggest market, dropped 4.8 percent in Hong Kong. Samsung Electronics Co., which gets a fifth of its sales in Europe, lost 1.4 percent in Seoul. Mitsubishi UFJ Financial Group Inc. (8306), Japan’s No. 1 listed lender by market value, sank 3.8 percent in Tokyo. Mitsubishi Corp., Japan’s biggest commodities trader, slumped 5.7 percent as oil and metal prices tumbled.

European stocks fell for a second day, extending losses from the Stoxx Europe 600 Index’s biggest quarterly drop since 2008, as concern deepened the region’s debt crisis will curb growth.

National benchmark indexes retreated in all 18 western European markets, except for Ireland. Germany’s DAX slumped 2.3 percent, France’s CAC 40 declined 1.9 percent and the U.K.’s FTSE 100 lost 1 percent.

FTSE 100 5,076 -52.98 -1.03%, CAC 40 2,927 -55.13 -1.85%, DAX 5,377 -125.32 -2.28%

BHP Billiton Ltd. (BHP) and Rio Tinto Group, the world’s biggest mining companies, declined more than 1.5 percent as copper tumbled to a 14-month low in London. Commerzbank AG (CBK) and Societe Generale SA led losses in banking shares. Bayerische Motoren Werke AG (BMW) sank to a one-year low.

U.S. stocks tumbled, sending the Standard & Poor’s 500 Index to a one-year low, as concern over the Greek debt crisis and Bank of America Corp.’s slump offset a rebound in manufacturing and construction spending.

According to the results of today's trading: Dow 10,653.64 -259.74 -2.38%, Nasdaq 2,335.83 -79.57 -3.29%, S&P 500 1,099.23 -32.19 -2.85%

The S&P 500 lost 2.9 percent to 1,099.23 at 4 p.m. New York time, its lowest close since Sept. 8, 2010. The Dow Jones Industrial Average declined 258.08 points, or 2.4 percent, to 10,655.30, also the lowest level in more than a year. Financial shares had the biggest drop in the S&P 500 as Bank of America fell 9.6 percent to the lowest level since March 2009. Citigroup Inc. (C) slumped 9.8 percent to $23.11. The bank may be penalized by regulators in Japan for the third time since 2004 after its Japanese retail banking unit possibly breached rules by failing to fully explain product risk to customers, two people familiar with the situation said. Alcoa Inc. (AA) fell 7 percent amid concern about slower demand for commodities. American Airlines parent AMR Corp. (AMR) slid 33 percent on concern the U.S. is nearing a return to recession and that the carrier may be forced to seek bankruptcy protection.

U.S. stocks rose, erasing an earlier loss, following a report that European Union officials were examining ways to coordinate the recapitalization of banks and valuations at the cheapest level since 2009 lured investors.

The Standard & Poor’s 500 rose 2.2 percent to 1,123.81 at 4 p.m. New York time, according to preliminary closing data. The index plunged as much as 2.2 percent earlier, to a level that would mark more than a 20 percent drop from an April peak, the threshold of a bear market.

The S&P 500 rose earlier after Fed Chairman Bernanke said the central bank “will continue to closely monitor economic developments and is prepared to take further action as appropriate to promote a stronger economic recovery in a context of price stability. Bernanke made his remarks today in testimony to Congress’s Joint Economic Committee in Washington.

Dow 10,808.71 +153.41 +1.44%, Nasdaq 2,405 +68.99 +2.95%, S&P 500 1,123.95 +24.72 +2.25%

Financial stocks in the Standard & Poor’s 500 Index jumped 4.1 percent, reversing a 2.9 percent drop. Bank of America Corp. and JPMorgan Chase & Co. added at least 4.1 percent. DuPont Co. and Hewlett-Packard Co. (HPQ) rallied more than 3.6 percent, pacing in companies most-tied to economic growth. AMR Corp. (AMR) surged 21 percent as analysts said the parent of American Airlines is unlikely to file for bankruptcy.

Apple Inc. dropped 3.6 percent to $361.23. The company, in its first product unveiling since Steve Jobs resigned as chief executive officer, introduced an iPhone with a stronger processor to help it vie with Google Inc.’s Android. The update of Apple’s best-selling product marks an early test for Tim Cook, CEO since Aug. 24, who hasn’t yet shown he can match his predecessor’s skills at product design and marketing.

Resistance 2: Chf0.9260 (Oct 4 high)

Resistance 1: Chf0.9235 (session high)

The current price: Chf0.9215

Support 1: Chf0.9185/90 (session low)

Support 2: Chf0.9145 (Oct 4 low)

Support 3: Chf0.9080/85 (Oct 3 low)

Comments: the pair is corrected within uptrend. In focus support Chf0.9185.

Resistance 2: $ 1.5495 (Oct 4 high)

Resistance 1: $ 1.5465 (high of the Asian session on Oct 4)

The current price: $1.5430

Support 1 : $1.5410 (session low)

Support 2 : $1.5375 (low of the European session on Sep 23)

Support 3 : $1.5340 (Oct 4 low)

Comments: the pair is restored after three-day falling. The nearest resistance $1.5465.

00:30 Australia Retail sales (MoM) August +0,6%

00:30 Australia Retail Sales Y/Y August +1,6%

07:55 Germany Purchasing Manager Index Services September 50.3 50.3

08:00 Eurozone Purchasing Manager Index Services September 49.1 49.1

08:30 United Kingdom Purchasing Manager Index Services September 51.1 50.5

08:30 United Kingdom GDP final Quarter II +0.2% +0.2%

08:30 United Kingdom GDP final, y/y Quarter II +0.7% +0.7%

08:30 United Kingdom Current account, bln Quarter II -9.4 -10.8

09:00 Eurozone GDP (QoQ) Quarter II +0.2% +0.2%

09:00 Eurozone GDP (YoY) Quarter II +1.6% +1.6%

09:00 Eurozone Retail Sales (MoM) August +0.2% -0.3%

09:00 Eurozone Retail Sales (YoY) August -0.2% -0.7%

12:15 U.S. ADP Employment Report September +91К +75К

14:00 U.S. ISM Non-Manufacturing September 53,3 53,0

14:30 U.S. EIA Crude Oil Stocks change +1,9

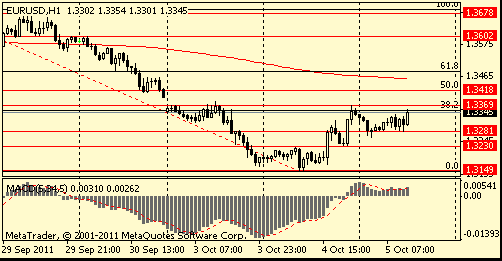

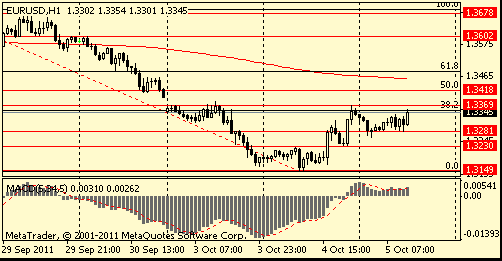

Resistance 2: $ 1.3460 (MA (200) H1)

Resistance 1: $ 1.3370 (Oct 3-4 high)

The current price: $1.3290

Support 1 : $1.3260 (session low)

Support 2 : $1.3230 (high of the European session on Oct 4)

Support 3 : $1.3170 (area of Oct 3-4 low)

Comments: the pair restored. The nearest resistance $1.3370.

Nikkei 225 8,456 -89.36 -1.05%

Hang Seng 16,250 -571.88 -3.40%

S&P/ASX 200 3,872 -24.91 -0.64%

Shanghai Composite 2,359 -6.12 -0.26%

FTSE 100 4,944 -131.06 -2.58%

CAC 40 2,851 -76.28 -2.61%

DAX 5,217 -159.99 -2.98%

Dow 10,808.71 +153.41 +1.44%

Nasdaq 2,405 +68.99 +2.95%

S&P 500 1,123.95 +24.72 +2.25%

10 Year Yield 1.78% -0.00 --

Oil $77.12 +1.45 +1.92%

Gold $1,622.90 +6.90 +0.43%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.