- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 07-10-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | National Australia Bank's Business Confidence | September | 1 | |

| 00:30 | Australia | ANZ Job Advertisements (MoM) | September | -2.8% | 2.8% |

| 01:45 | China | Markit/Caixin Services PMI | September | 52.1 | 52.9 |

| 04:00 | United Kingdom | BOE Gov Mark Carney Speaks | |||

| 05:00 | Japan | Eco Watchers Survey: Current | September | 42.8 | 42.4 |

| 05:00 | Japan | Eco Watchers Survey: Outlook | September | 39.7 | 44.2 |

| 05:45 | Switzerland | Unemployment Rate (non s.a.) | September | 2.1% | |

| 06:00 | Germany | Industrial Production s.a. (MoM) | August | -0.6% | -0.3% |

| 06:45 | France | Trade Balance, bln | August | -4.6 | -4.529 |

| 12:15 | Canada | Housing Starts | September | 226.6 | 215 |

| 12:30 | Canada | Building Permits (MoM) | August | 3% | -2% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | September | 0.3% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | September | 2.3% | 2.3% |

| 12:30 | U.S. | PPI, y/y | September | 1.8% | 1.8% |

| 12:30 | U.S. | PPI, m/m | September | 0.1% | 0.1% |

| 17:35 | U.S. | FOMC Member Charles Evans Speaks | |||

| 18:30 | U.S. | Fed Chair Powell Speaks | |||

| 21:00 | U.S. | FOMC Member Kashkari Speaks |

Major US stocks fell, but only slightly, as investors held back on the move ahead of trade talks between the US and China later this week.

Recent media reports have heightened doubts about the possibility of a breakthrough in negotiations between the two largest economies in the world. Over the weekend, Bloomberg reported that China is increasingly reluctant to agree to a wide trade deal with the United States and will not offer options for reforming China's industrial policy or government subsidies. This proposal would remove one of the main requirements of the Trump administration.

The White House today confirmed that US-Chinese talks will resume on Thursday with the participation of Chinese Deputy Prime Minister Liu He, US Treasury Secretary Stephen Mnuchin and US Trade Representative Robert Lighthizer. The parties will discuss six issues, including forced technology transfer, intellectual property rights, services, non-tariff barriers, and agriculture and law enforcement.

Meanwhile, Director of the White House National Economic Council, Larry Kudlow, said in an interview with Fox Business that he did not want to predict the outcome of negotiations between the US and China. He also said that the issue of removing Chinese companies from the registers of US exchanges in the Trump administration is not discussed.

Markets also analyzed comments by Federal Reserve Bank President Minneapolis Neil Kashkari, who said the economy faces new risks and is happy that the Fed is cutting interest rates. He also added that he did not yet know how much more to reduce the rate. According to the FedWatch CME Group tool, traders see a 73.2% chance of lowering rates at the Fed meeting at the end of this month, compared with 39.6% a week ago.

Most of the DOW components completed trading in the red (22 of 30). Outsider turned out to be the shares of The Coca-Cola Co. (KO; -1.38%). The biggest gainers were UnitedHealth Group Inc. (UNH; + 0.81%).

All S&P sectors recorded a decline. The conglomerate sector showed the largest decrease (-0.7%).

At the time of closing:

Index

Dow 26,478.02 -95.70 -0.36%

S&P 500 2,938.79 -13.22 -0.45%

Nasdaq 100 7,956.29 -26.18 -0.33%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | National Australia Bank's Business Confidence | September | 1 | |

| 00:30 | Australia | ANZ Job Advertisements (MoM) | September | -2.8% | 2.8% |

| 01:45 | China | Markit/Caixin Services PMI | September | 52.1 | 52.9 |

| 04:00 | United Kingdom | BOE Gov Mark Carney Speaks | |||

| 05:00 | Japan | Eco Watchers Survey: Current | September | 42.8 | 42.4 |

| 05:00 | Japan | Eco Watchers Survey: Outlook | September | 39.7 | 44.2 |

| 05:45 | Switzerland | Unemployment Rate (non s.a.) | September | 2.1% | |

| 06:00 | Germany | Industrial Production s.a. (MoM) | August | -0.6% | -0.3% |

| 06:45 | France | Trade Balance, bln | August | -4.6 | -4.529 |

| 12:15 | Canada | Housing Starts | September | 226.6 | 215 |

| 12:30 | Canada | Building Permits (MoM) | August | 3% | -2% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | September | 0.3% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | September | 2.3% | 2.3% |

| 12:30 | U.S. | PPI, y/y | September | 1.8% | 1.8% |

| 12:30 | U.S. | PPI, m/m | September | 0.1% | 0.1% |

| 17:35 | U.S. | FOMC Member Charles Evans Speaks | |||

| 18:30 | U.S. | Fed Chair Powell Speaks | |||

| 21:00 | U.S. | FOMC Member Kashkari Speaks |

Deutsche Bankэы analysts list the major economic events and data releases that are going to have maximum impact on the direction of markets for the week ahead.

- “Tuesday.

- Data: Japan August cash earnings, current account balance, trade balance; China September Caixin services and composite PMIs; Australia NAB business conditions, foreign reserves; UK Q2 unit labor costs; Germany August industrial production; France August trade balance, current account balance; US September PPI, NFIB small business optimism;

- Central Banks: Remarks from Fed's Powell, Evans, Kashkari, BoE's Carney, Tenreyro, Haldane, ECB's Lane, Constancio, Norges Bank's Olsen. Uganda rate decision;

- Politics: European Parliament holds confirmation hearings for its three incoming vice presidents;

- Other: New IMF Director Kristalina Georgieva speaks.

- Wednesday.

- Data: Japan preliminary September machine tool orders; France September industry sentiment; US MBA mortgage applications, August JOLTS, wholesale trade sales and inventories;

- Central Banks: Fed's Powell and George speak; September FOMC meeting minutes; BoE Financial Policy Committee quarterly statement;

- Politics: The C40 climate summit starts in Copenhagen;

- Other: IMF World Economic Outlook analytic chapters published.

- Thursday.

- Data: Japan September PPI and core machine orders; Germany August trade balance and current account balance; France August industrial and manufacturing production; UK September RICS house price balance, August monthly GDP, industrial and manufacturing production, construction output, trade balance; US September CPI, hourly earnings, initial and continuing claims;

- Central Banks: Remarks from BoJ's Amamiya, Fed's Mester, Bostic; ECB Accounts of September Policy Meeting; Peru rate decision;

- Politics: Chinese Vice Premier Liu He visits Washington for trade talks with his US counterparts; EU Economic and Financial Affairs Council hold meetings in Luxembourg;

- Other: OPEC Oil Market Report released;

- Earnings: Delta Airlines, Walgreens Boots Alliance.

- Friday.

- Data: Germany September CPI; US preliminary October University of Michigan survey, September import and export price index;

- Central Banks: Remark's from Fed's Kashkari, Rosengren and Kaplan;

- Politics: Chinese President Xi Jinping and Indian Prime Minister Narendra Modi meet for their second unofficial summit.”

- Economy faces more risks, happy Fed cutting rates

- If a recession were to come, it would be appropriate to use QE

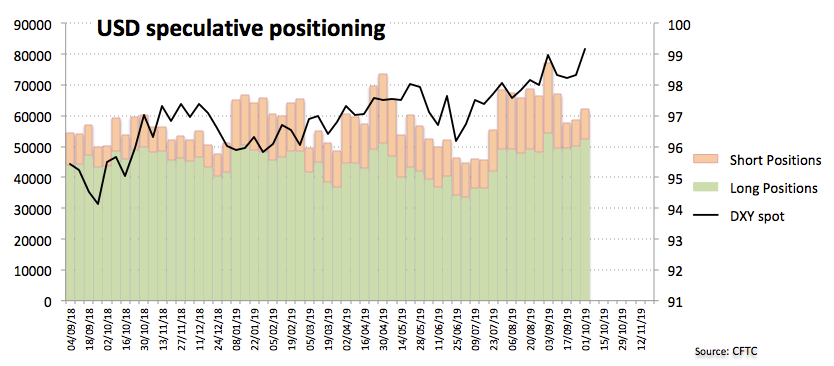

According to CFTC Commitment of Traders Report, USD net longs edged higher for a sixth consecutive week, holding at their highest levels since April 2017, notes analysts at Rabobank.

- “Net EUR short positions climbed again last week.

- Net short GBP positions dropped back for a third consecutive week.

- JPY net positions have been back in positive ground for nine straight weeks on safe-haven demand, but they are well off their recent highs.

- Latest data show CHF net shorts climbing for a third week.

- CAD net long positions recovered a little ground last week.

- AUD net shorts increased for a second week.”

Analysts at BNP Paribas note that China’s economic growth continues to slow, so they have cut their GDP forecasts since June.

- “Industrial activity and exports have been hard hit by US tariff hikes. Domestic demand has also decelerated.

- The central bank is easing liquidity and credit conditions, though the reduction in financial-instability risks should remain a priority and banks seem to remain prudent. Fiscal policy is expansionary through increased infrastructure spending and a rising number of household/corporate tax cuts.

- In the short term, exports and private domestic investment should continue to decelerate. Tax measures should have some success in supporting consumer spending.”

Han de Jong, the chief economist at ABN AMRO, notes that the UK's PM Boris Johnson has so far failed to produce Brexit proposals to the rest of the EU that are acceptable in the eyes of the European parliament.

- “I wonder if he intends to produce proposals that the EU can agree with and I also wonder if the European parliament will agree anything the UK government comes up with. And even if Johnson’s intentions are positive and constructive and the EU is equally constructive, how likely is it that a deal will be greeted positively by the UK parliament? Not very, I would think.

- We continue to think that elections are highly likely, but that the outcome is hugely difficult to predict. According to opinion polls, support for the Conservatives is edging higher and they have a 12 point lead over Labour. What is interesting is that support for the Lib Dems is rising.

- As the election may effectively become another Brexit referendum, it is not impossible that the Lib Dems will continue to rise as they have a very clear position on the issue: they are against Brexit. That can’t be said about Labour. Therefore, Labour voters for whom trying to prevent (a hard) Brexit is important may flock towards the Lib Dems. This also creates a new perspective for Tory voters who do not like the idea of (a hard) Brexit.

- What is very unfortunate, it seems to me, is that the Lib Dem’s new leader, Jo Swinson, is relatively unknown. According to http://www.yougov.co.uk, 10% of surveyed people approve of her, whereas 33% approve of Boris Johnson. The difference is explained by a large number of people not knowing Swinson: only 37% of surveyed people say they know her, against 98% in the case of the prime minister. The positive of that is that relatively few people say they disapprove of Swinson: 10% against 48% in Johnson’s case.”

- China's Vice Premier Liu He will meet with USTR Lighthizer and Treasury Secretary Mnuchin

- Two sides will look to build on the deputy-level talks of the past weeks

- Topics of discussion will include forced technology transfer, intellectual property rights, services, non-tariff barriers, agriculture, and enforcement.

U.S. stock-index futures fell moderately on Monday as investors awaited the resumption of US-China trade talks later in the week.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,375.25 | -34.95 | -0.16% |

Hang Seng | - | - | - |

Shanghai | - | - | - |

S&P/ASX | 6,563.60 | +46.50 | +0.71% |

FTSE | 7,177.63 | +22.25 | +0.31% |

CAC | 5,500.31 | +11.99 | +0.22% |

DAX | 12,028.90 | +16.09 | +0.13% |

Crude oil | $53.56 | +1.42% | |

Gold | $1,502.80 | -0.67% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 154.84 | -0.39(-0.25%) | 3644 |

ALCOA INC. | AA | 19.14 | 0.09(0.47%) | 2604 |

ALTRIA GROUP INC. | MO | 40.55 | -0.26(-0.64%) | 12138 |

Amazon.com Inc., NASDAQ | AMZN | 1,725.00 | 0.58(0.03%) | 43641 |

Apple Inc. | AAPL | 225.62 | 4.80(2.17%) | 790103 |

AT&T Inc | T | 37.3 | 0.11(0.30%) | 38990 |

Boeing Co | BA | 372.5 | 0.43(0.12%) | 5501 |

Caterpillar Inc | CAT | 120.48 | 0.44(0.37%) | 3641 |

Chevron Corp | CVX | 113.54 | 0.39(0.34%) | 3694 |

Citigroup Inc., NYSE | C | 66.67 | -0.03(-0.05%) | 26975 |

Exxon Mobil Corp | XOM | 68.16 | 0.18(0.26%) | 4199 |

Facebook, Inc. | FB | 179.59 | 0.21(0.12%) | 68057 |

FedEx Corporation, NYSE | FDX | 141.43 | -0.28(-0.20%) | 1870 |

Ford Motor Co. | F | 8.73 | 0.02(0.23%) | 26148 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.84 | -0.02(-0.23%) | 44373 |

General Electric Co | GE | 8.6 | -0.11(-1.26%) | 443221 |

General Motors Company, NYSE | GM | 35.06 | 0.08(0.23%) | 1396 |

Goldman Sachs | GS | 197.25 | 0.01(0.01%) | 2317 |

Google Inc. | GOOG | 1,189.87 | 2.04(0.17%) | 5016 |

Hewlett-Packard Co. | HPQ | 17.3 | -1.10(-5.98%) | 186181 |

Home Depot Inc | HD | 226.35 | -0.46(-0.20%) | 2323 |

Intel Corp | INTC | 50.3 | 0.27(0.54%) | 12525 |

International Business Machines Co... | IBM | 142.28 | 0.26(0.18%) | 355 |

Johnson & Johnson | JNJ | 131.5 | 0.31(0.24%) | 2145 |

JPMorgan Chase and Co | JPM | 112.3 | 0.11(0.10%) | 17360 |

McDonald's Corp | MCD | 212 | 1.97(0.94%) | 54327 |

Merck & Co Inc | MRK | 82.17 | -0.57(-0.69%) | 328 |

Microsoft Corp | MSFT | 136.5 | 0.22(0.16%) | 81693 |

Nike | NKE | 92.19 | -0.03(-0.03%) | 8774 |

Pfizer Inc | PFE | 35.5 | 0.05(0.14%) | 5144 |

Procter & Gamble Co | PG | 122 | 0.26(0.21%) | 5543 |

Starbucks Corporation, NASDAQ | SBUX | 84.7 | 0.03(0.04%) | 3366 |

Tesla Motors, Inc., NASDAQ | TSLA | 232.11 | -0.92(-0.39%) | 40099 |

The Coca-Cola Co | KO | 53.8 | -0.04(-0.07%) | 2615 |

Twitter, Inc., NYSE | TWTR | 40.15 | 0.15(0.38%) | 20357 |

United Technologies Corp | UTX | 130.85 | -0.36(-0.27%) | 481 |

Verizon Communications Inc | VZ | 59.02 | 0.01(0.02%) | 6576 |

Visa | V | 174 | 1.13(0.65%) | 32210 |

Wal-Mart Stores Inc | WMT | 115.98 | -0.33(-0.28%) | 1794 |

Walt Disney Co | DIS | 128.3 | 0.15(0.12%) | 11610 |

Yandex N.V., NASDAQ | YNDX | 35 | 0.07(0.20%) | 2000 |

Analysts at Deutsche Bank note the latest U.S. NFP report, which was released on Friday and followed jarringly poor ISM surveys earlier last week, ended up being a bit of damp squib with something for both the bulls and the bears.

- “The headline change in payrolls was slightly below consensus (136,000 versus 145,000), but the employment rate fell 0.2pp to a new 50-year low of 3.5%. The private payrolls figure was similar, coming in at 114,000 compared to expectations for 130,000. These misses were offset somewhat by a healthy +45,000 net revision to the previous two months.

- More interestingly, wage growth was flat on the month, taking the year-on-year figure to 2.9%, its weakest pace in a year. Our economists think this will make the Fed more confident that the natural rate of unemployment has fallen, which should still enable them to cut rates later this month.”

Netflix (NFLX) target lowered to $300 from $380 at Evercore ISI

Uber (UBER) upgraded to Buy from Neutral at Citigroup; target $45

- Says campaigners seeking an order to force PM Johnson to seek a Brexit extension have not made out their case

Analysts at BNP Paribas note that the U.S. growth is slowing and this trend is expected to continue under the influence of corporate investment (slower profits growth, uncertainty) and housing (declining trend of affordability).

- “Consumer spending should be more resilient. The trade dispute with China acts as an additional drag. Inflation is expected to decline, due to softer growth and weaker oil prices.

- We expect one more Fed Funds target rate cut of 25bp this year and two additional cuts in 2020.”

Rabobank's analyst supposes that the Battle of Brexit is to be fought in Westminster, not in Brussels as the EU and the UK are treading carefully to avoid any blame when things go wrong, but it remains highly unlikely that a deal will be reached in the next two weeks.

- “Prime Minister Johnson has finally recognized that his Brexit deal entails some uncomfortable trade-offs: we’re getting two borders for the price of one.

- Even though Johnson’s Brexit deal would only lead to limited checks, it is very hard to see why Europe/Ireland would eventually accept such a proposal. EU leaders gratefully accepted the UK’s concession of Northern Ireland alignment but did not give one iota in return.

- Meanwhile, both the EU and the UK are treading carefully to avoid any blame when things go wrong and count on the UK Parliament to prevent a no-deal Brexit on October 31.

- The EU and the UK will continue talking in the run-up to the Oct. 17-18 European Council, but the focus should be on Westminster.

- An election is inevitable and in the interest of each and every party in these negotiations, but it is far from certain that this will solve matters. The three-month extension to Article 50 that is currently being suggested by the Benn Act looks to be too tight. It’s hard to see the UK getting its act together before this deadline.”

Our proposal is very fair and reasonable

- This is a generous offer we've made, we need to hear the EU's thoughts

- EU leaders can see the argument for pushing on and getting into substantial talks

- Issue is what is the EU's objection, we haven't heard detail from them on what problems are

- We wll study any judgment from Scottish Court on case about Brexit extension law

Philippe Dauba-Pantanacce, the senior economist at Standard Chartered, suggests that political risk has become a dominant market driver as it spreads across multiple geographical and political contexts.

- “Whereas political risk was traditionally confined mostly to frontier- or emerging-market analysis, it is now a factor in assessing all types of markets, including developed ones. This phenomenon has been evident since the GFC and has gained further momentum in recent years.

- Political risk, which often has economic repercussions, manifests itself in various forms; popular protests are one of the most common. This year’s Hong Kong protests are emblematic of the increasing power and impact of protest movements across the globe – they took many by surprise and have led to policy change, economic repercussions, and market volatility.

- Protests have increased in frequency and power in recent years, bringing about regime change (for example, Tunisia in 2011) or economic policy changes (France’s ‘yellow vests’ in 2018-19); in the case of Syria in 2011-12, they presaged armed conflict.”

CFTC Positioning Report for the week ended October 1 notes that USD net longs extended the uptrend and are now in levels last seen in late April 2017.

- "Speculators’ optimism around the buck stayed firm for yet another week. Despite further rate cuts by the Fed remains in the pipeline, the dovish signals from other central banks and the generalized weakness in overseas economies appear to be lending support to the Greenback for the time being.

- Net longs in WTI receded to 4-week lows amidst a generalized weakness in the global manufacturing sector and its impact on the demand for crude oil. In addition, traders appear to have started to gauge the possibility of deeper output cuts by the OPEC should the prospects of oil demand worsen.

- GBP net shorts shrunk to the lowest level since mid-July on the back of renewed expectations of a Brexit deal before/around the October deadline."

- We are ready to talk to EU at a pace to secure a deal but if this is to be possible the EU must match the compromises Britain has made

- Asked if Friday is the deadline says PM has been clear on the time pressures

- Not seeking a time-limited backstop

- Expects PM to speak to PMs of Sweden, Denmark and Poland today

- PM is engaging with foreign leaders on Brexit plans put forward

Analysts at TD Securities note that German factory orders were weak, posting a 0.6% m/m contraction in August, driven by capital goods.

- “The details showed some strength, with shipments suggesting we could see a much stronger than expected IP print tomorrow, potentially posting a gain of over 1% m/m in August.”

FX strategists at ING suggest that the reason for the dollar’s resilience is the lack of attractive alternatives. And in a world of secular stagnation, no one wants a stronger currency right now.

- "Deep challenges faced in Europe and Asia now mean that it will be Washington’s job to get the dollar weaker - either through trade conciliation or the Fed shifting to a full-on easing cycle. Neither of those outcomes look immediate, meaning that the risk environment could well deteriorate into year-end. We continue to favour the JPY.

- All this means that EUR/USD should languish in the 1.05-1.10 range into year-end as the European slowdown broadens from the manufacturing to the service sector and the ECB resumes Quantitative Easing. The likelihood that the Brexit deadline is extended into next March means no resolution here and that GBP could well fall another 5%.

- Elsewhere in Europe, the Polish FX mortgage story could have been worse but the region is slowly showing signs of slowdown and CE4 FX is not immune. In the EMEA space, RUB may be the best performer on seasonal current account trends through 4Q19.

- In Asia, we’re fearful that the PBOC allows more CNY weakness to show through as trade relations deteriorate further. Asian FX is following and it looks like the MAS will have to join with easier policy in October. In Latam, the medium/long term prospects for the BRL are improving, just as those for the MXN are deteriorating. But timing is everything!"

Greece’s government is forecasting 2.8% economic growth in 2020, putting the country on track to meet a primary surplus target it agreed on with creditors while still enacting tax relief measures.

The creditors, however, have warned that the cost of polices Prime Minister Kyriakos Mitsotakis’s government has committed to will create a shortfall of up to 900 million euros toward meeting the target of a primary surplus at 3.5% of gross domestic product for 2020.

Greece’s finance ministry insists the target will be met and sees a primary surplus of 3.56% of GDP next year.

The two sides are set to continue talks to bridge the gap until October 15, when Greece and other European Union members must submit budget plans for 2020.

The government’s budget plan “secures fiscal space to reduce taxes and promote growth while at the same time covering the fiscal gap inherited by the new government for 2020 (as well as this year),” Deputy Finance Minister Theodoros Skylakakis said.

Unemployment is expected to decline further, to 15.6% in 2020 from 17.4% in 2019, while investment is expected to increase by 13.4%. Private consumption is seen rising 1.8%.

The Rabobank Research Team provide the near-term outlook on the Turkish Lira, in the wake of rising geopolitical tensions surrounding Turkey and Syria. Earlier this morning, Turkish President Erdogan said that he hopes to visit US President Trump in the first half of next month.

“The Turkish lira was the weakest link in the EM space in the early hours of trading as Turkey’s incursion into northern Syria seems imminent. If it wasn’t for President Erdogan convincing Trump that Turkey cannot wait any longer to create a bigger buffer with Syria (as Turkey has reached its limits for hosting refugees), USD/TRY would have been trading significantly higher, i.e. at least around 6.00. Initial market reaction so far today has been therefore relatively restrained. That said, the path of the least resistance in the short-term is skewed to the upside in USD/TRY as a military conflict is never positive for the markets.”

Chinese officials have significantly narrowed the scope of issues they’re willing to discuss at upcoming trade negotiations with the U.S., Bloomberg News reported.

The leader of China’s trade delegation, Vice Premier Liu He, recently told dignitaries that China will not commit to reforming industrial policies or government subsidies — two of the Trump administration’s main complaints — Bloomberg reported.

Experts believe China may be gaining the upper hand in trade negotiations as President Donald Trump gets caught up in impeachment proceedings and U.S. economic data continues to weaken, the report said. U.S. and Chinese negotiators are scheduled to hold trade talks in Washington this week.

The U.S. economy is actually looking “quite robust” thanks to a healthy labor market and higher consumer spending, Steve Schwarzman, the co-founder, chairman and CEO of Blackstone Group, told CNBC.

A slew of disappointing economic data last week suggested the ongoing U.S.-China trade war was starting to take its toll, fueling concerns of a possible recession. On Tuesday, a gauge of U.S. manufacturing showed the lowest reading in more than 10 years for September.

But Schwarzman noted that manufacturing accounts for about 11% of the U.S. economy. “The U.S. consumer is around 70%, maybe even a little more, of the U.S. economy …. (and) the 70% is doing quite well,” he told.

“Why is that? Because we have full employment in the U.S. — 3.5% unemployment it’s the lowest since 1969 — that’s pretty amazing. This shortage of labor is starting to create higher wages for workers …. (and) what people are doing with that money is they’re spending it. So, we have 70% of the economy that is quite robust. The only thing, I think, that’s going to disturb that is some kind of geopolitical problem,” Schwarzman said.

“I don’t see a normal business cycle taking the U.S. into a recession,” he added.

According to the report from Sentix, there is no positive reaction to the central banks' aid measures, and economic assessments are broadly negative in October. At -16.8 points, the sentix overall economic index for the Euro area marks the lowest level since April 2013. The recovery of expectations from the previous month has thus completely evaporated. In addition, the assessment of the current situation gives cause for concern. For the eurozone, this falls by 6 points to a 5-year low, and for Germany the value drops for the fifth time in a row at a rapid pace.

Germany: Climate discussion

The economic climate in Germany is eroding at record speed, and the overall index for the former economic engine in Europe in October marks the lowest level since July 2009! Pressure is building up, and the first mover among the leading indicators is sending a clear signal to the people involved that the economic slowdown requires a rapid and courageous reaction.

The other regions of the world are also descending. The US overall index marks its lowest level since August 2012, which is also pushing the index for the global economy massively downwards. There is nothing to be seen of the autumn upswing.

Analysts at Danske Bank offer a brief preview of the key event risks to be watched out for in the week ahead.

“Focus this week will turn to the 13th round of high-level trade talks between the US and China taking place in Washington on Thursday and Friday. If we get an interim deal we expect a short-term relief in equity markets, see US-China Trade - 60% probability of an interim deal, 2 October 2019. On the other hand, a failure to reach such a deal should put risk appetite under pressure again as US tariffs on USD250bn of Chinese goods are then set to move up from 25% to 30% on 15 October (next week). Another important topic to follow will be the development in the Brexit drama. French President Macron has said negotiations must be concluded by the end of this week (same signals were sent by EU ambassadors last week).”

Research team at Nordea Markets - in the monthly Financial Forecast report - expects the Fed to cut interest rates in both October and December.

"Especially the deteriorating macro momentum and the fear of tightening financial conditions too much should weigh in the Fed’s decision-making, while the inflation picture is more mixed. We do, however, see late-cycles warnings linked to the inflation outlook and the slightly de-anchored inflation expectations as clear factors speaking in favour of more easing ahead. We believe the current cycle is comparable with the mid-90s, when after a cumulative 300 bp of rate hikes, the Fed cut rates by 75 bp and managed to fend off a recession. This time, the Fed has hiked by a cumulative 225 bp plus delivered additional tightening via the normalisation of the balance sheet. Acting pre-emptively with two more cuts in October and December could prevent a recession and extend the current expansion. We do, however, still expect the US economy to slow further from here, with the risk of a recession being non-negligible", Nordea Markets said.

According to the report from Halifax Bank of Scotland, UK house prices in September were 1.1% higher than in the same month a year earlier. Economists had expected a 1.6% increase. On a monthly basis, house prices fell by 0.4%. Economists had expected a 0.1% increase. In the latest quarter (July to September) house prices were 0.4% higher than in the preceding three months (April to June).

Russell Galley, Managing Director, Halifax, said: “Annual house price growth slowed somewhat in September, rising by just 1.1% over the last year. Whilst this is lowest level of growth since April 2013, it remains in keeping with the predominantly flat trend we’ve seen in recent months. Underlying market indicators, including completed sales and mortgages approvals, continue to be broadly stable. Meanwhile for buyers, important affordability measures – such as wage growth and interest rates – still look favourable. Looking ahead, we expect activity levels and price growth to remain subdued while the current period of economic uncertainty persists.”

The National Association for Business Economics said in a survey released Monday that US GDP growth next year will drop below 2% for the first time since 2016. In the previous survey, the consensus expectation for next year was 2.1% — now it has dropped to 1.8%.

Although the 54 economists surveyed don't yet expect a recession, the dour forecast is the latest example that a slowdown is no longer merely an expectation. It's here now, and it's likely to stay.

Last week, an Institute for Supply Management report found the manufacturing sector contracted for the second straight month in September. One index measured the industry's monthly growth at its lowest since June 2009. The services sector, too, unexpectedly slowed.

The Fed has raised interest rates twice so far this year to keep growth going. But expectations for monetary policy in the remainder of 2019, are all over the place. The NABE economists are split, with 40% anticipating another rate cut this year. Three-quarters of them expect a rate cut by the end of 2020. By comparison, market expectations call for a 78% chance of a quarter percentage point cut this month, and a nearly 90% chance for a decrease in December, according to the CME FedWatch Tool.

Credit Suisse discusses AUD/USD technical outlook and maintains a bearish bias pending a close back above 0.6776/84.

"Big picture, below the .6677 low for the year is expected in due course to resolve the range to the downside for a resumption of the core bear trend with little in the way of meaningful support not seen until the potential uptrend from the 2001 low, currently at .6552. Big picture, we see more important starting at the .6249 low of 2009 and stretching down to .6009, the 2008 low. Above .6776/84 is needed to mark a near -term base, with resistance then at .6806 initially," CS adds.

In opinion of FX Strategists at UOB Group, EUR/USD could attempt a move to 1.10 in the very near term.

24-hour view: “We highlighted last Friday EUR “could retest the 1.1000 level” and added, “the next resistance at 1.1025 is unlikely to come into the picture”. EUR rose briefly during NY hours and touched 1.0997 before easing off quickly and subsequently traded mostly sideways. From here, the underlying tone still appears to be on the firm side but while EUR could edge above 1.1000, the next resistance at 1.1025 is still unlikely to be challenged. Support is at 1.0955 but only a move below 1.0935 would suggest the current mild upward pressure has eased”.

Next 1-3 weeks: “The consolidation phase that started last Thursday (03 Oct, spot at 1.0960) is still in the early stages and we continue to expect EUR to trade sideways for a while more. However, as highlighted last Friday (04 Oct, spot at 1.0970), looking forward, the top of the expected 1.0890/1.1025 range appears to be more ‘vulnerable’. To put it another way, if EUR were to register a NY closing above 1.1025, it would suggest last Monday’s (30 Sep) low of 1.0877 could be a more significant bottom than currently expected”.

China's foreign exchange reserves declined in September, figures from the People's Bank of China showed.

Forex reserves totaled $3.092 trillion at the end of September compared to $3.107 trillion in August. The expected level was $3.105 trillion.

The currency exchange rate and changes in asset prices affected the level of foreign exchange reserves. Martin Lynge Rasmussen, an economist at Capital Economics, said the central bank relied on state banks during August to contain forex volatility, but the latest forex reserves figures suggests that last month this may have been either replaced with, or supplemented by, direct forex sales by the PBoC.

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had decreased in August 2019 a seasonally and calendar adjusted 0.6% on the previous month. Economists had expected a 0.3% decrease. For July 2019, revision of the preliminary outcome resulted in a decrease of 2.1% compared with June 2019 (provisional: -2.7%). Price-adjusted new orders without major orders in manufacturing had decreased in August 2019 a seasonally and calendar adjusted 0.3% on the previous month.

Domestic orders decreased by 2.6% and foreign orders increased by 0.9% in August 2019 on the previous month. New orders from the euro area were up 1.5%, new orders from other countries rose 0.4% compared to July 2019.

In August 2019 the manufacturers of intermediate goods saw new orders increase by 1.1% compared with July 2019. The manufacturers of capital goods showed decreases of 1.6% on the previous month. For consumer goods, a decrease in new orders of 0.9% was recorded.

The price-adjusted turnover in manufacturing in August 2019 was up a seasonally and calendar adjusted 1.3% on the previous month. For July 2019, the corrected figure showed a decrease of 1.2% to June 2019, (provisional: -0.9%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1116 (2890)

$1.1092 (2048)

$1.1074 (576)

Price at time of writing this review: $1.0980

Support levels (open interest**, contracts):

$1.0913 (3282)

$1.0876 (3256)

$1.0834 (2877)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 8 is 61076 contracts (according to data from October, 4) with the maximum number of contracts with strike price $1,0800 (3506);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2542 (738)

$1.2516 (115)

$1.2473 (168)

Price at time of writing this review: $1.2324

Support levels (open interest**, contracts):

$1.2261 (1170)

$1.2211 (227)

$1.2170 (639)

Comments:

- Overall open interest on the CALL options with the expiration date November, 8 is 31288 contracts, with the maximum number of contracts with strike price $1,3300 (3788);

- Overall open interest on the PUT options with the expiration date November, 8 is 17331 contracts, with the maximum number of contracts with strike price $1,2000 (1603);

- The ratio of PUT/CALL was 0.55 versus 1.15 from the previous trading day according to data from October, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 58.22 | 1.38 |

| WTI | 52.85 | 1.25 |

| Silver | 17.52 | -0.11 |

| Gold | 1504.568 | -0.02 |

| Palladium | 1664.28 | 0.51 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 68.46 | 21410.2 | 0.32 |

| Hang Seng | -289.28 | 25821.03 | -1.11 |

| KOSPI | -11.22 | 2020.69 | -0.55 |

| ASX 200 | 24.1 | 6517.1 | 0.37 |

| FTSE 100 | 77.74 | 7155.38 | 1.1 |

| DAX | 87.56 | 12012.81 | 0.73 |

| CAC 40 | 49.55 | 5488.32 | 0.91 |

| Dow Jones | 372.68 | 26573.72 | 1.42 |

| S&P 500 | 41.38 | 2952.01 | 1.42 |

| NASDAQ Composite | 110.21 | 7982.47 | 1.4 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67677 | 0.37 |

| EURJPY | 117.366 | 0.09 |

| EURUSD | 1.09773 | 0.07 |

| GBPJPY | 131.843 | -0.01 |

| GBPUSD | 1.23311 | -0.04 |

| NZDUSD | 0.63132 | 0.23 |

| USDCAD | 1.33063 | -0.2 |

| USDCHF | 0.99511 | -0.34 |

| USDJPY | 106.904 | 0.03 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.