- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 13-08-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Westpac Consumer Confidence | August | 96.5 | |

| 01:30 | Australia | Wage Price Index, y/y | Quarter II | 2.3% | 2.3% |

| 01:30 | Australia | Wage Price Index, q/q | Quarter II | 0.5% | 0.5% |

| 02:00 | China | Retail Sales y/y | July | 9.8% | 8.6% |

| 02:00 | China | Industrial Production y/y | July | 6.3% | 5.8% |

| 02:00 | China | Fixed Asset Investment | July | 5.8% | 5.8% |

| 06:00 | Germany | GDP (YoY) | Quarter II | 0.7% | 0.1% |

| 06:00 | Germany | GDP (QoQ) | Quarter II | 0.4% | -0.1% |

| 06:45 | France | CPI, y/y | July | 1.2% | 1.1% |

| 06:45 | France | CPI, m/m | July | 0.2% | -0.2% |

| 08:30 | United Kingdom | Producer Price Index - Output (YoY) | July | 1.6% | 1.7% |

| 08:30 | United Kingdom | Producer Price Index - Input (MoM) | July | -1.4% | 0.5% |

| 08:30 | United Kingdom | Producer Price Index - Input (YoY) | July | -0.3% | 0.1% |

| 08:30 | United Kingdom | Producer Price Index - Output (MoM) | July | -0.1% | 0.1% |

| 08:30 | United Kingdom | Retail Price Index, m/m | July | 0.1% | 0% |

| 08:30 | United Kingdom | HICP ex EFAT, Y/Y | July | 1.7% | 1.8% |

| 08:30 | United Kingdom | Retail prices, Y/Y | July | 2.9% | 2.8% |

| 08:30 | United Kingdom | HICP, m/m | July | 0% | -0.1% |

| 08:30 | United Kingdom | HICP, Y/Y | July | 2% | 1.9% |

| 09:00 | Eurozone | Industrial Production (YoY) | June | -0.5% | -1.2% |

| 09:00 | Eurozone | Industrial production, (MoM) | June | 0.9% | -1.4% |

| 09:00 | Eurozone | Employment Change | Quarter II | 0.3% | 0.3% |

| 09:00 | Eurozone | GDP (YoY) | Quarter II | 1.2% | 1.1% |

| 09:00 | Eurozone | GDP (QoQ) | Quarter II | 0.4% | 0.2% |

| 12:30 | U.S. | Import Price Index | July | -0.9% | 0% |

| 14:30 | U.S. | Crude Oil Inventories | August | 2.385 | -2.761 |

| 23:00 | Australia | RBA Assist Gov Debelle Speaks |

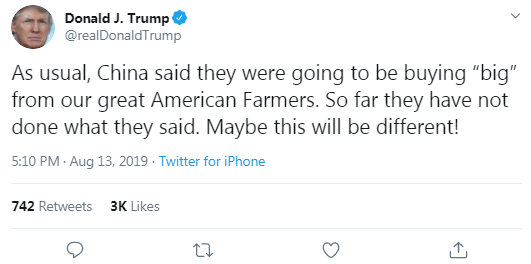

Major US stock indexes rose significantly after the US presidential administration announced that it would postpone the introduction of 10 percent tariffs on some Chinese products until December 15, including laptops, mobile phones, clothes and game consoles.

The news of Washington’s move, which marks a retreat from a tough stance in trade negotiations with Beijing, helped outweigh concerns about geopolitical and economic challenges.

Apple's 4.3% jump in stocks (AAPL), which manufactures its iPhone and MacBook in China, along with chip makers ’shares pushed the tech sector up 1.7%. Semiconductor maker Philadelphia Semiconductor Index (SOX) is up nearly 3%.

Investors also studied the Labor Department report, which showed that US consumer prices rose in July. According to the report, the consumer price index rose 0.3%, as predicted, after rising 0.1% in May and June. In the 12 months to July, the consumer price index rose 1.8% after rising 1.6% in June. Excluding food and energy prices, basic consumer prices also rose 0.3% for the second month in a row, while economists forecast 0.2% growth. The so-called basic consumer price index was increased due to higher prices for clothes, airline tickets, medical equipment and household items. In the 12 months to July, the base consumer price index rose 2.2% after rising 2.1% in June.

Almost all DOW components completed trading in positive territory (29 out of 30). The biggest gainers were Apple Inc. (AAPL, + 4.30%). Only Pfizer Inc. shares down (PFE, -0.57%).

All S&P sectors recorded an increase. The largest growth was shown by the technology sector (+ 1.7%).

At the time of closing:

Dow 26,279.91 +382.20 +1.48%

S&P 500 2,926.15 +43.06 +1.49%

Nasdaq 100 8,016.36 +152.95 +1.95%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Westpac Consumer Confidence | August | 96.5 | |

| 01:30 | Australia | Wage Price Index, y/y | Quarter II | 2.3% | 2.3% |

| 01:30 | Australia | Wage Price Index, q/q | Quarter II | 0.5% | 0.5% |

| 02:00 | China | Retail Sales y/y | July | 9.8% | 8.6% |

| 02:00 | China | Industrial Production y/y | July | 6.3% | 5.8% |

| 02:00 | China | Fixed Asset Investment | July | 5.8% | 5.8% |

| 06:00 | Germany | GDP (YoY) | Quarter II | 0.7% | 0.1% |

| 06:00 | Germany | GDP (QoQ) | Quarter II | 0.4% | -0.1% |

| 06:45 | France | CPI, y/y | July | 1.2% | 1.1% |

| 06:45 | France | CPI, m/m | July | 0.2% | -0.2% |

| 08:30 | United Kingdom | Producer Price Index - Output (YoY) | July | 1.6% | 1.7% |

| 08:30 | United Kingdom | Producer Price Index - Input (MoM) | July | -1.4% | 0.5% |

| 08:30 | United Kingdom | Producer Price Index - Input (YoY) | July | -0.3% | 0.1% |

| 08:30 | United Kingdom | Producer Price Index - Output (MoM) | July | -0.1% | 0.1% |

| 08:30 | United Kingdom | Retail Price Index, m/m | July | 0.1% | 0% |

| 08:30 | United Kingdom | HICP ex EFAT, Y/Y | July | 1.7% | 1.8% |

| 08:30 | United Kingdom | Retail prices, Y/Y | July | 2.9% | 2.8% |

| 08:30 | United Kingdom | HICP, m/m | July | 0% | -0.1% |

| 08:30 | United Kingdom | HICP, Y/Y | July | 2% | 1.9% |

| 09:00 | Eurozone | Industrial Production (YoY) | June | -0.5% | -1.2% |

| 09:00 | Eurozone | Industrial production, (MoM) | June | 0.9% | -1.4% |

| 09:00 | Eurozone | Employment Change | Quarter II | 0.3% | 0.3% |

| 09:00 | Eurozone | GDP (YoY) | Quarter II | 1.2% | 1.1% |

| 09:00 | Eurozone | GDP (QoQ) | Quarter II | 0.4% | 0.2% |

| 12:30 | U.S. | Import Price Index | July | -0.9% | 0% |

| 14:30 | U.S. | Crude Oil Inventories | August | 2.385 | -2.761 |

| 23:00 | Australia | RBA Assist Gov Debelle Speaks |

- James Knightley, the chief international economist at ING, notes the U.S. headline and core consumer price inflation both rose 0.3% MoM in July, which was enough to push the annual rates of inflation up to 1.8% and 2.2% respectively.

- "The headline increase was as expected, but the core increase was a surprise. This is the second 0.3% monthly increase in a row, something that hasn’t happened since 2001. It perhaps provides some food for thought given that everyone is expecting the Federal Reserve to cut interest rates further in the next few months.

- Even though core inflation is moving higher, it is the outlook for economic activity that is driving sentiment right now. The market is assuming a US downturn is coming due to intensifying trade tensions, weaker global activity and dollar strength. The view is that this will dampen price pressures over the medium term and give the Federal Reserve significant room to cut interest rates – the market expects four 25bp cuts over the next 18 months.

- However, there is the possibility of a more positive economic scenario. A strong jobs market and rising real wage growth keep consumer spending strong – watch out for another decent retail sales report on Thursday. This can help to offset weakness elsewhere before a more durable US-China trade truce is potentially struck later in the year.

- With inflation close to target and equity markets likely to rally hard on a positive trade outcome we could end up seeing a significant re-evaluation of the outlook for monetary policy later this year that also results in a sharp correction higher in Treasury yields. Our house view remains two 25bp rate cuts in the second half of 2019."

Analysts at TD Securities note that the U.S. headline inflation came in line with expectations in July at 0.3% m/m, which lifted the annual measure higher to 1.8% y/y (TD: 1.8%; consensus: 1.7%).

- “Core inflation surprised consensus expectations for a second straight month at 0.3% m/m (0.291% unrounded) and 2.2% y/y — its highest level in eight months. Strength in the monthly print was broad-based, with both the core services and core goods segments posting firm increases in July. The latter, at 0.2% m/m, continues to reflect the ongoing rebound in some of the items the kept core goods prices depressed in recent months.

- Despite the firmer July core CPI print, we do not see the reading fundamentally changing the calculus for the Fed. We continue to expect the Fed to deliver cuts at its September and October FOMC meetings, with global growth, manufacturing, and trade remaining key concerns.”

- Some products are being removed from China tariff list based on health, safety, national security and other factors; will not face additional tariffs of 10%

Analysts at ING believe the German economy appears to be stuck between solid domestic fundamentals and external risks.

- "Cars have played and will continue to play an important role in this situation and among the multiple explanations for the problems in the automotive sector, surprisingly is China. Understanding recent developments in the Chinese automotive market is an important piece of the puzzle in comprehending the outlook for the German automotive market.

- The delayed introduction of the new emissions standard - the worldwide light vehicles test procedure, or WLTP - and delays in complying with these new standards led to severe disruptions in German automotive production and delivery. The US-China trade war and subsequent slowdown of the Chinese economy have also contributed to Germany's car problems.

- The Chinese market is the most important market for the majority of German car manufacturers. In 2018, almost one-quarter of all cars sold in China were German. BMW and Daimler sold more than one-third of their total car sales in China. For Volkswagen, the share is even bigger at 40%.

- Looking ahead, things aren't looking too good for German car manufacturers. New car sales in China have fallen for 13 months in a row, a slump that started in the second half of 2018 when the trade war between China and the US began to heat up.

- So, we think the current crumbling of the Chinese car market appears to be a simultaneous combination of cyclical factors, one-off effects and structural changes.

- And for the German economy, it's not actually the trade conflict that is most concerning but the structural shifts in the Chinese automotive market, which could turn out to be one of the biggest threats in the years ahead."

It was also reported that they plan to hold discussions again within the next two weeks.

U.S. stock-index futures fell on Tuesday, as geopolitical angst and economic uncertainty continued to weigh on market sentiment.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,455.44 | -229.38 | -1.11% |

Hang Seng | 25,281.30 | -543.42 | -2.10% |

Shanghai | 2,797.26 | -17.73 | -0.63% |

S&P/ASX | 6,568.50 | -21.80 | -0.33% |

FTSE | 7,175.92 | -50.80 | -0.70% |

CAC | 5,278.60 | -31.71 | -0.60% |

DAX | 11,558.00 | -121.68 | -1.04% |

Crude oil | $54.59 | -0.62% | |

Gold | $1,532.70 | +1.02% |

Jane Foley, the senior FX strategist at Rabobank, notes that the news that the Swiss National Bank's (SNB) sight deposits jumped the most in two years last week provided a strong signal to the market that the bank had intervened in the FX market to offset CHF gains.

- “This is not a huge surprise since the SNB makes it very clear that its maintains FX intervention (and the threat of it) as a policy tool. So far, August has been defined by a surge in demand for safe-haven assets.”

- “The CHF has been gaining ground vs. the EUR since late April. This may partly be attributable to a pick-up in expectations about the prospects of further forthcoming policy easing by the ECB.”

- “In response to the general increase in demand for safe-haven assets, last week net positions in the JPY climbed into positive territory for the first time since late 2016. By contrast, not only did net speculators’ CHF positions remain in negative territory, but net shorts increased last week.”

- “Given the weight of bad news and the accommodative policy bias of the ECB, the SNB could struggle to weaken the value of the CHF in the coming months. CPI inflation in Switzerland remains extremely low, at 0.3% y/y in July. Clearly, the risk of further currency appreciation would be problematic to the central bank given its mandate “to ensure price stability, while taking account of economic developments”. As a consequence, speculation is building that the SNB may cut its policy rate at its September policy meeting, despite this already being at -0.75%.”

- “There is little doubt that the SNB will continue to hammer a bearish drum going forward. That said, as long as demand for safe-haven remains heightened, the SNB will be in fire-fighting mode. The optimal backdrop for an effective policy pass-through for the SNB would be strong and stable growth in the Eurozone and a return to healthy levels of risk appetite. In the absence of this, the outlook for the CHF will be dominated by safe-haven demand. We see scope for the CHF to lose a little ground vs the JPY in the coming months, but expect EUR/CHF to creep down towards 1.07 on a 3- to 6-month view.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 161.62 | -0.48(-0.30%) | 1403 |

ALTRIA GROUP INC. | MO | 45.9 | -0.08(-0.17%) | 11758 |

Amazon.com Inc., NASDAQ | AMZN | 1,776.53 | -8.39(-0.47%) | 16845 |

Apple Inc. | AAPL | 200.3 | -0.18(-0.09%) | 131698 |

AT&T Inc | T | 34.39 | -0.09(-0.26%) | 13158 |

Boeing Co | BA | 331.58 | -1.36(-0.41%) | 4150 |

Caterpillar Inc | CAT | 116.08 | -0.64(-0.55%) | 1934 |

Cisco Systems Inc | CSCO | 51.3 | -0.24(-0.47%) | 15027 |

Citigroup Inc., NYSE | C | 63.92 | -0.32(-0.50%) | 15889 |

Deere & Company, NYSE | DE | 146.13 | -0.92(-0.63%) | 787 |

E. I. du Pont de Nemours and Co | DD | 67.69 | -0.25(-0.37%) | 538 |

Exxon Mobil Corp | XOM | 69.52 | -0.11(-0.16%) | 4487 |

Facebook, Inc. | FB | 184.52 | -0.85(-0.46%) | 25976 |

FedEx Corporation, NYSE | FDX | 158.01 | -0.80(-0.50%) | 328 |

Ford Motor Co. | F | 9.31 | 0.02(0.22%) | 39616 |

General Electric Co | GE | 9.13 | 0.08(0.88%) | 471952 |

Goldman Sachs | GS | 200.72 | -0.80(-0.40%) | 921 |

Google Inc. | GOOG | 1,171.00 | -3.71(-0.32%) | 1221 |

Home Depot Inc | HD | 206.25 | -0.76(-0.37%) | 1888 |

Intel Corp | INTC | 45.31 | -0.29(-0.64%) | 8325 |

International Business Machines Co... | IBM | 133.41 | -0.26(-0.19%) | 9477 |

International Paper Company | IP | 38.57 | 0.03(0.08%) | 936 |

Johnson & Johnson | JNJ | 131.95 | 0.02(0.02%) | 1017 |

JPMorgan Chase and Co | JPM | 107.18 | -0.50(-0.46%) | 6133 |

McDonald's Corp | MCD | 217.79 | 0.63(0.29%) | 1366 |

Merck & Co Inc | MRK | 85.68 | 0.66(0.78%) | 2457 |

Microsoft Corp | MSFT | 135.16 | -0.63(-0.46%) | 42615 |

Nike | NKE | 81.54 | -0.11(-0.13%) | 475 |

Pfizer Inc | PFE | 35.34 | -0.05(-0.14%) | 7730 |

Procter & Gamble Co | PG | 115.8 | -0.23(-0.20%) | 1338 |

Starbucks Corporation, NASDAQ | SBUX | 95.35 | 0.44(0.46%) | 913 |

Tesla Motors, Inc., NASDAQ | TSLA | 227.76 | -1.25(-0.55%) | 39210 |

Twitter, Inc., NYSE | TWTR | 40.29 | -0.19(-0.47%) | 20241 |

UnitedHealth Group Inc | UNH | 243 | -0.20(-0.08%) | 450 |

Verizon Communications Inc | VZ | 55.78 | 0.09(0.16%) | 281 |

Visa | V | 176.12 | -0.22(-0.12%) | 9790 |

Wal-Mart Stores Inc | WMT | 105 | -0.22(-0.21%) | 1638 |

Walt Disney Co | DIS | 135.25 | -0.50(-0.37%) | 4232 |

Yandex N.V., NASDAQ | YNDX | 36.24 | -0.03(-0.08%) | 2200 |

Advanced Micro (AMD) initiated with Hold at Loop Capital

Intel (INTC) initiated with Hold at Loop Capital

McDonald's Corp (MCD) initiated with Buy at MKM Partners

The Labor

Department announced on Tuesday the U.S. consumer price index (CPI) rose 0.3

percent m-o-m in July, following a 0.1 percent m-o-m uptick in the previous

month.

Over the last

12 months, the CPI rose 1.8 percent y-o-y last month, following a 1.6 percent

m-o-m advance in the 12 months through June.

Economists had forecast

the CPI to increase 0.3 percent m-o-m and 1.7 percent y-o-y in the 12-month

period.

According to

the report, gains in the indexes for gasoline and shelter were the major

factors in the seasonally adjusted all items monthly increase. The index for

food was unchanged for the second month in a row, as a drop in the food at home

index was offset by an advance in the food away from home index.

Meanwhile, the

core CPI excluding volatile food and fuel costs increased 0.3 percent m-o-m in

July, the same pace as in the previous month.

In the 12

months through July, the core CPI rose 2.2 percent after a 2.1 percent increase

for the 12 months ending June. It was the largest increase since January.

Economists had

forecast the core CPI to rise 0.2 percent m-o-m and 2.1 percent y-o-y last

month.

Analysts at TD Securities note that Australia’s Westpac сonsumer sentiment print for July dropped to 2yr lows, -4% m/m.

- “We had anticipated a bounce given the last survey covered the legislated tax cuts and RBA cut but there were substantial falls in expectations about personal finances and the economy over the next year and concerns about unemployment lifted sharply in NSW, Vic and WA. Let's see if sentiment improves.”

- “For Q2 wages, we forecast 0.55% q/q and 2.3% y/y. Annual wage growth has been moving at a glacial pace. At 2.3% y/y, this is tracking well below levels implied by the underutilisation rate that suggest annual wages growth should be closer to 2.9%. However, we don't expect wage pressures to pick up materially given there are more unemployed than there are vacancies.”

JD.com (JD) reported Q2 FY 2019 earnings of RMB 2.30 per share (versus RMB 0.33 in Q2 FY 2018), beating analysts’ consensus estimate of RMB 0.54.

The company’s quarterly revenues amounted to RMB 150.281 bln (+22.9% y/y), beating analysts’ consensus estimate of RMB 147.444 bln.

The company also issued in-line guidance for Q3 FY 2019, projecting revenues of RMB 126-130 bln versus analysts’ consensus estimate of RMB 126.13 bln.

JD rose to $28.30 (+4.20%) in pre-market trading.

notes that the UK wage growth has hit another post-crisis high amid ongoing skill shortages in the jobs market and this suggests it may be too early to be talking about Bank of England rate cuts, although as ever, it all depends on Brexit.

- "At 3.9%, UK wage growth (excluding bonuses) has hit another post-crisis high and is a key reason why it is probably too early to be talking about Bank of England rate cuts. And for the time being at least, we think pay growth has the potential to remain strong. "

- "The jobs side of this month’s report was also pretty encouraging, with employment rising by 115k in the three months to June. Until recently, PMIs had hinted at improved hiring appetite among firms, perhaps triggered by the temporary lull in uncertainty after the decision to extend Article 50 back in April."

- "That’s not to say there aren’t risks. The number of job vacancies, while still high, has been falling since the start of 2019. We’d also note that a large chunk of job gains over recent months has been driven by self-employed workers – in particular part-time. Up until these latest figures, the number of people in ‘employee’ roles had been falling in the past couple of jobs reports."

- "When it comes to the Bank of England though, the stronger wage growth backdrop suggests that policy easing is unlikely in the near-term. A lot depends on Brexit of course, but for the time being, we think markets may be slightly overestimating the chances of BoE easing – investors are now pricing in a rate cut by early 2020."

Analysts at TD Securities are expecting the U.S. headline CPI to rise two tenths to 1.8% y/y (market 1.7%) in July on the back of a solid 0.3% (market 0.3%) monthly print.

- “We expect the non-core segment to be driven by a modest rebound in the energy segment on the back of a 1.5% m/m rise in gasoline prices.

- Separately, core inflation should remain steady at 2.1% y/y (mkt 2.1%), reflecting a firm 0.2% m/m advance (mkt 0.2%). Core prices should be supported by both a 0.2% m/m increase in core services inflation and new gain in core goods at 0.2%. We anticipate OER to remain largely steady at 0.3% m/m and for the ex-shelter segment to slow marginally on a monthly basis.”

Analysts at Standard Chartered do not believe an imminent US FX intervention is likely but suggests that neither is it impossible.

- “If the US Treasury intervened in FX markets to support the USD, the Federal Reserve would have a number of alternatives. We do not expect Fed to stand pat if the Treasury intervenes, even if this it is a theoretical possibility. Ultimately, we believe the Fed’s decision will be driven by what signal it wants to send to the markets and whether a stronger signal is perceived to carry greater political upside or downside risks relative to a weaker one.

- The strongest message to the markets would be intervening alongside the Treasury and not sterilising. Nevertheless, for political, monetary policy or institutional reasons, the Fed may prefer a less aggressive stance.

- For instance, it could coordinate the timing of a policy rate cut with a Treasury intervention even if it did not join in intervention. The Fed could also intervene along with the Treasury close to a policy rate cut and nominally sterilise the intervention. The rate cut would effectively unsterilise Treasury intervention. The Fed could also help finance a larger Treasury intervention by raising the warehousing limit, though we believe a substantial increase in this limit is unlikely, as it would involve considerable political risk.

- Given limited precedents for these options against the backdrop of a sizeable Fed balance sheet, it is hard to convincingly argue which option the Fed would choose and how market participants would respond. Neither we, the Fed nor market participants have much precedent to lean on. However, in any FX intervention that is unsterilised or is closely followed by a rate cut, the eventual flow of reserves would be expected to put downward pressure on US money-market rates as foreigners either exchange USDs back to local currencies or invest directly in US assets.”

Analysts at TD Securities note that this morning's UK labour market data was a bit of a mixed bag, but on net they think that it was a positive outcome.

- “The soft spot was the unemployment rate coming in a tenth higher than expected at 3.9%. But the trend in employment growth is quite strong (+115K 3m/3m rate vs mkt 60k), so that points to a more robust labour market picture. Ex-bonus wage growth was in line with our forecast and a bit stronger than expected at 3.9% y/y (mkt 3.8%), notably hitting its highest growth rate since before the financial crisis.

- And real wage growth (1.8% y/y) has finally returned to where it was before the EU Referendum in June 2016 and the associated inflation shock from the fall in GBP.”

The National

Federation of Independent Business (NFIB) reported on Tuesday the Small

Business Optimism Index increased by 1.4 points to 104.7 in July, recovering

after a 1.7-point drop posted in June.

The July increase

in the headline index was attributable to an improvement in expectations for business

conditions, real sales, and expansion.

According to

the report, seven of 10 index components advanced, two declined, and one was

unchanged. It also revealed that small business owners’ plans to create new

jobs and make capital outlays increased and earnings trends improved, helped by

a solid improvement in sales trends. In addition, plans to order new

inventories posted a solid gain.

“While many are

talking about a slowing economy and possible signs of a recession, the 3rd

largest economy in the world continues to defy expectations, generating output,

creating value, and expanding the economy,” noted NFIB President and CEO

Juanita D. Duggan. “Small business owners want to grow their operations, and

the only thing stopping them is finding qualified workers.”

A majority of Britons believe Prime Minister Boris Johnson must take Britain out of the European Union “by any means”, even if that involves suspending parliament, an opinion poll conducted for the Daily Telegraph said.

Johnson has promised to lead Britain out of the EU on Oct. 31 regardless of whether he manages to secure an exit deal with Brussels, despite many in parliament being opposed to leaving without a deal.

A ComRes opinion poll showed 54% of respondents said they agreed with the statement: “Boris (Johnson) needs to deliver Brexit by any means, including suspending parliament if necessary, in order to prevent MPs (Members of Parliament) from stopping it.”

The poll showed 46% disagreed with the statement. The result was based on the answers of 1,645 respondents, after those who said they did not know their preference had been excluded.

Labour market data showing the fastest pay growth in 11 years and more people in work show the underlying strength of the British economy, finance minister Sajid Javid said.

"Today's figures are another sign that despite the challenges across the global economy, the fundamentals of the British economy are strong as we prepare to leave the EU," Javid said in a statement.

ING, one of Europe's largest banks, said its central assumption was Brexit would be delayed, with a 40 percent chance of a national election in the United Kingdom.

ING economist James Smith said his central assumption was that Britain would end up with an election.

"It is very risky to go to the voters if there is a no-deal Brexit," Smith told. "A general election looks increasingly likely."

Parliament, he said, was likely to force a vote of no confidence on Johnson's government and then would try to force a delay to Brexit.

"There's a 40 percent probability of a general election coupled with an Article 50 extension," Smith said, referring to the notification Britain would leave the EU. He raised the probability of a no-deal Brexit to 25 percent from 20 percent.

The bank said sterling could fall to 95 pence per euro this quarter and that the British economy would feel the pressure too.

The Centre for European Economic Research (ZEW) said, the Indicator of Economic Sentiment for Germany once again decreased sharply in August 2019. Expectations are now at -44.1 points. This corresponds to a drop of 19.6 points compared to the previous month. The indicator’s long-term average is 21.6 points. The ZEW Indicator of Economic Sentiment is therefore at its lowest level since December 2011. Over the same period, the assessment of the economic situation in Germany worsened considerably by 12.4 points, with the corresponding indicator falling to a current reading of minus 13.5 points in August.

“The ZEW Indicator of Economic Sentiment points to a significant deterioration in the outlook for the German economy. The most recent escalation in the trade dispute between the US and China, the risk of competitive devaluations, and the increased likelihood of a no-deal Brexit place additional pressure on the already weak economic growth. This will most likely put a further strain on the development of German exports and industrial production,” comments ZEW President Professor Achim Wambach.

The financial market experts’ sentiment concerning the economic development of the eurozone also experienced a significant drop, bringing the indicator to a current level of -43.6 points, 23.3 points lower than in the previous month. The indicator for the current economic situation in the eurozone fell 3.9 points to a level of -14.5 points in August.

According to the report from Office for National Statistics, from April to June the UK unemployment rate was estimated at 3.9%; lower than a year earlier (4.0%); on the quarter the rate was 0.1 percentage points higher. Unemployment was expected to remain at 3.8%.

The UK employment rate was estimated at 76.1%, the joint-highest on record since comparable records began in 1971. The UK economic inactivity rate was estimated at 20.7%, a joint-record low.

Estimates for April to June 2019 show 32.81 million people aged 16 years and over in employment, this is a record high and 425,000 more than for a year earlier. This annual increase of 425,000 was mainly because of more people working full-time (up 262,000 on the year to reach 24.11 million). Part-time working also showed an increase of 162,000 on the year to reach 8.70 million.

Estimated annual growth in average weekly earnings for employees in UK increased to 3.7% for total pay (including bonuses) and 3.9% for regular pay (excluding bonuses). Economists had expected an increase to 3.7% for total pay and 3.8% for regular pay.

In real terms (after adjusting for inflation), total pay is estimated to have increased by 1.8% compared with a year earlier, and regular pay is estimated to have increased by 1.9%.

Danske Bank analysts point out that in the UK, the labour market report for June is due out and will be a key economic release for the day.

“The growth rates in wages and employment have been fairly high despite rather weak economic momentum. The question is whether this can continue or the labour market will start to show signs of moderation. In the euro area, the main focus is on the German Zew. We expect the Zew to decline further and hence continue to point to a gloomy outlook in the uncertain global environment and the escalation of trade war. In the US, CPI core is being released. We expect it rose +0.2% m/m in July, which translates into an unchanged annual inflation rate at 2.1% y/y.”

In its latest review on the Japanese banking sector, Fitch Ratings said that Japanese major banks' profitability will remain under pressure due to structural challenges despite efforts to improve efficiency.

“Persistently low interest rates in Japan, a declining and aging population, changes in consumer expectations from financial services providers combined with rising uncertainties in the global economy are major headwinds. Key to the banks' medium-term outcomes is their capital strategy to build loss-absorption buffers commensurate with their risk appetite, and management's ability to present and execute a sustainable strategy. The major banks will maintain sound asset quality, although credit costs are likely to rise as the challenges continue to build. Stable liquidity and funding positions are supported by a sound franchise in the domestic market.”

China's yuan is at an appropriate level currently and its fluctuations will not necessarily cause disorderly capital flows, a senior official at the People's Bank of China told.

China is able to “navigate all scenarios” arising from Washington’s recent move to label Beijing a currency manipulator, Zhu Jun, head of the central bank’s international department, said.

She said China was “shocked” by the U.S. Treasury Department’s move last week to label China a currency manipulator, hours after China let the yuan drop through a key support level to its lowest point in more than a decade.

China is confident that the yuan will be a “strong currency” over the medium and long term, Zhu said.

TD Research discusses USD/JPY tactical outlook and maintains a bearish bias noticing that prices are now within striking distance of the flash-crash lows around 104.90.

"Risk markets are heading south again, reflecting a mix of skittish sentiment and a re-calibration of positioning. One of the major concerns now lies in the fact that global equity positioning runs at multi-year highs as global growth concerns linger. The rise in geopolitical stress and elevated uncertainty jeopardizes the muddle along scenario, especially if China tries to export deflation. The result has been a surge in demand for perceived safe-havens like gold, JPY, and CHF. The market cap of global negative yielding debt jumped to $15.5 trillion, rising roughly 80% oya. USDJPY has collapsed in kind and now looks within striking distance of the flash-crash lows around 104.90. The USD benefits too," TD adds.

Morgan Stanley analysts said that they now expect the U.S. Federal Reserve to cut rates in September and then again in October.

“Trade’s ‘simmer’ has begun to boil, business sentiment and capex (capital expenditures) have softened further, global growth remains weak and inflation expectations have fallen,” while the gap between 3-month and 10-year U.S. government bonds points to overly restrictive monetary policy, the investment bank’s analysts said in a note.

The analysts previously predicted a cut in October alone, saying the central bank would “wait for further evidence that downside risks are weighing on the economy.”

The bank joins a number of investors betting that the Fed’s first rate cut since 2008, late last month, will be the first of several moves to lower borrowing costs.

Karen Jones, analyst at Commerzbank, explains that EUR/USD pair has continued to consolidate just below resistance at 1.1285 and the 200 day ma at 1.1294.

“The consolidation is viewed in a positive light, intraday Elliott wave counts are positive. Key resistance is 1.1354/71, the 2018-2019 down channel and the 55 week ma. A weekly close above this latter level is needed for us to adopt an outright bullish stance. Dips lower are likely to find some support circa 1.1150/06. Key support is the 1.0961 2018-2019 support line and below here lies the 78.6% retracement at 1.0814/78.6% retracement. The market will need to regain the 55 week ma and channel at 1.1360/77 to generate upside interest.”

According to the report from Destatis, сonsumer prices in Germany were up 1.7% in July 2019 compared with July 2018. Destatis also reports that the inflation rate was slightly up (June 2019: +1.6%). Compared with June 2019, the consumer price index rose by 0.5% in July 2019.

Energy product prices increased above average by 2.4% from July 2018 to July 2019 (June 2019: +2.5%) and had an upward effect on the inflation rate, as had been the case in the previous month. Food prices rose above average (+2.1%) in July 2019 year on year. The price increase accelerated markedly on the previous month (June 2019: +1.2%). The prices of goods (total) were by 1.8% higher in July 2019 than in the same month a year earlier. Compared with goods prices, the prices of services rose somewhat less strongly year on year (+1.5%) in July 2019. A major factor contributing to the development of service prices was the increase in net rents exclusive of heating expenses (+1.4%).

A separate report from Destatis showed that selling prices in wholesale trade fell by 0,1% in July 2019 from the corresponding month of the preceding year. In June 2019 and in May 2019 the annual rates of change had been +0,3% and +1,6%, respectively. From June 2019 to July 2019 the index fell by 0.3%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1318 (4316)

$1.1295 (1869)

$1.1268 (753)

Price at time of writing this review: $1.1190

Support levels (open interest**, contracts):

$1.1156 (5883)

$1.1122 (3699)

$1.1083 (4827)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 6 is 101815 contracts (according to data from August, 12) with the maximum number of contracts with strike price $1,1400 (9054);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2266 (1153)

$1.2209 (872)

$1.2168 (322)

Price at time of writing this review: $1.2066

Support levels (open interest**, contracts):

$1.1988 (2319)

$1.1960 (1453)

$1.1929 (1563)

Comments:

- Overall open interest on the CALL options with the expiration date September, 6 is 29692 contracts, with the maximum number of contracts with strike price $1,2750 (4128);

- Overall open interest on the PUT options with the expiration date September, 6 is 23180 contracts, with the maximum number of contracts with strike price $1,2100 (2319);

- The ratio of PUT/CALL was 0.78 versus 0.80 from the previous trading day according to data from August, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 58.23 | 0.33 |

| WTI | 54.62 | 1 |

| Silver | 17.04 | 0.65 |

| Gold | 1511.607 | 0.99 |

| Palladium | 1428.19 | 0.47 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| Hang Seng | -114.58 | 25824.72 | -0.44 |

| KOSPI | 4.54 | 1942.29 | 0.23 |

| ASX 200 | 5.9 | 6590.3 | 0.09 |

| FTSE 100 | -27.13 | 7226.72 | -0.37 |

| DAX | -14.12 | 11679.68 | -0.12 |

| Dow Jones | -391 | 25896.44 | -1.49 |

| S&P 500 | -35.95 | 2882.7 | -1.23 |

| NASDAQ Composite | -95.73 | 7863.41 | -1.2 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67493 | -0.47 |

| EURJPY | 117.997 | -0.28 |

| EURUSD | 1.12148 | 0.13 |

| GBPJPY | 127.109 | 0.04 |

| GBPUSD | 1.20822 | 0.47 |

| NZDUSD | 0.64438 | -0.28 |

| USDCAD | 1.32351 | 0.16 |

| USDCHF | 0.96867 | -0.38 |

| USDJPY | 105.206 | -0.4 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.