- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 16-01-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 02:00 | China | Industrial Production y/y | December | 6.2% | 5.9% |

| 02:00 | China | Retail Sales y/y | December | 8% | 7.8% |

| 02:00 | China | Fixed Asset Investment | December | 5.2% | 5.2% |

| 02:00 | China | GDP y/y | Quarter IV | 6% | 6% |

| 04:30 | Japan | Tertiary Industry Index | November | -4.6% | 3.9% |

| 07:30 | Switzerland | Producer & Import Prices, y/y | December | -2.5% | -2.5% |

| 09:00 | Eurozone | Current account, unadjusted, bln | November | 41 | |

| 09:30 | United Kingdom | Retail Sales (MoM) | December | -0.6% | 0.5% |

| 09:30 | United Kingdom | Retail Sales (YoY) | December | 1% | 2.6% |

| 10:00 | Eurozone | Construction Output, y/y | November | 0.3% | 1.9% |

| 10:00 | Eurozone | Harmonized CPI | December | -0.3% | 0.3% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | December | 1.3% | 1.3% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | December | 1% | 1.3% |

| 13:30 | Canada | Foreign Securities Purchases | November | 11.32 | |

| 13:30 | U.S. | Housing Starts | December | 1.365 | 1.375 |

| 13:30 | U.S. | Building Permits | December | 1.474 | 1.468 |

| 14:00 | U.S. | FOMC Member Harker Speaks | |||

| 14:15 | U.S. | Capacity Utilization | December | 77.3% | 77.1% |

| 14:15 | U.S. | Industrial Production YoY | December | -0.8% | |

| 14:15 | U.S. | Industrial Production (MoM) | December | 1.1% | -0.2% |

| 15:00 | U.S. | JOLTs Job Openings | November | 7.267 | 7.233 |

| 15:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | January | 99.3 | 99.3 |

| 18:00 | U.S. | Baker Hughes Oil Rig Count | January | 659 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 02:00 | China | Industrial Production y/y | December | 6.2% | 5.9% |

| 02:00 | China | Retail Sales y/y | December | 8% | 7.8% |

| 02:00 | China | Fixed Asset Investment | December | 5.2% | 5.2% |

| 02:00 | China | GDP y/y | Quarter IV | 6% | 6% |

| 04:30 | Japan | Tertiary Industry Index | November | -4.6% | 3.9% |

| 07:30 | Switzerland | Producer & Import Prices, y/y | December | -2.5% | -2.5% |

| 09:00 | Eurozone | Current account, unadjusted, bln | November | 41 | |

| 09:30 | United Kingdom | Retail Sales (MoM) | December | -0.6% | 0.5% |

| 09:30 | United Kingdom | Retail Sales (YoY) | December | 1% | 2.6% |

| 10:00 | Eurozone | Construction Output, y/y | November | 0.3% | 1.9% |

| 10:00 | Eurozone | Harmonized CPI | December | -0.3% | 0.3% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | December | 1.3% | 1.3% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | December | 1% | 1.3% |

| 13:30 | Canada | Foreign Securities Purchases | November | 11.32 | |

| 13:30 | U.S. | Housing Starts | December | 1.365 | 1.375 |

| 13:30 | U.S. | Building Permits | December | 1.474 | 1.468 |

| 14:00 | U.S. | FOMC Member Harker Speaks | |||

| 14:15 | U.S. | Capacity Utilization | December | 77.3% | 77.1% |

| 14:15 | U.S. | Industrial Production YoY | December | -0.8% | |

| 14:15 | U.S. | Industrial Production (MoM) | December | 1.1% | -0.2% |

| 15:00 | U.S. | JOLTs Job Openings | November | 7.267 | 7.233 |

| 15:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | January | 99.3 | 99.3 |

| 18:00 | U.S. | Baker Hughes Oil Rig Count | January | 659 |

FXStreet reports that according to analysts at Rabobank, the ECB appears to be satisfied with the current path of inflation, and since data have improved somewhat in recent weeks, this should support their confidence that Eurozone growth is stabilizing.

Key quotes

We don’t expect changes to the guidance that “the Council expects interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.”

"We calculate that the ECB will face a shortage of supply towards the end this year."

"Based on our global outlook we see the Eurozone economy slow down further this year, ultimately forcing the ECB to pile on more stimulus. We now expect the next move in June."

FXStreet reports that Carsten Brzeski, chief economist at ING, notes that the latest ECB minutes of the December meeting try to paint a picture of an ECB in cosy togetherness, having come to terms with past disagreements and wait-and-see seems to be the preferred option for 2020.

Key Quotes

"The December meeting was a confirmation of the status quo and did not hint at any upcoming policy changes. The just-released minutes do the same."

"Here are the most important takeaways from the minutes:

- At the December press conference, Lagarde had already communicated subtle changes to the ECB's macro-economic assessment. These changes were also reflected in the minutes.

- As regards inflation, the ECB acknowledged "some indications of a mild increase" in measures of underlying inflation. Interestingly, the minutes explicitly mention the fact that housing-related costs are not sufficiently incorporated in the current HICP measure, an issue which will definitely be pursued in the strategy review.

- Regarding the current monetary policy stance, the minutes show broad agreement to stick to the current position, a reconfirmation of the September decision. This view is nicely formulated in the minutes with:

- "The present monetary policy stimulus appeared fully appropriate, lending substantial support to growth and inflation developments. While vigilance on the efficacy of the policy measures and the appropriateness of the monetary policy stance was called for, it was highlighted that the measures should be given time to exert their full impact on the euro area economy."

- The only caveat to the current stance was made in the reference to possible side effects of the present measures.

- Maybe a bit of a disappointment for market participants, but according to the minutes the ECB did not discuss any details of the upcoming strategy review. So, we will never know whether Christine Lagarde's comments on the review, leaving no stone unturned, during the press conference was her personal view or that of the ECB's Governing Council."

"The minutes of the ECB December meeting suggest that the central bank has returned to harmony or, at least, is trying to keep controversies behind closed doors. Looking forward, the strategy review could be the most excitement we will get from the ECB this year. It increasingly looks as if the ECB will stay on hold throughout the entire year."

The Commerce Department announced on Thursday that business inventories dropped 0.2 m-o-m in November, following a revised 0.1 m-o-m advance in November (originally a 0.2 percent gain m-o-m).

That was below the economists' forecast for a 0.1 percent m-o-m decrease.

According to the report, retail inventories decreased 0.8 percent m-o-m, while stocks at wholesalers edged down 0.1 percent m-o-m and stocks at manufacturers rose 0.3 percent m-o-m.

In y-o-y terms, business inventories climbed 2.8 percent in November.

The National Association of Homebuilders (NAHB) announced on Thursday its housing market index (HMI) edged down one point to 75 in January 2020 from an unrevised December 2019 reading of 76.

Economists had forecast the HMI to drop to 75.

A reading over 50 indicates more builders view conditions as good than poor.

The three HMI components were mixed this month.

The indicator gauging current sales conditions decreased three points to 81, while the component measuring traffic of prospective buyers increased one point to 58 (the highest level since December 2017), and the measure charting sales expectations in the next six months held steady at 79.

NAHB Chairman Greg Ugalde noted: "Low interest rates and a healthy labor market combined with a need for additional inventory is setting the stage for further home building gains in 2020".

Meanwhile, NAHB Chief Economist Robert Dietz said: "With the Federal Reserve on pause and attractive mortgage rates, the steady rise in single-family construction that began last spring will continue into 2020. However, builders continue to grapple with a shortage of lots and labor while buyers are frustrated by a lack of inventory, particularly among starter homes."

FXStreet reports that Tuuli Koivu, analyst at Nordea Markets, suggests that although the main emphasis of the US-China agreement is on increasing quickly exports from the US to China, and thus probably serves more Trump’s personal purposes than the US future economic development, the deal is not totally empty on the structural questions.

Key Quotes

“There seems to be some progress, especially on forced technological transfers. The promises on the intellectual property rights and opening up the financial sector seems to be more or less repeating China’s earlier commitments and as always, the implementation will be followed very carefully. Regarding the follow-up process, the US was able to push China to establish a bilateral body in order to resolve the disputes.”

“But of course most of the challenges will remain in place as the phase one deal falls short of removing most of the structural problems between the countries. China will keep developing further its economic model where the state (and the Communist party) plays a key role.”

“This path will certainly create increasing challenges between China and the Western counterparts, not just the US and we expect that there will be a continuous flow of measures hindering further cooperation especially from the US side. For example, the role of Huawei and 5G was not part of the Phase one deal.”

“However, the year 2020 is about the US presidential elections and the as Trump has also noticed one should not expect results from the Phase two negotiations prior to the US elections. Given that Trump can declare a victory after the Phase one deal, he does not want to rock the boat before November.”

The Labor Department reported on Thursday the import-price index, measuring the cost of goods ranging from Canadian oil to Chinese electronics, rose 0.3 percent m-o-m in December, following a revised 0.1 percent m-o-m gain in November (originally a 0.2 percent m-o-m advance). That was the largest monthly advance since March. Economists had expected prices to increase 0.3 percent m-o-m last month.

According to the report, the December gain was driven by higher prices for import fuel (+2.8 percent m-o-m), while nonfuel import prices were unchanged m-o-m.

Over the 12-month period ended in December, import prices climbed 0.5 percent, helped by a climb in fuel prices (+19.3 percent), which more than offset a drop in nonfuel prices (-1.4 percent).

Meanwhile, the price index for U.S. exports decreased 0.2 percent m-o-m in December, following an unrevised 0.2 percent m-o-m gain in the previous month.

Lower prices for both nonagricultural exports (-0.1 percent m-o-m) and agricultural exports (-0.1 percent m-o-m) contributed to the December drop.

Over the past 12 months, the price index for exports dropped 0.7 percent, weighed down by declines in prices for both nonagricultural exports (-1.3 percent) and agricultural exports (-0.6 percent). The 2019 decline marked the first calendar-year fall since 2015.

U.S. stock-index futures rose on Thursday, as investors digested the latest raft of economic data, earnings reports from U.S. companies as well as a key trade agreement between China and the U.S.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 23,933.13 | +16.55 | +0.07% |

| Hang Seng | 28,883.04 | +109.45 | +0.38% |

| Shanghai | 3,074.08 | -15.96 | -0.52% |

| S&P/ASX | 7,041.80 | +47.00 | +0.67% |

| FTSE | 7,612.80 | -30.00 | -0.39% |

| CAC | 6,028.64 | -3.97 | -0.07% |

| DAX | 13,416.46 | -15.84 | -0.12% |

| Crude oil | $58.05 | | +0.42% |

| Gold | $1,554.40 | | +0.03% |

The Commerce Department announced on Thursday the sales at U.S. retailers rose 0.3 percent m-o-m in December, following a revised 0.3 percent m-o-m advance in December (originally a 0.2 percent m-o-m gain).

Economists had expected total sales would increase 0.3 percent m-o-m in December.

Excluding auto, retail sales climbed 0.7 percent m-o-m in December after a revised flat m-o-m performance in the previous month (originally a 0.1 percent m-o-m advance), beating economists' forecast for a 0.5 percent m-o-m gain.

Meanwhile, closely watched core retail sales, which exclude automobiles, gasoline, building materials and food services, and are used in GDP calculations, increased 0.5 percent m-o-m in December after a downwardly revised 0.1 percent m-o-m rise in November.

In y-o-y terms, the U.S. retail sales surged 5.8 percent in December, following a 3.3 jump in the previous month.

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 180.71 | 0.93(0.52%) | 430 |

| ALCOA INC. | AA | 19.75 | -0.43(-2.13%) | 36963 |

| ALTRIA GROUP INC. | MO | 51.39 | 0.14(0.27%) | 1993 |

| Amazon.com Inc., NASDAQ | AMZN | 1,875.98 | 13.96(0.75%) | 22838 |

| American Express Co | AXP | 130.11 | 0.29(0.22%) | 1187 |

| Apple Inc. | AAPL | 314.05 | 2.71(0.87%) | 295388 |

| Boeing Co | BA | 330.98 | 1.18(0.36%) | 27727 |

| Caterpillar Inc | CAT | 146.77 | 1.20(0.82%) | 2967 |

| Chevron Corp | CVX | 116.54 | 0.41(0.35%) | 4196 |

| Cisco Systems Inc | CSCO | 48.38 | 0.37(0.77%) | 9364 |

| Citigroup Inc., NYSE | C | 81.92 | 0.68(0.84%) | 7150 |

| Exxon Mobil Corp | XOM | 69.24 | 0.15(0.22%) | 19323 |

| Facebook, Inc. | FB | 222.44 | 1.29(0.58%) | 56016 |

| FedEx Corporation, NYSE | FDX | 160.02 | 0.87(0.55%) | 8815 |

| Ford Motor Co. | F | 9.24 | 0.05(0.54%) | 49321 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.06 | 0.08(0.62%) | 56708 |

| General Electric Co | GE | 11.92 | 0.05(0.42%) | 146579 |

| General Motors Company, NYSE | GM | 35.27 | 0.12(0.34%) | 1620 |

| Google Inc. | GOOG | 1,445.07 | 5.87(0.41%) | 3532 |

| Hewlett-Packard Co. | HPQ | 21.5 | 0.08(0.37%) | 8717 |

| Home Depot Inc | HD | 225.28 | 0.69(0.31%) | 1999 |

| International Business Machines Co... | IBM | 137.4 | 0.78(0.57%) | 824 |

| JPMorgan Chase and Co | JPM | 137.61 | 0.89(0.65%) | 184534 |

| McDonald's Corp | MCD | 210.27 | 0.50(0.24%) | 2349 |

| Microsoft Corp | MSFT | 164.24 | 1.06(0.65%) | 79943 |

| Nike | NKE | 102.6 | -0.19(-0.18%) | 14166 |

| Pfizer Inc | PFE | 40.8 | 0.13(0.32%) | 7081 |

| Tesla Motors, Inc., NASDAQ | TSLA | 497.2 | -21.30(-4.11%) | 1063055 |

| Twitter, Inc., NYSE | TWTR | 33.45 | 0.22(0.66%) | 28138 |

| United Technologies Corp | UTX | 152.98 | 1.02(0.67%) | 200726 |

| UnitedHealth Group Inc | UNH | 298.35 | 1.94(0.65%) | 3699 |

| Verizon Communications Inc | VZ | 59.37 | 0.27(0.46%) | 3524 |

| Visa | V | 201.5 | 1.70(0.85%) | 35173 |

| Wal-Mart Stores Inc | WMT | 115.4 | 0.12(0.10%) | 6582 |

| Walt Disney Co | DIS | 145 | 0.68(0.47%) | 25039 |

| Yandex N.V., NASDAQ | YNDX | 45.05 | 1.82(4.21%) | 65042 |

Tesla (TSLA) downgraded to Underweight from Equal-Weight at Morgan Stanley; target raised to $360

Barrick (GOLD) upgraded to Outperform from Neutral at Credit Suisse; target raised to $22

The data from the Labor Department revealed on Thursday the number of applications for unemployment benefits unexpectedly decrease last week, pointing to ongoing labor market strength.

According to the report, the initial claims for unemployment benefits decreased by 10,000 to a seasonally adjusted 204,000 for the week ended January 11.

Economists had expected 216,000 new claims last week.

Claims for the prior week were remained unchanged at 214,000.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:00 | Germany | CPI, m/m | December | -0.8% | 0.5% | 0.5% |

| 07:00 | Germany | CPI, y/y | December | 1.1% | 1.5% | 1.5% |

| 09:00 | France | IEA Oil Market Report | ||||

| 12:30 | Eurozone | ECB Monetary Policy Meeting Accounts |

GBP rose slightly in the European session on Thursday as market participants paused the growing of bets on the Bank of England (BoE) lowering interest rates in January.

The pound tumbled earlier this week after another BoE's MPC member said he would vote for a rate cut unless the UK's economic data improved noticeably. Weaker inflation data, which were released on Wednesday, also added to the currency's woes.

Traders are now pricing in a nearly 57 percent chance of a 25 bps rate cut later this month compared to more than 60 percent on Wednesday.

Investors are awaiting the release of the December retail sales data due on Friday as well as the statistics on PMIs next week. It is expected that evidences that the UK's economy failed to improve after the general election that was held in December are to increase odds of a rate cut and knock the pound lower.

The euro traded mixed against its major counterparts after the release of the European Central Bank's (ECB) accounts of its December monetary policy meeting.

Meanwhile, the release of German final inflation data for December had little impact on the euro. Federal Statistical Office (Destatis) reported Germany's consumer price index rose by 0.5 percent in December 2019 compared with November 20 19. The gain was largely attributable to the seasonally higher prices of package holidays (+21.1 percent). Compared to December 2018, consumer prices as a whole were up 1.5%., pointing to an acceleration of inflation at the end of the year (November and October 2019: +1.1% each).

Reaction in currencies to the U.S.-China trade deal remained muted. As part of the deal, China agreed to purchase $200 billion worth of U.S. goods over the next two years, including up to $50 billion worth of agricultural products. The agreement also purportedly addresses issues such as intellectual property (IP) theft, forced technology transfers and currency manipulation by China. In exchange, the U.S. will cancel a new round of tariffs and lower already-imposed tariffs on approximately $120 billion worth of China's goods in half (to 7.5 percent). The U.S. president Donald Trump said that a 25 percent tariff on $250 billion worth of Chinese imports will remain in place in order to give the U.S. leverage as the two countries enter into phase-two talks.

Alcoa (AA) reported Q4 FY 2019 net loss of $0.31 per share (versus earnings of $0.66 in Q4 FY 2018), worse than analysts' consensus estimate of -$0.22.

The company's quarterly revenues amounted to $2.436 bln (-27.2% y/y), missing analysts' consensus estimate of $2.490 bln.

AA fell to $19.73 (-2.23%) in pre-market trading.

The ECB released the account of its December monetary policy meeting. It noted that since October meeting:

- there have been signs of increased optimism among market participants;

- there had been a solid upward movement in underlying inflation, supported by high capacity utilisation levels, rising energy commodity prices and tight labour markets;

- Incoming data pointed to continued weak but stabilising euro area growth dynamics.

- It was also noted that global geopolitical situation was not conducive to lowering uncertainty;

- there appeared to be tentative indications that industrial production might bottom out before these spillovers became more generalized;

- further efforts should be made to try to better understand the reasons behind the unexplained weakness in inflation;

- the implementation of monetary policy could also be adjusted to reduce unwanted side effects;

- faced with a subdued inflation outlook, members reiterated the need for a highly accommodative monetary policy stance for a prolonged period of time.

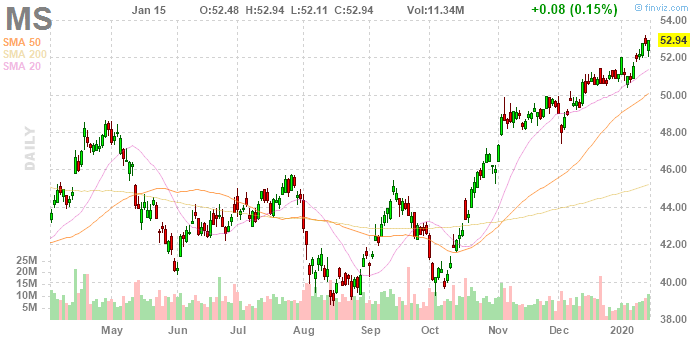

Morgan Stanley (MS) reported Q4 FY 2019 earnings of $1.20 per share (versus $0.80 in Q4 FY 2018), beating analysts' consensus estimate of $1.02.

The company's quarterly revenues amounted to $10.857 bln (+27.0% y/y), beating analysts' consensus estimate of $9.720 bln.

MS rose to $54.20 (+2.38%) in pre-market trading.

Analysts at Danske Bank expect the Norges Bank to leave the policy rate unchanged at 1.50% and signal unchanged rates for the coming period.

- "We expect no new signals from Norges Bank (NB) at its monetary policy meeting on 23 January. Hence, we expect NB to leave the policy rate at 1.50% and reiterate that rates most likely will remain unchanged in the period ahead. Note that this is an interim meeting with no monetary policy report, rate path or press conference. Indeed in recent years, NB has tended to give very little new information at these interim meetings which fall only one month after the last monetary policy report.

- At the meeting in December, NB stated that 'the policy rate will most likely remain at this level in the coming period'. Meanwhile, the rate path implicitly suggested a 40% probability of a 2020 hike, highlighting a modest bias towards further tightening.

- Our base case remains a fifth NB rate hike in 2020 (in June), but the probability of this call materializing has arguably fallen in recent weeks. We estimate the true probability of another NB hike as marginally higher than 50% given the recent news flow. In comparison, markets price roughly 2bp and 5bp worth of cuts (accumulative) for end-2020 and end-2021, respectively. Hence we still see value in positioning for higher short-end rates."

In view of analysts at ANZ, the signing of the deal will bring some near-term stability to China's trade outlook and financial markets.

"The eight-chapter agreement outlines many pragmatic action points in several areas, while others remain vague. At the same time, issues such as 5G technology, cyber security and SOE subsidies have not been included in the current agreement and could be topics for further negotiations, if there are any.

- Although China's official statement describes the agreement as a balanced one between the two countries, it actually has more obligations to fulfil than the US, which could rekindle conflicts in the future."

Rabobank analysts point out that we get a flurry of US data today, starting at 14:30 CET with the Philly Fed, retail sales, jobless claims, and import prices, followed by the Bloomberg indices (15:45 CET), business inventories and the NAHB housing market index (both at 16:00 CET) and finally the TIC data (22:00 CET).

- "Generally speaking, labor market and consumption data in the US remain solid, while the business surveys show that the manufacturing sector is in trouble. We expect this weakness to spread to the services sector and subsequently drag down employment growth and finally consumption as well. Meanwhile, we do not expect the Phase 1 trade deal to remove the fundamental uncertainty about international trade and supply chains that is facing US corporations."

The Global Times notes that China's Vice Premier Liu He and the U.S. President Donald Trump signed the phase one trade agreement on Wednesday and the deal was largely in line with expectations.

Among the main points is China's pledge to increase imports of the U.S. agricultural, manufacturing and energy products by $200 billion from $186 billion in 2017.

According to Liang Ming, the director of the Chinese Academy of International Trade and Economic Cooperation's foreign trade institute, this should not be too difficult.

He also noted that the pledge to increase imports of manufactured goods by $77.7 billion will include large machinery and China also has a huge demand for crude and natural gas imports. "Prices of these U.S. products are very competitive so we can't say China has been taken advantage of," he added.

In addition, the deal included terms about the U.S. ensuring market supply, which could mean Washington will lift bans on the chip exports to China, Liang said. If it's the case, there is a huge potential as China imports $300 billion worth of chips each year, he estimated.

Apart from the purchases, the agreement also included terms on intellectual property rights (IPR) protection, technology transfer and market opening.

"The U.S. largely confirmed that there would be equal treatment as China in IPR protection and technology transfer, which could be a tacit approval of Huawei going into the US market," Wang Wen, executive dean of Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times, referring to the Chinese telecom company that has been blacklisted by the U.S.

A crucial guarantee of the healthy development of China-U.S. trade relations, the Trade Framework Group, will be created to discuss the implementation of the phase one trade agreement and to settle disputes.

"The mechanism can help relieve distrust between the two countries. Once trust is built, the two sides are expected to resolve trade friction through dialogue and communication instead of imposing additional tariffs," Liang said, noting that he believed the mechanism could be earnestly implemented to reduce serious trade confrontations between the two.

Along with the signing of the trade deal, a certain amount of the existing tariffs on Chinese products imposed by the U.S. may be lifted in mid-2020, Liang added.

According to analysts at TD Securities, retail sales probably rose solidly in December (+0.5% MoM) even with a drop in autos.

"Reports on holiday shopping were generally positive, albeit with department stores continuing to lose market share to nonstore retailers. We also forecast sales in the control group to have advanced at a similarly firm 0.5% m/m. Separately, we look for the Philly Fed index to have recovered partially to 6 in January following its 6pt drop to 2.4 in December. We expect the improvement in sentiment to be positively influenced by the US-China trade deal. Lastly, we look for initial jobless claims to print a moderate 218k for the week of Jan 11, marginally up from 214k in the week prior."

According to Germany's BDI industry association, German economic growth is seen at 0.5% in 2020, helped mainly by a higher number of working days, while calendar-adjusted is projected at 0.1%.

Meanwhile, BDI's President Kempf called on the German government to implement a massive investment programme in infrastructure over the next 10 years to boost GDP growth. Kempf said the German government must cut corporate taxes to push down overall burden to below 25% from 31% currently.

Berlin should also massively hike public investment in infrastructure over next 10 years to boost growth, he added.

German Chancellor Angela Merkel told the Financial Times that US has slowly lost interest in Europe as other countries and regions have enjoyed surging economic growth and influence.

Merkel noted a "shift" in how the US looks at the world over the last few years.

"President Obama already spoke about the Asian century, as seen from the U.S. perspective. This also means that Europe is no longer, so to say, at the centre of world events," Merkel told.

President rump has challenged the 28-member bloc and, in particular, Germany on different occasions. He has accused Berlin of currency manipulation, of not adequately contributing to the NATO budget and has also threatened to impose tariffs on German cars.

Merkel argued that Europe "needs to take on more responsibility" to address this tense relationship with the U.S. "The United States' focus on Europe is declining - that will be the case under any president," Merkel said.

China government advisor said that China will need time to assess the just-signed phase one trade agreement and other complicating factors before launching negotiations with the US for a phase two agreement.

"Given the complexity of the contentious issues that were left out, China may make key judgments about the launch of phase two trade talks by analyzing monumental international issues," an advisor to the Chinese Ministry of Commerce told the Global Times.

The advisor, who spoke on condition of anonymity, specifically mentioned a recent joint statement from the US, the EU and Japan, in which the trio proposed new global trade rules aimed at curbing subsidies. Some analysts have read the move as targeting China.

"China is not in a hurry to commence the next phase of trade talks, which will involve deeper and more ingrained issues. We should therefore move more cautiously and steadily," said Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies

Dong said China may demand that the US roll back all tariffs before it agrees to begin phase two negotiations.

-

US-Iran tensions and Iraqi protests had only minimal impact on oil operations.

-

Iraq oil supply potentially vulnerable amid rising political risks in the region.

-

But fragile situation may limit Iraq's plans to expand oil production capacity.

-

US-Iran de-escalation means major threat to oil supplies appears to have receded.

-

IEA keeps oil demand growth estimate for 2020 at 1.2 mln bpd on subdued prices, higher GDP growth and trade war progress.

-

Global oil demand rose by 955,000 bpd year on year to 101.1 mln bpd in October.

-

OECD oil demand set to fall by 115,000 bpd in 2019 but grow by 275,000 bpd in 2020.

-

Global oil supply fell 780,000 bpd in Dec month on month due to Saudi cuts, seasonal decline of biofuels.

-

OPEC crude production fell in December by 180,000 bpd month on month to 29.44 mln bpd.

-

Demand for OPEC crude set to fall to 28.5 mln bpd during H1 2020.

-

Non-OPEC supply growth set to expand from 2 mln bpd in 2019 to 2.1 mln bpd in 2020.

-

OECD oil stocks fell by 2.9 mln barrels in Nov to 2.912 bln barrels, 8.9 mln above 5-year average.

According to the report from People's Bank of China (PBOC), chinese banks issued 1.14 trillion yuan worth of new yuan loans in December. Economists expected 1.1 trillion yuan of new loans in December. In November, new loans stood at CNY1.39 trillion.

Total social financing, a broader measurement of credit in the economy that includes both bank loans and nonbank financing, was CNY2.1 trillion in December, up from CNY1.99 trillion in November.

Outstanding yuan loans grew 12.3% from a year earlier, a notch below 12.4% growth forecast by analysts and November's pace, which was also 12.4%.

The central bank is widely expected to keep its policy supportive despite recent signs of improvement in the economy as Sino-U.S. trade tensions ease. Economic growth cooled to 6% in the third quarter, the slowest in nearly 30 years.

"Our current rhetoric of 'with oversold conditions, it is likely that the spot rate would transit next into a sideways pattern going forth' seems to be panning out well, USD stabilizing at around 6.9000 on Wed. That said, upward momentum is underwhelming and a sustained recovery above 6.9000 remains unlikely. Resistance is at 6.9030 and 6.9120. On the downside, the next key support is at 6.8720 but it should be out of reach today. As for тext 1-3 weeks, USD touched a low of 6.8802 on Mon and slipped further on Tue morning. While the down-move is becoming increasingly stretched, it appears that USD may still have scope to decline towards 6.8400 in the coming sessions. On the topside, expect resistances 6.9250 and 6.9370. Overall, USD is expected to stay on the back foot unless it can reclaim 6.9500." - FX Strategists at UOB Group said.

David Bloom, HSBC's Global Head of Foreign-Exchange Strategy, offered his outlook on currencies for this year, making a bullish case for the US dollar.

"Everyone's convinced themselves the dollar's going to be weaker. It's the third year in a row they're going to fail. The one currency we are very bullish against the dollar is sterling. The political risk was very negative for sterling, so we've taken one negative factor and we've chucked it away. That's got to be good for the currency. Once those yields start compressing" even further than they have done already, "you've got kind of developed market yields but emerging-market risks. After we see the great rally in EM and the race to the bottom of interest rates we could see at some point later this year, or maybe it's next year, you could see suddenly your yields are just too low for the risks involved."

Credit Agricole CIB Research discusses CHF outlook, paying attention to the EUR/CHF.

"CHF has been in demand, partly on the back of the notion that the SNB may be inclined to turn less dovish on monetary policy. After all, the US Treasury decided to put Switzerland on its currency watch list while the latest news-flow suggests that political pressure on the central bank to abandon negative rates is rising. It needs to be considered that criticism from politics as well as organizations including the Swiss Bankers Association has been around for the last few years with impact on the central bank's decision making process being close to zero. The same holds true as when it comes to the risk of the US labelling Switzerland as currency manipulator. We advise against chasing crosses such as EUR/CHF lower from here and we rather consider current levels as attractive buying territory for the longer term," CACIB adds.

Danske Bank analysts suggest that repercussions from US-China trade agreement and hints on phase 2 could stay on the agenda today, but otherwise focus will be on the ECB minutes from December.

"The meeting did not reveal new policy signals, but the potential for governing council members viewing the economic outlook more positively is worth keeping an eye on. For the longer term, we will look for clues about the strategic review. Then on to US retail sales for December: there have been indications that US Christmas sales disappointed, which will come on the back of subdued growth in November. Consumer confidence remains high and the housing market is still improving supported by the lower mortgage rates and decent real wage growth."

Data from the European Automobile Manufacturers' Association, or ACEA, showed that in December 2019 EU passenger car demand grew for the fourth month in a row (+21.7%), marking the highest December total on record to date. This was partially the result of a low base of comparison, as registrations fell by 8.4% in December 2018. However, specific market changes also contributed to this exceptional growth.

A surge in car sales was observed in France (+27.7%) and Sweden (+109.3%). As a result, all EU countries - including the five big markets - posted solid growth rates in December.

Overall in 2019, new-car registrations increased by 1.2% across the European Union, reaching more than 15.3 million units in total and marking the sixth consecutive year of growth. The year started on weak footing due to the lasting impact of the introduction of the WLTP test in September 2018. Yet, the final quarter of 2019, and December in particular, pushed the full-year performance of the EU market into positive territory.

Asian currencies rose on Thursday amid hopes that a US-China trade agreement could portend warmer relations between the world's two largest economies and help revive global growth.

Beijing and Washington touted the Phase 1 agreement, signed overnight at the White house, as a step forward in resolving their bitter trade dispute. U.S. Vice President Mike Pence said that further Phase 2 discussions had already begun.

The greenback was also marginally lower against the euro and pound, with analysts figuring a bounceback in the world economy could be negative for the dollar.

Experts believe that the partial trade agreement signed on Wednesday between the US and China brings some relief to the market, but uncertainty still persists

"There's a great sense of welcome that the deal was signed and a little bit of relief, naturally, and some measured optimism about how we can move forward," said Gregory Gilligan, chairman of the American Chamber of Commerce in China.

As part of the deal, China also agreed to purchase an additional $200 billion in U.S. goods over the next two years.

Although tariffs are still being levied on $370 billion worth of imported Chinese goods, how the "phase one" deal works will help toward the making of a "phase two" deal, Gilligan told

As for the additional $200 billion of U.S. goods that China has promised to purchase, Gilligan said "hitting those targets will be difficult, but that's good problem to have.

Meanwhile, China's Vice Premier Liu He said on Thursday that China's 2019 GDP is estimated to grow more than 6%, according to Chinese state news agency Xinhua News. Liu added that data for this month points to a better-than-expected economic outlook, Xinhua reported.

Federal Statistical Office (Destatis) said, in December 2019, consumer price index rose by 0.5% compared with November 2019. The increase was largely attributable to the seasonally higher prices of package holidays (+21.1%).

Consumer prices as a whole were up 1.5% in December 2019 compared with December 2018. Hence the inflation rate increased at the end of the year (November and October 2019: +1.1% each). The higher inflation rate as compared with the previous months was mainly attributable to the development of energy prices, which in December 2019 were only 0.1% lower year on year (November 2019: -3.7% compared with November 2018). Excluding energy prices, the rate of inflation would have been 1.8% in December 2019. Food prices rose by 2.1% between December 2018 and December 2019. Markedly higher prices were recorded for meat and meat products (+5.5%).

The prices of services (total) were up 1.8% over the same period. Among services, net rents exclusive of heating expenses were up 1.5%.

Destatis also reports that consumer prices in Germany rose by 1.4% in 2019 on an annual average basis compared with 2018. Year-on-year rate of price increase was lower in 2019 than in the previous year (2018: +1.8%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1275 (3325)

$1.1243 (3049)

$1.1220 (1860)

Price at time of writing this review: $1.1147

Support levels (open interest**, contracts):

$1.1087 (4645)

$1.1044 (4386)

$1.0997 (1369)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 7 is 51208 contracts (according to data from January, 15) with the maximum number of contracts with strike price $1,1350 (4715);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3196 (982)

$1.3164 (1382)

$1.3112 (1039)

Price at time of writing this review: $1.3038

Support levels (open interest**, contracts):

$1.2987 (2668)

$1.2965 (1156)

$1.2938 (3060)

Comments:

- Overall open interest on the CALL options with the expiration date February, 7 is 23919 contracts, with the maximum number of contracts with strike price $1,3600 (3946);

- Overall open interest on the PUT options with the expiration date February, 7 is 20559 contracts, with the maximum number of contracts with strike price $1,3000 (3060);

- The ratio of PUT/CALL was 0.86 versus 0.84 from the previous trading day according to data from January, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 64.51 | -0.15 |

| WTI | 58.05 | -0.12 |

| Silver | 17.97 | 1.13 |

| Gold | 1556.045 | 0.64 |

| Palladium | 2262.67 | 3.1 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -108.59 | 23916.58 | -0.45 |

| Hang Seng | -111.55 | 28773.59 | -0.39 |

| KOSPI | -7.9 | 2230.98 | -0.35 |

| ASX 200 | 32.6 | 6994.8 | 0.47 |

| FTSE 100 | 20.45 | 7642.8 | 0.27 |

| DAX | -24.19 | 13432.3 | -0.18 |

| CAC 40 | -8.28 | 6032.61 | -0.14 |

| Dow Jones | 90.55 | 29030.22 | 0.31 |

| S&P 500 | 6.14 | 3289.29 | 0.19 |

| NASDAQ Composite | 7.37 | 9258.7 | 0.08 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69055 | 0.04 |

| EURJPY | 122.534 | 0.13 |

| EURUSD | 1.11491 | 0.21 |

| GBPJPY | 143.289 | 0.07 |

| GBPUSD | 1.30379 | 0.16 |

| NZDUSD | 0.66172 | 0.07 |

| USDCAD | 1.30418 | -0.14 |

| USDCHF | 0.96397 | -0.34 |

| USDJPY | 109.899 | -0.08 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.