- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 16-12-2016

Major U.S. stock-indexes little changed on Friday. The Fed sees three rate hikes next year instead of the two foreseen in September, partly as a result of the expected economic benefits under President-elect Donald Trump.

Most of Dow stocks in negative area (17 of 30). Top gainer - General Electric Company (GE, +1.17%). Top loser - Intel Corporation (INTC, -1.36%).

All S&P sectors in positive area. Top gainer - Conglomerates (+1.5%). Top loser - Technology (-0.5%).

At the moment:

Dow 19811.00 +8.00 +0.04%

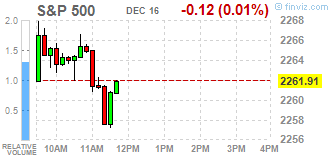

S&P 500 2255.75 -2.75 -0.12%

Nasdaq 100 4921.75 -13.00 -0.26%

Oil 53.00 +1.03 +1.98%

Gold 1140.50 +10.70 +0.95%

U.S. 10yr 2.58 +0.00

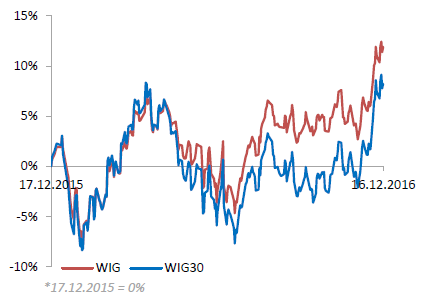

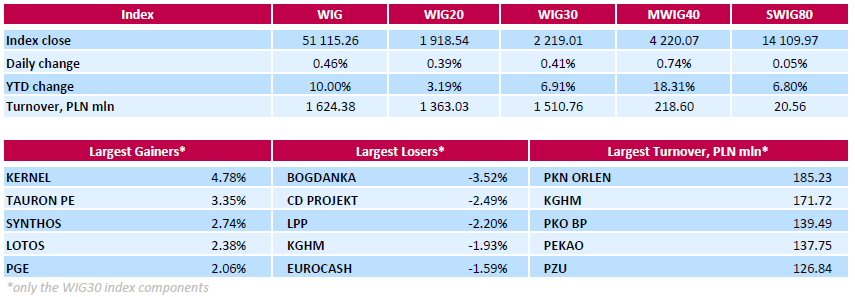

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, surged by 0.46%. The WIG sub-sector indices were mainly higher with food stocks (+2.87%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 0.41%. Nearly 2/3 of all index components returned gains, with the way up led by agricultural producer KERNEL (WSE: KER), genco TAURON PE (WSE: TPE), chemical producer SYNTHOS (WSE: SNS) and oil refiner LOTOS (WSE: LTS), which added between 2.38% and 4.78%. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB), videogame developer CD PROJEKT (WSE: CDR) and clothing retailer LPP (WSE: LPP) topped decliners' list, falling by 3.52%, 2.49% and 2.2% respectively.

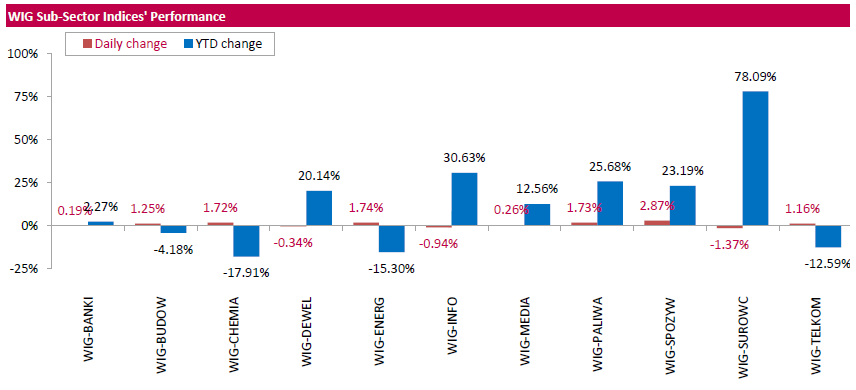

Oil prices edged up on Friday despite pressure from potential production increases in Libya, where operations have restarted at two key oil fields.

Even after OPEC cobbled together a deal to cut almost 2% from global oil production to tackle a supply glut and rally prices, returning production from major oil producers such as Libya is threatening to boost supply. says Dow Jones.

Libya's oil production has dropped steeply in the past five years, since dictator Moammar Gadhafi's 2011 ouster, but in recent months it has been ramping back up. Earlier this week Libyan officials said revived production could bring back more than 200,000 barrels a day of oil within days

Brent crude, the global oil benchmark, rose 0.54% to $54.32 a barrel on London's ICE Futures exchange. On the New York Mercantile Exchange, West Texas Intermediate futures were trading up 0.14% at $50.96 a barrel.

China's central bank has made a move to encourage commercial banks to lend to large non-bank financial institutions, after many of them have suspended interbank operations in a tough situation with liquidity. This was announced by the Chinese financial magazine Caixin.

Caixin said that traders indicate worsening sentiment among banks about market conditions and growing caution with respect to inter-bank lending, especially after the US Federal Reserve provoked a sell-off in the bond market, futures signaled a greater number of rate hikes in 2017.

Liquidity has become a major factor in the market after the central bank increased the cost of open market operations last month.

Wall Street began from a slight increase, although the scale of change suggests that we will see a replication scenario for the last days. The whole week of trading in America shows consolidation but the bulls have the chance of a successful closing of the next week, which is important due to adverse for market shares statement of Fed.

On 15:50 (Warsaw time) on the Warsaw market has started the last 60 minutes of continuous trading, which will be decisive to determine the settlement price of the December series.

Into this last hour of trading the WIG20 enter on the level of 1,917 points (+ 0.32%).

U.S. stock-index futures rose slightly, approaching to the pre-Fed levels.

Global Stocks:

Nikkei 19,401.15 +127.36 +0.66%

Hang Seng 22,020.75 -38.65 -0.18%

Shanghai 3,124.03 +6.35 +0.20%

FTSE 7,008.03 +9.02 +0.13%

CAC 4,832.98 +13.75 +0.29%

DAX 11,400.89 +34.49 +0.30%

Crude $51.28 (+0.75%)

Gold $1,135.40 (+0.50%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 763.5 | 2.50(0.3285%) | 9115 |

| American Express Co | AXP | 75.12 | 0.18(0.2402%) | 500 |

| Apple Inc. | AAPL | 116.4 | 0.58(0.5008%) | 125217 |

| Barrick Gold Corporation, NYSE | ABX | 14.2 | 0.20(1.4286%) | 68595 |

| Boeing Co | BA | 153.59 | -0.18(-0.1171%) | 225 |

| Caterpillar Inc | CAT | 94.86 | 0.33(0.3491%) | 1079 |

| Citigroup Inc., NYSE | C | 60.6 | 0.37(0.6143%) | 5989 |

| Exxon Mobil Corp | XOM | 91.26 | 0.37(0.4071%) | 4070 |

| Facebook, Inc. | FB | 120.87 | 0.30(0.2488%) | 23274 |

| Ford Motor Co. | F | 12.67 | 0.09(0.7154%) | 14806 |

| General Electric Co | GE | 31.61 | 0.35(1.1196%) | 71927 |

| Goldman Sachs | GS | 244.09 | 1.09(0.4486%) | 5570 |

| Google Inc. | GOOG | 801 | 3.15(0.3948%) | 1004 |

| Home Depot Inc | HD | 136.13 | 0.29(0.2135%) | 2395 |

| HONEYWELL INTERNATIONAL INC. | HON | 113.56 | -2.78(-2.3895%) | 12568 |

| Intel Corp | INTC | 36.68 | -0.11(-0.299%) | 2254 |

| International Business Machines Co... | IBM | 169.1 | 1.08(0.6428%) | 1718 |

| JPMorgan Chase and Co | JPM | 86.39 | 0.39(0.4535%) | 10923 |

| Merck & Co Inc | MRK | 62.75 | 0.38(0.6093%) | 3286 |

| Microsoft Corp | MSFT | 62.72 | 0.14(0.2237%) | 990 |

| Nike | NKE | 51.63 | 0.34(0.6629%) | 14782 |

| Pfizer Inc | PFE | 33 | 0.25(0.7634%) | 4408 |

| Procter & Gamble Co | PG | 84.8 | 0.12(0.1417%) | 1419 |

| Tesla Motors, Inc., NASDAQ | TSLA | 199.45 | 1.87(0.9465%) | 5488 |

| The Coca-Cola Co | KO | 41.4 | -0.15(-0.361%) | 32825 |

| Twitter, Inc., NYSE | TWTR | 18.87 | 0.08(0.4258%) | 44674 |

| UnitedHealth Group Inc | UNH | 160.73 | 0.11(0.0685%) | 685 |

| Walt Disney Co | DIS | 104.67 | 0.28(0.2682%) | 3460 |

| Yahoo! Inc., NASDAQ | YHOO | 38.79 | 0.38(0.9893%) | 7310 |

| Yandex N.V., NASDAQ | YNDX | 20.82 | 0.24(1.1662%) | 17541 |

EURUSD 1.0300 (EUR 929m) 1.0350 ( 2.19bln) 1.0400 (1.56bln) 1.0500 (3.02bln) 1.0600 (2.29bln) 1.0700 (1.96bln) 1.0800 (3.95bln)

USDJPY 113.00 (USD 885m) 116.00 (USD 1.22bln)

GBPUSD 1.2700 (GBP 777m)

AUDUSD 0.7435-40 (AUD 537m)

USDCAD 1.3350 (USD 857m) 1.3500 (927m)

Upgrades:

General Electric (GE) upgraded to Outperform from Mkt Perform at Bernstein

Downgrades:

Coca-Cola (KO) downgraded to Equal-Weight from Overweight at Morgan Stanley

Other:

Apple (AAPL) resumed with a Overweight at Piper Jaffray; target $155

FedEx (FDX) target raised to $240 at Cowen

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,201,000. This is 4.7 percent below the revised October rate of 1,260,000 and is 6.6 percent below the November 2015 estimate of 1,286,000.

Single-family authorizations in November were at a rate of 778,000; this is 0.5 percent above the revised October figure of 774,000. Authorizations of units in buildings with five units or more were at a rate of 384,000 in November.

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,090,000. This is 18.7 percent below the revised October estimate of 1,340,000 and is 6.9 percent below the November 2015 rate of 1,171,000.

Single-family housing starts in November were at a rate of 828,000; this is 4.1 percent * below the revised October figure of 863,000. The November rate for units in buildings with five units or more was 259,000.

Foreign acquisitions of Canadian securities reached $15.8 billion in October, above the monthly average investment of $13.7 billion from January to September. The activity was mainly concentrated in Canadian debt securities issued by private corporations, both short- and long-term instruments.

Non-resident investors resumed their acquisitions in the Canadian money market by adding $7.7 billion worth to their holdings in October, following a $5.4 billion divestment in September. Foreign acquisitions of private corporate paper accounted for the bulk of the investment, reaching a record $6.8 billion, mainly paper denominated in foreign currencies. Canadian short-term interest rates were down slightly and the Canadian dollar depreciated against its US counterpart by 1.7 US cents in the month.

Foreign investment in Canadian bonds slowed to $6.3 billion in October. Foreign acquisitions of Canadian private corporate bonds amounted to $5.0 billion, mainly new issues denominated in foreign currencies. This followed an investment of $11.1 billion in these instruments in September.

The survey of 482 firms found that total order books were at a 20-month high, while export order books softened for a second successive month but remained above historical norms.

Growth in output was the highest since mid-2014 and was broad-based. Just 4 of the 18 sectors reported a fall in production, with mechanical engineering and the aerospace sectors the main drivers of the improvement. Expectations for production growth in the first quarter of 2017 remain solid.

EUR/USD

Offers 1.0465 1.0485 1.0500 1.0525 1.0550-55 1.05851.0600 1.0625-30 1.0650

Bids 1.0420 1.0400 1.0380 1.0350 1.030-35 1.0300

GBP/USD

Offers 1.2460 1.2480 1.2500 1.2530 1.2550 1.2565 1.2580 1.2600 1.2630-35 1.2650

Bids 1.2400 1.2380-85 1.2350 1.2330-35 1.2300 1.2275 1.2250

EUR/GBP

Offers 0.8420-25 0.8450 0.8460-65 0.8480 0.8500

Bids 0.8380 0.8350-55 0.8330-35 0.8300 0.8285 0.8250

EUR/JPY

Offers 123.60 123.85 124.00-10 124.30 124.50 124.80 125.00

Bids 123.00 122.80 122.50 122.20 122.00 121.75 121.50 121.00

USD/JPY

Offers 118.25-30 118.60 118.80 119.00 119.20 119.50 120.00

Bids 117.80 117.50 117.20 117.00 116.80 116.50 116.30 116.00 115.85 115.50 115.00

AUD/USD

Offers 0.7380 0.7400 0.7430 0.7450 0.7485 0.7500 0.7520-25 0.7550

Bids 0.7350 0.7330 0.7300 0.7285 0.7250 0.7200

The morning part of today's trading on the Warsaw market ended for the WIG20 index with minor changes and with a modest level of turnover. The course of today's trading indicates more waiting for the final hour than a consolidation after the last increases.

At the halfway point of the session, the WIG20 index was on the level of 1,913 points (+0,12%). The turnover in the segment of blue-chips was amounted to PLN 267 million.

European stocks traded higher, near the highest level since January, helped by growth in the health sector and telecommunications. At the same time, lower banks shares inhibits the rally.

Certain influence on the dynamics of trade had statistical data for the euro area. The final report, submitted by Statistics agency Eurostat showed that in November, consumer prices in the euro area fell by 0.1% after rising 0.2% in October. However, the decline in prices has confirmed the expectations of experts. Meanwhile, the growth rate of annual inflation accelerated to 0.6% from 0.5% in the previous month. Core CPI, which excludes energy and food prices, rose 0.8% year on year, confirming the forecasts and coincided with the previous estimate. Recall that in October the index also increased by 0.8%. Among EU countries, annual inflation rose in November by 0.6% after rising 0.5% in October. A year earlier the rate was at 0.1%. The report also stated that the bigest increase in prices in the euro area (in annual terms) was seen in restaurants and cafes (+ 0.07%). Expenses for the rent increased by 0.04%. The cost of tobacco products also increased by 0.04%.

The composite index of the largest companies in the region Stoxx Europe 600 is trading with an increase of 0.29 percent. Over the past two weeks, the index rose nearly 6 percent .

Shares of Banca Monte dei Paschi di Siena increased by 0.7 per cent after receiving regulatory approval to extend the bond exchange program. However, experts note that the concerns about the need for government intervention remain.

At the moment:

FTSE 100 +13.36 7012.30 + 0.19%

DAX +52.38 11418.78 + 0.46%

CAC 40 +26.77 4846.00 + 0.56%

-

Inflation Slowed to 5.6% As of Dec 12

-

Sees Inflation at 4% by End-2017

-

Decrease in Inflation Expectations Remains Unstable

-

Slowing Consumer Price Inflation Partly Caused by Temporary Factors

-

Inflation in Line with Forecast, Inflation Risks Eased a Little

The first estimate for euro area (EA19) exports of goods to the rest of the world in October 2016 was €172.5 billion, a decrease of 5% compared with October 2015 (€180.8 bn). Imports from the rest of the world stood at €152.4 bn, a fall of 3% compared with October 2015 (€157.5 bn). As a result, the euro area recorded a €20.1 bn surplus in trade in goods with the rest of the world in October 2016, compared with +€23.2 bn in October 2015. Intra-euro area trade fell to €144.7 bn in October 2016, down by 3% compared with October 2015.

Euro area annual inflation was 0.6% in November 2016, up from 0.5% in October. In November 2015 the rate was 0.1%. European Union annual inflation was 0.6% in November 2016, up from 0.5% in October. A year earlier the rate was 0.1%. These figures come from Eurostat, the statistical office of the European Union.

In November 2016, negative annual rates were observed in six Member States. The lowest annual rates were registered in Bulgaria and Cyprus (both -0.8%). The highest annual rates were recorded in Belgium (1.7%), the Czech Republic (1.6%) and Austria (1.5%). Compared with October 2016, annual inflation fell in five Member States, remained stable in six and rose in seventeen.

The largest upward impacts to euro area annual inflation came from restaurants & cafés (+0.07 percentage points), rents and tobacco (both +0.04 pp), while gas (-0.11 pp), heating oil (-0.05 pp) and package holidays (-0.04 pp) had the biggest downward impacts.

EUR/USD 1.0300 (EUR 929m) 1.0350 ( 2.19bln) 1.0400 (1.56bln) 1.0500 (3.02bln) 1.0600 (2.29bln) 1.0700 (1.96bln) 1.0800 (3.95bln)

USD/JPY 113.00 (USD 885m) 116.00 (USD 1.22bln)

GBP/USD 1.2700 (GBP 777m)

AUD/USD 0.7435-40 (AUD 537m)

USD/CAD 1.3350 (USD 857m) 1.3500 (927m)

Информационно-аналитический отдел TeleTrade

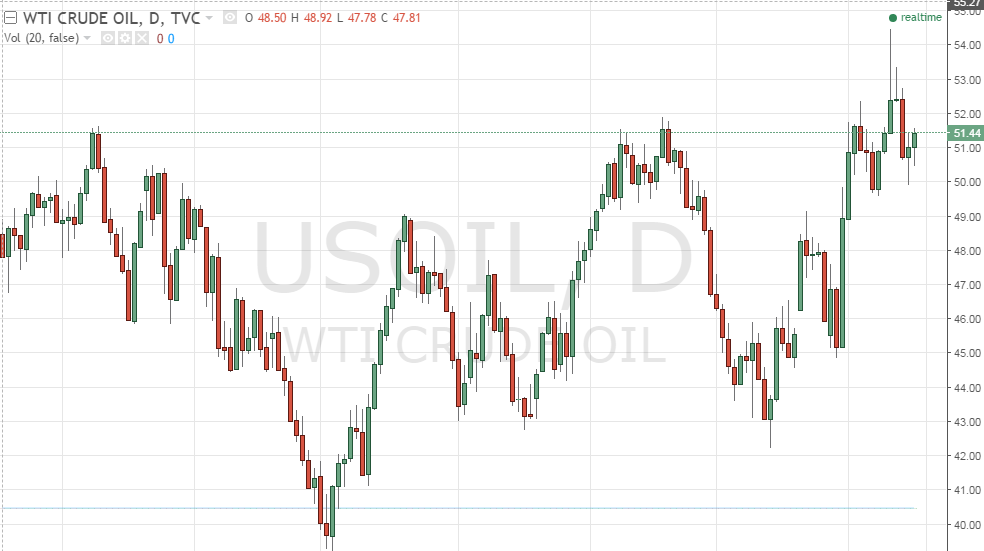

This morning, the New York futures for Brent rose 0.02% to $ 50.90 and WTI rose 0.06% to $ 54.04 per barrel. Thus, the black gold is trading little changed as Kuwait announced a reduction of deliveries within the framework of a global agreement on the reduction of production volumes.

OPEC and non-state concluded a first agreement in 2001 to jointly cut production after almost a year of negotiations in which they called to restore balance in the global market and to support the prices of raw materials.

On Monday, the Australian Government will make "The economic and budgetary projections." Economists point out that if projections prove weak, the global rating agencies will deprive Australia of the highest credit rating of "AAA". According to the forecasts, the cumulative reduction of the budget could reach about 15 billion Australian dollars over the next four fiscal years.

Some analysts believe that the probability of this scenario is 50%. Reducing the sovereign rating of the country will also reduce the ratings of major banks. The downgrade will lead to the fact that Australia will harder attract investment.

WIG20 index opened at 1913.05 points (+0.10%)*

WIG 50982.38 0.20%

WIG30 2215.75 0.27%

mWIG40 4200.84 0.28%

*/ - change to previous close

Investors in Europe started the day from virtually neutral level. In the Warsaw market, we have to deal with the optimism and after the first transactions the WIG20 index rose by 0.5 percent. For the bulls helps the stronger zloty, but the turnover does not look impressive. After fifteen minutes of trading WIG20 index reached 1,919 points (+ 0.44%).

-

At 10:30 GMT the Bank of Russia will announce interest rate decision

-

At 12:15 GMT the ECB Vice-President Vitor Constancio will give a speech

-

At 17:30 GMT FOMC member Jeffrey Lacker will give a speech

-

Also today, the European Council hold a meeting

"The FOMC delivered the market a hawkish surprise this week, with the 2017 dots signalling three hikes next year, up from the two signalled in September. USD strength followed, and we think USD/JPY has the furthest to run.

With the BOJ remaining committed to its yield control policy, the widening rates differential is likely to be highly supportive for USD/JPY. Risk sentiment reaction remains important for the cross, but so far seems contained.We are not expecting any surprises from the BOJ next week, and with low easing expectations market reactions should be muted.

We expect USD to outperform over 2017, but unlike 2016 it is likely to be driven more by the fiscal purse rather than monetary policy easing. Stronger global growth momentum than a year ago should also reduce the likelihood of a risk-off environment that caused the position unwind earlier this year.

The "Trumpflation trade" is still in full swing, and as we write this USD crosses are breaking above key levels at an impressive pace.

We expect this to continue into the new year and more so if President-elect Trump passes legislation at a faster pace than the market is expecting. Politics will likely continue to dominate the headlines next year, and we expect EUR to move below parity and GBP to reach new lows.

CAD is likely to outperform AUD and NZD, while SEK and NOK are likely to outperform CHF as their central banks turn more hawkish. Finally, we believe foreign bond flows could have a greater impact on EUR going forward, as the higher FX hedge costs for euro area investors could mean a stronger FX impact from those outflows".

Copyright © 2016 Nomura, eFXnews™

Consumer confidence in New Zealand fron ANZ was down 2.1% in December, well below the previous value of +3.5%.

ANZ said consumer sentiment fell in December, but economic signals remain healthy. Strong levels of trust - a sign of continued sustainable growth in all sectors of the economy. Earthquakes in the last month, did not seem to have any significant effect

Data on consumer confidence include inflation expectations, which, according to the report ncreased to 3.4% in December from the previous value of 3.3% - this is in line with the average value, which occurred in the previous 12 months

Ms. Ellis recalled that the events of recent years have clearly demonstrated that the economic downturn may have long-term negative consequences for the labor market. At the same time, the economist refused to comment on the possibility that the Australian economy in the second quarter may decline again. Reserve Bank of Australia is trying not to talk about a recession in the country. Lucy Ellis also referred to the slow recovery in the United States, stressing that the world economic recessions have become increasingly protracted and complex in terms of the restoration of the number of jobs.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0719 (449)

$1.0671 (316)

$1.0612 (212)

Price at time of writing this review: $1.0438

Support levels (open interest**, contracts):

$1.0364 (1080)

$1.0325 (1856)

$1.0278 (2744)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 41807 contracts, with the maximum number of contracts with strike price $1,1500 (3226);

- Overall open interest on the PUT options with the expiration date March, 13 is 51196 contracts, with the maximum number of contracts with strike price $1,0000 (5591);

- The ratio of PUT/CALL was 1.22 versus 1.02 from the previous trading day according to data from December, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.2713 (484)

$1.2617 (991)

$1.2521 (331)

Price at time of writing this review: $1.2428

Support levels (open interest**, contracts):

$1.2380 (273)

$1.2283 (357)

$1.2187 (533)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 9896 contracts, with the maximum number of contracts with strike price $1,2600 (991);

- Overall open interest on the PUT options with the expiration date March, 13 is 12831 contracts, with the maximum number of contracts with strike price $1,1500 (2954);

- The ratio of PUT/CALL was 1.30 versus 1.31 from the previous trading day according to data from December, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Indices on the New York stock markets rose slightly on Thursday after the release of good macroeconomic data from the US economy. Oil remained largely unchanged. Heavily fell quotations of gold. Rising yields of the US bonds. The dollar is the strongest since 2003. The Dow Jones Industrial at closing increased by 0.3 percent, the S&P500 by 0.39 percent while the Nasdaq Comp. went up by 0.37 per cent.

From the perspective of European markets, the most important element is light withdrawal on Wall Street in the second half of the day which may result in a similar withdrawal in Europe.

It must be remembered that today the world is facing a session with the settlement of derivatives, so part of the trade will be disturbed by players from futures markets.

There is no important elements in the macro calendar today.

Third Friday in December is also the day of settlement of derivative in Warsaw. Usually the market may be muted in anticipation of the final hour of the session and the festival of basket orders, which not only disturb the image of activity during the day, but also discourage entry into the game before the time of miracles. Thus, for reliable technical trade we have to wait until the next week.

European stocks on Thursday closed just shy of a 2016 high as bank shares rallied and the euro sank after the U.S. Federal Reserve signaled a faster pace of interest-rate hikes than previously mapped out. But shares in mining companies fell as the U.S. dollar continued its post-Fed surge. The dollar's jump came partly at the expense of the shared currency, which traded at 14-year lows against the greenback.

U.S. stocks closed higher Thursday, but off their intraday highs, as investors adjusted to the Federal Reserve's plan for a faster path of interest-rate increases in 2017. After a pullback following the Fed decision Wednesday, stock-market indexes resumed their post-election march higher.

Asian shares steadied on Friday, tracking U.S. gains, with financials leading Japan's stock market to a fresh high for the year. Japan financials are benefiting from rising yields for global government bonds, in which they invest heavily.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.