- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 22-12-2021

- WTI extends two-day uptrend to refresh the highest level in a fortnight.

- Bullish MACD signals back sustained break of 200-DMA, previous resistance line from November.

- 100-DMA, rising wedge’s resistance line challenge immediate upside.

WTI crude oil pierces $73.00 threshold to poke monthly high, flashed before two weeks, during Thursday’s Asian session. In doing so, the black gold justifies a clear upside break of the 200-DMA and a descending trend line from November 10.

Given the bullish MACD signals favoring the latest breakout, the present upside momentum is likely to extend.

However, a convergence of the 100-DMA and upper line of a short-term rising wedge bearish chart pattern, near $73.80, becomes crucial for the WTI bulls.

Adding to the upside filter is the November 22 swing low of $74.65, a break of which will direct the oil prices towards the early November’s bottom surrounding $77.60 and then to the $80.00 threshold.

On the contrary, pullback moves may initially aim for the 200-DMA level of $70.37 before retesting the resistance-turned-support line close to $69.70.

Should WTI sellers conquer $69.70 support, the lower line of the stated rising wedge, near $67.00 will be crucial as a break of which will direct the prices towards the monthly low near $62.30.

WTI: Daily chart

Trend: Further upside expected

- NZD/USD seesaws near one-week high after being the second biggest G10 gainer.

- Stimulus hopes, Omicron updates favored risk appetite despite strong US data.

- NZ already reduced booster gap to four months, eyes 90% jabbing.

- US Durable Goods Orders, PCE Inflation for November eyed for fresh impulse, risk catalysts are important too.

NZD/USD remains sidelined after refreshing the weekly top by 0.6823, easing to 0.6800 during the initial Asian session on Thursday. The kiwi pair previously cheered risk-on mood before the latest challenges to the market sentiment and a light calendar tested the bulls.

Recent comments from the White House, shared by the Financial Times (FT), raise concerns over the availability of Pfizer’s drug that earlier favored optimism concerning Omicron’s cure. On the same line was the FT news stating, “France on Wednesday canceled its order of Merck’s drug after data showed it resulted in a reduction of only 30% in the risk of hospitalization and death, significantly lower than earlier expectations.”

Hopes of overcoming the South African covid variant, dubbed as Omicron, joined optimism concerning US President Joe Biden's Build Back Better (BBB) stimulus to favor the market’s mood the previous day.

After US Army conveyed positive updates for a single vaccine to battle covid and all variants, the US Food and Drug Administration (FDA) approved a pill from Pfizer to treat Covid-19.

On the other hand, Reuters quotes White House spokeswoman Jen Psaki while saying, “We believe that Senator Manchin has been engaging with us over the course of time and months in good faith." It’s worth noting that Joe Manchin poured cold water on the face of stimulus expectations by being the only Democrat to oppose the much-awaited aid package that needs all the party members’ support to get through the house.

It’s worth noting that the strong US data also failed to stop the NZD/USD on Wednesday, neither did the Sino-American tension and the US-Russia tussles. That said. the US Q3 GDP rose past the 2.1% forecast to 2.3% whereas the CB Consumer Confidence for December came in better than upwardly revised 111.9 prior to 115.8.

Additionally helping the NZD/USD prices is New Zealand’s push for faster vaccinations to match Australia’s global record of 90%. Recently, Auckland reduced the time for booster shots to four months versus the previous six.

To portray the risk-on mood, the Wall Street benchmarks had a second positive day while the US 10-year Treasury yields and the Dollar Index (DXY) marked a negative daily closing by the end of Wednesday’s North America session. Also, the S&P 500 Futures print mild gains by the press time.

Moving on, a lack of data ahead of the US open might extend the latest pullback moves. However, positive headlines concerning Omicron and US stimulus may help the NZD/USD pair buyers to keep the reins. Following that, the US November PCE inflation and Durable Goods Orders will be crucial to watch amid hopes of a faster Fed rate hike, starting with early 2022.

Technical analysis

Bullish MACD signals join upside break of the 100-SMA and a five-week-old falling trend line to underpin the NZD/USD battle with the monthly resistance line near 0.6820. However, RSI conditions are overbought and may probe further advances.

Should Kiwi pair buyers rise past 0.6820, the 200-SMA level near 0.6880 and late November’s swing high near 0.6960 will be next in the line of the bull’s targets.

Meanwhile, pullback moves may initially aim for the 100-SMA level of 0.6775 before challenging three-week-long horizontal support near 0.6735-30.

- The NZD/JPY extends its gains in the week, up some 1.49%.

- The market sentiment is upbeat on Covid-19 news from South Africa and Pfizer’s pill.

- NZD/JPY Technical Outlook: It has a downward bias, though a break of the 200-DMA could send the NZD/JPY up to 79.00

The NZD/JPY rallies for the second consecutive day, trims losses from December 16, trading at 77.63 as the Asian session begins, at the time of writing. The New York session ended with an upbeat market sentiment spurred by positive news in the Covid-19 front. US equities finished in the green, gaining between 0.74% and 1.21%, led by the heavy-tech Nasdaq. At press time, Asian equity futures eyes towards a higher open, as positive market sentiment get follow-through in Asia.

On Wednesday’s overnight session, the NZD/JPY seesawed around the 76.90-77.20 range in the Asian session. However, as the overlap between Asia and Europe kicked in, the NZD/JPY surged aggressively, printing a daily high at 77.89, a price level not seen since December 16.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY daily chart depicts the pair still in a downward bias, as the daily moving averages (DMAs) reside well above the spot price, slightly horizontal, and would be strong resistance to overcome for NZD bulls. The NZD/JPY surged aggressively on Wednesday, though the upward move stalled near the 200-DMA at 78.01, to then settling around current levels.

To the upside, the first resistance would be December’s 16 cycle high at 77.96. The breach of the latter would expose the 200-DMA at 78.01, immediately followed by the 100-DMA at 78.28

On the flip side, the first support would be the psychological 77.00. A clear break of that level would add downward pressure on the NZD/JPY, exposing key support levels. The next one would be the December 3 swing low at 75.95, followed by the July 20 swing low at 75.25.

-637758111353223506.png)

“Japan plans to issue 4.2 trillion yen ($37 billion) of 40-year government bonds in the new fiscal year, a 17% increase that comes even as the government plans to cut its bond issuance overall,” said Reuters, quoting anonymous sources, during early Thursday morning in Asia.

Key quotes

It marks a third straight year of increases in issuance of the 40-year bonds, which are closely watched by the market, and reflects solid demand from life insurers at the long end of the yield curve, said the sources.

Prime Minister Fumio Kishida's inaugural debt issuance plan will see overall calendar-based sales of Japanese Government Bonds (JGBs) at around 200 trillion yen, or down about 20 trillion yen from this year, the sources said, reflecting the new premier's push to keep a lid on debt.

The increase in the 40-year bonds would mean sales of around 700 billion yen at auctions every other month, from auctions of 600 billion yen now, the sources said.

The government will keep issuance steady of five-year, 20-year, 30-year and inflation-linked 10-year bonds, the sources said.

The government also plans to boost liquidity-enhancing auctions by 600 billion yen in the next fiscal year, the sources said. In liquidity enhancing auctions, the Ministry of Finance issues additional amounts of existing JGBs to improve liquidity.

Market reaction

The news favored USD/JPY prices to pick up from intraday low to 114.13. However, bulls await Tokyo open amid recent challenges to the previous risk-on mood, raised by the White House.

Read: White House warns Pfizer Covid-19 pill will not be widely available for months – FT

The White House dims optimism over the Omicron cure after the US Food and Drug Administration (FDA) approved a pill from Pfizer to treat Covid-19.

“The White House has warned it will take more than six months to fulfill its initial order for Pfizer’s antiviral Covid-19 pill, as officials damped speculation the drug could immediately turn the tables on the pandemic,” said the Financial Times (FT)

Key quotes (from FT)

The US drugs regulator on Wednesday gave emergency authorization for the pill, called Paxlovid, to be used on people aged 12 and over with mild or moderate Covid-19 who are at risk of more severe symptoms.

But senior health advisers to President Joe Biden quickly warned that it would take months for the company to make and distribute all 10m treatment courses already on order.

Pfizer has said its pill cuts the risk of hospitalisation or death in Covid-19 patients by 89 percent.

It is likely to be especially important in the coming months because early lab tests show it continues to work against the fast-spreading Omicron variant, unlike some of the monoclonal antibody treatments already available.

FX reaction

Given the latest risk-on mood mainly driven by hopes of overcoming the South African covid variant, dubbed as Omicron, the news negatively affects the sentiment and should weigh on the recent gainers, namely Antipodeans and commodities.

Read: AUD/USD: Well-set for 0.7300 on firmer sentiment, US Durable Goods Orders, PCE Inflation eyed

- AUD/USD grinds higher around weekly top after crossing key hurdle to the north.

- Aussie cabinet meeting showed confidence in overcoming the virus variant.

- Omicron, US BBB updates favored risk appetite, mixed data from Australia, US got mostly ignored.

- Key US data, risk catalysts are the key before Christmas Eve.

AUD/USD defends 0.7200 resistance breakout, taking rounds to 0.7215-20 during early Thursday morning in Asia.

In doing so, the Aussie pair remains near the monthly peak of 0.7225, which holds the gate for a rally towards the 0.7300 hurdles. That said, the quote became the biggest currency pair gainer among the Group of Ten (G10) on Wednesday as market sentiment remained firmer.

Although rising virus cases and fears of not so happening year-end celebrations prevail, positive news about the cure and nature of the South African covid variant, dubbed as Omicron, favored the risk appetite of late. After US Army conveyed positive updates for a single vaccine to battle covid and all variants, the US Food and Drug Administration (FDA) approved a pill from Pfizer to treat Covid-19.

Adding to the Omicron-linked market optimism was the Aussie cabinet’s “easy play” to tame the virus strain, by pushing for caution and masks but not reducing the gap between two-shots and booster vaccinations.

Elsewhere, positive updates concerning US President Joe Biden's Build Back Better (BBB) stimulus add to the brighter mood and underpin the AUD/USD prices, due to the pair’s risk barometer status. "We believe that Senator Manchin has been engaging with us over the course of time and months in good faith," White House spokeswoman Jen Psaki told reporters. "There will be more negotiations, no doubt about it. Everybody stay tuned and settle in," per Reuters.

On a different page, hawkish expectations concerning Australia’s main export item iron ore also favor the AUD/USD bulls.

It’s worth noting that the Sino-American tension and the US-Russia tussles remain on the table but were ignored. So do the mostly firmer US data and downbeat Aussie figures. That said. the US Q3 GDP rose past the 2.1% forecast to 2.3% whereas the CB Consumer Confidence for December came in better than upwardly revised 111.9 prior to 115.8. On the other hand, Australia Westpac Leading Index for November dropped below 0.27% to 0.12%.

Amid these plays, the Wall Street benchmarks had a second positive day while the US 10-year Treasury yields and the Dollar Index (DXY) marked a negative daily closing by the end of Wednesday’s North America session.

Looking forward, US November PCE inflation and Durable Goods Orders will be crucial to watch amid hopes of a faster Fed rate hike, starting with early 2022. Also important to watch will be the risk catalysts stated above.

Technical analysis

A clear upside break of the 200-SMA and monthly resistance line, close to 0.7200, gains support from bullish MACD signals and firmer RSI to direct AUD/USD buyers towards a horizontal area stretched from November 11, 0.7295-7300. However, a sustained rise past the monthly high near 0.7225 becomes necessary for the bulls.

- Gold vs. the euro advances some 0.01% as the Thursday Asian session begins.

- XAU/EUR Price Forecast: Bullish-biased though it faces strong resistance around the €1,595-1,600 area.

Gold (XAU/EUR) vs. the euro advances as the New York session ends, trading at €1,592 at the time of writing. During the New York session, the market sentiment was upbeat, spurred in part by good news on the Covid-19 Omicron-variant front. South Africa continues reporting positive news, which according to a study, 80% of the people infected by the newly discovered strain did not need hospitalizations. Furthermore, in the mid-American session, the US Food and Drug Administration (FDA) approved the use of a Pfizer pill, a treatment for the coronavirus, that could be used to treat high-risk patients.

Apart from that, the German 10-year bund yield rises three basis points, from -0.314% to -0.289%, a headwind for the yellow-metal throughout Wednesday's session.

In the meantime, the precious metals segment, XAU/USD, rose to $1,803, while silver failed to cling to the $23.00 threshold, trading at $22.84.

XAU/EUR Price Forecast: Technical outlook

The XAU/EUR daily chart depicts that the non-yielding metal is upward biased, as shown by the daily moving averages (DMAs) residing below the spot price. Further, in the last 17 days, gold has been seesawing around Andrew Pitchfork’s uptrend-channel mid-line, at press time resistance, while the 50-DMA at €1,576 acted as support.

To the upside, the first resistance level is the Pitchfork’s mid-line at €1,595. A breach of the latter would leave December’s 20 daily high at 1603.40, followed by November’s 23 cycle high at €1,612.28.

On the downside, the first support would be the 50-DMA at €1,576. A decisive break of the 50-DMA leaves gold bulls leaning on December’s 15 pivot low at €1,558.32, followed by December’s two cycle low at €1,555.31.

-637758089890567475.png)

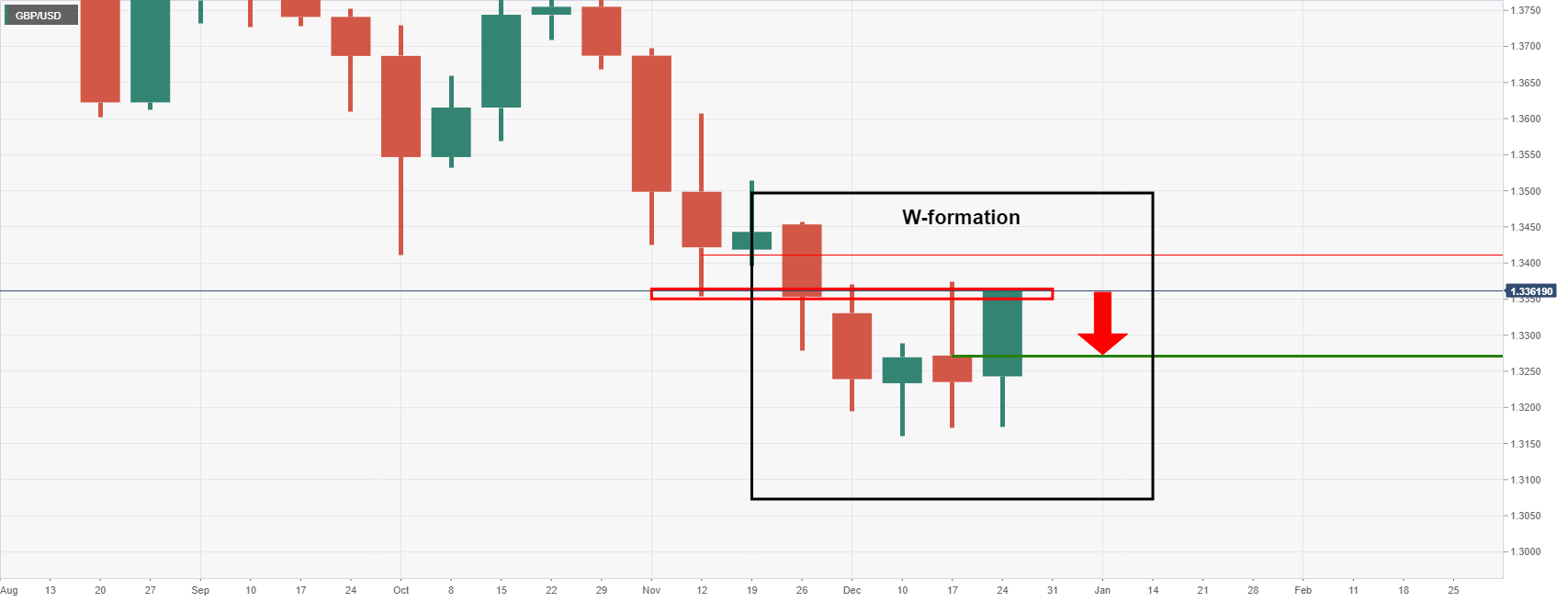

- GBP/USD bulls are taking on critical daily resistance.

- Bears will be looking for a downside correction, as per the weekly W-formation.

GBP/USD has ended the US sessions firmly bid and has taken out the prior closing highs for the week which leaves the bulls in good stead for the remaining sessions ahead of the holidays. At the time of writing, GBP/USD is higher by some 0.77% after travelling from a low of 1.3239 to a high of 1.3363.

While the 1.34's could be on the cards, the weekly W-formation is noted as a bearish reversion pattern. Therefore, a correction towards 1.3264 as the neckline of the formation could be on the cards for the coming days as illustrated in the following analysis.

GBP/USD daily chart

The price can easily continue for a test into the 1.34 area, however ...

GBP/USD weekly chart

The weekly chart has prospects of a downside correction as follows:

Here is what you need to know on Wednesday, December 23:

What began as a relatively subdued session for FX markets turned significantly more risk-on as the US trading session got underway, with the net result for G10 FX being outperformance of risk-sensitive currencies and underperformance of the havens. Sentiment took a turn for the better midway through Wednesday trade following strong US December Consumer Confidence and final Q3 GDP data, and amid a string of positive pandemic-related updates.

The US FDA approved Pfizer’s highly effective Covid-19 treatment pill (for “high risk” patients) and three new studies (one from South Africa, one from Scottish Universities and one from Imperial College London) all showed that infection with Omicron is significantly less likely to result in hospitalisation. Amid the broadly risk-on market tone that also saw global equities and commodities gaining ground, the US dollar thus weakened due to its safe-haven status. That pushed the DXY lower by about 0.4% to trade just above 96.00, though FX strategists will note that this is still well within December ranges and caution against reading too much into FX market moves amid pre-holiday thinned trading conditions.

The yen also performer poorly and, alongside the US dollar, made up the bottom two spots in the G10 performance table. By contrast, the risk-sensitive Aussie, kiwi, NOK and pound were the best G10 performers on the day, gaining between 0.7-0.9% on the session each. AUD/USD rose 60 pips to move back above 0.7200, NZD/USD gained 50 pips to move back above 0.6800 and GBP/USD gained nearly 100 pips to move above 1.3350, with each pair within a few pips of monthly highs. A mixed UK GDP report released early on during European trading hours did not faze GBP traders.

Elsewhere, CAD gained about 0.6% on the session versus the buck, pushing USD/CAD back below 1.2850, more than 100 pips below annual highs printed back on Monday above 1.2950. The euro, Swiss franc and SEK were all up about 0.4% versus the buck on Monday as a result of its risk-on related weakness rather than as a function of any domestic fundamentals. Generally, hawkish vibes from ECB policymakers who spoke on Wednesday does not seem to have shifted the dial much for the euro, with EUR/USD trading well within December’s 1.1240-1.1360ish ranges, though is worth noting.

- The DXY slides some 0.39% but stays above the 96.00 figure as the New York session winds down.

- Positive Covid-19 news improved the market mood weakening the greenback.

- US Dollar Index (DXY) Price Forecast: Upward bias, though testing the bottom-trendline of the ascending triangle.

The US Dollar Index (DXY), which tracks the performance of the US dollar against a basket of six rivals, slides 0.39%, sits at 96.07 during the New York session at the time of writing. A risk-on market mood spurred by positive Covid-19 news.

A study made in South Africa reports that people infected with the Omicron variant are 80% less likely to be hospitalized. Additionally, in the last hour, the US Food and Drug Administration (FDA) approved Pfizer’s Paxlovid pill for home treatment to treat high-risk patients.

Apart from this, the fall in US bond yields dented demand for US dollars, though it did not drag the USD/JPY to follow its steps. US Treasuries led by 10s, the 20s, and 30s, drop between two and a half and four basis points, sitting at 1.462%, 1.8846%, and 1.857%, respectively.

On Wednesday, the US macroeconomic docket featured the Gross Domestic Product for the third quarter. The annual base reading came at 2.3%, higher than the 2.1% estimated, while the quarterly based, uptick to 6.0%, better than the 5.9% foreseen. Furthermore, the Conference Board reported that Consumer Confidence in December rose by 115.8, more than the 110.8 estimated. Since July, it is the best mark before the Delta wave that weakened confidence in the Q3.

US Dollar Index (DXY) Price Forecast: Technical outlook

The US Dollar Index daily chart depicts the strong dollar narrative keeps in place. The DXY broke below the central Pitchfork’s uptrend channel, which confluences with the ascending triangle on an uptrend.

At the time of writing, the DXY is testing the bottom-trendline of the ascending triangle on an uptrend, threatening to break to the downside, which would invalidate the triangle formation sending the DX tumbling towards November 30, 95.55.

To the upside, the first resistance would be the figure at 97.00. A breach of the latter would expose the June 30 high at 97.80, followed by the ascending triangle target at 98.00.

-637758017772906890.png)

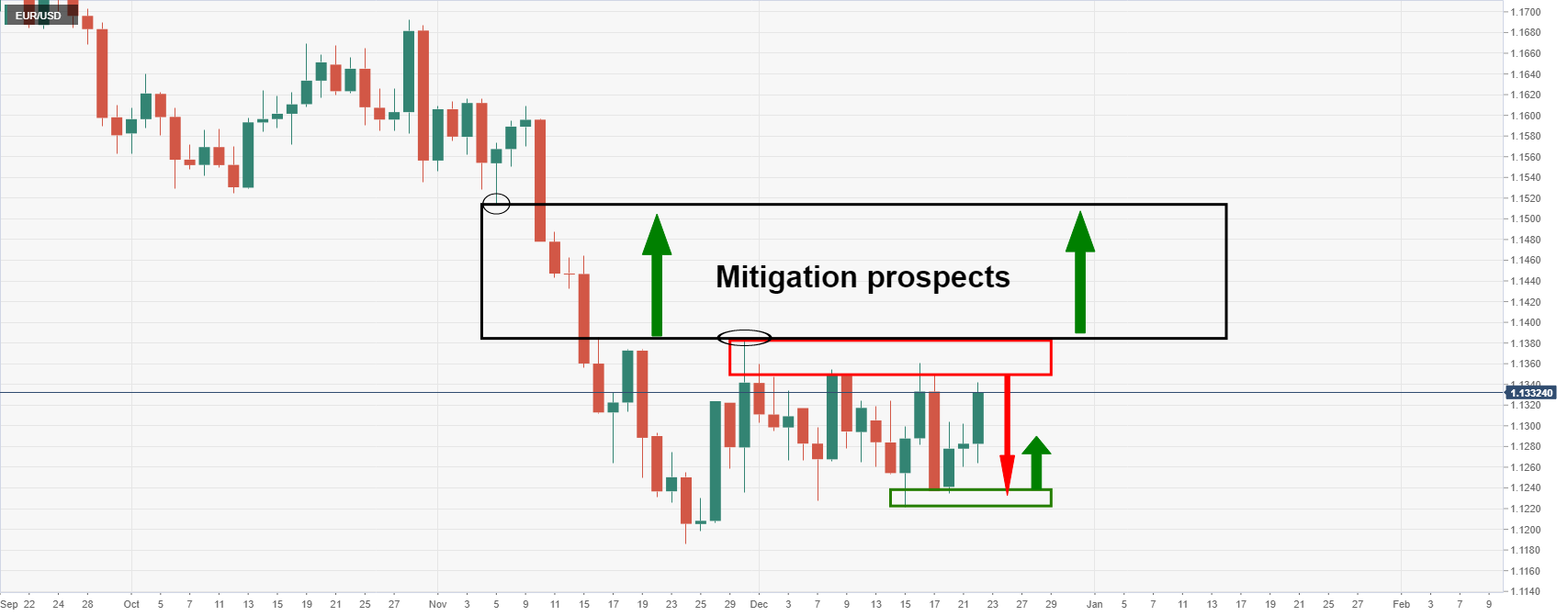

- EUR/USD bulls keep control in risk-on environment and eye 1.1350.

- A break of 1.1380 opens prospects towards 1.1513.

EUR/USD is trapped in a sideways daily consolidation following a strong bearish impulse that started in November from the 1.16s. The price fell all the way to 1.1186 before stalling and the question now is whether this is a phase of redistribution or accumulation?

The following illustrates the market structure from a bullish perspective in anticipation of a break of the critical daily support near 1.1380 for the days ahead.

EUR/USD daily chart

The price has stalled and moved into a sideways consolidation that is yet to be determined as being redistribution or accumulation. A break of 1.1380 would likely confirm the accumulation bias with prospects of the imbalance of the downside being mitigated by the bulls for the weeks ahead. This area comes between 1.1383 and 1.1513.

EUR/USD H1 chart

The bulls are in charge and rallying towards the key resistance zone around 1.1350.

- US equities are higher, with the S&P 500 up 0.8%, the Nasdaq 100 up 1.0% and the Dow up 0.6%.

- Traders are citing strong US data and a string of positive pandemic updates as supporting risk appetite.

US equity markets have maintained/built on Tuesday’s momentum and the S&P 500 index is currently trading 0.8% higher on the session in the 4680s with less than an hour to go until the close. That comes after the index posted an impressive 1.8% rally on Tuesday and means that it is now 3.3% higher versus Monday’s lows close to 4530.

The index still trades about 1.3% below record intra-day highs posted a few weeks ago, but given how far the index has already advanced from lows, equity bulls would be forgiven for hoping that this week’s Santa rally, or Santa recovery, can deliver record levels before the Thursday close. The NYSE and Nasdaq exchanges will be closed on Friday. When a holiday falls on a Saturday (Christmas Day), the two major US equity exchanges close on Friday before.

Looking at the other major US indices; the Nasdaq 100 rose 1.0% and has now reclaimed the 16K level and is now up nearly 4.0% from Monday lows, while the Dow rose 0.6%, up nearly 3.0% from weekly lows. The S&P 500 CBOE volatility index dropped more than 1.50 and is now back below 20.00 and eyeing a test of December lows just above 18.00.

Driving the day

Higher equities in the US reflect a broader risk-on tone to global market trade, with traders citing strong US data and a string of positive pandemic updates as supporting risk appetite. Starting with the pandemic latest, the FDA announced that it had approved Pfizer’s highly effective Covid-19 treatment pill (for “high risk” patients). Elsewhere, three new studies (one out of South Africa, one from Scottish Universities and one from Imperial College London) all showed that infection with Omicron is significantly less likely to result in hospitalisation.

While “we are still struggling for direction in the face of the Omicron outbreak” said analysts at BMO Wealth Management, “but in the past few days ... more and more evidence is building that the strain is potentially less severe than prior strains, specifically Delta, which bodes well for economic momentum in 2022”. Optimism about economic momentum heading into 2022 was given a boost on Wednesday after the US Conference Board released a much stronger than expected Consumer Confidence survey. The survey showed that, versus November, more consumers were planning to buy a house and other “big-ticket” items such as cars and expensive household appliances, as well as to go on holiday over the next six months.

One of the factors attributed as contributing to Monday’s sharp stock market drop was the fact that on Sunday, Democrat Senator Joe Manchin said he would not support the Biden administration’s $1.75T Build Back Better spending bill in its current form, dampening hopes for further US fiscal stimulus in the near-term. But as the week has progressed, it has become increasingly clear that negotiations on the bill, which forms the centre of US President Joe Biden’s economic agenda, will continue. According to the White House on Wednesday, there is broad agreement within the Democrat Party on the requirement to move forward with the bill, and talks with Manchin continue.

- The USD/JPY advances some 0.10% amid a risk-on market mood.

- USD/JPY Technical Outlook: Tilted to the upside as USD bulls have reclaimed the 114.00 figure now eyeing 115.00.

The USD/JPY barely advance during the New York session, trading at 114.19 at the time of writing. US equities remain tilted to the upside, reflecting market participants’ mood to the detriment of safe-haven assets. In the FX market, risk-sensitive currencies rise while safe-haven statuses like the USD and the CHF advance against the low-yielder Japanese yen.

The US Dollar Index, which tracks the greenback’s value against a basket of its peers, slumps 0.35%, sitting at 96.14, clinging with its nails to the 96.00 threshold. In the meantime, the US 10-year Treasury yield drops three basis points, down to 1.458%.

USD/JPY Price Forecast: Technical outlook

In the overnight session, the USD/JPY pair slide slightly towards the daily low aright at the central daily pivot at 113.95. As market sentiment improved, the US dollar strengthened versus the yen, surging towards the R1 daily pivot at 114.34 before settling down at current levels.

The USD/JPY daily chart shows that the pair has an upward bias. The daily moving averages (DMAs) remain under the spot price, with the 50-DMA at 113.86, the closest to the current price action. Additionally, a four-month-old upslope trendline, respected two times, intersects with the aforementioned DMA, leaving the 113.80-90 area as a problematic demand zone to overcome for JPY bulls.

To the upside, the first resistance would be November’s 1 daily high at 114.44. A breach of the latter could send USD/JPY rallying towards October’s pivot high at 114.70, followed by the 115.00 threshold.

On the other hand, the 114.00 figure would be the first line of defense for USD bulls. Once the aforementioned level is breached, the next stop would be the 50-DMA at 113.86, immediately followed by December’s 17 daily low at 113.14.

-637757986470987700.png)

- USD/CAD bears have taken over despite the offer in the greenback.

- Bulls will be looking for critical support to hold at this juncture.

USD/CAD has been on the march in recent days and had broken through an important daily resistance. It would be expected to extend to rally to the upside in due course. The following illustrates the recent price action and market structure.

USD/CAD daily chart

The daily chart's outlook is bullish given the price has already moved in on the 61.8% Fibonacci and broken prior resistance that would now be expected to act as support.

USD/CAD 4-hour chart

The price, however, from a 4-hour perspective, has dropped hard and the structure offers no bullish tendencies as of yet. There are probabilities of a period of consolidation for the sessions ahead if not a test lower towards 1.28 the figure.

- GBP/JPY has surged from under 151.50 to test 152.50 and is now up nearly 2.0% from weekly lows near 149.50.

- Risk appetite has continued to improve significantly on Wednesday, driving the pair higher.

Risk appetite has picked up in recent hours amid strong US Consumer Confidence and GDP data, as well as following a string of recent positive pandemic-related updates, and this is being reflected in FX markets. Risk-sensitive currencies are, generally speaking, performing better than safe-haven currencies. GBP fits more in the former category, whilst the yen is most certainly viewed as a safe haven asset, so the net result on Wednesday has been a higher GBP/JPY.

Looking at the price action, the pair has rallied from underneath 151.50 during Asia Pacific and early European trade all the way to the 152.50 level and is currently probing last week’s highs. That marks an impressive 0.9% rally on the day and comes on the heels of Tuesday’s 0.8% rally. Indeed, since the Monday low just above 149.50 (when markets were in a much more risk-off mood), the pair has rallied nearly 2.0%, impressive stuff.

A mixed UK Q3 GDP report does not seem to have deterred the bulls on Wednesday. The UK economy grew at a 1.1% QoQ pace in Q3, data this morning showed, slower than the expected pace of 1.3%, though the YoY rate of growth was better than expected at 6.8% (forecasts were for 6.6%). A slowing of the pace of new infection growth in UK Omicron hotspot London and a Scottish study showing the virus is significantly less likely than delta to result in hospitalisation seems to have breather some optimism into sterling. Still, the pandemic is a significant risk to the UK economy and December survey data has shown it has already had a chilling impact that seems likely to last into January.

Whether that is enough to stop GBP/JPY blasting above 152.50, which has been a key balance for the price action area in recent months, is another thing. Given the proximity of Christmas Day on Saturday, North American and European volumes are expected to decline significantly over the next two days as market participants take time off for holiday celebrations. According to analysts at ING, the couple of weeks either side of Christmas day usually see low volatility for currencies, though they caution that “this year some seasonal tendencies will be mixed with the Omicron variant threatening to force new restrictions and markets still processing a week full of key central bank decisions”.

- The New Zealand dollar edges higher some 0.69%.

- Positive Covid-19 news from South Africa and Pfizer’s Covid-19 treatment pill’s approval ease investors’ worries.

- US GDP rose by 2.3%, better than the 1.9% foreseen yearly base, while US Consumer Confidence improved.

The New Zealand dollar follows other risk-sensitive currencies’ footsteps, rallies during the New York session, trading at 0.6815 at the time of writing. The market sentiment was mixed earlier in the day, though improved in the last three hours.

According to a study, positive news in the coronavirus front with South Africa reporting that people infected with the Omicron variant are 80% less likely to be hospitalized. Additionally, in the last hour, the US Food and Drug Administration (FDA) approved Pfizer’s Paxlovid pill for home treatment to treat high-risk patients.

In the overnight session, the NZD/USD dipped as low as 0.6740. Then as the day progresses, it is staging a comeback, jumping 80-pips towards the daily high at 0.6818, as coronavirus positive news crosses the wires, easing investors’ worries of the possibility of a global economic slowdown.

Apart from this, the US Dollar Index, which measures the greenback’s performance against a basket of six rivals, slumps 0.40%, sitting at 96.10, clinging with its nails to the 96.00 threshold. At the same time, the US 10-year Treasury yield drops two and a half basis points, down to 1.460%.

On Wednesday, the US economic docket featured the Gross Domestic Product for the third quarter. The annual base reading came at 2.3%, higher than the 2.1% estimated, while the quarterly based, uptick to 6.0%, better than the 5.9% foreseen. Furthermore, the Conference Board reported that Consumer Confidence in December rose by 115.8, more than the 110.8 estimated. Since July, it is the best mark before the Delta wave that weakened confidence in the Q3.

Therefore, Wednesday’s NZD/USD price action has been subject mainly to market sentiment as the NZD is rallying despite the excellent results of US macroeconomic data. However, NZD/USD downside risks remain unless NZD bulls reclaim the 0.7000 figure, where it lies, the 50 and the 100-DMA.

- AUD/USD holds in positive grounds as the dollar slides in risk-on.

- US stocks have rallied as US data lifts spirits for the holidays.

AUD is the strongest currency on the day in a risk-on environment with US Consumer Confidence coming in higher than forecasted for December as third-quarter economic growth was revised higher. The US stock market has rallied and high beta plays are aligned positively, benefitting from the renewed enthusiasm.

The Nasdaq Composite jumped 0.9% to 15,486.29 intraday, with S&P 500 up 0.8% and the Dow Jones Industrial Average 0.4% higher. All sectors were in the green, with consumer discretionary and technology leading the charge.

UD/USD is firm, 0.9% higher around the highs of the day near 0.7217 at the time of writing. The 10-year US Treasury yield .is down 0.34% points to 1.46% and the US dollar, as measured by the DXY is down 0.39% sliding from 96.602 to a low of 96.036. US rates are starting to normalize. However, analysts at Brown Brothers Harriman explained that the ''market tightening expectations for the Fed still have room to adjust; 2-year yield differentials are moving back in the dollar’s favour.''

''If inflation returns to the 2% target, then that implies a negative real policy rate at the end of a Fed tightening cycle, with the economy near full employment.,'' the analysts added, ''Sure, there are downside risks from more variants but the rates market seems to be pricing in perfection from the Fed. We continue to believe that markets are underestimating the Fed’s propensity to tighten, and this should lead to a further rise in US short-term rates in 2022.''

Meanwhile, the consumer confidence index rose to 115.8 in December from November's upwardly revised 111.9 level, the Conference Board reported Wednesday. The consensus among analysts on Econoday indicated a 110.7 print. The survey's cutoff was Dec. 16. The US Gross Domestic Product was also revised higher in the third estimate for the third quarter, Q3, to 2.3% from 2.1% in the second estimate, versus expectations for no revisions.

- Positive pandemic news is boosting risk appetite and, coupled with bullish inventory data, has pushed WTI above $72.00 per barrel.

- The US FDA approved Pfizer’s effective at-home Covid pill and more studies have shown Omicron to be milder than delta.

Sentiment has taken a turn for the better during US trading hours, with a string of positive Covid-19 developments/stories seemingly injecting a dose of optimism into a market that had otherwise been subdued and in holiday mode. This is giving crude oil a lift and front-month WTI futures recently crossed back to the north of the $72.00 level, where it trades at weekly highs. On the day, WTI is now close to $1.0 higher and the bulls will be eyeing a test of the $73.00 level, a key zone of resistance that has capped the price action for the whole of December thus far.

In terms of the recent positive developments, the US FDA just approved Pfizer’s Paxlovid pill to treat Covid-19 infection in at-risk patients at home. As long as patients begin treatment within five days of infection, the pill allegedly reduces hospitalisation and mortality rates in the at-risk by as much as an incredible 90%. Pfizer said it was ready to begin distributing the drug in the US immediately and other nations will likely approve the drug and start rolling it out soon too.

Elsewhere, more studies on the severity of Omicron have been released (one out of Scotland and one out of South Africa) and both strengthen the narrative that infection with Omicron is significantly less likely to result in hospitalisation. The above news will strengthen investor conviction that the hit to the global economy posed by Omicron will not be catastrophic or long-lasting. Of course, this is great news for crude oil markets, just as it is for other risk assets.

Elsewhere in notable crude oil markets news, official weekly US oil inventories were out and, as indicated by the private weekly API report on Tuesday, the drawdown in headlines stocks was much larger than expected at over 4.7M barrels. This supported crude oil prices, despite a massive, unexpected more than 5.5M build in gasoline stocks and a surprise drop WoW in refinery utilisation rates.

The US Food and Drug Administration on Wednesday authorised Pfizer's Paxlovid pill, the first anti-Covid-19 treatment pill to be authorised in the country. It will be used to treat high-risk patients with moderate to severe disease within five days of symptom onset. Pfizer said it was ready to commence delivery of the pill immediately.

- The Swiss franc appreciates some 0.40% against the US dollar amid broad greenback weakness.

- An upbeat market mood failed to boost the buck vs. the low-yield currencies like the EUR, CHF, and JPY.

- Falling US T-bond yields weighed on the US dollar.

- USD/CHF Technical Outlook: Neutral with no clear bias, though the breakout of the trading range could offer some opportunities in the re-test of those levels.

The USD/CHF edges slightly lower during the New York session, trading at 0.9201 at the time of writing. A risk-on market mood has kept the greenback on the backfoot, undermined by falling US bond yields, with the 10-year Treasury yield down two and a half basis points, sitting at 1.462%.

The cause of investors’ confidence is that the Omicron variant slightly dented the market mood before Wall Street opened. Nevertheless, in the last couple of hours, equities rallied, while in the FX market, risk-sensitive currencies point upwards, to the detriment of the greenback. Moreover, positive news from South Africa, reporting that the current wave of contagious are 80% less likely to be hospitalized if people catch the Omicron strain, according to a study, improved risk appetite.

In the meantime, the US Dollar Index, which tracks the greenback’s performance against a basket of six rivals, falls 0.37%, down to 96.13.

USD/CHF Price Forecast: Technical outlook

The USD/CHF pair has been seesawing around the 0.9160-0.9250 for the last fourteen days. The daily moving averages (DMAs) hover around the spot price, though trendless, almost horizontally providing support/resistance levels for the pair.

If the USD/CHF breaks to the downside, the first support would be the 200-DMA at 0.9176. the breach of the latter would expose the November 30 daily low at 0.9157, followed by a test of the 0.9100 figure.

Upwards, the first resistance would be 0.9250. A decisive break above that level could pave the way for further upside. The next resistance would be the December 15 swing high at 0.9294, followed by 0.9300, and the November 26 daily high at 0.9359.

-637757899865214319.png)

According to experts from Edinburgh and Strathclyde University, "early national data suggests that Omicron is associated with a two-thirds reduction in the risk of Covid-19 hospitalisation when compared to Delta". The study added that a third booster dose of the Covid-19 vaccine offers substantial additional protection against the risk of symptomatic Covid-19 from Omicron infection.

Scottish First Minister Nicola Sturgeon, reacting to the study on Twitter, said that the early data was encouraging, but doubled down on her warning that the Omicron variant still poses a risk to the economy and health care system if enough people catch it all at once.

Market Reaction

Markets were already in a fairly risk-on mood, but the latest study will help to calm some fears about hospitals in developed countries being overwhelmed. The Scottish study comes on the back of a recent South African study which showed the hospitalisation risk with Omicron there to be 80% less versus infection by Delta.

- Spot silver is currently trading just under weekly highs at $22.80, having pushed higher on Wednesday.

- A weaker dollar and lower yields despite strong US data is giving tailwinds to precious metals.

- A test of resistance at $23.00 is on the cards, but may be seen as selling opportunity.

Spot silver (XAG/USD) prices have been pushing higher this Wednesday and, having found support earlier in the session at the $22.50 area, are now trading around weekly/monthly highs just under $22.80. At current levels, spot prices are about 1.0% higher on the day. Dollar weakness is the main driver of the strength being seen across precious metals markets, with the DXY lower by about half a percent, making dollar-denominated precious metals slightly cheaper on the international market.

Slightly lower US nominal and real yields are also liking giving silver some tailwinds, with the 10-year down about 2.5bps and heading back towards 1.45% and the 10-year TIPS yield down a similar amount and back under -1.0%. This reduces the opportunity cost of holding non-yielding precious metals, thus boosting demand. Yields and the dollar are both softer despite strong final US Q3 GDP figures and better than expected December Consumer Confidence numbers.

In truth, both yields and the dollar and just consolidating within recent ranges with markets more broadly trading with a lack of conviction as year-end and Christmas holidays fast approach. That suggests that while silver is trading at monthly highs in the $22.75 area, it may struggle to make further significant upwards strides. A test of $23.00 is certainly on the cards, but has been a key balance area in recent months and will thus offer tough resistance.

With the Fed primed to turn more hawkish in 2022, the scope for future silver (or gold) rallies seems increasingly limited. With the precious metals bears are prowling, any push to $23.00 or beyond may be seen as an opportunity to load up on short positions.

- Canadian dollar strengthens versus US dollar amid risk appetite.

- USD/CAD falls for the second day in a row, turns negative for the current week.

The USD/CAD accelerated the decline during the American session as US stocks rose further and amid a rally in crude oil prices. The pair dropped to 1.2840, hitting the lowest level since Friday. It remains near the lows, under pressure.

On the downside, the 1.2835 region emerges as the next support, followed by 1.2800. The 1.2865 level has become now the immediate resistance.

WTI up, Wall Street green

The Dow Jones is rising 0.50% and the Nasdaq gains 0.71%. The WTI barrel is up by almost 1%, hovering around 71.60%. The improvement in risk sentiment, combined with modestly lower US yields are keeping the US dollar under pressure.

Economic data from the US showed the US economy grew at a 2.3% rate during the third quarter, above the 2.1% previously reported. Conference Board’s index of consumer confidence climbed to 115.8 in December from 111.9 in the prior month. The dollar did not benefit from the numbers. The key day regarding economic data will be Thursday. IN the US, the Core CPE and jobless claims numbers are due.

In Canada, GDP figures are due. “GDP should print slightly below flash estimates at 0.7% in October, with a solid performance across goods and services. Manufacturing (autos) and energy will help drive the former, while services should see slightly softer growth. A 0.7% print will bode well for Q4, but we will also be watching new flash estimates for insight towards November and the early impact of the BC floods”, mentioned analysts at TD Securities.

Technical levels

- The British pound advances sharply up some 0.57%.

- An upbeat market mood, increased demand for risk-sensitive currencies like the GBP, the US dollar weaken.

- US Consumer Confidence risen the most since July, the GBP/USD trended higher on the release.

- GBP/USD Technical Outlook: In the near-term upwards, but it would face strong resistance at 1.3374.

The British pound is rallying during the New York session, trading at 1.3344 at the time of writing. The market sentiment is upbeat, as shown by European and US stock indices, trading in the green while the greenback weakens across the board. Additionally, the US Consumer Confidence increased in December, more than estimations.

Investors’ assessment of the Omicron variant slightly dented the market mood before Wall Street opened. Nevertheless, at the last hour, equities rallied, while in the FX market, risk-sensitive currencies point upwards, led by the GBP. Furthermore, positive news from South Africa, reporting that the current wave of contagious are 80% less likely to be hospitalized if people catch the Omicron strain, according to a study, improved risk appetite.

The Conference Board reported that Consumer Confidence in December rose by 115.8, more than the 110.8 estimated. Since July, it is the best mark before the Delta wave that weakened confidence in the Q3. “Consumer confidence improved further in December, following a very modest gain in November,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board.

Franco added that “meanwhile, concerns about inflation declined after hitting a 13-year high last month, as did concerns about COVID-19, despite reports of continued price increases and the emergence of the Omicron variant.”

The GBP/USD reacted upwards after the report hit the wires, jumping from 1.3318 to 1.3334.

Looking ahead in the week, the UK economic docket would not report data on Thursday. Meanwhile, across the pond, Durable Goods Orders for November, Initial Jobless Claims, and the Core Personal Consumptions Expenditures, the Fed’s favorite gauge of inflation, will entertain GBP/USD traders.

GBP/USD Price Forecast: Technical outlook

The GBP/USD daily chart depicts that USD bulls have the edge. The daily moving averages (DMAs) reside well above the spot price, confirming the abovementioned. Nevertheless, the near-term trend is upward and will face strong resistance at the December 16 swing high at 1.3374.

In the event of breaking above the previously mentioned level, the GBP/USD would challenge the 1.3400 figure. A breach of the latter could send the pair rallying up to the 50-DMA at 1.3459.

On the other hand, the first support would be 1.3300, which, once broken, would open the door for further losses. The first support would be the December 7 swing high previous resistance-turned-support at 1.3289, followed by the December 21 low at 1.3197.

- EUR/USD is up about 0.3% and trading in the 1.1320s, as technicians eye a move to last week’s 1.1360 highs.

- EUR/USD continues to push higher as FX markets adopt somewhat risk-on posture, though most majors remain within recent ranges.

- Stronger than expected US GDP and Consumer Confidence data was largely ignored.

EUR/USD is extending on earlier session gains and has now convincingly cleared its earlier weekly highs around 1.1304 and is pressing on into the 1.1320s. Despite a broadly subdued tone to trade in other asset classes (like equities and bonds), FX markets have adopted a somewhat more risk-on posture on Wednesday, though most major G10 pairs have not broken out of recent intra-day/week ranges.

That goes for EUR/USD too, though the pair is at weekly highs and now up about 0.3% on the day, it still trades well below last week’s 1.1360ish highs. Moreover, the pair continues to trade well within the 1.1240-1.1360ish trading range that has prevailed throughout the month thus far. Those seeking to play the range would likely see any push towards the middle/upper 1.1300s as an opportunity to add tentative short positions and ride the pair back under the 1.1300 handle.

Just as hawkish rhetoric from ECB members in the Wednesday European morning (ECB’s Peter Kazimir warned of upside inflation risks whilst Robert Holzmann outlined his “extreme” scenario for rate hikes in 2022) failed to impact markets, US data releases did too. The final estimate for US Q3 GDP was better than expected and revised higher to 2.3% form 2.1%. Meanwhile, the headline Conference Board Consumer Confidence index rose more than expected to 115.8 in December from 109.5, its highest levels since July.

The GDP numbers were ignored likely because, at this point, they are very backward-looking. Meanwhile, though it was nice to see US Consumer Confidence rise in December, any improvement is likely to be short-lived, with a wave of Omicron infections and associated higher levels of “pandemic fear” likely to weigh in January.

- EUR/GBP has fallen under 0.8500, though found support at its 50DMA at 0.8480.

- The pair fell despite hawkish ECB rhetoric and mixed UK GDP figures.

EUR/GBP has rebounded from session lows at 0.8480, which coincides with the pair’s 50-day moving average, in recent trade and currently trades close to 0.8490. That means, on the day, the pair trades with losses of about 0.2%, having opened the session to the north of the 0.8500 level and that, on the week, the pair is back to flat.

EUR/GBP’s downside comes despite a mixed UK GDP report released at the start of Wednesday’s European session. The UK economy grew at a 1.1% QoQ pace in Q3, data this morning showed, slower than the expected pace of 1.3%, though the YoY rate of growth was better than expected at 6.8% (forecasts were for 6.6%). The downside also comes despite more hawkish rhetoric from ECB policymakers including Slovakian central bank head Peter Kazimir and Austrian central bank head Robert Holzmann.

The former joined a throng of other ECB members who have been warning about upside inflation risks in the Eurozone, while the latter, who has also recently warned about upside inflation risks, outlined his scenario for 2022 rate hikes. In an extreme scenario, he warned, the ECB could lift rates before the end of next year, adding that if the ECB upgraded its inflation forecast for 2023-24 to above the 2.0% target and axed its bond-buying, that would signal a rate hike within the next two quarters.

EUR/GBP underperformance can be explained by the fact that, despite a subdued feel to trade in other asset classes, FX markets have adopted a somewhat risk-on posture on Wednesday. GBP is more risk-sensitive compared to the euro, so this typically weighs on EUR/GBP. But FX strategists have said that volatility in the coming sessions, or indeed until the start of January 2022, is expected to be mild as markets enter their typical holiday lull.

According to analysts at ING, the couple of weeks either side of Christmas day usually see low volatility for currencies, though they caution that “this year some seasonal tendencies will be mixed with the Omicron variant threatening to force new restrictions and markets still processing a week full of key central bank decisions”. As far as EUR/GBP is concerned, that suggests a meaningful break lower towards last month’s sub-0.8400 lows looks unlikely.

- EUR/JPY attempts to break range, potential double bottom.

- Slide back under 128.50 to remove bullish bias.

- Key resistance awaits at 129.80 and then 130.10.

The EUR/JPY is rising for the third consecutive day on Wednesday and is attempting to break a lateral range that has been in place since the beginning of December. It is trading at weekly highs at 129.30, with a positive tone.

The daily RSI and Momentum point to the upside, supporting a bullish short-term outlook that will hold while EUR/JPY remains above 128.50. A slide below should negate the positive tone, exposing the next support at 127.85.

The 20-day moving average is turning flat, also supporting the euro. A consolidation around current levels should point to a test of the 129.70/80 area, the 100-day simple moving average. The next target is seen at 130.10

The rebound that started three days ago from 127.50 is becoming a potential double bottom that could anticipate more gains ahead. With a neckline at 129.00, the target is 130.50.

EUR/JPY daily chart

-637757829096538652.png)

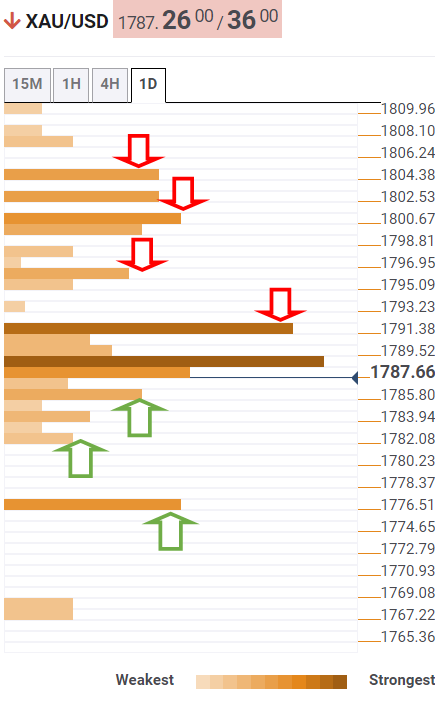

- Gold advances during the New York session, some 0.19%.

- A mixed market mood and broad US dollar weakness keep investors using gold to hedge higher inflation as US PCE data looms.

- XAU/USD Technical Outlook: Neutral-bearish, unless gold bulls reclaim $1,793.

Gold (XAU/USD) edged higher during the New York session, trading at $1,791.63 at the time of writing. The market sentiment is upbeat, though US equity indices fluctuate between gainers and losers. Additionally, the US dollar weakened across the board, while US T-bond yields, with the 10-year benchmark note, retreats after testing the 1.50% threshold in the overnight session.

Factors like investors assessing the economic impact of the Omicron variant and the delay of the US President Joe Biden Build Back Better agenda dented market participants’ mood.

That said, the US Dollar Index, which measures the greenback’s value against a basket of six currencies, edges lower 0.27%, down to 96.25. Furthermore, as previously mentioned, the 10-year Treasury yield is down some three basis points, at 1.457%, from 1.487% reached on Tuesday’s session.

Before Wall Street opened, the US economic docket featured one of the last waves of data of 2021. The US Bureau of Economic Analysis reported that the US economy in the third-quarters grew at an annualized pace of 2.3%, higher than the 2.1% estimated. Moreover, the Personal Consumption Expenditures Prices rose by 5.3%, according to expectations.

In the overnight session, gold remained subdued in a narrow range, between $1,785-$1,795. In the mid-European session, the non-yielding metal trended up, though faced strong resistance at the 100-hour simple moving average (SMA), retreating at press time to current levels. That said, unless XAU/USD decisively breaks above $1,793, the precious metal would remain bearish biased.

XAU/USD Price Forecast: Technical outlook

The XAU/USD daily chart depicts indecision, as shown by the daily moving averages (DMAs) almost “horizontally” contained in the $1,787-$1,800 range. From a market structure perspective, unless gold bulls reclaim $1,792.95, the bias is bearish, though to resume the trend, USD bulls would need a daily close below the December 16 pivot low at $1,775.40.

On the way south, the first support would be the December 16 low at $1,775.40. A break beneath that level would exert downward pressure on the precious metal, exposing crucial support areas. The next one would be the December 2 low at $1,761.72, followed by the December 15 cycle low at $1,752.44

To the upside, the first resistance would be the December 8 cycle high at $1,792.95. A clear break of that level would immediately expose $1,800, followed by the September 3 swing high at $1,834.

-637757821808833109.png)

According to the latest US Conference Board survey, headline Consumer Confidence rose to 115.8 in December from 109.5 in November, above the expected rise to 110.8. That marked the best such reading since July, prior to the peak of the delta wave that sapped confidence later in Q3. Economists suspect confidence will slip from current levels in January as Omicron takes a firmer foothold in the US.

The Consumer Expectations index rose to 96.9 from November's 90.2 reading, which had been revised higher from 87.6. The Jobs Hard-To-Get index rose slightly to 12.5 in December from 10.8 in November. The 1-year Consumer Inflation Rate expectation fell slightly to 6.9% from 7.3% in November.

Market Reaction

The DXY did not see any notable reaction to the data.

GBP/USD is extending its rejection of sub1.32 levels on Monday to a breach of 1.33 today. Economists at Scotiabank note that the cable is set to turn bullish once above the 1.3350 neighborhood.

Support is seen at the mid-1.32s

“A firm break past the mid-1.33s and a test of 1.34 (solid resistance) would turn the GBP technical picture to bullish after bouncing off the 38.1% Fib retracement of the 2020-21 move at 1.3165.”

“Support is the mid-1.32s zone followed by the figure.”

The loonie reluctantly firms up on a supportive fundamental backdrop. Economists at Scotiabank expect the Canadian dollar to definitely start a race higher after the holidays.

Seasonal trends can make life a little tricky for the CAD

“The CAD has picked up a little support amid firmer stocks and steadier crude oil prices (reflecting weaker US crude stockpiles) but trade is very light and the CAD still looks somewhat undervalued relative to domestic fundamentals supportive, short-term yield spreads and positive terms of trade.”

“We do know that seasonal trends can make life a little tricky for the CAD around this time of year and into January so we will have to remain patient and look for USD gains to remain capped near recent range peaks around 1.2950 and a stronger CAD tone to emerge after the holidays.”

- NZD/USD has rallied on Wednesday, but has now into resistance at the 21DMA at 0.6792.

- Further substantial gains are not expected amid a broader subdued feel to financial market trade pre-holidays.

Despite the subdued tone to trade in global equities and commodity complex as markets enter “holiday mode”, FX markets are adopting an increasingly risk-on bias, and this is supporting NZD. NZD/USD has thus been advancing in recent trade, rallying from overnight lows in the 0.6940s to current levels just shy of the 0.6800 mark. At current levels in the 0.6790s, where the pair trades with on-the-day gains of about 0.4%, the 21-day moving average at 0.6792 is offering some resistance.

Amid the lack of broader financial market conviction and slow newsflow, where focus predominantly remains on the global spread of Omicron and reaction from government authorities, a further spurt above 0.6800 for NZD/USD would be surprising. News on Omicron has been mixed and there hasn’t really been much to alter the macro narrative. European nations continue to assess whether tighter curbs are required to reduce transmission and cases are surging in the US, which is bad, but the good news is that evidence continues to suggest that Omicron is milder than delta.

According to analysts at ING, the couple of weeks either side of Christmas day usually see low volatility for currencies, though they caution that “this year some seasonal tendencies will be mixed with the Omicron variant threatening to force new restrictions and markets still processing a week full of key central bank decisions”. So even if NZD/USD is able to break to the north of the 0.6800 level, it seems unlikely that it would break substantially above earlier December highs in the 0.6830-0.6860 area.

EUR/USD edges above 1.13 on broader USD drop. However, economists at Scotiabank expect the world’s most popular currency pair to turn back lower towards 1.12.

Holding above 1.1250 to take some pressure off the euro

“The EUR is attempting another cross of 1.13 but selling pressure seems to remain at the figure area to prevent a test of the month’s range ceiling at ~1.1350.”

“Sideways trading looks set to continue in the near-term but longer-term signals point to further losses in the EUR toward a re-test of 1.12; holding above 1.1250, which is support after 1.1260/65, does take some pressure off the EUR.”

For years the Bank of Japan (BoJ) has taken the crown as the most dovish central bank in the G10. That is unlikely to change in the foreseeable future, therefore, USD/JPY is set to edge higher towards the 115.00 level, in the view of economists at Rabobank.

Extraordinary easing policies of the BoJ to continue

“In its December policy meeting, the BoJ announced that its monetary policy provisions would remain very generous in terms of its QQE programme and a negative policy rate. That said, the BoJ did confirm that it would complete its additional purchases of CP and corporate bonds at the end of March 2022 as scheduled. From April, purchases will return to about pre-pandemic levels.”

“USD/JPY is likely to trend higher at a gentle pace towards 115 medium-term, with the JPY undermined by the continued extraordinary easing policies of the BoJ.”

- A combination of diverging forces failed to provide any meaningful impetus to USD/CAD.

- The risk-on mood, retreating US bond yields weighed on the USD and capped the upside.

- A softer tone around crude oil prices undermined the loonie and extended some support.

The USD/CAD pair extended its sideways consolidative price move through the early North American session and held steady above the 1.2900 mark post-US GDP.

A combination of factors kept the US dollar bulls on the defensive for the third successive day on Wednesday and acted as a headwind for the USD/CAD pair. The downside, however, remained cushioned amid a modest downtick in crude oil prices, which tend to undermine the commodity-linked loonie.

The optimism led by reports that the Omicron is less severe and that the current vaccines may be more effective than first thought in fighting the new strain weighed on the safe-haven greenback. This, along with a fresh leg down in the US Treasury bond yields, kept the USD bulls on the defensive.

On the economic data front, the final US GDP report showed that the world's largest economy expanded by 2.3% annualized pace during the third quarter as against 2.1% estimated previously. This, however, did little to lend any support to the greenback or provide any impetus to the USD/CAD pair.

Meanwhile, crude oil prices struggled to capitalize on this week's solid rebound from the $68.00 level and witnessed some intraday selling. This, in turn, weighed on the Canadian dollar and helped limit any deeper losses for the USD/CAD pair amid relatively thin liquidity conditions in the markets.

Apart from this, the Fed's hawkish outlook, indicating at least three rate hikes next year, should act as a tailwind for the greenback. This makes it prudent to wait for some follow-through selling before confirming that the USD/CAD pair has topped out and positioning for a deeper pullback.

Technical levels to watch

According to four sources speaking to Reuters, the Turkish government launched its latest scheme to protect lira savings from losses via depreciation against the dollar after deciding that the 18.00 in USD/TRY level was a "red line". According to the sources, the Turkish government came up with the scheme last week, but decided to wait for USD/TRY to hit what they called the "absurd" 18.00 level before unveiling the new scheme.

To recap; the lira surged more than 25% in value on Monday against the US dollar, with USD/TRY dropping from above 18.00 to the 13.00s and has since continued to drop into the 12.00s. That still leaves it about 30% above early November levels, but also more than 30% below Monday's highs. The Turkish government's decision to reimburse the losses incurred by holders of lira savings as a result of exchange rate fluctuations was seen by markets as a "rate hike through the back door". The main difference to a traditional rate hike is that the increased interest rate that Turkish savers will get over the CBRT rate will come from the government and depend on exchange rate fluctuations.

Still, it should encourage savings in the near term, which may help to take some of the sting out of inflation in Turkey. The big concern now will be whether the Turkish government will be able to find the money to reimburse savers their lira exchange rate depreciation incurred losses.

Market Reaction

The lira has not reacted to the reports in recent trade.

According to the US Bureau of Economic Analysis (BEA)'s final GDP estimate, the US economy grew at an annualised QoQ pace of 2.3% in Q3 2021, above the prior estimate for a growth rate of 2.1%.

Market Reaction

The DXY did not see any notable reaction to the final Q3 GDP estimate. The index has fallen back in recent trade to its lowest levels since last Friday around the 96.30 mark, but has, for now, found support in the form of its 21-day moving average, which resides pretty much bang on 96.30.

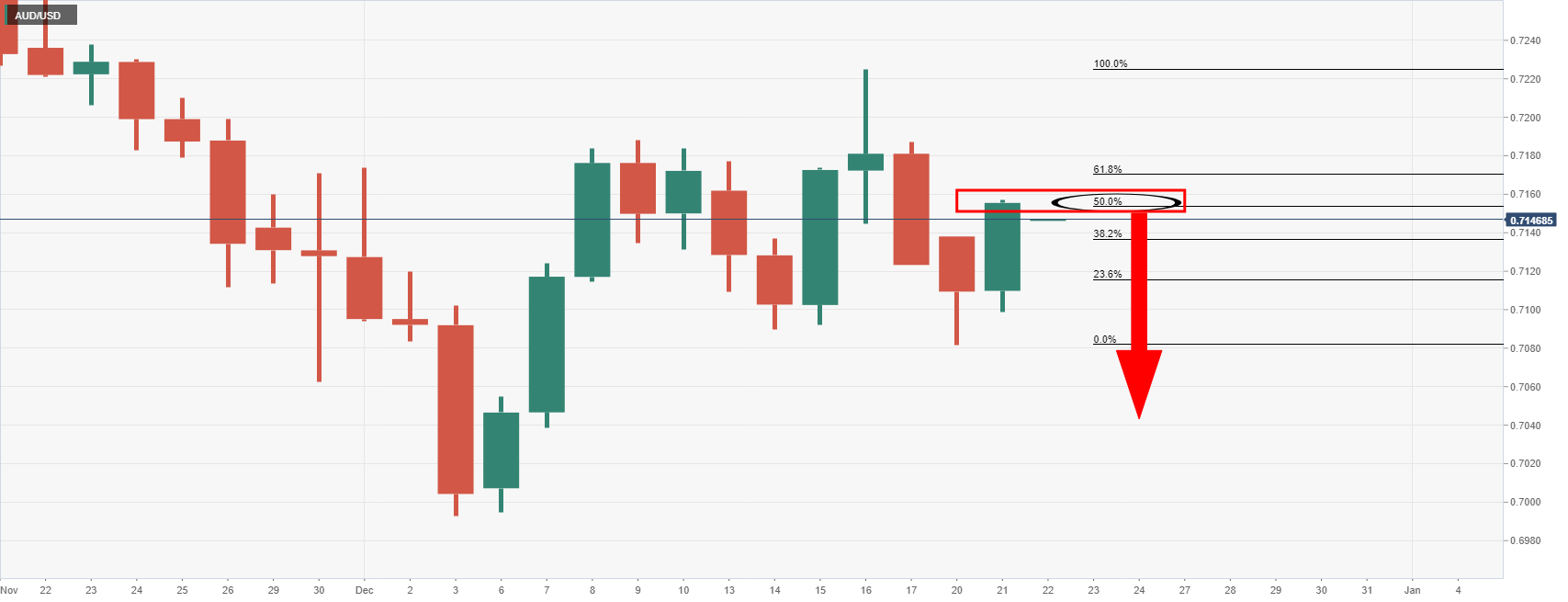

- A combination of factors assisted AUD/USD to attract some dip-buying on Wednesday.

- A positive risk tone benefitted the perceived riskier aussie amid a modest USD weakness.

- The technical setup warrants some caution before positioning for any meaningful gains.

The AUD/USD pair attracted some dip-buying near the 0.7120 region on Wednesday and turned positive for the second successive day. The intraday move up pushed spot prices to a fresh weekly high, around the 0.7170-75 region, heading into the North American session.

Investors turned optimistic amid reports that the Omicron is less severe than all previous variants of COVID-19 and the current vaccines may be more effective than first thought in fighting the new strain. This was evident from a generally positive risk tone, which, in turn, benefitted the perceived riskier aussie.

On the other hand, retreating US Treasury bond yields undermined the US dollar. This was seen as another factor that contributed to the AUD/USD pair's goodish intraday bounce of over 50 pips. That said, the Fed's hawkish outlook should limit the USD downside and keep a lid on any further gains for the major.

From a technical perspective, any subsequent move up is likely to confront some resistance near the 0.7185 region. This is closely followed by the 0.7200 round-figure mark and the monthly swing high, around the 0.7220-25 region, which if cleared decisively would be seen as a fresh trigger for bullish traders.

Meanwhile, technical indicators on the daily chart – though have recovered from the negative territory – are yet to confirm the bullish bias. This makes it prudent to wait for a strong follow-through buying before positioning for any further gains amid thin liquidity heading into the year-end holiday season.

On the flip side, immediate support is pegged near mid-0.7100s, below which the AUD/USD pair could drop back to retest the daily swing low, around the 0.7120 region. Some follow-through selling, leading to a subsequent break below the 0.7100 mark, could prompt technical selling and turn the pair vulnerable.

That said, bearish traders would still wait for sustained weakness below the 0.7090-80 region. The AUD/USD pair might then accelerate the fall to intermediate support near the 0.7060 region before dropping to challenge the YTD low, around the key 0.7000 psychological mark touched earlier this December.

AUD/USD 4-hour chart

Technical levels to watch

- WTI is ranging to the north of the $71.00 level in subdued Tuesday trade, $5.0 up fom Monday’s lows.

- Record high European nat gas prices and bullish inventory data are likely helping, but Omicron concerns continue to lurk.

Since recovering back to the north of the $71.00 level on Tuesday, front-month WTI futures have been heading sideways within a $71.00-$71.70ish range. For now, the key psychological level and 21-day moving average at $71.09 are acting as support, though if this level was to go, the door would be open to a swift drop back towards $70.00. The crude oil bulls will likely be pleased with how well oil markets were able to recover from Monday’s lows just above $66.00.

Surging natural gas prices in Europe is likely lending some support. Prices there have been hitting fresh record highs this week amid fears of Russia withholding gas deliveries amid political tensions with NATO over Ukraine. There has been a significant build-up of Russian troops on the Ukrainian border as Russia demands no more Eastwards NATO expansions and no more deployment of offensive weapons close to its border. Given European dependence on Russian gas imports, it is not surprising to see Russia flexing this leverage in order to hurt the European economy. Reports over the last few days suggest that industry across the EU has been affected by the surge in prices, with many factories halting production as a result of high energy costs.

With regards to how this relates to crude oil markets, higher gas prices incentivises power producers to substitute in comparatively cheaper crude oil, increasing its demand, thus boosting oil prices. Tuesday also saw the release of the weekly US API crude oil inventory report which saw a much larger drawdown on stocks than expected of 3.67M versus forecasts for 2.6M. The bullish report is for now likely helping to keep WTI supported above $71.00, though oil traders will be looking ahead to the release of official weekly US inventory data at 1530GMT for confirmation.

In the meantime, news of fresh international travel restrictions isn’t helpful to sentiment is likely to stand in the way of further gains from Monday’s lows, with focus on Singapore halting quarantine-free travel and freezing all new airplane ticket sales for flights and buses until 20 January amid Omicron risks. These travel restriction comes as nations across Europe consider or move ahead with fresh restrictions to curb Omicron transmission, with South Korea also imposing fresh measures. Analysts have pointed out that markets look increasingly to be entering “holiday mode” ahead of Christmas day celebrations across the Christian world on Saturday and New Year celebrations next week. For oil markets, that might mean conditions are more rangebound than usual amid lower than normal liquidity.

US Q3 GDP Overview

Wednesday's US economic docket highlights the releases of the final Q3 GDP print, scheduled at 13:30 GMT. The final estimate is expected to match the preliminary release and confirm that the world's largest economy expanded by 2.1% annualized pace during the July-September period.

How Could it Affect EUR/USD?

The backward-looking report is unlikely to provide any impetus as the market focus remains on developments surrounding the coronavirus saga. That said, any significant revision could move the US dollar and produce some meaningful trading opportunities around the EUR/USD pair. The market reaction, however, is likely to remain limited amid relatively thin liquidity conditions heading into the year-end holiday season.

Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook for the EUR/USD pair: “The Relative Strength Index (RSI) indicator on the daily chart returned to 50 early Wednesday, pointing to the pair's indecisiveness in the near term.”

Eren further provided important technical levels to trade the major: “Currently, EUR/USD is testing the static support that is located at 1.1270 and if a four-hour candle closes below that level, additional losses toward 1.1240, the next static level, could be witnessed. 1.1200 (psychological level) aligns as the next target on the downside but an extended decline toward that support is unlikely unless fueled by a fundamental driver.”

“On the upside, key resistance aligns at 1.1295/1.1300 (100-period SMA, psychological level, upper limit of the current trading range) before 1.1320 (static level) and 1.1330 (200-period SMA),” he added further.

Key Notes

• EUR/USD Forecast: Bears to retain control as euro fails to clear key hurdle

• Morgan Stanley slashes 2022 US GDP forecast from 4.9% to 4.6%

• EUR/USD nudges above 1.1300 amid subdued holiday trading conditions

About US GDP

The Gross Domestic Product Annualized released by the US Bureau of Economic Analysis shows the monetary value of all the goods, services and structures produced within a country in a given period of time. GDP Annualized is a gross measure of market activity because it indicates the pace at which a country's economy is growing or decreasing. Generally speaking, a high reading or a better than expected number is seen as positive for equities, while a low reading is negative.

- EUR/USD has pushed above 1.1300 in recent trade and is up about 0.2%.

- Some have suggested that hawkish commentary from ECB’s Kazimir earlier in the session is lifting the euro.

- FX markets are very much in “holiday mode” now, given the proximity to Christmas and New Years' celebrations.

EUR/USD has nudged above the 1.1300 level in recent trade, with the pair now up about 0.2% on the session. The recent push higher marks a decent effort by the pair to break away from its 21-day moving average, which trades in the 1.1280s and had been acting as a magnet to the price action since Monday. Some are suggesting that some hawkish commentary from ECB governing council member and Slovakian central bank head Peter Kazimir, who joined a throng of other hawkish leaning ECB policymakers in warning about upside risks to the ECB’s inflation forecasts, is helping the euro marginally on Wednesday and that could well be the case.

Traders would do well not to read too much into recent moves, or extrapolate too much. FX markets are very much in “holiday mode” now, given the proximity to Christmas and New Years celebrations, which means a lot of market participants are taking time off. Liquidity conditions are thus thin, and markets are expected to trade with a lack of conviction. This can become a self-fulfilling prophecy, with the market participants that are still present opting not to place big bets until activity picks up in the new year. For EUR/USD, that means a break out of recent 1.1250.1.1350ish ranges is unlikely.

Looking ahead, the third estimate of US Q3 GDP data is scheduled for release at 1330GMT, but given how backward-looking it is, shouldn’t garner too much attention. The release of the US Conference Board’s Consumer Confidence survey at 1500GMT is likely to garner more attention given it is much timelier and will be a guage of how badly the arrival of Omicron on US shores has dented sentiment. Still, given holiday conditions, the impact on EUR/USD is likely to be minimal. The latest news on Omicron itself is likely to remain the main market driver as nations across Europe take steps to reimpose varying degrees of restrictions in an attempt to curb transmission.

- GBP/USD gained strong positive traction for the second successive day on Wednesday.

- A positive risk tone, sliding US bond yields undermined the USD and extended support.

- The Fed’s hawkish outlook could act as a tailwind for the greenback and cap the upside.

- The worsening COVID-19 situation in the UK further warrants caution for bullish traders.

The emergence of some selling around the USD pushed the GBP/USD pair to a fresh weekly high, around the 1.3325 region during the mid-European session.

The pair added to the previous day's positive move and gained strong follow-through traction for the second successive day on Wednesday. The momentum allowed the GBP/USD pair to build on this week's bounce from the vicinity of the YTD low and was sponsored by a modest US dollar weakness.

Concerns that the fast-spreading Omicron variant could derail the global economic recovery eased amid reports that the current vaccines may be more effective than first thought in fighting the new strain. This, in turn, boosted investors' confidence and undermined the safe-haven greenback.

Apart from this, a softer tone around the US Treasury bond yields turned out to be another factor that weighed on the greenback. This, along with some technical buying on a sustained strength beyond the 1.3300 round figure, further contributed to the GBP/USD pair's strong intraday move up.

It, however, remains to be seen if bulls are able to capitalize on the move amid the worsening COVID-19 situation in the United Kingdom. In fact, UK Prime Minister Borish Johnson said that the Omicron-related data will be kept under review to see if stricter measures are needed next week.

This, along with the UK-EU impasse over the Northern Ireland Protocol could act as a headwind for the British pound. The UK Foreign Minister Liz Truss – now in charge of Brexit negotiations – reiterated that triggering Article 16 remains an option if the EU does not compromise further.

On the other hand, the Fed's hawkish outlook, indicating at least three rate hikes next year, should attract some USD buying at lower levels and keep a lid on any further gains for the GBP/USD pair. This, in turn, suggests that the intraday move up runs the risk of fizzling out rather quickly.

Market participants now look forward to the US economic docket, highlighting the release of the final Q3 GDP print and the Conference Board's Consumer Confidence Index. This, along with the US bond yields, might influence the USD price dynamics and provide some impetus to the GBP/USD pair.

Technical levels to watch

- USD/CHF struggled to preserve modest intraday gains to the 0.9250 strong resistance zone.

- Retreating US bond yields kept the USD bulls on the defensive and capped gains for the pair.

- The Fed’s hawkish outlook should act as a tailwind for the USD and limit any meaningful slide.

The USD/CHF pair surrendered modest intraday gains and dropped to the lower end of its daily trading range, around the 0.9230 region during the first half of the European session

The pair gained some positive traction during the early part of the trading on Wednesday, albeit continued with its struggle to make it through the 0.9250 resistance zone. A fresh leg down in the US Treasury bond yields kept the US dollar bulls on the defensive and capped the early uptick for the USD/CHF pair, rather prompted some intraday selling.

That said, a combination of supporting factors should lend some support and help limit any deeper losses, at least for now. The Fed's hawkish outlook, indicating at least three rate hikes next year, should lend some support to the greenback. Apart from this, fading safe-haven demand should assist the USD/CHF pair to attract some dip-buying at lower levels.

Investors turned optimistic after reports suggested that the current vaccines may be more effective than first thought in fighting the Omicron variant. The optimism should act as a headwind for the safe-haven Swiss franc and extend some support to the USD/CHF pair. This warrants caution before placing bearish bets and positioning for any meaningful slide.