- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 23-10-2015

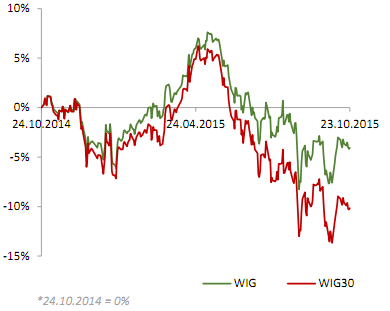

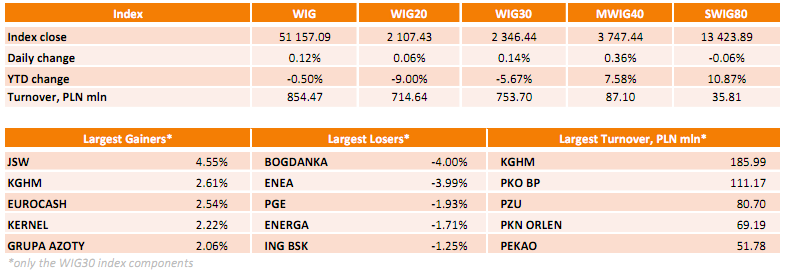

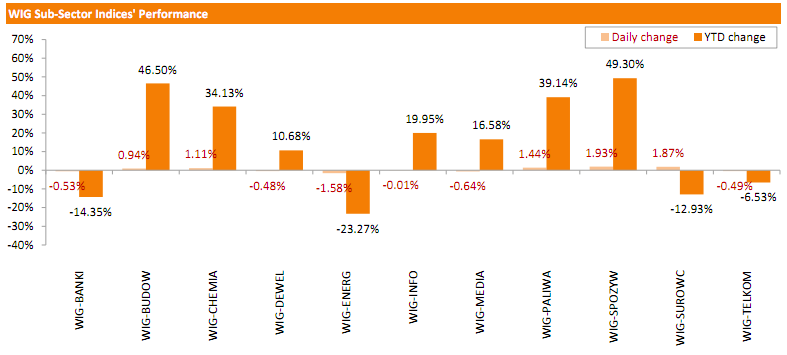

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, rose 0.12%. Sector performance in the WIG Index was mixed. Food sector (+1.93%) and materials (+1.87%) recorded the biggest gains, while utilities (-1.58%) lagged behind, as Poland's government pushes the energy generating companies to invest in troubled mine.

The large-cap stocks' measure, the WIG30 Index, added 0.14%. Within the index components, JSW (WSE: JSW) led the gainers with a 4.55% advance, followed by KGHM (WSE: KGH), EUROCASH (WSE: EUR), KERNEL (WSE: KER) and GRUPA AZOTY (WSE: ATT), growing by 2.06%-2.61%.

On the other side of the ledger, BOGDANKA (WSE: LWB) fared the worst, tumbling by 4%, on the news that ENEA (WSE: ENA), which took over the company earlier this month, may buy another troubled coal mine KHW. This ENEA's buying could pose a risk to BOGDANKA's coal sales, as BOGDANKA's and KHW output far exceeds ENEA's needs. ENEA (WSE: ENA) plunged by 3.99%.

Stock indices closed higher on China's interest rate decision. The People's Bank of China (PBoC) announced on Friday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.35%. It was the sixth interest rate cut since last November.

The central bank hopes with this decision to support the country's economy.

The interest rate cut would be effective from October 24.

Meanwhile, the economic data from the Eurozone was mainly positive. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI remained unchanged 52.0 in October, beating expectations for a decline to 51.7.

Eurozone's preliminary services PMI rose to 54.2 in October from 53.7 in September. Analysts had expected the index to decrease to 53.5.

Markit's Chief Economist Chris Williamson said that Eurozone's economy "picked up some momentum in October".

"The PMI remains at a level signalling a modest 0.4% quarterly rise in GDP, suggesting the region will struggle to attain more than 1.5% overall growth in 2015. The rate of job creation, although on the rise, remains insufficient to make serious headway into reducing unemployment," he added.

Germany's preliminary manufacturing PMI declined to 51.6 in October from 52.3 in September, in line with expectations.

Germany's preliminary services PMI was up to 55.2 in October from 54.1 in September. Analysts had expected index to decline to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by the services sector.

France's preliminary manufacturing PMI rose to 50.7 in October from 50.6 in September, beating forecasts of a fall to 50.2.

France's preliminary services PMI increased to 52.3 in October from 51.9 in September. Analysts had expected the index to decline to 51.6.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,444.08 +67.80 +1.06 %

DAX 10,794.54 +302.57 +2.88 %

CAC 40 4,923.64 +121.46 +2.53 %

Oil prices fell on a stronger U.S. dollar. The greenback rose against other currencies on better-than-expected U.S. preliminary manufacturing purchasing managers' index. The U.S. preliminary manufacturing purchasing managers' index (PMI) climbed to 54 in October from 53.1 in September, beating expectations for a decline to 52.8.

"The positive start to the fourth quarter suggests the economy may be picking up speed again after slowing in the third quarter, for which the PMI surveys pointed to annualised GDP growth of 2.2%," Markit Chief Economist Chris Williamson.

The greenback also rose on China's interest rate decision. The People's Bank of China (PBoC) announced on Friday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.35%. It was the sixth interest rate cut since last November.

The central bank hopes with this decision to support the country's economy.

The interest rate cut would be effective from October 24.

Market participants are awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported last Friday that the number of active U.S. rigs declined by 10 rigs to 595 last week. It was the seventh consecutive decrease and the lowest level since the week ending July 23, 2010.

WTI crude oil for December delivery declined to $45.31 a barrel on the New York Mercantile Exchange.

Brent crude oil for December fell to $48.07 a barrel on ICE Futures Europe.

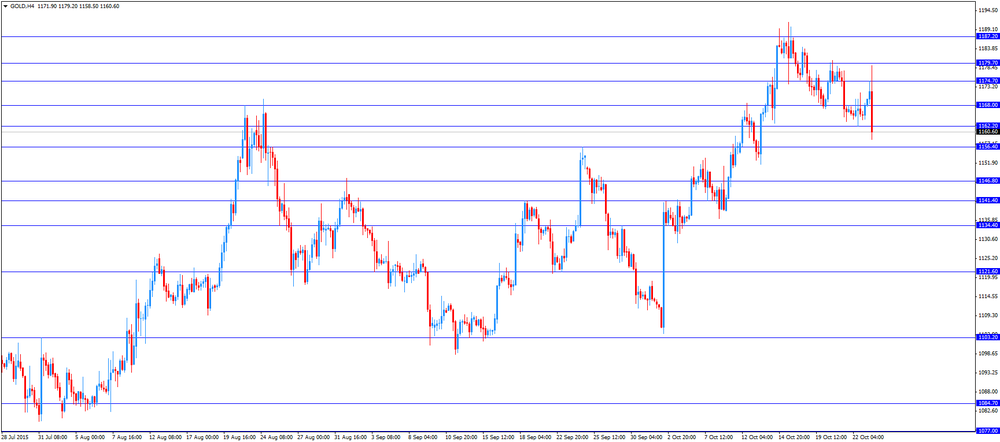

Gold price declined on a stronger U.S. dollar. The greenback rose against other currencies on better-than-expected U.S. preliminary manufacturing purchasing managers' index. The U.S. preliminary manufacturing purchasing managers' index (PMI) climbed to 54 in October from 53.1 in September, beating expectations for a decline to 52.8.

"The positive start to the fourth quarter suggests the economy may be picking up speed again after slowing in the third quarter, for which the PMI surveys pointed to annualised GDP growth of 2.2%," Markit Chief Economist Chris Williamson.

Earlier, gold price rose on China's interest rate decision. The People's Bank of China (PBoC) announced on Friday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.35%. It was the sixth interest rate cut since last November.

The central bank hopes with this decision to support the country's economy.

The interest rate cut would be effective from October 24.

One-year benchmark deposit rates were cut by 25 basis point to 1.50%, reserve requirements (RRR) were lowered by 50 basis points to 17.5% for all banks.

New reserve requirements would be effective on October 24.

December futures for gold on the COMEX today declined to 1162.90 dollars per ounce.

Destatis released its construction orders data on Friday. German construction orders rose by a seasonally and working-day-adjusted rate of 0.4% in August.

On an annual basis, German construction orders climbed by a seasonally and working-day-adjusted rate of 0.9% in August

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) climbed to 54 in October from 53.1 in September, beating expectations for a decline to 52.8.

A reading above 50 indicates expansion in economic activity.

The increase was driven by a faster pace of expansion in output and new orders volumes.

"The positive start to the fourth quarter suggests the economy may be picking up speed again after slowing in the third quarter, for which the PMI surveys pointed to annualised GDP growth of 2.2%," Markit Chief Economist Chris Williamson.

"The faster growth of export sales is particularly good news and will help to alleviate fears that the US economy is being hurt by the stronger dollar and slower growth in China," he added.

The European Central Bank (ECB) released its Survey of Professional Forecasters for Q4 2015 on Friday. Forecasters cut their inflation forecasts. Eurozone's inflation is expected to be 0.1% in 2015, down from July estimate of 0.2%, 1.0% in 2016, down from July estimate of 1.3%, and 1.5% in 2016, down from July estimate of 1.6%.

Long-term inflation forecasts (for 2020) remained unchanged at 1.9%.

The economic growth in the Eurozone is expected to expand 1.5% this year, up from July estimate of 1.4%, 1.7% next year, down from July estimate of 1.8%, and 1.8% in 2017, unchanged from July estimate.

The National Bank of Belgium (NBB) released its business survey on Friday. The business climate rise to -4.0 in October from -6.8 in September.

All indicators increased in October.

The business climate index for the manufacturing sector climbed to -5.6 in October from -8.7 in September due to more favourable assessments of stock levels, and total order books, and more optimistic employment forecasts.

The business climate index for the services sector was up to 7.2 in October from 3.3 in September due to a more positive outlook for firms' own activity.

The business climate index for the building sector increased to -8.5 in October from -9.0 in September due to a rise in new orders.

The business climate index for the trade sector rose to -4.3 in October from -6.5 in September due to an increase in staff numbers and higher orders.

USD/JPY 119.50 (USD 467m) 120.00-05 (1.8bln)

EUR/USD 1.1000 (EUR 1.6bln) 1.1100 (1.2bln) 1.1250 (600m) 1.1275 (400m) 1.1300 (500m) 1.1350-60 (830m)

USD/CHF 0.9460 (USD 430m)

USD/CAD 1.3000 (USD 608m) 1.3060 (250m) 1.3200 (395m)

AUD/USD 0.7180 (AUD 290m) 0.7200 (367m) 0.7300 (300m)

U.S. stock-index futures rose amid corporate earnings and China rate cut.

Global Stocks:

Nikkei 18,825.3 +389.43 +2.11%

Hang Seng 23,151.94 +306.57 +1.34

Shanghai Composite 3,413.19 +44.45 +1.32%

FTSE 6,464.15 +87.87 +1.38%

CAC 4,933.36 +131.18 +2.73%

DAX 10,808.24 +316.27 +3.01%

Crude oil $45.39 (0,00%)

Gold $1177.8 (+1.01%)

(company / ticker / price / change, % / volume)

| Google Inc. | GOOG | 726.01 | 11.39% | 144.9K |

| Microsoft Corp | MSFT | 52.90 | 10.14% | 2.7M |

| Amazon.com Inc., NASDAQ | AMZN | 617.75 | 9.55% | 221.0K |

| Yahoo! Inc., NASDAQ | YHOO | 32.72 | 3.32% | 70.7K |

| Barrick Gold Corporation, NYSE | ABX | 7.84 | 3.29% | 17.4K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.41 | 3.24% | 63.5K |

| Facebook, Inc. | FB | 102.88 | 3.22% | 131.6K |

| Procter & Gamble Co | PG | 77.00 | 2.87% | 28.7K |

| Yandex N.V., NASDAQ | YNDX | 13.17 | 2.41% | 1.8K |

| ALCOA INC. | AA | 9.30 | 2.31% | 135.4K |

| AT&T Inc | T | 34.69 | 2.15% | 85.7K |

| Caterpillar Inc | CAT | 72.22 | 1.89% | 2.3K |

| Tesla Motors, Inc., NASDAQ | TSLA | 215.49 | 1.78% | 12.5K |

| Twitter, Inc., NYSE | TWTR | 29.67 | 1.78% | 39.5K |

| Visa | V | 77.67 | 1.64% | 3.0K |

| Apple Inc. | AAPL | 117.10 | 1.39% | 338.9K |

| Citigroup Inc., NYSE | C | 53.20 | 1.31% | 35.8K |

| FedEx Corporation, NYSE | FDX | 161.72 | 1.25% | 1.2K |

| AMERICAN INTERNATIONAL GROUP | AIG | 61.49 | 1.22% | 0.1K |

| Goldman Sachs | GS | 185.75 | 1.19% | 0.7K |

| JPMorgan Chase and Co | JPM | 63.91 | 1.14% | 2.1K |

| Intel Corp | INTC | 34.76 | 1.05% | 46.7K |

| Verizon Communications Inc | VZ | 46.33 | 0.96% | 6.8K |

| Home Depot Inc | HD | 125.49 | 0.91% | 2.1K |

| Starbucks Corporation, NASDAQ | SBUX | 62.05 | 0.91% | 5.0K |

| Ford Motor Co. | F | 15.72 | 0.90% | 11.4K |

| Boeing Co | BA | 147.60 | 0.88% | 3.6K |

| McDonald's Corp | MCD | 111.75 | 0.79% | 25.1K |

| General Motors Company, NYSE | GM | 35.70 | 0.79% | 15.1K |

| 3M Co | MMM | 157.20 | 0.77% | 1.5K |

| E. I. du Pont de Nemours and Co | DD | 59.64 | 0.76% | 0.9K |

| International Business Machines Co... | IBM | 145.17 | 0.75% | 3.5K |

| Walt Disney Co | DIS | 114.10 | 0.75% | 23.7K |

| Pfizer Inc | PFE | 33.57 | 0.72% | 3.8K |

| Johnson & Johnson | JNJ | 100.21 | 0.68% | 6.3K |

| Wal-Mart Stores Inc | WMT | 59.30 | 0.68% | 7.5K |

| United Technologies Corp | UTX | 100.46 | 0.67% | 0.6K |

| HONEYWELL INTERNATIONAL INC. | HON | 103.25 | 0.65% | 0.1K |

| Chevron Corp | CVX | 92.20 | 0.63% | 6.6K |

| Hewlett-Packard Co. | HPQ | 28.95 | 0.63% | 4.2K |

| American Express Co | AXP | 72.95 | 0.62% | 7.6K |

| Exxon Mobil Corp | XOM | 83.39 | 0.60% | 12.6K |

| Merck & Co Inc | MRK | 52.32 | 0.60% | 1.9K |

| ALTRIA GROUP INC. | MO | 61.77 | 0.60% | 1.7K |

| Travelers Companies Inc | TRV | 112.97 | 0.58% | 2.4K |

| UnitedHealth Group Inc | UNH | 114.39 | 0.51% | 0.5K |

| General Electric Co | GE | 29.72 | 0.47% | 111.9K |

| Cisco Systems Inc | CSCO | 29.14 | 0.45% | 18.6K |

| Nike | NKE | 132.80 | 0.29% | 10.4K |

| The Coca-Cola Co | KO | 43.32 | 0.19% | 12.9K |

The People's Bank of China (PBoC) announced on Friday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.35%. It was the sixth interest rate cut since last November.

The central bank hopes with this decision to support the country's economy.

The interest rate cut would be effective from October 24.

One-year benchmark deposit rates were cut by 25 basis point to 1.50%, reserve requirements (RRR) were lowered by 50 basis points to 17.5% for all banks.

New reserve requirements would be effective on October 24.

Upgrades:

Microsoft (MSFT) upgraded to Buy from Neutral at BofA/Merrill

McDonald's (MCD) upgraded to Overweight from Neutral at Piper Jaffray; target $130

Apple (AAPL) upgraded to Buy from Hold at Maxim Group

Downgrades:

Other:

Alphabet (GOOG) target raised to $812 from $723 at Piper Jaffray

Alphabet (GOOG) reiterated at Overweight at JP Morgan; target raised to $900 from $800

Alphabet (GOOG) reiterated at Outperform at RBC Capital Mkts; target raised to $880 from $750

Amazon (AMZN) target raised to $800 from $650 at Piper Jaffray

Amazon (AMZN) target raised to $777 from $720 at Credit Suisse

Amazon (AMZN) target raised to $800 from $710 at JPMorgan

Amazon (AMZN) target raised to $720 from $645 at Mizuho

Amazon (AMZN) target raised to $750 from $700 at Stifel

Amazon (AMZN) target raised to to $710 from $630 at Baird

Microsoft (MSFT) target raised to $60 from $53 at FBR Capital

Microsoft (MSFT) reiterated at Outperform at RBC Capital Mkts; target raised to $57 from $54

Apple (AAPL) removed from US Focus List at Citigroup

McDonald's (MCD) reiterated at Outperform at RBC Capital Mkts; target raised to $120 from $110

3M (MMM) reiterated at Underperform at RBC Capital Mkts; target lowered to $138 from $141

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation fell 0.2% in September, missing expectations for a 0.1% decline, after a flat reading in August.

The monthly decline was driven by a drop in transportation prices, which slid 1.4% in September.

On a yearly basis, the consumer price index dropped to 1.0% in September from1.3% in August, missing expectations for a decrease to 1.1%.

The consumer price index was partly driven by higher food prices. Food prices climbed 3.5% year-on-year in September, while transportation prices decreased 3.5%.

Clothing and footwear prices climbed by 1.2% in September from the same month a year earlier, while gasoline prices dropped 18.8%.

The Canadian core consumer price index, which excludes some volatile goods, rose 0.2% in September, after a 0.2% gain in August.

On a yearly basis, core consumer price index in Canada remained unchanged at 2.1% in September, in line with expectations.

The Bank of Canada's inflation target is 2.0%.

The Italian statistical office ISTAT released its consumer confidence index for Italy on Friday. Contractual wages and salaries per hour in Italy were flat in September, after a flat reading in August.

On a yearly basis, contractual wages and salaries per hour increased 1.2% in September, after a 1.2% gain in August.

Contractual wages and salaries in the private sector jumped 1.8% in September, while wages in the public sector remained flat.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Preliminary) October 51 50.6 52.5

05:00 Japan Coincident Index (Finally) August 113.1 112.2

05:00 Japan Leading Economic Index (Finally) August 105 103.5

07:00 France Services PMI (Preliminary) October 51.9 51.6 52.3

07:00 France Manufacturing PMI (Preliminary) October 50.6 50.2 50.7

07:30 Germany Manufacturing PMI (Preliminary) October 52.3 51.6 51.6

07:30 Germany Services PMI (Preliminary) October 54.1 53.9 55.2

08:00 Eurozone Services PMI (Preliminary) October 53.7 53.5 54.2

08:00 Eurozone Manufacturing PMI (Preliminary) October 52 51.7 52.0

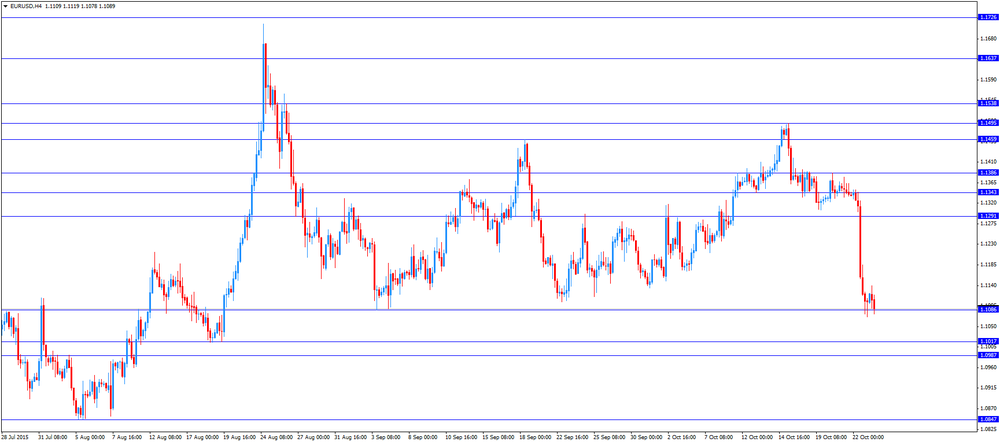

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. preliminary manufacturing PMI data. The U.S. preliminary manufacturing PMI is expected to decline to 52.8 in October from 53.1 in September.

The euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI remained unchanged 52.0 in October, beating expectations for a decline to 51.7.

Eurozone's preliminary services PMI rose to 54.2 in October from 53.7 in September. Analysts had expected the index to decrease to 53.5.

Markit's Chief Economist Chris Williamson said that Eurozone's economy "picked up some momentum in October".

"The PMI remains at a level signalling a modest 0.4% quarterly rise in GDP, suggesting the region will struggle to attain more than 1.5% overall growth in 2015. The rate of job creation, although on the rise, remains insufficient to make serious headway into reducing unemployment," he added.

Germany's preliminary manufacturing PMI declined to 51.6 in October from 52.3 in September, in line with expectations.

Germany's preliminary services PMI was up to 55.2 in October from 54.1 in September. Analysts had expected index to decline to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by the services sector.

France's preliminary manufacturing PMI rose to 50.7 in October from 50.6 in September, beating forecasts of a fall to 50.2.

France's preliminary services PMI increased to 52.3 in October from 51.9 in September. Analysts had expected the index to decline to 51.6.

Comments by the European Central Bank's (ECB) President Mario Draghi weighed on the euro. He said at a press conference on Thursday that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December. He pointed out that the central bank will expand its asset-buying programme if needed to boost inflation toward the 2% target.

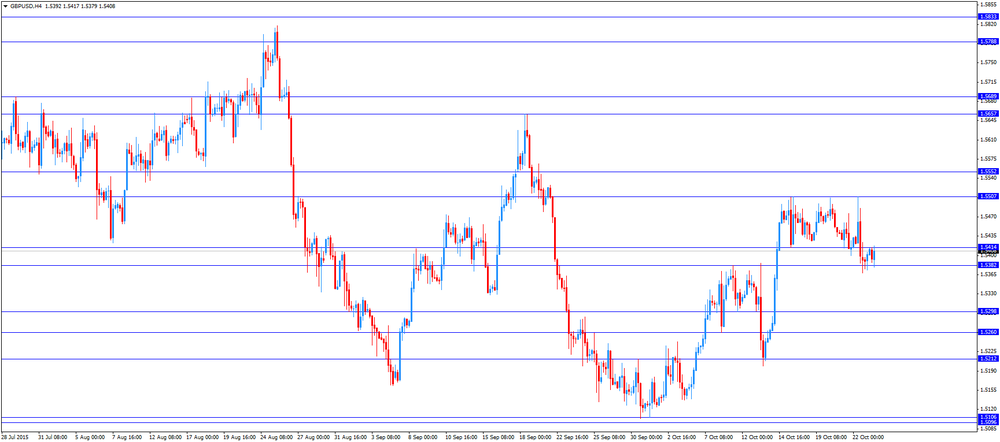

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the consumer price inflation data from Canada. The consumer price index in Canada is expected to fall to 1.1% year-on-year in September from 1.3% in August.

The core consumer price index in Canada is expected to remain unchanged at 2.1% year-on-year in September.

EUR/USD: the currency pair declined to $1.1078

GBP/USD: the currency pair traded mixed

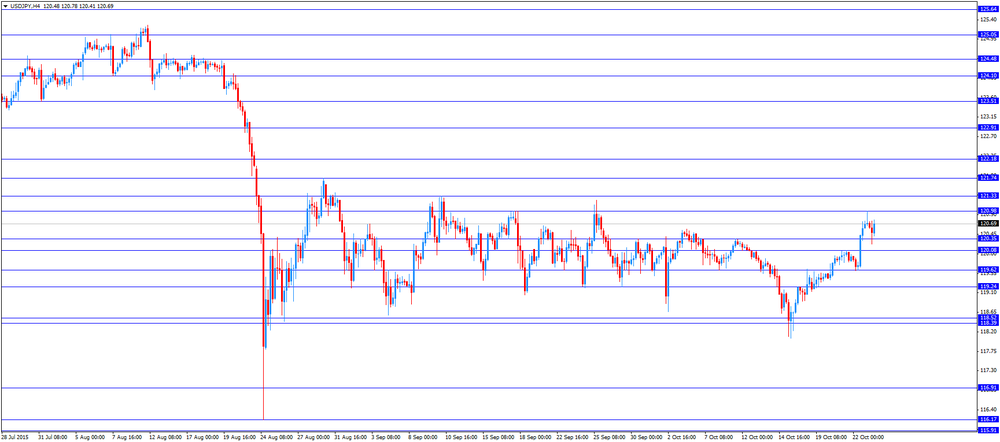

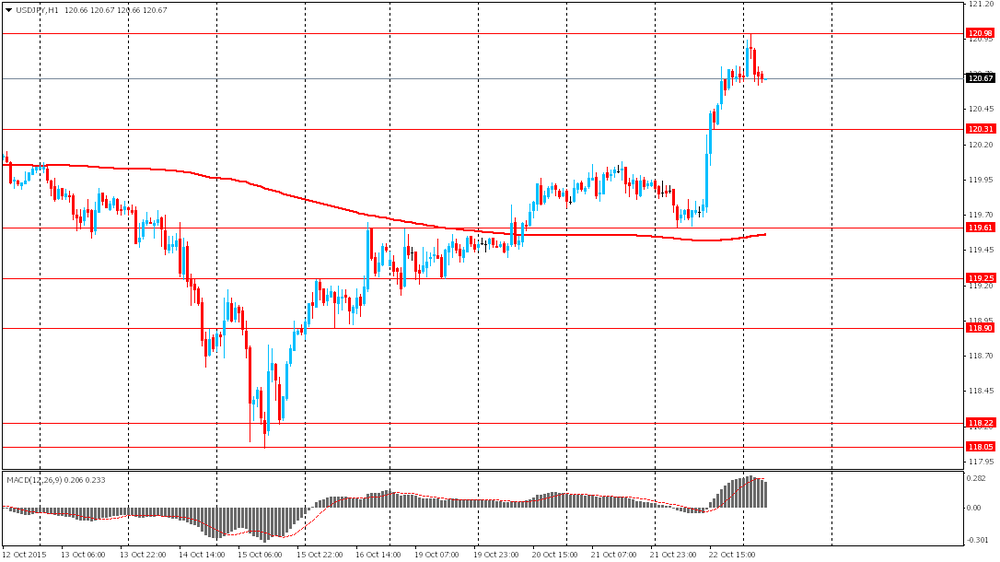

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Consumer Price Index m / m September 0.0% -0.1%

12:30 Canada Consumer price index, y/y September 1.3% 1.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September 2.1% 2.1%

13:00 Belgium Business Climate October -6.8

13:45 U.S. Manufacturing PMI (Preliminary) October 53.1 52.8

EUR/USD

Offers 1.1125 1.1150 1.1175-80 1.1200 1.1225-30 1.1250 1.1275 1.1300

Bids 1.1100 1.1070-75 1.1050 1.1025-30 1.1000 1.0985 1.0960 1.0930 1.0900

GBP/USD

Offers 1.5420-25 1.5445-50 1.5480 1.5500-10 1.5525-30 1.5550 1.5565 1.5585 1.5600 1.5620

Bids 1.5375-80 1.5350 1.5330 1.5300 1.5285 1.5265 1.5250 1.5220 1.5200

EUR/GBP

Offers 0.7225-30 0.7250 0.7275-80 0.7300 0.7325-30 0.7350

Bids 0.7200 0.7175-80 0.7165 0.7150 0.7130 0.7100 0.7085 0.7050

EUR/JPY

Offers 134.00 134.20-25 134.50 134.80 135.00 135.25 135.50

Bids 133.50-55 133.30 133.00 132.80 132.50 132.25-30 132.00

USD/JPY

Offers 120.60 12075-.80 121.00 121.30 121.50 121.80 122.00

Bids 120.20 120.00 119.80-85 119.50 119.25-30 119.00 118.85 118.65-70 118.50 118.30 118.00

AUD/USD

Offers 0.7300 0.7325 0.7335 0.7350 0.7375 0.7400

Bids 0.7250 0.7230 0.7200 0.7180-85 0.7150 0.7125-30 0.7100

Stock indices traded higher as comments by the European Central Bank's (ECB) President Mario Draghi continued to support. He said at a press conference on Thursday that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December. He pointed out that the central bank will expand its asset-buying programme if needed to boost inflation toward the 2% target.

Meanwhile, the economic data from the Eurozone was mainly positive. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI remained unchanged 52.0 in October, beating expectations for a decline to 51.7.

Eurozone's preliminary services PMI rose to 54.2 in October from 53.7 in September. Analysts had expected the index to decrease to 53.5.

Markit's Chief Economist Chris Williamson said that Eurozone's economy "picked up some momentum in October".

"The PMI remains at a level signalling a modest 0.4% quarterly rise in GDP, suggesting the region will struggle to attain more than 1.5% overall growth in 2015. The rate of job creation, although on the rise, remains insufficient to make serious headway into reducing unemployment," he added.

Germany's preliminary manufacturing PMI declined to 51.6 in October from 52.3 in September, in line with expectations.

Germany's preliminary services PMI was up to 55.2 in October from 54.1 in September. Analysts had expected index to decline to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by the services sector.

France's preliminary manufacturing PMI rose to 50.7 in October from 50.6 in September, beating forecasts of a fall to 50.2.

France's preliminary services PMI increased to 52.3 in October from 51.9 in September. Analysts had expected the index to decline to 51.6.

Current figures:

Name Price Change Change %

FTSE 100 6,427.58 +51.30 +0.80 %

DAX 10,645.36 +153.39 +1.46 %

CAC 40 4,871.77 +69.59 +1.45 %

The Italian statistical office Istat released its retail sales data for Italy on Friday. Italian retail sales climbed at a seasonally adjusted rate of 0.3% in August, after a 0.3% increase in July. July's figure was revised down from a 0.4% rise.

Sales of food products were up 0.1% in August, while sales of non-food products climbed by 0.3%.

On a yearly basis, retail sales in Italy increased 1.3% in August, after a 1.6% rise in July. July's figure was revised down from a 1.7% gain.

The Italian statistical office Istat released its industrial orders data for Italy on Friday. Industrial turnover in Italy dropped at a seasonally adjusted rate of 1.6% in August, after a 1.1% decrease in July.

Domestic market orders plunged 2.2% in August, while demand from non-domestic markets fell by 0.5%.

On a yearly basis, the seasonally adjusted industrial turnover in Italy slid 2.4% in August, after a 2.3% gain in July.

The seasonally adjusted industrial new orders index dropped by 5.5% month-on-month in August.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Friday. France's preliminary manufacturing PMI rose to 50.7 in October from 50.6 in September, beating forecasts of a fall to 50.2.

France's preliminary services PMI increased to 52.3 in October from 51.9 in September. Analysts had expected the index to decline to 51.6.

"French private sector output growth firmed slightly in October, underpinned by rising activity across both services and manufacturing. The data point to modest growth momentum at the start of the final quarter, following a likely small rise in GDP during Q3," the Senior Economist at Markit Jack Kennedy said.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Friday. Germany's preliminary manufacturing PMI declined to 51.6 in October from 52.3 in September, in line with expectations.

Germany's preliminary services PMI was up to 55.2 in October from 54.1 in September. Analysts had expected index to decline to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by the services sector.

"October's PMI results paint a fairly passive picture of the health of the German private sector economy at the start of the final quarter of 2015. Companies signalled a slight acceleration of output growth and were able to secure new contracts despite raising their charges to the greatest extent in 21 months," he noted.

USD/JPY 119.50 (USD 467m) 120.00-05 (1.8bln)

EUR/USD 1.1000 (EUR 1.6bln) 1.1100 (1.2bln) 1.1250 (600m) 1.1275 (400m) 1.1300 (500m) 1.1350-60 (830m)

USD/CHF 0.9460 (USD 430m)

USD/CAD 1.3000 (USD 608m) 1.3060 (250m) 1.3200 (395m)

AUD/USD 0.7180 (AUD 290m) 0.7200 (367m) 0.7300 (300m)

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI remained unchanged 52.0 in October, beating expectations for a decline to 51.7.

Eurozone's preliminary services PMI rose to 54.2 in October from 53.7 in September. Analysts had expected the index to decrease to 53.5.

Markit's Chief Economist Chris Williamson said that Eurozone's economy "picked up some momentum in October".

"The PMI remains at a level signalling a modest 0.4% quarterly rise in GDP, suggesting the region will struggle to attain more than 1.5% overall growth in 2015. The rate of job creation, although on the rise, remains insufficient to make serious headway into reducing unemployment," he added.

Ratings agency Fitch Ratings said in its report on Thursday that emerging economies pose risk to the global economy. The agency added that the slowdown in emerging economies was driven by a drop in commodity prices and political shocks.

The interest rate hike by the Fed will put more pressure on emerging economies, Fitch noted.

"Latin American countries, notably Brazil, also face headwinds challenges, but mainly due to weakening fundamentals rather than through high levels of unhedged US dollar funding," the agency said.

The German Chambers of Commerce (DIHK) said in its survey on Thursday that the German economy will expand at lower pace than forecasted by the government. DIHK expect the economy to grow 1.7% in 2015, down from its previous estimate of 1.8%, and 1.3% in 2016.

The German government forecasted the country's economy to expand 1.7% in 2015 and 1.8% in 2016.

The weak growth in emerging economies is a risk to the German economy, according to DIHK.

"Several emerging markets, such as in South America, are weakening. Heavyweight China is entering a notable weaker growth path. The robust performance in the U.S. and Europe is supporting German export business, but can only partly compensate for their negative development," DIHK said.

Chinese Premier Li Keqiang said during a meeting with former U.S. treasury secretary Henry Paulson in Beijing on Thursday that there is no basis for long-term depreciation of the yuan.

Li also said that the country implemented measures to deal with unusual capital market fluctuations.

"We will continue to boost reform and institutional construction, fostering an open, transparent, stable and healthy multiple-level capital market," he said.

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan climbed to 52.5 in October from 51.0 in September, beating expectations for a decline to 50.6.

A reading below 50 indicates contraction of activity.

The index was partly driven by a rise in output and new orders.

"Latest survey data indicated a marked improvement in operating conditions at Japanese manufacturers. Production increased at the joint-sharpest rate since February and was marked in the context of historical data," economist at Markit, Amy Brownbill, said.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 42 in October from 44.5 in September. The decline was driven by a slower pace of job creation.

39% of respondents said that the U.S. economy was getting worse, while 23% of respondents noted that the economy was improving.

On a weekly basis, consumers' expectations for U.S. economy decreased to 43.5 in in the week ended October 18 from 45.2 the prior week. The decline was driven by a worse sentiment on spending.

The measure of views of the economy was little changed.

The buying climate index fell to 37.2 from 39.5.

The personal finances index was down to 58.4 from 60.5.

West Texas Intermediate futures for December delivery climbed to $45.58 (+0.44%), while Brent crude rose to $48.47 (+.81%) amid favorable economic data and gains in stock markets around the globe.

Market participants are waiting for the latest U.S. rig count data and preliminary PMI data for the euro zone and the U.S. to assess production and demand.

Gold climbed to $1,169.30 (+0.27%) on Friday, but a relatively strong dollar and strong economic data intensified expectations for an imminent rate hike by the Federal Reserve thus limiting bullion's growth.

Physical demand failed to support the precious metal. Retailers in India (world's second biggest consumer) sold gold at reduced prices even during the festival season. Dealers were offering a discount of $8 to $12 an ounce this week, compared to $7 to $11 in the previous week.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1296 (2198)

$1.1234 (730)

$1.1189 (819)

Price at time of writing this review: $1.1105

Support levels (open interest**, contracts):

$1.1071 (2343)

$1.1054 (5242)

$1.1033 (3174)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 39859 contracts, with the maximum number of contracts with strike price $1,1500 (3307);

- Overall open interest on the PUT options with the expiration date November, 6 is 51088 contracts, with the maximum number of contracts with strike price $1,1200 (5242);

- The ratio of PUT/CALL was 1.28 versus 1.28 from the previous trading day according to data from October, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.5701 (835)

$1.5602 (1232)

$1.5505 (2287)

Price at time of writing this review: $1.5407

Support levels (open interest**, contracts):

$1.5294 (2813)

$1.5197 (2942)

$1.5098 (1749)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 20678 contracts, with the maximum number of contracts with strike price $1,5350 (2600);

- Overall open interest on the PUT options with the expiration date November, 6 is 20924 contracts, with the maximum number of contracts with strike price $1,5200 (2942);

- The ratio of PUT/CALL was 1.01 versus 1.01 from the previous trading day according to data from October, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

U.S. stock indices rose on Thursday amid better-than-expected earnings reports and hints at more stimulus from European Central Bank President Mario Draghi.

The Dow Jones Industrial Average rose 320.55, or 1.9%, to 17,489.16. The S&P 500 rose 33.57 points, or 1.7%, to 2,052.51 (nevertheless its health-care sector fell 0.5%). The Nasdaq Composite Index gained 77.55, or 1.6%, to 4,917.67.

Shares of eBay rose by about 14% on better-than-expected earnings.

The number of initial jobless claims in the U.S. rose by 3000 to 259,000 on a seasonally adjusted basis in the week ending October 17. The indicator is still at a historically low level.

Meanwhile the leading index for the U.S. economy released by the Conference Board declined by 0.2% in September to 123.3 (2010 = 100). The coincident index rose by 0.2% to 112.8.

This morning in Asia Hong Kong Hang Seng rose 1.34%, or 306.61, or 23,151.98. China Shanghai Composite Index climbed 0.02%, or 0.69, to 3.369.43. The Nikkei gained 2.12%, or 390.06, to 18,825.93.

Asian indices rose following growth in U.S. stocks, which was triggered by ECB President's comments. Mario Draghi said the central bank will assess sufficiency of stimulus measures at the next meeting in December.

Japanese Manufacturing PMI from Nomura/JMMA rose to 52.5 in October (the best result in 18 months) from 51.00 reported previously. Economists had expected a reading of 50.6.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Preliminary) October 51 50.6 52.5

05:00 Japan Coincident Index (Finally) August 113.1 112.2

05:00 Japan Leading Economic Index (Finally) August 105 103.5

The euro rose on comments by European Central Bank President Mario Draghi. The EUR/USD pair is trading above Thursday close level, which can be explained by profit taking. Yesterday the ECB decided to keep its benchmark rate at 0.05%, where it had been over a year. The deposit rate was left at -0.2%. ECB President Draghi said that the central bank will assess sufficiency of current stimulus measures at the next meeting in December.

The yen rose on Japanese manufacturing activity data from Nomura/JMMA. The corresponding PMI rose to 52.5 in October vs 51.00 reported previously and 50.6 expected. This is the highest reading in 18 months.

The Australian dollar rose amid upbeat data on China's real estate market. An average price of a new home in China rose by 0.2% m/m in September compared to +0.1% in August. Prices rose in 39 towns out of 70. Prices in Beijing rose by 4.7%, while prices in Shanghai advanced by 8.3%.

EUR/USD: the pair fluctuated within $1.1070-20 in Asian trade

USD/JPY: the pair traded within Y120.60-00

GBP/USD: the pair rose to $1.5415

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 France Services PMI (Preliminary) October 51.9 51.6

07:00 France Manufacturing PMI (Preliminary) October 50.6 50.2

07:30 Germany Manufacturing PMI (Preliminary) October 52.3 51.6

07:30 Germany Services PMI (Preliminary) October 54.1 53.9

08:00 Eurozone Services PMI (Preliminary) October 53.7 53.5

08:00 Eurozone Manufacturing PMI (Preliminary) October 52 51.7

12:30 Canada Consumer Price Index m / m September 0.0% -0.1%

12:30 Canada Consumer price index, y/y September 1.3% 1.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September 2.1% 2.1%

13:00 Belgium Business Climate October -6.8

13:45 U.S. Manufacturing PMI (Preliminary) October 53.1 52.8

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.