- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 25-11-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Private Capital Expenditure | Quarter III | -5.9% | -1.5% |

| 05:00 (GMT) | Japan | Coincident Index | September | 79.4 | 80.8 |

| 05:00 (GMT) | Japan | Leading Economic Index | September | 88.5 | 92.9 |

| 07:00 (GMT) | Germany | Gfk Consumer Confidence Survey | December | -3.1 | -5 |

| 07:45 (GMT) | France | Consumer confidence | November | 94 | 92 |

| 09:00 (GMT) | Eurozone | Private Loans, Y/Y | October | 3.1% | |

| 09:00 (GMT) | Eurozone | M3 money supply, adjusted y/y | October | 10.4% | 10.4% |

| 12:30 (GMT) | Eurozone | ECB Monetary Policy Meeting Accounts | |||

| 23:30 (GMT) | Japan | Tokyo Consumer Price Index, y/y | November | -0.3% | |

| 23:30 (GMT) | Japan | Tokyo CPI ex Fresh Food, y/y | November | -0.5% | -0.7% |

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories

decreased by 0.745 million barrels in the week ended November 20. Economists

had forecast a build of 0.127 million barrels.

At the same

time, gasoline stocks rose by 2.200 million barrels, while analysts had

expected a gain of 0.614 million barrels. Distillate stocks fell by 1.400

million barrels, while analysts had forecast a decrease of 1.586 million

barrels.

Meanwhile, oil

production in the U.S. increased by 100,000 barrels a day to 11.000 million

barrels a day.

U.S. crude oil

imports averaged 5.2 million barrels per day last week, down by 26,000 barrels per

day from the previous week.

The U.S.

Commerce Department announced on Wednesday that the sales of new single-family

homes fell 0.3 percent m-o-m to a seasonally adjusted annual rate of 999,000

units in October.

Economists had

forecast the sales pace of 970,000 last month.

September’s

sales pace was revised up to 1,002,000 units from the originally reported 959,000

units.

According to

the report, new home sales in the South, the largest area, declined 2.0 percent

m-o-m in October and sales in the West decreased 1.7 percent m-o-m. Meanwhile, sales

in the Midwest surged 11.2 percent m-o-m and sales in the Northeast increased

5.1 percent m-o-m.

The Commerce

Department reported on Wednesday that consumer spending in the U.S. rose 0.5 percent

m-o-m in October after a revised 1.2 percent m-o-m increase in September (originally

a 1.4 percent m-o-m gain). Economists had forecast the reading to show a 0.4

percent m-o-m advance.

Meanwhile,

consumer income decreased 0.7 percent m-o-m in October, following a revised 0.7

percent m-o-m gain in the previous month (originally a 0.9 percent m-o-m growth). Economists

had forecast no change m-o-m.

The October drop

in personal income reflected a decrease in government social benefits that was

partly offset by gains in compensation and proprietors’ income (led by farm).

The personal

consumption expenditures (PCE) price index, excluding the volatile categories

of food and energy, which is the Fed's preferred inflation measure, was

unchanged m-o-m in October, following an unrevised 0.2 percent m-o-m increase

in the prior month.

Economists had projected the index would be flat m-o-m.

In the 12 months through October, the core PCE

increased 1.4 percent, following a revised 1.6 percent climb in the 12 months

through September (originally a 1.5 percent climb). Economists had forecast an

advance of 1.4 percent y-o-y.

The final

reading for the November Reuters/Michigan index of consumer sentiment came in

at 76.9 compared to a preliminary reading of 77.0 and the October final reading

of 81.8. This was the lowest reading since August.

Economists had

forecast the index to remain unrevised at 77.0.

According to

the report, the index of consumer expectations plunged 11.0 percent m-o-m to 70.5

from October’s final reading of 79.2, while the index of the current economic

conditions rose 1.3 percent m-o-m to 87.0 from October’s final reading of 85.9.

“…the November

data were less optimistic than last month due to the resurgence in covid

infections and deaths as well as partisan shifts due to the outcome of the

presidential election)”, noted Richard Curtin, the Surveys of Consumers chief

economist.

U.S. stock-index futures were little changed on Wednesday, as market participants digested a raft of U.S. economic data and prepared for Thanksgiving holiday.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 26,296.86 | +131.27 | +0.50% |

Hang Seng | 26,669.75 | +81.55 | +0.31% |

Shanghai | 3,362.33 | -40.50 | -1.19% |

S&P/ASX | 6,683.30 | +39.20 | +0.59% |

FTSE | 6,394.48 | -37.69 | -0.59% |

CAC | 5,552.38 | -6.04 | -0.11% |

DAX | 13,276.21 | -16.23 | -0.12% |

Crude oil | $45.27 | +0.80% | |

Gold | $1,813.30 | +0.48% |

FXStreet reports that Brent Crude Oil is gaining upward momentum after having been rangebound for months and strategists at Credit Suisse see scope for strength to extend towards $60 should the market see a weekly close above the $46.53 August high.

“Brent Crude has pushed strongly higher after holding the 38.2% retracement of the whole April/September upmove at $34.86 and is now pushing above its $46.53 August high. A weekly close above here would resolve the May-November range higher, with resistance seen next at the 61.8% retracement of the Q1 fall at $50.45, ahead of $55.88 and then the 78.6% retracement and February 2020 high at $59.82/60.00.”

“Whilst we would expect the $60.00 mark to prove a tougher barrier, should strength directly extend, this can expose the $71.75 high for the year.”

“Support at $42.63 now ideally holds to keep the immediate risk higher."

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 175.49 | -1.59(-0.90%) | 2291 |

ALCOA INC. | AA | 20.62 | -0.20(-0.96%) | 30164 |

ALTRIA GROUP INC. | MO | 41.1 | 0.10(0.24%) | 14948 |

Amazon.com Inc., NASDAQ | AMZN | 3,142.00 | 23.94(0.77%) | 62977 |

American Express Co | AXP | 120.19 | -0.20(-0.17%) | 6414 |

AMERICAN INTERNATIONAL GROUP | AIG | 40.71 | -0.27(-0.66%) | 847 |

Apple Inc. | AAPL | 115.2 | 0.03(0.03%) | 934475 |

AT&T Inc | T | 29.28 | 0.05(0.17%) | 113806 |

Boeing Co | BA | 216.5 | -1.99(-0.91%) | 289466 |

Caterpillar Inc | CAT | 177.15 | 0.25(0.14%) | 5431 |

Chevron Corp | CVX | 94.84 | -0.78(-0.82%) | 61860 |

Cisco Systems Inc | CSCO | 42.81 | 0.20(0.47%) | 61220 |

Citigroup Inc., NYSE | C | 56.3 | -0.76(-1.33%) | 200468 |

Deere & Company, NYSE | DE | 269.5 | 7.99(3.06%) | 43950 |

E. I. du Pont de Nemours and Co | DD | 66 | 0.16(0.24%) | 4834 |

Exxon Mobil Corp | XOM | 41.55 | -0.43(-1.02%) | 252160 |

Facebook, Inc. | FB | 278 | 1.08(0.39%) | 105733 |

FedEx Corporation, NYSE | FDX | 294 | 2.32(0.80%) | 13359 |

Ford Motor Co. | F | 9.26 | -0.19(-2.01%) | 849857 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 23.06 | -0.05(-0.22%) | 125093 |

General Electric Co | GE | 10.55 | 0.10(0.96%) | 1542400 |

General Motors Company, NYSE | GM | 46.03 | -0.43(-0.93%) | 1162984 |

Goldman Sachs | GS | 236.04 | -1.46(-0.61%) | 11707 |

Google Inc. | GOOG | 1,772.00 | 3.12(0.18%) | 10509 |

Hewlett-Packard Co. | HPQ | 22.87 | 1.12(5.15%) | 132523 |

Home Depot Inc | HD | 274 | 0.69(0.25%) | 3970 |

Intel Corp | INTC | 47.2 | 0.19(0.40%) | 111403 |

International Business Machines Co... | IBM | 124 | -0.42(-0.34%) | 8966 |

International Paper Company | IP | 51.97 | 0.10(0.19%) | 458 |

Johnson & Johnson | JNJ | 144.1 | 0.23(0.16%) | 11446 |

JPMorgan Chase and Co | JPM | 121.8 | -1.52(-1.23%) | 72730 |

Merck & Co Inc | MRK | 80.34 | 0.20(0.25%) | 10881 |

Microsoft Corp | MSFT | 214.71 | 0.85(0.40%) | 135550 |

Nike | NKE | 134.45 | -0.25(-0.19%) | 3657 |

Pfizer Inc | PFE | 36.47 | -0.13(-0.36%) | 347542 |

Procter & Gamble Co | PG | 138.3 | -0.01(-0.01%) | 3528 |

Starbucks Corporation, NASDAQ | SBUX | 98.44 | 0.14(0.14%) | 5882 |

Tesla Motors, Inc., NASDAQ | TSLA | 543.73 | -11.65(-2.10%) | 2273424 |

The Coca-Cola Co | KO | 53.24 | 0.02(0.04%) | 16734 |

Twitter, Inc., NYSE | TWTR | 44.95 | -0.28(-0.62%) | 36915 |

UnitedHealth Group Inc | UNH | 337.2 | 1.19(0.35%) | 906 |

Verizon Communications Inc | VZ | 60.56 | -0.08(-0.13%) | 2435 |

Visa | V | 209.01 | -0.67(-0.32%) | 12628 |

Walt Disney Co | DIS | 150.5 | -0.99(-0.65%) | 51409 |

Yandex N.V., NASDAQ | YNDX | 64.68 | -0.70(-1.07%) | 15935 |

The U.S.

Commerce Department reported on Wednesday that the durable goods orders rose 1.3

percent m-o-m in October, following a revised 2.1 percent m-o-m jump in September

(originally a 1.9 percent m-o-m increase).

Economists had

forecast a 0.9 percent m-o-m gain.

According to

the report, orders for durable goods excluding transportation also increased 1.3

percent m-o-m in October, following a revised 1.5 percent m-o-m advance in October

(originally a gain of 0.8 percent m-o-m), beating economists’ forecast of 0.5

percent m-o-m rise.

Meanwhile,

orders for non-defense capital goods excluding aircraft, a closely watched

proxy for business spending plans, increased 0.7 percent m-o-m in October after

a revised 1.9 percent climb m-o-m in September (originally a 1.0 percent m-o-m

gain). Economists had called for a 0.5 percent m-o-m advance in core capital

goods orders in October.

Shipments of

these core capital goods surged 2.3 percent m-o-m in October after a revised 0.7

percent m-o-m increase in the prior month (originally a 0.5 percent m-o-m advance).

A report from

the Commerce Department showed on Wednesday that the U.S. economy expanded as

initially estimated in the third quarter of 2020, as upward revisions to

nonresidential fixed investment, residential investment, and exports were

offset by downward revisions to state and local government spending, private

inventory investment, and personal consumption expenditures (PCE). At the same

time, imports, which are a subtraction in the calculation of GDP, were revised

up.

According to the

“second” estimate, the U.S. gross domestic product (GDP) grew at an annual rate

of 33.1 percent in the third quarter, as it was reported in the “advance”

estimate. This was the biggest expansion ever.

Economists had

expected the contraction rate to be revised up to 33.2 percent.

In the second

quarter, the economy plunged by record 31.4 percent q-o-q.

The increase in

real GDP reflected advances in PCE, private inventory investment, exports,

nonresidential fixed investment, and residential fixed investment, which,

however, were partly offset by declines in federal government spending

(reflecting fewer fees paid to administer the Paycheck Protection Program

loans) and state and local government spending. Imports, which are a

subtraction in the calculation of GDP, rose.

The data from

the Labor Department revealed on Wednesday the number of applications for

unemployment unexpectedly increased last week, as the U.S. labor market is

struggling to recover from its biggest shock in history, caused by the COVID-19

pandemic.

According to

the report, the initial claims for unemployment benefits rose by 30,000 to 778,000

for the week ended November 21. This marked the second straight rise in weekly

initial claims since the week ended October 11.

Economists had

expected 730,000 new claims last week.

Claims for the

prior week were revised upwardly to 748,000 from the initial estimate of 742,000.

Meanwhile, the

four-week moving average of claims rose to 748,500 from an upwardly revised 743,500

in the previous week.

Continuing

claims declined to 6,071,000 million from a downwardly revised 6,370,000 in the

previous week.

USD traded flat and mixed against its major rivals in the European session on Wednesday after recent declines, caused by news about progress on the coronavirus vaccine front and Biden's transition to the White House, as well as hopes for more fiscal stimulus, which increased after media reports that former Fed chair Janet Yellen would be nominated for U.S. Treasury secretary. Favorable news bolstered investors' risk appetite and maintained 2021 recovery optimism.

The U.S. Dollar Index (DXY), measuring the U.S. currency's value relative to a basket of foreign currencies, edged down 0.06% to 92.17.

Market participants are awaiting the release of a raft of U.S. economic data, including weekly jobless claims, revised Q3 GDP data and consumer income/spending statistics for October. Later, the FOMC will release the minutes from its November meeting.

- We want to make practical arrangements to help businesses in Northern Ireland

- ECB currently calibrating different stimulus options

- ECB will consider oil price, vaccine in December decision

- News of vaccine bolstered sentiment

- The goal is to keep credit flowing

- Our position on fisheries hasn't changed

Dell (DELL) reported Q3 FY 2020 earnings of $2.03 per share (versus $1.75 per share in Q3 FY 2019), beating analysts’ consensus estimate of $1.42 per share.

The company’s quarterly revenues amounted to $23.500 bln (+2.9% y/y), beating analysts’ consensus estimate of $21.880 bln.

DELL rose to $70.95 (+0.88%) in pre-market trading.

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. surged 3.9 percent in the week ended November 20, following a 0.3

percent decrease in the previous week.

According to

the report, refinance applications climbed 4.5 percent, while applications to purchase

a home rose 3.5 percent.

Meanwhile, the

average fixed 30-year mortgage rate fell from 2.99 percent to a survey low of 2.92

percent.

“Weekly

mortgage rate volatility has emerged again, as markets respond to fiscal policy

uncertainty and a resurgence in Covid-19 cases around the country,” noted Joel

Kan, MBA’s associate vice president of industry and economic forecasting.

HP (HPQ) reported Q4 FY 2020 earnings of $0.62 per share (versus $0.60 per share in Q4 FY 2019), beating analysts’ consensus estimate of $0.52 per share.

The company’s quarterly revenues amounted to $15.258 bln (-1.0% y/y), beating analysts’ consensus estimate of $14.709 bln.

The company also issued upside guidance for Q1 FY 2021, projecting EPS of $0.64-0.70 versus analysts’ consensus estimate of $0.57.

HP increased quarterly dividends to $0.1938/share from $0.1762/share.

HPQ rose to $22.48 (+3.36%) in pre-market trading.

Deere (DE) reported Q4 FY 2020 earnings of $2.39 per share (versus $2.14 per share in Q4 FY 2019), beating analysts’ consensus estimate of $1.45 per share.

The company’s quarterly revenues amounted to $8.659 bln (-0.5% y/y), beating analysts’ consensus estimate of $7.623 bln.

DE was flat at $261.51 (0.00%) in pre-market trading.

FXStreet reports that the US dollar suffered again on Tuesday with investor optimism lingering. Economists at MUFG Bank believe the risk appetite can persist and, subsequently, expect the CHF to underperform while the NOK, the CAD, the GBP and the EUR could catch-up in coming days due to different reasons.

“NOK, CAD (oil-related) and GBP (Brexit) are the three worst performing G10 currencies on a year-to-date basis but given our bullish oil price view and given the likelihood of a UK-EU trade deal in the coming days, we see scope for these underperformers to play catch-up.”

“The Swiss franc is the second best performing currency and if this level of risk appetite persists, is likely to underperform further.”

FXStreet reports that silver (XAG/USD) has rallied to and failed at the three-month downtrend at 25.49 and is now eroding its six-week support line. Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, is unable to rule out losses to the 200-day ma at 20.53 but 21.64/63 should as decent support.

“Silver remains negative while contained by the three-month downtrend at 25.49. It has started to erode a six-week support line and near-term risks remain on the downside.”

“We would allow for a retest of the 21.64 September low 21.63, the July 2014 high. The 21.40 2008 peak guard the 200-day ma at 20.53, where we would look for signs of stabilisation, if seen.”

“Initial support lies at 22.59, the low from end of October.”

FXStreet reports that gold overall trend is still up, and strategists at CIBC are forecasting an even stronger performance in 2021 to $2300/oz.

“Governments are under pressure to continue pumping money into the system to fend off further balance sheet pressures. We have yet to see the long-term fallout for the stimulus to date and yet more stimulus is expected”

“We forecast real rates, the primary driver for gold prices, to remain under pressure for the next several years as governments tackle heavy debt loads and focus on reducing unemployment numbers. The US Fed Reserve will likely reiterate a ‘lower for longer outlook’ particularly in light of the global economic backdrop, which we continue to view as positive for gold.”

“Our gold price forecast now stands at $2,300/$2,200/$2,100/$2,000 per oz for 2021/2022/2023/2024, spot prices of $1875/oz.”

RTTNews reports that Japan's government maintained its economic assessment but downgraded its view on capital spending.

The Cabinet Office said Japanese economy is still in a severe situation due to the Novel Coronavirus, but it is showing movements of picking up.

Downgrading its assessment of business investment, the government said investment is decreasing recently. In October report, the cabinet office said business investment is showing weakness.

The government repeated that private consumption is picking up. Also, the government retained its view on exports and industrial production. Both exports and industrial production are picking up, the cabinet office added.

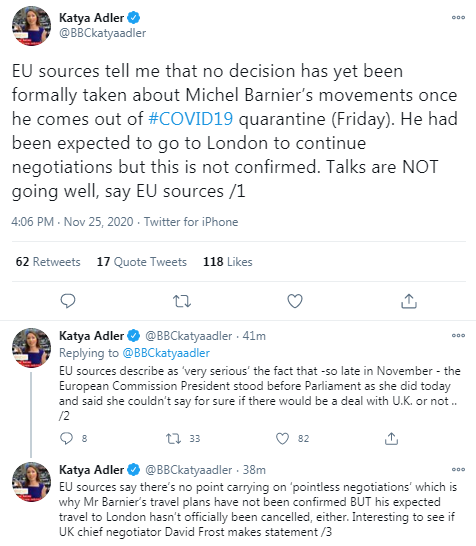

Reuters reports that the head of the European Union's executive reported "genuine progress" in Brexit talks but said the risk of Britain leaving the EU without a deal on Dec. 31 remained, an outcome she said the bloc was prepared for.

"The next days are going to be decisive," European Commission president Ursula von der Leyen told the European Parliament. "The European Union is well prepared for a no-deal-scenario, but of course we prefer to have an agreement."

"With very little time ahead of us, we will do all in our power to reach an agreement. We are ready to be creative. But we are not ready to put into question the integrity of our single market," she said.

Negotiators have agreed the outline of a new partnership treaty on goods and services, as well as on transport, she said.

FXStreet reports that Quek Ser Leang at UOB Group’s reviews the outlook for the US Dollar Index (DXY).

“We highlighted that ‘USD Index is in a consolidation phase’ and we held the view that it ‘could trade within September’s range of 91.75/94.74 for a period of time’. While our view was not wrong as USD Index traded within September’s range for the past one month or so, it is currently approaching the bottom of the range at 91.75. This level is not only the low in September but it is also close to the bottom of the monthly Ichimoku cloud. The bottom of the cloud offers solid support as can be seen back in 2018 when USD Index rebounded after failing to break below the cloud.”

“On top of that, the rising trend-line connecting the lows of 2011 and 2014 also sits near 91.75. In other words, 91.75 is a key long-term support and a break of such a critical level could potentially lead to a sharp and rapid drop,”

CNBC reports that according to Credit Suisse, China’s equity and bond markets are set to give investors progressively greater opportunities in 2021.

Chinese markets offer “high rates of growth at still attractive valuations,” the Credit Suisse said in its 2021 outlook report. The world’s second-largest economy is predicted to be one of the few countries to register a positive GDP figure this year after bringing the coronavirus outbreak relatively under control.

Credit Suisse predicted China will record 2.2% growth for 2020, followed by a sharp jump to 7.1% in 2021.

One of the main growth areas in China’s markets is the technology sector, according to Ray Farris, chief investment officer for South Asia at Credit Suisse. China is “one of the few economies that has a credible and rapidly growing tech sector,” Farris said.

FXStreet reports that economists at UBS recommend investors diversify for the next leg, hunt for yield and position for a weaker dollar in 2021.

“We expect equity markets to continue moving higher in 2021, but think some of 2020's laggards will 'catch up'. We think 2021 will be about going cyclical, small, and global as the sectors and markets most heavily affected by lockdowns start to revive. US stocks, particularly large caps, will start to underperform other markets at some stage in the coming year.”

“We expect interest rates on cash and bond yields to stay at very low levels for the foreseeable future. This makes it harder to find income and investors will need to consider being more active or finding alternative means of earning income. We think investors can still find positive real returns in emerging market USD-denominated sovereign bonds, Asian high yield and bonds in the ‘crossover zone’ between investment grade and high yield, globally.”

FXStreet reports that economists at Westpac see potential for further NZD/USD gains above 0.7000 over the next few days.

“The NZD/USD rally has been given fresh energy, the Finance Minister’s intervention in the RBNZ’s remit (proposing to include a house price clause) interpreted by the market as potentially lessening the need for further easing.”

“Multi-month, we expect risk sentiment to remain elevated into year-end, supported by unprecedented global central bank and government stimulus, and the USD to remain in a downtrend. In addition, the NZ economy’s performance since covid has been impressive, providing fundamental support for NZD outperformance.”

Reuters reports that Bank of England (BoE) policymaker Michael Saunders said the long-term effects of Brexit could have a bigger impact on companies than the coronavirus pandemic.

"Businesses will shake off the effect of COVID-19 as they're temporary, but the long-term effects of Brexit could be more permanent," Saunders said.

BoE Governor Andrew Bailey said on Monday that a no-deal Brexit would cause longer-term damage to Britain's economy than the pandemic, and the impact of the change might be felt for decades.

Saunders also said Britain's economy was unlikely to fall into a recession.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | Construction Work Done | Quarter III | -0.3% | -2% | -2.6% |

During today's Asian trading, the US dollar consolidated against the euro and rose against the yen. However, the ICE index, which tracks the dynamics of the US dollar against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), is declining amid growing risk appetite on news about coronavirus vaccines and the beginning of the transfer of power in the US.

Earlier, CNN reported that the General services Administration (GSA) of the United States has established that Joe Biden is the winner of the presidential election. According to a letter from GSA chief Emily Murphy, the White house is ready to officially begin the process of transferring power.

In addition, according to media reports, Joe Biden plans to nominate former Fed chair Janet Yellen for the post of Treasury Secretary. "The long - term consequences of Yellen's nomination are definitely negative for the US dollar," said John Hardy, chief currency strategist at Saxo Bank. He recalled that "for four years in his post (head of the Fed) it almost always leaned in the "pigeon" side."

On Wednesday, investors expect the publication of US statistical data. The US Commerce Department will release revised data on changes in GDP in the third quarter, data on household income and spending in October, and new home sales last month.

Meanwhile, the country's Labor Department is releasing statistics on the number of Americans who first applied for unemployment benefits last week. The University of Michigan will publish the final value of the US consumer confidence index for November.

The Australian dollar moved lower after reaching its highest since early September against the US dollar earlier in trading.

FXStreet reports that FX Strategists at UOB Group said that cable looks firm and could advance to the area past 1.3400.

Next 1-3 weeks: “We have held a positive view in GBP since last Tuesday. In our latest narrative from yesterday (23 Nov), we indicated that ‘upward momentum has improved and a break of 1.3322 would shift the focus to 1.3360 (followed by 1.3400)’. That said, we did not anticipate the sped-up price actions as GBP blew past 1.3322 and 1.3360 and hit a high of 1.3396. The advance was however short-lived as GBP plummeted from the high (overnight low of 1.3265). Despite the set-back, it is too soon to call for a short-term top. As long as 1.3200 is intact (no change in ‘strong support’ level), there is a chance, albeit not a high one, for GBP to push above 1.3400. However, overbought shorter-term conditions could lead to a couple of days of consolidation first. Looking forward, the next resistance level of note above 1.3400 is at the year-to-date high of 1.3481.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1973 (1402)

$1.1941 (4222)

$1.1918 (2031)

Price at time of writing this review: $1.1900

Support levels (open interest**, contracts):

$1.1846 (135)

$1.1820 (1074)

$1.1785 (2429)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 4 is 103118 contracts (according to data from November, 24) with the maximum number of contracts with strike price $1,1200 (6560);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3467 (1464)

$1.3441 (1249)

$1.3403 (1635)

Price at time of writing this review: $1.3364

Support levels (open interest**, contracts):

$1.3262 (1020)

$1.3200 (727)

$1.3123 (1269)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 23976 contracts, with the maximum number of contracts with strike price $1,3500 (2750);

- Overall open interest on the PUT options with the expiration date December, 4 is 40836 contracts, with the maximum number of contracts with strike price $1,2700 (11992);

- The ratio of PUT/CALL was 1.70 versus 1.71 from the previous trading day according to data from November, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

eFXdata reports that MUFG Research discusses the expectations around the December ECB policy meeting.

"The release of the PMI surveys from Europe painted a more downbeat picture. The negative impact on business sentiment from the renewed restrictions on activity over the winter period was more evident" MUFG notes.

"The weakness in the euro-zone PMI surveys highlights that it would currently benefit more from a weaker currency than the US economy. The ECB will be hoping that their plan to ease monetary policy at their next meeting on 10th December will at least help to dampen euro strength and prevent EUR/USD from breaking to the upside out the current trading range between 1.1600 and 1.2000," MUFG adds.

RTTNews reports that according to the report from Australian Bureau of Statistics, the total value of construction work done in Australia was down a seasonally adjusted 2.6 percent q/q in the third quarter of 2020, coming in at A$51.179 billion.

That missed expectations for a fall of 2.0 percent following the 0.7 percent decline in the previous three months.

On a yearly basis, the value of construction was down 4.2 percent.

Building work was down 2.0 percent on quarter and 7.2 percent on year at A$28.971 billion.

Residential work was down 1.0 percent on quarter and 8.9 percent on year, while non-residential work fell 3.4 percent on quarter and 4.5 percent on year.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 47.66 | 4.15 |

| Silver | 23.23 | -1.48 |

| Gold | 1807.533 | -1.63 |

| Palladium | 2343.78 | -0.08 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 638.22 | 26165.59 | 2.5 |

| Hang Seng | 102 | 26588.2 | 0.39 |

| KOSPI | 15.17 | 2617.76 | 0.58 |

| ASX 200 | 82.5 | 6644.1 | 1.26 |

| FTSE 100 | 98.33 | 6432.17 | 1.55 |

| CAC 40 | 66.27 | 5558.42 | 1.21 |

| Dow Jones | 454.97 | 30046.24 | 1.54 |

| S&P 500 | 57.82 | 3635.41 | 1.62 |

| NASDAQ Composite | 156.16 | 12036.79 | 1.31 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Construction Work Done | Quarter III | -0.7% | -2% |

| 09:00 (GMT) | Switzerland | Credit Suisse ZEW Survey (Expectations) | November | 2.3 | |

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | November | 6372 | 6020 |

| 13:30 (GMT) | U.S. | Goods Trade Balance, $ bln. | October | -79.37 | |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | November | 742 | 730 |

| 13:30 (GMT) | U.S. | PCE price index ex food, energy, q/q | Quarter III | -0.8% | 3.5% |

| 13:30 (GMT) | U.S. | PCE price index, q/q | Quarter III | -1.6% | |

| 13:30 (GMT) | U.S. | Durable goods orders ex defense | October | 3.4% | |

| 13:30 (GMT) | U.S. | Durable Goods Orders ex Transportation | October | 0.8% | 0.5% |

| 13:30 (GMT) | U.S. | Durable Goods Orders | October | 1.9% | 0.9% |

| 13:30 (GMT) | U.S. | GDP, q/q | Quarter III | -31.4% | 33.2% |

| 14:00 (GMT) | Belgium | Business Climate | November | -8.5 | |

| 15:00 (GMT) | U.S. | Personal spending | October | 1.4% | 0.3% |

| 15:00 (GMT) | U.S. | New Home Sales | October | 0.959 | 0.97 |

| 15:00 (GMT) | U.S. | PCE price index ex food, energy, m/m | October | 0.2% | 0% |

| 15:00 (GMT) | U.S. | PCE price index ex food, energy, Y/Y | October | 1.5% | 1.4% |

| 15:00 (GMT) | U.S. | Personal Income, m/m | October | 0.9% | 0.1% |

| 15:00 (GMT) | U.S. | Reuters/Michigan Consumer Sentiment Index | November | 81.8 | 77 |

| 15:30 (GMT) | U.S. | Crude Oil Inventories | November | 0.768 | -0.333 |

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | November | 231 | |

| 19:00 (GMT) | U.S. | FOMC meeting minutes | |||

| 21:45 (GMT) | New Zealand | Trade Balance, mln | October | -1017 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.73606 | 1.02 |

| EURJPY | 124.184 | 0.35 |

| EURUSD | 1.18898 | 0.42 |

| GBPJPY | 139.535 | 0.21 |

| GBPUSD | 1.33597 | 0.28 |

| NZDUSD | 0.69777 | 0.81 |

| USDCAD | 1.29977 | -0.65 |

| USDCHF | 0.91111 | -0.12 |

| USDJPY | 104.44 | -0.07 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.