- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 27-01-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | National Australia Bank's Business Confidence | December | 1 | |

| 07:00 | Switzerland | Trade Balance | December | 2.2 | |

| 11:00 | United Kingdom | CBI retail sales volume balance | January | 3 | |

| 13:30 | U.S. | Durable goods orders ex defense | December | 0.8% | 0.5% |

| 13:30 | U.S. | Durable Goods Orders ex Transportation | December | 0% | 0.2% |

| 13:30 | U.S. | Durable Goods Orders | December | -2% | 0.5% |

| 14:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | November | 2.2% | 2.4% |

| 15:00 | U.S. | Richmond Fed Manufacturing Index | January | -5 | 9 |

| 15:00 | U.S. | Consumer confidence | January | 126.5 | 128 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | National Australia Bank's Business Confidence | December | 1 | |

| 07:00 | Switzerland | Trade Balance | December | 2.2 | |

| 11:00 | United Kingdom | CBI retail sales volume balance | January | 3 | |

| 13:30 | U.S. | Durable goods orders ex defense | December | 0.8% | 0.5% |

| 13:30 | U.S. | Durable Goods Orders ex Transportation | December | 0% | 0.2% |

| 13:30 | U.S. | Durable Goods Orders | December | -2% | 0.5% |

| 14:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | November | 2.2% | 2.4% |

| 15:00 | U.S. | Richmond Fed Manufacturing Index | January | -5 | 9 |

| 15:00 | U.S. | Consumer confidence | January | 126.5 | 128 |

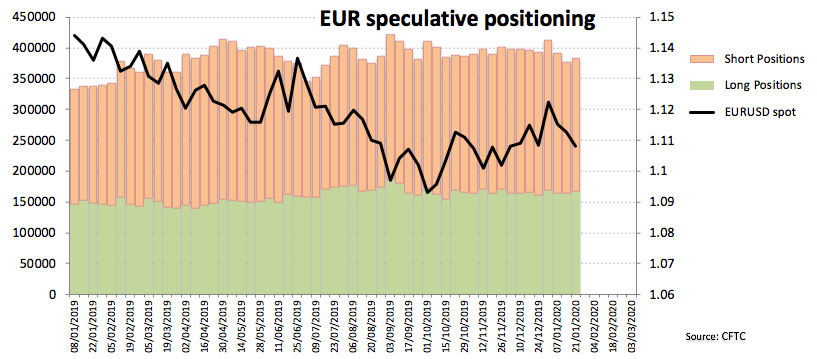

Francesco Pesole, an FX Strategist at ING, notes that the CFTC FX positioning data, covering the period 15-21 January, shows net sterling speculative positions at 13% of open interest, down 3.2% - after consistently rising since the end of November 2019.

"This measure has recently lost its correlation with spot movements in the pound, and speculation about a possible Bank of England rate cut at the 30 January meeting seems to have contributed to this dynamic. While talk of easing has limited the pound's upside, it has only marginally affected buying among speculators. Last week’s relatively marginal correction in positioning has done little to dent the view that speculative investors remain broadly sceptical about the possibility of a cut."

"We are not expecting a BoE move on Thursday, but the market is pricing an approximate 60% probability of a cut, despite the long-awaited PMI numbers on Friday beat expectations."

"Dollar speculative buying remains subdued in general, although EUR/USD net positioning appears to be stuck in a tight range again as low appetite for the common currency prevents it from taking advantage of USD selling. It must be noted that the data does not cover the European Central Bank meeting on Thursday 23 January, which triggered a drop in the pair."

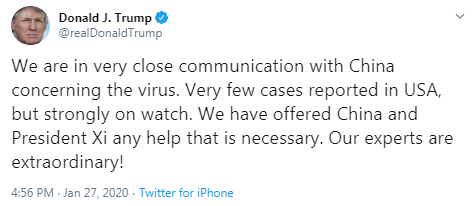

"The spread of the coronavirus and the related market fears had not hit speculative sentiment by the time the data was collected on Tuesday 21 January. Net positioning in the Japanese yen dropped for a second consecutive week, consolidating the currency’s role as the biggest G10 speculative short."

"Speculative buying on the Swiss franc kept rising in the week under analysis, which continues to indicate market appetite to test the SNB's limits for an intervention. Such appetite appears to be confirmed by the EUR/CHF response to the market-friendly news on Italian politics (ruling coalition winning key regional elections). This prompted a jump in Italian sovereign bonds, which are usually well correlated with the pair."

The U.S. Commerce Department announced on Monday that the sales of new single-family homes fell 0.4 percent m-o-m to a seasonally adjusted annual rate of 694, 000 units in December, the lowest since July.

Economists had forecast the sales pace of 730,000 last month.

November's sales pace was revised down to 697,000 units from the originally reported 719,000 units.

According to the report, the December drop in purchases of new homes was due to declines in the South (-15.4 percent m-o-m), the largest region, and the Northeast (-11.8 percent m-o-m), which, however, were partially offset by gains in the Midwest (+10.1 percent m-o-m) and West (+31.0 percent m-o-m).

For all of 2019, new home sales surged 10.3 percent to 681,000 units, the highest since 2006.

Carsten Brzeski, Chief Economist ING Germany, notes Germany’s most prominent leading indicator, the Ifo index, just started the new year with a disappointment, dropping for the first time since August last year. "In January, the Ifo index decreased to 95.9, from 96.3 in December. While the current assessment component strengthened somewhat, the expectations component fell after three consecutive increases."

"Today’s Ifo index illustrates that the German economy, particularly the manufacturing sector, is still searching for a bottom. Also, it is plateauing at low levels, still masking significant differences across sectors. While the service sector has already gone through a real rebound since the summer, the manufacturing sector still looks paralyzed, suffering from trade conflicts and the global manufacturing downturn. In Germany, the manufacturing slump goes beyond the automotive sector as all sectors, except for food and tobacco, are still in recessionary territory.

More promising PMI readings from last week and an Ifo index still searching for a lower bound suggest that the economy is currently bottoming out. However, this will not necessarily be followed by a strong rebound. In fact, at the current juncture, it is not at all clear what form the recovery will take from the alphabet soup of options."

"All in all, today’s Ifo index is a painful warning against premature optimism. The German economy is in a phase of bottoming out, which could come just in time to avoid more negative spillover effects from the manufacturing weakness to the labour market. However, for the time being, the economy remains stuck at the bottom."

FXStreet notуs the USD/CAD pair added to last week's positive move and gained some follow-through traction for the second consecutive session on Monday. The momentum lifted the pair to fresh monthly tops, with bulls now challenging the top end of monthly ascending trend-channel.

A sharp fall in crude oil prices – concerns over the outbreak of the deadly coronavirus – undermined demand for the commodity-linked currency – the loonie. This coupled with the prevailing risk-off mood benefitted the USD's perceived safe-haven status and remained supportive.

Meanwhile, technical indicators on maintained their bullish bias on short-term charts, albeit have moved on the verge of breaking into the overbought territory on hourly charts. This seemed to be the only factor holding traders from placing fresh bullish bets and might cap additional gains.

Having said that, sustained strength above the mentioned barrier might accelerate the momentum further towards the very important 200-day SMA, around the 1.3235 region. The pair then might aim towards testing the next major resistance near the 1.3265-70 supply zone.

On the flip side, immediate support is now pegged near mid-1.3100s (daily lows) and is closely followed by the 1.3125-20 horizontal zone. Failure to defend the mentioned support levels might now drag the pair back below the 1.3100 mark towards the 1.3070-60 resistance breakpoint turned support.

U.S. stock-index futures fell sharply on Monday amid worries about the impact of the coronavirus outbreak on the global economy.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 23,343.51 | -483.67 | -2.03% |

| Hang Seng | - | - | - |

| Shanghai | - | - | - |

| S&P/ASX | - | - | - |

| FTSE | 7,411.88 | -174.10 | -2.30% |

| CAC | 5,876.92 | -147.34 | -2.45% |

| DAX | 13,244.76 | -331.92 | -2.44% |

| Crude oil | $52.63 | | -2.88% |

| Gold | $1,582.10 | | +0.65% |

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 1,832.01 | -29.63(-1.59%) | 59420 |

| Google Inc. | GOOG | 1,436.30 | -30.41(-2.07%) | 17665 |

| 3M Co | MMM | 177.35 | -0.80(-0.45%) | 23627 |

| ALCOA INC. | AA | 15.13 | -0.38(-2.45%) | 181754 |

| ALTRIA GROUP INC. | MO | 49.7 | -0.55(-1.09%) | 6350 |

| American Express Co | AXP | 132.73 | -2.38(-1.76%) | 14311 |

| AMERICAN INTERNATIONAL GROUP | AIG | 50.09 | -0.97(-1.90%) | 2205 |

| Apple Inc. | AAPL | 311.43 | -6.88(-2.16%) | 789963 |

| AT&T Inc | T | 38.08 | -0.42(-1.09%) | 101757 |

| Boeing Co | BA | 317.85 | -5.20(-1.61%) | 90213 |

| Caterpillar Inc | CAT | 136.61 | -3.77(-2.69%) | 13958 |

| Chevron Corp | CVX | 110.01 | -1.84(-1.65%) | 19988 |

| Cisco Systems Inc | CSCO | 48.01 | -0.84(-1.72%) | 48243 |

| Citigroup Inc., NYSE | C | 76.36 | -2.06(-2.63%) | 20792 |

| Deere & Company, NYSE | DE | 166 | -4.12(-2.42%) | 4357 |

| E. I. du Pont de Nemours and Co | DD | 58.4 | -0.99(-1.67%) | 7394 |

| Exxon Mobil Corp | XOM | 65.36 | -0.96(-1.45%) | 2716648 |

| Facebook, Inc. | FB | 214.14 | -3.80(-1.74%) | 199608 |

| FedEx Corporation, NYSE | FDX | 150.4 | -3.67(-2.38%) | 7715 |

| Ford Motor Co. | F | 8.9 | -0.10(-1.11%) | 199239 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.36 | -0.48(-4.05%) | 173065 |

| General Electric Co | GE | 11.52 | -0.19(-1.62%) | 208128 |

| General Motors Company, NYSE | GM | 33.66 | -0.65(-1.89%) | 31962 |

| Goldman Sachs | GS | 236.61 | -5.31(-2.19%) | 9656 |

| Hewlett-Packard Co. | HPQ | 21.59 | -0.39(-1.77%) | 17183 |

| Home Depot Inc | HD | 228.21 | -3.79(-1.63%) | 8201 |

| HONEYWELL INTERNATIONAL INC. | HON | 174.5 | -2.63(-1.48%) | 4083 |

| Intel Corp | INTC | 66.95 | -1.52(-2.22%) | 422387 |

| International Business Machines Co... | IBM | 138.65 | -1.91(-1.36%) | 23346 |

| International Paper Company | IP | 43.21 | -0.32(-0.74%) | 606 |

| Johnson & Johnson | JNJ | 147.69 | -0.63(-0.42%) | 11368 |

| JPMorgan Chase and Co | JPM | 130.03 | -3.12(-2.34%) | 57712 |

| McDonald's Corp | MCD | 207.65 | -3.59(-1.70%) | 17795 |

| Merck & Co Inc | MRK | 85.48 | -0.50(-0.58%) | 6858 |

| Microsoft Corp | MSFT | 162.02 | -3.02(-1.83%) | 327297 |

| Nike | NKE | 99.3 | -2.73(-2.68%) | 31222 |

| Pfizer Inc | PFE | 39.5 | -0.32(-0.80%) | 39593 |

| Procter & Gamble Co | PG | 124.5 | -0.64(-0.51%) | 10750 |

| Starbucks Corporation, NASDAQ | SBUX | 89.41 | -2.62(-2.85%) | 45667 |

| Tesla Motors, Inc., NASDAQ | TSLA | 542.16 | -22.66(-4.01%) | 420671 |

| The Coca-Cola Co | KO | 57.43 | -0.25(-0.43%) | 13750 |

| Twitter, Inc., NYSE | TWTR | 32.4 | -0.79(-2.38%) | 170310 |

| United Technologies Corp | UTX | 150.93 | -2.26(-1.48%) | 133864 |

| UnitedHealth Group Inc | UNH | 287 | -5.81(-1.98%) | 8158 |

| Verizon Communications Inc | VZ | 60 | -0.28(-0.46%) | 26471 |

| Visa | V | 200.25 | -4.75(-2.32%) | 57872 |

| Wal-Mart Stores Inc | WMT | 113.34 | -1.03(-0.90%) | 13319 |

| Walt Disney Co | DIS | 136.46 | -3.62(-2.58%) | 113181 |

| Yandex N.V., NASDAQ | YNDX | 43.7 | -1.68(-3.70%) | 20577 |

Alphabet A (GOOGL) target raised to $1650 from $1450 at Mizuho

Netflix (NFLX) target raised to $350 from $325 at Citigroup; Neutral

Facebook (FB) target raised to $250 from $240 at Stifel

Amazon (AMZN) target raised to $2300 from $2100 at The Benchmark Company

Intel (INTC) downgraded to Market Perform from Outperform at Northland Capital; target $70

American Express (AXP) downgraded to Equal-Weight from Overweight at Stephens; target $144

FXStreet reports that фnalysts at Australia and New Zealand Banking Group (ANZ) provide a quick analysis of the PMI reports released last Friday on both sides of the Atlantic.

“UK January composite PMI rose to 52.4 from 49.3; manufacturing rose 49.8 from 47.5. Although the lift in UK PMI data is encouraging, inflation continues to drift away from target.

Euro area PMI data improved across the board with new orders and future output sub-indices picking up sharply, corroborating other surveys that reduced uncertainty is supporting the outlook. The composite PMI was unchanged at 50.9; manufacturing rose to 47.8 from 46.3. The German manufacturing PMI rose to 45.2 – the highest level since February 2019. All sub-components rose, with particular strength in forward indicators.

The US January composite PMI rose to 53.1, its highest level since April last year. Manufacturing was a touch softer at 51.7 from 52.4, while services picked up to 53.2 from 52.8. The vast majority of the US economy is performing well.”

That is slightly higher from the previous estimate of +1.0%

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:00 | Germany | IFO - Current Assessment | January | 98.8 | 99.2 | 99.1 |

| 09:00 | Germany | IFO - Expectations | January | 93.9 | 95 | 92.9 |

| 09:00 | Germany | IFO - Business Climate | January | 96.3 | 97 | 95.9 |

| 09:30 | United Kingdom | Mortgage Approvals | December | 44.058 | 46.815 |

JPY strengthed against most major counterparts in the European session, while HKD and AUD, as well as other commodity-linked currencies, weakened as demand for "safe havens" remains strong amid lingering worries about the impact of the coronavirus outbreak on the global economy.

A coronavirus outbreak that originated in Wuhan has killed at more than 80 people in China and infected nearly 2,800 people globally. China’s National Health Commission announced on Sunday the ability of the virus to spread was getting stronger. China’s government promised to extend the Lunar New Year holidays to help prevent and control the virus.

Elsewhere, GBP traded little changed against most major rivals after the release of the December data on U.K. mortgage approvals.

The report from UK Finance revealed that gross mortgage lending across the residential market in December 2019 was £22.2 billion, bringing the annual total for 2019 to £265.8 billion. Although annually 1.1 percent lower than in 2018, the last two years have broadly reflected the continuation of a stronger long term lending trend over recent years. An annual total of 982,286 mortgages were approved by the main high street banks during 2019, 7.4 percent more than in 2018. The full-year number of mortgages approved for home purchases were 8.0 percent higher, remortgage approvals were 7.9 percent higher and approvals for other secured borrowing were 3.0 percent higher than in 2018.

Market participants await the Bank of England's (BoE) decision on its interest rates later this week. While weak economic data and dovish remarks from the BoE's officials have triggered speculation that the bank could lower rates as its January 30 meeting, upbeat economic readings in recent days have cast doubt on that view. Markets see the odds of the rate cut as 50-50.

FXStreet reports that heading into the North-American session, analysts at TD Securities (TDS) provided key highlights of Monday's trading action and also offered a brief preview of the US new home sales data.

“Risk appetite remains under pressure as the newsflow surrounding the coronavirus outbreak continues to deteriorate, as we expected. Today's disappointing IFO reading has not helped matters, keeping EUR - and sentiment in general - under pressure. We think the recent EURUSD downtrend can extend a bit further toward the key 1.0980/90 pivot. A significant and sustained move below there puts us onto a more bearish near-term footing but that might be hard to achieve ahead of the week's key risk event, Wednesday's FOMC meeting.”

“Today's main data release will be US new home sales, however, markets are likely to be focusing on coronavirus developments. We expect new home sales to end 2019 on a strong note, rising to 735k in Dec from 730k in Nov. If realized, this would be the highest level for new home sales since 2007 and would continue to add to the positive momentum in housing activity.”

FXStreet provides main highlights from the latest CFTC Positioning Report for the week ended on January 21st.

- Speculators dragged the net shorts in EUR to the lowest level since early August 2019 at more than 47K contracts. Renewed optimism on the region's fundamentals and the perception that the ECB will remain 'on hold' in the next months have been supporting the single currency as of late.

- Net shorts in AUD continued to retreat, reaching the lowest level since mid-June 2018, always on the back of the upbeat sentiment following the US-China trade agreement ('Phase 1') and also supported by positive results from the domestic docket.

- CHF moved to the positive territory for the first time since late December 2016. The speculative community is now long the Swiss franc after Switzerland has returned to the FX monitoring list elaborated by the US Treasury.

- David Frost to lead UK's team on future relationship talks

- Tim Barrow will become UK's ambassador to EU

- Urges markets to not overreact to the possible impact of the coronavirus on oil demand

- Notes that oil market is driven by "psychological factors"

- Adds that he is confident in China and international community's ability to bring the outbreak under control

- Very challenging to reach a trade deal with UK by end of the year

- We have a short time to reach a new trade deal with UK

January 28

Before the Open:

3M (MMM). Consensus EPS $2.10, Consensus Revenues $8121.13 mln

Pfizer (PFE). Consensus EPS $0.54, Consensus Revenues $12727.64 mln

United Tech (UTX). Consensus EPS $1.84, Consensus Revenues $19340.58 mln

After the Close:

Advanced Micro (AMD). Consensus EPS $0.30, Consensus Revenues $2105.27 mln

Apple (AAPL). Consensus EPS $4.38, Consensus Revenues $86210.39 mln

eBay (EBAY). Consensus EPS $0.76, Consensus Revenues $2811.03 mln

Starbucks (SBUX). Consensus EPS $0.76, Consensus Revenues $7107.14 mln

January 29

Before the Open:

AT&T (T). Consensus EPS $0.88, Consensus Revenues $47062.15 mln

Boeing (BA). Consensus EPS -$1.64, Consensus Revenues $21797.76 mln

Dow (DOW). Consensus EPS $0.73, Consensus Revenues $10104.48 mln

General Electric (GE). Consensus EPS $0.18, Consensus Revenues $25766.17 mln

MasterCard (MA). Consensus EPS $1.87, Consensus Revenues $4400.11 mln

McDonald's (MCD). Consensus EPS $1.96, Consensus Revenues $5294.84 mln

After the Close:

Facebook (FB). Consensus EPS $2.53, Consensus Revenues $20891.15 mln

Microsoft (MSFT). Consensus EPS $1.27, Consensus Revenues $35683.25 mln

Tesla (TSLA). Consensus EPS $0.61, Consensus Revenues $7053.89 mln

January 30

Before the Open:

Altria (MO). Consensus EPS $1.02, Consensus Revenues $4885.16 mln

Coca-Cola (KO). Consensus EPS $0.44, Consensus Revenues $8865.34 mln

DuPont (DD). Consensus EPS $0.95, Consensus Revenues $5235.60 mln

Int'l Paper (IP). Consensus EPS $1.03, Consensus Revenues $5617.81 mln

UPS (UPS). Consensus EPS $2.11, Consensus Revenues $20656.36 mln

Verizon (VZ). Consensus EPS $1.15, Consensus Revenues $34630.47 mln

After the Close:

Amazon (AMZN). Consensus EPS $4.07, Consensus Revenues $86038.11 mln

Visa (V). Consensus EPS $1.47, Consensus Revenues $6076.87 mln

January 31

Before the Open:

Caterpillar (CAT). Consensus EPS $2.38, Consensus Revenues $13425.73 mln

Chevron (CVX). Consensus EPS $1.49, Consensus Revenues $39591.86 mln

Exxon Mobil (XOM). Consensus EPS $0.48, Consensus Revenues $64660.40 mln

Honeywell (HON). Consensus EPS $2.04, Consensus Revenues $9621.88 mln

FXStreet reports that according to Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, further upside in the pair carries the potential to visit the 0.9760 region.

"USD/CHF eroded its two month downtrend line last week. We would allow for a deeper recovery towards the .9762 10th January peak and possibly the 55 day ma at .9808. Dips will find minor support at .9660."

"Key resistance remains .9841/44, the September and October lows and while capped here we will maintain an overall negative bias."

CNBC reports that Dr. Tedros Adhanom Ghebreyesus, the World Health Organization's director general, is traveling to Beijing, China, to meet with government and health officials on the Wuhan coronavirus outbreak.

The WHO has so far declined to declare the dangerous respiratory disease a global health emergency, despite the spread of the infection from China to at least 10 other countries and the increasing death toll.

The mayor of Wuhan said on Sunday that there could be about 1,000 more confirmed cases of the virus in the city. About 5 million people left Wuhan before travel was restricted, and nine million people are currently living there.

The WHO said it needs more data before declaring the virus, which is spreading through human-to-human contact, a global health emergency.

FXStreet reports that in the view of the Rabobank Research Team, the Bank of England (BOE) monetary policy decision and the UK's exit out of the European Union on January, 31st will stand out this week.

"The BoE policy meeting on January 31 is more likely to have market participants sitting on the edges of their seats. Following a shockingly weak UK December retail sales data release, a weak CPI inflation report and some dovish commentary from a handful of MPC officials including BoE Governor Carney, expectations for a BoE rate cut surged earlier this month.

These hopes were subsequently reined in by some better than expected UK data releases which underpinned the perception that the economy could be benefitting from a 'Boris bounce' after the December general election.

As it stands the money market is less confidence about a January move than a week or so ago but a rate cut in the coming months is priced in. It is our view that the BoE could cut rates twice during the course of this year.

The UK CBI January retail survey and the Nationwide January house price index will be watched this week.

January 31 will be significant in the UK for another reason. Three and a half years after the Brexit referendum in June 2016, the UK will finally leave the EU. The occasion will open the door for talks between the UK and the EU on their future relationship and for trade negotiations with other nations."

FXStreet reports that the Macro Strategists at Deutsche Bank offer a brief preview of the US Federal Reserve (Fed) monetary policy decision due to be announced on Wednesday.

"As for the FOMC on Wednesday, our US economists write in their preview that the FOMC should hold rates steady, and that "the current stance is likely to be unchanged barring a "material reassessment to the outlook."

However, they do foresee a 5bp upward technical adjustment to the interest rate on excess reserves (IOER), though they write that "it is a close call given the communication challenges of such a move."

All eyes will be on Chair Powell's press conference following the meeting for any new information. The full-day by day week ahead is at the end."

According to the report from UK Finance, gross mortgage lending across the residential market in December 2019 was £22.2 billion, bringing the annual total for 2019 to £265.8 billion. Although annually 1.1 per cent lower than in 2018, the last two years have broadly reflected the continuation of a stronger long term lending trend over recent years.

An annual total of 982,286 mortgages were approved by the main high street banks during 2019, 7.4 per cent more than in 2018. The full year number of mortgages approved for home purchases were 8.0 per cent higher, remortgage approvals were 7.9 per cent higher and approvals for other secured borrowing were 3.0 per cent higher than in 2018.

Credit card spending of £11.8 billion in December 2019 was 7.3 per cent higher than in December 2018. Repayments continue to offset spending, so that the level of borrowing on cards is currently growing at only 2.4 per cent annually, continuing the general slowdown from the recent high of 6.6 per cent in October 2016.

Personal borrowing through loans in December 2019 was 14.0 per cent higher than in December 2018, reflecting the exceptionally weak demand a year earlier. Overdraft borrowing has been declining over recent years, such that December's level was 0.8 per cent lower than at the same time a year earlier.

Personal deposits grew by 2.5 per cent in the year to December 2019. Three-quarters of deposits were held in immediate access accounts in December 2019, in line with the same period last year.

Ifo Institute for Economic Research said that German business morale deteriorated unexpectedly in January as the outlook darkened.

Business climate index fell to 95.9 after 96.3 in December. Economists had expected an increase to 97.0. This monthly indicator published by the IFO economic institute based in Frankfurt defines - via a survey of 7,000 entrepreneurs - the level of confidence in the German economy. This index has a great influence on the Euro currency because it highlights the German economic dynamism and investment levels for the next 6 months.

IFO also said that current economic assessment fell to 99.7 points compared to last month's 98.8 and 99.2 anticipated. Expectations Index - indicating firms' projections for the next six months - came in at 92.9, down from previous month's 93.8 and missed expectations (95.0)

CNBC reports that U.S. government debt prices were higher Monday, with investors increasingly concerned about the economic impact of the fast-spreading coronavirus

The benchmark 10-year Treasury note, which moves inversely to price, was lower at around 1.6530%, while the yield on the 30-year Treasury bond was also lower at around 2.106%.

Chinese officials confirmed Sunday that there had been more than 2,700 confirmed cases of the deadly pneumonia-like virus, including 461 people in a critical condition as the death toll rose to 80.

The virus, which started in the Chinese city of Wuhan, comes from a large family of coronaviruses, according to the World Health Organization (WHO). The WHO has said that while the virus - which is spreading via human-to-human contact - is "an emergency in China," it has not yet become a global health emergency.

FXStreet reports that in opinion of Karen Jones, Team Head FICC Technical Analysis at Commerzbank, the European cross remains under pressure and further downside could re-visit the 0.8240 region.

"EUR/GBP has held the initial test of the 61.8% retracement at .8380. The market remains under pressure having recently failed at the .8610 resistance. The failure of the .8453 support last week suggests that it is capable of retesting the .8239 December low. This together with the 55 quarter moving average at .8226 represents key support. The intraday Elliott wave count is negative, but we would allow for a small rally to .8490."

"Below .8226 remain the June and October 2012 highs as well as the April 2016 high and the January and February 2014 lows at .8167/18."

London has lost its position as the world's main financial center to new York in part to uncertainty over Brexit, according to a survey by consultants Duff & Phelps published on Monday.

A survey of 245 senior officials from asset management, banking and other financial companies from around the world found that 56% of respondents consider new York the most important money center in the world, an increase of 33 percentage points over the past two years. Only 33% now consider London to be the world's top financial center, down more than 20 percentage points over the past two years.

The survey showed that both new York and London will lose ground in the next five years, while new centers in Hong Kong, Singapore and Shanghai are expected to see the largest growth.

The survey showed that only 22% predict that in five years, London will remain the largest financial center. Few respondents see Paris, Frankfurt, or any other European city coming close to replacing new York or London.

FXStreet reports that according to analysts at Danske Bank, markets will continue to pay close attention to headlines regarding the spreading of the corona virus. Meanwhile, the global calendar is light today with the only scheduled release of the German IFO index for January.

"As the Chinese New Year has kicked off, markets will continue to pay close attention to headlines regarding the spreading of the corona virus. Later this week Chinese PMI figures (Friday) will be closely watched for any potential negative impact already showing up in service sector activity."

"We start the week in a quiet manner on the data front with the German IFO index for January released today. In light of a further rebound in the ZEW and PMI numbers last week, we expect IFO to chime in with the signal that the gloomy skies over Germany's manufacturing sector are brightening."

"Later this week, we look forward to the FOMC (Wednesday) and Bank of England (Thursday) meetings and European inflation figures (Friday)."

During today's Asian trading, the yen is rising against the dollar and the euro in the face of increased demand for safe haven assets due to concerns about a new type of coronavirus that causes pneumonia, which was detected in China. The offshore yuan has fallen to its lowest level in the last 4 weeks.

Chinese President XI Jinping said on Saturday that the rate of spread of the dangerous coronavirus in China is accelerating. "We are faced with a difficult situation, as the spread of the new coronavirus is accelerating," he was quoted as saying by official Chinese media.

According to official data, the number of people infected with pneumonia, the causative agent of which was previously unknown coronavirus, exceeded 2700 people, while 80 cases of death have already been registered. On Sunday, the Chinese authorities admitted that the epidemic has not yet been brought under control, despite restrictions on leaving a number of cities in the country.

About 5 million residents left the Chinese city of Wuhan, the epicenter of the new coronavirus, before authorities isolated it due to the threat of spreading the disease, the South China Morning Post reported, citing the city's mayor, Zhou Xianwang.

The Chinese authorities extended the official weekend on the occasion of the Lunar new year celebration for 3 days in order to "reduce mass gatherings of people" and "prevent the spread of the epidemic".

In addition to China, cases have been identified in Thailand, Australia, Singapore, Japan, South Korea, the United States, Malaysia, France, Vietnam, and Nepal.

FXStreet reports that Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, suggested that in light of the recent price action, Cable could attempt a test of the area below the 1.2900 mark.

"GBP/USD charted an outside day to the downside on Friday and it is possible that it will react back to its 1.2893 uptrend and while this holds we will assume that there is scope for a deeper recovery to the 1.3285 Fibonacci retracement."

"The market should remain underpinned by the 1.2893 uptrend and the December low at 1.2908. Failure here would put the 200 day moving average at 1.2690 back on the plate."

EUR/USD

Resistance levels (open interest**, contracts)

$1.1204 (3218)

$1.1159 (2367)

$1.1120 (1304)

Price at time of writing this review: $1.1028

Support levels (open interest**, contracts):

$1.0987 (1848)

$1.0945 (930)

$1.0898 (684)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 7 is 56319 contracts (according to data from January, 24) with the maximum number of contracts with strike price $1,1350 (4631);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3233 (1269)

$1.3198 (1000)

$1.3169 (1764)

Price at time of writing this review: $1.3063

Support levels (open interest**, contracts):

$1.3031 (2657)

$1.3003 (1201)

$1.2970 (3251)

Comments:

- Overall open interest on the CALL options with the expiration date February, 7 is 24611 contracts, with the maximum number of contracts with strike price $1,3600 (3935);

- Overall open interest on the PUT options with the expiration date February, 7 is 21817 contracts, with the maximum number of contracts with strike price $1,3000 (3251);

- The ratio of PUT/CALL was 0.89 versus 0.88 from the previous trading day according to data from January, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 60.75 | -2.13 |

| WTI | 54.31 | -2.32 |

| Silver | 18.08 | 1.69 |

| Gold | 1570.799 | 0.53 |

| Palladium | 2414.89 | -1.77 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 31.74 | 23827.18 | 0.13 |

| Hang Seng | 40.52 | 27949.64 | 0.15 |

| ASX 200 | 2.5 | 7090.5 | 0.04 |

| FTSE 100 | 78.31 | 7585.98 | 1.04 |

| DAX | 188.26 | 13576.68 | 1.41 |

| CAC 40 | 52.47 | 6024.26 | 0.88 |

| Dow Jones | -170.36 | 28989.73 | -0.58 |

| S&P 500 | -30.07 | 3295.47 | -0.9 |

| NASDAQ Composite | -87.57 | 9314.91 | -0.93 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68251 | -0.31 |

| EURJPY | 120.487 | -0.46 |

| EURUSD | 1.1025 | -0.28 |

| GBPJPY | 142.836 | -0.59 |

| GBPUSD | 1.30705 | -0.41 |

| NZDUSD | 0.66078 | -0.14 |

| USDCAD | 1.31467 | 0.16 |

| USDCHF | 0.97095 | 0.21 |

| USDJPY | 109.278 | -0.18 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.