- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 27-09-2011

from trading than from lending.

Greek Parliament Passes Law Implementing New EFSF Powers

European stocks climbed the most in 16 months amid speculation policy makers will increase efforts to contain the region’s sovereign-debt crisis.

Rio Tinto Group led a rally in raw-material shares, surging 7.8 percent, as metal prices rose. BNP Paribas (BNP) SA and Societe Generale (GLE) SA, France’s biggest banks, soared more than 14 percent. MAN SE (MAN) rose the most in two years as European Union regulators cleared Volkswagen AG (VOW)’s takeover of the truckmaker.

The euro gained for a third day versus the dollar after Slovenia approved an expansion to the region’s rescue fund.

The dollar fell 0.7 percent against the euro to $1.3525 at 11:07 a.m. in New York. The greenback rose 0.4 percent to 76.65 yen.

U.S. stock indexes have shown growth of about 2.5%.

Dow 11,335.77 +291.91 +2.64%, Nasdaq 2,578 +61.22 +2.43%, S&P 500 1,192.39 +29.44 +2.53%.

All sectors of S

& P500 index show growth. The leaders of the basic materials sector (+3.5%)

and industrial goods sector (+3.4%), minimal increase in utilities sector

(+1.5%).

Bank of America Corp. (BAC) and JPMorgan Chase & Co. added at least 2.7 percent, following gains in European lenders. Alcoa Inc. and Chevron Corp. rose more than 3 percent to pace a rally in commodity producers. Apple Inc. (AAPL) added 0.8 percent as JPMorgan analyst Mark Moskowitz said research from his colleagues in Asia about a cut in the company’s iPad orders doesn’t represent the views of the securities firm’s U.S. team.

Gold futures rose the most since March 2009 as commodities and equities rallied amid optimism that European leaders will take steps to resolve the region’s debt crisis. In the previous three sessions, gold tumbled 12 percent, the most since 1983, on sales by investors to cover losses in other markets amid mounting concern that the global economy would slump.

Gold futures for December delivery gained $64.90, or 4.1 percent, to $1,659.60 an ounce by 10:23 a.m. on the Comex in New York. A close at that price would mark the biggest gain for a most-active contract since March 19, 2009. Yesterday, the metal tumbled as much as $104.80 to $1,535, the lowest since July 8.

Futures climbed as much as 4.4 percent after U.S. Treasury Secretary Timothy F. Geithner predicted Europe will intensify efforts to contain its debt problems after a chiding from counterparts around the world. Greek lawmakers vote today on a property tax that’s key to persuading the European Union and International Monetary Fund to release aid and avert default.

U.S. crude stockpiles probably climbed 2.2 million barrels in the week to Sept. 23 as demand weakened in the world’s largest oil-consuming country, according to the median estimate of analysts before an Energy Department report tomorrow. Gasoline inventories are expected to have risen 900,000 barrels to the highest level since July.

- Troika returning to Athens tomorrow or day after

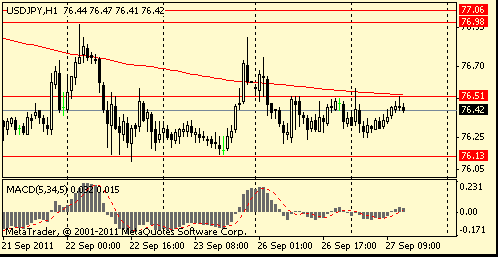

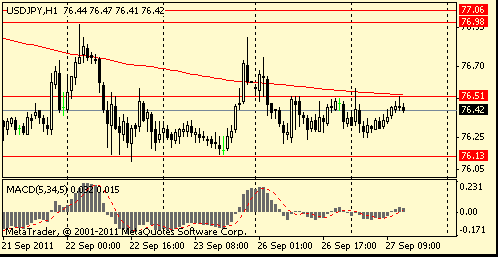

USD/JPY Y76.00, Y76.25, Y76.40, Y76.50, Y77.00

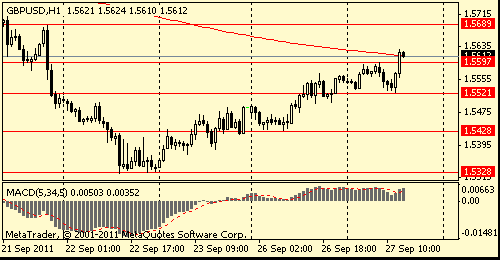

GBP/USD $1.5575, $1.5500

EUR/JPY Y104.00

AUD/USD $1.0000, $0.9900, $0.9850

U.S. stock futures advanced amid speculation that policy makers will move to avoid a worsening of the European debt crisis.

Data:

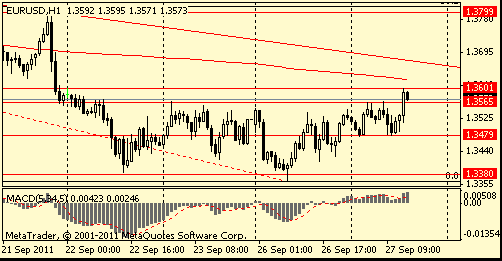

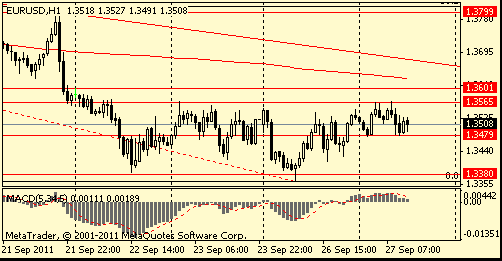

EUR/USD: the pair grown in $1.3600 area.

EUR/USD

Bids $1.3440, $1.3410/00, $1.3350, $1.3300

Resistance 3: Y77.30 (Sep 15 high)

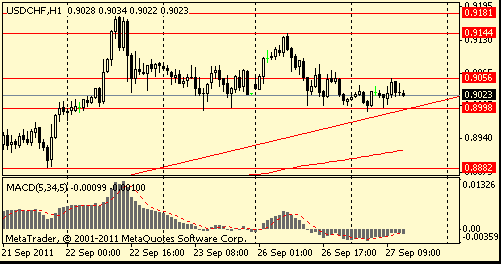

Resistance 3:Chf0.9180 (Sep 22 high)

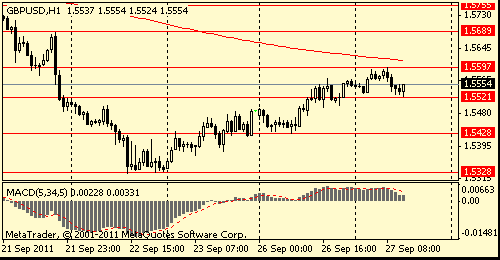

Resistance 3: $ 1.5750 (area of Sep 19-21 high)

Resistance 3: $ 1.3675 (resistance line from Sep 7)

Currently FTSE 5,203 +113.21 +2.22%, CAC 2,953 +93.47 +3.27%, DAX 5,525 +179.59 +3.36%.

BNP Paribas (BNP) SA and Societe Generale SA led a rally in banks, soaring at least 8 percent.

Sold 3-month T-bill at average yield 1.692% vs 1.357% previous

The dollar held a two-day drop against the euro as Asian stocks extended a rally in global equities, damping demand for the U.S. currency as a refuge.

Australia’s dollar advanced for a third day versus the U.S. currency and the yen on higher prices for commodities, which make up majority of the nation’s exports. The euro declined earlier as Italy and Spain prepare to sell short-term debt amid a regional fiscal crisis. Demand for the greenback was limited before a report forecast to show U.S. consumer confidence stayed near the lowest level in two years.

St. Louis Fed President James Bullard said faster inflation won’t reduce the housing glut. He also said “monetary policy is ultra-loose right now, and appropriately so.”

Fed Chairman Ben S. Bernanke and colleagues have discussed adopting specific levels of inflation and unemployment as conditions for keeping interest rates near zero.

EUR/USD: on asian session the pair gain, but later dropped.

USD/JPY: on asian session the pair hold Y76.20/50.

Focus today Merkel to meet Papandrou in Berlin at 1800GMT; Slovenian parliament votes on EFSF before it is dissolved; Spain sells 3-/6-month T-bills for E2.5bln-E3.5bln; Austria Fin committee meets to consider EFSF Bill to go to Special Parliament session.

In European session the Euro rose as market reacts to wire comments suggesting the ECB is considering restarting covered bond purchases.

Yesterday start the U.S. session was accompanied by a fall in the major currencies in Europe: the dollar, the pound and the franc, as in the past at the weekend meetings of finance ministers and the IMF, European leaders failed to introduce additional measures to stop the regional debt crisis. The leaders of Finland and the Netherlands said that they plan toincrease their commitments to rescue the funds of the euro area.

By the time the closing European stock markets, and growth of major benchmark indexes, the dollar, pound and franc rebounded.

EUR/USD: the pair rose.

GBP/USD: the pair rose and showed new weekly high at $1.5570

USD/JPY: yestherday the pair hold Y76.25-Y76.55.

Focus today Merkel to meet Papandrou in Berlin at 1800GMT; Slovenian parliament votes on EFSF before it is dissolved; Spain sells 3-/6-month T-bills for E2.5bln-E3.5bln; Austria Fin committee meets to consider EFSF Bill to go to Special Parliament session.

- We've proven can raise rates when inflation risks

- Europe fundamentals much better than elsewhere

National benchmark indexes rallied in all 18 western European markets today, except Greece and Norway.

German Chancellor Angela Merkel said euro-region leaders must erect a firewall around Greece to avert a cascade of market attacks on other European states and said expanding the powers of the region’s rescue fund, the European Financial Stability Facility, was necessary to avert contagion.

Allianz SE (ALV) and Axa SA (CS), Europe’s biggest insurers, jumped the most in more than a year.

Deutsche Bank AG led lenders higher amid speculation the European Central Bank may cut interest rates and as executives called for a U.S.-style Troubled Asset Relief Program in Europe.

Fresnillo Plc (FRES) tumbled 6.9 percent as silver had the biggest three-day drop since 1980.

Deutsche Bank rose 8.7 percent to 25.12 euros. NP Paribas (BNP) SA, France’s biggest bank, rallied 4 percent to 26.33 euros.

U.S. stocks advanced, giving the Dow Jones Industrial Average its biggest increase in a month, amid speculation that European policy makers will act to prevent the region’s debt crisis from getting worse.

ECB policy makers are likely to debate next week restarting their covered-bond purchases along with further measures to ease monetary conditions, a euro-region central bank official said.

Interest-Rate Cuts

Equities rebounded after ECB Governing Council member Ewald Nowotny said there may be “good reason” to reintroduce loans with a maturity of more than six months.

Company news:

Bank of America Corp. and JPMorgan Chase & Co. (JPM) rose more than 4.5 percent as the European Central Bank was said to consider restarting covered-bond purchases along with further measures to ease monetary conditions.

Berkshire Hathaway Inc. (BRK/A) Class B shares added 8.6 percent as the company plans a stock buyback.

Boeing Co. (BA) rallied 4.2 percent as the delivery of the 787 Dreamliner ended more than three years of delays.

Resistance 2: Y77.85/90 (Sep 23 high)

Resistance 1: Y76.55 (American session of Sep 22 high)

The current price: Y76.35

Support 1:Y76.25 (session low)

Support 2:Y76.10 (area of Sep 21-23 low)

Support 3:Y75.90 (area of historical low)

Comments: the pair hold Y76.25-Y76.55. Losses below to last week low Y76.10.

Resistance 2: Chf0.9080 (Sep 23 high)

Resistance 1: Chf0.9045 (session high)

The current price: Chf0.9030

Support 1: Chf0.8995 (Sep 23 low, session high)

Support 2: Chf0.8920 (Sep 20 low)

Support 3: Chf0.8855/60 (area of Sep 19-20 low)

Comments: the pair bargains in downtrend. In focus support on Chf0.8995

Resistance 2: $ 1.5690 (Sep 21 high)

Resistance 1: $ 1.5620 (FIBO 23.6 % $1.5326-$1.6617)

The current price: $1.5569

Support 1 : $1.5530 (session low)

Support 2 : $1.5490 (Sep 21 low)

Support 3 : $1.5435 (Sep 26 low)

Коментарии: the pair bargains in uptrend. In focus resistance FIBO of 23.6 % $1.5326-$ 1.6617

Resistance 2: $ 1.3645 (FIBO 50 % $1.3361-$ 1.3935)

Resistance 1: $ 1.3565 (session high)

The current price: $1.3225

Support 1 : $1.3480 (session high)

Support 2 : $1.3425 (Sep 23 low)

Support 3 : $1.3360 (Sep 26 low)

Comments: the pair holds on the week high. In focus resistance $1.3645.

Nikkei 225 8,374 -186.51 -2.18%

Hang Seng 17,240 -429.16 -2.43%

S&P/ASX 3,866 -37.46 -0.96%

Shanghai Composite 2,404 -28.80 -1.18%

FTSE 100 5,089 +22.56 +0.45%

CAC 40 2,859 +49.23 +1.75%

DAX 5,346 +149.00 +2.87%

Dow 11,043.86 +272.38 +2.53%

Nasdaq 2,517 +33.46 +1.35%

S&P 500 1,162.95 +26.52 +2.33%

10 Year Yield 1.90% +0.10 --

Oil $81.18 +0.94 +1.17%

Gold $1,623.60 +28.80 +1.81%

06:00 United Kingdom Nationwide house price index, y/y August -0.4% -0.5%

06:00 Germany Gfk Consumer Confidence Survey October 5.2 5.1

06:00 Switzerland UBS Consumption Indicator August 1.29

06:00 United Kingdom Nationwide house price index August -0.6% +0.2%

08:00 Eurozone M3 money supply, adjusted y/y August +2.0% +2.0%

08:00 Eurozone Private Loans August +2.4% +2.5%

09:30 Switzerland KOF Institute Economic Forecast IV quarter

10:00 United Kingdom CBI retail sales volume balance September -14 -14

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y July -4.5% -4.4%

14:00 U.S. Consumer confidence September 44.5 46.4

14:00 U.S. Richmond Fed Manufacturing Index September -10 -8

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.