- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 28-11-2011

The euro rose in early U.S. session amid falling yields of government bonds from the Italian medium term and there were rumors that the IMF is preparing a preemptive bailout for Italy in the amount of 400-600 million euros. But then quickly followed by denials,including an official from the IMF. Negative background outweighed the sentiment and the euro fell. Thus, Moody's warned that the rapid development of the sovereign and banking crisis threatening the region's rankings of European government bonds. The Organization for Economic Cooperation and Development (OECD) said that France needed to take more stringent economic measures in order to achieve the goal of a budget deficit for 2012, as GDP growth may not reach projected levels due to the recession.

Investors are awaiting tomorrow's meeting of Ministers of the euro area, which may adopt the rules of the European Foundation for financial stability. Their approval would allow the fund to $ 440 billion euros to attract funds from investors.

The pound weakened versus higher- yielding peers after data showed U.K. house prices dropped last month and retail sales fell, and as the British Chambers of Commerce cut its economic-growth forecasts. Chancellor of the Exchequer George Osborne presents updated economic and fiscal forecasts to Parliament tomorrow amid speculation government growth estimates will be cut and budget shortfalls will be greater than predicted. The central bank said last week that the threat of the euro-area debt crisis on the U.K. economy has increased. Minutes of the central bank’s Nov. 9-10 meeting released on Nov. 23 showed some policy makers said an increase in stimulus may be needed to support the economy. The minutes also revealed the nine-member Monetary Policy Committee voted unanimously to keep its key interest rate at a record low of 0.5 percent.

European stocks surged, rebounding from their biggest selloff in two months, amid speculation euro- area policy makers are intensifying their efforts to contain the sovereign-debt crisis.

Welt am Sonntag reported that the euro area’s two biggest economies plan for member states to commit to greater fiscal discipline without waiting to change European Union treaties. The newspaper did not say where it got the information.

The euro climbed as German Finance Minister Wolfgang Schaeuble urged fast-track treaty changes to tighten budget discipline and as speculation mounted that policy makers are planning to provide more aid for Italy.

Schaeuble said in an interview with ARD television in Berlin yesterday that treaty change is necessary to give veto power over member states’ budgets to the European Commission.

Separately, La Stampa reported that the International Monetary Fund is preparing a 600-billion euro ($800 billion) loan for Italy in case the sovereign-debt crisis worsens, without saying where it got the information.

An IMF official today said the Washington-based lender is not in talks with Italy about a loan program.

National benchmark indexes climbed in every western- European market except Iceland. France’s CAC 40 Index gained 5.5 percent, the U.K.’s FTSE 100 Index rose 2.9 percent and Germany’s DAX Index increased 4.6 percent.

A gauge of bank shares rallied 5.7 percent, its biggest advance in a month, as borrowing costs fell in Spain and Italy before euro-area finance ministers meet in Brussels on Nov. 29 as governments bid to regain the confidence of financial markets.

The European Financial Stability Facility may insure the bonds of debt-stricken countries with guarantees of 20 percent to 30 percent of each issue, depending on financial markets, according to EFSF guidelines that finance ministers will discuss this week.

BNP Paribas SA surged 10 percent to 28.52 euros as the Financial Times reported that France’s biggest bank (BNP) may plan to sell a portfolio of more than 50 private-equity fund interests for $700 million.

Commerzbank AG advanced 4.1 percent to 1.31 euros as Financial Times Deutschland reported that Germany’s second- largest lender is planning to repurchase so-called hybrid bonds and pay holders with new shares at it seeks ways to boost capital and reduce risk.

Dexia and KBC, Belgium’s biggest bank and insurer, soared 15 percent to 42.7 euro cents and 14 percent to 8.93 euros respectively, after Belgium sold 2 billion euros of bonds maturing between 2018 and 2041. The 10-year bond yield dropped after the auction, which followed the country’s first credit downgrade in almost 13 years.

BHP Billiton Ltd. rallied 4.4 percent to 1,836.5 pence and Total SA rose 3.7 percent to 37.01 euros, leading a rally in mining and energy companies, as copper led base metals higher in London and crude oil climbed in New York.

Rio Tinto Group also rose after the world’s second-largest mining company (RIO) said it expects to increase capital spending 17 percent next year. The company also raised its iron-ore target to meet demand from China. The shares rallied 4.4 percent to 3,164 pence.

Elsewhere, Thomas Cook Group Plc soared 21 percent to 21.73 pence after its banks agreed to provide a 200 million-pound ($311 million) loan, giving Europe’s second-largest tour operator time to reorganize its business.

Rolls-Royce Holdings Plc increased 3 percent to 698.5 pence after the company signed a contract with Deutsche Bank AG (DBK) to lower the risk on its 3 billion pounds in pension liabilities.

U.S. stocks rose, snapping a seven- day decline in the Standard & Poor’s 500 Index, after Thanksgiving retail sales climbed to a record and euro-area leaders were said to boost efforts to end the debt crisis.

U.S. retail sales during the Thanksgiving weekend increased 16 percent to $52.4 billion, the National Retail Federation said, citing a survey conducted by BIGresearch. The average shopper spent $398.62, up from $365.34 a year earlier. Consumer spending, which accounts for about 70 percent of the economy, grew at a 2.3 percent annual rate in the third quarter, the fastest pace in 2011, the Commerce Department said Nov. 22.

U.S. stocks maintained gains after a report showing fewer new homes were purchased in October than forecast. Sales increased 1.3 percent to a 307,000 annual pace, data from the Commerce Department showed today in Washington. The median estimate of 70 economists surveyed by Bloomberg News projected a 315,000 rate.

In Europe, German newspaper Welt am Sonntag reported German Chancellor Angela Merkel and French President Nicolas Sarkozy are discussing an agreement under which member states will commit to tighter budget discipline without waiting for treaty changes. The newspaper did not say where it got the information.

German Finance Minister Wolfgang Schaeuble called for fast- track treaty changes to tighten budget discipline among member states of the euro area. He spoke in an interview with ARD television in Berlin yesterday. The European Financial Stability Facility may insure the bonds of debt-stricken countries with guarantees of 20 percent to 30 percent of each issue, depending on market circumstances, according to EFSF guidelines that finance ministers will discuss this week. Euro-area finance ministers meet in Brussels on Nov. 29 as governments bid to regain the confidence of financial markets.

on record Black Friday sales of its Kindle products.

The increased severity of the debt crisis is threatening the credit standing of the region’s countries, Moody’s Investors Service said in a report today. More than $1.2 trillion has been erased from U.S. stocks since Nov. 15 on mounting concern that the crisis will spread and American policy makers failed to reach agreement on reducing the federal budget.

Dow 11,534.06 +302.28 +2.69%, Nasdaq 2,528.05 +86.54 +3.54%, S&P 500 1,193.96 +35.29 +3.05%

JPMorgan jumped 4.2 percent to $29.68, while Bank of America (BAC) advanced 3.8 percent to $5.37. Goldman Sachs Group Inc. surged 3.1 percent to $91.54. A gauge of European banking shares climbed 5.2 percent, among the best performances in the benchmark Stoxx Europe 600 Index.

Energy and raw-material producers rallied at least 4 percent, the most among 10 groups in the S&P 500, as crude oil rose above $100 a barrel for the first time in more than a week on signs of economic recovery in the U.S., while sanctions on Syria stoked concern Middle East crude supplies may be threatened.

Alcoa gained 5.3 percent to $9.42. The largest U.S. aluminum producer rose the most in the Dow as copper, lead, nickel and zinc advanced on the London Metal Exchange. Freeport- McMoRan Copper & Gold Inc., the world’s biggest publicly traded copper producer, surged 6.3 percent to $35.96. Molycorp Inc. climbed 6.2 percent to $28.65.

Suncor Energy Inc. gained 4.1 percent to $28.17. Marathon Oil Corp. increased 6.2 percent to $26.18. Halliburton Co. (HAL) advanced 3.9 percent to $33.04.

Companies most-tied to the economy rose, sending the Morgan Stanley Cyclical Index up 4 percent after a 6.2 percent decline last week. Caterpillar Inc. (CAT), the world’s largest construction and mining-equipment maker, increased 5 percent to $91.06.

AT&T climbed 1.9 percent to $27.92. The company, which faces regulatory opposition to its takeover of T-Mobile USA, is preparing its biggest antitrust remedy proposal to salvage the deal, according to a person familiar with the plan. AT&T may offer to divest a significantly larger portion of assets than it had planned. That could be as much as 40 percent of T-Mobile USA’s assets, the person said.

Amazon.com rose 5.8 percent to $192.88. The world’s largest Internet retailer said it sold four times more Kindle products on Black Friday compared with last year.

Genworth Financial Inc. posted the biggest gain in the S&P 500, climbing 13 percent to $6.08. Citigroup Inc. upgraded the insurer for the second time this month on the prospect that the company can withstand mortgage-related losses.

Oil climbed as Thanksgiving retail sales advanced to a record in the U.S., a signal of economic growth in the world’s biggest crude-consuming country.

Futures rose as high as $100.74 after U.S. consumers spent $52.4 billion during the holiday weekend, according to the National Retail Federation, citing a survey from BIGresearch. The dollar fell and commodities gained after the Welt am Sonntag newspaper reported German Chancellor Angela Merkel and French President Nicolas Sarkozy are planning a stability pact.

Crude oil for January delivery increased to $98.26 a barrel at the moment on the New York Mercantile Exchange. Futures touched the highest level since Nov. 17. Prices have risen 8.1 percent this year.

Brent oil for January settlement climbed $2.38, or 2.2 percent, to $108.78 a barrel on the London-based ICE Futures Europe exchange.

Gold prices rise sharply following the rise in world stock market indices in the background waiting speedy solution to the debt problems in Europe. Stock indexes in Europe are growing at 3-5%, the U.S. stocks increased by more than 3% in expectation of harmonization of the European Financial Stability Facility (EFSF), including the markets of government bonds. The European Financial Stability Facility may insure the bonds of debt-stricken countries with guarantees of 20 percent to 30 percent of each issue, depending on financial markets, according to EFSF guidelines that finance ministers will discuss this week.

Rising gold prices in 2010 to 30% was a record for the third quarter of 2011 gold has risen in price by 8% in October - 6%. Ten-year growth in the value of the metal has become the longest, at least since 1920.

Investors will be watching closely on Tuesday for the Ministerial Meeting of the eurozone, which may adopt the rules of the European Foundation for financial stability. Their approval would allow the fund to $ 440 billion euros to attract funds from investors.

Aggregate reserves backed by gold ETF funds last week increased by 300,500 ounces to a record 69.978 million, even though on Friday inflows to mutual funds because of a holiday in the United States was not observed.

Analysts warn that the rise in gold prices may be short-lived as investors are wary, fearing the influence of the debt crisis in the eurozone. Rating agency Moody's Investors Service warned that the rapid development of the debt and banking crisis threatening the eurozone government bond ratings of all European.

Today, December gold futures trading on the Comex in New York increased to 1722.4 dollars per troy ounce.

Growth forecast downgrade in inf rpt due to eurozone crisis

Need contingency plans vs Eurozone crisis worsening

Creditors will have to bear some of Eurozone rebal burden

UK banks clearly better capitalised vs some Eurozone ones

Euro area has increasingly threatened UK recovery

Funding strains are causing great deal of concern

Things could get better in Eurozone - 'Absolutely'

Clear what is going on at the moment, rebalancing of economy

Expect to see subdued wage growth to continue

All inflation expectations signs fail to show significant pickup

Factors which drove inflation higher are diminishing

Resistance 2:1200 (Nov 22 high)

Resistance 1:1195 (session high, 38,2 % FIBO 1270-1147)

Current price: 1194,50

Support 1 : 1183 (intraday low)

Support 2 : 1170 (session low, Oct 7 low)

Support 3 : 1157 (close price of the last week)

- was case for tightening policy at start 2011;

- became increasingly concerned about weak consumer;

- may well need to do more QE;

- seems very likely inflation will fall sharply;

- CPI most likely to fall below 2.0%.

- was case for tightening policy at start 2011;

- became increasingly concerned about weak consumer;

- may well need to do more QE;

- seems very likely inflation will fall sharply;

- CPI most likely to fall below 2.0%.

EUR/USD $1.3285, $1.3300, $1.3320, $1.3375, $1.3400, $1.3490

USD/JPY Y76.00, Y77.25, Y77.50, Y77.65, Y77.75AUD/USD $0.9700, $0.9815, $1.0000

GBP/USD $1.5450, $1.5500, $1.5550, $1.5600, $1.5700, $1.5745

EUR/JPY Y104.00

USD/CHF Chf0.9300, Chf0.9350

US stocks futeres rose as data showed than Black Friday 2011 had $11.40 billion in retail purchases and the biggest dollar amount ever spent during the day, according to ShopperTrak. Black Friday sales increased 6.6 percent over the same day last year.

Futures surged on rumors that the International Monetary Fund is preparing a 600-billion euro ($801 billion) loan for Italy in case the sovereign-debt crisis worsens, without saying where it got the information.

An IMF official today said the Washington-based lender is not in talks with Italy about a loan program.

Nikkei 8,287 +127.48 +1.56%

Hang Seng 18,038 +348.33 +1.97%

Shanghai Composite 2,383 +2.81 +0.12%

FTSE 5,285 +120.57 +2.33%

CAC 2,977 +120.31 +4.21%

DAX 5,704 +210.93 +3.84%

Crode oil: $99.27 (+2,6%).

Gold: $1720,20 (+2,1%).

Verizon (VZ) was upgraded to a Buy from Neutral at UBS.

American Express (AXP) was downgraded to Equal Weight from Overweight at Morgan Stanley.

Data:

09:00 EU(17) M3 money supply (October) adjusted Y/Y 2.6%

09:00 EU(17) M3 money supply (3 months to October) adjusted Y/Y 2.8%

09:00 Italy Business confidence (October) 94.4

11:00 UK CBI retail sales volume balance (November) -19%

13:00 Germany CPI (November) preliminary 0.0%

13:00 Germany CPI (November) preliminary Y/Y 2.4%

The U.S. dollar fell and the euro rallied on optimism that Italy may get much-needed financial aid to slash its huge public debt.

Italian newspaper La Stampa reported that the International Monetary Fund is preparing a E600 billion loan for Italy, which somewhat helped ease the anxiety about the sovereign debt crisis in Europe.

Higher-yielding currencies such as the Aussie drew decent buying as Asian stocks rallied, while Japanese government bond prices fell, in signs of easing investor risk aversion.

EUR/USD: during european session the pair rose, tested a mark $1.3400. Later the rate decreased in $1.3360 area.

GBP/USD: the pair has shown high in $1.5600 area. Later the rate receded in $1,5560 area.

USD/JPY: the pair was in Y77.60-Y77.80 area.

EUR/USD

Offers $1.3480/85, $1.3400/20, $1.3380/400

Bids $1.3350, $1.3320, $1.3300, $1.3375/70, $1.3210/00

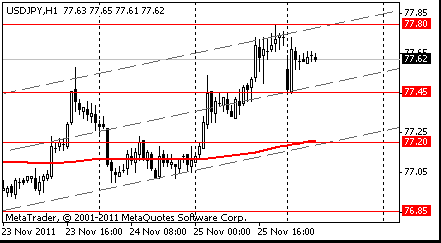

Resistance 3: Y78.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 4 high)

Resistance 1: Y77.80 (session high, Nov 25 high)

Current price: Y77.75

Support 1:Y77.45 (session low)

Support 2:Y77.10/00 (Nov 24 low, МА (200) for Н1)

Support 3:Y77.80 (Nov 22 low)

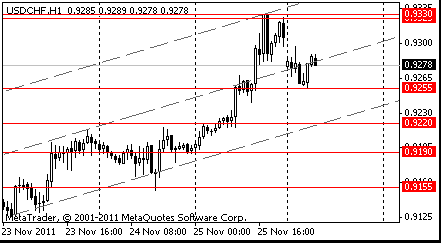

Resistance 3: Chf0.9330 (Nov 25 high)

Resistance 2: Chf0.9300/10 (area of session high)

Resistance 1: Chf0.9240/55 (low of american session on Nov 25, low of today's asian session)

Current price: Chf0.9217

Support 1: Chf0.9175 (session low)

Support 2: Chf0.9155 (Nov 24 low)

Support 3: Chf0.9100 (area of Nov 22 low)

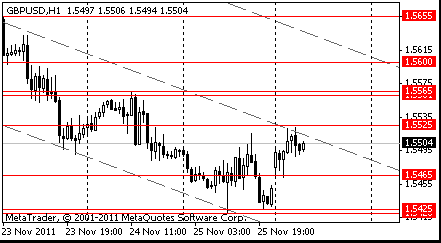

Resistance 3: $ 1.5690/710 (Nov 22 high, 61,8 % FIBO $1,5890-$ 1.5420)

Resistance 2: $ 1.5650 (50.0 % FIBO $1,5890-$ 1.5420)

Resistance 1: $ 1.5600 (session high, 38,2 % FIBO of $1,5890-$ 1.5420, the top border of downchannel from Nov 14)

Current price: $1.5563

Support 1 : $1.5520 (high of asian session)

Support 2 : $1.5460 (session low)

Support 3 : $1.5420 (Nov 25 low)

Resistance 3: $ 1.3570 (Nov 22 high)

Resistance 2: $ 1.3430 (61.8 % FIBO $1.3570-$ 1.3210)

Resistance 1: $ 1.3400/10 (session high, Nov 24 high, resistance line from Oct 27)

Current price: $1.3368

Support 1 : $1.3340 (high of asian session)

Support 2 : $1.3270 (session low)

Support 3 : $1.3210 (Nov 25 low)

cuts 2011 UK growth forecast to 0.9% vs previous 1.4%;

cuts UK 2012 fcast to 0.5% vs prev 1.8%; 2013 seen 1.8%;

cuts China 2012 GDP forecast to 8.5% from 9.2%; 2011 9.3%;

lower CPI, house prices to allow China rate cut mid-2012;

see Greece 2011 GDP -6.1%, 2012 -3.0%, 2013 +0.5%;

see Greece 2011 public deficit 9.0%, 2012 7.0%, 2013 5.3%;

sees EMU GDP of 1.6% in '11, 0.2% in '12, 1.4% in '13;

sees EMU hicp of 2.6% in '11, 1.6% in '12, 1.2% in '13;

see negative EMU growth in q4, q1, muted recovery mid-'12;

Italy 2011 GDP +0.7%, 2012 -0.5%, 2013 +0.5%;

Italy 2011 debt ratio 120%, 2012 120.4%, 2013 118.9%;

Italy 2011 public deficit ratio 3.6%,2012 1.6%,2013 -0.1%;

German GDP to grow at 0.6% in 2012; 1.9% in 2013;

France GDP to grow at 0.3% in 2012; 1.4% in 2013.

EUR/USD $1.3285, $1.3300, $1.3320, $1.3375, $1.3400, $1.3490

USD/JPY Y76.00, Y77.25, Y77.50, Y77.65, Y77.75AUD/USD $0.9700, $0.9815, $1.0000

GBP/USD $1.5450, $1.5500, $1.5550, $1.5600, $1.5700, $1.5745

EUR/JPY Y104.00

USD/CHF Chf0.9300, Chf0.9350

Nikkei 225 8,287 +127.48 +1.56%

Hang Seng 18,038 +348.33 +1.97%

S&P/ASX 4,058 +73.86 +1.85%

Shanghai Composite 2,383 +2.81 +0.12%

WTI has picked up to $99.29 in recent trade and has resistance ahead at $100.11

The euro climbed after a report in La Stampa that the International Monetary Fund is preparing a 600-billion euro ($794 billion) loan for Italy in case the country’s debt crisis worsens. The Italian daily didn’t say where it got the information.

The 17-nation currency jumped to $1.3333 as of 7:56 a.m. in Sydney from $1.3239 in New York on Nov. 25.

German Finance Minister Wolfgang Schaeuble said that European governments are struggling to enact a pledge to beef up the euro rescue fund, as he called for fast- track treaty changes to tighten budget discipline as the key to calming markets.

Schaeuble, in an interview with ARD television in Berlin, said that the European Financial Stability Facility recently paid a higher rate of interest on debt than France or the other AAA rated countries that guarantee the EFSF, underscoring the “crisis of confidence” in the euro area. The “decisive” answer remains budget discipline enforced by means of European Union treaty change, he said.

New Zealand’s dollar rose against its 16 major peers after Prime Minister John Key was re-elected with his party’s biggest mandate in 60 years, strengthening his ability to balance the budget.

The so-called kiwi climbed along with Australia’s dollar on speculation European leaders may be working on a fast-track solution to the region’s debt crisis and after reports the International Monetary Fund may consider aid for Italy. Both South Pacific nations’ currencies were bolstered as Asian stocks rose for the first time in four days, spurring demand for higher-yielding assets.

EUR/USD: on Asian session the pair traded in a range $1.3275-$ 1.3335.

GBP/USD: on Asian session the pair traded in a range $1.5465-$ 1.5525.

USD/JPY: on Asian session the pair gain.

On Monday at 09:00 GMT the Eurozone will publish change of M3 Money Supply for October. At 11:00 GMT in Britain there will be a statistics on CBI Realized Sales for November. At 13:00 GMT Germany will publish a preliminary consumer price index for November. At 15:00 GMT in the USA there will be data on New Home Sales for October. Japan at 23:30 GMT will report about change of Household spending, and at 23:50 GMT - about change of Retail sales for October.

On Monday the euro rose against the U.S. dollar against the backdrop of media reports that a special committee ("supercommittee") of the U.S. Congress, designed to reduce the budget deficit will soon announce the failure to reach a compromise solution. Before November 23 "supercommittee" must submit a plan to reduce the budget deficit ($ 1.2 trillion. For 10 years), however, to the present moment, the consensus between Republicans and Democrats on the structure of public spending cuts was not found until. Despite the fact that the costs would be cut in any case (after the "dip" in the negotiations the country will face automatic "sequestering" the budget for the same amount), the inability of the major parties to take a decision on the consolidated fiscal policy could provoke a new round of concerns about reducing the country's sovereign rating international agencies (Fitch and Moody's).

On Tuesday the euro gained versus the yen as appetite for safety declined amid speculation officials were tackling Europe’s sovereign-debt crisis. The 17-nation currency rose against the dollar after the International Monetary Fund revamped its credit-line program to help countries facing outside shocks. It fluctuated earlier as the U.S. economy grew less than estimated and ratings companies affirmed U.S. credit grades. The dollar remained lower after the Federal Reserve released minutes of its last meeting. Canada’s dollar climbed on a rise in oil, the nation’s biggest export.

On Wednesday the euro fell to a six-week low against the dollar after Germany received insufficient bids at a debt auction, adding to concern Europe’s sovereign-debt crisis is driving away investors from the region’s assets. Germany missed its 6 billion-euro ($8 billion) maximum sales target at a 10-year bond auction today by 35 percent, prompting investors to question the status of the securities as a haven from the region’s debt crisis. The bunds drew a yield of 1.98 percent. A composite index based on a survey of purchasing managers in European manufacturing and services rose to 47.2 from 46.5 in October, Markit Economics said in an initial estimate, suggesting the sovereign-debt crisis is starting to affect economic growth in the region’s core nations. The dollar rose versus all of its 16 most-traded peers as a gauge of European services and manufacturing output shrank and data signaled China’s manufacturing will tumble. The HSBC Flash Manufacturing PMI for China, Australia’s biggest trading partner, fell to 48 this month, predicting the biggest contraction since March 2009. That compares with a final reading of 51 in October.

On Thursday the euro strengthened from a seven-week low against the dollar as German reports showed business confidence improved and economic growth accelerated even with Europe’s worsening debt crisis. The Munich-based Ifo institute said its business climate index increased to 106.6 this month from 106.4 in October. The euro also advanced versus the pound amid signs Germany is softening its opposition to allowing issuance of common euro-area bonds. Yesterday Germany received insufficient bids at a bond auction, fueling concern that Europe’s sovereign-debt crisis is driving away investors from the region’s assets. German newspaper editorials and opposition politicians stepped up bids for Chancellor Angela Merkel to shift from an incremental approach after the government sold 35 percent less bonds than its maximum target at yesterday’s auction. Bild newspaper reported Merkel’s coalition is concerned it may have to agree to euro bonds under certain conditions. But euro fell later. At second half of yesterday Fitch lowers Portugal's growth fcst due European outlook. Sees Portugal 2012 GDP falling 3%. Cites Portugal high debt,large fiscal imbalances. Portugal could be further downgraded if growth disappoints..

On Friday the euro declined as French consumer confidence dropped to the least since 2009 and Italian borrowing costs increased at a sale of six-month bills. The dollar rose versus all its major peers as stock losses spurred demand for safer assets. Italy sold 8 billion euros ($10.6 billion) of 183-day bills at a rate of 6.504 percent, the highest since August 1997, and up from 3.535 percent at the prior auction on Oct. 26. Demand dropped to 1.47 times the amount on offer from 1.57 times last month. The dollar was boosted this week as Germany failed to sell its maximum amount at a bund auction and German Chancellor Angela Merkel ruled out the issuance of joint euro-area bonds.

The pound dropped for a fifth day versus the dollar as an industry group reduced its outlook for U.K. house prices.

Following the session on Friday the major stocks from Asian region showed a negative trend the third consecutive day. The main negative factor was the statement by German Chancellor Angela Merkel was not necessary in the emergence of common European bonds, since they can lead to equalization of interest rates in the region. Go to the protracted problems in Europe also added to investors' concerns about the deteriorating debt in Japan, which led to the speculation that the international rating agency Standard & Poor's sovereign rating may reduce the country with the current AA-. Uncertainty of the results of general elections in New Zealand, to be held on Saturday, November 26, also increased the tendency to fire-sale prices.

According to trade in Chinese Shanghai Composite, Hong Kong's Hang Seng, the Australian S & P / ASX 200 and Japanese Nikkei 225 index and the South Korean Kospi lowered from its asset 0.7%, 1.4%, 1.5% and 0.1% respectively.

Shares of Europe's biggest lender HSBC Holdings fell 1.8% in trading in Hong Kong, while the paper Australian banks Commonwealth Bank of Australia and Westpac Banking fell 2.2% and 1.6% respectively.

Chinese container terminal operator Cosco Pacific's market capitalization decreased by 2.8%, while the paper's largest by market value in South Korea automaker Hyundai Motor fell 3.3%.

Quotes of the second largest oil producers in Australia's Woodside Petroleum fell by 5.8% due to expectations of a slowdown in production of oil in 2012.

At the same time, shares of a Japanese manufacturer of optical equipment, Olympus rose 8.6% on news of a possible resignation of the board of directors, vice president and internal auditor charged with fraud, which led to losses.

The third largest producer of microchips in Japan, Elpida Memory boosted its market capitalization by 7.9% due to increased SMBC Nikko Securities analysts rating its shares.

European stocks advanced, trimming the biggest weekly loss in two months, amid speculation that policy makers have discussed a proposal to drop private-sector involvement from their permanent bailout mechanism.

Euro-area states are considering dropping private sector involvement from the permanent bailout mechanism as part of wider treaty change discussions, Reuters reported, citing European Union officials.

German Chancellor Angela Merkel and French President Nicolas Sarkozy “confirmed their support for Italy, saying that they are aware that the collapse of Italy would inevitably lead to the end of the euro,” Italian Prime Minister Mario Monti told a Cabinet meeting, according to an e-mailed statement.

The European Financial Stability Facility may fail to raise enough funds to increase its capacity to more than 1 trillion euros as planned because of a deterioration in market conditions over the past month, the Financial Times reported, citing three unnamed senior euro-area officials.

European Central Bank Executive Board member Jose Manuel Gonzalez-Paramo said euro-area politicians should not rely on the ECB.

Italy sold six-month bills today, at double the yield compared with the last auction on Oct. 26. The Rome-based Treasury sold 8 billion euros ($10.6 billion) of 183-day bills to yield 6.504 percent. The yield at the sale last month was 3.535 percent.

The country’s bonds and bank shares fell after the sale. Banca Monte dei Paschi di Siena SpA declined 1.2 percent to 24 euro cents. Banca Popolare dell’Emilia Romagna Scrl slipped 3 percent to 4.61 euros.

Axa SA, the biggest French insurer, jumped 1.7 percent after Goldman Sachs Group Inc. recommended buying the shares.

A gauge of oil companies led the rebound in the Stoxx 600 as oil advanced in New York. Royal Dutch Shell, Europe’s biggest oil company, rose 1.5 percent to 2,101 pence. Total, the region’s largest refiner by capacity, increased 2.4 percent to 35.69 euros. Statoil ASA, Norway’s national oil company, climbed 1.9 percent to 139.20 kroner.

Vedanta Resources Plc, the largest copper miner in India, dropped 2.8 percent to 928 pence. Copper headed for its fourth weekly drop on the London Metal Exchange.

Thomas Cook Group Plc rallied 10 percent to 18.02 pence, extending the gains from the past two days to 67 percent. The Daily Telegraph reported the tour operator’s lenders, a syndicate of 17 banks, are close to extending a 100 million- pound ($155 million) loan to it. The shares sank 75 percent on Nov. 22 after a collapse in bookings caused the tour operator to hold new talks with banks and delay its full-year results.

U.S. stocks fell, capping the worst Thanksgiving-week drop since 1932 in the Standard & Poor’s 500 Index, as S&P cut Belgium’s rating and a report said Greece is demanding private investors accept larger losses on their debt.

Stocks reversed gains today as Reuters reported that Greece is demanding that new bonds issued to investors as part of a debt swap have a net present value of 25 percent, lower than the “high 40s the banks have in mind.” Belgium’s credit rating was cut one step to AA by S&P, which said bank guarantees, political instability and slowing economic growth will make it difficult to reduce the nation’s debt load.

Dow 11,231.94 -25.61 -0.23%, Nasdaq 2,441.58 -18.50 -0.75%, S&P 500 1,158.67 -3.12 -0.27%

Banks had the biggest gain in the S&P 500 among 24 industries, rising 1 percent. Wells Fargo & Co. jumped 1.3 percent to $23.51. BB&T Corp. rose 0.6 percent to $21.17.

Some of the biggest American companies fell today. Chevron retreated 1.6 percent to $92.29. Hewlett-Packard declined 1.5 percent to $25.39.

A measure of retailers in the S&P 500 fell 0.8 percent, the second-biggest decline among 24 industries. Sears Holdings slid 1.3 percent to $58.40. Wal-Mart rose 0.4 percent to $56.89. Amazon.com Inc., the biggest Internet retailer, slumped 3.5 percent to $182.40.

Black Friday arrived with consumer sentiment at levels previously reached during recessions, as a record share of households said this is a bad time to spend, according to the Bloomberg Consumer Comfort Index. The measure has reached minus 50 or less in nine of the past 10 weeks, an unprecedented performance in its 26-year history.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.25 (Nov 4 high)

Resistance 1: Y77.80 (session high)

The current price: Y77.63

Support 1: Y77.45 (session low)

Support 2: Y77.20 (support line from Nov 18)

Support 3: Y76.85 (Nov 22 low)

Comments: the pair is on uptrend. In focus resistance Y77.80.

Resistance 3: Chf0.9390 (Feb 23 high)

Resistance 2: Chf0.9360 (Mar 10-11 high)

Resistance 1: Chf0.9325/30 (area of Nov 25 high)

The current price: Chf0.9278

Support 1: Chf0.9255 (session low)

Support 2: Chf0.9220 (50.0% FIBO Chf0.9106-Chf0.9330)

Support 3: Chf0.9190 (61.8% FIBO Chf0.9106-Chf0.9330)

Comments: the pair is on uptrend. In focus support Chf0.9325.

Resistance 3 : $1.5600 (38.2 % FIBO $1.5420-$1.5885)

Resistance 2 : $1.5560/65 (area of Nov 24 high)

Resistance 1 : $1.5525 (session high)

The current price: $1.5504

Support 1 : $1.5465 (session low)

Support 2 : $1.5420/25 (area of Nov 24 low)

Support 3 : $1.5340 (Oct 4 low)

Comments: the pair is on downtrend. In focus support $1.5465.

Resistance 3: $1.3480 (high of the European session on Nov 23)

Resistance 2: $1.3410 (Nov 24 high)

Resistance 1: $1.3335 (session high)

The current price: $1.3295

Support 1 : $1.3275 (session low)

Support 2 : $1.3210 (Nov 25 low)

Support 3 : $1.3145 (Oct 4 low)

Comments: the pair is on downtrend. In focus support $1.3275.

00:00 New Zealand NBNZ Business Confidence November 13.2 18.3

07:00 Germany Gfk Consumer Confidence Survey December 5.3 5.2

09:00 Eurozone M3 money supply, adjusted y/y October +3.1% +3.4%

09:00 Italy Business confidence November 94.0 93.0

11:00 United Kingdom CBI retail sales volume balance November -11 -12

13:00 Germany CPI preliminary November 0.0% +0.1%

13:00 Germany CPI preliminary Y/Y November +2.5% +2.4%

15:00 U.S. New Home Sales October 313K 312K

23:30 Japan Household spending Y/Y October -1.9% -1.4%

23:30 Japan Unemployment Rate October 4.1% 4.2%

23:50 Japan Retail sales, y/y October -1.2% +0.8%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.