- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Gold $1,294.4 +0.10 +0.008%

ICE Brent Crude Oil $105.62 -2.14 -1.99%

NYMEX Crude Oil $99.64 -1.78 -1.76%Nikkei 14,791.99 -35.84 -0.24%

Hang Seng 22,448.54 +297.48 +0.39%

Shanghai Composite 2,047.46 +14.15 +0.70%

S&P 500 1,885.55 +13.18 +0.70%

NASDAQ 4,268.04 +69.05 +1.64%

Dow 16,532.61 +74.95 +0.46%

FTSE 6,652.61 +54.24 +0.82%

CAC 4,426.72 +35.22 +0.80%

DAX 9,603.71 +47.80 +0.50%EUR/USD $1,3792+0,14%

GBP/USD $1,6629 -0,20%

USD/CHF Chf0,8834 -0,07%

USD/JPY Y103,68 +0,44%

EUR/JPY Y143,01 +0,59%

GBP/JPY Y172,40 +0,26%

AUD/USD $0,9237 -0,29%

NZD/USD $0,8621 -0,58%

USD/CAD C$1,1026 -0,23%08:30 Australia Building Permits, m/m February +6.8% -1.7%

08:30 Australia Building Permits, y/y February +34.6%

14:00 United Kingdom Nationwide house price index March +0.6% +0.8%

14:00 United Kingdom Nationwide house price index, y/y March +9.4% +9.6%

16:30 United Kingdom PMI Construction March 62.6 63.1

17:00 Eurozone GDP (QoQ) (Finally) Quarter IV +0.3% +0.3%

17:00 Eurozone GDP (YoY) (Finally) Quarter IV +0.5% +0.5%

17:00 Eurozone Producer Price Index, MoM February -0.3% 0.0%

17:00 Eurozone Producer Price Index (YoY) February -1.4% -1.6%

17:00 Eurozone ECOFIN Meetings

17:00 Eurozone ECB’s Vitor Constancio Speaks

20:15 U.S. ADP Employment Report March 139 192

22:00 U.S. Factory Orders February -0.7% +1.3%

22:30 U.S. Crude Oil Inventories March +6.6

06:30 Australia AIG Services Index March 55.2

The U.S. dollar rose to its highest level against the yen since late January . Investors value analyzed data published in the U.S. on the back of higher consumption tax in Japan and deteriorating prospects for business sentiment in Japan .

Consumption tax in Japan was raised to 8 % from 5 % on Tuesday . Bank of Japan Tankan report pointed to expectations of a sharp deterioration in sentiment this year.

Moderately euro rose against the dollar after data showed that manufacturing activity in the U.S. in March grew slightly more rapidly than the previous month. According to the Institute for Supply Management (ISM), the manufacturing index rose to 53.7 from 53.2 . Economists had expected the index was 54.2 .

Published data also reported an increase in construction spending in February by 0.1%. Meanwhile, the calculated final Markit Purchasing Managers Index (PMI) remained unchanged at 55.5 .

Early growth of the euro has been associated with the release of data on European PMI. Note that the PMI indices surpassed forecasts in Spain, Italy and France, confirmed the forecast of the eurozone as a whole, and not short of expectations in Germany. As it became known , the growth in the manufacturing sector slowed in the euro zone last month , and confirmed the experts' forecasts , and initial estimates . According to the final index of business activity in the manufacturing sector amounted to 53.0 points in March , which corresponds to the preliminary estimate, but below the February index at 53.2 points .

We also add that the expansion in the manufacturing sector slowed in Germany last month , which was due to weaker growth in new orders and export orders in Europe's largest economy . According to the report, the purchasing managers' index for the German manufacturing sector , which accounts for about a fifth of the economy, fell to 53.7 in March from 54.8 in February , compared with a preliminary estimate at 53.8 points . Final reading , however , was significantly above the 50- point mark that separates growth from contraction for nine consecutive months.

Were positive and data on unemployment in Germany and the euro area. Report from the Ministry of Labor in Germany showed that the unemployment rate in March fell more than expected , underscoring the continuing improvement in Europe's largest economy . Seasonally adjusted , the number of unemployed fell by 12,000 in March , beating the forecasts of experts at -9000 people. The unemployment rate was 6.7% , unchanged compared with February , the figure for which was revised down from 6.8% . Add that this is the fourth consecutive month to reduce unemployment .

Meanwhile , unemployment in the euro area declined slightly in February , but with the downward revision from the previous month to reach 11.9 percent from 12.0 percent, unchanged. This result was pleasantly surprised many experts , as their unemployment rate was forecast to reach 12.0 percent . In February, the euro zone was recorded 18,970 million unemployed , which was at 35 thousand less than in the previous month .

Pound fell against the dollar amid weak data on activity in the manufacturing sector. Note that the increase in activity in the British manufacturing sector slowed sharply in March , while showing the slowest pace in eight months , which was associated with a drop in purchase prices . According to the index of manufacturing activity fell in March to 55.3 points , its lowest value since last July , and was below economists' forecasts at 56.7 points . We also add that the February figure was revised down to 56.2 points from 56.9 points . It was the fourth consecutive month in which the index fell, although it remained significantly above 50 , which indicates growth. In Markit said that the slowdown in the sector was mainly concentrated among companies that make the machines and equipment . Meanwhile, we add that although there were signs of growth of business investment in recent years , the sub- index for new export orders fell to the lowest level since May 2013 , and some companies reported fewer orders from the Asia- Pacific region.

European stocks advanced, after the Stoxx Europe 600 Index declined last month, as a report showed manufacturing in the U.S. expanded at a faster pace in March.

The Stoxx 600 gained 0.6 percent to 336.35 at the close of trading. The benchmark gauge fell 1.1 percent in March amid tension between Russia and the West over Ukraine’s Crimea region. The volume of shares changing hands in Stoxx 600 companies today was 15 percent greater than the average of the last 30 days, according to data compiled by Bloomberg.

American manufacturing growth accelerated in March, data showed today. The Institute for Supply Management’s index rose to 53.7 from 53.2 in February. That missed the median economist estimate of 54.0. Readings above 50 signal expansion.

Unemployment in the euro-area stood at 11.9 percent in February, unchanged from a revised 11.9 percent the previous month, according to a report from Eurostat in Luxembourg. Analysts had forecast a 12 percent rate for the month.

Growth in euro-area manufacturing activity stayed close to the highest level in almost three years in March, according to data released today. An index based on a survey of purchasing managers slipped to 53.0 from 53.2 February, matching an initial estimate released last week, London-based Markit Economics Ltd. said. The index has stayed above 50 since July.

National benchmark indexes advanced in 16 of the 18 western-European markets today. France’s CAC 40 rose 0.8 percent, Germany’s DAX climbed 0.5 percent, and the U.K.’s FTSE 100 added 0.8 percent.

In China, a purchasing managers’ index by HSBC Holdings Plc and Markit Economics fell to 48 in March, the lowest reading since July, from 48.5 in February. Another PMI from the government, with a larger sample size, stood at 50.3 from 50.2 the previous month. China is the world’s biggest commodity consumer. Rio Tinto Group, the world’s second-largest mining company, rose 1.1 percent to 3,375 pence.

Alstom advanced 8.1 percent to 21.43 euros after the French maker of trains and power-generation equipment agreed to sell an auxiliary components unit to Triton for an enterprise value of about 730 million euros ($1 billion).

Metso jumped 19 percent to 28.34 euros. Weir said in a statement that its indicative all-share merger proposal offers significant efficiencies and synergies, without giving further details. Metso confirmed separately that it’s considering an unsolicited approach from the British pressure-pump maker. The Times reported Weir may pay as much as 30 euros a share for the Finnish business. Weir declined 0.7 percent to 2,518 pence.

ICAP rose 2.6 percent to 387.5 pence. The company said estimates for its full-year profit range between 266 million pounds ($443 million) and 280 million pounds, according to a poll of 11 analysts by the company. It reports full-year results on May 14. Revenue at ICAP’s global broking division fell 14 percent in February and March compared to the same period last year, the London-based firm said in a statement.

Cap Gemini SA dropped 2.4 percent to 53.66 euros. Bank of America Corp. cut the French competitor to International Business Machines Corp. to underperform from neutral, meaning investors should sell the shares. The bank cited the stock’s high valuation and signs of pricing pressure. Cap Gemini trades at 15.1 times estimated earnings, compared with an average 14.3 in the past five years, according to data compiled by Bloomberg.

Osram Licht AG slipped 0.8 percent to 46.70 euros, after earlier losing as much as 5 percent. The lighting manufacturer said traditional-lamp sales continued to decline in the first two months of the recent quarter.

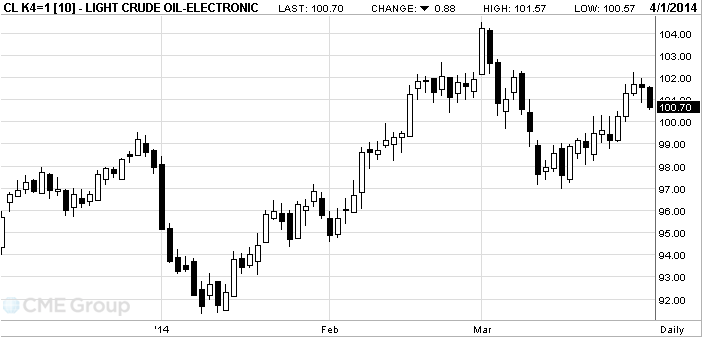

West

WTI dropped

as much as 1 percent. Stockpiles may have climbed 2.5 million barrels last

week, according to a Bloomberg survey before a government report scheduled for

release tomorrow. The Institute for Supply Management’s index reached

“All the

news is bearish today,” said Michael Lynch, president of Strategic Energy &

Economic Research in

WTI for May

delivery declined 87 cents, or 0.9 percent, to $100.71 a barrel at 10:12 a.m.

on the New York Mercantile Exchange. The volume of all futures traded was 18

percent below the 100-day average. Prices dropped 1 percent in March.

Brent crude

for May settlement slid 60 cents, or 0.6 percent, to $107.16 a barrel on the

London-based ICE Futures Europe exchange. Volume was 25 percent below the

100-day average. The European benchmark was at a $6.45 premium to WTI after

closing at $6.18 yesterday.

Gold prices fell to a minimum of seven weeks due to the outflow of investments backed by gold exchange-traded funds in riskier assets .

Stocks of the world's largest exchange-traded fund backed by gold (ETF) SPDR Gold Trust on Monday fell by 3.89 tons to 813.08 tons , the biggest outflow of more than a month .

The price of gold 99.99 fine on the Shanghai Gold Exchange at $ 1 per ounce below the spot price in London , compared with a discount of $ 8 in March , dealers said .

Reduction occurs on a background of gold as investors about the outlook for policy tightening by the Federal Reserve System .

The U.S. economy is still " some time " will need to be supported , said yesterday the Fed chief Janet Yellen . Yellen said on March 19 that the controller can start to raise rates about six months after completion of the redemption in this year.

Gold has completed the first month of this year, a fall - fell from a high of quotes the past six months , recorded March 17 , when the demand for the precious metal rose amid the Crimea to Russia . Russia yesterday began to divert troops from the border with Ukraine, which took place the last two days of talks Ministers of Foreign Affairs of the Russian Federation and the United States helped ease investors' concerns about the possible escalation of the crisis .

The cost of the June gold futures on the COMEX today dropped to $ 1277.40 per ounce.

USD/JPY Y102.10, Y102.30, Y102.50, Y103.25/30, Y103.75

EUR/USD $1.3580, $1.3650, $1.3700, $1.3750, $1.3763, $1.3790, $1.3800, $1.3830, $1.3895

USD/CAD Cad1.0800, Cad1.0900, Cad1.1030, Cad1.1200

EUR/JPY Y139.90, Y143.00

GBP/USD $1.6500, $1.6630

EUR/NOK Nok8.4000

AUD/JPY Y94.00

U.S. stock-index futures rose, investors awaited data from ISM.

Global markets:

FTSE 6,635.41 +0.56%

CAC 4,430.72 +0.89%

DAX 9,615.33 +0.62%

Nikkei 14,791.99 -0.24%

Hang Seng 22,448.54 +1.34%

Shanghai Composite 2,047.46 +0.70%

Crude oil $101.29 (-0.31%)

Gold $1285.30 (+0.10%).

01:00 China Manufacturing PMI March 50.2 50.1 50.3

01:30 Japan Labor Cash Earnings, YoY February -0.2% -0.1% 0.0%

01:45 China HSBC Manufacturing PMI (Finally) March 48.5 48.5 48.0

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

05:30 Australia Commodity Prices, Y/Y March -12.1% -12.8%

07:30 Switzerland Manufacturing PMI March 57.6 56.7 54.4

07:48 France Manufacturing PMI (Finally) March 51.9 51.9 52.1

07:53 Germany Manufacturing PMI (Finally) March 53.8 53.8 53.7

07:55 Germany Unemployment Change March -14 -9 -12

07:55 Germany Unemployment Rate s.a. March 6.7% Revised From 6.8% 6.8% 6.7%

07:58 Eurozone Manufacturing PMI (Finally) March 53.0 53.0 53.0

08:30 United Kingdom Purchasing Manager Index Manufacturing March 56.9 56.7 55.3

09:00 Eurozone ECOFIN Meetings

09:00 Eurozone Eurogroup Meetings

09:00 Eurozone ECB President Mario Draghi Speaks

09:00 Eurozone Unemployment Rate February 11.9% 12.0% 11.9%

The euro rose against the dollar, which was associated with the release of data on PMI. Note that the PMI indices surpassed forecasts in Spain, Italy and France, confirmed the forecast of the eurozone as a whole, and not short of expectations in Germany. As it became known , the growth in the manufacturing sector slowed in the euro zone last month , and confirmed the experts' forecasts , and initial estimates . According to the final index of business activity in the manufacturing sector amounted to 53.0 points in March , which corresponds to the preliminary estimate, but below the February index at 53.2 points .

We also add that the expansion in the manufacturing sector slowed in Germany last month , which was due to weaker growth in new orders and export orders in Europe's largest economy . According to the report, the purchasing managers' index for the German manufacturing sector , which accounts for about a fifth of the economy, fell to 53.7 in March from 54.8 in February , compared with a preliminary estimate at 53.8 points . Final reading , however , was significantly above the 50- point mark that separates growth from contraction for nine consecutive months.

Were positive and data on unemployment in Germany and the euro area. Report from the Ministry of Labor in Germany showed that the unemployment rate in March fell more than expected , underscoring the continuing improvement in Europe's largest economy . Seasonally adjusted , the number of unemployed fell by 12,000 in March , beating the forecasts of experts at -9000 people. The unemployment rate was 6.7% , unchanged compared with February , the figure for which was revised down from 6.8% . Add that this is the fourth consecutive month to reduce unemployment .

Meanwhile , unemployment in the euro area declined slightly in February , but with the downward revision from the previous month to reach 11.9 percent from 12.0 percent, unchanged. This result was pleasantly surprised many experts , as their unemployment rate was forecast to reach 12.0 percent . In February, the euro zone was recorded 18,970 million unemployed , which was at 35 thousand less than in the previous month .

Pound fell against the dollar amid weak data on activity in the manufacturing sector. Note that the increase in activity in the British manufacturing sector slowed sharply in March , while showing the slowest pace in eight months , which was associated with a drop in purchase prices . According to the index of manufacturing activity fell in March to 55.3 points , its lowest value since last July , and was below economists' forecasts at 56.7 points . We also add that the February figure was revised down to 56.2 points from 56.9 points . It was the fourth consecutive month in which the index fell, although it remained significantly above 50 , which indicates growth. In Markit said that the slowdown in the sector was mainly concentrated among companies that make the machines and equipment . Meanwhile, we add that although there were signs of growth of business investment in recent years , the sub- index for new export orders fell to the lowest level since May 2013 , and some companies reported fewer orders from the Asia- Pacific region.

EUR / USD: during the European session, the pair rose to $ 1.3801

GBP / USD: during the European session, the pair fell to $ 1.6635

USD / JPY: during the European session, the pair rose to Y103.42

At 12:30 GMT in Canada will be represented by the price index for raw materials in February and the PMI index for the manufacturing of RBC in March . At 14:00 GMT the U.S. ISM manufacturing index will be released in March . At 20:30 GMT the U.S. will report on changes in the volume of crude oil , according to the API. At 23:50 GMT , Japan will announce to the change in the monetary base in March .

EUR/USD

Offers $1.3880, $1.3845/50, $1.3820, $1.3810

Bids $1.3705/00, $1.3694, $1.3650, $1.3640, $1.3630/20

GBP/USD

Offers $1.6785, $1.6715/20, $1.6700

Bids $1.6600/10, $1.6580, $1.6550, $1.6520, $1.6500

AUD/USD

Offers $0.9400, $0.9350, $0.9300/10

Bids $0.9215/20, $0.9200, $0.9170, $0.9155/50, $0.9120

EUR/JPY

Offers Y144.00, Y143.40, Y143.00, Y142.60/65

Bids Y141.70/80, Y141.10/20, Y140.50, Y139.95/00

USD/JPY

Offers Y104.00, Y103.75, Y103.45

Bids Y102.70, Y102.45, Y102.00, Y101.70/80, Y101.20

EUR/GBP

Offers stg0.8350/60, stg0.8320/25, stg0.8300

Bids stg0.8245, stg0.8210/00, stg0.8180

European stocks advanced, after posting a monthly decline, as investors awaited U.S. manufacturing data. U.S. stock-index futures were little changed, while Asian shares rose.

The Stoxx Europe 600 Index gained 0.3 percent to 335.36 at 10:20 a.m. in London. The benchmark gauge fell 1.1 percent in March amid tension between Russia and the West over Ukraine’s Crimea region.

A report may show manufacturing in the world’s biggest economy expanded in March. The Institute for Supply Management’s index rose to 54 from 53.2 in February, according to the median forecast of economists. Readings above 50 signal expansion.

Growth in euro-area manufacturing activity stayed close to the highest level in almost three years in March, according to data released today. An index based on a survey of purchasing managers slipped to 53.0 from 53.2 February, matching an initial estimate released last week, London-based Markit Economics Ltd. said. The index has stayed above 50 since July.

Two factory reports signaled weakness in China, the world’s biggest commodity consumer. A purchasing managers’ index by HSBC Holdings Plc and Markit Economics fell to 48 in March, the lowest reading since July, from 48.5 in February. Another PMI from the government, with a larger sample size, stood at 50.3 from 50.2 the previous month.

Alstom advanced 7 percent to 21.21 euros after the French maker of trains and power-generation equipment agreed to sell an auxiliary components unit to Triton for an enterprise value of about 730 million euros ($1 billion).

Metso jumped 18 percent to 28.09 euros after the Times reported Weir Group may be willing to pay as much as 30 euros a share for the Finnish operation. The companies have been in informal talks, the newspaper reported, citing an unnamed person familiar with the matter. Weir Group declined 2.3 percent to 2,479 pence.

BHP Billiton Ltd. added 2.8 percent to 1,895.5 pence after saying that it is looking to simplify its operations to focus on iron ore, copper, coal and petroleum. The world’s biggest mining company is considering options including spinning off aluminum, nickel and bauxite assets in a A$20 billion ($18.5 billion) transaction, the Australian Financial Review reported.

ICAP rose 2.9 percent to 388.7 pence. Revenue at ICAP’s global broking division fell 14 percent in February and March compared to the same period last year, the London-based firm said in a statement. The company said estimates for its full-year profit range between 266 million pounds ($443 million) and 280 million pounds, according to a poll of 11 analysts by the company. It reports full-year results on May 14.

Cap Gemini SA (CAP) dropped 1.2 percent to 54.29 euros. Bank of America Corp. cut the French competitor to International Business Machines Corp. to underperform from neutral, meaning investors should sell the shares. The bank cited an unattractive risk/reward relationship, the stock’s high valuation and signs of pricing pressure. Cap Gemini trades at 15.4 times estimated earnings, compared with an average 14.3 in the past five years, according to data compiled by Bloomberg.

Osram Licht AG declined 1.5 percent to 46.35 euros. The lighting manufacturer said traditional-lamp sales continued to decline in the first two months of the recent quarter.

FTSE 100 6,626.48 +28.11 +0.43%

CAC 40 4,422.95 +31.45 +0.72%

DAX 9,604.74 +48.83 +0.51%

USD/JPY Y102.10, Y102.30, Y102.50, Y103.25/30, Y103.75

EUR/USD $1.3580, $1.3650, $1.3700, $1.3750, $1.3763, $1.3790, $1.3800, $1.3830, $1.3895

USD/CAD Cad1.0800, Cad1.0900, Cad1.1030, Cad1.1200

EUR/JPY Y139.90, Y143.00

GBP/USD $1.6500, $1.6630

EUR/NOK Nok8.4000

AUD/JPY Y94.00

Asian stocks swung between gains and losses as investors weighed reports on China’s manufacturing that pointed to weakness in the world’s second-biggest economy. A Chinese Purchasing Managers’ Index fell to 48 in March, the lowest reading since July, from 48.5, HSBC Holdings Plc and Markit Economics said today. A separate PMI from the government, with a larger sample size, registered 50.3 from 50.2 in February.

Nikkei 225 14,791.99 -35.84 -0.24%

S&P/ASX 200 5,389.2 -5.63 -0.10%

Shanghai Composite 2,046.36 +13.05 +0.64%

Evergrande Real Estate Group Ltd., China’s third-biggest developer by area sold, soared 6.3 percent in Hong Kong as investors welcomed the company’s dividend and full-year earnings beat estimates.

Sands China Ltd. and Galaxy Entertainment Group advanced in Hong Kong after Credit Suisse Group AG said casino revenue may rise 13 percent in March.

Hokkaido Electric Power Co. slumped 10 percent in Tokyo on a report the Development Bank of Japan Inc. will inject 50 billion yen ($484 million) into the utility.

Asian session: The greenback remained lower

01:00 China Manufacturing PMI March 50.2 50.1 50.3

01:30 Japan Labor Cash Earnings, YoY February -0.2% -0.1% 0.0%

01:45 China HSBC Manufacturing PMI (Finally) March 48.5 48.5 48.0

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

The greenback remained lower following a two-day decline against the euro after Federal Reserve Chair Janet Yellen said the world’s biggest economy will need monetary stimulus “for some time.” Economists predict a report today will show a growth in manufacturing quickened last month. The Institute for Supply Management’s U.S. manufacturing index climbed to 54 last month from 53.2 in February, according to the median forecast of analysts surveyed by Bloomberg.

The Australian dollar rose after a gauge of Chinese manufacturing climbed and before a Reserve Bank policy decision today. Government data today showed the manufacturing Purchasing Managers’ Index for China, Australia’s biggest trading partner, rose to 50.3 last month from 50.2 in February. That compares with economists’ forecast for a reading of 50.1 in a Bloomberg survey.

Australia’s dollar broke above 93 U.S. cents for the first time in four months after the central bank left interest rates unchanged and said a record-low benchmark would help strengthen growth. The Aussie pared gains as Governor Glenn Stevens changed his references to the currency, indicating recent gains may detract from an economic rebalancing as mining investment declines. He reiterated that it “remains high by historical standards.” Australia’s dollar advanced earlier after a Chinese official manufacturing index strengthened for the first time in five months.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3765-75

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6655-70

USD / JPY: on Asian session the pair traded in the range of Y103.10-35

Eurozone (starting with Spain at 0715GMT through to EZ at 0758GMT) and UK manufacturing PMI (0828GMT) data due out this morning and will concentrate interest.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.