- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Gold $1,294.4 +0.10 +0.008%

ICE Brent Crude Oil $108.07 +0.32 +0.30%

NYMEX Crude Oil $101.67 +0.28 +0.28%

(index / closing price / change items /% change)

Nikkei 14,827.83 +131.80 +0.90%

Hang Seng 22,151.06 +85.53 +0.39%

Shanghai Composite ,033.31 -8.41 -0.41%

S&P 500 1,872.34 +14.72 +0.79%

NASDAQ,198.99 +43.23 +1.04%

Dow 16,457.66 +134.60 +0.82%

FTSE 6,598.37 -17.21 -0.26%

CAC 4,391.5 -19.76 -0.45%

DAX 9,555.91-31.28 -0.33%

EUR/USD $1,3773 +0,24%

GBP/USD $ 1,6662 +0,35%

USD/CHF Chf0,8840 -0,28%

USD/JPY Y103,22 +0,96%

EUR/JPY Y142,17 +1,20%

GBP/JPY Y171,96 +1,31%

AUD/USD $0,9264 +0,05%

NZD/USD $0,8671 +0,06%

USD/CAD C$1,1051 +0,18%

01:00 China Manufacturing PMI March 50.2 50.1

01:30 Japan Labor Cash Earnings, YoY February -0.2% -0.1%

01:45 China HSBC Manufacturing PMI (Finally) March 48.5 48.5

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

03:30 Australia RBA Rate Statement

05:30 Australia Commodity Prices, Y/Y March -12.1%

07:30 Switzerland Manufacturing PMI March 57.6 56.7

07:48 France Manufacturing PMI (Finally) March 51.9 51.9

07:53 Germany Manufacturing PMI (Finally) March 53.8 53.8

07:55 Germany Unemployment Change March -14 -9

07:55 Germany Unemployment Rate s.a. March 6.8% 6.8%

07:58 Eurozone Manufacturing PMI (Finally) March 53.0 53.0

08:30 United Kingdom Purchasing Manager Index Manufacturing March 56.9 56.7

09:00 Eurozone Unemployment Rate February 12.0% 12.0%

12:30 Canada Industrial Product Prices, m/m February +1.4% +0.7%

12:30 Canada Raw Material Price Index February +2.6% +2.3%

12:58 U.S. Manufacturing PMI (Finally) March 55.5 55.9

14:00 U.S. Construction Spending, m/m February +0.1% +0.2%

14:00 U.S. ISM Manufacturing March 53.2 54.2

20:30 U.S. API Crude Oil Inventories March +6.3

23:30 Japan Monetary Base, y/y March 55.7% 60.2%

The euro edged higher against the U.S. dollar on a background of comments Janet Yellen . Fed Chairman Yellen , who spoke today at a conference in Chicago, defended the loose monetary policy of the USA , stating that its purpose was to help the economy and the labor market in particular.

Yellen noted that the Fed's commitment to promotion policies is still a necessity, and this situation will continue for some time . She also pointed to the fact that low interest rates will remain low for an extended period of time.

The Fed chief has listed a large number of part-time workers , slow wage growth , a large number of workers who do not have full employment , fall in the share of the working population as indicators that the labor market is still in a difficult situation . She also noted that for some Americans the current economic situation was more complicated than in a recession .

Earlier pressure on euro was weak data on inflation in the eurozone, but the comments of the ECB representative Nowotny able to offset this negative.

As it became known , the annual inflation rate in the euro zone fell again in March , beating the average forecast with experts and reaching its lowest level since late 2009. According to a report in the March consumer price index rose by 0.5 % from March 2013 , compared with a gain of 0.7 % a month earlier and rated at 0.6 . Add index more and more away from the target of the European Central Bank , which is set at "a little less than 2% ." The data also showed that the cost of energy in the eurozone fell in March by 2.1 % after declining 2.3% in February. Food, alcohol and tobacco products rose by 1 % after rising 1.5 % the previous month . Core CPI , which excludes vollatilnye elements - such as energy and food - growth slowed to 0.8% from 1.0% in February.

With regard to the Novotny , he said that the recession in the euro area came to an end , and the economic situation in the region has significantly improved , but he still has to deal with their problems . Nowotny , who also heads the Austrian Central Bank , says that in 2014 the Austrian budget deficit will exceed 3 %, but next year will fall below 2%. He noted , however, that it is not a structural deficit.

The yen declined significantly against the U.S. dollar . Recent comments on the Bank of Japan that it was too early to discuss specific exit strategy from quantitative easing weighed on the yen. Now, there are several factors that can support the growth of the pair this week : first, the U.S. was to publish a number of reports that may indicate the recovery of the U.S. economy. This will increase the rate differential gap between the U.S. and Japan , respectively, and press on the yen , and secondly , the global risk sentiment remains unstable, as the conflict between Russia and Ukraine is still a threat to global geopolitics .

Franc rose against the dollar , despite the weak data . The growth was due to the weakening of the U.S. currency , as well as the head of the SNB Jordan comments . He said the Swiss franc is still high, and the minimum level for the pair EUR / CHF - an essential tool for maintaining price stability. Meanwhile, he added that the current exchange rate policy will remain relevant for the Swiss National Bank in the foreseeable future , but do not rule out negative interest rates to maintain proper monetary conditions .

European advanced, after the biggest weekly gain in more than a month, as investors awaited economic data out of Europe and America later this week.

Federal Reserve Chair Janet Yellen said the central bank’s unprecedented accommodation will be needed for “some time” as the labor market is still recovering. Investors await payroll data due April 4, which will probably show that hiring accelerated in March, according to economists’ forecasts compiled by Bloomberg.

Separate reports this week may show that manufacturing in the world’s largest economy expanded further this month, while factory orders rebounded in February, according to economists’ forecasts in Bloomberg News surveys.

On April 3, the European Central Bank will probably maintain its key interest rate at a record low of 0.25 percent, economists’ projections show.

In Germany, a report showed today that retail sales rose 1.3 percent last month after a revised 1.7 percent gain in January. Economists in a Bloomberg News survey had forecast a 0.5 percent drop for February. Separate data showed inflation in the euro area slowed this month more than forecast, keeping pressure on the ECB to take action.

National benchmark indexes advanced in 15 of the 18 western-European markets today. France’s CAC 40 slipped 0.5 percent, while Germany’s DAX and the U.K.’s FTSE 100 each dropped 0.3 percent.

Novartis gained 3.5 percent, the most since January 2013, to 75 Swiss francs. The company ended the drug trial early as the results showed patients treated with it lived longer without being hospitalized for heart failure than those who received standard treatment. Novartis will ask global regulators for marketing approval for the drug.

Monte dei Paschi jumped 4.9 percent to 26.5 euro cents. Fondazione Monte dei Paschi di Siena said it agreed to sell a 6.5 percent stake in the Italian bank to Fintech Advisory Inc. and BTG Pactual Europe LLP. Antonella Mansi, the foundation’s chairman, said the investor pact creates a stable, strategic shareholding for the lender. The non-profit foundation sold 12 percent of Monte dei Paschi earlier this month as it sought to reduce debt.

ING Groep NV climbed 2.8 percent to 10.28 euros after saying it intends to resume dividend payments as soon as next year after a five-year pause. The Dutch financial-services company will pay a dividend over 2015 after fully repaying a 2008 government bailout by next May at the latest. Dividend payouts should grow to at least 40 percent of net income by 2017, ING said.

Drillisch AG added 2.8 percent to 26.34 euros. Chief Executive Officer Paschalis Choulidis told Welt am Sonntag the provider of phone services may pay a special dividend or buy back shares if it doesn’t make acquisitions by 2015.

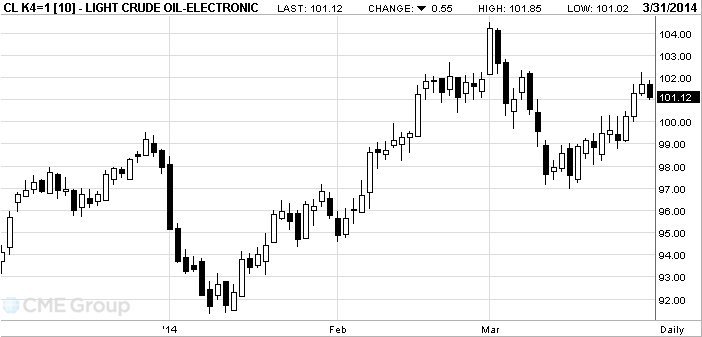

West Texas

Intermediate crude traded near the highest close in three weeks as the

Futures

were little changed in

“There is a

looming tension on

WTI for May

delivery was at $101.31 a barrel in electronic trading on the New York

Mercantile Exchange, down 36 cents, at 12:39 p.m.

Brent for

May settlement was at $107.81 a barrel, down 24 cents on the London-based ICE

Futures Europe exchange. The March 28 close was the highest since March 14. The

European benchmark crude was at a premium of $6.53 to WTI. The spread narrowed

for a third day on March 28 to close at $6.40.

Brent is

poised for a decline of 2.7 percent this quarter.

Gold prices traded within a range close to Friday's six-week low and decline in March due to growing optimism about the U.S. economy and weak demand in the physical markets of Asia.

Kept gold prices rise weak statistics on industrial production in Japan. The volume of industrial production in Japan in February unexpectedly fell 2.3 % on a monthly basis , after rising 3.8 % in January. Analysts , on the contrary , had expected growth of 0.3%.

The analysts point out that the price of gold is under some pressure due to uncertainty about the Fed's policy .

Gold's appeal as a low-risk investments decreased this year due to high U.S. macroeconomic indicators . Fed Chairman Janet Yellen hinted at the beginning of March , the central bank may raise interest rates in the first half of 2015.

" Janet Yellen talked about raising rates , which put pressure on gold, but investors should remember that while the improved statistics , the U.S. economy is far from strong ," - believes macroeconomic strategist at Everbright Futures Co. Sun Yonggang .

"Prices continue to fall , because the factors supporting the gold in the first quarter , for example, geopolitical issues and the crisis in developing countries, now weakened ," - said the precious metals market analyst Jinrui Futures Chen Ming . According to him , the physical demand in Asia may rise when prices fall to $ 1.180-1.200 .

The cost of the April gold futures on the COMEX today dropped to $ 1288.70 per ounce.

USD/JPY Y101.50, Y102.00, Y102.30, Y102.50, Y103.00, Y103.25, Y103.50

EUR/USD $1.3700, $1.3750, $1.3775, $1.3800, $1.3900

AUD/USD $0.9130, $0.9135, $0.9165/70, $0.9230, $0.9300

USD/CAD Cad1.1000

EUR/JPY Y141.75

GBP/USD $1.6550, $1.6615, $1.6750

EUR/GBP stg0.8300

U.S. stock-index futures rose, investors await a speech by Federal Reserve Chair Janet Yellen.

Global markets:

Nikkei 14,827.83 +0.90%

Hang Seng 22,151.06 +0.39%

Shanghai Composite 2,033.31 -0.41%

FTSE 6,635.48 +0.30%

CAC 4,416.34 +0.12%

DAX 9,612.43 +0.26%

Crude oil $101.47 (-0.20%)

Gold $1292.30 (-0.12%).

00:00 Australia HIA New Home Sales, m/m February +0.5% +4.6%

00:00 New Zealand ANZ Business Confidence March 70.8 67.3

00:30 Australia Private Sector Credit, m/m February +0.4% +0.4% +0.4%

00:30 Australia Private Sector Credit, y/y February +4.1% +4.3%

06:00 Germany Retail sales, real adjusted February +1.7% Revised From +2.5% -0.3% +1.3%

06:00 Germany Retail sales, real unadjusted, y/y February +0.9% +2.0%

06:45 France GDP, q/q (Finally) Quarter IV +0.3% +0.3% +0.3%

06:45 France GDP, Y/Y (Finally) Quarter IV +0.8% +0.8% +0.8%

07:00 Switzerland KOF Leading Indicator March 2.03 2.08 1.99

08:30 United Kingdom Net Lending to Individuals, bln February 2.1 2.3 1.7

08:30 United Kingdom Mortgage Approvals February 77.0 75.0 70.3

09:00 Eurozone Harmonized CPI, Y/Y March +0.7% +0.6% +0.5%

The euro exchange rate against the dollar rose sharply , returning with all previously lost ground. Pressure on the pair had a weak data on inflation in the eurozone, but the comments of the ECB representative Nowotny able to offset this negative.

As it became known , the annual inflation rate in the euro zone fell again in March , beating the average forecast with experts and reaching its lowest level since late 2009. According to a report in the March consumer price index rose by 0.5 % from March 2013 , compared with a gain of 0.7 % a month earlier and rated at 0.6 . Add index more and more away from the target of the European Central Bank , which is set at "a little less than 2% ." The data also showed that the cost of energy in the eurozone fell in March by 2.1 % after declining 2.3% in February. Food, alcohol and tobacco products rose by 1 % after rising 1.5 % the previous month . Core CPI , which excludes vollatilnye elements - such as energy and food - growth slowed to 0.8% from 1.0% in February.

With regard to the Novotny , he said that the recession in the euro area came to an end , and the economic situation in the region has significantly improved , but he still has to deal with their problems . Nowotny , who also heads the Austrian Central Bank , says that in 2014 the Austrian budget deficit will exceed 3 %, but next year will fall below 2%. He noted , however, that it is not a structural deficit.

The yen declined significantly against the U.S. dollar , which is associated with the expectations of today's speech by U.S. Federal Reserve Janet Yellen to be held in Chicago. Recall the last FOMC meeting , Yellen said that ready in 6 months after the reduction of the QE program to begin to raise interest rates . Currently, the program of quantitative easing has been reduced to $ 55 billion next meeting of the Federal Open Market Committee Federal Reserve will take place April 29-30 .

Recent comments on the Bank of Japan that it was too early to discuss specific exit strategy from quantitative easing also put pressure on the yen. Now, there are several factors that can support the growth of the pair this week : first, the U.S. was to publish a number of reports that may indicate the recovery of the U.S. economy. This will increase the rate differential gap between the U.S. and Japan , respectively, and press on the yen , and secondly , the global risk sentiment remains unstable, as the conflict between Russia and Ukraine is still a threat to global geopolitics .

Franc rose against the dollar , despite the weak data . The growth was due to the weakening of the U.S. currency , as well as the head of the SNB Jordan comments . He said the Swiss franc is still high, and the minimum level for the pair EUR / CHF - an essential tool for maintaining price stability. Meanwhile, he added that the current exchange rate policy will remain relevant for the Swiss National Bank in the foreseeable future , but do not rule out negative interest rates to maintain proper monetary conditions .

EUR / USD: during the European session, the pair rose to $ 1.3805

GBP / USD: during the European session, the pair rose to $ 1.6655

USD / JPY: during the European session, the pair rose to Y103.30

At 12:30 GMT , Canada will report on changes in the volume of GDP in January . At 13:30 GMT the U.S. Chairman of the Board of Governors of the Federal Reserve Janet Yellen will speak . At 13:45 GMT the U.S. Chicago PMI index will be released in March . At 23:00 GMT Australia will present prices of housing from RPData-Rismark March . At 23:50 GMT , Japan will release the index of activity in the sector of large manufacturers Tankan, the index of non-manufacturing activity in the Tankan index 'Tankan' capital expenditures for large enterprises of all branches of the 1st quarter , as well as the predicted value of the index 'Tankan' for large enterprises the production sector and predictive value of the index 'Tankan' non-manufacturing areas in the 2nd quarter .

EUR/USD

Offers $1.3880, $1.3845/50, $1.3820, $1.3800

Bids $1.3705/00, $1.3694, $1.3650, $1.3640, $1.3630/20

GBP/USD

Offers $1.6785, $1.6715/20, $1.6700, $1.6665

Bids $1.6580, $1.6550, $1.6520, $1.6500

AUD/USD

Offers $0.9400, $0.9350, $0.9300, $0.9275/80

Bids $0.9200, $0.9170, $0.9155/50, $0.9120

EUR/JPY

Offers Y143.00, Y142.60, Y142.20, Y141.95/00

Bids Y141.00/10, Y140.50, Y139.95/00

USD/JPY

Offers Y103.75, Y103.45, Y103.00/10

Bids Y102.25/35, Y102.00, Y101.80, Y101.60, Y101.50, Y101.35/30

EUR/GBP

Offers stg0.8350, stg0.8325, stg0.8300, stg0.8280

Bids stg0.8245, stg0.8210/00, stg0.8180

European stocks were little changed , after the biggest weekly gain in more than a month , as investors awaited economic data from Europe and America at the end of this week. Futures on American stock indexes and Asian shares rose .

Little influenced by the data for the euro area , namely inflation . As it became known , the annual inflation rate in the euro zone fell again in March , beating with the average forecasts of experts , and the lowest level since late 2009 . According to a report in the March consumer price index rose by 0.5 % from March 2013 , compared with a gain of 0.7 % a month earlier , and estimates at 0.6 .

The data also showed that the cost of energy in the eurozone fell in March by 2.1 % after declining 2.3% in February. Food, alcohol and tobacco products rose by 1 % after rising 1.5 % the previous month .

Core CPI , which excludes vollatilnye items such as energy and food prices , growth slowed to 0.8% from 1.0% in February.

The Stoxx Europe 600 Index gained 0.1 percent. Last week, the sensor increased by 1.8 percent .

Now switch to the attention of investors reports on business activity in the manufacturing industry and services the United States, as well as the March unemployment in the U.S. , which will be released this week.

Will also be an important meeting of the European Central Bank, which is likely to keep its key interest rate at a record low - 0.25 percent .

Shares of Novartis AG - Swiss pharmaceutical company , rose 3.2%. The company announced positive results of the last phase of clinical trials of the drug to compensate for chronic heart failure.

The cost of the Dutch ING Groep NV increased by 2.4 % , as it became known that the FCCU intends to repay the bailout state loan no later than May 2015 and in the same year to resume the payment of dividends to shareholders.

Quotes Drillish AG - German telephone service provider , rose 2.4 % on expectations of a special dividend or share repurchases.

Cost of Banca Monte dei Paschi di Siena SpA jumped 9 percent after the biggest investor said he sells an additional share .

At the current moment

FTSE 100 6,624.58 +9.00 +0.14 %

CAC 40 4,405.26 -6.00 -0.14%

DAX 9,582.1 -5.09 -0.05%

USD/JPY Y101.50, Y102.00, Y102.30, Y102.50, Y103.00, Y103.25, Y103.50

EUR/USD $1.3700, $1.3750, $1.3775, $1.3800, $1.3900

AUD/USD $0.9130, $0.9135, $0.9165/70, $0.9230, $0.9300

USD/CAD Cad1.1000

EUR/JPY Y141.75

GBP/USD $1.6550, $1.6615, $1.6750

EUR/GBP stg0.8300

Asian stocks rose, with the regional benchmark index heading for its fourth straight daily gain, as consumer shares led advances. Federal Reserve Chair Janet Yellen speaks in Chicago today as investors await payrolls data due later in the week to assess the outlook for U.S. interest rates.

Nikkei 225 14,827.83 +131.80 +0.90%

S&P/ASX 200 5,394.8 +27.86 +0.52%

Shanghai Composite 2,036.48 -5.24 -0.26%

Eclat Textile Co., which sells fabrics and garments, rose 7 percent in Taiwan, the most among the MSCI Asia Pacific Index group tracking consumer discretionary shares.

Samsung SDI Co., a South Korean supplier of batteries to Apple Inc., jumped 8 percent, after it agreed to buy Cheil Industries Inc.

Mazda Motor Corp., a Japanese automaker that gets about 30 percent of its revenue in North America, gained 4.1 percent.

00:00 Australia HIA New Home Sales, m/m February +0.5% +4.6%

00:00 New Zealand ANZ Business Confidence March 70.8 67.3

00:30 Australia Private Sector Credit, m/m February +0.4% +0.4% +0.4%

00:30 Australia Private Sector Credit, y/y February +4.1% +4.3%

The euro traded near a one-month low before data today that may show inflation slowed in the currency’s region, boosting bets the European Central Bank will signal stimulus measures at a policy meeting this week. The European Union’s statistics office will probably say in an initial estimate today that consumer prices in the region rose 0.6 percent this month from a year earlier, compared with a 0.7 percent final figure for February, according to economists surveyed by Bloomberg News.

The dollar approached a two-week high versus the yen before Federal Reserve Chair Janet Yellen speaks and ahead of figures tomorrow that may show U.S. manufacturing strengthened this month. Yellen is scheduled to deliver remarks at a conference in Chicago today. The U.S. central bank head said this month borrowing costs could rise “around six months” after officials end the Fed’s monthly bond-buying program, which currently stands at $55 billion. The Federal Open Market Committee next meets on April 29-30.

The Australian dollar headed for its best quarterly performance since 2011 against the greenback, with 27 of 33 economists surveyed by Bloomberg predicting the central bank will refrain from cutting interest rates this year. All expect no change in the cash rate from a record-low 2.5 percent at tomorrow’s meeting.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3740-60

GBP / USD: during the Asian session the pair fell to $ 1.6625

USD / JPY: on Asian session the pair traded in the range of Y102.80-95

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.