- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Gold $1,284.4 -7.30 -0.57%

ICE Brent Crude Oil $106.15 +1.36 +1.30%

NYMEX Crude Oil $100.38 +0.98 +0.99%

Nikkei 15,071.88 +125.56 +0.84%

Hang Seng 22,565.08 +41.14 +0.18%

Shanghai Composite 2,043.7 -15.29 -0.74%

S&P 500 1,888.77 -2.13 -0.11%

NASDAQ 4,237.74 -38.72 -0.91%

Dow 16,572.55 -0.45 0.00%

FTSE 6,649.14 -9.90 -0.15%

CAC 4,449.33 +18.47 +0.42%

DAX 9,628.82 +5.46 +0.06%EUR/USD $1,3717 -0,35%

GBP/USD $1,6593 -0,18%

USD/CHF Chf0,8910 +0,49%

USD/JPY Y103,91 +0,05%

EUR/JPY Y142,54 -0,29%

GBP/JPY Y172,43 -0,13%

AUD/USD $0,9227 -0,25%

NZD/USD $0,8539 -0,40%

USD/CAD C$1,1036 +0,05%

07:00 United Kingdom Halifax house price index March +2.4% +0.7%

07:00 United Kingdom Halifax house price index 3m Y/Y March +7.9%

10:00 Germany Factory Orders s.a. (MoM) February +1.2% +0.5%

10:00 Germany Factory Orders n.s.a. (YoY) March +8.4%

12:30 Canada Unemployment rate March 7.0% 7.0%

12:30 Canada Employment March -7.0 25.3

12:30 U.S. Average workweek March 34.2 34.2

12:30 U.S. Average hourly earnings March +0.4% +0.2%

12:30 U.S. Unemployment Rate March 6.7% 6.6%

12:30 U.S. Nonfarm Payrolls March 175 196

14:00 Canada Ivey Purchasing Managers Index March 57.2 58.3

The euro fell after the head of the European Central Bank Mario Draghi did not rule out that the European regulator may implement quantitative easing program , while maintaining a long period of inflation.

" We do not exclude the possibility of quantitative easing in order to cope with that too long a period of low inflation " - Draghi said at a press conference after a meeting of the ECB.

He said that the controller is ready to use unconventional instruments of monetary policy , if the need arises , and the current mandate allows it. While Draghi noted that while the lack of traditional instruments .

Today the ECB left its key interest rate at a record low of 0.25 % per annum.

Officials have refrained from raising against the backdrop of conflicting signals on the one hand, the economy in the region , covering 18 states , is gradually recovering , and on the other hand, the unemployment rate remains very high. At the same time companies are trying to raise prices .

According to Draghi , the possibility of quantitative easing was discussed at the meeting on Thursday as a possible tool .

By prognozamn ECB head , inflation will remain at a minimal level during the current year , and the acceleration will be recorded only in the 2015 target of 2% consumer price inflation reached only by the end of 2016

As for economic growth , it is restored at a moderate pace , although downside risks remain , Draghi said .

Some support to the dollar was data showing that in March the index of business activity in the U.S. service sector , calculated by the Institute for Supply Management (ISM), increased slightly, reaching the level of 53.1 while compared with the February reading at around 51.6 . According to experts , the value of this indicator was up to 55.5 . All major sub- indices were in February in the territory of the expansion (more than 50 ), and 3 out of 4 even showed growth.

Little impact on the European currency also have today's data , which showed that business activity index for the services sector fell in March to reach 52.2 from February's 32-month high of 52.6 points . Experts expect that this figure will be 52.4 points. However, the service sector firms were more optimistic about future prospects - the sub- index of business expectations rose to 64.0 from 62.4 , the highest since mid-2011. The final composite index fell to 53.1 from 53.3 in March . Preliminary reported 53.2 . However, the index remains above 50 for the ninth consecutive month , based on improved market conditions and an increase in new orders.

Another report showed : in February, sales rose by 0.4 percent compared with an increase of 1.0 percent in January (revised downwards from 1.6 per cent). Many economists had forecast a decline in sales of 0.3 percent. Add that food sales rose in February by 0.3 percent , while sales of non-food - by 0.8 percent . In annual terms, sales in February also increased - by 0.8 percent , which was slightly higher than estimates of experts at 0.6 percent.

Pound fell against the dollar , which was associated with the release of weak UK data . As it became known , the services sector continued to expand in the UK last month , indicating that the sustained economic growth in the first quarter , although the pace of this growth was the slowest since June last year . According to the index of purchasing managers index for the services sector fell to 57.6 points in March from 58.2 in February , which was below the consensus forecast of economists at the level of 58.2 points. Nevertheless, the index remained well above the level of 50 points , which indicates expansion and points to strong growth in the services sector , which accounts for over three quarters of the UK economy. We add that the employment index in the services sector fell to 53.5 in March from 55.6 in February , the new orders index increased at the slowest pace in 10 months , and the index of business expectations fell to its lowest level since November . Studies have also revealed that the composite index of business activity for the manufacturing, construction and service sector fell to 58.1 in March from 58.6 in February , while reaching the lowest level since June last year. We add that the prices paid index fell to its lowest in nearly a year .

The yen traded almost unchanged against the dollar ahead of tomorrow's publication of official unemployment data from the U.S. Labor Department . According to the median forecast of economists in March U.S. employers created 200 thousand jobs against 175 thousand in the previous month . Yesterday the published employment figures from the Research Institute of ADP. In March, private sector employment increased markedly , came close to the forecasted values. According to a report last month, the number of employees increased by 191 thousand compared with a revised upward figure for the previous month at 178 million ( initially reported growth of 139 thousand ) . Add projected their number would grow to 192 thousand

The Japanese yen also affected the data for China , which showed that the mood in the service sector in China have improved in March , which is a positive sign for the second largest economy in the world . Purchasing Managers Index for China's services sector , which is calculated HSBC, rose to 51.9 against 51.0 in February. Nevertheless , the official index of manufacturing activity in China in March dropped to around 54.5 to 55.0 in February.

Stocks in Europe were little changed, after climbing for seven days, as European Central Bank President Mario Draghi said policy makers are prepared to add further measures to support the euro-area economy if necessary.

The Stoxx Europe 600 Index advanced 0.1 percent to 337.25 at the close of trading. The equity benchmark has gained 4 percent since March 24 as improving U.S. data signaled the world’s largest economy is recovering from the harsh winter.

The ECB left its benchmark interest rate unchanged at a record low 0.25 percent, matching all but three of 57 economists’ projections compiled by Bloomberg. Central bank officials held the deposit rate at zero and the ">Draghi said that the central bank discussed the possibility of using quantitative easing among a range of measures at today’s monthly meeting. “The Governing Council is unanimous in its commitment to using also unconventional instruments within its mandate in order to cope effectively with risks of a too prolonged period of low inflation,” he said.

U.S. data showed service industries expanded at a faster pace last month. The Institute for Supply Management said its non-manufacturing index rose to 53.1 in March from 51.6 in February. The median economist projection was for a reading of 53.5. Numbers greater than 50 signal expansion in industries that make up almost 90 percent of the world’s largest economy.

National benchmark indexes rose in nine of 18 western-European markets today. France’s CAC 40 gained 0.4 percent, the U.K.’s FTSE 100 lost 0.2 percent, and Germany’s DAX added 0.1 percent. Markets in Italy and Spain closed at their highest levels since May 2011.

BTG added 1 percent to 546.5 pence. The British biotechnology company, which won U.S. regulatory clearance for its varicose-vein treatment in November, said sales for the year ended March 31 probably neared the top end of its 275 million pound ($456 million) to 285 million-pound projection. BTG will report its annual results on May 20.

Nokian Renkaat dropped 2.7 percent to 29.86 euros. The Finnish tiremaker said net sales and operating profit will probably drop this year because of the weaker outlook for Russia’s economy and the declining ruble. The company had predicted revenue and earnings growth on Feb. 7. Russia and its neighboring countries in the Commonwealth of Independent States accounted for 34 percent of the company’s sales last year.

Rexel SA declined 2.3 percent to 18.95 euros. Ray Investment SARL, Rexel’s second-largest publicly disclosed investor, said it sold 26.9 million shares in the wire and cable distributor at 18.85 euros apiece.

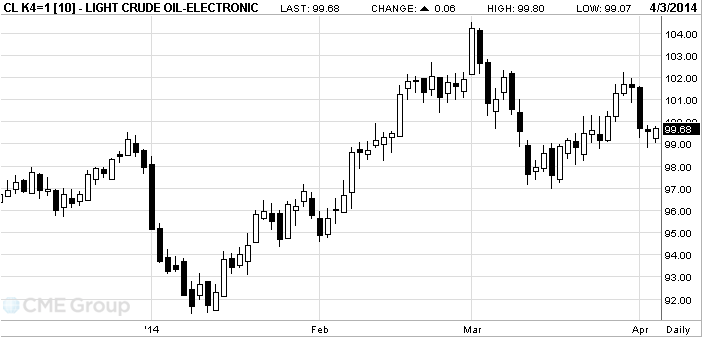

Brent

crude rose from the lowest level in almost five months amid concern that talks

between the Libyan government and rebels won’t restore oil exports. West Texas

Intermediate’s discount to Brent widened.

The

European benchmark gained as much as 0.6 percent. The rebels’ Executive Office

for Barqa, representing the region of Cyrenaica, denied a report that the group

will cede one of the four ports that have been under its control since July to

the government in a few days. WTI traded below $100 as U.S. jobless claims rose

more than forecast last week.

“Libya

is right on Europe’s doorstep and it has more impact on Brent,” said Michael

Lynch, president of Strategic Energy & Economic Research in Winchester,

Massachusetts. “There are concerns about Libya’s ports and oil exports.”

Brent

for May settlement gained 23 cents to $105.02 a barrel at 10:46 a.m. New York

time on the London-based ICE Futures Europe exchange. Volume was 35 percent

above the 100-day average. Prices fell to $104.79 yesterday, the lowest

settlement since Nov. 7. The North Sea grade is used to price more than half

the world’s oil, including exports from Libya.

WTI for

May delivery declined 23 cents to $99.39 a barrel on the New York Mercantile

Exchange. The volume of all futures traded was 24 percent below the 100-day

average.

WTI was

at a discount of $5.63 to the European benchmark crude. The spread shrank to

$5.17 yesterday, the narrowest level since October.

Gold prices decline on the eve of leaving Friday employment report in the U.S., which will assess the state of the economy and prospects for Fed stimulus .

Today we have published weekly data on initial applications for unemployment benefits . The number of people who first applied for unemployment benefits , rose moderately last week , topping forecasts while most experts .

The Labor Department said : for the week ending March 29, the number of initial claims for unemployment benefits rose by 16,000 to a seasonally adjusted , while reaching 326 thousand Nevertheless , despite the increase in the number of complaints remains below the pore level in 400,000 the resolution of which may talk about the problems in the labor market . Economists had expected the value of this ratio will rise to 319 thousand add the result for the previous week was revised downwards - to 310 thousand from 311 thousand Analyst Ministry of Labour said there were no special factors that could have an impact on the overall result.

Today's data were presented for the day on how the Ministry of Labour will publish its monthly employment figures . Economists expect the March U.S. employers created 196 thousand jobs against 175 thousand in the previous month . These indicators would point to the labor market recovery, after poor results in December and January , when employers added 213,000 in the general positions. Many economists blame the unusually cold weather that left people without jobs in those months .

" Some physical markets in Asia did not show any activity that is not good for gold. As stock markets tend to new heights, gold increasingly difficult to compete with them ," - said precious metals trader in Hong Kong.

Prices in China on Wednesday briefly rose above London , but then dropped down to their level , and on Thursday were lower by $ 2 per ounce. Gold in China since the beginning of March offered cheaper than in London. According to dealers , they see weak demand in other major markets in Asia - India, Thailand and Indonesia.

The cost of the June gold futures on the COMEX today dropped to $ 1281.90 per ounce.

USD/JPY Y102.30, Y102.40, Y102.50, Y102.75, Y103.00/05, Y103.25, Y103.50, Y104.00, Y104.20, Y104.25

EUR/USD $1.3600/05, $1.3620, $1.3650, $1.3700, $1.3770, $1.3785, $1.3800/05, $1.3850, $1.3925, $1.3935

GBP/USD $1.6500

EUR/GBP stg0.8250, stg0.8285, stg0.8300

USD/CHF Chf0.8925, Chf0.8950, Chf0.8975, Chf0.9000, Chf0.9025, Chf0.9040

EUR/CHF Chf1.2180, Chf1.2210

AUD/USD $0.9100, $0.9125, $0.9150, $0.9200, $0.9250

USD/CAD C$1.1000, C$1.1050, C$1.1060, C$1.1090, C$1.1100, C$1.1175, C$1.1220, C$1.1250, C$1.1295, C$1.1300

U.S. stock-index futures little changed after report showed jobless claims rose more than estimated last week.

Global markets:

Nikkei 15,071.88 +125.56 +0.84%

Hang Seng 22,565.08 +41.14 +0.18%

Shanghai Composite 2,043.7 -15.29 -0.74%

FTSE 6,662.72 +3.68 +0.06%

CAC 4,443.16 +12.30 +0.28%

DAX 9,640.23 +16.87 +0.18%

Crude oil $99.55 (-0.07%)

Gold $1285.50 (-0.41%).

Data

00:30 Australia Retail sales (MoM) February +1.2% +0.4% +0.2%

00:30 Australia Retail Sales Y/Y February +6.2% +4.9%

00:30 Australia Trade Balance February 1.39 Revised From 1.43 0.82 1.20

01:00 China Non-Manufacturing PMI March 55.0 54.5

01:45 China HSBC Services PMI March 51.0 51.9

07:48 France Services PMI (Finally) March 51.4 51.4 51.5

07:53 Germany Services PMI (Finally) March 54.0 54.0 53.0

07:58 Eurozone Services PMI (Finally) March 52.4 52.4 52.2

08:30 United Kingdom Purchasing Manager Index Services March 58.2 58.2 57.6

08:30 United Kingdom BOE Credit Conditions Survey Quarter I

09:00 Eurozone Retail Sales (MoM) February +1.0% Revised From +1.6% -0.3% +0.4%

09:00 Eurozone Retail Sales (YoY) February +1.3% +0.6% +0.8%

11:45 Eurozone ECB Interest Rate Decision 0.25% 0.25% 0.25%

The Euro is trading slightly higher against the dollar after the ECB's decision to leave rates unchanged - at 0.25 %. Now market participants' attention switches to the ECB press conference . Investors were cautious , fearing that the ECB may respond to lower inflation by easing policy . Nevertheless , they remain skeptical that the ECB wants to take more effective action in the short term , reducing refinancing or increasing liquidity.

Little impact on today's currency also provided data that showed business activity index for the services sector fell in March to reach 52.2 from February's 32-month high of 52.6 points . Experts expect that this figure will be 52.4 points. However, the service sector firms were more optimistic about future prospects - the sub- index of business expectations rose to 64.0 from 62.4 , the highest since mid-2011. The final composite index fell to 53.1 from 53.3 in March . Preliminary reported 53.2 . However, the index remains above 50 for the ninth consecutive month , based on improved market conditions and an increase in new orders.

Another report showed : in February, sales rose by 0.4 percent compared with an increase of 1.0 percent in January (revised downwards from 1.6 per cent). Many economists had forecast a decline in sales of 0.3 percent. Add that food sales rose in February by 0.3 percent , while sales of non-food - by 0.8 percent . In annual terms, sales in February also increased - by 0.8 percent , which was slightly higher than estimates of experts at 0.6 percent.

Pound fell against the dollar , which was associated with the release of weak UK data . As it became known , the services sector continued to expand in the UK last month , indicating that the sustained economic growth in the first quarter , although the pace of this growth was the slowest since June last year . According to the index of purchasing managers index for the services sector fell to 57.6 points in March from 58.2 in February , which was below the consensus forecast of economists at the level of 58.2 points. Nevertheless, the index remained well above the level of 50 points , which indicates expansion and points to strong growth in the services sector , which accounts for over three quarters of the UK economy. We add that the employment index in the services sector fell to 53.5 in March from 55.6 in February , the new orders index increased at the slowest pace in 10 months , and the index of business expectations fell to its lowest level since November . Studies have also revealed that the composite index of business activity for the manufacturing, construction and service sector fell to 58.1 in March from 58.6 in February , while reaching the lowest level since June last year. We add that the prices paid index fell to its lowest in nearly a year .

The yen traded almost unchanged against the dollar ahead of tomorrow's publication of official unemployment data from the U.S. Labor Department . According to the median forecast of economists in March U.S. employers created 200 thousand jobs against 175 thousand in the previous month . Yesterday the published employment figures from the Research Institute of ADP. In March, private sector employment increased markedly , came close to the forecasted values. According to a report last month, the number of employees increased by 191 thousand compared with a revised upward figure for the previous month at 178 million ( initially reported growth of 139 thousand ) . Add projected their number would grow to 192 thousand

The Japanese yen also affected the data for China , which showed that the mood in the service sector in China have improved in March , which is a positive sign for the second largest economy in the world . Purchasing Managers Index for China's services sector , which is calculated HSBC, rose to 51.9 against 51.0 in February. Nevertheless , the official index of manufacturing activity in China in March dropped to around 54.5 to 55.0 in February.

EUR / USD: during the European session, the pair fell to $ 1.3743 , but then recovered to $ 1.3770

GBP / USD: during the European session, the pair fell to $ 1.6578

USD / JPY: during the European session, the pair fell to Y104.07 from Y103.92

At 12:30 GMT will be held monthly press conference of the ECB. Also at 12:30 GMT Canada and the U.S. will report on its trade balance for February. At 14:00 GMT the United States will composite index of ISM non-manufacturing areas in March.

EUR/USD

Offers $1.3945, $1.3900, $1.3880, $1.3845/50, $1.3835, $1.3800

Bids $1.3750, $1.3705/00, $1.3694, $1.3650

GBP/USD

Offers $1.6785, $1.6715/20, $1.6700, $1.6685

Bids $1.6590/00, $1.6575/80, $1.6550, $1.6520, $1.6500

AUD/USD

Offers $0.9400, $0.9350, $0.9300/10, $0.9260

Bids $0.9200, $0.9170, $0.9155/50, $0.9120

EUR/JPY

Offers Y144.00, Y143.80, Y143.60

Bids Y142.60, Y142.00, Y141.70/80, Y141.40/50

USD/JPY

Offers Y104.95/00, Y104.45, Y104.10

Ордера на покупку Y103.55, Y103.30, Y103.00, Y102.90, Y102.45, Y102.00

EUR/GBP

Offers stg0.8350/60, stg0.8320/25, stg0.8300, stg0.8280

Bids stg0.8260, stg0.8245, stg0.8210/00, stg0.8180

European stocks were little changed, after climbing for seven days, as investors awaited the outcome of the European Central Bank’s meeting. U.S. stock-index futures and Asian shares were also little changed.

The Stoxx Europe 600 Index advanced 0.1 percent to 337.15 at 10 a.m. in London, following its longest winning streak since October. The equity benchmark has climbed 3.9 percent since March 24 as improving U.S. data signaled the world’s largest economy is recovering from the harsh winter.

The ECB will probably leave its benchmark interest rate unchanged at a record low 0.25 percent, according economist projections. The central bank will announce its policy decision at 1:45 p.m. in Frankfurt, and President Mario Draghi holds a press conference 45 minutes later.

U.S. data at 10 a.m. New York time may show service industries expanded at a faster pace last month. The Institute for Supply Management’s non-manufacturing index rose to 53.5 in March from 51.6 in February, according to the median economist projection. A reading greater than 50 signals expansion in industries that make up almost 90 percent of the world’s largest economy.

Nokian Renkaat dropped 3 percent to 29.77 euros. The Finnish tiremaker said net sales and operating profit will probably drop this year because of the weaker outlook for Russia’s economy and the declining ruble. The company had predicted revenue and earnings growth on Feb. 7. Russia and its neighboring countries in the Commonwealth of Independent States accounted for 34 percent of the company’s sales last year.

Deutsche Bank slipped 1.5 percent to 32.83 euros. JPMorgan cut the stock to neutral from overweight, a rating similar to buy. Analyst Kian Abouhossein predicted that liquidity rules from the European Banking Authority will reduce the bank’s capital by 2.2 billion euros ($3 billion) by September.

Rexel SA (RXL) lost 2.7 percent to 18.89 euros, its largest drop in almost six weeks. Ray Investment SARL, Rexel’s second-largest publicly disclosed investor, offered 27 million shares in the wire and cable distributor at 18.85 apiece, according to three people familiar with the deal who asked not to be named.

BTG added 2.8 percent to 556 pence. The British biotechnology company, which won U.S. regulatory clearance for its varicose-vein treatment in November, said sales for the year ended March 31 probably neared the top end of its 275 million pound ($458 million) to 285 million-pound projection. BTG will report its annual results on May 20.

FTSE 100 6,654.6 -4.44 -0.07%

CAC 40 4,426.43 -4.43 -0.10%

DAX 9,616.76 -6.60 -0.07%

USD/JPY Y102.30, Y102.40, Y102.50, Y102.75, Y103.00/05, Y103.25, Y103.50, Y104.00, Y104.20, Y104.25

EUR/USD $1.3600/05, $1.3620, $1.3650, $1.3700, $1.3770, $1.3785, $1.3800/05, $1.3850, $1.3925, $1.3935

GBP/USD $1.6500

EUR/GBP stg0.8250, stg0.8285, stg0.8300

USD/CHF Chf0.8925, Chf0.8950, Chf0.8975, Chf0.9000, Chf0.9025, Chf0.9040

EUR/CHF Chf1.2180, Chf1.2210

AUD/USD $0.9100, $0.9125, $0.9150, $0.9200, $0.9250

USD/CAD C$1.1000, C$1.1050, C$1.1060, C$1.1090, C$1.1100, C$1.1175, C$1.1220, C$1.1250, C$1.1295, C$1.1300

Most Asian shares climbed after data showed U.S. companies added workers. Railway stocks surged in Hong Kong as China outlined economic stimulus plans.

Nikkei 225 15,071.88 +125.56 +0.84%

S&P/ASX 200 5,409.9 +6.60 +0.12%

Shanghai Composite 2,044.19 -14.80 -0.72%

Samsung Electronics Co., South Korea’s biggest exporter of consumer electronics, rose 2.4 percent, contributing the most to the regional equity gauge’s advance.

China Railway Construction Corp. jumped 7.2 percent in Hong Kong after the government said it plans more than 6,600 kilometers (4,100 miles) of new rail lines this year.

Prada SpA sank 6.8 percent in Hong Kong after the Italian handbag maker forecast slower luxury sales growth.

00:30 Australia Retail sales (MoM) February +1.2% +0.4% +0.2%

00:30 Australia Retail Sales Y/Y February +6.2% +4.9%

00:30 Australia Trade Balance February 1.39 Revised From 1.43 0.82 1.20

01:00 China Non-Manufacturing PMI March 55.0 54.5

01:45 China HSBC Services PMI March 51.0 51.9

The dollar rose to a two-month high against the yen before U.S. data forecast to show services industries and nonfarm payrolls strengthened, supporting the case for the Federal Reserve to pare stimulus. The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major currencies, rose yesterday to the highest close in one week after a private report showed American companies increased hiring. U.S. companies increased payrolls by 191,000 last month, up from a revised 178,000, figures from the ADP Research Institute in Roseland, New Jersey, showed yesterday.

The euro was weaker versus most major peers before the European Central Bank sets policy today. ECB policy makers will keep their main refinancing rate at a record 0.25 percent today, according to all except three of 57 economists surveyed by Bloomberg. One sees a cut to 0.1 percent, while two call for a reduction to 0.15 percent. International Monetary Fund Managing Director Christine Lagarde said yesterday more monetary easing is needed in the currency bloc.

Australia’s dollar fell from a four-month high after growth in retail sales trailed economists’ estimate. In Australia, retail sales rose 0.2 percent in February from the previous month, when it gained 1.2 percent, a government report showed today. The median estimate was for a 0.3 percent increase. Reserve Bank of Australia Governor Glenn Stevens will speak in Brisbane today.

EUR / USD: during the Asian session the pair fell to $ 1.3755

GBP / USD: during the Asian session, the pair rose to $ 1.6660

USD / JPY: during the Asian session, the pair rose to Y104.10

The ECB policy decision and Mario Draghi's subsequent press conference will be the stand out feature in the European session Thursday, although the early release of the euro area services PMI number will give the central bank a pre-meet look at the region's economy. The euro area final services PMIs for March start at 0715GMT, with the release of the Spanish data, followed by the Italian data at 0745GMT, France at 0750GMT, Germany at 0755GMT and the amalgamated Eurozone data at 0900GMT. Overall, the PMIs are seen unchanged to a touch lower on the previous month's reading, although all above the 50 mark. German services are seen unchanged at 54, with the composite reading at 55. The eurozone services PMI is seen unchanged at 52.4, with the composite at 53.2. Further Euro area data is set for publication at 0900GMT, when the EMU February retail sales numbers cross the wires. Economists are looking for a fall of 0.5% on month and a year on year rise of 0.7%. The ECB is set to announce its policy decision at 1145GMT, to be followed at 1230GMT by President Mario Draghi's press conference. Late European data sees the French March INSEE economic outlook numbers released at 2000GMT.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.