- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Gold $1,290.9 +8.40 +0.65%

ICE Brent Crude Oil $104.79 -0.83 -0.79%

NYMEX Crude Oil $99.29 -0.49 -0.49%

Nikke 14,946.32 +154.33 +1.04%

Hang Seng 22,523.94 +75.40 +0.34%

Shanghai Composite 2,058.99 +11.53 +0.56%

S&P 500 1,890.9 +5.38 +0.29%

NASDAQ 4,276.46 +8.42 +0.20%

Dow 16,573 +40.39 +0.24%

FTSE 6,659.04 +6.43 +0.10%

CAC 4,430.86 +4.14 +0.09%

DAX 9,623.36 +19.65 +0.20%(pare/closed(GMT +2)/change, %)

EUR/USD $1,3765 -0,20%

GBP/USD $1,6623 -0,04%

USD/CHF Chf0,8866+0,36%

USD/JPY Y103,86 +0,17%

EUR/JPY Y142,96 -0,03%

GBP/JPY Y172,66 +0,15%

AUD/USD $0,9250 +0,14%

NZD/USD $0,8573 -0,56%

USD/CAD C$1,1031 +0,05%

(time / country / index / period / previous value / forecast)

00:30 Australia Retail sales (MoM) February +1.2% +0.4%

00:30 Australia Retail Sales Y/Y February +6.2%

00:30 Australia Trade Balance February 1.43 0.82

01:00 China Non-Manufacturing PMI March 55.0

01:45 China HSBC Services PMI March 51.0

07:48 France Services PMI (Finally) March 51.4 51.4

07:53 Germany Services PMI (Finally) March 54.0 54.0

07:58 Eurozone Services PMI (Finally) March 52.4 52.4

08:30 United Kingdom Purchasing Manager Index Services March 58.2 58.2

08:30 United Kingdom BOE Credit Conditions Survey Quarter I

09:00 Eurozone Retail Sales (MoM) February +1.6% -0.3%

09:00 Eurozone Retail Sales (YoY) February +1.3% +0.6%

11:45 Eurozone ECB Interest Rate Decision 0.25% 0.25%

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions February -0.18 0.2

12:30 U.S. International Trade, bln February -39.1 -38.3

12:30 U.S. Initial Jobless Claims March 311 319

14:00 U.S. ISM Non-Manufacturing March 51.6 55.5The euro fell against the U.S. dollar amid confident data on the employment market USA. As shown by recent data that were presented Automatic Data Processing (ADP), in March, private sector employment increased markedly , and came close to the predictive values. According to a report last month, the number of employees increased by 191 thousand people, compared with a revised upward figure for the previous month at 178 million ( initially reported growth of 139 thousand ) . Add that, according to the average forecast of this indicator would grow by 192 thousand

Strengthening of the dollar also contributed data on the growth of industrial orders in the United States. Factor in the growth in orders was supposed to economic recovery after the winter with bad weather conditions , because of which there is a delay before. Increase in orders was the highest in seven months.

Commerce Department said Wednesday that new orders for producers rose in February by 1.6% , which was the highest growth since September. Economists had expected orders by 1.3%. Data on changes in the volume of orders in January were revised with the reduction - reduction of 1.0% compared to the previously reported decrease of 0.7%. The volume of orders except the volatile transportation category rose in February by 0.7 % , the biggest increase since July. In January, the volume of orders for this category decreased by 0.1 %.

Euro also declined on weak data for the euro area and the approaching meeting of the ECB . Recently, increased expectations that the ECB will leave monetary policy unchanged and Draghi will optimistic. However, the media have been rumors that on Thursday members of the Governing Council will be conducted " vigorous debate " since the March Inflation Report has been very disappointing. This means that members of the ECB is still deep in thought as to what steps to take and launch new stimulus is not excluded.

Eurozone producer prices fell by 0.2 per cent ( on a monthly basis ) , after easing to 0.3 percent in January . Experts predicted that this figure will remain unchanged in February. Excluding energy , producer prices remained unchanged , after rising 0.1 percent in January . Prices for capital goods and consumer non-durables also remained unchanged in February. The cost of intermediate goods decreased by 0.1 percent , offsetting an increase of 0.1 percent in January . Meanwhile, lower energy prices slowed to 0.5 percent from 1.2 percent. On an annualized basis , producer prices fell by 1.7 per cent compared with a fall of 1.4 percent in the previous month . Fall also exceeded economists' consensus forecasts at -1.6 percent.

Meanwhile, another report from Eurostat showed : in the fourth quarter, the eurozone economy grew by 0.5% after falling 0.3 % in the previous quarter . Rate in quarterly terms rose by 0.2 % vs. 0.1% . Add that these data will be final. Experts predicted that GDP will rise by 0.3 % qoq and 0.5% per annum.

Pound showed a steady increase against the dollar in anticipation of UK PMI data , but weak report forced the couple to change the direction of his dvizheniya.Indeks business in the construction sector from Markit / CIPS fell in March to a level of 62.5 points from 62.6 in February , but remained near the maximum for the last 6.5 years , which was recorded in January (64.6 points). We add that the index remains above the neutral mark for 11 consecutive months. Many experts , however, expect that figure will rise to the level of 63.1 points. Also, the report showed that the builders were elated last month ( optimism rose to its highest level since January 2007) and hired staff at the fastest pace in four months.

Put pressure on the pound and a report from the Nationwide Building Society, which showed that house prices rose in March by 9.5 percent ( yoy ) , after rising 9.4 percent in February. The latest increase was slightly less than the experts' forecasts at 9.7 percent, but was the highest since May 2010 , when prices rose by 9.8 percent . Given these changes , the average cost of housing in March totaled 180,264 pounds - the highest level since January 2008 . On a monthly basis , prices rose only 0.4 percent in March , which was slower than the 0.7 percent growth recorded in February and economists' forecasts at 0.8 percent. Nevertheless , it was the fifteenth consecutive monthly gain .

European stocks climbed for a seventh day after a U.S. private-payrolls report showed companies in the world’s largest economy added more workers last month and factory orders increased in February.

The Stoxx Europe 600 Index advanced 0.2 percent to 336.93 at the close of trading. The equity benchmark has climbed 3.9 percent since March 24 as better-than-forecast U.S. consumer-confidence data signaled the world’s largest economy is recovering from weakness due to the bad winter.

A report from ADP Research Institute showed that U.S. companies hired a net 191,000 workers last month, up from a revised 178,000 in February. That narrowly missed the median estimate for March of 195,000 in a Bloomberg survey of economists. A separate release from the Commerce Department showed factory orders climbed 1.6 percent in February. They dropped in January. Both reports had shown weakness at the beginning of the year as unusually harsh winter temperatures suppressed economic activity.

National benchmark indexes climbed in 13 of 18 western-European markets. France’s CAC 40 added 0.1 percent, the U.K.’s FTSE 100 gained 0.1 percent, and Germany’s DAX rose 0.2 percent.

Deutsche Post advanced 4.6 percent to a record 28.43 euros after saying earnings before interest and taxes will rise to as much as 5.22 billion euros ($7.2 billion) by 2020 under a new strategy. Ebit will grow more than 8 percent a year, the company said in a presentation.

Neste Oil, a Finnish maker of renewable diesel, rallied 5.6 percent to 15.86 euros, its highest price since October. The chairman of the Senate Finance Committee, Ron Wyden, proposed retroactively extending expired tax credits for biodiesel and renewable diesel -- or refined vegetable oil -- until the end of next year, Bloomberg Industries wrote after the close of European trading yesterday.

Alcatel-Lucent SA rose 3.2 percent to 3.03 euros. Natixis SA raised the network-equipment maker to buy from neutral, saying that telecommunications companies will increase their capital expenditure. Alcatel-Lucent has deals with China Mobile Ltd. and Bouygues SA.

Deutsche Boerse fell 2.2 percent to 56.59 euros. The operator of the Frankfurt Stock Exchange said the U.S. Attorney for the Southern District of New York has made Clearstream Banking SA the subject of a criminal investigation in connection with alleged violations of U.S. money-laundering and Iran-sanction laws. Deutsche Boerse said Clearstream will co-operate with the probe, which is at a very early stage.

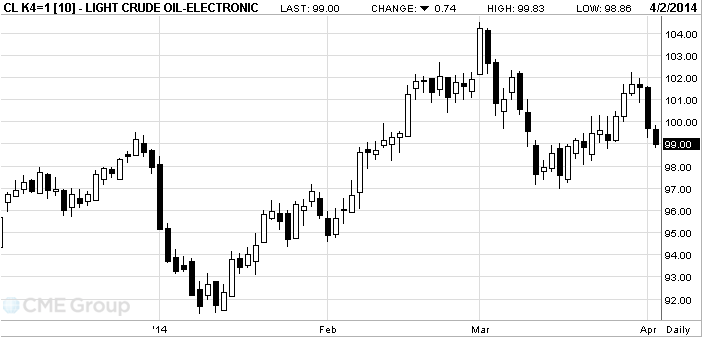

West Texas Intermediate oil maintained losses after a government report showed that U.S. crude inventories unexpectedly dropped.

Futures slid as much as 0.9 percent in New York. Supplies decreased 2.38 million barrels to 380.1 million last week, according to the Energy Information Administration. U.S. crude stockpiles were projected to climb 2.5 million barrels, according to the median of analyst responses in a Bloomberg survey. The Houston Ship Channel, home to the nations’s largest petrochemical complex and export port, reopened March 26 after an oil spill shut it for four days.

U.S. crude production increased 2,000 barrels a day to 8.19 million, the EIA said. Output has surged to the highest level since 1988 this year as a combination of horizontal drilling and hydraulic fracturing, or fracking, which has unlocked supplies trapped in shale formations.

Crude supplies at Cushing, Oklahoma, the delivery point for WTI, decreased 1.22 million barrels to a four-year low of 27.3 million, the report showed. Stockpiles at the hub have fallen since the southern portion of the Keystone XL pipeline began moving oil to the Texas Gulf Coast from Cushing in January.

Refineries operated at 87.7 percent of capacity in the seven days ended March 28, up 1.7 percentage points from the prior week, according to the EIA, the Energy Department’s statistical arm.

WTI for May delivery decreased 63 cents, or 0.6 percent, to $99.11 a barrel at 10:46 a.m. on the New York Mercantile Exchange. The contract traded at $99.23 before the release of the report at 10:30 a.m. in Washington. The volume of all futures traded was 6.1 percent above the 100-day average for the time of day.

Brent for May settlement fell $1.32, or 1.3 percent, to $104.30 a barrel on the London-based ICE Futures Europe exchange. Futures touched $104.12, the lowest level since Nov. 8. Volume was 83 percent above the 100-day average. The European benchmark grade traded at a $5.19 premium to WTI. The spread shrank to the narrowest level since October.

Gold prices rose after two days of sales, but remain near seven-week low after reporting growth in manufacturing activity and employment in the United States .

Some analysts predict a decline in prices because of the rise in stock markets , while others believe that prices , on the contrary , will increase due to increased demand in the physical market and geopolitical tensions in the Ukraine. Analyst Ed Meir INTL FCStone believes that the rise of stock price does not necessarily cause the outflow of funds from the gold market.

" In addition, although the situation in Ukraine is not so critical , tensions remain , given the accumulation of Russian troops from the Ukrainian border," - he said. "In the medium term charts are negative, but it should be noted that the market moves to the mark when it is resold. We expect that in April, prices will fluctuate in the range of $ 1.250 -$ 1.330 ."

Support gold prices have data on the growth of employment in the United States . As shown by recent data that were presented Automatic Data Processing (ADP), in March of private sector employment increased markedly , came close to the forecasted values.

According to a report last month, the number of employees increased by 191 thousand people, compared with a revised upward figure for the previous month at 178 million ( initially reported growth of 139 thousand ) . Add that, according to the average forecast of this indicator would grow by 192 thousand

Stocks of the world's largest exchange-traded fund backed by gold (ETF) SPDR Gold Trust on Tuesday declined by 2.1 tons to 810.98 tons. Price 99.99 fine gold on the Shanghai Gold Exchange is comparable to the spot price in London. In January, prices in Shanghai have been $ 20 higher than in London, but in March, prices reached $ 08.10 per ounce.

The cost of the June gold futures on the COMEX today rose to $ 1294.90 per ounce.

USD/JPY Y102.00, Y102.30, Y102.35/40, Y102.50, Y102.60, Y102.80, Y103.00, Y103.75/80

EUR/JPY Y141.00

EUR/USD $1.3685, $1.3700, $1.3725, $1.3750, $1.3800

EUR/GBP stg0.8300, stg0.8430, stg0.8475

USD/CHF Chf0.8950

USD/CAD C$1.1055, C$1.1100, C$1.1120, C$1.1140, C$1.1150, C$1.1200

U.S. stock-index U.S. little changed as data showed companies added to payrolls last month.

Global markets:

Nikkei 14,946.32 +1.04%

Hang Seng 22,523.94 +0.34%

Shanghai Composite 2,058.99 +0.56%

FTSE 6,657.39 +0.07%

CAC 4,427.89 +0.03%

DAX 9,624.53 +0.22%

Crude oil $99.03 (-0.72%)

Gold $1290.70 (+0.84%).

Data

00:30 Australia Building Permits, m/m February +6.8% -1.7% -5.0%

00:30 Australia Building Permits, y/y February +34.6% +23.2%

06:00 United Kingdom Nationwide house price index March +0.6% +0.8% +0.4%

06:00 United Kingdom Nationwide house price index, y/y March +9.4% +9.6% +9.5%

08:30 United Kingdom PMI Construction March 62.6 63.1 62.5

09:00 Eurozone GDP (QoQ) (Finally) Quarter IV +0.3% +0.3% +0.2%

09:00 Eurozone GDP (YoY) (Finally) Quarter IV +0.5% +0.5% +0.5%

09:00 Eurozone Producer Price Index, MoM February -0.3% 0.0% -0.2%

09:00 Eurozone Producer Price Index (YoY) February -1.4% -1.6% -1.7%

09:00 Eurozone ECOFIN Meetings

09:00 Eurozone ECB’s Vitor Constancio Speaks

The euro exchange rate has lost all previously earned positions against the dollar on weak data and approximating the ECB meeting . Recently, increased expectations that the ECB will leave monetary policy unchanged and Draghi will optimistic. However, the media have been rumors that on Thursday members of the Governing Council will be conducted " vigorous debate " since the March Inflation Report has been very disappointing. This means that members of the ECB is still deep in thought as to what steps to take and launch new stimulus is not excluded. As for today's data , they showed that producer prices fell by 0.2 per cent ( on a monthly basis ) , after easing to 0.3 percent in January . Experts predicted that this figure will remain unchanged in February. Excluding energy , producer prices remained unchanged , after rising 0.1 percent in January . Prices for capital goods and consumer non-durables also remained unchanged in February. The cost of intermediate goods decreased by 0.1 percent , offsetting an increase of 0.1 percent in January . Meanwhile, lower energy prices slowed to 0.5 percent from 1.2 percent. On an annualized basis , producer prices fell by 1.7 per cent compared with a fall of 1.4 percent in the previous month . Fall also exceeded economists' consensus forecasts at -1.6 percent.

Meanwhile, another report from Eurostat showed : in the fourth quarter, the eurozone economy grew by 0.5% after falling 0.3 % in the previous quarter . Rate in quarterly terms rose by 0.2 % vs. 0.1% . Add that these data will be final. Experts predicted that GDP will rise by 0.3 % qoq and 0.5% per annum.

Pound showed a steady increase against the dollar in anticipation of UK PMI data , but weak report forced the couple to change its direction of motion . Despite the fact that it was a minor report , the market is still longed to get a new catalyst to propel the pair above , but nothing happened . Now the focus of employment data from the U.S. ADP , which in the case of a positive result can cause the couple to continue to grow, and to update the maximum. As for the data , they showed that the index of business activity in the construction sector from Markit / CIPS fell in March to a level of 62.5 points from 62.6 in February , but remained near the maximum for the last 6.5 years , which was recorded in January ( 64.6 points). We add that the index remains above the neutral mark for 11 consecutive months. Many experts , however, expect that figure will rise to the level of 63.1 points. Also, the report showed that the builders were elated last month ( optimism rose to its highest level since January 2007) and hired staff at the fastest pace in four months.

Put pressure on the pound and a report from the Nationwide Building Society, which showed that house prices rose in March by 9.5 percent ( yoy ) , after rising 9.4 percent in February. The latest increase was slightly less than the experts' forecasts at 9.7 percent, but was the highest since May 2010 , when prices rose by 9.8 percent . Given these changes , the average cost of housing in March totaled 180,264 pounds - the highest level since January 2008 . On a monthly basis , prices rose only 0.4 percent in March , which was slower than the 0.7 percent growth recorded in February and economists' forecasts at 0.8 percent. Nevertheless , it was the fifteenth consecutive monthly gain .

Dollar traded little change against the yen on the eve of today's publication of the U.S. data . Now all eyes are on the ADP employment report . According to the median forecast of economists in March, the number of new jobs created in the U.S. increased by 192 thousand , after rising by 139 thousand in the previous month . If the results are positive, it will cause the expectations for that go into Friday's payrolls USDA , followed closely following the Federal Reserve will also be optimistic. According to the median forecast of economists in March U.S. employers created 200 thousand jobs , against 175 thousand in the previous month . If the estimates are confirmed, the dollar has strengthened even more.

EUR / USD: during the European session, the pair fell to $ 1.3783

GBP / USD: during the European session, the pair rose to $ 1.6663

USD / JPY: during the European session, the pair fell to Y103.65 from Y103.95

At 12:15 GMT the U.S. will report on changes in the number of employees from ADP in March , and 14:00 GMT - a change in volume production orders for February. At 14:30 GMT the United States , there are data on crude oil inventories from the Energy Department . At 22:30 GMT , Australia will publish the index of activity in the service of AiG March . At 23:01 GMT Britain submit BRC Retail Sales Monitor for March. At 23:15 GMT Japan is to publish an index of business activity in the services sector in March .

EUR/USD

Offers $1.3945, $1.3900, $1.3880, $1.3845/50, $1.3835

Bids $1.3770/80, $1.3705/00, $1.3694, $1.3650

GBP/USD

Offers $1.6785, $1.6715/20, $1.6700

Bids $1.6600/10, $1.6575/80, $1.6550, $1.6520, $1.6500

AUD/USD

Offers $0.9400, $0.9350, $0.9300/10

Bids $0.9215/20, $0.9200, $0.9170, $0.9155/50, $0.9120

EUR/JPY

Offers Y144.00, Y143.80, Y143.60

Bids Y142.90, Y142.60, Y142.00, Y141.70/80, Y141.40/50

USD/JPY

Offers Y104.95, Y104.45, Y104.00,

Bids Y103.45, Y103.00, Y102.90, Y102.45, Y102.00

EUR/GBP

Offers stg0.8350/60, stg0.8320/25

Bids stg0.8260, stg0.8245, stg0.8210/00, stg0.8180

Most European stocks climbed as investors awaited reports that may show the U.S. economic recovery is gathering pace following the harsh winter. U.S. index futures were little changed, while Asian shares advanced.

The Stoxx Europe 600 Index gained 0.2 percent to 336.99 at 10:28 a.m. in London as more than three stocks rose for every two that fell. The benchmark has climbed 3.9 percent since March 24 as better-than-forecast U.S. consumer-confidence data signaled the world’s largest economy has rebounded from the bad winter.

“Stabilizing growth and disinflationary pressures in recent data globally have been the signal to buy stocks,” Daniel Weston, a portfolio manager at Aimed Capital GmbH in Munich, said in an interview. “The room for continued accommodative policy remains while the inflation genie is kept in the bottle, leading investors to continue being bullish stocks.”

A report from ADP Research Institute will probably show that U.S. companies added more workers last month than in February. A separate release from the Commerce Department at 10 a.m. may show factory orders climbed in February. They dropped in January. Both reports had shown weakness at the beginning of the year as unusually harsh winter temperatures suppressed economic activity.

Deutsche Post advanced 3.6 percent to 28.15 euros after saying earnings before interest and taxes will rise to as much as 5.22 billion euros ($7.2 billion) by 2020 under a new strategy. Ebit will grow at an average 8 percent a year, the company said in a presentation. The new strategy will focus on expanding into emerging economies through organic growth, rather than buying businesses to move into new markets.

Neste Oil, a Finnish maker of renewable diesel, rallied 5.3 percent to 15.82 euros. The chairman of the Senate Finance Committee, Ron Wyden, proposed retroactively extending expired tax credits for biodiesel and renewable diesel -- or refined vegetable oil -- until the end of next year.

Alcatel-Lucent SA (ALU) rose 3.3 percent to 3.04 euros. Natixis SA raised the network-equipment maker to buy from neutral, saying that telecommunications companies will increase their capital expenditure. Alcatel-Lucent has deals with China Mobile Ltd. and Bouygues SA.

Deutsche Boerse lost 2.2 percent to 56.57 euros. The operator of the Frankfurt stock exchange said the U.S. Attorney for the Southern District of New York has made Clearstream Banking SA the subject of a criminal investigation in connection with alleged violations of U.S. money-laundering and Iran-sanction laws. Deutsche Boerse said Clearstream will co-operate with the probe, which is at a very early stage.

FTSE 100 6,667.79 +15.18 +0.23%

CAC 40 4,430.54 +3.82 +0.09%

DAX 9,632.8 +29.09 +0.30%

USD/JPY Y102.00, Y102.30, Y102.35/40, Y102.50, Y102.60, Y102.80, Y103.00, Y103.75/80

EUR/JPY Y141.00

EUR/USD $1.3685, $1.3700, $1.3725, $1.3750, $1.3800

EUR/GBP stg0.8300, stg0.8430, stg0.8475

USD/CHF Chf0.8950

USD/CAD C$1.1055, C$1.1100, C$1.1120, C$1.1140, C$1.1150, C$1.1200

Asian stocks rose, with the regional benchmark index extending its winning streak to a sixth day, after an increase in U.S. manufacturing boosted optimism about growth in the world’s biggest economy.

Nikkei 225 14,946.32 +154.33 +1.04%

S&P/ASX 200 5,403.3 +14.13 +0.26%

Shanghai Composite 2,053.65 +6.19 +0.30%

Nissan Motor Co., a Japanese carmaker that gets 34 percent of its revenue in North America, added 2.1 percent.

Renesas Electronics Corp. soared 9.3 percent in Tokyo on a report Apple Inc. is seeking to buy a stake in a unit that designs chips for liquid-crystal displays used in smartphones.

Noble Group Ltd. advanced 3.8 percent in Singapore after Cofco Corp. agreed to buy 51 percent of Noble’s agricultural trading unit.

00:30 Australia Building Permits, m/m February +6.8% -1.7% -5.0%

00:30 Australia Building Permits, y/y February +34.6% +23.2%

The dollar rose to the highest level in more than two months against the yen before a private report today that may show stronger U.S. jobs growth. Figures today from the ADP Research Institute may show companies in the U.S. added 195,000 jobs in March after boosting positions by 139,000 the previous month, according to the median forecast of economists surveyed by Bloomberg News.

The Institute for Supply Management’s non-manufacturing index probably rose to 53.5 last month from 51.6 in February, the lowest since 2010, analysts in a separate poll predicted. The Tempe, Arizona-based group will release the figures tomorrow.

Economists forecast the Labor Department will say on April 4 U.S. employers added 200,000 jobs jobs in March after boosting positions by 175,000 the previous month.

The yen dropped against the euro as gains in Japanese stocks damped demand for the local currency and before the European Central Bank decides policy tomorrow. ECB policy makers will probably keep the region’s benchmark interest rate at a record-low 0.25 percent tomorrow, according to all but three of the 57 economists surveyed by Bloomberg. The euro area will probably avoid outright deflation as a “soft” recovery gradually reduces spare capacity in the economy, ECB Vice President Vitor Constancio said at a press conference in Athens yesterday. An initial estimate on March 31 showed consumer prices in the region gained 0.5 percent last month from a year earlier after rising 0.7 percent in February.

EUR / USD: during the Asian session, the pair rose to $ 1.3805

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6620-35

USD / JPY: during the Asian session, the pair rose to Y103.95

UK construction PMI at 0830GMT the morning focus.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.