- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 12-06-2012.

The euro fell against most of its major counterparts after Spanish bond yields surged and Fitch Ratings said the nation won’t meet budget-deficit goals, adding to concern Europe’s debt crisis is worsening. The 17-nation currency fluctuated against the dollar after weakening for a fourth day as Spain’s 10-year bond yields reached a euro-era record. The yield on 10-year Spanish debt touched 6.83 percent, a euro-era record. Similar-maturity Italian bond yields rose 14 basis points, or 0.14 percentage point, to 6.17 percent, after reaching as high as 6.30 percent.

Fitch also cut its rating on 18 Spanish banks, citing concern about further loan deterioration. The company cut Spain’s long-term credit rating to BBB on June 7, two levels from junk status.

The yen weakened versus most peers after the International Monetary Fund said it was overvalued. Japan should consider additional monetary stimulus, including buying longer-maturity government bonds and private securities, the IMF said in a report today.

The BOJ, which starts a two-day policy meeting on June 14, refrained from adding to monetary stimulus last month after expanding its asset-purchase program in April. Japanese Finance Minister Jun Azumi earlier this month pledged to take “decisive” action on currencies after the yen climbed to 77.66 per dollar, the strongest since February.

The Dollar Index, which Intercontinental Exchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, was little changed at 82.490 after falling as much as 0.2 percent.

EUR/USD $1.2450, $1.2540, $1.2625

USD/JPY Y79.00, Y79.05, Y79.25, Y79.30, Y80.00

EUR/JPY Y99.80

EUR/GBP stg0.8050

AUD/USD $0.9770, $0.9950, $1.0000

EUR/USD

Offers $1.2620, $1.2600, $1.2580/85, $1.2550/60, $1.2520/30

Bids $1.2445/40, $1.2425/20, $1.2410/00, $1.2385/80

GBP/USD

Offers $1.5650, $1.5615/25, $1.5600, $1.5550/55

Bids $1.5405/395

AUD/USD

Offers $1.0030, $1.0020, $1.0000/10, $0.9985/90, $0.9950, $0.9940

Bids $0.9850, $0.9800, $0.9775/70, $0.9750

USD/JPY

Offers Y80.20, Y80.10, Y80.00, Y79.70/80

Bids Y79.20, Y79.10/00, Y78.85/80

EUR/JPY

Offers Y101.10/20, Y101.00, Y100.75/80, Y100.45/50, Y100.30/35, Y100.00, Y99.75/80

Bids Y99.05/00, Y98.75/70, Y98.50, Y98.25/20, Y98.00, Y97.75/70

EUR/GBP

Offers stg0.8220/25, stg0.8200, stg0.8135/40, stg0.8110/20, stg0.8095/100

Bids stg0.8050/45, stg0.8015/00, stg0.7950

Resistance 3: Y80.55 (May 3 and 16 highs)

Resistance 2: Y80.15 (May 22 high, МА (100) for D1)

Resistance 1: Y79.80 (May 25, Jun 7-11 highs)

Current price: Y79.58

Support 1: Y79.30 (МА (100) for Н1)

Support 2: Y79.10 (session low, Jun 8 low)

Support 3: Y78.95 (МА (200) for Н1)

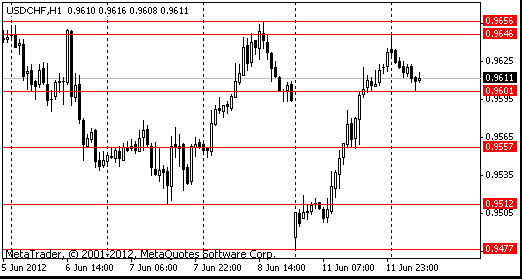

Resistance 3: Chf0.9780 (highs of 2011-2012)

Resistance 2: Chf0.9665/75 (session high, Jun 5 high)

Resistance 1: Chf0.9630 (МА (200) for Н1)

Current price: Chf0.9598

Support 1: Chf0.9590/80 (МА (100) for Н1, session low)

Support 2: Chf0.9475 (May 11 low)

Support 3: Chf0.9410 (50,0 % FIBO Chf0,9040-Chf0,9780)

Resistance 3 : $1.5720 (area of May 24, 28-29 highs)

Resistance 2 : $1.5660 (38,2 % FIBO $1.6300-$ 1.5260)

Resistance 1 : $1.5580/600 (Jun 7 and 11 highs)

Current price: $1.5480

Support 1 : $1.5480 (МА (100) for Н1)

Support 2 : $1.5450 (session low)

Support 3 : $1.5400 (Jun 8 low)

Resistance 3 : $1.2785 (50,0 % FIBO $1,3280-$ 1,2280)

Resistance 2 : $1.2670 (38,2 % FIBO $1,3280-$ 1,2280, Jun 11 high)

Resistance 1 : $1.2520 (МА (100) for Н1)

Current price: $1.2522

Support 1 : $1.2470 (МА (200) for Н1)

Support 2 : $1.2430 (Jun 8 low)

Support 3 : $1.2400 (Jun 5 low)

EUR/USD $1.2450, $1.2540, $1.2625

USD/JPY Y79.00, Y79.05, Y79.25, Y79.30, Y80.00

EUR/JPY Y99.80

EUR/GBP stg0.8050

AUD/USD $0.9770, $0.9950, $1.0000

00:00 Japan BOJ Governor Shirakawa Speaks -

01:30 Australia National Australia Bank's Business Confidence May 4 -2

The yen halted gains against its major counterparts after comments by the International Monetary Fund stoked speculation global policy makers will tolerate attempts by Japan to weaken its currency. The yen fell against the euro for the first time in three days after the IMF said Japan’s currency was “moderately overvalued” and the fund’s First Deputy Managing Director David Lipton said intervention can be used to avoid a disorderly market. The Bank of Japan, which is due to start a two-day policy meeting on June 14, should ease policy further, Lipton said in Tokyo today. The BOJ refrained from adding to monetary stimulus last month after expanding its asset-purchase program in April.

The Dollar Index snapped a three-day advance as Federal Reserve Bank of Chicago President Charles Evans said he would support a variety of measures to generate faster job growth. The Chicago Fed’s Evans has been “in favor of pretty much any accommodative policy,” he said in an interview with Bloomberg Television airing today. “More asset purchases would be useful. More mortgage-backed securities purchases would be good,” said Evans, who doesn’t vote on the policy-setting Federal Open Market Committee this year.

The Australian and New Zealand dollars rallied from an earlier drop amid speculation recent losses were excessive and after a private index showed the smaller South Pacific nation’s home prices climbed last month. The so-called Aussie and kiwi declined earlier as Asian shares slid on concern Italy will become the next focus of Europe’s debt crisis after Spain requested a bailout for its banks.

EUR/USD: during the Asian session the pair restored after yesterday's falling.

GBP/USD: during the Asian session the pair traded in a range $1.5460-$1.5500.

USD/JPY: during the Asian session the pair gain to a yesterday's high.

UK data at 0830GMT sees the release of industrial production data for April. In clear focus for Tuesday, German Chancellor Angela Merkel speaks at 1200GMT at a conference organised by the CDU economic council. The Finnish PM speaks around the same time. US data continues with the 1230GMT release of the Import/Export Price Index, while at 1255GMT the Johnson Redbook weekly chain store sales are due. At 1400GMT, IMF Managing Director Christine Lagarde speaks in Washington on the UN Conference on Sustainable Development to be held in Rio De Janeiro, to the Center for Global Development.

Yesterday the euro fell against most of its major peers as Spain’s bailout spurred concern that the sovereign-debt crisis is deepening as it spreads among indebted nations before Greek elections June 17.

The 17-nation currency earlier rose, touching a two-week high, after Spain asked for as much as 100 billion euros ($126 billion) to save its banking system, making it the fourth member of the currency bloc to seek a rescue. The bailout helped move Italy to the front lines of the crisis, as bets increased Europe’s third largest economy may be the next one to succumb.

Seven months after winning a landslide victory, Spanish Prime Minister Mariano Rajoy was forced to abandon his bid to recapitalize banks without external help. The bailout loan will be channeled through the state’s bank-rescue fund, known as FROB, and extended to lenders that need it, Economy Minister Luis de Guindos Jurado said in Madrid on June 9.

Spanish and Italian 10-year bonds fell for a fourth day, reversing earlier gains. The Spanish yield rose 31 basis points to 6.52 percent, while the rate on the Italian securities climbed 27 basis points to 6.04 percent.

Italy’s economy, the third-biggest in the region, shrank 0.8 percent in the first three months of this year from the fourth quarter, Istat, the Rome-based national statistics institute said, confirming an initial estimate. Household spending decreased 1 percent and exports fell 0.6 percent.

EUR/USD: yesterday the pair fell on two figures, lowered below $1.2500.

GBP/USD: yesterday the pair fell below $1.5500.

USD/JPY: yesterday the pair traded in range Y79.35-Y79.70.

UK data at 0830GMT sees the release of industrial production data for April. In clear focus for Tuesday, German Chancellor Angela Merkel speaks at 1200GMT at a conference organised by the CDU economic council. The Finnish PM speaks around the same time. US data continues with the 1230GMT release of the Import/Export Price Index, while at 1255GMT the Johnson Redbook weekly chain store sales are due. At 1400GMT, IMF Managing Director Christine Lagarde speaks in Washington on the UN Conference on Sustainable Development to be held in Rio De Janeiro, to the Center for Global Development.

Resistance 3: Chf0.9770 (Jun 1 high)

Resistance 2: Chf0.9720 (May 30 high)

Resistance 1: Chf0.9645/55 (area of Jun 6-12 high)

The current price: Chf0.9611

Support 1: Chf0.9600 (session low)

Support 2: Chf0.9555 (low of the American session on Jun 11)

Support 3: Chf0.9512 (Jun 7 low)

Resistance 3 : $1.2625 (Jun 7 high)

Resistance 2 : $1.2565 (high of the American session on Jun 11)

Resistance 1 : $1.2505 (session high)

The current price: $1.2493

Support 1 : $1.2435/45 (area of Jun 6-12 low)

Support 2 : $1.2405 (Jun 5 low)

Support 3 : $1.2365 (May 30 low)

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2466 -0,40%

GBP/USD $1,5470 +0,01%

USD/CHF Chf0,9632 +0,39%

USD/JPY Y79,39 -0,09%

EUR/JPY Y98,95 -0,53%

GBP/JPY Y122,80 -0,10%

AUD/USD $0,9855 -0,61%

NZD/USD $0,7678 -0,30%

USD/CAD C$1,0320 +0,57%

00:00 Japan BOJ Governor Shirakawa Speaks -

00:15 U.S. FOMC Member Charles Evans Speaks -

01:30 Australia National Australia Bank's Business Confidence May 4

05:45 Switzerland SECO Economic Forecasts Quarter III

08:30 United Kingdom Industrial Production (MoM) April -0.3% +0.2%

08:30 United Kingdom Industrial Production (YoY) April -2.6% -0.9%

08:30 United Kingdom Manufacturing Production (MoM) April +0.9% +0.1%

08:30 United Kingdom Manufacturing Production (YoY) April -0.9% +0.4%

12:30 U.S. Import Price Index May -0.5% -1.0%

14:00 United Kingdom NIESR GDP Estimate May +0.1%

15:30 U.S. FOMC Member Tarullo Speaks -

18:00 U.S. Federal budget May 59.1 -107.2

22:00 New Zealand Westpac Consumer Sentiment Quarter II 102.4

23:01 United Kingdom Nationwide Consumer Confidence May 44 45

23:10 Australia RBA's Governor Glenn Stevens Speech -

23:50 Japan Core Machinery Orders April -2.8% +1.9%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.