- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 16-12-2020.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Unemployment rate | November | 7% | 7% |

| 00:30 (GMT) | Australia | Changing the number of employed | November | 178.8 | 50 |

| 07:00 (GMT) | Switzerland | Trade Balance | November | 2.9 | |

| 08:30 (GMT) | Switzerland | SNB Interest Rate Decision | -0.75% | -0.75% | |

| 09:30 (GMT) | Switzerland | SNB Press Conference | |||

| 10:00 (GMT) | Eurozone | Harmonized CPI ex EFAT, Y/Y | November | 0.2% | 0.2% |

| 10:00 (GMT) | Eurozone | Harmonized CPI | November | 0.2% | -0.3% |

| 10:00 (GMT) | Eurozone | Harmonized CPI, Y/Y | November | -0.3% | -0.3% |

| 12:00 (GMT) | United Kingdom | Asset Purchase Facility | 875 | ||

| 12:00 (GMT) | United Kingdom | BoE Interest Rate Decision | 0.1% | 0.1% | |

| 12:00 (GMT) | United Kingdom | Bank of England Minutes | |||

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | December | 5757 | 5598 |

| 13:30 (GMT) | U.S. | Housing Starts | November | 1.53 | 1.53 |

| 13:30 (GMT) | U.S. | Building Permits | November | 1.545 | 1.55 |

| 13:30 (GMT) | U.S. | Philadelphia Fed Manufacturing Survey | December | 26.3 | 20 |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | December | 853 | 800 |

| 15:30 (GMT) | United Kingdom | MPC Member Dr Ben Broadbent Speaks | |||

| 21:45 (GMT) | New Zealand | Trade Balance, mln | November | -500 | |

| 23:30 (GMT) | Japan | National CPI Ex-Fresh Food, y/y | November | -0.7% | -0.9% |

| 23:30 (GMT) | Japan | National Consumer Price Index, y/y | November | -0.4% |

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories dropped

by 3.135 million barrels in the week ended December 11. Economists had forecast

a decline of 1.937 million barrels.

At the same

time, gasoline stocks rose by 1.020 million barrels, while analysts had

expected a gain of 1.614 million barrels. Distillate stocks increased by 0.167

million barrels, while analysts had forecast an advance of 0.886 million

barrels.

Meanwhile, oil

production in the U.S. decreased by 100,000 barrels a day to 11.000 million barrels

a day.

U.S. crude oil

imports averaged 5.4 million barrels per day last week, decreased by 1.1

million barrels per day from the previous week.

The Commerce

Department announced on Wednesday that business inventories rose 0.7 percent

m-o-m in October, following a revised 0.8 percent m-o-m advance in September (originally

a 0.7 percent m-o-m gain).

That was in

line with economists’ forecast for a 0.7 percent m-o-m increase.

According to

the report, inventories at wholesalers jumped 1.1 percent m-o-m in October,

while stocks at retailers rose 0.9 percent m-o-m and those at manufacturers edged

up 0.2 percent m-o-m.

The National

Association of Homebuilders (NAHB) announced on Wednesday its housing market

index (HMI) fell 4 points to 86 in December from November’s all time high of 90.

Economists had

forecast the HMI to decline to 88.

A reading over

50 indicates more builders view conditions as good than poor.

All three HMI

components recorded declines this month. The indicator gauging current sales

conditions fell 4 points to 92 in December, while the component measuring

traffic of prospective buyers also decreased 4 points to 73 and the measure

charting sales expectations dropped 4 points to 85.

NAHB Chairman

Chuck Fowke noted: “Housing demand is strong entering 2021, however the coming

year will see housing affordability challenges as inventory remains low and

construction costs are rising. Policymakers should take note to avoid

increasing regulatory costs associated with land development and residential

construction”.

Meanwhile, NAHB

Chief Economist Robert Dietz said: “Builder confidence fell back from historic

levels in December, as housing remains a bright spot for a recovering economy. The

issues that have limited housing supply in recent years, including land and

material availability and a persistent skilled labor shortage, will continue to

place upward pressure on construction costs. As the economy improves with the

deployment of a COVID-19 vaccine, interest rates will increase in 2021, further

challenging housing affordability in the face of strong demand for

single-family homes”.

Preliminary

data released by IHS Markit on Wednesday revealed that U.S. private sector business

activity continued to expand strongly during December, albeit at a softer pace

than in November.

According to

the report, the Markit flash manufacturing purchasing manager's index (PMI)

came in at 56.5 in December, down slightly from 56.7 in November. Economists

had expected the reading to drop to 55.7. A reading above 50 signals an

expansion in activity, while a reading below this level signals a contraction. The

headline figure was broadly sustained by the greatest deterioration in vendor

performance since data collection began in May 2007 as supplier delivery times

were extended following severe raw material shortages and supplier capacity and

logistical constraints. At the same time, expansions in output and new orders remained

strong.

The Markit

flash services purchasing manager's index (PMI) fell to 55.3 in December from 58.4

in the previous month. The rate of growth was the slowest for three months,

albeit solid. Economists had expected the reading to decrease to 55.9. The restrictions that were imposed to contain a resurge in Covid-19 cases and softer demand weighed on

total services activity.

Overall, IHS

Markit Flash U.S. Composite PMI Output Index came in at 55.7 in December, down

from November’s 68-month high of 58.6, pointing to the loss of growth momentum

due to rising virus case numbers and re-imposed restrictions in many states, while

the post-election uptick and vaccine confidence waned.

Chris

Williamson, Chief Business Economist at HIS Markit noted: “Business reported

that the US economy lost growth momentum in December, though encouragingly continued

to expand at a solid pace. The survey data add to the likelihood of the economy

having continued to expand in the fourth quarter, building on the recovery seen

in the third quarter.”

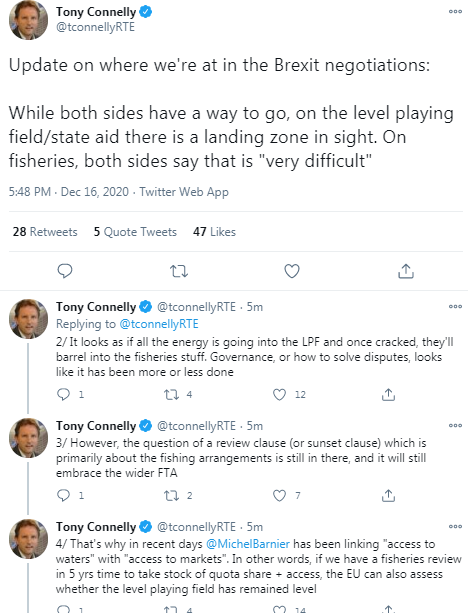

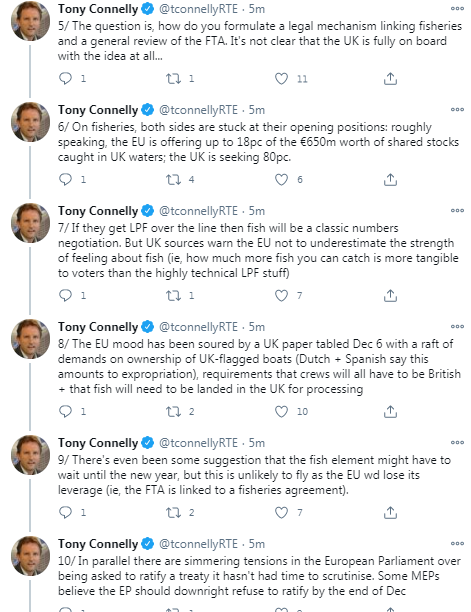

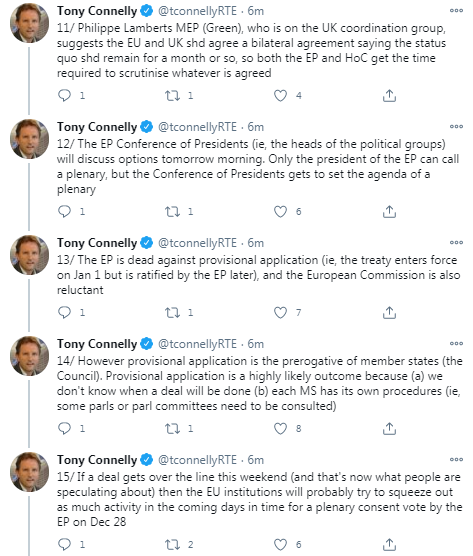

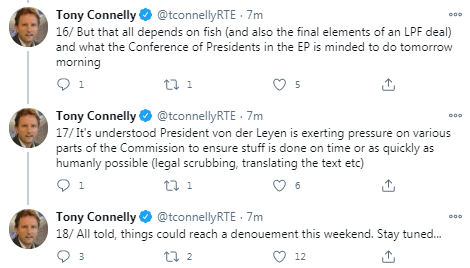

- Our position is still that we want to reach an free trade agreement with EU

- But it is still the case that most likely outcome is still leaving on Australia terms

- We have made some progress in some areas in negotiations, but there are still gaps

- Two sides are trying to bridge remaining gaps

FXStreet notes that the S&P 500 rally has lost momentum and the risk of a correction lower continues to increase, but analysts at Credit Suisse continue to give the upside the benefit of the doubt still and thus maintain an immediate tactical bullish bias whilst above 3633.

“The S&P 500 has held support at 3633 and managed to recover back above its 13-day exponential average, but with daily MACD having also crossed lower the rally has lost momentum.”

“Whilst 3633 holds, the upside will continue to be given the direct benefit of the doubt for now, but with a move above 3698 needed to clear the way for a move back to 3712, ahead of our 3720/25 next objective. Whilst we would expect this to cap at first, a direct break can see a cluster of what we expect to be tougher resistances in the 3765/85 zone.”

The Commerce

Department reported on Wednesday the sales at U.S. retailers fell 1.1 percent

m-o-m in November, following a revised 0.1 percent m-o-m decrease in October

(originally a 0.3 percent m-o-m gain).

Economists had expected total sales would drop 0.3 percent m-o-m in November.

Excluding auto,

retail sales decreased 0.9 percent m-o-m in November after a revised 0.1

percent m-o-m fall in the previous month (originally a 0.2 percent m-o-m

increase), being much worse than economists’ forecast of a 0.1 percent m-o-m

rise.

Meanwhile,

closely watched core retail sales, which exclude automobiles, gasoline,

building materials and food services, and are used in GDP calculations, dropped

0.5 percent m-o-m in November after a downwardly revised 0.1 percent m-o-m dip

in October (originally a 0.1 percent m-o-m gain).

In y-o-y terms,

the U.S. retail sales grew 4.1 percent in November after a revised 5.5 climb in

the previous month (originally a 5.7 percent jump).

Statistics

Canada reported on Wednesday the country’s consumer price index (CPI) edged up 0.1

percent m-o-m in November, following a 0.4 percent m-o-m gain in the previous

month.

On the y-o-y

basis, Canada’s inflation rate increased 1.0 percent last month after advancing

0.7 percent in October.

Economists had

predicted inflation would be flat m-o-m and increase 0.8 percent y-o-y in November.

According to

the report, prices rose in six of the eight major components on a

year-over-year basis in November, led by gains in prices for food (+1.9 percent

y-o-y), shelter (+1.9 percent y-o-y) and health and personal care (+2.0 percent

y-o-y).

Meanwhile, the closely watched the Bank of Canada's

core index rose 1.5 percent y-o-y in November, following a 1.0 percent y-o-y

advance in October. This was the highest rate since March.

FXStreet notes that after the first lockdown in the second quarter of 2020, the economy rebounded strongly in the third quarter. But analysts at Natixis believe that the economic rebound in the first quarter of 2021 after the lockdown in the fourth quarter of 2020 will be weaker, and that if there is another lockdown in the second quarter of 2021 then the rebound in the third quarter of 2021 will be weaker still.

“In the third quarter of 2020, after the first lockdown, very few people expected there would be a second lockdown. First, this explains why the public health restrictions were almost completely lifted in the third quarter of 2020, which led to the second wave. It also explains the strong rebound in consumption. After the second or possibly third lockdown, there will no longer be this expectation of a return to normal.”

“Each lockdown leads to a further deterioration in corporate balance sheets, due to the fall in sales and the increase in debt, which then increases the proportion of zombie firms which struggle to invest.”

“The best strategy in the first half of 2021 will be to try to avert a third wave of COVID by keeping in place the necessary public health measures and by responding rapidly to any sign of uptick in the pandemic.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:15 | France | Manufacturing PMI | December | 49.6 | 50.1 | 51.1 |

| 08:15 | France | Services PMI | December | 38.8 | 40 | 49.2 |

| 08:30 | Germany | Services PMI | December | 46 | 44 | 47.7 |

| 08:30 | Germany | Manufacturing PMI | December | 57.8 | 56.4 | 58.6 |

| 09:00 | Eurozone | Manufacturing PMI | December | 53.8 | 53 | 55.5 |

| 09:00 | Eurozone | Services PMI | December | 41.7 | 41.9 | 47.3 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | December | 47.6 | 50.5 | 49.9 |

| 09:30 | United Kingdom | Purchasing Manager Index Manufacturing | December | 55.6 | 55.9 | 57.3 |

| 10:00 | Eurozone | Construction Output, y/y | October | -2.3% | -1.4% | |

| 10:00 | Eurozone | Trade balance unadjusted | October | 24.4 | 30 |

GBP rose against its major rivals in the European session on Wednesday as the latest comments from the UK and the EU's leaders indicated that a Brexit trade deal could be agreed made in the coming days.

The UK's Prime Minister (PM) Boris Johnson said on Wednesday that he has "every hope" of a post-Brexit trade deal being done. He, however, added that the UK will prosper, whatever happens.

Earlier today, the European Commission's (EC) President Ursula von der Leyen told the European Parliament that the UK and the EU's negotiators "have found a way forward on most issues but two issues remain outstanding: the level playing field and fisheries". She added that “there is a path to an agreement now” and "the next few days are going to be decisive." Von der Leyen's comments heightened hopes for a Brexit deal being reached by the weekend.

Meanwhile, Reuters reported that a UK source, commenting on von der Leyen's remarks, said that the two sides made some progress but are still very far apart in key areas.

Germany's chancellor Angela Merkel also acknowledged that some progress was made in the latest round of trade talks but noted that the negotiators haven't been able to make a breakthrough yet. She also added that the negotiations will continue until the end of this week.

- Brexit trade talks to continue until the end of this week

- Germany remains on the view that a deal would be better than a no-deal outcome

- We are prepared either way

- There is every opportunity and every hope that EU will reach trade deal with UK

- Whatever happens, Britain will prosper

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. increased 1.1 percent in the week ended December 11, following a 1.2

percent drop in the previous week.

According to

the report, applications to purchase a home rose 1.8 percent, while refinance

applications went up 1.4 percent.

Meanwhile, the average fixed 30-year mortgage rate dropped from 2.90 percent to another - the 15th this year - record low of 2.85 percent.

“U.S. Treasury

rates stayed low last week, in part due to uncertainty over the prospects of

additional pandemic-related government stimulus, as well as concerns about the

continued rise in Covid-19 cases across the country,” said Joel Kan, MBA’s

associate vice president of economic and industry forecasting. “Applications to

buy a home increased for the fourth time in five weeks, as both conventional

and government segments of the market saw gains,” Kan added. “Government

purchase applications rose for the sixth straight week to the highest level

since June - perhaps a sign that more first-time buyers are entering the

market.”

FXStreet notes that USD/CHF is testing below the lower end of the tight range and below the crucial 0.8875 long-term retracement support. Although economists at Credit Suisse stay medium-term bearish, the bank’s analyst team stays biased towards further range trading in the short-term.

“USD/CHF is seeing another attempt to break out of its tight range to the downside after breaking below 0.8950 this morning. Despite the early test below this level, we remain biased for now for further near-term sideways trading, with the Fed tonight a potential catalyst for a near-term reversal back into the range.”

“We remain biased lower over the medium-term and look for a clear and sustained move lower, with support seen initially at price support and key psychological inflection point at 0.8802/00, where we would expect to see another attempt to hold at first. Beyond here though could see a move back to 0.8765/62.”

FXStreet notes that the dollar remains at weak levels as the DXY Index is trading at a new low just above the 90 mark, a level last seen in April 2018, which analysts at MUFG Bank believe underlines high expectations that the Fed will deliver a message of continued loose monetary policy for a considerable period to come.

“We now suspect the FOMC to hold off on altering the QE composition but it remains a very close call. However, the guidance statement may well include an option to alter the composition and may suggest that the FOMC is monitoring the Weighted Average Maturity (WAM) and suggest the WAM could be changed if the FOMC believes financial market conditions are not conducive to reaching its new inflation average target. The guidance will also likely be much more explicit on maintaining the current pace of QE until labour market conditions are ‘on track to reach maximum employment and inflation is on track to sustain 2% on average over time’.”

“Without a QE composition change, the US dollar may rebound modestly but assuming the guidance is explicit and strongly-worded like we expect, the dollar is set to remain weak, close to current levels through the remainder of the year and into 2021.”

FXStreet reports that analysts at Credit Suisse note that USD/CAD continues to hover around the pivotal May 2018 low at 1.2730, but the overall core downtrend remains intact, with next major support at 1.2620.

“With short-term momentum waning, further near-term sideways trading is likely at first. Post this consolidation, we remain biased lower over the medium-term, as a large ‘head and shoulders’ top still in place.”

“Support is seen initially at 1.2700/1.2699, then back at 1.2688, removal of which should see a move back to the 78.6% retracement of the 2017/2020 surge at 1.2620, where we would expect to see fresh buyers at first.”

FXStreet reports that Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, said that the USD/CNH pair is heading towards 2016 and 2017 lows.

“USD/CNH’s decline is ongoing with the currency pair sliding towards the 2016 and 2017 lows and 78.6% Fibonacci retracement at 6.4437/17. There it may at least short-term stabilise. Further down sit the May 2018 high at 6.4323 and also the February and early May 2018 highs at 6.3835/6.3774.”

“Minor resistance above the 6.5971 late November high comes in between the October low and the November 12 high at 6.6274/6.6349 and also at the November 9 high at 6.6495. Further resistance can be seen along the May-to-November downtrend line at 6.6646 and also sits at the 6.6787 October 9 low.”

According to the report from Eurostat, in October 2020 compared with September 2020, seasonally adjusted production in the construction sector increased by 0.5% in the euro area and by 0.9% in the EU. In September 2020, production in construction fell by 2.7% in the euro area and by 2.5% in the EU.

In October 2020 compared with October 2019, production in construction decreased by 1.4% in the euro area and by 1.2% in the EU.

In the euro area in October 2020, compared with September 2020, building construction increased by 1.1% while civil engineering decreased by 1.5%. In the EU, building construction increased by 1.6% while civil engineering decreased by 1.3%.

In the euro area in October 2020, compared with October 2019, building construction decreased by 1.5% and civil engineering by 0.3%. In the EU civil engineering decreased by 1.3% and building construction by 0.9%.

According to the report from Eurostat, the first estimate for euro area exports of goods to the rest of the world in October 2020 was €199.3 billion, a decrease of 9.0% compared with October 2019 (€219.0 bn). Imports from the rest of the world stood at €169.3 bn, a fall of 11.7% compared with October 2019 (€191.8 bn). As a result, the euro area recorded a €30.0 bn surplus in trade in goods with the rest of the world in October 2020, compared with +€27.2 bn in October 2019. Intra-euro area trade fell to €166.1 bn in October 2020, down by 6.8% compared with October 2019.

In January to October 2020, euro area exports of goods to the rest of the world fell to €1 744.0 bn (a decrease of 11.1% compared with January-October 2019), and imports fell to €1 564.0 bn (a decrease of 12.4% compared with January-October 2019). As a result the euro area recorded a surplus of €180.1 bn, compared with +€178.2 bn in January-October 2019. Intra-euro area trade fell to €1 478.4 bn in January-October 2020, down by 10.8% compared with January-October 2019.

According to the report from IHS Markit / CIPS, December data highlighted a marginal expansion of UK private sector output, driven by another solid increase in manufacturing production. In contrast, overall levels of service sector activity stagnated at the end of 2020, largely due to ongoing coronavirus disease 2019 (COVID-19) restrictions on hospitality, leisure and travel businesses.

The latest survey also indicated severe pressure on manufacturing supply chains, which was overwhelmingly linked to freight delays following congestion at UK ports. Around 45% of the survey panel reported longer wait times from suppliers, while only 2% saw an improvement. The lengthening of lead times in December was the third-steepest since the survey began in 1992, exceeded only by those seen amid COVID-19 shutdowns in April and May. Shortages of critical inputs, alongside pressure on capacity following forward-purchasing by clients ahead of Brexit, contributed to the sharpest rise in backlogs of work across the manufacturing sector since May 2010.

At 50.7 in December, the seasonally adjusted Flash UK Composite Output Index – which is based on approximately 85% of usual monthly replies – was up from 49.0 in November and back above the crucial 50.0 no-change mark. However, the latest reading signalled only a slight rise in private sector output and the rate of growth was slower than seen from July to October 2020. A relatively subdued service sector performance (49.9) continued to hold back the recovery, while manufacturing production was firmly in growth territory (55.3).

According to the report from IHS Markit, Eurozone business activity came close to stabilising in December as stronger manufacturing output growth helped to counter a further drop in service sector activity. Encouragingly, future output expectations jumped to a 32-month high, as prospects brightened amid recent news on vaccine developments.

The flash Eurozone Composite PMI rose from 45.3 to 49.8 in December, registering a marginal drop in business activity after a steep decline in November. The improvement means the PMI has averaged 48.4 in the fourth quarter. Although down from 52.4 in the third quarter, the fourth quarter average is well above that seen in the second quarter (31.3), suggesting that the economic impact of the second waves of virus infections has been far less severe than the first wave.

Although manufacturing output growth accelerated in December, having slowed in November, the service sector saw output contract for a fourth successive month, albeit with the rate of decline easing markedly to the slowest since September as fewer companies reported output to have been hit by coronavirus disease 2019 (COVID 19) lockdown restrictions compared to November.

Inflows of new orders rose marginally and for the first time since September, boosted by an increased rate of growth of new orders in the manufacturing sector and a substantial slowing in the rate of loss of new business in the service sector compared to that suffered in November.

According to the report from IHS Markit, December’s ‘flash’ PMI survey pointed to ongoing resilience in the German economy, with strength in manufacturing continuing to offset service sector weakness. The survey meanwhile pointed to a minor setback in private sector employment, though firms remained optimistic about the year-ahead outlook. Elsewhere, there were signs of increasing supply chain pressures driving a sharp rise in manufacturing input costs.

The headline Flash Germany Composite Output Index registered 52.5 in December. This was up slightly from October’s five-month low of 51.7, with the survey indicating a reduced drag from falling service sector activity (index at 47.7 up from 46.0). Manufacturing production meanwhile continued to exhibit strong growth, albeit with a dip in the respective output index from 62.2 to 61.4 signalling a further slight loss of momentum. Coronavirus disease 2019 (COVID-19) lockdown measures, including the closure of the hospitality and leisure industries and travel restrictions, continued to weigh on service sector activity in December. Manufacturing output, by contrast, showed little impact from the virus containment measures at home or abroad, with panellists often attributing growth to a sustained rise in demand.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Japan | Manufacturing PMI | December | 49 | 49.7 | |

| 00:30 | Japan | Nikkei Services PMI | December | 47.8 | 47.2 | |

| 07:00 | United Kingdom | Producer Price Index - Input (MoM) | November | 0.4% | 0.4% | 0.2% |

| 07:00 | United Kingdom | Producer Price Index - Input (YoY) | November | -1.2% | -0.5% | |

| 07:00 | United Kingdom | Producer Price Index - Output (YoY) | November | -1.4% | -0.9% | -0.8% |

| 07:00 | United Kingdom | Producer Price Index - Output (MoM) | November | 0.0% | 0.1% | 0.2% |

| 07:00 | United Kingdom | Retail Price Index, m/m | November | 0.3% | 0.2% | -0.3% |

| 07:00 | United Kingdom | HICP ex EFAT, Y/Y | November | 1.5% | 1.1% | |

| 07:00 | United Kingdom | Retail prices, Y/Y | November | 1.3% | 1.3% | 0.9% |

| 07:00 | United Kingdom | HICP, m/m | November | 0% | 0.1% | -0.1% |

| 07:00 | United Kingdom | HICP, Y/Y | November | 0.7% | 0.6% | 0.3% |

During today's Asian trading, the US dollar fell against the euro and the yen in anticipation of the Fed decision.

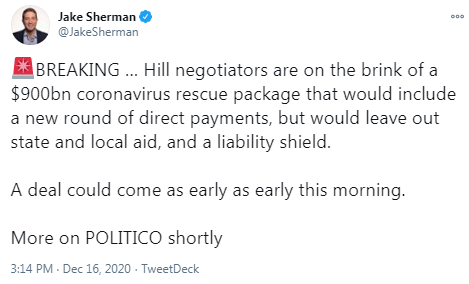

The focus of traders ' attention also remains on the ongoing negotiations of US lawmakers on a new package of measures to support the economy. Congressional leaders held another meeting on Tuesday, seeking to agree on a stimulus package this week-before the christmas holiday, as well as before the expiration of a number of key assistance programs. "We have made significant progress, and I am optimistic that we can reach a full understanding soon," said republican senate majority leader Mitch mcconnell.

The Fed will not make major changes to monetary policy following the meeting ending on Wednesday, but may announce new benchmarks for the bond repurchase program, analysts say. The Fed has been buying back $120 billion a month of government securities since June this year, and has previously stated that it intends to maintain the current pace of redemption "in the coming months."

Experts expect that on Wednesday the Fed will announce its intention to continue buying bonds in this volume until certain economic benchmarks are reached. Thus, it will be difficult for the Fed to curtail this program prematurely, which will consolidate the stimulating monetary policy for the coming years.

The ICE index, which tracks the dollar's performance against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell 0.1%.

eFXdata reports that Bank of America discusses its expectations for this week's BoE policy meeting.

"We expect little news from the Bank of England (BoE) policy meeting and a unanimous vote to keep policy on hold. Brexit news remains the potential near-term catalyst for a change at the BoE. If markets become jittery, the BoE could increase the QE purchase pace at short notice. We would expect rate cuts into negative territory in a no-deal scenario, but that would need to wait until February we suspect," BofA notes.

"GBP remains fixated by Brexit. Fundamentals will have to wait until 2021 as a driver for GBP," BofA adds.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2255 (986)

$1.2236 (1397)

$1.2222 (832)

Price at time of writing this review: $1.2167

Support levels (open interest**, contracts):

$1.2082 (1792)

$1.2051 (4587)

$1.2015 (1140)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 8 is 65059 contracts (according to data from December, 15) with the maximum number of contracts with strike price $1,1800 (4587);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3573 (226)

$1.3547 (303)

$1.3526 (646)

Price at time of writing this review: $1.3470

Support levels (open interest**, contracts):

$1.3341 (643)

$1.3294 (520)

$1.3238 (654)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 58918 contracts, with the maximum number of contracts with strike price $1,4000 (33030);

- Overall open interest on the PUT options with the expiration date January, 8 is 27967 contracts, with the maximum number of contracts with strike price $1,2800 (4026);

- The ratio of PUT/CALL was 0.47 versus 0.47 from the previous trading day according to data from December, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

RTTNews reports that the New Zealand government upgraded its economic and fiscal outlook as the economy rebounded from the Covid-19 restrictions.

According to the latest update, the economy will grow 1.5 percent over the year to June 2021 instead of a 0.5 percent contraction estimated in the Pre-Election Economic and Fiscal Update, or PREFU, released in September.

The treasury said the fiscal outlook has improved mainly due to stronger economic activity than previously forecast.

The budget deficits have reduced in all years across the forecast period when compared to the PREFU. The budget deficit is seen at NZ$21.6 billion in the fiscal year 2021, NZ$16.4 billion in the fiscal year 2022 and NZ$10.3 billion in the fiscal 2023. The pace of the reduction in the budget deficits is expected to be faster than previously expected.

The unemployment rate is forecast to peak at 6.9 percent by the end of 2021, compared to 7.8 percent forecast in the pre-election update.

According to the report from Office for National Statistics, the Consumer Prices Index (CPI) 12-month rate was 0.3% in November 2020, down from 0.7% in October. Economists had expected a 0.6% increase.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) 12-month inflation rate was 0.6% in November 2020, down from 0.9% in October 2020.

The largest contribution to the CPIH 12-month inflation rate in November 2020 came from recreation and culture (0.24 percentage points).

Falling prices for clothing, and food and non-alcoholic beverages resulted in the largest downward contributions (of 0.17 and 0.09 percentage points respectively) to the change in the CPIH 12-month inflation rate between October and November 2020.

These were partially offset by upward contributions from games, toys and hobbies, and accommodation services.

As a result of the increased restrictions caused by the coronavirus (COVID-19) pandemic, 72 CPIH items were identified as unavailable in November, accounting for 13.9% of the basket by weight; the number has increased from eight in October but is down from 90 in April, the first full month of lockdown; for November, we collected a weighted total of 83.8% of comparable coverage collected before the first lockdown (excluding unavailable items).

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Japan | Manufacturing PMI | December | 49 | |

| 00:30 (GMT) | Japan | Nikkei Services PMI | December | 46.7 | |

| 07:00 (GMT) | United Kingdom | Producer Price Index - Input (MoM) | November | 0.2% | 0.4% |

| 07:00 (GMT) | United Kingdom | Producer Price Index - Input (YoY) | November | -1.3% | |

| 07:00 (GMT) | United Kingdom | Producer Price Index - Output (YoY) | November | -1.4% | -0.9% |

| 07:00 (GMT) | United Kingdom | Producer Price Index - Output (MoM) | November | 0.0% | 0.1% |

| 07:00 (GMT) | United Kingdom | Retail Price Index, m/m | November | 0% | 0.2% |

| 07:00 (GMT) | United Kingdom | HICP ex EFAT, Y/Y | November | 1.5% | |

| 07:00 (GMT) | United Kingdom | Retail prices, Y/Y | November | 1.3% | 1.3% |

| 07:00 (GMT) | United Kingdom | HICP, m/m | November | 0% | 0.1% |

| 07:00 (GMT) | United Kingdom | HICP, Y/Y | November | 0.7% | 0.6% |

| 08:15 (GMT) | France | Services PMI | December | 38.8 | 40 |

| 08:15 (GMT) | France | Manufacturing PMI | December | 49.6 | 50.1 |

| 08:30 (GMT) | Germany | Services PMI | December | 46 | 44 |

| 08:30 (GMT) | Germany | Manufacturing PMI | December | 57.8 | 56.4 |

| 09:00 (GMT) | Eurozone | Manufacturing PMI | December | 53.8 | 53 |

| 09:00 (GMT) | Eurozone | Services PMI | December | 41.7 | 41.9 |

| 09:30 (GMT) | United Kingdom | Purchasing Manager Index Services | December | 47.6 | 50.5 |

| 09:30 (GMT) | United Kingdom | Purchasing Manager Index Manufacturing | December | 55.6 | 55.9 |

| 10:00 (GMT) | Eurozone | Construction Output, y/y | October | -2.5% | |

| 10:00 (GMT) | Eurozone | Trade balance unadjusted | October | 24.8 | |

| 13:30 (GMT) | Canada | Foreign Securities Purchases | October | 4.5 | |

| 13:30 (GMT) | Canada | Wholesale Sales, m/m | October | 0.9% | 0.9% |

| 13:30 (GMT) | U.S. | Retail sales | November | 0.3% | -0.3% |

| 13:30 (GMT) | U.S. | Retail Sales YoY | November | 5.7% | |

| 13:30 (GMT) | U.S. | Retail sales excluding auto | November | 0.2% | 0.1% |

| 13:30 (GMT) | Canada | Consumer Price Index m / m | November | 0.4% | 0% |

| 13:30 (GMT) | Canada | Bank of Canada Consumer Price Index Core, y/y | November | 1% | |

| 13:30 (GMT) | Canada | Consumer price index, y/y | November | 0.7% | 0.8% |

| 14:45 (GMT) | U.S. | Services PMI | December | 58.4 | 55.9 |

| 14:45 (GMT) | U.S. | Manufacturing PMI | December | 56.7 | 55.7 |

| 15:00 (GMT) | U.S. | NAHB Housing Market Index | December | 90 | 88 |

| 15:00 (GMT) | U.S. | Business inventories | October | 0.7% | 0.7% |

| 15:30 (GMT) | U.S. | Crude Oil Inventories | December | 15.189 | |

| 19:00 (GMT) | U.S. | FOMC Economic Projections | |||

| 19:00 (GMT) | U.S. | Fed Interest Rate Decision | 0.25% | 0.25% | |

| 19:30 (GMT) | U.S. | Federal Reserve Press Conference | |||

| 21:45 (GMT) | New Zealand | GDP y/y | Quarter III | -12.4% | -1.3% |

| 21:45 (GMT) | New Zealand | GDP q/q | Quarter III | -12.2% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.75558 | 0.36 |

| EURJPY | 125.962 | -0.28 |

| EURUSD | 1.21542 | 0.1 |

| GBPJPY | 139.49 | 0.63 |

| GBPUSD | 1.34601 | 1.03 |

| NZDUSD | 0.70881 | 0.13 |

| USDCAD | 1.26987 | -0.47 |

| USDCHF | 0.88533 | -0.07 |

| USDJPY | 103.63 | -0.39 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.