- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 18-12-2020.

On Monday, at 02:00 GMT, New Zealand will announce a change in credit card spending for November. At 11:00 GMT, Britain will release the retail sales index according to the Confederation of British Industrialists for December. At 15:00 GMT, the eurozone will publish a consumer confidence indicator for December.

On Tuesday, at 00:30 GMT, Australia will report a change in retail trade volume for November. At 07:00 GMT, Britain will announce changes in Gdp, balance of payments and commercial investment for the 3rd quarter, as well as net public sector debt for November. In addition, at 07:00 GMT, Germany will publish the Gfk consumer climate index for January. At 13:30 GMT, the US will announce the change in Gdp for the 3rd quarter and release the price index for the 3rd quarter. At 15:00 GMT, the US will report changes in the existing home sales for November and release the Fed-Richmond manufacturing index for December. At 23:50 GMT, in Japan, the Bank of Japan monetary policy meeting minutes will be released.

On Wednesday, at 09:00 GMT, Switzerland will present an index of expectations of Swiss investors, according to data from ZEW and Credit Suisse for December. At 13:30 GMT, Canada will announce the change in GDP for October. Also at 13:30 GMT, the US will report changes in personal income and expenses for November. At 14:00 GMT in Switzerland, the SNB quarterly inflation report will be released. Also at 14:00 GMT, the US will present the housing price index for October. At 15:00 GMT, the United States will announce a change in new home sales for November and publish the consumer sentiment index from the University of Michigan for December. At 15:30 GMT, the US will announce changes in oil reserves according to the Ministry of Energy. At 18:00 GMT, the US will present the Baker Hughes report on the number of active oil drilling rigs.

On Thursday, at 13:30 GMT, Canada will announce the change in construction permits for November. Also at 13: 30 GMT, the US will announce changes in the volume of orders for durable goods for November and the number of initial applications for unemployment benefits. At 23:30 GMT, Japan will release the Tokyo consumer price index for December and announce a change in the unemployment rate for November. At 23:50 GMT, Japan will report a change in retail sales for November.

On Friday at 05:00 GMT, Japan will announce a change in the housing starts for November.

James Smith, a Developed Market economist at ING, notes that the fact that UK retail sales fell by 'only' 2.6% during the November lockdowns is fairly remarkable but it also reflects huge shifts in the way consumers are shopping, and the latest restrictions have only amplified the divide between online and physical retail.

"The fact that UK retail sales (ex fuel) fell by ‘only’ 2.6% in November is pretty remarkable. This means that despite lockdowns across most of the UK, the level of spending is still higher than where it was in August, and comfortably above its pre-virus level."

"Unsurprisingly though, this solid aggregate performance masks huge shifts in spending patterns beneath the surface. Online spending rose by over 40% during the first lockdown and has not really fallen back since."

"On the high street, it is a much different story. Clothing/footwear sales for instance never recovered to pre-virus levels, and November’s lockdown now means this category is 30% down on January levels. We suspect this is partly linked to the ongoing restrictions on hospitality - a principle reason for buying new outfits is for particular occasions or seasons, and less socialisation and holidaying means demand is unsurprisingly lower."

"As we head into the Christmas season, this online vs physical retail split has, if anything, only become more pronounced."

"In principle, consumer fundamentals are ‘ok’ - at least in relative terms compared to the size of the shock the UK economy has experienced this year. While unemployment has risen, the furlough scheme has helped protect incomes and will have helped support confidence. Savings levels have also risen noticeably this year, and retailers will therefore be hoping for a higher per-person spend this year."

FXStreet notes that just as the arrival of the COVID-19 virus determined the course of the global economy of 2020, so the retreat of the virus will dictate the recovery of 2021. Once vulnerable groups have built up immunity, the restrictions can gradually be lifted. This will boost GDP growth rates around the summer of 2021 and take us to pre-corona levels of prosperity by the end of 2021. Thereafter, a period of above-trend growth will begin in which, thanks to stimulus from governments and loose monetary policy, economies will begin the long climb towards their potential levels, according to economists ABN Amro.

“All countries – with the exception of China – are likely to continue muddling their way through alternating relaxations and restrictions until the vaccine makes a sustainable easing of measures possible. We expect the winding down of restrictions to start in Q2 2021. Once approved vaccines with full (rather than emergency) market access start to be broadly rolled out, the relaxations can be accelerated around the summer... The economic damage in the fourth quarter of 2020 with a possible spill-over to the first quarter of 2021 is expected to be more limited than in the first wave.”

“With the phasing out of restrictions between the second quarter and the end of 2021 comes the recovery. Immediately after the first easing of restrictions, there will be strong growth figures for a few quarters, if only because of the aforementioned base effects. Nevertheless, we do not expect a so-called V-shaped recovery. This is due to the anticipated spending levels and proposed stimulus measures.”

“We expect both the euroarea, the US and China to grow above trend in 2022. This will gradually bring the level of prosperity closer to the potential level of prosperity, thus narrowing the output gap and reducing the risk of disinflation."

The Conference

Board announced on Friday its Leading Economic Index (LEI) for the U.S. rose

0.6 percent m-o-m in November to 109.1 (2016 = 100), following a revised 0.8

percent m-o-m jump in October (originally a 0.7 percent m-o-m gain).

Economists had

forecast an increase of 0.5 percent m-o-m.

“The US LEI

continued rising in November, but its pace of improvement has been decelerating

in recent months, suggesting a significant moderation in growth as the US

economy heads into 2021,” noted Ataman Ozyildirim, Senior Director of Economic

Research at The Conference Board. “Initial claims for unemployment insurance,

new orders for manufacturing, residential construction permits, and stock

prices made the largest positive contributions to the LEI. However, falling

average working hours in manufacturing and consumers’ worsening outlook

underscore the downside risks to growth from a second wave of COVID-19 and high

unemployment.”

The report also

revealed the Conference Board Coincident Economic Index (CEI) for the U.S.

increased 0.2 percent m-o-m in November to 103.2, following a 0.6 percent m-o-m

gain in October. Meanwhile, its Lagging Economic Index (LAG) for the U.S. fell

0.4 percent m-o-m in November to 106.9, following a 0.3 percent advance in October.

The Department

of Commerce reported on Friday that the current account (C/A) gap in the U.S. widened

by 10.6 percent q-o-q to $178.5 billion in the third quarter of 2020 from a revised

$161.4 billion gap in the previous quarter (originally -$170.5 billion). This

was the highest C/A deficit since the second quarter of 2008.

The deficit was

3.4 percentage of current-dollar GDP in the third quarter, up from 3.3 percent

in the second quarter.

Economists had

forecast a deficit of $189.0 billion.

According to

the report, the $17.2 billion widening of the current account deficit in the

third quarter mostly reflected an increased deficit on goods that was partly

offset by an expanded surplus on primary income.

Exports of

goods rose $68.4 billion to $357.1 billion, while imports of goods increased

$94.4 billion to $602.7 billion. The gains in both exports and imports

reflected increases in all major categories, led by automotive vehicles, parts,

and engines, mainly parts and engines and passenger cars.

Exports of

services went up $2.8 billion to $164.8 billion, while imports of services rose

$6.5 billion to $107.7 billion.

Receipts of

primary income grew $26.8 billion to $238.7 billion, and payments of primary

income increased $11.9 billion to $190.6 billion. The advances in both receipts

and payments mainly reflected gains in direct investment income, primarily

earnings.

Elsewhere, receipts

of secondary income increased $1.4 billion to $35.3 billion, reflecting an

increase in private transfers, that was partly offset by a fall in general

government transfers. Meanwhile, payments of secondary income rose $3.7 billion

to $73.5 billion, reflecting increases in private transfers and in general

government transfers.

FXStreet notes that regardless of the eventual consequences of the U.S. Treasury’s decision to label Switzerland and Vietnam currency manipulators, strategists at Capital Economics think that there are good reasons why the US dollar will weaken against both the franc and the dong along with most other currencies over the next two years.

“The decision to label Switzerland and Vietnam currency manipulators is probably dollar negative. The SNB may become slightly less active in the FX market. And Vietnam’s authorities will probably allow the dong to appreciate a bit against the dollar to avoid further troubles. Regardless of what the Biden administration will actually do, though, we think that there are plenty of other reasons why the franc, the dong and most other DM and EM currencies will strengthen against the US dollar over the next two years or so.”

“The global economy is at the beginning of a recovery cycle, which has tended to favour risky assets and led the dollar to weaken across the board. ”

“Changes in yield differentials may also weigh on the dollar at the margin. We think that monetary policy in the US will remain accommodative for a long time, effectively anchoring US nominal yields at around their current levels. Meanwhile, we think that monetary policy will start to be tightened in some emerging economies, most notably in China.”

Statistics

Canada announced on Friday that the Canadian retail sales rose 0.4 percent

m-o-m to CAD54.59 billion in October, following an unrevised 1.1 percent m-o-m

gain in September.

Economists had

forecast a 0.2 percent m-o-m increase for October.

According to

the report, sales increased in 6 of 11 subsectors in October, accounting for 50.9

percent of total retail sales. The motor vehicle and parts dealers subsector

contributed the most to the sales advance in October, climbing 1.5 percent

m-o-m. Excluding motor vehicle and parts dealers, retail sales were flat m-o-m

in October compared to an unrevised 1.0 percent m-o-m advance in September and

economists’ forecast for a 0.2 percent m-o-m rise.

Meanwhile, core

retail sales, which excludes gasoline stations and motor vehicle and parts

dealers, rose 0.3 percent m-o-m in October after climbing 2.1 percent m-o-m in September,

bolstered by higher sales at sporting goods, hobby, book and music stores

(+11.8 percent m-o-m), furniture and home furnishings stores (+6.6 percent

m-o-m), as well as building material and garden equipment and supplies dealers

(+2.9 percent m-o-m).

In y-o-y terms,

Canadian retail sales climbed 7.5 percent in October, following a revised 5.6

percent increase in September (originally a 4.6 percent surge).

- UK must deal with Brexit, whether deal or no-deal

- Negative rates could help UK complete recovery

- Risk that negative rates are counterproductive is low

- Mix of quantitative easing and rate would be best if markets are stable

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:00 | Eurozone | Current account, unadjusted, bln | October | 33.5 | 34.1 | |

| 09:00 | Germany | IFO - Expectations | December | 91.5 | 92.8 | |

| 09:00 | Germany | IFO - Current Assessment | December | 90.0 | 91.3 | |

| 09:00 | Germany | IFO - Business Climate | December | 90.7 | 92.1 | |

| 11:00 | United Kingdom | CBI industrial order books balance | December | -40 | -34 | -25 |

GBP fell against its major rivals in the European session on Friday, as concerns over the outcome of the trade talks between the EU and the UK reemerged after pessimistic remarks from both sides' leaders.

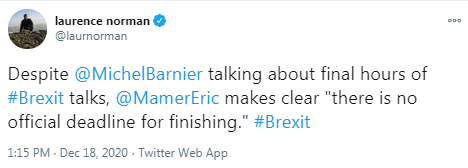

EU's chief Brexit negotiator Michel Barnier warned there are "just a few hours left" for the two sides to agree on a post-Brexit trade deal. He also said that the obstacles for a deal remain large, but it is still possible.

Meanwhile, the European Commission's (EC) spokesperson acknowledged that many issues regarding fisheries remain difficult to solve and said it is still unknown if and when the sides will reach an agreement.

British Prime Minister (PM) Boris Johnson stated that the UK's position is "to keep talking if there is any chance of a deal", but added that "things are looking difficult" and "there is a gap that needs to be bridged". He also noted that the EU's negotiators must “bring something to the table” in talks or the UK will leave the transition period on WTO terms.

The latest comments of the EU and the UK's leaders raised a little bit of doubt about whether the sides would be able to strike a trade deal before the UK's post-Brexit transition period ends on December 31.

FXStreet reports that USD/JPY is a touch higher amid a broadly-stronger USD after the Bank of Japan policy meeting came and went overnight without much fanfare. However, economists at TD Securities expect the yen to remain on a solid foot and forecast the USD/JPY below the 100 level.

“The BoJ kept policy unchanged but extended some virus support programs. The BoJ also unexpectedly launched a broad policy review – although YCC is likely to remain in place and negative rates also do not appear to be on the table either. This should keep the JPY on a firm footing.”

“.. The lack of any real pushback is a green light for the further steady grind lower in the pair that we expect over the next year. We see USD/JPY below, finishing 2021 at 99.”

“USD/JPY has bounced after sliding to a fresh post-pandemic low just under 103 on Thursday. We are inclined to fade this move, however, and think the yen should stay firm even if our expectation that the USD may bounce proves correct. We think 102.35 is likely to be the next port of call to any further move lower.”

FXStreet reports that the S&P 500 Index has pushed to a new record high closing at 3722. With momentum not confirming the new highs and with the market seen in a “euphoric” state, analysts at Credit Suisse look for the 3720/25 area to cap at first. Indeed, the contributors have growing concerns the market may be close to seeing a more concerted pullback/correction.

“The S&P 500 has pushed to a new record high to our 3720/25 next objective, which is capping for now as expected. With the market seen in a ‘euphoric’ state (90% S&P 500 stocks are above their 200-day average) and with daily MACD momentum also turning lower and daily RSI momentum not confirming the new highs, the market is seen in an increasingly vulnerable state, with the threat of a correction lower seen growing steadily.”

“Support at 3691/86 holding can keep the immediate risk higher for now and post some near-term consolidation above 3725 can see strength extend to a cluster of what we expect to be tougher resistances in the 3765/85 zone, from which we will then look for a more concerted effort to see a correction.”

- We must be able to control our laws and waters

- Our door is open

- Things are looking difficult, there is gap that needs to be bridged

- EU must come to table with something, if they don't, we will trade on WTO terms

- WTO terms may be difficult at first but we will prosper

FXStreet notes that USD/CAD is losing short-term momentum around the May low and psychological support at 1.2730/00. According to analysts at Credit Suisse, support is seen at 1.2689/88, then more importantly at 1.2620.

“USD/CAD remains in its near-term range and is still struggling to pick up short-term momentum, with the daily RSI actually turning up from oversold territory. Hence, we think that there is potential for an extension of the rangebound environment in the near-term.”

“Post this consolidation though, we remain biased lower over the medium-term, as a large ‘head and shoulders’ top still in place. With this in mind, initial support is at 1.2718/13, then back at 1.2689/88, removal of which would see a resumption of the core bear trend. Next key support is seen thereafter at the 78.6% retracement of the 2017/2020 surge at 1.2620, where we would expect to see fresh buyers at first.”

- Many issues regarding fisheries remain difficult to solve

- We continue to do our best to reach a deal with UK

The latest

survey by the Confederation of British Industry (CBI) revealed on Friday the UK

manufacturers' order books improved to their strongest in ten months in

December but remained far below their long-run average.

According to

the report, the CBI's monthly factory order book balance increased to -25 in December

from -40 in the previous month, but remained well below the long-run average of

-14. This was the highest reading since February. Economists had forecast the

reading to come in at -34. Export order books (-44) also rose from November

(-51), but the improvement was much less marked, leaving them far below their

long-run average (-18).

The CBI also

reported that output volumes in the three months to December (-6) dropped at a similarly slow pace to November (-6). It was also expected that output

would fall at a modest pace in the next three months (-6). In addition,

manufacturers forecast output prices to see a very muted pricing pressure in

the next three months (0 from -8 in November).

“In a positive

sign for the pipeline of manufacturing activity, total order books in December

improved to their strongest since February. By contrast, despite a mild

improvement, export order books remained poor”, noted Anna Leach, CBI Deputy

Chief Economist. “The rollout of the Covid vaccine brings hope that conditions

for manufacturers will improve in the coming months. The government must

continue to do what it can to support companies through the winter while demand

remains disrupted by Covid restrictions.”

Meanwhile, Tom

Crotty, Group Director at INEOS and Chair of the CBI Manufacturing Council,

said: “2020 has been an incredibly difficult year for manufacturers, as firms

have had to deal with the dual impact of a global pandemic and continued Brexit

uncertainty. While the roll-out of the COVID-19 vaccine raises hopes for the

future, government will still need to support manufacturers to get through the

winter. One of the key ways the government can help manufacturers is to strike

a Brexit deal, as manufacturing is one of the sectors that would be hardest hit

by a no deal Brexit.”

Reuters reports that Ifo economist Klaus Wohlrabe said that the German economy will shrink by 0.4% in the last three months of 2020 before growing again early next year, as a lockdown to curb coronavirus infections has slowed recovery.

Wohlrabe said he expected the economy to grow by 0.6% in the first quarter, adding that industrial orders were looking good, driven by domestic customers.

FXStreet reports that analysts at Credit Suisse maintain a EUR/USD core bullish outlook.

“Assuming the EUR/USD pair sees a weekly close above r 1.2145/55, which we see no reason not to, we maintain our core bullish outlook and look for the rally to extend.”

“We look for a move to 1.2292/99 next, ahead of the March ‘measured base objective’ at 1.2355, from which we look or an initial pullback.”

“Big picture, we continue to look for an eventual move to the 1.2414 April 2018 high next and then our core objective from late July at 1.2518/98 – the 2018 high, 38. 2% retracement of the entire 2008/2016 bear market and 61.8% retracement of the fall from 2014 – which we expect to prove a much tougher barrier.”

CNBC reports that EU Chief Negotiator Michel Barnier warned that the U.K. and the EU are running out of time to agree terms on a post-Brexit trading arrangement.

Both sides have offered conflicting messages in recent days over the likelihood of a trade deal being agreed before Britain departs the EU’s orbit in two weeks’ time.

Barnier said negotiations had reached “the moment of truth.”

“We have little time remaining, just a few hours, to work through these negotiations in a useful fashion if we want the agreement to enter into force on the 1st January,” Barner said.

“There is a chance of getting an agreement but the path to such an agreement is very narrow.”

FXStreet reports that analysts at MUFG Bank said that central banks are set to keep stimulus, backed by governments too. Therefore, the US dollar is expected to remain on a downward trajectory.

“The BoE as expected left its policy stance unchanged after increasing QE by GBP150 B in November. It did extend the Funding for Lending Scheme for SMEs and importantly emphasised the flexibility of the QE program.”

“The SNB unsurprisingly, countered strongly in communications after its meeting arguing that the US Treasury currency report does not adequately account for Switzerland’s particular situation. We concur with that and it is hard to layout credible grounds to show SNB action is grounded in gaining a competitive advantage through currency manipulation. The SNB message was clear – there will be no change in the monetary policy strategy.”

“The BoJ announced an extension to its COVID-19 loan programmes by a further six months to September 2021 while also adjusting the terms in order to make them more flexible. Perhaps more importantly though, the BoJ announced a full review of its monetary policy.”

“The announcements this week certainly reinforce the prospects of loose monetary conditions and favourable risk asset performance, which led by the Fed will keep the US dollar on a weakening path.”

According to the report from European Central Bank, the current account of the euro area recorded a surplus of €27 billion in October 2020, increasing by €2 billion from the previous month. Surpluses were recorded for goods (€35 billion) and services (€9 billion). Deficits were recorded for secondary income (€12 billion) and primary income (€5 billion).

In the 12 months to October 2020, the current account recorded a surplus of €228 billion (2.0% of euro area GDP), compared with a surplus of €272 billion (2.3% of euro area GDP) in the 12 months to October 2019. This decline was driven by reductions in the surpluses for services (down from €69 billion to €27 billion) and for primary income (down from €55 billion to €16 billion). These developments were partly offset by a larger surplus for goods (up from €311 billion to €331 billion) and a smaller deficit for secondary income (down from €163 billion to €146 billion).

In financial account, euro area residents’ net acquisitions of foreign portfolio investment securities totalled €473 billion and non-residents’ net acquisitions of euro area portfolio investment securities totalled €344 billion in 12 months to October 2020

Reuters reports that a Ifo institute survey showed that German business morale rose unexpectedly in December even as Europe's biggest economy went into a strict lockdown to contain a second wave of coronavirus infections.

Business climate index rose to 92.1 from an upwardly revised reading of 90.9 in November. Economists had expected a decrease to 90.0. Current Economic Assessment arrived at 91.3 points in the reported month as compared to last month's 90.0 and 89.0 anticipated. Expectations Index rose to 92.8 for December from the previous month’s 91.5 reading and worse than the market expectations of 92.5.

"Companies were satisfied with their business situation," Ifo President Clemens Fuest said. "They are looking at the first half of the year with less scepticism. But the lockdown is hitting some branches hard. The German economy is on the whole showing its resilience."

CNBC reports that according to former Trump trade negotiator Clete Willems, U.S. President-elect Joe Biden’s pick for his incoming administration’s top trade official will likely carry on a tough line against China.

Biden last week named Katherine Tai, a trade lawyer, as his choice for the U.S. trade representative.

“Katherine Tai is an excellent choice for USTR and the right person for the moment,” Willems told CNBC.

Tai played a key role as chief trade counsel on the House Ways and Means Committee in pushing for stronger labor and environmental provisions in the U.S.-Mexico-Canada Agreement (USMCA).

Despite her affiliation with the Democrats, Tai is receiving “strong bipartisan support,” said Willems. He pointed out that Republican Sen. Rob Portman had endorsed Tai’s nomination.

Reuters reports that Britain and European Union negotiators will resume trade talks on Friday with both sides warning that they remained far apart on a number of issues.

"It is a very serious situation. We will test every route to seeking a free trade agreement with the European Union, but we cannot do so at the expense of our national sovereignty," Britain's schools minister Nick Gibb told Sky News.

He was echoing a similar message from Britain's chief negotiator David Frost and Prime Minister Boris Johnson who spoke to European Commission President Ursula von der Leyen late on Thursday to take stock of the situation.

Johnson's office said time was running out and the EU had to change its position substantially.

Senior British minister Michael Gove on Thursday put the chances of getting a deal at less than 50%.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:00 | New Zealand | ANZ Business Confidence | December | -6.9 | 9.4 | |

| 03:00 | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | -0.1% | |

| 07:00 | Germany | Producer Price Index (YoY) | November | -0.7% | -0.6% | -0.5% |

| 07:00 | Germany | Producer Price Index (MoM) | November | 0.1% | 0.1% | 0.2% |

| 07:00 | United Kingdom | Retail Sales (YoY) | November | 5.8% | 2.8% | 2.4% |

| 07:00 | United Kingdom | Retail Sales (MoM) | November | 1.3% | -4.2% | -3.8% |

During today's Asian trading, the US dollar rose against major world currencies after a sharp drop in the previous session. The Federal Reserve's announcement of its intention to continue buying $120 billion worth of assets a month until significant progress is made in achieving the goals of maximum employment and price stability has given traders the green light to sell dollars.

The dollar index rose to its highest level in more than three years earlier this year amid an influx of investor funds into the most reliable assets at the peak of the Covid-19 pandemic. Since March, however, the index value has fallen by 13%.

The yen is getting cheaper. Following the results of the meeting on Friday, the Japanese Central Bank decided to extend the term of the emergency lending program for companies affected by the COVID-19 pandemic for six months - until September 2021. He kept the short-term interest rate on deposits of commercial banks in the Central Bank at -0.1% per annum, the target yield of ten-year government bonds of Japan - about zero.

The ICE index, which tracks the dollar's performance against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), rose 0.13%. On the eve of the index value fell below 90 points for the first time since April 2018. Since the beginning of 2020, the ICE index has fallen by 6.8%.

FXStreet reports that economists at ANZ Bank expect to New Zealand dollar to remain well-supported over the Christmas period.

“While we are cautious not to extrapolate the trend (that pace of growth simply isn’t sustainable) that’s a story for later, and for now the market has chalked up the data as yet another positive rebound indicator amid rising commodity prices, broad USD weakness, improving risk appetite and best-in-class fiscal flexibility.

“We have seen some profit-taking in the last hours as bond yields have spiked higher, weighing on equities, but if we get a US fiscal deal and a Brexit deal before Christmas, there will be nothing stopping Kiwi. Typically, positive seasonality also supports the NZD over the holidays.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.2337 (1342)

$1.2314 (1380)

$1.2303 (1643)

Price at time of writing this review: $1.2250

Support levels (open interest**, contracts):

$1.2187 (2032)

$1.2156 (1484)

$1.2120 (2135)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 8 is 72014 contracts (according to data from December, 17) with the maximum number of contracts with strike price $1,1800 (4680);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3673 (226)

$1.3655 (303)

$1.3629 (1530)

Price at time of writing this review: $1.3544

Support levels (open interest**, contracts):

$1.3473 (285)

$1.3422 (646)

$1.3361 (523)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 58857 contracts, with the maximum number of contracts with strike price $1,4000 (33141);

- Overall open interest on the PUT options with the expiration date January, 8 is 28543 contracts, with the maximum number of contracts with strike price $1,2800 (4020);

- The ratio of PUT/CALL was 0.48 versus 0.48 from the previous trading day according to data from December, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

According to the report from the Federal Statistical Office (Destatis), compared with the preceding month October the overall index increased by 0.2% in November 2020 (+0.1% in October). Economists had expected a 0.1% increase. in November 2020, the index of producer prices for industrial products decreased by 0.5% compared with the corresponding month of the preceding year. In October the annual rate of change all over had been –0.7%.

Energy prices as a whole decreased by 2.7% compared to November 2019 but increased by 0.4% compared to October 2020. On an annual basis, prices of petroleum products were down 16.7%, prices of natural gas (distribution) decreased by 5.2%. Electricity prices increased by 1.6%.

The overall index disregarding energy was 0.3% up on November 2019.

Prices of intermediate goods increased by 0.2% compared to November 2019. Prices of non-durable consumer goods decreased by 0.7% compared to November 2019. Food prices decreased by 1.6%. Pork prices were down 21.5%. Prices of capital goods increased by 0.8% compared to November 2019, durable consumer goods by 1.5%.

According to the report from Office for National Statistics, in November 2020, retail sales volumes decreased by 3.8% when compared with October as many stores ceased trading following government guidance during the coronavirus (COVID-19) pandemic.

Economists had expected a 4.2% decrease. Despite the monthly fall, overall sales remain above their pre-pandemic levels.

In November 2020, clothing store sales saw a sharp fall in sale volumes when compared with the previous month, at negative 19.0%, as did fuel sales, which decreased by 16.6%.

In November 2020, food stores at 3.1% and household goods stores at 1.6% were the only sectors to show growth in monthly volume of sales.

The year-on-year growth rate in the volume of retail sales increased by 2.4%, with feedback from businesses suggesting that consumers had brought forward Christmas spending.

Online retailing accounted for 31.4% of total retailing compared with 28.6% in October 2020, with an overall growth of 74.7% in the value of sales when compared with November 2019.

RTTNews reports that the Bank of Japan said it is set to assess the sustainability of monetary easing policy.

As economic activity and prices have remained under prolonged downward pressure, there is a need to support the economy and thereby achieve the price stability target of 2 percent, the bank said.

The bank viewed that there is no need to change the framework of "QQE with Yield Curve Control". The bank is set to announce its findings at the March 2021 meeting.

The announcement came after the official data showed that core consumer prices fell 0.9 percent in November, which was the fastest in more than a decade.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 (GMT) | New Zealand | ANZ Business Confidence | December | -6.9 | |

| 03:00 (GMT) | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | |

| 07:00 (GMT) | Germany | Producer Price Index (YoY) | November | -0.7% | -0.6% |

| 07:00 (GMT) | Germany | Producer Price Index (MoM) | November | 0.1% | 0.1% |

| 07:00 (GMT) | United Kingdom | Retail Sales (YoY) | November | 5.8% | 2.8% |

| 07:00 (GMT) | United Kingdom | Retail Sales (MoM) | November | 1.2% | -4.2% |

| 09:00 (GMT) | Eurozone | Current account, unadjusted, bln | October | 33.5 | |

| 09:00 (GMT) | Germany | IFO - Expectations | December | 91.5 | |

| 09:00 (GMT) | Germany | IFO - Current Assessment | December | 90.0 | |

| 09:00 (GMT) | Germany | IFO - Business Climate | December | 90.7 | |

| 11:00 (GMT) | United Kingdom | CBI industrial order books balance | December | -40 | -34 |

| 13:30 (GMT) | Canada | Retail Sales YoY | October | 4.6% | |

| 13:30 (GMT) | Canada | Retail Sales, m/m | October | 1.1% | 0.2% |

| 13:30 (GMT) | Canada | New Housing Price Index, YoY | November | 3.9% | |

| 13:30 (GMT) | Canada | New Housing Price Index, MoM | November | 0.8% | |

| 13:30 (GMT) | U.S. | Current account, bln | Quarter III | -170.5 | -189 |

| 13:30 (GMT) | Canada | Retail Sales ex Autos, m/m | October | 1% | 0.2% |

| 14:00 (GMT) | Belgium | Business Climate | December | -12.1 | -13.4 |

| 15:00 (GMT) | U.S. | Leading Indicators | November | 0.7% | 0.5% |

| 16:00 (GMT) | U.S. | FOMC Member Charles Evans Speaks | |||

| 16:10 (GMT) | U.S. | FOMC Member Brainard Speaks | |||

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | December | 258 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.76266 | 0.7 |

| EURJPY | 126.468 | 0.25 |

| EURUSD | 1.22702 | 0.61 |

| GBPJPY | 139.963 | 0.21 |

| GBPUSD | 1.35794 | 0.59 |

| NZDUSD | 0.71506 | 0.56 |

| USDCAD | 1.27218 | -0.1 |

| USDCHF | 0.88387 | -0.1 |

| USDJPY | 103.064 | -0.35 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.