- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 23-12-2020.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 (GMT) | Japan | BOJ Governor Haruhiko Kuroda Speaks | |||

| 13:30 (GMT) | Canada | Building Permits (MoM) | November | -14.6% | 3% |

| 23:30 (GMT) | Japan | Tokyo CPI ex Fresh Food, y/y | December | -0.7% | -0.8% |

| 23:30 (GMT) | Japan | Tokyo Consumer Price Index, y/y | December | -0.7% | |

| 23:30 (GMT) | Japan | Unemployment Rate | November | 3.1% | 3.1% |

| 23:50 (GMT) | Japan | Retail sales, y/y | November | 6.4% | 1.7% |

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories

dropped by 0.562 million barrels in the week ended December 18. Economists had

forecast a decline of 3.186 million barrels.

At the same

time, gasoline stocks fell by 1.125 million barrels, while analysts had

expected a gain of 1.210 million barrels. Distillate stocks plunged by 2.325

million barrels, while analysts had forecast a decrease of 0.904 million

barrels.

Meanwhile, oil

production in the U.S. remained unchanged at 11.000 million barrels a day.

U.S. crude oil

imports averaged 5.6 million barrels per day last week, up by 140,000 barrels

per day from the previous week.

The U.S.

Commerce Department announced on Wednesday that the sales of new single-family

homes plunged 11.0 percent m-o-m to a seasonally adjusted annual rate of 841,000

units in November. That was the lowest reading since June.

Economists had

forecast the sales pace of 995,000 last month.

October’s sales

pace was revised down to 945,000 units from the originally reported 999,000 units.

According to

the report, new home sales in the South, the largest area, declined 2.0 percent

m-o-m in November. Meanwhile, sales in the Midwest tumbled 43.3 percent m-o-m, sales

in the West slumped 17.3 percent m-o-m and sales in the Northeast decreased 2.5

percent m-o-m.

The final reading for the December Reuters/Michigan index of consumer sentiment came in at 80.7 compared to a preliminary reading of 81.4 and the November final reading of 76.9.

Economists had forecast the index to be revised slightly downward to 81.3.

According to

the report, the index of consumer expectations surged 5.8 percent m-o-m to 74.6

from November’s final reading of 70.5, while the index of the current economic

conditions rose 3.4 percent m-o-m to 90.0 from November’s final reading of 87.0.

The Sentiment

Index slipped in late December, although it remained higher than last month

despite the ongoing surge in covid infections and deaths”, noted Richard

Curtin, the Surveys of Consumers chief economist.

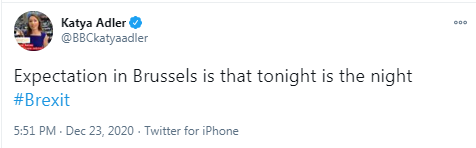

- Trade deal between UK and EU is imminent

- EU member states will have to approve provisional application of the deal with effect from January 1 because there is not enough time for it to be ratified by European Parliament

The U.S.

Commerce Department reported on Wednesday that the durable goods orders increased

0.9 percent m-o-m in November, following a revised 1.8 percent m-o-m jump in October

(originally a 1.3 percent m-o-m climb).

Economists had

forecast a 0.6 percent m-o-m gain.

According to

the report, orders for durable goods excluding transportation increased 0.4

percent m-o-m in November, following a revised 1.9 percent m-o-m advance in October

(originally a gain of 1.3 percent m-o-m), slightly missing economists’ forecast

of 0.5 percent m-o-m rise.

Meanwhile,

orders for non-defense capital goods excluding aircraft, a closely watched

proxy for business spending plans, increased 0.4 percent m-o-m in November after

a revised 1.6 percent climb m-o-m in October (originally a 0.8 percent m-o-m

gain). Economists had called for a 0.7 percent m-o-m advance in core capital

goods orders in November.

Shipments of these core capital goods rose 0.4 percent m-o-m in November after a revised 2.6 percent m-o-m jump in the prior month (originally a 2.4 percent m-o-m surge).

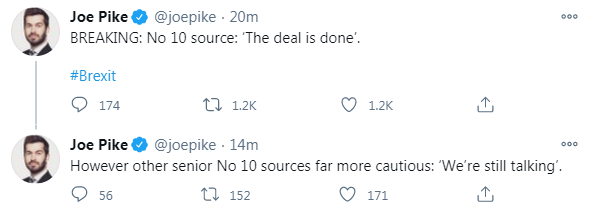

- Europea Commission told member stated to be ready for meeting on Thursday morning in case deal is finalized on Wednesday

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment unexpectedly fell last week.

According to the report, the initial claims for unemployment benefits decreased by 89,000 to 803,000 for the week ended December 19. Economists had expected 885,000 new claims last week.

Claims for the

prior week were revised upwardly to 892,000 from the initial estimate of 885,000.

Meanwhile, the

four-week moving average of claims rose to 818,250 from an upwardly revised 814,250

in the previous week.

Continuing

claims dropped to 5,337,000 million from a downwardly revised 5,507,000 in the

previous week.

Statistics

Canada announced on Wednesday that the country’s gross domestic product (GDP)

grew 0.4 percent m-o-m in October, following an unrevised 0.8 percent m-o-m

advance in September.

This was above

economists’ forecast for a 0.3 percent m-o-m advance and marked the sixth

consecutive monthly gain. However, overall economic activity was still about 4

percent below February's pre-pandemic level.

In y-o-y terms,

the Canadian GDP fell 3.5 percent in October.

According to the

report, both goods-producing (+0.1 percent m-o-m) and services-producing (+0.5

percent m-o-m) industries were up as 16 of 20 industrial sectors posted

advances in October.

The Commerce

Department reported on Wednesday that consumer spending in the U.S. fell 0.4

percent m-o-m in November after a revised 0.3 percent m-o-m increase in October

(originally a 0.5 percent m-o-m gain). This was the first monthly fall since April.

Economists had forecast the reading to show a 0.2 percent m-o-m drop.

Meanwhile,

consumer income decreased 1.1 percent m-o-m in November, following a revised 0.6

percent m-o-m decline in the previous month (originally a 0.7 percent m-o-m fall).

Economists had forecast a 0.3 percent m-o-m drop.

The November drop

in personal income reflected primarily reflected declined in proprietors’

income (both nonfarm and farm) and government social benefits that were partly

offset by a gain in compensation.

The personal

consumption expenditures (PCE) price index, excluding the volatile categories

of food and energy, which is the Fed's preferred inflation measure, was

unchanged m-o-m in November, following a revised 0.2 percent m-o-m increase in

the prior month (originally flat m-o-m). Economists had projected the index

would edge up 0.1 percent m-o-m.

In the 12

months through November, the core PCE increased 1.4 percent, the same pace as

in the 12 months through October. Economists had forecast an

advance of 1.5 percent y-o-y.

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. increased 0.8 percent in the week ended December 18, following a 1.1

percent advance in the previous week.

According to

the report, refinance applications surged 3.8 percent, while applications to

purchase a home fell 4.6 percent.

Meanwhile, the

average fixed 30-year mortgage rate edged up 2.86 to from record low of 2.85

percent.

“Last week’s

increase in refinance applications was driven by FHA and VA activity, while

conventional refinances saw a slight decline,” said Joel Kan, MBA’s associate

vice president of economic and industry forecasting. “There are still signs of

relative strength in the housing market as 2020 ends. However, housing

affordability will be worth monitoring next year,” he added.

GBP rose against most of its major counterparts in the European session on Wednesday, supported by the announcement that France reopened its borders with the UK, which were closed on Sunday following news of an outbreak in southeast England of a new COVID-19 variant.

On Tuesday night, France and Britain reached a deal to restore rail, air and sea routes between the two countries on Wednesday morning. Under the agreement, truck drivers could travel to France if they were administered a rapid coronavirus test. Admittance to France will also be granted to those traveling for urgent reasons, EU citizens, and the UK's citizens with EU residency, who have gotten a negative coronavirus test result less than 72 hours before departure. The deal is to be reviewed on December 31.

In addition, investors continued to hope that the UK and the EU would be able to strike a deal before the end of the Brexit transition period on December 31, despite dismal comments on the talks from both sides. British Housing Secretary Robert Jenrick told Sky News earlier today that there remained "the same serious areas of disagreement whether that’s on fisheries or the level playing field". "At the moment there isn’t sufficient progress", he added. "It isn’t a deal that the prime minister feels he can sign us up to.” Ireland's Prime Minister Micheál Martin also acknowledged that the gap in the EU-UK trade talks was still wide on fisheries. But added that there should be a deal on balance.

FXStreet reports that the Credit Suisse analyst team note that the AUD/USD pair remains in its high-level range above key supports at 0.7532/00 for now but the risk of a corrective setback is growing.

"AUD/USD maintains its sharp rejection from key resistance and our first core upside objective at the 38.2% retracement of the entire 2011/2020 fall at 0.7625/40. This rejection reinforced the potential for a phase of consolidation to help the market to unwind its previously overbought condition and importantly, the risk of a deeper correction setback is also growing.”

“Support stays at the 13-day exponential average and psychological barrier at 0.7532/00, which needs to hold on a closing basis to avoid such a setback. Assuming this is the case, the risk will stay seen higher post further sideways ranging and with a large ‘head and shoulders’ base still in place, a clear break of 0.7632/40 is looked for post this phase, with next initial resistance at 0.7673/77.”

FXStreet reports that analysts at Morgan Stanley suggest that two events could change the trajectory of fiscal policy in 2021 in the United States: the need to raise the debt ceiling and the coming expiry of key corporate tax breaks. These events could introduce volatility into markets generally, but for bond investors, they may be an opportunity.

“On the debt ceiling, the need to approve an increase in the US's self-imposed Treasury issuance cap has been a flashpoint for budget negotiations in the past, most notably in the summer of 2011, when it was used by members of Congress to demand future spending cuts. We're watching for something of a repeat of that phenomenon if Republicans maintain control of the Senate.”

“On corporate tax breaks, starting in 2022, the deductibility of interest becomes more constrained. Businesses will also have to deduct research and development in software costs over five years. In 2023, upfront deductibility of capital investment begins to phase out. Together, these policies would meaningfully increase corporate taxes. Unless a compromise is struck to extend these breaks, the result will be a modest fiscal contraction, which again, depending on the economic context, could put downward pressure on bond yields.”

“Since we expect much of 2021 will be about a continued strong economic recovery as the US emerges from the COVID-19 recession, we also expect a material increase in bond yields and falling bond prices along the way. If that ends up being correct, then this late-year concern on the US fiscal outlook could be an opportunity for a good entry point and stable returns.”

FXStreet reports that economists at HSBC remain constructive on US equities as cyclical parts of the market can potentially benefit from the second pandemic relief package worth USD900 B. Overall, an overweight position in global equities makes sense.

“This new fiscal package comes at a crucial time, given US economic growth has started to slow more notably as the effect of previous fiscal stimulus efforts wane and a significant resurgence of virus cases has prompted renewed lockdown restrictions in some areas of the US. This is reflected in labour market data with new claims for unemployment assistance increasing in recent weeks. In this context, the package provides an important bridge of support for US households and businesses before the wider rollout of vaccines can help bring the pandemic under control.“

“We remain constructive on US equities. Significant tech and quality exposure remains a positive, while cyclical parts of the market can potentially benefit from these fresh measures – the US economy likely to maintain a relative growth advantage.”

“This package significantly reduces the risk of fiscal policy under-delivery in the near-term”

“We maintain our view that an overweight position in global equities makes sense, although we need to be realistic about what medium-term investment returns can be achieved following this year’s strong performance.”

FXStreet notes that GBP/USD is advancing this morning as some speculate a Brexit deal could be reached as soon as tonight. France agreed to open its border with Britain to trucks and EU passengers, conditioned on a rapid coronavirus test, but disruptions are set to continue, leaving the pound vulnerable, per MUFG Bank.

“An agreement has been reached to test truck drivers at the UK border before being allowed to travel into France with the UK government bringing in the army to speed up the process of testing. Basically, considerable disruption and severe frictions in trade are set to continue despite this deal. The fact that the UK government is bringing the army in to speed up the process is itself indicative of the disruptions that are set to continue over the coming weeks as the backlog is slowly cleared.”

“With many issues now resolved according to reports from Brussels, the haggling over fishing appears to be what still needs to be agreed. If those reports are correct, then surely at this stage, a positive Brexit outcome is most likely.”

“The percentage of fish the EU will have to sacrifice and the transition period to that new number will now need to be sorted at the highest level. We assume any deal announced later will include some grace period on customs checks going live on the EU side.”

“We still would expect to see GBP/USD drop to the mid-1.2000’s on a no-deal, and quite quickly if no contingency plan was agreed between the EU and the UK.”

- If there is a breakthrough tonight or tomorrow, EU officials would work on text on Christmas day

- On balance, there should be a Brexit deal

- No-deal would be an appalling shock to the economic system

RTTNews reports that final data from the statistical office INE showed that Spain's economy rebounded from the recession in the third quarter but the pace of growth was slightly slower than the initial estimate.

Gross domestic product surged 16.4 percent sequentially, in contrast to a 17.9 percent fall in the second quarter and the 5.3 percent drop in the first quarter. The growth rate for the third quarter was revised down from 16.7 percent.

Year-on-year, GDP fell 9.0 percent after shrinking 21.5 percent in the preceding period. The initial estimate was -8.7 percent.

FXStreet reports that economists at HSBC continue to see the GBP underperforming its G10 peers.

“The emergence of a new, potentially more virulent form of COVID-19 in the UK has had a number of important consequences. Domestically, greater restrictions have already been imposed on much of the country and could potentially last longer than previously envisaged.”

“While political fudges such as a provisional deal with ex-post ratification are possible, market participants will no doubt be acutely aware of the risk of heading to a ‘no-deal’ scenario by accident. In such a ‘no-deal’ world, we would expect GBP/USD to be significantly lower, but the broad scale of USD’s recent weakness may limit some of that”

“We continue to expect the GBP to underperform in a G10 context, and think the GBP will barely make gains even against a broadly soft USD in the months ahead, against the backdrop of an improving global economy.”

FXStreet reports that Credit Suisse discusses EUR/GBP outlook.

“EUR/GBP remains capped at the recent high at 0.9230 and the subsequent setback from here maintains a broader choppy range. Immediate support stays seen at the lower end of the price gap from the beginning of the week and price support at 0.9071/61.”

“Below 0.9071/61 is needed to clear the way for a retest of the recent lows and 200-day average at 0.8988/82, but with a break below here needed to rekindle thoughts we are seeing the formation of the ‘right shoulder’ to a larger top and a test of medium-term support at 0.8871/61.”

eFXdata reports that ANZ Research discusses GBP outlook.

"Despite the UK’s uncertain post-EU future, sterling is trading firmly against the dollar and holding its own on the crosses. By any measure of valuation, the pound is cheap (long run post-EMU average is 1.58 vs USD). But the transition the economy faces, amid tighter fiscal constraints, suggests sustained currency undervaluation would be optimal, from a policy perspective. Domestic inflation pressures are muted, the balance of payments deficit will widen again as the economy recovers and the BoE is examining the feasibility of negative interest rates", ANZ adds.

According to the report from Insee, the industrial producer prices rose by 1.2% in November 2020, after –0.1% in the previous month. The prices for the home market ramped up (+1.7% after a stability) while those for the foreign markets increased very slightly (+0.2% after –0.4%). Year on year, the industrial producer prices decreased by 1.9% in November 2020 (after –2.0% in the previous month).

The industrial producer prices for the home market rose by 1.7% in November 2020 (after a stability), driven up by the prices of mining and quarrying products, energy and water. However, those of manufactured products stabilized (after +0.2%). Year on year, the industrial producer prices for the home market declined by 1.8% in November 2020 (after –2.1% in the previous month).

In November 2020, the prices of mining and quarrying products, energy and water rebounded strongly (+6.7% after –0.3%), owing to a seasonal rise in producer prices of electricity, gas, steam and air conditioning (+8.7% after a stability), especially those of electricity transmission and distribution services, due to the switch to the winter rate. Year on year, the prices of mining and quarrying products, energy and water fell however by 0.3% in November 2020 (after –0.7% in the previous month).

In the wake of crude oil prices, the prices of refined petroleum products grew by 2.8% in November 2020 over a month (after +0.1%). Over a year, they fell by 37.7% over a year (after –39.7%).

FXStreet reports that economists at MUFG Bank said that the dollar is on the back foot but could rebound as consumer confidence also receives a hit.

“The USD900 B fiscal stimulus package agreed on Monday has failed to reignite the optimism and is now under a cloud of fresh doubt after President Trump tweeted a video last night calling the package “a disgrace” with unnecessary spending included.

“Trump’s wish for larger stimulus for individuals may also be helping provide support for the markets although the Republicans in the Senate are very unlikely to agree to the increase Trump called for. So the market’s indifference could quickly begin to change and that would likely result in a correction lower in risk and some further rebound for the US dollar.”

“The stimulus legislation also incorporates government funding and hence if not signed by 28th December, a government shutdown would follow. This renewed uncertainty adds to near-term risks which will provide some added support for the dollar. Although we suspect the deal will be signed. It surely would not be good for the Republicans in the Senate run-off elections to scupper this deal now.”

Reuters reports that a British minister said that Britain and the European Union have still not clinched a Brexit trade deal as serious issues remain unresolved that prevent Prime Minister Boris Johnson signing up.

The trade negotiations have broken every deadline that has yet been set, though both sides say they must either reach a deal or part without one by the end of a transition period on Dec. 31.

The EU is making a "final push" to strike a trade deal with Britain, although there are still deep rifts over fishing rights, EU chief negotiator Michel Barnier said on Tuesday before meeting EU ambassadors in Brussels.

"I'm still reasonably optimistic but there's no news to report to you this morning," British Housing Secretary Robert Jenrick told Sky News amid speculation in London that a deal could be announced on Wednesday.

FXStreet reports that according to economists at Natixis, the world is on a deflationary path due to the sharp rise in private savings, which will be difficult to correct in the short-term.

“The fact there are structural excess savings over investment (ex-ante, before reaching the equilibrium that inevitably rebalances savings and investment at the global level), i.e. a deflationary trend, is revealed by the decline in inflation and the decline in real long-term interest rates. We also note that ex-post, the global savings rate has risen, which is a sign of an even larger increase ex-ante; and that the global private savings rate has risen considerably.”

“If the deflationary trend is not corrected, the world could slide into a real deflation. Getting off the deflationary path will require an increase in investment, which could result from an increase in efficient public investment (Energy transition, healthcare and medicines, education, digital economy, etc.) in OECD countries and in emerging countries with low investment rates (Africa, Latin America), international financing of additional investment, both public and private.”

Reuters reports that Andy Haldane, the Bank of England's chief economist, said that the Bank of England must have a "laser focus" on keeping inflation expectations in check once the COVID-19 crisis eases.

"The last thing the world needs right now is a nasty inflation surprise," Haldane said.

Haldane told that any overshoot could not become entrenched otherwise bond yields would rise, pushing up the cost of repayments on Britain's 2 trillion-pound debt mountain and jeopardising any recovery.

He also said he was much more confident about the economy in the second half of 2021 than in the first quarter of the year because of the prospects for rolling out COVID-19 vaccines.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | Private Sector Credit, m/m | November | 0.0% | 0.1% | |

| 00:30 | Australia | Private Sector Credit, y/y | November | 1.8% | 1.7% | |

| 05:00 | Japan | Leading Economic Index | October | 93.3 | 93.8 | 94.3 |

| 05:00 | Japan | Coincident Index | October | 84.8 | 89.7 | 89.4 |

During today's Asian trading, the US dollar declined against the euro and the yen after strengthening slightly earlier in the week. Another wave of growth in demand for safe haven assets, caused by reports of the emergence of a new type of coronavirus in the UK and several other European countries, supported the US currency.

The ICE index, which tracks the dollar's performance against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell 0.31%.

"The recent strengthening of the dollar is a technical lift caused by increased demand for reliable assets," analyst DailyFX.com Margaret Young said. The approval by the US Congress of a new stimulus package, however, provoked profit-taking by investors, which led to a weakening of the dollar, she says.

The upcoming adoption by the US authorities of the next package of measures to support the economy, as well as expectations of the imminent introduction of vaccines from COVID-19, support investors ' optimism about the prospects for the global economy, which will contribute to the weakening of the dollar.

As reported, US lawmakers this week agreed on a new program to support the economy, which provides, in particular, direct payments to citizens in the amount of $600. US President Donald Trump has demanded that Congress amend the bill to increase direct payments to Americans.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2272 (1289)

$1.2249 (960)

$1.2232 (1375)

Price at time of writing this review: $1.2192

Support levels (open interest**, contracts):

$1.2144 (3535)

$1.2122 (1446)

$1.2095 (2247)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 8 is 77164 contracts (according to data from December, 22) with the maximum number of contracts with strike price $1,2100 (4838);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3619 (1241)

$1.3567 (967)

$1.3524 (318)

Price at time of writing this review: $1.3430

Support levels (open interest**, contracts):

$1.3290 (644)

$1.3251 (525)

$1.3228 (864)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 58675 contracts, with the maximum number of contracts with strike price $1,4000 (33098);

- Overall open interest on the PUT options with the expiration date January, 8 is 28926 contracts, with the maximum number of contracts with strike price $1,2800 (2939);

- The ratio of PUT/CALL was 0.49 versus 0.51 from the previous trading day according to data from December, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Reuters reports that the Confederation of British Industry said that a fall in British business activity deepened after the country began to tighten coronavirus restrictions again last month.

The balance of firms reporting growth in the three months to December slipped to -21 from -16 a month earlier, although it remained a long way above a pandemic crisis low of -71 in June, the CBI's monthly growth indicator showed.

The survey was carried out before last weekend's introduction of new, tougher restrictions for London and surrounding areas as well as other regions in the United Kingdom.

British businesses are also facing uncertainty about the country's trading relationship with the European Union ahead of the Dec. 31 expiry of a post-Brexit transition period.

A measure of expectations for the next three months stood at -18, an improvement from November but still suggesting little recovery in early 2021.

Economists say that an extension of the latest coronavirus restrictions into January could push Britain's economy into a new recession, albeit a less severe one than in 2020.

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 3.8% in November 2020 compared with the corresponding month of the preceding year. In October 2020 and in September 2020 the annual rates of change were -3.9% and -4.3%, respectively. From October 2020 to November 2020 the index rose by 0.5%.

The index of import prices, excluding crude oil and mineral oil products, decreased in November 2020 by 1.3% compared with November 2019.

The index of export prices decreased by 0.6% in November 2020 compared with the corresponding month of the preceding year. In October 2020 and in September 2020 the annual rates of change were -1.0% and -1.1%, respectively. From October 2020 to November 2020 the index rose by 0.4%.

According to the report from the Society of Motor Manufacturers and Traders (SMMT), UK car production declined -1.4% in November to 106,243 units. Although a better year on year performance than many other months in a challenging 2020, the fall in output masks a particularly weak November 2019 when precautionary factory shutdowns in anticipation of a potential ‘no deal’ Brexit on 31 October depressed output.

November saw 1,501 fewer cars made than in the same month last year, as many of the factors present throughout much of 2020 conspired to dampen domestic orders, not least a second national lockdown in England and subsequent economic and political turbulence. Export volumes were flat, up just 0.3% and equivalent to a rise of 310 units, boosted by shipments to key markets in the EU, Asia and the US.

More than eight in 10 (85.3%) cars built in November were built for export, highlighting the critical importance of free and fair trade with global markets to UK car makers.

In the 11 months to November, total UK car production is now down -31.0% compared with the same period in 2019, representing a loss of 380,809 models at a cost of some £10.5 billion to the sector. This puts the industry on course to produce fewer than a million cars this year for only the second time since the early eighties and facing a tough future with potential further production losses amounting to £55.4 billion over the next five years if the sector is forced to trade on WTO conditions in a ‘no deal’ Brexit.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Private Sector Credit, m/m | November | 0.0% | |

| 00:30 (GMT) | Australia | Private Sector Credit, y/y | November | 1.8% | |

| 05:00 (GMT) | Japan | Leading Economic Index | October | 93.3 | 93.8 |

| 05:00 (GMT) | Japan | Coincident Index | October | 84.8 | 89.7 |

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | December | 5508 | 5558 |

| 13:30 (GMT) | Canada | GDP (m/m) | October | 0.8% | 0.3% |

| 13:30 (GMT) | U.S. | Personal spending | November | 0.5% | -0.2% |

| 13:30 (GMT) | U.S. | PCE price index ex food, energy, Y/Y | November | 1.4% | 1.5% |

| 13:30 (GMT) | U.S. | PCE price index ex food, energy, m/m | November | 0% | 0.1% |

| 13:30 (GMT) | U.S. | Personal Income, m/m | November | -0.7% | -0.3% |

| 13:30 (GMT) | U.S. | Durable Goods Orders | November | 1.3% | 0.6% |

| 13:30 (GMT) | U.S. | Durable Goods Orders ex Transportation | November | 1.3% | 0.5% |

| 13:30 (GMT) | U.S. | Durable goods orders ex defense | November | 0.2% | |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | December | 885 | 885 |

| 14:00 (GMT) | U.S. | Housing Price Index, y/y | October | 9.1% | |

| 14:00 (GMT) | U.S. | Housing Price Index, m/m | October | 1.7% | |

| 14:00 (GMT) | Switzerland | SNB Quarterly Bulletin | |||

| 15:00 (GMT) | U.S. | New Home Sales | November | 0.999 | 0.995 |

| 15:00 (GMT) | U.S. | Reuters/Michigan Consumer Sentiment Index | December | 76.9 | 81.4 |

| 15:30 (GMT) | U.S. | Crude Oil Inventories | December | -3.135 | -3.25 |

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | December | 263 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.75251 | -0.68 |

| EURJPY | 126.017 | -0.29 |

| EURUSD | 1.21639 | -0.58 |

| GBPJPY | 138.507 | -0.4 |

| GBPUSD | 1.33695 | -0.7 |

| NZDUSD | 0.70429 | -0.62 |

| USDCAD | 1.29074 | 0.46 |

| USDCHF | 0.88927 | 0.41 |

| USDJPY | 103.593 | 0.28 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.