- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 22-12-2020.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Private Sector Credit, m/m | November | 0.0% | |

| 00:30 (GMT) | Australia | Private Sector Credit, y/y | November | 1.8% | |

| 05:00 (GMT) | Japan | Leading Economic Index | October | 93.3 | 93.8 |

| 05:00 (GMT) | Japan | Coincident Index | October | 84.8 | 89.7 |

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | December | 5508 | 5558 |

| 13:30 (GMT) | Canada | GDP (m/m) | October | 0.8% | 0.3% |

| 13:30 (GMT) | U.S. | Personal spending | November | 0.5% | -0.2% |

| 13:30 (GMT) | U.S. | PCE price index ex food, energy, Y/Y | November | 1.4% | 1.5% |

| 13:30 (GMT) | U.S. | PCE price index ex food, energy, m/m | November | 0% | 0.1% |

| 13:30 (GMT) | U.S. | Personal Income, m/m | November | -0.7% | -0.3% |

| 13:30 (GMT) | U.S. | Durable Goods Orders | November | 1.3% | 0.6% |

| 13:30 (GMT) | U.S. | Durable Goods Orders ex Transportation | November | 1.3% | 0.5% |

| 13:30 (GMT) | U.S. | Durable goods orders ex defense | November | 0.2% | |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | December | 885 | 885 |

| 14:00 (GMT) | U.S. | Housing Price Index, y/y | October | 9.1% | |

| 14:00 (GMT) | U.S. | Housing Price Index, m/m | October | 1.7% | |

| 14:00 (GMT) | Switzerland | SNB Quarterly Bulletin | |||

| 15:00 (GMT) | U.S. | New Home Sales | November | 0.999 | 0.995 |

| 15:00 (GMT) | U.S. | Reuters/Michigan Consumer Sentiment Index | December | 76.9 | 81.4 |

| 15:30 (GMT) | U.S. | Crude Oil Inventories | December | -3.135 | -3.25 |

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | December | 263 |

The National

Association of Realtors (NAR) announced on Tuesday that the U.S. existing home

sales fell 2.5 percent m-o-m to a seasonally adjusted rate of 6.69 million in

November from a revised 6.86 million in October (originally 6.85 million). That

was first monthly decline since May.

Economists had

forecast home resales decreasing to a 6.70 million-unit pace last month.

In y-o-y terms,

existing-home sales surged 25.8 percent in November.

According to

the report, three of the four major regions recorded m-o-m declines in existing-home

sales in November but all four regions rose from one year ago. Single-family

home sales stood at a seasonally-adjusted annual rate of 5.98 million in

November, down 2.4 percent from 6.13 million in October, and up 25.6 percent from

one year ago. The median existing single-family home price was $315,500 in

November, up 15.1 percent from November 2019. Meanwhile, existing condominium

and co-op sales were recorded at a seasonally-adjusted annual rate of 710,000

units in November, down 2.7 percent from October and up 26.8 percent from one

year ago. The median existing condo price was $271,400 in November, an advance

of 9.5 percent from a year ago.

"Home

sales in November took a marginal step back, but sales for all of 2020 are

already on pace to surpass last year's levels," said Lawrence Yun, NAR's

chief economist. "Given the COVID-19 pandemic, it's amazing that the

housing sector is outperforming expectations." He also noted that circumstances

were far from being back to the pre-pandemic normal. "However, the latest

stimulus package and with the vaccine distribution underway, and a very strong

demand for homeownership still prevalent, robust growth is forthcoming for 2021,"

Yun added.

The Conference

Board announced on Tuesday its U.S. consumer confidence fell 3.7 points to 88.6

in December from 92.9 in November.

Economists had

expected consumer confidence to come in at 97.0.

November’s

consumer confidence reading was revised down from originally-estimated 96.1.

The survey

showed that the expectations index rose from 84.3 last month to 87.5 this

month. Meanwhile, the present situation index plunged from 105.9 in November to

90.3.

“Consumers’

assessment of current conditions deteriorated sharply in December, as the

resurgence of COVID-19 remains a drag on confidence,” noted Lynn Franco, Senior

Director of Economic Indicators at The Conference Board. “As a result,

consumers’ vacation intentions, which had notably improved in October, have

retreated. On the flip side, as consumers continue to hunker down at home,

intentions to purchase appliances have risen. Overall, it appears that growth

has weakened further in Q4, and consumers do not foresee the economy gaining

any significant momentum in early 2021.”

- We are giving it "final push"

NFXStreet reports that Jane Foley, Senior FX Strategist at Rabobank, notes that rising COVID-19 cases, government wrangling, a widening of tier 4 restrictions in England, increased pressure on the public purse and, in all likelihood, a continuation of negotiations with the EU on areas such as financial services and security suggest the GBP may be unable to shrug off its vulnerability or volatility in 2021.

“While GBP is likely to find support on any news that a trade deal has been struck, it remains likely that any relief rally will be cut short. Firstly, any deal is set to leave many sectors, particularly in services, out in the cold. In addition, the likelihood that larger swathes of the UK will be entering higher ‘tier 4’ restriction to prevent the transmission of the virus will significantly dampen recovery prospects.”

“Assuming a deal is struck we retain our view that EUR/GBP will struggle to push below the 0.89/0.88 area in the coming months. Without a deal, we expect EUR/GBP to rise to 0.93/0.95 dependent on whether the door is left open for talks on some sectors next year.”

FXStreet notes that the S&P 500 Index has seen its expected rejection at 3720/25 for a test of the key 3633 December low, which is holding for now. Whilst the Credit Suisse analyst team’s bias remains for a lengthier correction/consolidation, only below 3633 would mark a near-term top.

“The S&P 500 setback extended to test as expected the 3633 low from earlier in December, from which a sharp recovery has been seen. Although the broader trend stays seen higher, with momentum not confirming the new highs in addition to further signs of exhaustion/’euphoria’ our bias remains to look for further consolidation/corrective weakness for now.”

“We look for resistance from the top of the price gap from yesterday morning at 3709 to cap for now with support seen at 3682/81 initially, beneath which can see a move back to 3656, then a retest of 3636/33. Only a move below here though would see a near-term top complete to warn of a more concerted corrective setback, with support seen next at 3594/90 ahead of the 38.2% retracement of the October/December rally at 3544/38.”

A report from

the Commerce Department showed on Tuesday that the U.S. economy grew slightly more

than initially thought in the third quarter of 2020, as gains in personal

consumption expenditures (PCE) and nonresidential fixed investment were revised

upwardly.

According to

the third estimate, the U.S. gross domestic product (GDP) surged at an annual

rate of 33.4 percent in the third quarter, better than a 33.1 percent advance reported

in the second estimate. This represented the biggest expansion ever.

Economists had

expected the contraction rate to be unrevised at 33.1 percent.

In the second

quarter, the economy shrank by record 31.4 percent q-o-q.

The increase in

real GDP reflected gains in PCE, private inventory investment, exports, nonresidential

fixed investment, and residential fixed investment, which, however, were partly

offset by declines in federal government spending (reflecting fewer fees paid

to administer the Paycheck Protection Program loans) and state and local

government spending. Meanwhile, imports, which are a subtraction in the

calculation of GDP, rose.

- EC recommends that flight and travel bans be discontinued given the needs of essential travel and to avoid supply chain disruptions

- EC recommends member countries to discourage all nonessential travel to and from UK until further notice

- But blanket travel bans should not prevent thousands of EU and UK citizens from returning to their homes

GBP declined against most of its major counterparts in the European session on Tuesday as increased hopes for a Brexit trade deal were not enough to outweigh concerns about a new coronavirus variant.

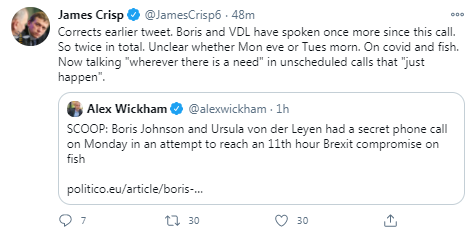

Reports that the UK's prime minister Boris Johnson and the European Commission's president Ursula von der Leyen held a phone call on Monday, trying to reach compromise in trade talks heightened hopes that the two sides could strike a deal before the end of the Brexit transition period on December 31. Politico's editor reported, citing an unnamed official familiar with the conversation, that the two leaders spoke about fresh proposals to resolve the existing stalemate on fisheries. But the UK's government official told Politico that the EU position was still miles off what was acceptable to them. Meanwhile, Reuters reported that EU sources said that the bloc was now willing to accept a reduction in the value of its catch in the UK waters of up to 25% over a period of time from 2021.

Investors remained concerned about a new COVID-19 strain in the UK, which had prompted stricter lockdown measures and restrictions on travel from the country. However, worries eased somewhat after the CEO of BioNTech (BNTX) Ugur Sahin stated that he was confident that his company's vaccine, developed with Pfizer (PFE), would work against the new UK variant. “We don’t know at the moment if our vaccine is also able to provide protection against this new variant,” he said. “But scientifically, it is highly likely that the immune response by this vaccine also can deal with the new virus variants.”

- Economy still in a hole, and the hole is still deep

- UK jobs support should end only when virus crisis is over

- Furlough scheme should only end when the coronavirus crisis is over

FXStreet notes that the top five global risks for investors in 2021 are all surprises to the consensus view: problems with the vaccine rollout, geopolitical and trade tensions do not subside, fiscal and/or monetary policy tightens, a “zombie” economy and interest rate/dollar shock. Whether or not these particular risks come to pass, a new year almost always brings surprises of one form or another. Having a well-balanced, diversified portfolio and being prepared with a plan in the event of an unexpected outcome are keys to successful investing, Jeffrey Kleintop, CFA, Senior Vice President, Chief Global Investment Strategist at Charles Schwab apprises.

“There is potential for the stock market to pull back some of the gains if vaccine distribution, adoption, or efficacy lags, resulting in delays to the recovery timeline. Bottlenecks with virus testing capacity and turnaround times in both the UK and the US raise concerns about the ability to roll out widespread vaccination, an even larger operation.”

“The market does not anticipate any flare-up in foreign policy tension in 2021. Yet, there are hot spots that could spill over into markets. US President-elect Biden has made it clear he won’t be easing trade tariffs immediately and intends to confront China on environmental and labor issues in addition to intellectual property rights. China may respond by alerting other countries that new alliances with the incoming Biden Administration against China might prompt retaliation. Australia and China have been in low key conflict over the past couple of years, but tensions have now escalated, with the potential for meaningful economic damage. Failure to craft a post-Brexit UK-EU trade deal could lead to conflict; heightened by a transition to new leadership in Europe. There is the potential for renewed US tensions between North Korea, Russia/Syria, Venezuela, and others with interests in conflict with US goals.”

“Markets are clearly betting on continued easy policy in 2021. Premature monetary or fiscal policy tightening in major economies could slow the recovery and deal a setback to the stock market. Policymakers are unlikely to tighten policy anywhere near as rapidly following this global recession compared to recent history. But signs of less easing may prompt a market pullback, should policymakers begin to seek ways to contain runaway budgets and balance sheets.”

“Instead of a quick return to the pre-crisis economy, it is possible we may need a longer period of structural adjustment. Continued easy fiscal and monetary policy could also result in a drag on productivity and growth from hordes of ‘zombie’ companies. These companies may use aid to make debt payments rather than fuel economic growth through hiring or spending on equipment.”

“An unexpected jump in inflation, surprise surge in bond yields or plunge in the dollar might lead to higher stock market volatility. Inflation expectations have been rising fast. Any breakout above the five-year range may spark tighter financial conditions and prompt investors to reassess stock market valuations."

FXStreet notes that NZD/USD saw a very sharp fall on Monday, which was partially reversed as risk-assets recovered later in the day. Whilst above key support at 0.7006/00, further high-level ranging remains the base case. However, a break below here would open up 0.6855, the Credit Suisse analyst team reports.

“NZD/USD saw a sharper rejection from the next major resistance at the 50% retracement of the entire 2014/2020 fall at 0.7151/71 yesterday, which reinforced the case for a potentially more significant consolidation phase prior to an eventual resumption of the core bull trend. The market saw the anticipated move towards the key price lows at 0.7006/00 on Monday, however, the rebound from this level has set up the potential for an intraday top and now needs to hold on a closing basis to avoid a much more protracted and damaging corrective phase, with a RSI top already in place.”

“Assuming we hold above 0.7006/00, an eventual clear and closing break above 0.7151/71 would trigger a resumption of the core bull trend, with resistance then seen at 0.7200.”

Politico's editor reported, citing an unnamed official familiar with the conversation, that Boris Johnson and Ursula von der Leyen spoke about fresh proposals to unlock the current impasse on fisheries. Meanwhile, the UK's government official told Politico that the EU position was still miles off what was acceptable to them.

Telegraph's Brussels correspondent added that the two leaders held another call Monday evening or Tuesday morning, during which they discussed fisheries and COVID-19.

FXStreet notes that in the opinion of economists at Danske Bank an expected higher EUR/USD near-term is set to lift EUR/CHF too.

“The SNB is preparing to continue sweating out the deflationary pressure in the Swiss economy and intervention remains the key policy tool. With the ECB set to hold rates and opt for other easing tools, Swiss policy rates are also set to stay unchanged at the longstanding -0.75% for an extended period of time.”

“Going into Q1, a potentially higher EUR/USD may shift EUR/CHF higher too, towards 1.09. The key for the pair is if global macro becomes so good in Europe that markets start talking about ECB rate hikes... Towards Q1, our base case is another jump higher in EUR/CHF.”

FXStreet reports that Credit Suisse discusses AUD/USD outlook.

“AUD/USD fell sharply on Monday to reject key resistance and our first core upside objective at the 38.2% retracement of the entire 2011/2020 fall at 0.7625/40. Although the fall was reversed by the close, this rejection has reinforced the potential for a phase of consolidation to help the market to unwind its previously overbought condition.”

“Support stays at the 13-day exponential average and psychological barrier at 0.7529/00, which needs to hold on a closing basis to avoid a deeper setback. Assuming this is the case, the risk will stay seen higher post further sideways ranging and with a large ‘head and shoulders’ base still in place, a clear break of 0.7632/40 is looked for post this phase. Next resistance is at 0.7673/77 and then the April 2018 high at 0.7813.

FXStreet reports that economists at Credit Suisse discusses EUR/USD outlook.

“A rollercoaster session for EUR/USD on Monday as early weakness was contained at price support at 1.2126/16 for an impressive intraday recovery, but with subsequent strength then capped at the top of the price gap from the open yesterday morning at 1.2259.”

“A break below 1.2129/22 though would now raise the prospect of a more concerted setback and a fall back to the 1.2059 recent low, potentially as far as what we expect to be better support at 1.2017/11 – the 38.2% retracement of the November/December rally and September high – with a better floor expected here.”

eFXdata reports that Credit Suisse discusses EUR/CHF outlook.

"Regarding the outlook for the Swiss franc, we still stick to our initial 1.0900 target in EURCHF. In a more optimistic scenario, we could even see the pair reaching 1.1000 after that. Our optimistic view is based on the expectation of an economic recovery in the Eurozone once the impact of the Covid-19 vaccines shows their first positive results in sentiment and hard data releases," CS notes.

FXStreet reports that economists at Danske Bank expect a stronger yuan over the next year.

“We look for a continuation of the move over the next six months as monetary policy is diverging with China aiming for exit, while the US still has an easing bias. Overall USD weakness also supports a decline in USD/CNY in the short-term.”

“We have revised down our one month forecast to 6.55 (from 6.60), three months forecast to 6.50 (from 6.55) and six months forecast to 6.45 (from 6.50) while keeping our 12 months forecast at 6.40. Our forecast points to a stronger CNY than the forward market expects.”

Bloomberg reports that the chief executive of BioNTech said that German pharmaceutical company is confident that its coronavirus vaccine works against the new UK variant, but further studies are need to be completely sure.

“We don’t know at the moment if our vaccine is also able to provide protection against this new variant,” Ugur Sahin told a news conference the day after the vaccine was approved for use in the European Union. “But scientifically, it is highly likely that the immune response by this vaccine also can deal with the new virus variants.”

Sahin said that the proteins on the UK variant are 99% the same as on the prevailing strains, and therefore BioNTech has “scientific confidence” that its vaccine will be effective.

eFXdata reports that ANZ Research discusses EUR/USD outlook.

"As the world’s largest trading bloc, the EA is benefitting from an improving global trade outlook. The ECB’s concerns about the disinflationary impulse of sustained EUR appreciation is valid, but it is relatively powerless to combat the euro’s rise. Deflation is propping up real EA interest rates and the large current account surplus is a structural positive for the currency," ANZ notes.

"However, we anticipate that verbal intervention will become more frequent as the ECB inevitably tries to slow the euro’s rise. We think that the central bank’s redline is closer to 1.25, whilst PPP estimates put fair value for EUR/USD around 1.30," ANZ adds.

FXStreet reports that according to economists at MUFG Bank, GBP/USD will struggle to surpass the 1.3500 mark even if a Brexit deal is reached.

“The trigger for the pound reversal were reports that the EU and UK are moving towards a compromise on fisheries in an attempt to unblock a Brexit trade deal.”

“We continue to believe that a last-minute trade deal will be reached but the risk of a no-deal is now elevated with time fast running out to reach compromises.”

“Even if a trade is reached, upside potential for the pound will now be dampened by recent negative COVID-19 developments in the UK. According to the BBC, more than 40 countries have banned UK arrivals, and France has shut its border with the UK for 48 hours. The EU is expected to announce a coordinated response today. In lights of these developments, GBP/USD will find it more of a struggle to rise beyond the 1.3500-level if a deal is reached before year-end.”

CNBC reports that Congress passed a mammoth coronavirus relief and government spending package Monday night.

Both chambers easily approved the more than $2 trillion legislation in votes that dragged late into the night. Congressional leaders attached $900 billion in pandemic aid to a $1.4 trillion measure to fund the government through Sept. 30.

The House approved the package in a 359-53 vote. The Senate then passed it by a 92-6 margin.

At the same time, Congress passed a seven-day stopgap spending bill to keep the government open during the time it takes for the full-year legislation to get to President Donald Trump’s desk.

Bloomberg reports that the dollar’s influence on how China sets its yuan exchange rate is expected to decrease again this year.

A branch of China’s central bank factors in the moves of a basket of trading partners’ currencies when setting the yuan’s daily reference rate. The weighting of each of the 24 components in the CFETS RMB Index is adjusted based on the proportion each nation took in total trade with China the previous year.

The greenback’s share is currently the highest in the basket, at slightly more than a fifth. But it has been declining since 2015. Last year, the U.S. accounted for 17.8% of China’s two-way shipments with the 24 peers last year, down from 20.5% in 2018, according to data compiled by Bloomberg. China is expected to adjust the basket by the end of the year.

FXStreet reports that analysts at Natixis focus on the effect of the creation of a CBDC (central bank digital currency) on the macro-financial equilibrium.

“Let us assume for example that the ECB introduces a central bank digital currency in the eurozone and that it is a retail currency accessible to all economic agents. Economic agents would convert bank deposits into this CBDC. This leads to a fall in bank deposits and in banks’ reserves at the central bank; in economic agents’ assets, the replacement of deposits with the digital currency and in the central bank’s liabilities, the replacement of banks’ reserves with the digital currency. If banks’ reserves at the central bank fall, there will be a fall in bank credit, leading to a further fall in deposits. The risk with the introduction of a CBDC is that credit may contract due to the fall in banks’ funding.”

“The central bank can restore the banks’ reserves by refinancing them (by buying or taking in repo more financial assets held by banks, such as government bonds). This would restore banks’ liquidity via a more expansionary monetary policy.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | Retail Sales, M/M | November | 1.4% | -0.6% | 7.0% |

| 07:00 | Germany | Gfk Consumer Confidence Survey | January | -6.8 | -8.8 | -7.3 |

| 07:00 | United Kingdom | PSNB, bln | November | -21.7 | -30 | -31.6 |

| 07:00 | United Kingdom | Business Investment, q/q | Quarter III | -25.4% | 9.4% | |

| 07:00 | United Kingdom | Business Investment, y/y | Quarter III | -25.2% | -19.2% | |

| 07:00 | United Kingdom | Current account, bln | Quarter III | -11.9 | -11.6 | -15.7 |

| 07:00 | United Kingdom | GDP, y/y | Quarter III | -20.8% | -9.6% | -8.6% |

| 07:00 | United Kingdom | GDP, q/q | Quarter III | -18.8% | 15.5% | 16% |

During today's Asian trading, the US dollar rose against the euro and the yen on news of the adoption of a new fiscal stimulus in the US.

The US Senate, following the House of representatives, supported a package of measures to stimulate the economy during the pandemic in the amount of $900 billion.

The ICE index, which tracks the dollar's performance against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), rose 0.21%.

Investors also continue to monitor the development of the situation due to the identification of a new strain of coronavirus in the UK.

"Initially, the event was considered significant only for the United Kingdom, but we fear that it may turn out to be a new global threat, since it is unlikely that the new strain will not spread outside the country (cases have already been reported in Australia, Denmark and the Netherlands)," said John Hardy, chief currency strategist at Saxo Bank.

According to Hardy, the pound " falls in part due to the isolation of the UK after the discovery of a new strain of COVID-19 and the ban on travel there, but also due to the lack of progress on Brexit."

Investors are also waiting for the publication of final data on the change in US GDP in the 3rd quarter.

The Australian dollar fell against the US dollar, despite the data on retail sales in Australia. Retail sales in the country jumped 7% in November from the previous month after rising 1.4% in October. Analysts had expected a decline of 0.6%.

eFXdata reports that Societe Generale Research discusses EUR/CHF outlook.

"Since the de-pegging of the franc, it is likely that 1.10 has been the trigger level for SNB FX intervention. This year has seen this policy tool return in a big way to prevent excessive currency strength, and the central bank has probably managed EUR/CHF so that it does not break through 1.05," SocGen notes.

"While interventions started to ease off in June, they seem to have really paused only since October, while EUR/CHF has still been trading in a 1.06-1.09 range. Given the failure to bring the pair back above 1.10, the SNB’s reaction function has probably changed. All in all, it seems that the SNB is now committed to defending 1.05 but is more tolerant of franc strength if volatility risk does not warrant FX interventions," SocGen adds.

According to the report from the GfK Group, consumer sentiment in November was significantly dampened by the partial lockdown. As was already the case in the previous month, both economic and income expectations as well as propensity to buy have declined. As a result, GfK has forecast a figure of -6.7 for December 2020, 3.5 points down from October this year (revised to -3.2 points).

A rapid increase in infection rates has prompted a second lockdown by the German government, albeit with less stringent restrictions than faced during the lockdown earlier this year.

"Though stores will remain open, the renewed shutdown of the hotel, restaurant and events industry – as well as the already struggling tourism industry – has had a serious impact on the consumer climate," explains Rolf Bürkl, consumer expert at GfK. "As a result, any hope we still had in early summer of a rapid recovery is now lost. Growing uncertainty has once again led to an increase in propensity to save, another factor which has contributed to the decline in the consumer climate."

The economic expectation indicator fell by 7.3 points to -0.2, it's lowest figure since May of this year when it stood at -10.4 points. Income expectations have suffered another setback in November in the wake of a declining economic outlook. The indicator lost 5.2 points, falling to 4.6 – a loss of 41 points when compared to the same period last year. Propensity to buy has not been immune to falling economic and income expectations. The indicator dropped 6.5 points to 30.5 – a level which is still considered satisfactory when compared to the other two indicators. In addition, concerns over job losses as a result of a possible increase in the number of bankruptcies will also impact propensity to consume.

According to the report from the Office for National Statistics, UK gross domestic product (GDP) is estimated to have increased by a record 16.0% in Quarter 3 (July to Sept) 2020, revised from the first estimate of 15.5% growth. Economists had expected a 15.5% increase.

Though this reflects some recovery of activity following the record contraction in Quarter 2 (Apr to June) 2020, the level of GDP in the UK is still 8.6% below where it was at the end of 2019, revised from an initial estimate of 9.7%.

Compared with the same quarter a year ago, the UK economy fell by a revised 8.6%.

While output in the services, production and construction sectors increased by record amounts in Quarter 3 2020, the level of output remains below Quarter 4 (Oct to Dec) 2019 levels, before the impact of the coronavirus (COVID-19) pandemic was seen.

There has been a recovery in private consumption, government consumption and, to a lesser extent, business investment in Quarter 3 2020 in line with the easing of public health restrictions, however, the levels remain below their pre-lockdown level.

The households’ saving ratio decreased to 16.9% in Quarter 3 2020, compared with 27.4% in Quarter 2 2020.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2370 (2927)

$1.2346 (1455)

$1.2326 (1262)

Price at time of writing this review: $1.2219

Support levels (open interest**, contracts):

$1.2184 (3537)

$1.2154 (1353)

$1.2118 (2447)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 8 is 77350 contracts (according to data from December, 21) with the maximum number of contracts with strike price $1,2100 (4804);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3630 (965)

$1.3571 (302)

$1.3535 (1532)

Price at time of writing this review: $1.3399

Support levels (open interest**, contracts):

$1.3303 (525)

$1.3245 (735)

$1.3178 (1562)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 58541 contracts, with the maximum number of contracts with strike price $1,4000 (33099);

- Overall open interest on the PUT options with the expiration date January, 8 is 29628 contracts, with the maximum number of contracts with strike price $1,2800 (4017);

- The ratio of PUT/CALL was 0.51 versus 0.49 from the previous trading day according to data from December, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Retail Sales, M/M | November | 1.4% | -0.6% |

| 07:00 (GMT) | Germany | Gfk Consumer Confidence Survey | January | -6.7 | -9 |

| 07:00 (GMT) | United Kingdom | PSNB, bln | November | -22.3 | -29 |

| 07:00 (GMT) | United Kingdom | Business Investment, q/q | Quarter III | -26.5% | |

| 07:00 (GMT) | United Kingdom | Business Investment, y/y | Quarter III | -26.1% | |

| 07:00 (GMT) | United Kingdom | Current account, bln | Quarter III | -2.8 | -9.5 |

| 07:00 (GMT) | United Kingdom | GDP, y/y | Quarter III | -21.5% | -9.6% |

| 07:00 (GMT) | United Kingdom | GDP, q/q | Quarter III | -19.8% | 15.5% |

| 13:30 (GMT) | U.S. | PCE price index, q/q | Quarter III | -1.6% | 3.7% |

| 13:30 (GMT) | U.S. | PCE price index ex food, energy, q/q | Quarter III | -0.8% | 3.5% |

| 13:30 (GMT) | U.S. | GDP, q/q | Quarter III | -31.4% | 33.1% |

| 15:00 (GMT) | U.S. | Richmond Fed Manufacturing Index | December | 15 | |

| 15:00 (GMT) | U.S. | Existing Home Sales | November | 6.85 | 6.7 |

| 15:00 (GMT) | U.S. | Consumer confidence | December | 96.1 | |

| 23:50 (GMT) | Japan | Monetary Policy Meeting Minutes |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.75818 | -0.1 |

| EURJPY | 126.38 | -0.1 |

| EURUSD | 1.22342 | 0.09 |

| GBPJPY | 139.016 | 0.14 |

| GBPUSD | 1.34575 | 0.35 |

| NZDUSD | 0.7094 | -0.24 |

| USDCAD | 1.28579 | 0.48 |

| USDCHF | 0.88566 | 0.12 |

| USDJPY | 103.293 | -0.2 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.