- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 17-12-2020.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 (GMT) | New Zealand | ANZ Business Confidence | December | -6.9 | |

| 03:00 (GMT) | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | |

| 07:00 (GMT) | Germany | Producer Price Index (YoY) | November | -0.7% | -0.6% |

| 07:00 (GMT) | Germany | Producer Price Index (MoM) | November | 0.1% | 0.1% |

| 07:00 (GMT) | United Kingdom | Retail Sales (YoY) | November | 5.8% | 2.8% |

| 07:00 (GMT) | United Kingdom | Retail Sales (MoM) | November | 1.2% | -4.2% |

| 09:00 (GMT) | Eurozone | Current account, unadjusted, bln | October | 33.5 | |

| 09:00 (GMT) | Germany | IFO - Expectations | December | 91.5 | |

| 09:00 (GMT) | Germany | IFO - Current Assessment | December | 90.0 | |

| 09:00 (GMT) | Germany | IFO - Business Climate | December | 90.7 | |

| 11:00 (GMT) | United Kingdom | CBI industrial order books balance | December | -40 | -34 |

| 13:30 (GMT) | Canada | Retail Sales YoY | October | 4.6% | |

| 13:30 (GMT) | Canada | Retail Sales, m/m | October | 1.1% | 0.2% |

| 13:30 (GMT) | Canada | New Housing Price Index, YoY | November | 3.9% | |

| 13:30 (GMT) | Canada | New Housing Price Index, MoM | November | 0.8% | |

| 13:30 (GMT) | U.S. | Current account, bln | Quarter III | -170.5 | -189 |

| 13:30 (GMT) | Canada | Retail Sales ex Autos, m/m | October | 1% | 0.2% |

| 14:00 (GMT) | Belgium | Business Climate | December | -12.1 | -13.4 |

| 15:00 (GMT) | U.S. | Leading Indicators | November | 0.7% | 0.5% |

| 16:00 (GMT) | U.S. | FOMC Member Charles Evans Speaks | |||

| 16:10 (GMT) | U.S. | FOMC Member Brainard Speaks | |||

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | December | 258 |

According to ActionForex, analysts at TD Bank Financial Group note that the U.S. housing starts increased by 1.2% to 1.55 million (annualized) units in November and this was appreciably better than the consensus forecast, which called for a modest 0.3% increase.

"Unlike previous months, the November gains were broad-based, with single and multi-family starts coming in higher. Single-family starts rose by a modest 0.4% to 1.19 million, extending their winning streak to seven straight months. In the more volatile multi-family segment, starts increased by 4% to 361k."

"Building permits also showed considerable strength, rising by 6.2% on the month after a 0.1% contraction in October. Like starts, single-family permits (+1.3%) continued to increase, advancing for seven straight months, while multifamily permits (+19.2%) rose for the first time in four months."

"Today’s report was a positive surprise, considering that a slowdown of sorts was expected given their strong pace of growth in recent months. The residential construction sector’s overall performance has decidedly been a positive one this year, with starts increasing in 6 of the past 7 months and rebounding within 1.3% of their pre-crisis levels. The November gains were driven by a bounce-back in multi-family starts, which had struggled of late in light of shifting housing demand in favor of bigger homes and more outdoor space."

"However, with new COVID-19 cases surging to record highs and restrictions making a comeback in several states, there is no shortage of near-term challenges for homebuilders. Builder confidence eased somewhat after soaring to new all-time highs in each of the past 3 months. The outlook is also muddied by looming affordability issues, as construction costs continue to rise and inventories remain low. These trends are expected to weigh on housing demand through 2021."

The

Manufacturing Business Outlook Survey, released by the Federal Reserve Bank of

Philadelphia on Thursday, revealed the region's manufacturing activity

continued to expand in December, albeit at a slower pace than in November.

According to

the survey, the diffusion index for current general activity fell from26.3 in November

to 11.1 this month. This was the lowest positive reading following the index decline

into negative territory in spring months.

Economists had

forecast the index to decrease to 20.0.

A reading above

0 signals expansion, while a reading below 0 indicates contraction.

According to

the report, the new orders index plunged 35.6 points to 2.3 this month, while

the current shipments index declined 10.5 points to 14.4. and the current

employment index tumbled 18.7 points to 8.5. Elsewhere, the survey’s price

indicators suggest that price increases were less widespread this month: the

prices paid index dropped 11.8 points to 27.1 and the prices received index decreased

7.7 points to 18.0.

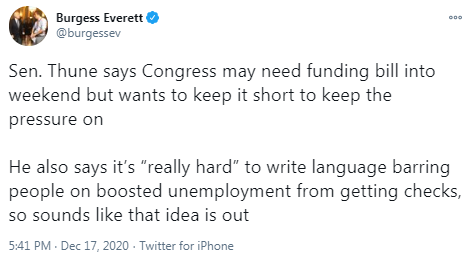

- Some of remaining differences go to "the very heart" of the government's mandate

- Regrettably, chances are more likely that we won't secure an agreement

The Commerce

Department reported on Thursday the housing starts rose by 1.2 percent m-o-m in

November to a seasonally adjusted annual pace of 1.547 million (the highest

since February), while building permits surged by 6.2 percent m-o-m to a

seasonally adjusted annual rate of 1.639 (the highest level since September

2006).

Economists had

forecast housing starts increasing to a pace of 1.530 million units last month

and building permits rising to a pace of 1.550 million units.

Data for October

was revised to show homebuilding growing to a pace of 1.528 million units,

instead of increasing at a rate of 1.530 million units as previously reported,

and permits dropping to a pace of 1.544 million units, instead of being flat

m-o-m at a rate of 1.545 million units as previously reported.

According to the report, permits for single-family homes, the largest segment of the market, rose 1.3 percent m-o-m in November, while approvals for the multi-family homes segment surged 19.2 percent m-o-m.

In the

meantime, groundbreaking on single-family homes rose 0.4 percent m-o-m in November, while housing starts for the multi-family climbed 4.0

percent m-o-m.

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment unexpectedly rose last week.

According to

the report, the initial claims for unemployment benefits increased by 23,000 to

885,000 for the week ended December 12. This was the highest total since the

week ended September 6.

Economists had

expected 800,000 new claims last week.

Claims for the

prior week were revised upwardly to 862,000 from the initial estimate of 853,000.

Meanwhile, the

four-week moving average of claims grew to 812,500 from an upwardly revised 778,250

in the previous week.

Continuing

claims dropped to 5,508,000 million from an upwardly revised 5,781,000 in the

previous week.

- Negotiators are still in Brussels to try to see if Brexit gaps can be narrowed

- UK will not extend Brexit negotiation into next year

FXStreet reports that the S&P 500 Index turned sharply back higher on Wednesday and analysts at Credit Suisse continue to give the upside the benefit of the doubt and maintain an immediate tactical bullish bias whilst above 3633.

“The S&P 500 quickly turned back higher on Wednesday after holding support at 3633. Despite daily MACD crossing lower and the market’s ‘euphoric’ state (90% S&P 500 stocks are above their 200-day average and above the upper end of what we see as its ‘typical’ extreme), we continue to give the upside the benefit of the doubt for now.”

“A move above 3711/12 is needed to add momentum to the upmove and open up our 3720/25 next objective. Whilst we would expect this to cap at first, a direct break can see a cluster of what we expect to be tougher resistances in the 3765/85 zone. The market does remain in a vulnerable state due to the loss of momentum, which keeps the risk of a correction lower elevated.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:30 | Switzerland | SNB Interest Rate Decision | -0.75% | -0.75% | -0.75% | |

| 09:30 | Switzerland | SNB Press Conference | ||||

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | November | 0.2% | 0.2% | 0.2% |

| 10:00 | Eurozone | Harmonized CPI | November | 0.2% | -0.3% | -0.3% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | November | -0.3% | -0.3% | -0.3% |

| 12:00 | United Kingdom | Asset Purchase Facility | 875 | 875 | ||

| 12:00 | United Kingdom | BoE Interest Rate Decision | 0.1% | 0.1% | 0.1% | |

| 12:00 | United Kingdom | Bank of England Minutes |

GBP firmed against its major rivals in the European session on Thursday, supported by hopes for a post-Brexit trade deal.

The EU's chief Brexit negotiator Michel Barnier tweeted earlier today that the trade talks with the UK are showing “good progress” but cautioned “last stumbling blocks remain”. In addition, the EU official familiar with the situation told Reuters that the two sides could possibly reach a trade deal by the end of the week, but added that he wouldn't bank on it.

Meanwhile, the latest monetary policy decision of the Bank of England’s (BoE) Monetary Policy Committee (MPC) had little impact on the pound. As widely expected, the BoE's policymakers decided to hold the bank's key rate at a record low of 0.10 percent and the government bond purchases at GBP 825 billion. The latest decision indicated that the BoE's MPC members took a wait-and-see approach, awaiting the outcome of the UK-EU trade negotiations. "The outlook for the economy remains unusually uncertain. It depends on the evolution of the pandemic and measures taken to protect public health, as well as the nature of, and transition to, the new trading arrangements between the European Union and the United Kingdom", the bank said in its policy statement. However, the Bank also noted that Covid-19 vaccine rollout is likely to reduce the downside risks to the economic outlook. "The successful rollout of vaccines should support the gradual removal of restrictions and rebound in activity that was assumed in the November Report."

FXStreet reports that USD/CHF is back under pressure after a roller-coaster session on Wednesday, and a move beneath 0.8826 would see the bear trend resume, according to the Credit Suisse analyst team.

“We see support initially at yesterday’s low at 0.8826, below which would confirm the resumption of the core bear trend and see support next at the price level and key psychological inflection point at 0.8802/00, where we would expect to see an initial attempt to hold."

“Resistance is seen initially at 0.8858, then 0.8892/96, before 0.8909/15, which ideally continues to cap any correction higher."

The Bank of

England (BoE) announced its Monetary Policy Committee (MPC) voted 9-0 to

maintain Bank Rate at 0.1 percent at its December meeting, as widely expected.

The MPC also

voted unanimously to continue with its existing programmes of UK government

bond and sterling non-financial investment-grade corporate bond purchases,

maintaining the target for the total stock of these purchases at £895 billion.

In its

statement, the BoE notes:

- MPC judged that existing stance of monetary policy remains appropriate;

- MPC will continue to monitor the situation closely; if outlook for inflation weakens, Committee stands ready to take whatever additional action is necessary to achieve its remit;

- MPC does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving 2%-inflation target sustainably;

- Outlook for the economy remains unusually uncertain; it depends on evolution of the pandemic and measures taken to protect public health, as well as nature of, and transition to, new trading arrangements between EU and UK, and the responses of households, businesses and financial markets to these developments;

- Covid-19 vaccine rollout is likely to reduce the downside risks to the economic outlook;

- Recent global activity has been affected by increase in Covid cases and associated re-imposition of restrictions;

- UK-weighted global GDP growth in 2020 Q4 is likely to be little weaker than expected in November;

- Restrictions are expected to weigh more on activity in 2021 Q1;

- Successful rollout of vaccines should support gradual removal of restrictions and rebound in activity that was assumed in November;

- Additional fiscal measures in Spending Review 2020 are likely to boost GDP by estimated peak of over 1% during 2021-22

- Extension of the government’s employment support schemes is likely to limit significantly near-term rise in unemployment, although substantial further increase is still likely over next few quarters;

- CPI inflation is expected to rise quite sharply towards target in spring, as VAT cut comes to end and large fall in energy prices earlier this year drops out of annual comparison.

FXStreet reports that economists at Westpac think it is hard to argue against a firmer EUR as manufacturing resilience offers hope but there will be plenty of area of restraint. All in all, the EUR/USD pair is set for a potential move towards 1.30 in the first quarter of the next year.

“The new US administration is likely to be more collaborative with the EU, turning the tide in trade relations after the hostile escalation of tensions during the Trump Administration. Although the EU may start to regulate against the tech giants, the initial thawing of relations, especially in the aerospace sector, is likely to add a further leg of support for EUR.”

“Eurozone nations are extending or imposing more stringent COVID-19 related restrictions into at least mid-January. This highlights the potential for serial periods of tighter restrictions until vaccination programs meaningfully protect the population. Such a situation is unlikely until H2 21. However, recent production data and new order components of the PMIs suggest that prospects for manufacturing are positive for 2021. Eurozone should benefit from the rapid recovery in China and N.E. Asia more than the US.”

“EU is now set to implement its Recovery Fund, but implementation may prove to be a lengthy process. Nevertheless, it will provide support to national fiscal expansion and reduce pressure on ECB, but also lift EUR prospects by providing greater confidence across the region. EUR/USD has solidly moved through resistance around 1.20 and appears to be well supported for potential moves towards 1.30 in Q1 2021.”

FXStreet notes that the aussie has barely paused since bouncing off 0.70 in early November and has just jumped above the 0.76 level. Commodities and related China industrial rebound plus global optimism underpinned by vaccine rollout should keep the AUD/USD uptrend intact multi-month. But Q1 could be more mixed, with no apparent risk premium priced to reflect the potential for China to keep scaling up its rejection of Australia’s exports. More Reserve Bank of Australia’s (RBA) QE is also on the way, helping cap rallies, per Westpac.

“With the US dollar under broad pressure, further appreciation is likely into early 2021. However, our end-Q1 21 forecast of 0.76 implies some headwinds capping gains. One is monetary policy. The RBA’s A$100B QE program will be wrapped up in a swift 6 months and with other major central banks continuing to expand their balance sheets and the RBA pointing to glacial wages growth undermining prospects of inflation returning to target, Westpac expects a further $100B in QE to be announced. This could come as early as the Feb meeting, keeping a lid on AUD.”

“The economic news is likely to be mostly encouraging, with consumer and business confidence having already rebounded sharply, the household saving ratio a whopping 18.9% in Q3 and the pace of job creation again beating consensus in November. But it is not obvious how this translates to demand for AUD, with a revival in tourism and education exports still quite distant.”

“Furthermore, AUD price action in recent weeks suggests negligible risk premium is in the price in the event that China scales up barriers to Australian exports even further. Australia’s coal exports to China over the past year for instance were near $11B; Chinese state media indicates that no such further imports are authorised. China also has alternative sources for a wide range of other imports that could come under fire in the new year. This story could move firmly onto the market radar in Q1, weighing on AUD on crosses and capping gains against a vulnerable USD.”

Bloomberg reports that Germany will sell a record amount of federal debt in 2021 to help prop up the economy in the second year of the coronavirus crisis.

According to the Federal Finance Agency’s provisional calendar, Europe’s benchmark issuer plans to sell as much as 471 billion euros ($576 billion) in bonds and bills, easily exceeding a previous high of 407 billion euros sold this year.

“The comparatively high issuance volume is primarily a consequence of the Covid-19 pandemic,” the agency said in a statement. The debt issuance includes funding for two special vehicles -- the Economic Stabilisation Fund to counter the fallout from the pandemic and the Financial Market Stabilisation Fund, set up during the financial crisis in 2008.

The agency also plans to sell a maiden 30-year green bond in May and as much as 8 billion euros in inflation-linked securities. Two of next year’s debt sales will be syndicated.

FXStreet reports that economists at Credit Suisse said that GBP/USD weekly close above 1.3514 should confirm the long-looked-for major base.

“GBP/USD has surged higher for what looks to be a conclusive break above the 2019 high at 1.3514. Assuming we see a weekly close above here, which we see no reason not to, this should confirm the major base we have been looking for from September to mark an important change of trend higher.”

“We would see resistance at 1.3620 initially, ahead of 1.3710/20 – the ‘neckline’ to the early 2018 top and 38.2% retracement of the entire 2007/2020 bear market. We would expect consolidation here, but big picture, we continue to look for a move above 1.4300 and eventually on to 1.5000.”

According to the report from Eurostat, the euro area annual inflation rate was -0.3% in November 2020, stable compared to October. A year earlier, the rate was 1.0%. European Union annual inflation was 0.2% in November 2020, down from 0.3% in October. A year earlier, the rate was 1.3%.

The lowest annual rates were registered in Greece (-2.1%), Estonia (-1.2%), Slovenia and Cyprus (both -1.1%). The highest annual rates were recorded in Poland (3.7%), Hungary and Czechia (both 2.8%). Compared with October, annual inflation fell in fourteen Member States, remained stable in four and rose in nine.

In November, the highest contribution to the annual euro area inflation rate came from food, alcohol & tobacco (+0.36 percentage points, pp), followed by services (+0.25 pp), non-energy industrial goods (-0.07 pp) and energy (-0.82 pp).

FXStreet reports that economists at Westpac said that New Zealand’s GDP rose by 14% in the September quarter, a stronger than expected rebound from the COVID-19 lockdown in the previous quarter, inform.

“Successfully eliminating the spread of COVID-19 has allowed the New Zealand economy to rapidly swing back into action once the restrictions were lifted. The production measure of GDP rose by 14% in the September quarter, following an 11% drop in the June quarter (revised up from -12.2%).”

“For the RBNZ’s part, it’s not so clear-cut. Its bottom line is whether inflation is on track to meet its mandated target, and stimulating the economy is a means to an end. A stronger performing economy on its own suggests higher inflation than otherwise. But our forecasts still suggest that the RBNZ will still struggle to bring inflation up to target over the next couple of years. Recent good news on the economic front has also led to a sharp rise in the New Zealand dollar, which depresses imported inflation.”

Reuters reports that Home Secretary Priti Patel said that the UK will work flat out for a Brexit trade deal and negotiators are in “tunnel” negotiations but if a deal with the European Union is not possible then the country will be prepared.

“First of all, the prime minister and the government, we’ve all been very clear we are not walking away, we will continue to negotiate to get this free-trade agreement,” Patel told LBC radio.

“You used metaphors: We are in that tunnel of negotiation and our teams continue to work incredibly hard,” Patel said.

FXStreet reports that economists at Westpac expect the USD bear trend to extend in 2021.

“Interest rate differentials are the USD’s Achilles heel, and they are likely to remain decidedly less favourable.”

“The Fed may have disappointed expectations by leaving the duration of their bond-buying unchanged, but flexible average targeting framework and their freshly minted forward guidance linking asset purchases to ‘substantial further progress’ will have much the same intended impact in capping yields, hindering any yield support that might otherwise emerge in the wake of a US recovery.”

“The US election crushed blue wave fiscal hopes, but Democratic wins in Georgia’s double Senate run-off races in early January and/or several moderate Republicans joining the fiscal cause could nudge the calculus back in favour of a major multi-year fiscal push.”

“Sustained Fed accommodation, a less combative US-China trading relationship, near 10% GDP growth for China in 2021 and a distinct lack of political uncertainties on the 2021 calendar should continue to drag DXY lower into 2021. DXY is limping into year’s end and likely continues to trade on the back foot toward 88 in Q1.”

The coronavirus pandemic is continuing to have a strong adverse effect on the economy.

Against this difficult backdrop, the SNB is maintaining its expansionary monetary policy with a view to stabilising economic activity and price developments.

In light of the highly valued Swiss franc, the SNB remains willing to intervene more strongly in the foreign exchange market.

Furthermore, it is supplying generous amounts of liquidity to the banking system via the SNB COVID-19 refinancing facility.

The SNB’s expansionary monetary policy provides favourable financing conditions, counters upward pressure on the Swiss franc, and contributes to an appropriate supply of credit and liquidity to the economy.

In the current situation, the inflation outlook remains subject to high uncertainty.

The new conditional inflation forecast through to the end of 2021 is slightly lower than in September. This is primarily due to the renewed deterioration in the economic situation as a result of the second wave of the pandemic.

The forecast for 2020 is negative (−0.7%). The inflation rate is likely to be higher again next year (0.0%) and slightly positive in 2022 (0.2%). The conditional inflation forecast is based on the assumption that the SNB policy rate remains at −0.75% over the entire forecast horizon.

Momentum is likely to be weak in Q4 2020 and Q1 2021.

The SNB expects that GDP will shrink by around 3% this year.

SNB expects GDP growth of 2.5% to 3% for 2021.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | Unemployment rate | November | 7% | 7% | 6.8% |

| 00:30 | Australia | Changing the number of employed | November | 180.3 | 50 | 90.0 |

| 07:00 | Switzerland | Trade Balance | November | 2.9 | 3.1 |

During today's asian trading, the US dollar fell against the euro and the yen after the announcement of the results of the US Fed meeting.

The Ice index, which tracks the dollar's performance against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell 0.57%.

According to the results of the meeting on December 15-16, the US Federal Reserve kept the interest rate on the federal funds rate in the range from 0% to 0.25% per annum. In addition, in the coming months, the Fed will continue to increase investments in government bonds by at least $80 billion and in mortgage securities by at least $40 billion per month, "until significant progress is made in achieving the goals of the committee on maximum employment and price stability."

Fed Chairman Jerome Powell said during a press conference that the US economy continues to recover, but at a slower pace. The Fed has improved its forecast for the US economy for 2021-2022. According to the regulator's December report, US GDP will decline by 2.4% this year, grow by 4.2% in 2021 and by 3.2% in 2022. In September, the Fed expected a fall of 3.7% this year and growth of 4% and 3%, respectively, in the next two years.

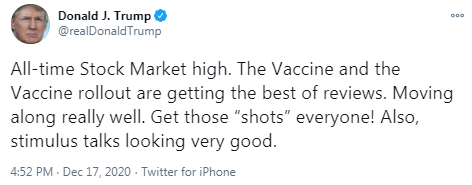

Meanwhile, according to the Wall Street Journal, US congressional leaders are close to agreeing on a stimulus package of about $900 billion. According to informed sources of the newspaper, the package that was discussed on Wednesday will not include assistance to state authorities and protection of companies from claims in connection with the pandemic. At the same time, it is expected that the support measures will include direct payments to citizens.

The pound rose against the dollar. The head of the European Commission (EC), Ursula von der Leyen, said on Wednesday during a speech in the European Parliament about the existence of a "path to an agreement". At the same time, she noted that the parties have not yet managed to settle the issues of fishing and providing equal conditions for competition.

Today, investors are waiting for the announcement of the results of the december meeting of the Bank of England. According to economists ' forecasts, the Bank of England is likely to keep the key rate at 0.1% and will not make changes to the asset purchase program after its increase by 150 billion pounds in november.

According to the business managers surveyed between 27 November and 14 December, the business climate in France has bounced back strongly: at 91, the synthetic indicator has gained 12 points and has returned to its level before the second lockdown (between 90 and 92), while remaining well below its long-term average (100).

Business leaders are significantly less pessimistic than in November about the expected activity for the next three months, whether it is for their sector as a whole or for their own business. This movement can be seen in all sectors surveyed in December (manufacturing industry, services, building construction and retail trade). At the same time, the balances of opinion relating to recent activity have fallen in manufacturing industry, services and especially in retail trade, in connection with the lockdown introduced at the end of October.

At the same time, the employment climate has bounced back slightly. At 86, it has gained two points from November, but still stands well below its pre-crisis level (above 105). This small rebound is mainly due to the rise in the balance of opinion on the expected workforce size in the tertiary sector – in particular retail trade and services exclusive of temporary work agencies – and, to a lesser extent, in manufacturing. However, the drop in the balance on recent workforce size in services exclusive of temporary work agencies has limited this rebound.

eFXdata reports that Bank of America discusses its expectations for this week's BoJ policy meeting.

"The BoJ is expected to keep all key policy targets unchanged. The policy board will likely extend the deadline for its COVID-19 corporate funding support program by 6 months, to Sep 2021," BofA notes.

"Likely absence of major actions by the BoJ in the near future justifies the lack of market interest in its policy. The BoJ's loose monetary policy stance maintains JPY's funding currency status. Since the COVID-19 outbreak, USD has also traded as a funding currency with the Fed focusing on supporting the economy and generating inflation. Further crowding of positioning in risk assets could pose downside risk to cross-yen (but not USD/JPY)," BofA adds.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2308 (1468)

$1.2280 (1358)

$1.2256 (970)

Price at time of writing this review: $1.2227

Support levels (open interest**, contracts):

$1.2114 (1463)

$1.2088 (2048)

$1.2057 (4686)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 8 is 67180 contracts (according to data from December, 16) with the maximum number of contracts with strike price $1,1800 (4686);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3714 (1001)

$1.3665 (1550)

$1.3611 (248)

Price at time of writing this review: $1.3567

Support levels (open interest**, contracts):

$1.3380 (646)

$1.3329 (521)

$1.3300 (865)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 58923 contracts, with the maximum number of contracts with strike price $1,4000 (33120);

- Overall open interest on the PUT options with the expiration date January, 8 is 28394 contracts, with the maximum number of contracts with strike price $1,2800 (4024);

- The ratio of PUT/CALL was 0.48 versus 0.47 from the previous trading day according to data from December, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

RTTNews reports that the Australian Bureau of Statistics said that the jobless rate in Australia came in at a seasonally adjusted 6.8 percent in November, beating expectations for 7.0 percent, which would have been unchanged.

The Australian economy added 90,000 jobs to 12,860,700 last month, blowing away forecasts for an increase of 50,000 jobs following the addition of 178,800 jobs in October.

Full-time employment added 84,200 jobs to 8,725,700 last month after gaining 97,000 in October. Part-time jobs gained 5,800 jobs to 4,135,00 last month after adding 81,800 jobs in October.

Unemployed people decreased by 17,300 to 942,100 and increased by 240,700 over the year to November 2020. The youth unemployment rate increased less than 0.1 pts to 15.6 percent and increased by 4.1 pts over the year to November 2020.

The participation rate came in at 66.1 percent, beating forecasts for 66.0 percent and up from 65.8 percent in the previous month. It increased by 0.2 pts for men to 71.0 percent and by 0.4 pts for women to 61.4 percent.

According to the report from European Automobile Manufacturers Association (ACEA), in November 2020, new car registrations in the European Union fell by 12.0% to 897,692 units, as several European governments introduced new measures to contain the second wave of the COVID‑19 pandemic. As a result, the EU’s four key passenger car markets all posted declines last month. France and Spain suffered double-digit drops (down 27.0% and 18.7% respectively), followed by Italy with a more modest decline (-8.3%). German losses were limited to just -3.0%.

From January to November, the EU passenger car market contracted by 25.5% to roughly 9 million units. This is a decline of more than 3 million units compared to the same period one year ago. Eleven months into the year, the impact of COVID-19 continued to weigh heavily on the cumulative performance of all EU markets, including the four major ones. Spain saw the biggest drop (-35.3%) so far in 2020, followed by Italy (-29.0%), France (-26.9%) and Germany (-21.6%).

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Unemployment rate | November | 7% | 7% |

| 00:30 (GMT) | Australia | Changing the number of employed | November | 178.8 | 50 |

| 07:00 (GMT) | Switzerland | Trade Balance | November | 2.9 | |

| 08:30 (GMT) | Switzerland | SNB Interest Rate Decision | -0.75% | -0.75% | |

| 09:30 (GMT) | Switzerland | SNB Press Conference | |||

| 10:00 (GMT) | Eurozone | Harmonized CPI ex EFAT, Y/Y | November | 0.2% | 0.2% |

| 10:00 (GMT) | Eurozone | Harmonized CPI | November | 0.2% | -0.3% |

| 10:00 (GMT) | Eurozone | Harmonized CPI, Y/Y | November | -0.3% | -0.3% |

| 12:00 (GMT) | United Kingdom | Asset Purchase Facility | 875 | ||

| 12:00 (GMT) | United Kingdom | BoE Interest Rate Decision | 0.1% | 0.1% | |

| 12:00 (GMT) | United Kingdom | Bank of England Minutes | |||

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | December | 5757 | 5598 |

| 13:30 (GMT) | U.S. | Housing Starts | November | 1.53 | 1.53 |

| 13:30 (GMT) | U.S. | Building Permits | November | 1.545 | 1.55 |

| 13:30 (GMT) | U.S. | Philadelphia Fed Manufacturing Survey | December | 26.3 | 20 |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | December | 853 | 800 |

| 15:30 (GMT) | United Kingdom | MPC Member Dr Ben Broadbent Speaks | |||

| 21:45 (GMT) | New Zealand | Trade Balance, mln | November | -500 | |

| 23:30 (GMT) | Japan | National CPI Ex-Fresh Food, y/y | November | -0.7% | -0.9% |

| 23:30 (GMT) | Japan | National Consumer Price Index, y/y | November | -0.4% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.75767 | 0.28 |

| EURJPY | 126.164 | 0.17 |

| EURUSD | 1.21993 | 0.41 |

| GBPJPY | 139.709 | 0.16 |

| GBPUSD | 1.35093 | 0.39 |

| NZDUSD | 0.71134 | 0.41 |

| USDCAD | 1.27365 | 0.31 |

| USDCHF | 0.88487 | -0.05 |

| USDJPY | 103.411 | -0.24 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.