- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 01-09-2011

- JP Morgan and Bank of AMerica still need substantial improvement.

- Ocwen Loan Servicing and Wells Fargo corrected deficiencies, now in need of moderate improvement (vs 'substantial' in 1Q).

- Despite July construction data is mixed bag, it "continue to show some improvement in the private nonresidential sector and persistent weakness in the private residential and public sectors.

- Total nominal construction spending fell 1.3% in July, with weakness spread throughout the various components.

- However, there were significant upward revisions to the construction data reported for May (from 0.3% to 2.5%) and June (from 0.2% to 1.6%), with much of these upward revisions concentrated in the private sector."

The US dollar soared versus the currencies of major trade partners as stronger-than-forecast factory data damped speculation the Federal Reserve may take further steps to stimulate growth, debasing the currency. The ISM manufacturing index dropped to 50.6 in August vs previous figure of 50.9 and expected decline to 48.0.

Earlier the currency rose as U.S. initial claims shaed to 409K for the week ending on August 27 and U.S. construction projects fell 1.3% in July.

The euro plummeted down amid intensified concerns about EU debt crisis.

Those fears increased as yesterday the Expert Committee on the Greek Parliament said that debt situation of Greece is out of control and its budget deficit would widen even if all planned measures taken in time.

A disappointing sale of new Spanish five-year benchmark government bonds put further pressure on the euro in European trading. Spanish bonds fell today as the nation sold 3.62 billion euros ($5.2 billion) of five-year securities. European Central Bank began buying Spanish and Italian debt

Earlier additional pressure on the currency was EU statistics, which showed that Q2 GDP growth of Germany, the largest economy in the eurozone, added only 0.1% compared with rising 1.5% in the previous period.

A European manufacturing gauge based on a survey of purchasing managers in the 17-nation euro region fell to 49 in August from 50.4 in the prior month. It was the weakest reading in two years and below an initial estimate of 49.7 published Aug. 23. A reading below 50 indicates contraction.

Economic growth in Germany, the euro region’s largest economy, slowed in the second quarter as household spending decreased. Germany’s gross domestic product expanded 0.1 percent in the second quarter, down from 1.3 percent in the first three months of the year, the nation’s Federal Statistics Office said today, confirming its initial Aug. 16 estimate.

The franc advanced against all of its 16 most-traded counterparts on signs European economies are slowing.

The loonie rose toward its strongest level in four weeks after the manufacturing report. The U.S. is Canada’s biggest trading partner.

Sales of Ford (F) rose 11%, lower than expected +14%.

Sales of Nissan (NSANY.PK) rose 19.2%, higher than expected +18%.

Sales of General Motors (GM) rose 18%, lower than expected + 19/20%.

Indexes are near zero.

Conglomerats (-0.6%) and Industrial Goods (-0.5%) suffer the largest losses. Gains from Ciena Corp. helped spur action in Technology sector (-0.1%) as the ommunications networking equipment provider posted a surprise quarterly adjusted profit as reduced operating costs helped boost margins.

"The main reason is the accumulation of evidence of weak hiring in late July and August: a sharp deterioration in perceptions of job availability in the latest Conf Board suvey a drop in today's ISM manufacturing employment index another drop in job advertising and a soft ADP report."

US Department of Labor will release nonfarm payrolls data tomorrow at 12:30 GMT. Previously the nonfarm payrolls rose by 117K in July. Median forecast for August figure is +90K.

EUR/USD $1.4300, $1.4315, $1.4400, $1.4500, $1.4515

USD/JPY Y77.00

EUR/JPY Y110.00

GBP/USD $1.6285, $1.6350

USD/CHF Chf0.8000

AUD/USD $1.0650, $1.0700, $1.0750

AUD/JPOY Y81.35

U.S. stock futures were little changed, following a four-day rally for the Standard & Poor’s 500 Index, as investors await a report that may show manufacturing shrank for the first time in two years.U.S. manufacturing probably shrank in August for the first time in two years, economists said before a report today. The Institute for Supply Management’s manufacturing index fell to 48.9 last month from 50.9 in July, according to the median estimate of economists.

Stock futures haven't really reacted to the latest dose of data, which included initial jobless claims for the week ended August 27. Those claims totaled 409,000, which is on par with the 410,000 claims that had been commonly expected among economists.

Data:

ISM Index and Construction are due at 1400GMT. Construction spending is expected to rise 0.2% in July. Housing starts fell in the month, suggesting that residential building continued its downward trend. The ISM manufacturing index is expected to fall to a reading of 48.5 in August after the sharp drop in July. The regional data already released suggest strong contraction. US data continues with the weekly EIA Natural Gas Stocks data at 1430GMT, while late data includes the 2030GMT release of M2 money supply.

EUR/USD $1.4300, $1.4315, $1.4400, $1.4500, $1.4515

USD/JPY Y77.00

EUR/JPY Y110.00

GBP/USD $1.6285, $1.6350

USD/CHF Chf0.8000

AUD/USD $1.0650, $1.0700, $1.0750

AUD/JPOY Y81.35

Data released:

06:00 Germany GDP (Q2) revised 0.1% 0.1% 1.5%

06:00 Germany GDP (Q2) revised Y/Y 2.7% 2.7% 4.9%

06:00 UK Nationwide house price index (August) -0.6% 0.1% 0.2%

06:00 UK Nationwide house price index (August) Y/Y -0.4% - -0.4%

07:45 Italy PMI (August) 47.0 49.1 50.1

07:50 France PMI (August) 49.1 49.3 50.5

07:55 Germany PMI (August) seasonally adjusted 50.9 52.0 52.0

08:00 EU(17) PMI (August) 49.0 49.7 50.4

08:30 UK CIPS manufacturing index (August) 49.0 48.8 49.1

The euro tumbled to the lowest in almost two weeks against the dollar as concern Europe’s sovereign-debt crisis may worsen curbed demand for the currency.

The 17-nation shared currency declined against all but three of its 16 major peers, as Spanish and Italian borrowing costs rose before Spain auctions debt. Economic growth in Germany, the euro region’s largest economy, slowed in the second quarter as data showed household spending declined.

Germany’s economic growth slowed to 0.1 percent in the second quarter, from 1.3 percent in the first three months of the year, the nation’s Federal Statistics Office said today, confirming its initial Aug. 16 estimate.

The yen fell against all but one of its major peers as gains in Asian stocks sapped demand for safer assets.

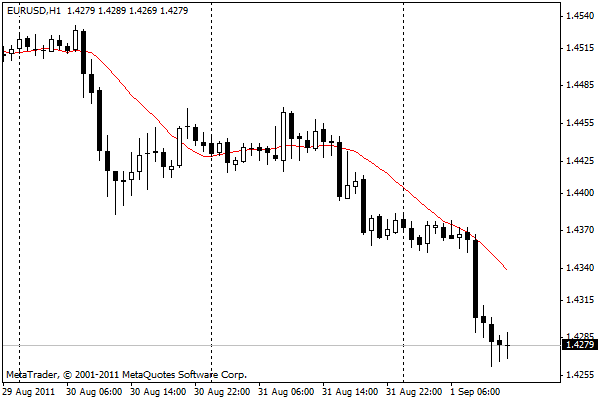

EUR/USD from $1.4370 retreated to current $1.4260.

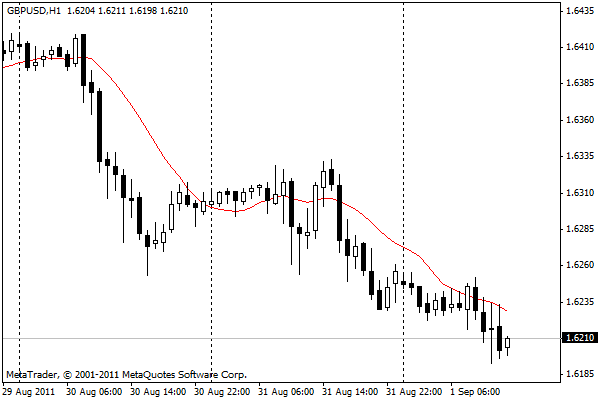

GBP/USD also retreats after it earlier tested $1.6250 and currently holds at $1.6200.

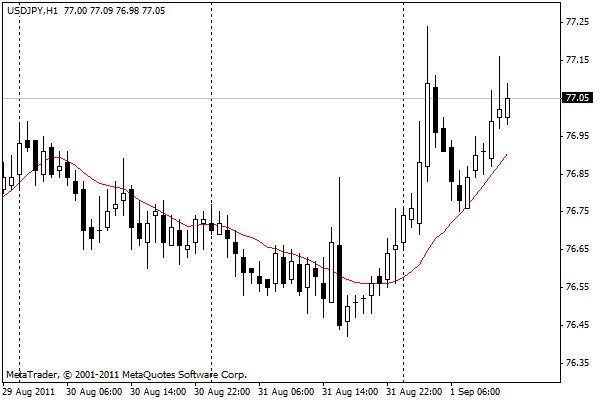

USD/JPY tries to hold above Y77.00.

US data starts at 1230GMT with Jobless Claims, Non-farm Productivity and Unit Labor Costs data. Initial jobless claims are expected to fall 7,000 to 410,000 in the August 27 week, as the impact of the Verizon strike should be diminished. Non-farm productivity is expected to be revised down to a 0.6% decline for the second quarter based on the downward revision to growth. Unit labor costs are expected to be revised up to +2.6% as a result.

ISM Index and Construction are due at 1400GMT. Construction spending is expected to rise 0.2% in July. Housing starts fell in the month, suggesting that residential building continued its downward trend. The ISM manufacturing index is expected to fall to a reading of 48.5 in August after the sharp drop in July. The regional data already released suggest strong contraction. US data continues with the weekly EIA Natural Gas Stocks data at 1430GMT, while late data includes the 2030GMT release of M2 money supply.

- Consolidation of course has costs, but helps confidence;

- We have ensured price stability

Majors close:

Nikkei 225 +1.30 (+0.01%) 8,955

FTSE 100 +125.87 (+2.39%) 5,395

CAC 40 +97.02 (+3.07%) 3,257

DAX +140.93 (+2.50%) 5,785

Dow +53.58 (+0.46%) 11,613.53

Nasdaq +3.35 (+0.13%) 2,579

S&P 500 +5.97 (+0.49%) 1,219

10 Year 2.22% +0.04

Oil +0.04 (+0.04%) $88.94

Gold -5.10 (-0.28%) $1,826.60

Japanese stocks swung between gains and losses, sending the Nikkei 225 (NKY) Stock Average to the biggest monthly drop in a year, after lower U.S. consumer confidence stoked speculation the Federal Reserve will take further steps to stimulate growth.

For the month, the Nikkei has fallen 8.9 percent, the biggest monthly loss since May 2010, while the Topix is down 8.4 percent.

Honda Motor Co., a carmaker that gets more than 80 percent of its revenue abroad, rose 1.5 percent, giving the biggest support for the Topix index.

Nintendo Co., the world’s largest maker of video-game players, rose 3.9 percent after SMBC Nikko Securities Inc. raised its rating on the company.

Taiheiyo Cement Corp. (5233), a cement maker, plunged 15 percent after saying it plans to sell shares to the public.

Sony Corp. (6758), Japan’s No. 1 exporter of consumer electronics, slid 1.8 percent to 1,665 yen.

Stocks also fell after Japan’s industrial production in July gained less than economists had expected.

European stocks gained for a third day, trimming their biggest monthly drop since 2008, as U.S. business activity and factory orders topped forecasts and Federal Reserve minutes showed some policy makers wanted to add to stimulus measures.

Bouygues SA (EN) soared 16 percent after announcing a buyback.

Smith & Nephew Plc (SN/), Europe’s biggest maker of artificial hips and knees, rallied 4.9 percent amid takeover speculation.

UPM- Kymmene Oyj, Europe’s second-largest papermaker, rose 7.5 percent after saying it will close mills to cut capacity.

Deutsche Telekom AG (DTE) sank 7.6 percent as the U.S. sued to block AT&T Inc.’s acquisition of its T-Mobile USA Inc. unit.

A report today showed German unemployment fell for a 26th straight month in August and the jobless rate held at 7 percent, the lowest since records for a reunified Germany began in 1991.

A gauge of carmakers surged 4.3 percent for the second- biggest gain in the Stoxx 600.

Bayerische Motoren Werke AG (BMW), the largest maker of luxury vehicles, rose 3.9 percent to 56.35 euros while Pirelli & C.

SpA, Europe’s third-largest maker of tires, climbed 6.7 percent to 5.83 euros.

Valeo SA (FR), France’s second-largest auto-parts maker, jumped 8.8 percent to 36.79 euros, the biggest increase in six months.

Stocks lost momentum Wednesday afternoon after enjoying a strong rally earlier in the day. The seesaw ride was fitting on this last day of what has been an extremely volatile month for Wall Street. Investors today digested several economic reports on the labor market and manufacturing.

The Dow was led higher by shares of manufacturing heavyweights Caterpillar (CAT, Fortune 500) and Alcoa (AA, Fortune 500), both up more than 3%, following two strong reports on factory orders and the Chicago purchasing managers' index.

But shares of AT&T (T, Fortune 500) dropped more than 4.5% following news that the U.S. Justice Department had filed an antitrust suit to block the telecommunications giant's proposed buyout of T-Mobile. Sprint (S, Fortune 500) shares jumped 7% on the news as well.

Economy: Challenger, Gray & Christmas said the number of planned job cuts fell 23% in August. And private-sector payrolls rose by 91,000 in August, according to payroll processor ADP. Economists were expecting the private sector to hire 100,000 new workers during the month, down from the 109,000 in the prior month.

The two reports come ahead of Friday's highly anticipated August jobs report. A CNNMoney survey of 17 economists forecasts that the U.S. economy added 80,000 jobs, and the unemployment rate remained at 9.1% in August.

In other economic data, the Commerce Department said June factory orders jumped 2.4%, much better than the 1% decline that economists were are looking for.

The Chicago purchasing managers index dropped to a reading of 56.5 in July compared with a reading of 58.8 the month before. However the number was well above the forecasted reading of 53.0 that economists had expected.

The franc rose as the Swiss National Bank refrained from announcing new steps to curb its gains, after intervening or referring to the currency’s strength on the first three Wednesdays of August.

The dollar erased earlier losses against the euro as better-than-forecast economic data damped bets the Federal Reserve may take further steps to stimulate growth.

The euro fell as US Commerce Department data showed orders placed with U.S. factories rose in July by the most in four months, increasing 2.4%.

The Institute for Supply Management-Chicago Inc.’s business barometer fell less than projected this month, declining to 56.5.

Data from ADP Employer Services earlier showed companies in the U.S. added 91,000 workers to payrolls in August, less than the 100,000 forecast. A government report on Sept. 2 is projected to show U.S. nonfarm payroll growth slowed to 70,000 this month from 117,000 in July.

The euro weakened today as data showed unemployment in the region held at 10% in July from the previous month.

European data starts at 0600GMT with detailed Q2 GDP data and H1 Maastricht debt data from Germany. At 0730GMT, ECB Executive Board member Juergen Stark is due to take part on a panel "Europe and Global Competition", in Alpbach, Austria. This morning also sees final services PMI releases from France at 0748GMT, Germany at 0753GMT and the main EMU release at 0758GMT, all of which are expected to remain unrevised from the preliminary readings.

UK data starts at 0600GMT with the latest UK Nationwide House Price data is due, which is expected to be unchanged m/m for August. At 0815GMT, Bank of England Executive Director Market Paul Fisher delivers a speech at a Cambridge/IESEG Conference on crisis lessons, which is an academic/central bank conference, closed to media and sponsored by the European Central Bank. With papers being delivered on credit, liquidity risks, sovereign defaults and the like the conference is highly topical, however. The text of Fisher's speech will be released. UK manufacturing PMI for August is then released at 0830GMT and is expected to slip to a reading of 48.6 after having already contracted in July, dropping below the key 50 level. The data are raising doubts over how strongly growth will rebound in Q3 after Q2 was hit by one-off effects including the Royal Wedding and the supply side disruptions from the Japanese tsunami.

US data starts at 1230GMT with Jobless Claims, Non-farm Productivity and Unit Labor Costs data. Initial jobless claims are expected to fall 7,000 to 410,000 in the August 27 week, as the impact of the Verizon strike should be diminished. Non-farm productivity is expected to be revised down to a 0.6% decline for the second quarter based on the downward revision to growth. Unit labor costs are expected to be revised up to +2.6% as a result.

ISM Index and Construction are due at 1400GMT. Construction spending is expected to rise 0.2% in July. Housing starts fell in the month, suggesting that residential building continued its downward trend. The ISM manufacturing index is expected to fall to a reading of 48.5 in August after the sharp drop in July. The regional data already released suggest strong contraction. US data continues with the weekly EIA Natural Gas Stocks data at 1430GMT, while late data includes the 2030GMT release of M2 money supply.

Despite some help by the slightly better-than-expected China PMI data, flows are light ahead of the US jobs data Friday and the long Labor Day weekend. The S&P Sep contract was last higher by 2.00 points at 1219.70, with the Nasdaq Sep contract ahead by 7.25 points at 2248.00. Dow futures are also higher, up 26 points at 11629.

Resistance 3: Y78.00/10

Resistance 2: Y77.70

Resistance 1: Y77.10

Current price: Y76.79

Support 1:Y76.50

Support 2:Y75.90

Support 3:Y75.50

Resistance 3: Chf0.8520

Resistance 2: Chf0.8400

Resistance 1: Chf0.8260

Current price: Chf0.8050

Support 1: Chf0.8000

Support 2: Chf0.7880

Support 3: Chf0.7810

Comments: Strong resistance at Chf0.8260 (channel line from the mid-Feb). Further rise may extend to Chf0.8400 and Chf0.8520 (Jul 01 high). Support is near Chf0.8000/10 (earlier resistance). Friday's lows come at Chf0.7880/85 with a break under targets Chf0.7810 (Aug 19 lows).

Resistance 3:$1.6460

Resistance 2:$1.6330

Resistance 1: $1.6260

Current price: $1.6229

Support 1:$1.6200

Support 2: $1.6160

Support 3: $1.6110

Comments: Rate remains under pressurel. Support is - at $1.6200/10 (Aug 26 lows). Below losses may widen to $1.6160 (Aug 12 lows). Closest resistance at $1.6260 (former support), ahead of Aug 31 high $1.6330. Strong resistance is around $1.6460 (61.8% Fibo of decline from Aug 19 high). Back above will target $1.6570 (Aug 12 high). Stronger resistance comes at $1.6620 (Aug 19 high).

Resistance 3: $1.4580

Resistance 2: $1.4550

Resistance 1: $1.4470

Current price: $1.4370

Support 1: $1.4350

Support 2: $1.4330

Support 3: $1.4260

Comments: Rate remains under pressure. Support is around yesterday's lows on $1.4350, stronger - at $1.4330 (Friday's low). Break under opens the way to Aug 19 low on $1.4260. Closest resistance is around $1.4470. Break above $1.4550 opens the way to $1.4580 (Jul 04 high).

Spreadbetters Cantor Index are calling the FTSE up 6, the DAX up 3, the CAC up 24 and the Eurostoxx 50 up 17.

Nikkei 225 +1.30 (+0.01%) 8,955

FTSE 100 +125.87 (+2.39%) 5,395

CAC 40 +97.02 (+3.07%) 3,257

DAX +140.93 (+2.50%) 5,785

Dow +53.58 (+0.46%) 11,613.53

Nasdaq +3.35 (+0.13%) 2,579

S&P 500 +5.97 (+0.49%) 1,219

10 Year 2.22% +0.04

Oil +0.04 (+0.04%) $88.94

Gold -5.10 (-0.28%) $1,826.60

06:00 Germany GDP (Q2) revised 0.1% 1.5%

06:00 Germany GDP (Q2) revised Y/Y 2.7% 4.9%

06:00 UK Nationwide house price index (August) 0.1% 0.2%

06:00 UK Nationwide house price index (August) Y/Y - -0.4%

07:45 Italy PMI (August) 49.1 50.1

07:50 France PMI (August) 49.3 50.5

07:55 Germany PMI (August) seasonally adjusted 52.0 52.0

08:00 EU(17) PMI (August) 49.7 50.4

08:30 UK CIPS manufacturing index (August) 48.8 49.1

12:30 USA Jobless claims (week to 27.08) 407K 417K

12:30 USA Productivity (Q2) revised -0.5% 1.8%

12:30 USA Unit labour cost (Q2) revised 2.4% 0.7%

14:00 USA ISM Mfg PMI (August) 48.0 50.9

14:00 USA Construction spending (July) 0.0% 0.2%

20:30 USA M2 money supply (22.08), bln - +5.1

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.