- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-09-2011

EUR/USD

Offers: $1.4140, $1.4180/85, $1.4220, $1.4240/50

Bids: $1.4100, $1.4080, $1.4055/50, $1.4015/00

GBP/USD

Offers: $1.6180/85, $1.6210/15, $1.6230, $1.6250/55, $1.6280

Bids: $1.6070, $1.6050/40, $1.6010/00, $1.5980, $1.5950

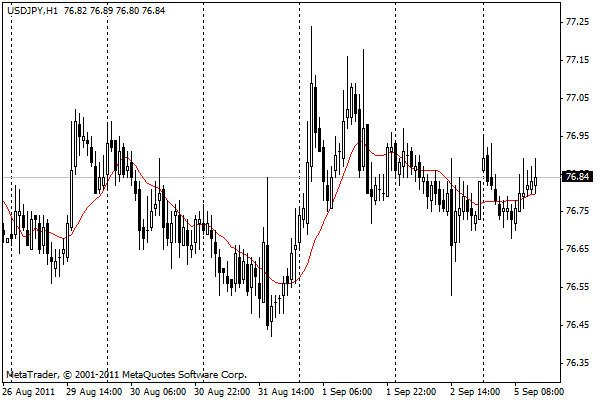

USD/JPY

Offers: Y77.00, Y77.20/25, Y77.50/55, Y77.70

Bids: Y76.55/50, Y76.45/40, Y76.25,

EUR/JPY

Offers: Y109.00, Y109.50/60, Y109.90/110.10, Y110.40/50

Bids: Y108.15/00, Y107.80, Y107.00, Y106.85/70

Data:

There are no any economic data from US and Canada as those countries' financial markets are closed in observance of Labor Day.

ECB responded to the crisis in timely, effective way

EUR/USD: $1.4200, $1.4250, $1.4300

USD/JPY: Y76.00, Y76.10, Y77.00

GBP/USD: $1.6200

AUD/USD: $1.0500, $1.0640, $1.0700

financial system in most fragile stae since WW2.

The dollar rose after an election loss for Germany’s ruling party stoked concern that support will fade for bailouts of the euro area’s indebted states, supporting demand for refuge currencies.

The euro slid to a three-week low versus the yen after German Chancellor Angela Merkel failed to sway voters in her home state.

“The U.S. economy is sluggish, the European debt concern is not going away in a hurry, so market sentiment is not going to improve for a very long time,” said Alex Sinton, a senior dealer at ANZ National Bank Ltd..

European Central Bank President Jean-Claude Trichet is scheduled to speak in Paris today before the ECB’s policy meeting on Sept. 8.

“If the ECB takes away the tightening bias, it’s going to take away some support out of the euro,” ANZ’s Sinton said. “You would see the euro moving down to the $1.4010 area.”

EUR/USD failed to break above $1.4200 and weakened to $1.4109.

GBP/USD was between $1.6170/90 before fell to $1.6110.

USD/JPY held within the range, limited by Y76.70/80, before declining to Y76.85.

At 08:30 GMT EU Sentix Investor Confidence is due to comes for September.

UK releases its PMI services index at 08:30 GMT too.

EU Retail sales data will come at 09:00 GMT.

There are no any economic data from US and Canada as those countries' financial markets are closed in observance of Labor Day.

Offers: $1.4100/10, $1.4080, $1.4060

GBP/USD:

Offers: $1.6180/85, $1.6200/10, $1.6225/30

Bids: $1.6135/30, $1.6110/00, $1.6070

Offers: Y76.95/00, Y77.25, Y77.50/55

Bids: Y76.65/70, Y76.50/55, Y76.25

AUD/USD:

Bids: $1.0570, $1.0550/60

EUR/JPY:

Offers: Y109.00/10

EUR/GBP

Offers: stg0.8770/75

Bids: stg0.8740, stg0.8725/20

EUR/USD: $1.4200, $1.4250, $1.4300

USD/JPY: Y76.00, Y76.10, Y77.00

GBP/USD: $1.6200

AUD/USD: $1.0500, $1.0640, $1.0700

Global markets reacted negatively to US data released Friday, stoking bears’ fears of a slowing economy while bolstering the hopes of investors looking for the Federal Reserve to pour more funds into the financial system.

In Asia, technology companies and carmakers were among the biggest losers, dragged down by concerns about the global economic recovery. Falling US sales weighed on Japanese carmakers, which are suffering from the yen’s strength, but South Korean carmakers were higher on the back of robust US sales.

Hong Kong’s Hang Seng index declined as banks mirrored losses in their US peers overnight.

Mainland lenders on the Shanghai exchange were also weighed down by concerns that Beijing is likely to maintain its tightening policies in the face of high inflation. Some investors are already looking ahead to August inflation figures due out next week.

In Sydney, mining companies lost ground after a fall in metals prices.

The MSCI Asia Pacific index snapped a six-day advance to drop 0.9 per cent, and Japan’s Nikkei fell 1.2 per cent. Australia’s S&P/ASX 200 index dropped 1.5 per cent.

Investors moved to lock in profits ahead of August US non-farm payrolls figures.

Germany’s Dax eroded gains from earlier in the week on Friday amid continuing worries over the eurozone economy and slowing growth in Germany.

The index, flat on the week at 5,538.33, has fallen more than 26 per cent since its peak in May, as European and US economic data that failed to meet expectations have added to concerns that the global economic recovery is at risk.

Deutsche Bank fell 4.9 per cent to €26.30 and Commerzbank dropped 5.2 per cent to €1.93.

Eon and RWE , Germany’s biggest utilities, fell 0.7 per cent to €14.32 and 1.1 per cent to €24.38, respectively.

The FTSE Eurofirst 300’s biggest riser this week was French company Bouygues , which made its largest gains in three years as it announced plans for a share buy-back. Bouygues’ stock rose 15.3 per cent to €25.61 over the week.

The vulnerable European car market fell on Thursday, headed by Fiat after Citigroup cut its rating from “buy” to “hold”.

Daimler also trailed, sinking 0.4 per cent to €34.00.

Portuguese company EDP rose 14.9 per cent to €2.47 as GDF Suez said it was considering a bid for the Portuguese government’s stake in the company.

The FTSE Eurofirst 300 index closed up 3.2 per cent over the week to 948.62.

Weak employment data and reports that a government regulator would bring mortgage-related lawsuits against US-based banks, reversed what had been a week of strong gains on Wall Street.

By Wednesday the S&P 500 index had recorded four successive days of gains for the first time since late June, and by Monday the index had closed above 1,200 for the first time since August 4. But the S&P 500 index was up only 0.5 per cent for the week at 1,183.58, far beneath the week high of 1,230 on Wednesday. Financial stocks in the index were down 0.7 per cent for the week.

The Dow Jones Industrial Average was up just 0.3 per cent for the week at 11,315.53, but the Nasdaq Composite index rose 1 per cent to 2,505.22.

US non-farm payrolls report showed zero job growth in the country’s private sector last month, undershooting expectations of about 70,000 new jobs. The previous two months’ figures were also revised lower by 58,000, adding to the general gloom.

“Employment data were weaker than expected, there is a renewed focus on Europe and this week we were again made aware of our country’s hostile regulatory environment,” said Karl Mills, chief investment officer at Jurika, Mills & Keifer. “The market also anticipates next Thursday’s speech from Barack Obama.” he said.

Bank of America, down 4.6 per cent lower for the week, was among the biggest fallers in the S&P 500.

Goldman fell 4.3 per cent for the week.

JPMorgan shares were down 3.6 per cent loss for the week.

Citigroup was down 3.2 per cent lower for the week.

Netflix fell 4.9 per cent for the week.

Meanwhile, Newmont Mining was a top performer, up 3.2 per cent for the week.

The euro lost ground last week as concerns over eurozone growth and the region’s fiscal crisis weighed on the currency.

The euro suffered as surveys of manufacturing activity across the region came in weaker than expected, revealing that the slowdown in activity had spread from the periphery of the eurozone to its core, with German manufacturing growing at its slowest pace in nearly two years.

This raised speculation that the European Central Bank might abandon its hawkish stance on interest rates at its policy meeting next week and might even loosen monetary policy and cut rates in a bid to stimulate growth in the months ahead.

Adding pressure on the euro were fresh worries over the eurozone debt crisis.

There was sluggish demand at an auction of Spanish government debt and reports that international debt inspectors from the EU, International Monetary Fund and ECB had paused their review of Greece’s austerity reforms, potentially delaying a second bail-out package.

Over the week, the euro fell 1.9% against the dollar, lost 0.9% against the pound and was 1.7% lower against the yen.

The Swiss franc was the biggest beneficiary as investors sought a haven from renewed concerns over eurozone government debt and growth in the region.

The franc rose as speculation receded that the Swiss National Bank would intervene directly in the market and sell the franc.

Indeed, traders said the SNB, which before last week had been active in the forwards market to drive down interest rates and suppress demand for the franc, had pulled back from the interest rate market, giving investors a green light to buy the currency.

Over the week it rose 5% against the euro and climbed 3.1% against the dollar.

The dollar found haven support even as disappointing US jobs data stoked more concern about the health of the US economy and raised speculation of a further round of quantitative easing.

U.S. payrolls were unchanged last month, the weakest reading since September 2010, after an 85,000 gain in July that was less than initially estimated, Labor Department data showed today. The median forecast called for a rise of 65,000.

Fed Chairman Ben S. Bernanke said last week the central bank still has tools to boost a recovery that has been weaker than forecast, while sticking to his view that growth will pick up. He spoke at a conference in Jackson Hole, Wyoming. At last year’s event, he foreshadowed the Federal Open Market Committee’s second round of quantitative easing, the purchase of $600 billion of Treasuries from November through June.

Minutes of policy makers’ last meeting on Aug. 9 showed some FOMC members favored more aggressive action to stimulate the economy. The minutes were released Aug. 30.

On the week, the dollar rose 0.2% against the yen and was up 1% against the pound.

Resistance 3: Y78.50

Resistance 2: Y77.70

Resistance 1: Y77.00

Current price: Y76.72

Support 1: Y76.50

Support 2: Y75.90

Support 3: Y75.20

Resistance 3: Chf0.8180

Resistance 2: Chf0.8080/90

Resistance 1: Chf0.7960

Current price: Chf0.7856

Support 1: Chf0.7760

Support 2: Chf0.7710

Support 3: Chf0.7650

Comments: Rate currently weakens after it failed to set above Chf0.7880. Minor support comes at Chf0.7760, then around Friday's lows on Chf0.7710/00. Stronger level - at Chf0.7650 (50% Fibo of Chf0.7060 - Chf0.8240 rise). Resistance is near hourly Thuirsday's high on Chf0.7960. Further rise may extend to $Chf0.8080/90 (Sep 01 high). Key resistance comes at CHf0.8180 (trend resistance line from Jun 01'2010).

Resistance 3: $1.6450

Resistance 2: $1.6330/60

Resistance 1: $1.6250

Current price: $1.6177

Support 1: $1.6130

Support 2: $1.6110

Support 3: $1.6070

Comments: Rate tested Thursday's lows on $1.6130 and recovered a bit. If sales resume there is a risk of challenging the $1.6110 Aug 11 low and $1.6070 Jul 20 low. Resistance is near Friday's high on $1.6250/60. Further resistance comes at Aug 31 high at $1.6330 and Aug 29 high on $1.6450/55.

Resistance 3: $1.4380

Resistance 2: $1.4280/90

Resistance 1: $1.4200

Current price: $1.4147

Support 1: $1.4130

Support 2: $1.4100

Support 3: $1.4050

Nikkei -110.06 (-1.21%) 8,951

FTSE-100 -126.62 (-2.34%) 5,292

DAX -192.30 (-3.36%) 5,538

CAC -117.30 (-3.59%) 3,149

Dow -253.31 (-2.20%) 11,240

Nasdaq -65.71 (-2.58%) 2,480.33

S&P500 -30.45 (-2.53%) 1,174

10-Years 2.00% -0.15

Oil -2.10 (-2.37%) $86.65

Gold +58.70 (+3.21%) $1,886.70

07:45 Italy PMI services (August) 49.2 48.6

07:50 France PMI services (August) 56.1 54.2

07:55 Germany PMI services (August) seasonally adjusted 50.3 52.9

08:00 EU(17) PMI services (August) 51.5 51.6

08:30 UK CIPS services index (August) 54.5 55.4

09:00 EU(17) Retail sales (July) adjusted -0.1% 0.9%

09:00 EU(17) Retail sales (July) adjusted Y/Y 0.1% -0.4%

Canada Labour Day

USA Labour Day

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.