- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-09-2011

The stock market is sitting at an afternoon low with a 2% loss. The aggressive sell-off came in the wake of a disappointing jobs report, which has been regarded by many as a reflection of the broader economy's weakness.

US currency recovered from lows, printed earlier ersus the Swiss franc and yen following the U.S. employment unexpectedly stagnated in August as investors bet the Federal Reserve will take further steps to stimulate growth.

The greenback headed for its first weekly loss in a month versus the franc amid speculation the Fed may start a third round of asset purchases, or quantitative easing.

“This number couldn’t get any worse; the nonfarm payrolls report makes QE3 in September a near certainty,” said Kathy Lien at GFT Forex. “This number was abysmally weak.”

U.S. payrolls were unchanged last month, the weakest reading since September 2010, after an 85,000 gain in July that was less than initially estimated, Labor Department data showed today. The median forecast called for a rise of 65,000.

Fed Chairman Ben S. Bernanke said last week the central bank still has tools to boost a recovery that has been weaker than forecast, while sticking to his view that growth will pick up. He spoke at a conference in Jackson Hole, Wyoming. At last year’s event, he foreshadowed the Federal Open Market Committee’s second round of quantitative easing, the purchase of $600 billion of Treasuries from November through June.

Minutes of policy makers’ last meeting on Aug. 9 showed some FOMC members favored more aggressive action to stimulate the economy. The minutes were released Aug. 30.

The euro fell on concern Europe’s debt crisis is worsening.

The euro weakened as survey showed factory orders in Germany, Europe’s biggest economy, likely decreased 1% in July from the prior month. The Economy Ministry will report the data on Sept. 6.

Stocks failed to sustain a recent move off of their lows. As a result, they have drifted back toward the depths that were set in the opening minutes of trade. For the second straight session financials are in the worst sector.

GBP/USD holds at $1.6202 area just ahead of the London fixing. rate earlier printed session lows on $1.6175. Residual bids seen at $1.6170 area with more at $1.6150.

EUR/JPY under pressure around Y109.12, a bit higher the intraday low Y109.04. Downside bids reported at Y109.10/00 (Y109.02 - 19 Aug low) ahead of bids at Y108.60/50 and Y108.10/00 (Y108.03 - 11 Aug low). Offers placed at Y109.90/00 ahead of Y110.45/50 (Y110.38/73 - 5, 21 day MA's/Tenkan line). Break above opens a move towards Y110.90/00.

"August payroll data is weaker than expected and offers support for Fed policymakers who want to provide additional accommodation to a flagging recovery."

EUR/USD $1.4150, $1.4280, $1.4295, $1.4305, $1.4310, $1.4350, $1.4400

USD/JPY Y76.00, Y76.35, Y76.70, Y76.80, Y76.90, Y77.05, Y77.50

GMP/USD $1.6310

EUR/GBP stg0.8900

USD/CHF Chf0.7900, Chf0.7930

EUR/CHF Chf1.1500

AUD/USD $1.0700, $1.0615

AUD/CHF Chf0.8585

Employment in the U.S. unexpectedly stagnated in August and the jobless rate held at 9.1 percent as American employers became less confident in the strength of the recovery.Payrolls were unchanged last month, the weakest reading since September 2010, after an 85,000 gain in July that was les than initially estimated, Labor Department data showed.

Data:

EUR/USD:

EUR/USD $1.4150, $1.4280, $1.4295, $1.4305, $1.4310, $1.4350, $1.4400 USD/JPY Y76.00, Y76.35, Y76.70, Y76.80, Y76.90, Y77.05, Y77.50

GMP/USD $1.6310

EUR/GBP stg0.8900

USD/CHF Chf0.7900, Chf0.7930

EUR/CHF Chf1.1500

AUD/USD $1.0700, $1.0615

AUD/CHF Chf0.8585

- says talks with troika in friendly climate

Data released:

06:00 Germany GDP (Q2) revised 0.1% 0.1% 1.5%

06:00 Germany GDP (Q2) revised Y/Y 2.7% 2.7% 4.9%

06:00 UK Nationwide house price index (August) -0.6% 0.1% 0.2%

06:00 UK Nationwide house price index (August) Y/Y -0.4% - -0.4%

07:45 Italy PMI (August) 47.0 49.1 50.1

07:50 France PMI (August) 49.1 49.3 50.5

07:55 Germany PMI (August) seasonally adjusted 50.9 52.0 52.0

08:00 EU(17) PMI (August) 49.0 49.7 50.4

08:30 UK CIPS manufacturing index (August) 49.0 48.8 49.1

The Swiss franc and the yen strengthened as talks between Greece and a visiting troika of international inspectors has been suspended over a dispute regarding Greek deficit targets.

before data forecast to show that U.S. job growth slowed last month and on reports the Federal government will sue banks over mortgage-backed securities.

The franc gained for a third day against the euro as Asian stocks and U.S. equity futures declined, spurring demand for safer assets. The euro extended its biggest weekly loss versus the dollar in two months before a German report next week that economists said will show factory orders fell.

The MSCI Asia Pacific Index of shares retreated 1 percent, snapping a six-day gain. Futures on the Standard & Poor’s 500 Index slipped 0.3 percent.

EUR/USD from $1.4280 retreated to current $1.4220.

GBP/USD currently holds at $1.6200.

USD/JPY remains under Y77.00.

At 1230GMT, US non-farm payrolls are forecast to rise only 70,000 for August after the 117,000 increase in July, while the unemployment rate is expected to stay at 9.1%. The strike at Verizon should have a large impact on payrolls this month. Hourly earnings are seen rising 0.2% after see-sawing sharply in the last three months. The average workweek is expected to hold steady at 34.3 hours for another month.

The US dollar soared versus the currencies of major trade partners as stronger-than-forecast factory data damped speculation the Federal Reserve may take further steps to stimulate growth, debasing the currency. The ISM manufacturing index dropped to 50.6 in August vs previous figure of 50.9 and expected decline to 48.0.

Earlier the currency rose as U.S. initial claims shaed to 409K for the week ending on August 27 and U.S. construction projects fell 1.3% in July.

The euro plummeted down amid intensified concerns about EU debt crisis.

Those fears increased as yesterday the Expert Committee on the Greek Parliament said that debt situation of Greece is out of control and its budget deficit would widen even if all planned measures taken in time.

A disappointing sale of new Spanish five-year benchmark government bonds put further pressure on the euro in European trading. Spanish bonds fell today as the nation sold 3.62 billion euros ($5.2 billion) of five-year securities. European Central Bank began buying Spanish and Italian debt

Earlier additional pressure on the currency was EU statistics, which showed that Q2 GDP growth of Germany, the largest economy in the eurozone, added only 0.1% compared with rising 1.5% in the previous period.

A European manufacturing gauge based on a survey of purchasing managers in the 17-nation euro region fell to 49 in August from 50.4 in the prior month. It was the weakest reading in two years and below an initial estimate of 49.7 published Aug. 23. A reading below 50 indicates contraction.

Economic growth in Germany, the euro region’s largest economy, slowed in the second quarter as household spending decreased. Germany’s gross domestic product expanded 0.1 percent in the second quarter, down from 1.3 percent in the first three months of the year, the nation’s Federal Statistics Office said today, confirming its initial Aug. 16 estimate.

The franc advanced against all of its 16 most-traded counterparts on signs European economies are slowing.

The loonie rose toward its strongest level in four weeks after the manufacturing report. The U.S. is Canada’s biggest trading partner.

UK data at 0830GMT includes Q2 Construction Orders data as well as the August Construction PMI.

At 1230GMT, US non-farm payrolls are forecast to rise only 70,000 for August after the 117,000 increase in July, while the unemployment rate is expected to stay at 9.1%. The strike at Verizon should have a large impact on payrolls this month. Hourly earnings are seen rising 0.2% after see-sawing sharply in the last three months. The average workweek is expected to hold steady at 34.3 hours for another month.

Nikkei +105.60 (+1.18%) 9,060.80

FTSE-100 +24.12 (+0.45%) 5,418.65

DAX -54.22 (-0.94%) 5,730.63

CAC 9.07 (+0.28%) 3,265.83

Dow -119.96 (-1.03%) 11,493.60

Nasdaq -33.42 (-1.30%) 2,546.04

S&P500 -14.47 (-1.19%) 1,204.42

10-Years 2.132% -0.091

Oil -0.030 (-0.03%) 88.780

Gold -4.300 (-0.23%) 1,827.400

Asian equity markets were mostly higher on the first trading day of the new month

The sentiment was supported by rise of US stocks the day before and amid speculations the U.S. Federal Reserve may use a range of tools to provide additional monetary stimulus if needed.

The input price components of the Chinese PMI data showed that inflation remained elevated in July. The Chinese government has been acting to curb inflation by tightening monetary policy, prompting worries of a hard-landing for the economy.

Gainers on Thursday included exporters, with shares of technology firm Samsung Electronics Co. gaining 3.6% in South Korea as well as Casio Computer Co. climbed 3.9% and Kyocera Corp. rose 2.3% in Tokyo.

The Japanese government announced it would invest $2.6 billion into a major new small-flat-screen joint venture linking Sony Corp. (+1.98%), Toshiba Corp. (+0.91%) and Hitachi Ltd. (+0.97%). The merged entity will be the world’s largest maker of small panels used in smartphones and tablet PCs. All three companies suffered losses on small panels until last

year so the merger will allow them to focus on their main operations.

European indexes closed Thursday higher in the wake of higher-than-expected US ISM manufacturing data

Earlier today the markets plummeted down amid intensified concerns about EU debt crisis.

Those fears increased as yesterday the Expert Committee on the Greek Parliament said that debt situation of Greece is out of control and its budget deficit would widen even if all planned measures taken in time.

Today European Central Bank began buying Spanish and Italian debt.

Earlier additional pressure on the markets was EU statistics, which showed that Q2 GDP growth of Germany, the largest economy in the eurozone, added only 0.1% compared with rising 1.5% in the previous period.

A European manufacturing gauge based on a survey of purchasing managers in the 17-nation euro region fell to 49 in August from 50.4 in the prior month. It was the weakest reading in two years and below an initial estimate of 49.7 published Aug. 23. A reading below 50 indicates contraction.

Economic growth in Germany, the euro region’s largest economy, slowed in the second quarter as household spending decreased. Germany’s gross domestic product expanded 0.1 percent in the second quarter, down from 1.3 percent in the first three months of the year, the nation’s Federal Statistics Office said Thursday, confirming its initial Aug. 16 estimate.

Nevertheless, strong US manufacturing data from ISM significantly supported the European equities.

U.K. banks led the gains on hopes that major reforms will be delayed, while French media conglomerate Lagardere SCA tumbled.

Shares of Royal Bank of Scotland Group PLC soared 8.2%, shares of Lloyds Banking Group PLC jumped 6.2% and shares of Barclays PLC added 5.6% in London. The moves came after the Financial Times reported that lenders will likely avoid any major restructuring until after a general election in 2015.

Financial-services group Hargreaves Lansdown PLC soared 17.7% after reporting a sharp rise in profit and saying planned changes to U.K. fund rules shouldn’t hurt its earnings.

Shares of Lagardere tumbled 11.1% after the conglomerate warned that profit for the year will fall short of expectations amid problems for its sports division.

Blue Chip stocks ended the day in the red zone amid mixed reaction on ISM manufacturing report

Economy: The markets affected today by the stronger-than-forecast factory data as it damped speculation that the Federal Reserve may take further steps to stimulate growth. The ISM manufacturing index dropped to 50.6 in August vs previous figure of 50.9 and expected decline to 48.0.

Earlier the U.S. initial claims for the week ending on August 27 were slightly better than expected (409K vs. forecast 410K), but hadn’t significant impact on the futures.

Another report showed the U.S. construction projects fell 1.3% in July vs. previous rise by 1.6% and forecast of unchanged figure.

Corporate news: All S&P groups dropped today. Conglomerats (-2.0%) and Industrial Goods (-1.8) suffer the largest losses. Gains from Ciena Corp. (CIEN +20.18%), helped spur action in Technology sector (-1.3%) as the communications networking equipment provider posted a surprise quarterly adjusted profit as reduced operating costs helped boost margins.

Major automakers Ford (F -2.43%), Toyota (TM -2.93%), GM (GM -4.17) reported sales figures for August. The figures came in a bit short of forecasts.

Retailers were among Thursday's top performers, including shares of Macy's (M +2.08%) and Costco (COST +1.20%) after both companies reported better-than-expected same-store sales for August. Both Macys and Costco shares rose on the day.

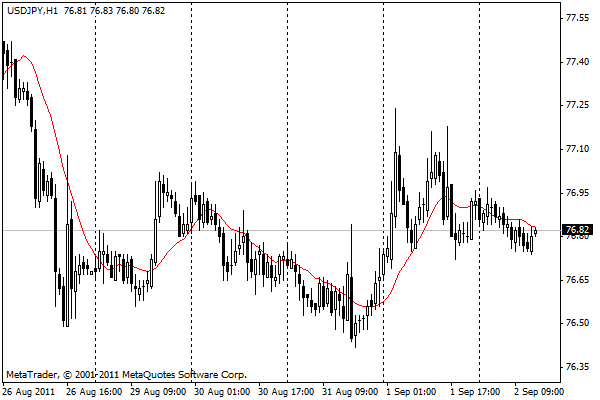

Resistance 3: Y78.00/10

Resistance 2: Y77.70

Resistance 1: Y77.20

Current price: Y76.79

Support 1:Y76.50

Support 2:Y75.90

Support 3:Y75.50

Resistance 3: Chf0.8090

Resistance 2: Chf0.8030

Resistance 1: Chf0.7960

Current price: Chf0.7910

Support 1: Chf0.7890

Support 2: Chf0.7870

Support 3: Chf0.7810

Comments: Rate remains under pressure. Support is near Chf0.7890. Friday's lows come at Chf0.7880/85 with a break under targets Chf0.7810 (Aug 19 lows). Closest resistance at Chf0.7960 (session high). Further rise may extend to Chf0.8030 and Chf0.8090.

Resistance 3:$1.6330

Resistance 2:$1.6250/60

Resistance 1: $1.6200

Current price: $1.6188

Support 1:$1.6130

Support 2: $1.6110

Support 3: $1.6070

Comments: Support is - at $1.6130/10. Below losses may widen to $1.6070 (Jul 20 low). Closest resistance at $1.6200 (session high), ahead of Sep 01 high $1.6250/60. Strong resistance is around $1.6330.

Resistance 3: $1.4470

Resistance 2: $1.4380

Resistance 1: $1.4320

Current price: $1.4256

Support 1: $1.4220

Support 2: $1.4150

Support 3: $1.4100

Comments: Rate remains under pressure. Support is around yesterday's lows on $1.4220, stronger - at $1.4150 (Aug 2.9 ятв 12 lows). Closest resistance is around $1.4320. Break above opens the way to $1.4380 (Sep 01 high).

Spreadbetters Cantor Index are calling the FTSE down 91, the DAX down 112, the CAC down 52 and the Eurostoxx 50 down 32.

Nikkei +105.60 (+1.18%) 9,060.80

FTSE-100 +24.12 (+0.45%) 5,418.65

DAX -54.22 (-0.94%) 5,730.63

CAC 9.07 (+0.28%) 3,265.83

Dow -119.96 (-1.03%) 11,493.60

Nasdaq -33.42 (-1.30%) 2,546.04

S&P500 -14.47 (-1.19%) 1,204.42

10-Years 2.132% -0.091

Oil -0.030 (-0.03%) 88.780

Gold -4.300 (-0.23%) 1,827.400

09:00 EU(17) PPI (July) 0.3% 0.0%

09:00 EU(17) PPI (July) Y/Y - 5.9%

12:30 USA Nonfarm payrolls (August) +77K +117K

12:30 USA Unemployment rate (August) 9.1% 9.1%

12:30 USA Average hourly earnings (August) 0.2% 0.4%

12:30 USA Average workweek (August) 34.3 34.3

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.