- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-09-2011

The stock market's steady ascent continues. As such, the S&P 500 is approaching a 3% gain. The stock market hasn't scored such a sizable gain since it spiked 3.4% on August 23, which was at the beginning of the winning streak that saw the S&P 500 climb in seven out of eight sessions.

Stocks continue to crawl higher. The steady pace has all three major equity averages up more than 2% to their best levels of the day. The action comes in stark contrast to what had been exhibited in the three previous sessions, when stocks suffered a string of losses that left the S&P 500 to shed more than 4%. Amid the decidedly positive tone of today's trade, advancing volume outnumbers declining volume by about 15-to-1 on the NYSE. Overall share volume isn't that robust, though

Financials have stretched their gains so that the sector is now up 3.2%. Bank of America (BAC 7.36, +0.38) remains a top performer following news that the outfit has established a co-chief operating officer role.

The pair recovers from any fixing related slows, stretches to $1.4065 area now on what may just be a shortsqueeze around the European close. Offers remain at $1.4080 area to provide nearby resistance.

The stock market is gradually adding to its opening gain. Stocks now sit at session highs.

Financial stocks have extended their lead (+2.1%) over the rest of the market. Regional lenders like Regions Financial (RF 4.11, +0.21) and insurance and financial services issues like Hartford Financial (HIG 17.48, +0.77) are atop the list of leaders.

EUR/USD $1.4000, $1.4100

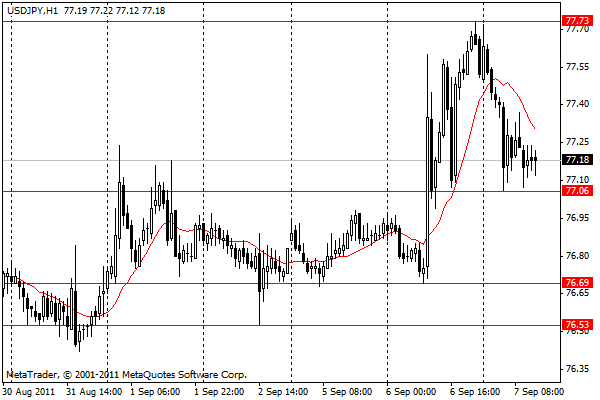

USD/JPY Y77.00, Y77.15, Y77.35

EUR/JPY Y108.00

AUD/USD $1.0600

Support at $1,793.90 and $1,728.50, with resistance on daily bar charts seen at $1,884,20. Contract down $49.60 at $1,823.70.

Stocks were poised to rebound Wednesday, as investors monitor the U.S. economy and await President Obama's highly anticipated jobs speech.

On Thursday, the president is expected to propose new stimulus measures that include a jobs package worth billions of dollars, and an extension of the payroll tax cut.

Jobs are clearly on investors' minds, especially following last week's dismal government report that showed zero job growth in August -- stoking fears of another recession.

Economy: Federal Reserve Chairman Ben Bernanke will discuss the nation's economic outlook at an event in Minnesota.

The Mortgage Bankers Association said the number of Americans who filed applications for the week ended Sept. 2 fell 4.9%.

The Federal Reserve will release its September "Beige Book" at 18:00 GMT. The report offers a localized and anecdotal account of economic conditions in the United States.

Companies: Investors will be keeping an eye on Yahoo (YHOO, Fortune 500). On Tuesday, news broke that Carol Bartz was fired. Tim Morse, the company's chief financial officer, will take over as Yahoo's interim CEO. Shares of the company rose 5% in premarket trading.

Late Tuesday, Bank of America (BAC, Fortune 500) announced plans to reshape its management team by letting go Joe Price, the president of consumer and small-business banking, and Sallie Krawcheck, president of wealth and investment management.

Bank of America shares rose 3% ahead of the opening bell.

Other financial stocks also moved higher in premarket trading, with shares of Citigroup (C, Fortune 500) and Goldman Sachs (GS, Fortune 500) rising 1.6%. JPMorgan (JPM, Fortune 500)'s stock gained nearly 2%.

After the close, homebuilder Hovnanian Enterprises (HOV) will release its corporate results.

World markets:

Oil for October delivery gained 78 cents to $86.80 a barrel.

Gold futures for December delivery fell $27.20 to $1,846.10 an ounce.

The price on the benchmark 10-year U.S. Treasury edged lower, with the yield rising to 2.02%.

Later the focus will be on BOC's rate decision at 13:00 GMT.

Japan's international trade and current account will end the day at 23:50 GMT.

The dollar weakened against the euro, snapping a six-day rally, as stock gains and the Swiss National Bank’s decision to cap the franc’s rate yesterday damped demand for safer assets.

EUR/USD currently holds at stg0.8802 after it printed high on stg0.8830 following the euro rise to $1.4150. EUR/USD now also below highs - at $1.4086.

Data released:

03:30 Japan BoJ meeting announcement 0.00-0.10% 0.00-0.10% 0.00-0.10%

05:00 Japan Leading indicators composite index (July) preliminary 106.0 105.9 103.2

05:00 Japan Coincident indicators composite index (July) preliminary 109.0 - 108.8

The dollar fell against the euro, snapping a six-day advance, as stocks gain and the Swiss National Bank’s decision to set a currency ceiling yesterday damped demand for the world’s main reserve currency.

The euro extended gains after Germany’s top court rejected constitutional challenges to the nation’s participation in the region’s rescue funds.

The greenback weakened before a speech by Chicago Federal Reserve President Charles Evans, who said last month he favored more U.S. monetary stimulus.

Australia’s dollar rose after a report showed the economy grew more than analysts forecast.

Second quarter GDP increased to 1.2% versus -0.9% on the previous quarter. The market anticipated an increase to only 1.0%. In year on year terms, GDP increased to 1.4% in Q2 from 1%. This development has cooled expectations of an interest rate cut.

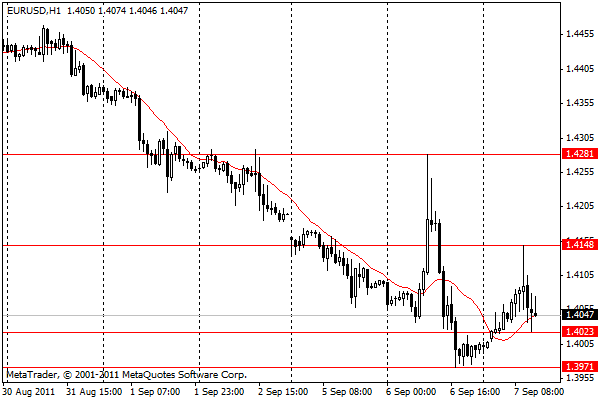

EUR/USD rose from $1.4000 to $1.4150 before retreated to $1.4092.

GBP/USD rose from $1.5940 to $1.6040 before back to $1.6012.

USD/JPY initially fell from Y77.70 to Y77.10. Later rate was back to Y77.40, but failed to hold and weakened to Y77.15.

Germany's Industrial production report comes at 10:00 GMT.

Later the focus will be on BOC's rate decision at 13:00 GMT.

Japan's international trade and current account will end the day at 23:50 GMT.

EUR/USD: $1.3900, $1.4000, $1.4170, $1.4270, $1.4300.

USD/JPY: Y77.00, Y77.15, Y77.35, Y78.00

EUR/JPY: Y108.00

GBP/USD: $1.6275

GBP/JPY: Y130.00

AUD/USD: $1.0600, $1.0500

EUR/USD

Offers: $1.4160/70, $1.4180/90

GBP/USD

Offers: $1.6040

USD/JPY

Offers: Y78.00

Bids: Y77.00/10

AUD/USD

Offers: $1.0650

- High yen not hurting Japan export volume

- Firms fear high yen to economy via sentiment

- Very high global uncertainty continues

- Japan firms going overseas for market expansion

- High yen not top reason but affects such move

- G7 to focus on European financial issue

- High yen not hurting Japan export volume

- Firms fear high yen to economy via sentiment

- Very high global uncertainty continues

- Japan firms going overseas for market expansion

- High yen not top reason but affects such move

- G7 to focus on European financial issue

Majors close

Japanese stocks fell for a third day, pushing the benchmark Nikkei 225 Stock Average to the lowest close since April 2009, as Europe’s worsening debt crisis saps demand for riskier assets.

Mitsubishi UFJ Financial Group Inc. (8306) fell 2.7% after the cost of insuring against default on European sovereign and financial debt surged to records.

Toshiba Corp. (6502) sank 5.1% after a newspaper said the company is in talks to buy Shaw Group’s 20 percent stake in Westinghouse Electric, a reactor builder.

Kansai Electric Power Co. jumped 3.5% after Japan’s new prime minister indicated his support for atomic energy.

The Nikkei 225 has lost about 16% this year amid concern U.S. growth is sputtering and Europe’s debt crisis will damage the banking system, damping demand in two of Japan’s biggest export markets

European stocks declined for a third day, reaching the lowest in more than two years, as deepening concern that the region’s debt crisis will derail the recovery overshadowed better-than-estimated growth in U.S. services.

UniCredit SpA (UCG) and Societe Generale SA fell more than 4% as a gauge of banks slid to the lowest level since March 2009.

Caja de Ahorros del Mediterraneo (CAM) slumped 8.4% after posting a loss.

Bayer AG (BAYN) plunged 7.5% after U.S. regulators asked for more data on the blood thinner Xarelto.

Factory orders in Germany, Europe’s largest economy, fell more than economists forecast in July, led by a drop in export demand as the global economy cooled, a report today showed.

HSBC Holdings Plc cut its forecast today for global economic growth for the next two years and said the efficacy of any further stimulus measures will be limited. The world economy will grow 2.6% this year and 2.8% in 2012, compared with estimates published in June of 3% and 3.4% respectively

U.S. stocks fell, giving the Standard & Poor’s 500 Index its longest slump in almost a month, amid concern that Europe’s debt crisis is worsening.

Corporate news: Hewlett-Packard Co. (HPQ) and General Electric Co. (GE) posted declines of at least 3.6%, pacing losses among companies most-tied to economic growth.

Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) decreased more than 3.3% on concern about a global financial crisis.

The two lenders were among 17 banks sued by the U.S. to recoup $196 billion spent on mortgage-backed securities bought by Fannie Mae and Freddie Mac. The Federal Housing Finance Agency, on behalf of Fannie Mae and Freddie Mac, filed 17 lawsuits on Sept. 2 in New York state and federal courts and in federal court in Connecticut.

Exxon Mobil Corp. (XOM) and Alcoa Inc. (AA) lost at least 1.8% on speculation demand for commodities will slow.

Economy: The Institute for Supply Management’s index of non-manufacturing businesses increased to 53.3 in August from 52.7 a month earlier.

Data released:

01:30 Australia Investment Lending for Homes (Jul) 1.9% -4.4% 1

01:30 Australia Home Loans (Jul) 1.0% 1.6% 0.6%Revised from 0.0% 2

01:30 Australia Current Account Balance (Q2) -7.42B -7.10B -11.12BRevised from 11.12B 2

04:30 Australia RBA Monetary Policy Statement 2

04:30 Australia RBA Interest Rate Decision (Sep 6) 4.75% 4.75% 4.75%

12:55 USA Redbook (03.09)

14:00 USA ISM Non-mfg PMI (August) 53.3 51.3 52.7

14:00 USA ISM Non-mfg business index (August) 55.6 - 56.1

The Swiss franc extended declines versus the dollar and euro after the Swiss National Bank set a minimum exchange rate of 1.20 francs per euro.

According to the SNB's statement the current massive overvaluation of the Swiss franc poses an acute threat to the Swiss economy and carries the risk of a deflationary development. The Swiss National Bank (SNB) is therefore aiming for a substantial weakening of the Swiss franc and set the minimum exchange rate at Chf1.2000/euro.

But even at a rate of CHF 1.20 per euro, the Swiss franc is still high and should continue to weaken over time. If the economic outlook and deflationary risks so require, the SNB will take further

measures.

EUR/USD rocketed from the lows around Chf1.4035 to the highs on $1.4280 before it retreated to current $1.4181. But the day was closed much lower - at $1.3970.

GBP/USD initially fell to $1.6060 before rallied to $1.6204. rate failed to hold above the figure and fell to $1.5920.

USD/JPY rose from Y76.70 to Y77.60. After some attemps to correct the rate rose to Y77.72.

In Europe attention will be on UK Manufacturing production data for July at 08:30 GMT.

Germany's Industrial production report comes at 10:00 GMT.

Later the focus will be on BOC's rate decision at 13:00 GMT.

Japan's international trade and current account will end the day at 23:50 GMT.

Resistance 2: Y78.50

Current price: Y77.28

Support 1:Y77.05/10

Comments: Rate worked out 61.8% Fibo of yesterday's rise and today it holds tight. Suppoort is near Y77.05/10 (61.8%, also Asian low). Below losses may extend to Y76.70 (yesterday's low) and to Y76.50 (Sep 02 low). Resistance comes at Y77.70 (yesterday's high, also Aug 25 high). Above there is a room for a rise up to Y78.50 (Aug 08 high) and Y79.00.

Resistance 2: Chf0.8800

Resistance 2: Chf0.8700

Resistance 1: Chf0.8630

Support 2: Chf0.8410/15

Support 3: Chf0.8280

Comments: Rate tries to recover with resistance comes at Chf0.8630 (Tuesday's high). Above the rise may extend to Chf0.8700 and Chf0.8800. Support is near Chf0.8535 (Tuesday's NY lows). Below rate may test Chf0.8410/15 (23.6% Fibo of the rise from Sep 02 lows at Chf0.7710 to yesterdays' high on Chf0.8630).

Resistance 2:$1.6060

Resistance 1:$1.5990/00

Support 1: $1.5920

Support 3: $1.5770

Comments: rate currently challenging resistance at $1.5990 (23.6% of yesterday's move) and retreated a bit. Break above will target Sep 01 low on $1.6060, then - at $1.6130 Sep 05 low). Support is near $1.5920 (yesterday's low). Below there is a risk of declining to $1.5860 and $1.5780 (Jul 12 lows).

Support 3: $1.3840

Comments: Rate corrected after yesterday's moves, but recovery still tight. Strong support comes at $1.3970/90 (yesterday's lows, also trend line from Jun 07'2010). Break below widens losses to $1.3950 and then - to $1.3840 (Jul lows). Resistance is near $1.4090 (Tuesday's NY high). Above there is a chance to test $1.4120/25 (50% of yesterday's fall). Further resistance comes at $1.4280 (Tuesday's high).

Japan's benchmark stock indices ended Wednesday's session higher, rallying from Tuesday's 2-1/2 year low. The Nikkei ended up 172.84 points, or 2.01%, to stand at 8763.41. The broader-based TOPIX was higher by 12.44 points at 753.64.

03:30 Japan BoJ meeting announcement 0.00-0.10% 0.00-0.10%

05:00 Japan Leading indicators composite index (July) preliminary 105.9 103.2

05:00 Japan Coincident indicators composite index (July) preliminary - 108.8

08:30 UK Industrial production (July) 0.0% 0.0%

08:30 UK Industrial production (July) Y/Y -0.6% -0.3%

08:30 UK Manufacturing output (July) 0.0% -0.4%

08:30 UK Manufacturing output (July) Y/Y 1.9% 2.1%

10:00 Germany Industrial production (July) seasonally adjusted 0.5% -1.1%

10:00 Germany Industrial production (July) not seasonally adjusted, workday adjusted Y/Y 6.7% 6.7%

13:00 Canada BOC meeting announcement 1.00% 1.00%

18:00 USA Fed Beige book

23:50 Japan Machinery orders core (July) adjusted -4.2% 7.7%

23:50 Japan Machinery orders core (July) unadjusted Y/Y 8.3% 17.9%

23:50 Japan Current account (July) unadjusted, trln 1.176 0.527

23:50 Japan Trade balance (July) unadjusted, trln - 0.132

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.