- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-09-2011

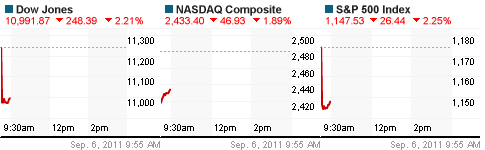

Stocks continue to pare their losses. The latest leg of the effort has taken stocks to fresh session highs. The Nasdaq's climb has been steeper than that of the Dow. As such, the Nasdaq's current loss is about one-quarter of what it had traded with at its session low, whereas the Dow's current loss is only a about half of what it was at its session low. The Nasdaq's relative strength stems from the likes of Apple (AAPL 376.87, +2.82) and Amazon.com (AMZN 214.40, +4.40).

The rate stretches to $1.4015 but move is as much about the lack of liquidity in euro-Swiss as anything else. The pair should find resistance here at the 200-DMA and also at the $1.4020 area of the earlier bounce high. $1.3950 low of July 13 is a key pivotal level. Break below seen exposing stops and stop entries as funds race to set fresh euro shorts.

Stocks are at their best levels of the day, but losses remain deep and broad. The weakness today, and in recent sessions, is largely underpinned by concerns about the financial and fiscal health and stability of the eurozone.

October NYMEX crude down $1.75 at $84,69, moving in line with lower stocks and a firmer US dollar. Like stocks, oil prices edged up from their early lows on the stronger-than-expected ISM data but remain under pressure.

All three major equity averages are down in excess of 2%. To little surprise, then, weakness is widespread.

Industrials, financials, and energy stocks are in the worst shape. The three sectors are all contending with losses of at least 3%. Telecom, which is down 1.5%, represents the best performing sector this morning.

Lift back from $1.6020 lows, edging to a recovery high of $1.6045, but momentum quickly fades. Decent demand said to remain in place into $1.6020, more between $1.6010/00 with the barrier at $1.6000 said to be for decent size. A break below $1.6000 to expose $1.5980, the level the 76.4% retrace of the move up from $1.5784/1.6618.

U.S. stocks were set to open lower Tuesday, amid renewed fears of a eurozone debt crisis and concerns about the global economy.

European markets fell sharply in the previous session, but edged higher Tuesday after the Swiss National Bank intervened on the franc. In a move to protect the currency from Europe's dept woes, the bank set a minimum exchange rate at 1.20 Swiss francs per euro.

Investors flocked to the safety of Treasuries on Tuesday. The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to a record low level of 1.93% from 2% late Friday.

Economy: Investors will get the Institute for Supply Management's services report for August at 14:00 GMT. Economists expect a reading of 51, down from July's reading of 52.7. Any reading above 50 signifies expansion.

Companies: Shares of Bank of America (BAC, Fortune 500) fell 5% in premarket trading, after reports surfaced that the bank could cut 30,000 workers over several years.

On Friday, the federal agency overseeing Fannie Mae and Freddie Mac filed lawsuits against 17 financial institutions. The lawsuits cited Bank of America, Citigroup (C, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Goldman Sachs (GS, Fortune 500); and were filed in an attempt to recover billions of dollars in losses from risky mortgage investments.

World markets:

Oil for October delivery slipped $2.10 to $84.68 a barrel.

Gold futures for December delivery rose $21.20 to $1,898.10 an ounce. The precious metal hit an intraday record earlier Tuesday of $1,923.70 an ounce.

"With the US projected to grow at a 1% pace during 2H11, it is no doubt vulnerable to contracting, and we lace recession risks at an elevated 40%. We see slow growth."

EUR/USD

Bids $1.4150/30, $1.4105/095, $1.4015/00

Data released:

01:30 Australia Investment Lending for Homes (Jul) 1.9% -4.4% 1

01:30 Australia Home Loans (Jul) 1.0% 1.6% 0.6%Revised from 0.0% 2

01:30 Australia Current Account Balance (Q2) -7.42B -7.10B -11.12BRevised from 11.12B 2

04:30 Australia RBA Monetary Policy Statement 2

04:30 Australia RBA Interest Rate Decision (Sep 6) 4.75% 4.75% 4.75%

The Swiss franc extended declines versus the dollar and euro after the Swiss National Bank set a minimum exchange rate of 1.20 francs per euro.

According to the SNB's statement the current massive overvaluation of the Swiss franc poses an acute threat to the Swiss economy and carries the risk of a deflationary development. The Swiss National Bank (SNB) is therefore aiming for a substantial weakening of the Swiss franc and set the minimum exchange rate at Chf1.2000/euro.

But even at a rate of CHF 1.20 per euro, the Swiss franc is still high and should continue to weaken over time. If the economic outlook and deflationary risks so require, the SNB will take further

measures.

EUR/USD rocketed from the lows around Chf1.4035 to the highs on $1.4280 before it retreated to current $1.4181.

GBP/USD initially fell to $1.6060 before rallied to $1.6204. Now rate holds around $1.6119.

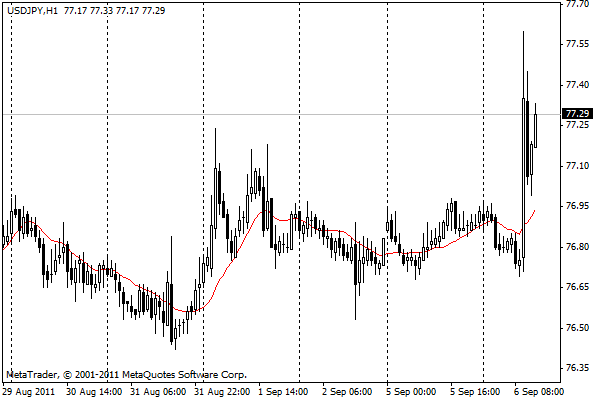

USD/JPY rose from Y76.70 to Y77.60.

Germany's manufacturing orders will be released at 10:00 GMT.Among the US data investors will digest US Non-mfg ISM at 14:00 GMT.

EUR/USD: $1.4200, $1.4300

USD/JPY: Y77.15, Y77.20, Y77.75, Y78.00, Y78.50

EUR/JPY: Y110.90, Y111.25

USD/CHF: Chf0.7665

AUD/USD: $1.0500, $1.0655, $1.0710

NZD/USD: $0.8110

Majors close

Hang Seng 19,616 -596.51 -2.95%

Shanghai Composite 2,479 -49.54 -1.96%

FTSE 5,103 -189.45 -3.58%

CAC 3,000 -148.99 -4.73%

DAX 5,246 -292.15 -5.28%

Japanese stocks fell the most in two weeks after a report showed U.S. employment stagnated, stoking concern the world’s biggest economy may slip into a recession and damping the earnings outlook for Asian exporters.

Honda Motor Co. dropped 4.7%.

Mitsubishi UFJ Financial Group Inc. (8306) dropped 2.3% after banks fell in the U.S.

Komatsu Ltd. (6301) fell 5.4% after Citigroup Global Markets Japan Inc. lowered its rating on the stock to “hold” from “buy,” citing a drop in its share of the Chinese market amid competition with local manufacturers.

The Nikkei 225 (NKY) Stock Average fell 1.9% to 8,784.46, the biggest drop since Aug. 19. The broader Topix index declined 1.8% to 755.82.

The Topix has lost about 16% this year as concerns about an economic slowdown in the U.S. and Europe’s debt crisis damped demand in two of Japan’s biggest export markets.

European stocks tumbled, with the Stoxx Europe 600 Index posting its biggest two-day drop since March 2009, as investors speculated that support for bailing out Europe’s indebted nations may fade.

Deutsche Bank AG (DBK) and Credit Suisse Group AG (CSGN) both tumbled more than 8% after the U.S. sued 17 lenders to recoup $196 billion and the cost of insuring against default in Europe surge to a record.

Clariant AG (CLN) led chemical makers lower, tumbling 16% after the company cut this year’s earnings forecasts.

Merkel’s party suffered its fifth election loss this year after the Chancellor failed to sway voters in her home state with a campaign based on her handling of the euro area’s debt crisis.

The Social Democrats, the main opposition party nationally, took 35.7% in Mecklenburg- Western Pomerania, while Merkel’s Christian Democratic Union had 23.1%, its worst result since voting began in 1990.

Among European lenders, the FHFA claimed Fannie Mae and Freddie Mac bought $14.2 billion from Deutsche Bank, $14.1 billion from Credit Suisse, $30.4 billion from RBS, $6.2 billion from HSBC Holdings Plc (HSBA), $4.9 billion from Barclays Plc (BARC) and $1.3 billion from Societe Generale (GLE) SA. The FHFA sued UBS AG (UBSN) in July. HSBC slid 3.8%, Barclays lost 6.7% and Societe Generale sank 8.6%.

Banks also fell as the premium they pay to borrow in dollars for three months through the swaps markets climbed to the most since December 2008, a sign that Europe’s lenders may be struggling to get funding.

France’s Arkema retreated 8.2%, Germany’s Wacker Chemie AG dropped 7.3% and Amsterdam-based Akzo Nobel NV sank 6.7%.

US stocks were closed in observance of Labor Day.

EUR/USD failed to break above $1.4200 and weakened to $1.4060. Rate later tried to recover before weakened again to $1.4090

GBP/USD was between $1.6170/90 before fell to $1.6090 and later - to $1.6060.

USD/JPY held within the range, limited by Y76.70/80, before declining to Y77.00.

Swiss inflation data is due to come at 07:15 GMT.

EU 2Q GDP report comes at 09:00 GMT with the median is for +0.2% q/q.

Germany's manufacturing orders will be released at 10:00 GMT.

Among the US data investors will digest US Non-mfg ISM at 14:00 GMT.

EUR/USD continues to go higher in early Europe. Rate currently trades around $1.4070, off recovery highs at $1.4074 after reported stops above

$1.4070 were targeted and tripped.

Resistance 3: Y78.50

Resistance 2: Y77.70

Resistance 1: Y76.90

Current price: Y76.77

Support 1: Y76.60

Support 2: Y75.90

Support 3: Y75.20

Resistance 3: Chf0.8170

Resistance 2: Chf0.8080/90

Resistance 1: Chf0.7910

Current price: Chf0.7870

Support 1: Chf0.7830

Support 2: Chf0.7710

Support 3: Chf0.7650

Comments: Rate consolidates. Minor support comes at Chf0.7830 (23.6% Fibo of Chf0.8230 - Chf0.7710 decline), then around Friday's lows on Chf0.7710/00. Stronger level - at Chf0.7650 (50% Fibo of Chf0.7060 - Chf0.8240 rise). Resistance is near yesterday's high on Chf0.7910. Further rise may extend to $Chf0.8080/90 (Sep 01 high). Key resistance comes at Chf0.8170 (trend resistance line from Jun 01'2010).

Resistance 3: $1.6280

Resistance 2: $1.6250/60

Resistance 1: $1.6120

Current price: $1.6070

Support 1: $1.6060

Support 2: $1.6000

Support 3: $1.5910

Comments: Rate holds steady above testerday's lows on $1.6060 (minor support). Stronger level comes at $1.6000 (trend line from May 20'2010, also Jul 18 lows). Below rate may probe Jun 27-28 lows on $1.5910. Resistance is around $1.6120. Further recoverr may extend to $1.6250/60 (Sep 02 highs) and then - to $1.6280 (channel line from Aug 19).

Resistance 3: $1.4240

Resistance 2: $1.4170

Resistance 1: $1.4100

Current price: $1.4044

Support 1: $1.4050/60

Support 2: $1.4010

Support 3: $1.3980

Hang Seng 19,616 -596.51 -2.95%

Shanghai Composite 2,479 -49.54 -1.96%

FTSE 5,103 -189.45 -3.58%

CAC 3,000 -148.99 -4.73%

DAX 5,246 -292.15 -5.28%

09:00 EU(17) GDP (Q2) revised 0.2% 0.2%

09:00 EU(17) GDP (Q2) revised Y/Y 1.7% 1.7%

10:00 Germany Manufacturing orders (July) seasonally adjusted -0.1% 1.8%

10:00 Germany Manufacturing orders (July) not seasonally adjusted, workday adjusted Y/Y 10.3% 9.5%

12:55 USA Redbook (03.09)

14:00 USA ISM Non-mfg PMI (August) 51.3 52.7

14:00 USA ISM Non-mfg business index (August) - 56.1

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.