- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 01-12-2021

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, dropped for the fifth consecutive day to test lowest levels since October 06 by the end of Wednesday North American session, per the data source Reuters. In doing so, the inflation gauge prints a 2.44% level at the latest.

The fall in the inflation expectations could be linked to Fed Chair Jerome Powell’s testimony 2.0. Fed’s Powell reiterated his inflation fears but also said he still believes inflation will come down “meaningfully” in the second half of 2022 during testimony in front of the House Financial Services Committee.

It should be noted, however, that worsening Omicron woes pushed New York Fed President John C. Williams to convey fears of more supply outages and a jump in inflation.

With this, the US 10-year Treasury yields dropped to the lowest since late September as bond buyers attack the 1.40% mark ahead of the key US jobs report for November.

Read: US nonfarm payrolls take center stage after Powell’s hawkishness

- GBP/USD pauses on the way to fresh yearly low.

- 200-week SMA, 38.2% Fibonacci retracement offers strong support.

- October’s bottom guards immediate upside, half-yearly resistance line is the key.

GBP/USD holds lower grounds near 1.3280, retreating towards the yearly low during Thursday’s Asian session. Although the cable pair grinds above the 2021 bottom marked on Tuesday, descending RSI line and sustained trading below the short-term key support, now resistance, keeps bears hopeful.

That said, a convergence of the 38.2% Fibonacci retracement (Fibo.) of March 2020 to June 2021 upside and 200-week SMA surrounding 1.3155 lures the sellers should they manage to conquer the latest yearly low of 1.3194.

It should be noted, however, that the RSI line inches closer to the oversold territory and hence can stop the GBP/USD bears around the stated strong support of 1.3155, failing to which can direct the quote towards the 1.3000 psychological magnet.

Meanwhile, an upside break of the October’s low surrounding 1.3410 becomes necessary for even short-term buyers to take the risk. Following that, 23.6% Fibo. level of 1.3580 may lure the bulls.

However, GBP/USD advances past 1.3588 will be considered elusive until the quote stays below a six-month-old descending resistance line, around 1.3720 by the press time.

GBP/USD: Weekly chart

Trend: Further weakness expected

- The NZD/JPY begins the Asian session on the right foot, up 0.16%.

- The market sentiment is mixed, as Wall Street closed in the red, whereas Asian equity futures point upwards.

- NZD/JPY bears would need a daily close below 76.65 to secure the downward bias.

As the Asian Pacific session begins, the NZD/JPY moderately advances during the day, up some 0.16%, trading at 76.86 during the day at the time of writing. The market sentiment is a mixed bag. Major US stock indices finished the day with losses, while Asian equity futures point upwards as the Asian session kicks in.

In the US, the CDC reported the first Omicron coronavirus case detected in California. That, coupled with South Africa registering double of Tuesday’s COVID-19 cases, increased investors’ worries as the New York session closed. Amid the abovementioned, the US central bank chief Jerome Powell appears at the US congress. He reinforced that the Federal Reserve will need to taper faster and will use the tools available to tackle inflation.

That said, in the overnight session, the NZD/JPY topped around 77.90, to then plummeting towards the December 1 low at 76.70, a 120-pip drop. The fall is attributed to weak market sentiment amid the Omicron coronavirus crisis unless more data could confirm that it would not cause several symptoms and if vaccines could help treat the newly discovered strain in South Africa.

NZD/JPY Price Forecast: Technical outlook

-637739979543328826.png)

From a technical perspective, the NZD/JPY daily chart depicts a downward bias, confirmed by the daily moving averages (DMA’s) residing above the spot price with a flattish slope. Further, the cross-currency pair broke below the September 3 high at 78.64 previous resistance-turned-support, a crucial level, as the 100 and the 200-DMA were exposed and broken, once the former gave way to JPY bulls.

In the outcome of extending the downward move, the first support would be the November 30 low at 76.65. A breach of the latter would expose the September 22 low at 76.33, followed by the August 19 low at 74.55.

On the other hand, the first resistance would be the November 30 high at 77.76. A break of that level would exert upward pressure on the pair, exposing the December 1 high at 77.90. Once that level is broken, the 100 and the 200-DMA’s would be exposed around the 78.09-78.25 area.

- AUD/USD remains on the back foot, retreats towards yearly low.

- Bears keeping reins despite firmer Aussie GDP, PMIs as US data, Fed hike gains more attention.

- Omicron-linked fears escalate ahead of Aussie Trade Balance for October.

- US Jobless Claims may offer additional catalysts during a likely pre-NFP trading lull.

AUD/USD licks its wounds around 0.7100, following a two-day downtrend, during early Thursday morning in Asia. In doing so, the Aussie pair consolidates weekly losses amid a quiet start to the Asia-Pacific trading session while waiting for Aussie trade numbers for October.

That said, spreading fears of the fresh covid variant and the hawkish Fed concerns are the key factors that recently weighed down the risk barometer pair.

Having found the first Omicron case in the US, Reuters ran a story quoting anonymous sources to mention the extension of the mask mandate. “US President Joe Biden's administration will extend requirements for travelers to wear masks on airplanes, trains and buses and at airports and train stations through mid-March to address ongoing COVID-19 risks,” said the news.

Previously, the World Health Organization (WHO) tried calming the virus woes with statements defending the current vaccines and marking less severe impacts of the COVID-19 strain.

Elsewhere, Australia Q3 GDP contracted lesser than forecast and the private PMIs were also upbeat for November but noting matches the firmer US figures that pushed the Federal Reserve (Fed) policymakers to stay hawkish. US ADP Employment Change and ISM Manufacturing PMI details for November ticked above market consensus of 525K and 61.0 respectively to 534K and 61.1 in that order.

Federal Reserve Chairman Jerome Powell reiterated his inflation fears but also said he still believes inflation will come down “meaningfully” in the second half of 2022, during testimony against a Senate Commission. On the other hand, the New York Times (NYT) quotes Federal Reserve Bank of New York President John C. Williams as saying, “Omicron could prolong supply and demand mismatches, causing some inflation pressures to last.”

The risk-off mood weighed on the Wall Street benchmarks but Treasury yields couldn’t benefit either, maybe due to the Fed’s less aggressive mood of late. Even so, S&P 500 Futures print mild gains by the press time.

Moving on, Australia Trade Balance for October, expected 11000M versus 12243M prior, will be in focus before the US Weekly Jobless Claims and Challenger Job Cuts for November. Above all, coronavirus updates will be the key for near-term direction during the pre-US jobs report trading lull.

Technical analysis

A five-week-old descending trend channel keeps AUD/USD bears hopeful until the quote stays below 0.7190. Adding to the upside filter is the 50-SMA and 23.6% Fibonacci retracement (Fibo.) of late October to November downside, around 0.7175-80. Meanwhile, the lower line of the stated channel and the yearly bottom, around 0.7075 and 0.7060 respectively, can entertain short-term traders.

Early Thursday morning in Asia, Reuters quotes anonymous sources to report, “US President Joe Biden's administration will extend requirements for travelers to wear masks on airplanes, trains and buses and at airports and train stations through mid-March to address ongoing COVID-19 risks.”

“A formal announcement extending the requirements through March 18 is expected on Thursday,” adds the source per Reuters.

“The White House and Transportation Security Administration (TSA) declined to comment. TSA in August extended the transportation mask order that runs through Jan. 18,” the news said further.

FX reaction

The news adds to the Omicron-led risk aversion, weighing on the US stock futures and Antipodeans. However, Fed Chair Jerome Powell’s measured response on inflation seems to put a carpet under the EUR/USD prices.

Read: EUR/USD defends 1.1300 even as yields refresh 10-week low

- EUR/USD remains sidelined after Tuesday’s seesaw move, recently consolidating losses.

- US marks the first Omicron case, ECB push back PEPP tapering on virus woes.

- Wall Street closed in red, US 10-year Treasury yields inch closer to 1.40%.

- Eurozone Unemployment Rate, US Jobless Claims eyed but covid updates are the key.

EUR/USD remains sidelined near 1.1320 during early Thursday morning in Asia, following a mildly negative daily performance. The currency major’s latest moves disagree with the fall in the US Treasury yields and the market sentiment following the fresh updates over the South African variant of the coronavirus and central bank, namely the Federal Reserve (Fed) and the European Central Bank (ECB).

Markets initially witnessed risk-on mood following the World Health Organization (WHO) tried calming the virus woes with statements defending the current vaccines and marking less severe impacts of the COVID-19 strain. However, the optimism blew on the news of the first Omicron case in the US.

Adding to the risk-off mood were strong US data and a measured testimony from Fed Chair Jerome Powell. US ADP Employment Change and ISM Manufacturing PMI details for November ticked above market consensus of 525K and 61.0 respectively to 534K and 61.1 in that order. Given the firmer US data supporting the Fed’s hawkish view, Federal Reserve Chairman Jerome Powell reiterated his inflation fears but also said he still believes inflation will come down “meaningfully” in the second half of 2022, during testimony against a Senate Commission.

Recently, Federal Reserve Bank of New York President John C. Williams said, per New York Times, that Omicron could prolong supply and demand mismatches, causing some inflation pressures to last.

It should be noted that the ECB conveyed, per Reuters, that policymakers are increasingly concerned that the economic outlook has become too murky for a comprehensive policy decision to be reached in December.

Against this backdrop, US 10-year Treasury yields dropped 3.7 basis points (bps) to 1.40%, the lowest since late September while the Wall Street benchmarks marked another negative day, despite an upbeat start.

Moving on, Eurozone Unemployment Rate for October and US Weekly Jobless Claims can entertain EUR/USD traders. However, the pre-NFP trading lull can challenge momentum while the covid headlines will add length to the watcher’s list.

Technical analysis

20-DMA level of 1.1363 precedes a double top around 1.1385 to restrict short-term EUR/USD recovery, suggesting gradual declines toward the yearly bottom of 1.1186.

- NZD/USD fades bounce off 2021 trough, marked on Tuesday.

- NZ Q3 Terms of Trade Index dropped below market forecast and prior, China Caixin Manufacturing PMI printed three-month low.

- Yields decline, equities print losses on first case of Omicron in US, Powell’ hawkish play 2.0.

- Second-tier US data to offer intermediate moves before Friday’s key US jobs report.

NZD/USD grinds lower around short-term horizontal support near 0.6800, reversing the previous corrective pullback from the yearly bottom.

That said, the Kiwi pair struggles amid fresh covid variant woes and the hawkish Fed concerns as traders brace for Thursday in Asia.

In addition to the risk catalysts, downbeat trade data at home, in contrast to the firmer US economics also exerts downside pressure on the NZD/USD prices.

New Zealand’s Terms of Trade Index came in 0.7% for Q3 2021, versus 2.0% expectations and 3.3% prior. On the other hand, US ADP Employment Change and ISM Manufacturing PMI details for November ticked above market consensus of 525K and 61.0 respectively to 534K and 61.1 in that order.

Given the firmer US data supporting the Fed’s hawkish view, Federal Reserve Chairman Jerome Powell reiterated his inflation fears but also said he still believes inflation will come down “meaningfully” in the second half of 2022, during testimony against a Senate Commission.

It’s worth noting that the finding of the first case of the South African coronavirus variant, dubbed as Omicron in the US added to the risk-off mood, following the initial relief rally in the markets on the World Health Organization (WHO) comments. The WHO tried calming the virus woes with statements defending the current vaccines and marking less severe impacts of the COVID-19 strain.

Amid these plays, US 10-year Treasury yields dropped 3.7 basis points (bps) to 1.40% while the Wall Street benchmarks marked another negative day, despite an upbeat start.

Looking forward, a lack of major data/events and the pre-NFP trading lull may bore markets. However, Australian trade numbers and US second-tier job reports may entertain traders, not to forget Omicron headlines.

Technical analysis

Failures to cross a fortnight-long resistance line, around 0.6860, join a steady RSI line to favor the continuation of the bearish trend. Adding to the upside filters the previous support line from November 12 and 50% Fibonacci retracement of latest fall from mid-November, near 0.6930 at the latest.

On the flip side, a weekly horizontal line near 0.6800 can entertain short-term sellers ahead of the yearly low of 0.6772. In a case where NZD/USD bears conquer the yearly bottom, tops marked in July and October 2020 surrounding 0.6725-15 will gain major attention.

- The Australian dollar fails to gain traction against the safe-haven status yen, dropped %.

- The first Omicron COVID-19 cases hit the US, adding to the list of countries, reporting new strain cases.

- On Wednesday, South Africa doubled Tuesday’s cases amid positive news from SA health authorities, which reported “mild” symptoms on the new variant.

The AUD/JPY declines sharply as the New York session ends, down some %, trading at 80.13 at the time of writing. The market sentiment is downbeat at press time, as depicted by the major US stock indices finishing in the red at the Wall Street close, as the US CDC reported the first COVID-19 Omicron case.

In South Africa, COVID-19 cases doubled from Tuesday. Also, the UK, Switzerland, and Brazil, added to the list of countries reporting Omicron cases. Despite being “negative” news, the World Health Organization (WHO) chief scientist commented that vaccines would protect against severe cases of the variant. That, along with Fed Chair Jerome Powell, comments reinforcing that the US central bank would do what it needs to tackle inflation, dented the market sentiment.

On Wednesday, in the overnight session, the AUD/JPY peaked at 81.47, falling sharply throughout the second half of the day, down to 80.00, breaking on the way down the 50-hour simple moving average (SMA), which at press time lies at 80.77.

That said, the AUD/JPY pair would stay lying on the dynamics of market sentiment. Further, the Reserve Bank of Australia’s (RBA) dovish stance would limit any upside move in the pair.

AUD/JPY Price Forecast: Technical outlook

The 1-hour chart depicts the pair is extending its free fall, printing a fresh two-month low at 79.97. The pair has a downward bias, portrayed by the daily moving averages (DMA’s) staying above the spot price with a downslope, with the 50-hour SMA -the shortest-timeframe- at 80.77, being the closest to current price action.

In the outcome of falling further, the AUD/JPY first support level would be the S1 daily pivot at 79.58. The breach of the latter would expose the S2 daily pivot at 79.08.

On the other hand, AUD/JPY first resistance would be the daily central pivot at 80.52. The break above that level would expose the 50-DMA at 80.77, followed by the confluence of the R1 daily pivot and the 100-hour SMA at 81.

-637739946256689727.png)

Turkish President Tayyip Erdogan threw another wild card by replacing a top minister during early Thursday morning in Asia.

This time, Turkish President Erdogan appointed Nureddin Nebati as Turkey's minister of Treasury and Finance. In doing so, Turkey’s Boss accepted the resignation of Lutfi Elvan, the last top official seen to adhere to the orthodox policy in a government gripped by a currency meltdown, per Reuters.

USD/TRY reverses pullback

Following the news, USD/TRY stays firmer above $13.00, sidelined around $13.35 at the latest. That said, the Turkish lira (TRY) pair eased from a record top the previous day, snapping a three-day uptrend.

Read: USD/TRY recedes from new all-time tops as CBRT takes action

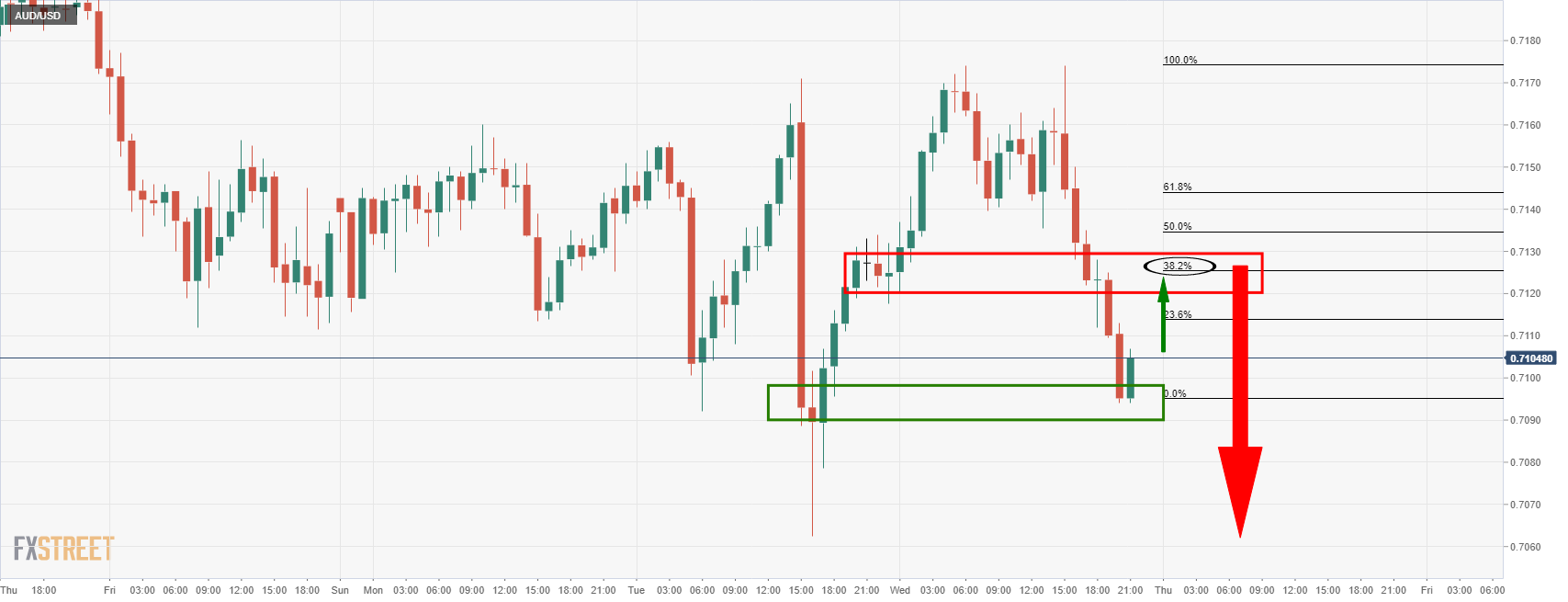

- AUD/USD has been correcting the daily bearish impulse on the lower time frames.

- The focus is on an H1 38.2% Fibonacci correction near term but for further downside longer term.

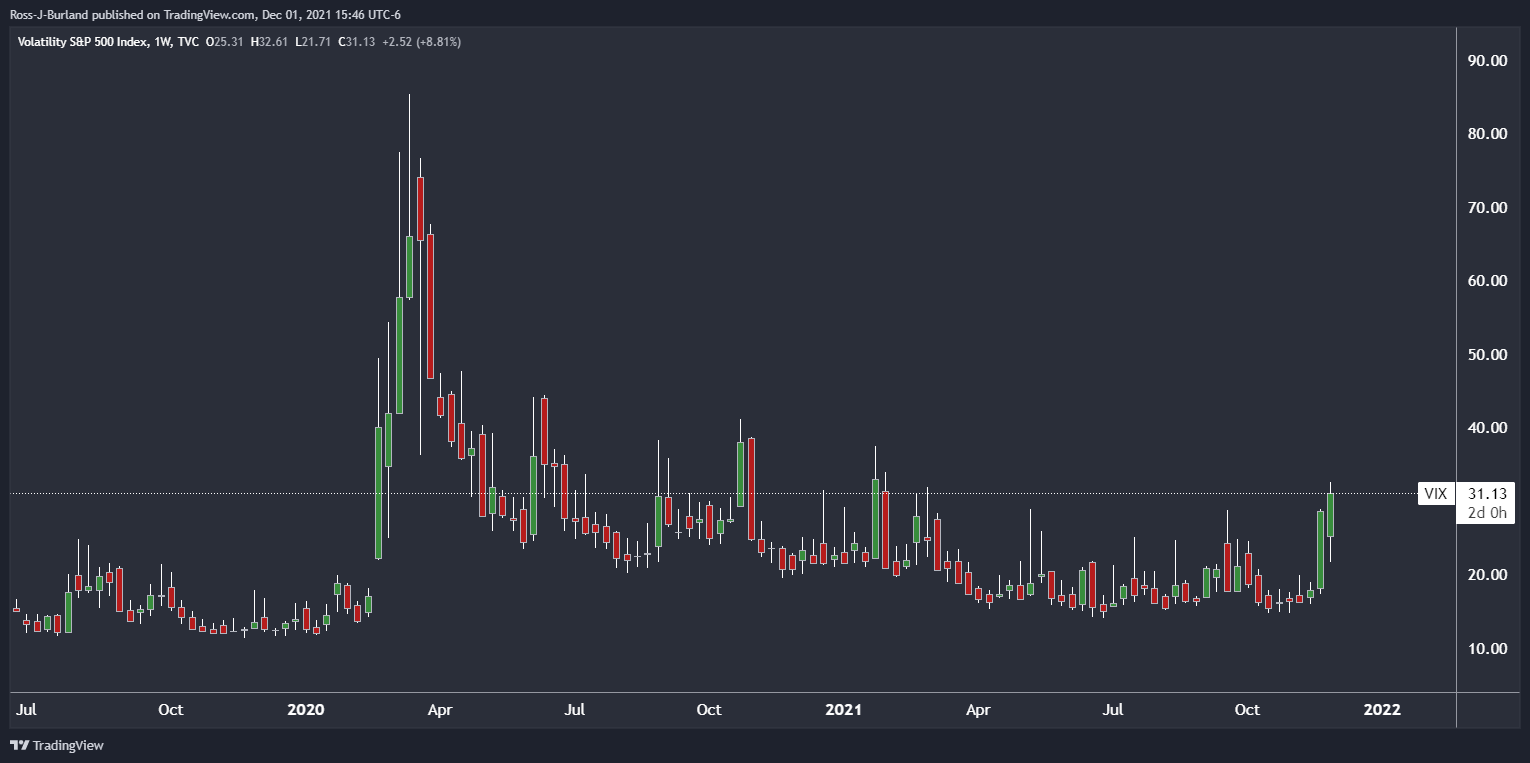

- Forex volatility is through the roof and the VIX has rallied to fresh highs.

AUD/USD bulls are stepping in at a familiar level of demand on the hourly time frame. However, the longer-term momentum is with the bears for a deeper continuation towards weekly support.

AUD/USD weekly chart

The momentum is to the downside and with the weekly lows near 0.70 the figure eyed as a key target. Meanwhile, the M-formation's neckline should not be ignored near 0.7170. The 38.2% Fibonacci level will have a confluence with 0.72 the figure or there about should the price indeed continue to deteriorate into the weekly lows. This could be a target should the bulls accumulate from the weekly lows in the coming weeks.

AUD/USD daily chart

The price has already made a significant correction as per the wicks meeting the 38.2% Fibonacci retracement level . Therefore, there is a high probability of a downside continuation, especially with volatility as high as it is at the moment. The VIX has rallied through 30 and the DBCVIX USD Volatility Index is at the highest it has been since the start of the year.

-637739919150088109.jpeg)

AUD/USD H1 chart

Meanwhile, the bulls are correcting on the lower time frames which bring in the 38.2% Fibonacci into scope for the meantime.

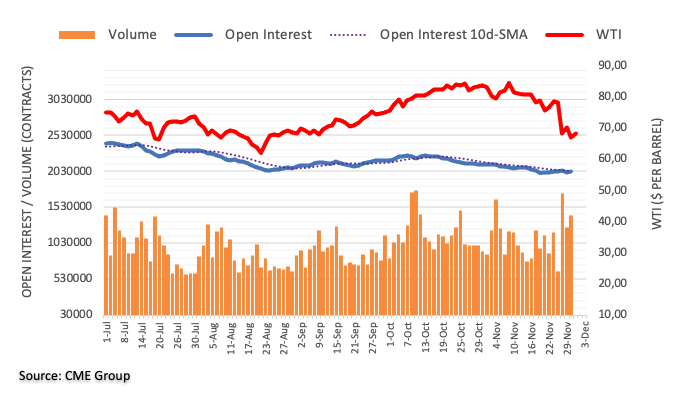

- After jumping from weekly losses, gold advances almost 1% amid the US reporting the first Omicron variant case.

- The market sentiment has dampened on the report of the first US Omicron COVID-19 case, US equities dropped.

- XAU/EUR: Has an upward bias, though it would need a daily close above €1,590 to extend its gains.

Gold (XAU/EUR) vs. the euro advances as Wall Street enters the last hour of the New York session, up some 0.75%, trading at €1,573 at the time of writing. Investors’ worries seem to be confirmed, as the first COVID-19 Omicron case in the US has been detected. That said, a sell-off in US equities is underway, with the three major indices posting losses between 0.63% and 1.15%.

In the overnight session XAU/EUR, pare some Tuesday’s losses, witnessing a jump from €1,561 up to €1,570, but as the Asian session began, gold spiked through the 50-hour simple moving average (SMA), peaking at €1,583, followed by a dip towards the €1,570 area.

The rise in XAU/EUR is also due to weak economic data from the Eurozone, particularly Germany. Retail Sales for October shrank 2.9% on a yearly basis, worse than the 0.3% contraction estimated. Contrarily, the monthly basis number fell 0.3%, better than the 1.9% decrease expected,

In the meantime, the German 10-year Bund yield is falling two basis points, sitting at -0.35%, boosting the yellow metal prospects against the single currency.

XAU/EUR Price Forecast: Technical outlook

The XAU/EUR daily chart depicts that trimmed some losses as we head towards the Wall Street close. Further, it is worth noting that gold found a strong support area near the June 1 swing high at €1,567 previous resistance-turned-support, some €10 above the 50-day moving average, lying at €1,556. Furthermore, the daily moving averages (DMA’s) with an upslope reside well below the spot price, signaling that XAU bulls are in charge.

In the outcome of extending Wednesday’s gains, the first support would be the November 30 high at €1,590. Breach of the latter could pave the way for further gains. The following resistance would be the €1,600 psychological level, followed by the November 18 cycle low previous support-turned-resistance at €1,633.

On the flip side, the first support would be the 50-DMA at €1,556. The break of the previous-mentioned would expose essential support areas, like the 100-DMA at €1,538, followed by the confluence of 200-DMA and the November 3 low, between the €1,515-19 range.

-637739892847185428.png)

- EUR/JPY reversed from highs above 128.50 to lows close to 127.50 over the course of Wednesday’s session.

- The move lower went in tandem with an elevation of safe-haven demand as broad risk appetite deteriorated.

Appetite for safe-haven assets has picked up in recent trade amid a deterioration in US (and global) equity market sentiment, EUR/JPY has been heading lower and looks on course to end the day with losses of about 0.5%. The first Omicron Covid-19 infection has been picked up in the US and, as the variant’s infection rate surges in South Africa, US stock investors have seemingly thrown in the towel. The S&P 500 is now down over 0.5% on the day having been nearly 2.0% higher in pre-market trade.

That has seen the yen catch a bid and EUR/JPY drop from earlier session highs above 128.50 back to just above weekly lows at 127.50. And the technicals aren’t looking great. When it topped out earlier in the session above 128.50, EUR/JPY seemed to find resistance at a long-term downtrend that has been capping the price action since early November. If support around 127.50 does go, the pair would slip to its lowest levels since February, which could open the door to a run lower towards 125.00, the next area of significant support.

That has seen the yen catch a bid and EUR/JPY drop from earlier session highs above 128.50 back to just above weekly lows at 127.50. And the technicals aren’t looking great. When it topped out earlier in the session above 128.50, EUR/JPY seemed to find resistance at a long-term downtrend that has been capping the price action since early November. If support around 127.50 does go, the pair would slip to its lowest levels since February, which could open the door to a run lower towards 125.00, the next area of significant support.

-637739892950729711.png)

- EUR/GBP has recovered off of earlier session lows in the 0.8500 area to trade flat on the day around 0.8520.

- Dip-buyers came in ahead of last Friday’s high and the 50DMA.

- The pair has carved out a 0.8500-0.8540ish range, though a move back towards the 200DMA may be on the cards.

EUR/GBP has eroded earlier losses and is back to trading flat on the day in the 0.8520 area as the end of the US session approaches. The pair found decent demand just under 0.8500, as traders bought at support in the form of last Friday’s highs and the 50-day moving average which currently resides just under 0.8490.

As traders assess the threat that the new Omicron variant poses to the global economy and what it means for central bank policy divergence, it is likely that EUR/GBP will continue to trade in rangebound fashion. To the upside, Tuesday’s high just above 0.8540 may cap the price action, while Wednesday’s lows around 0.8500 may form the near-term floor. Risk-off flows related to fears about the new variant have thus far favoured the euro over the pound. Should sentiment take a further knock in the coming days, a move towards the 200DMA at 0.8560 and the early November highs just under 0.8600.

In terms of fundamental catalysts, there hasn’t been much to drive the price action in EUR/GBP. BoE Governor Andrew Bailey didn’t reveal any new information to inform the BoE hike or no hike in the December debate – market participants/analysts remain split on this. Final Eurozone and UK November Manufacturing PMIs were broadly in line with the flash estimates released two weeks ago. Thursday sees the release of Eurozone Unemployment data for October, ahead of Final UK and Eurozone Service PMIs and ECB and more BoE speak on Friday.

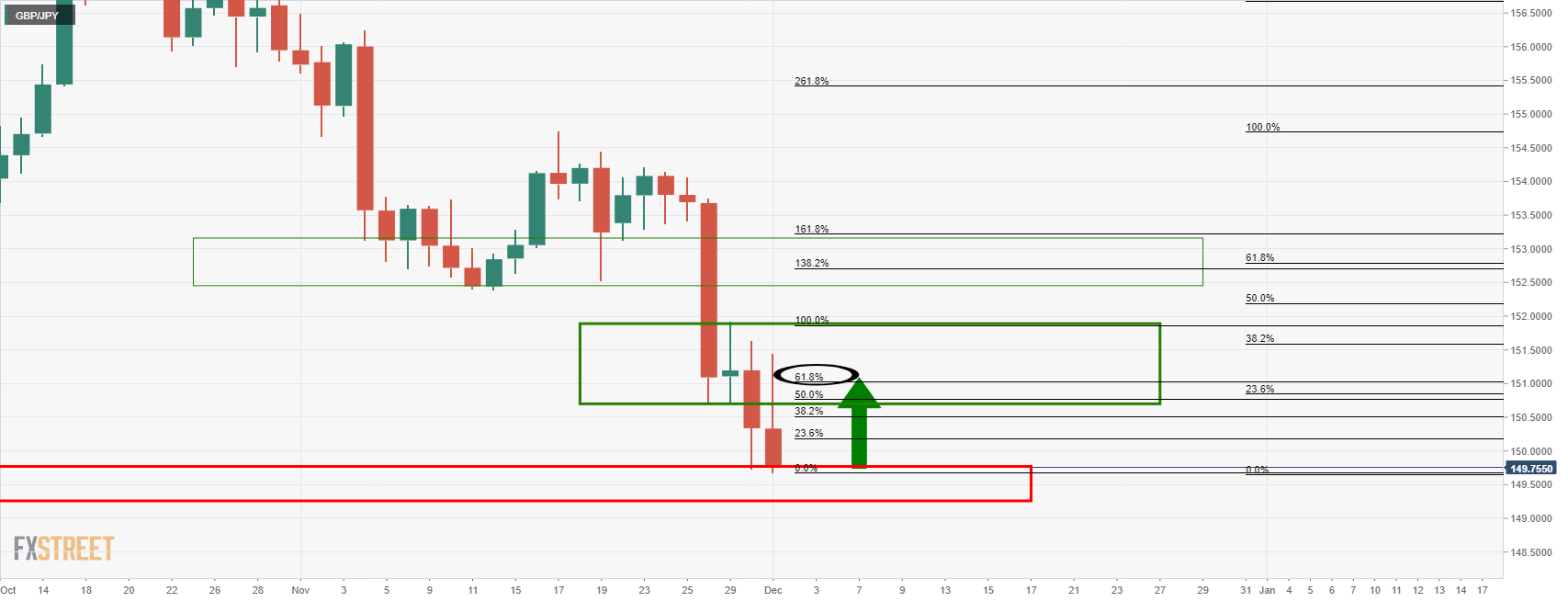

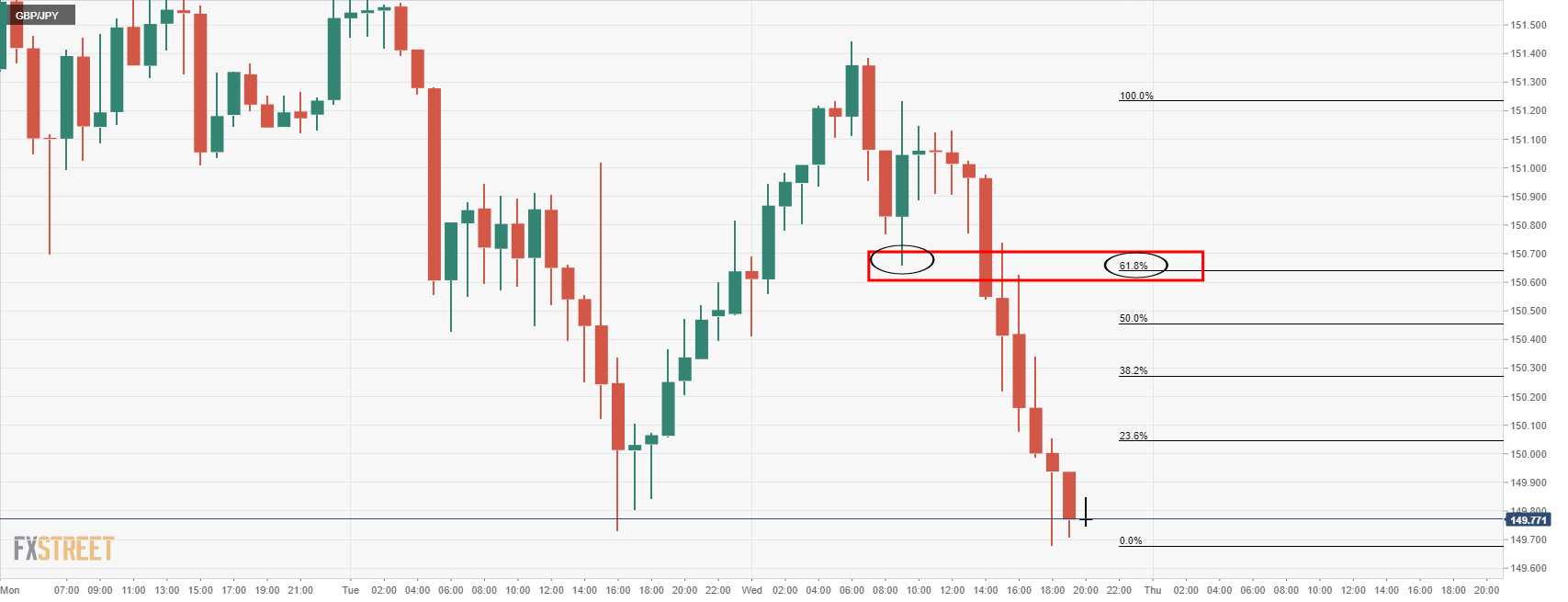

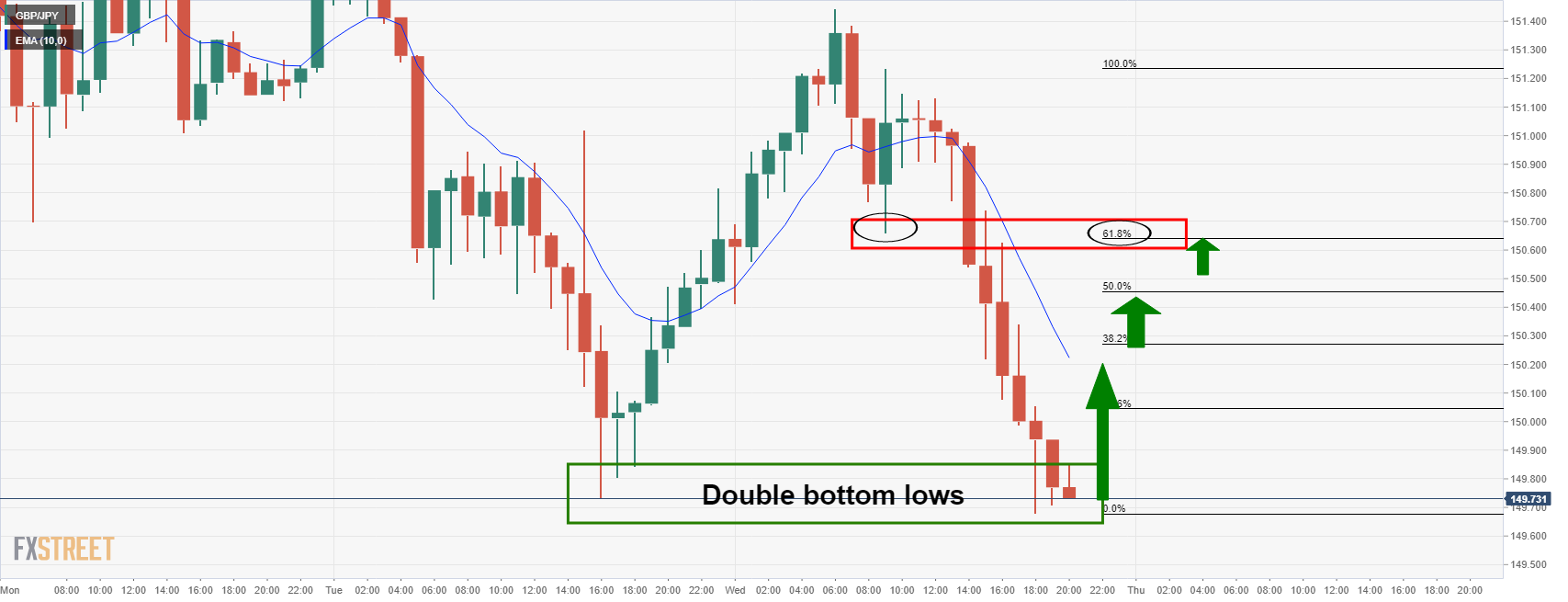

- GBP/JPY bulls stepping in to target a significant correction.

- Bulls eye the 61.8% Fibos across the time frames.

GBP/JPY has left a weekly M-formation which is a bullish reversion pattern. If the price holds at this support area, then it would be expected to target the 61.8% Fibonacci where it meets the neckline lows of the formation.

GBP/JPY weekly chart

However, given the topping of the 2020 rally, should the neckline hold, then a downside continuation could be sparked for a run to 146.00.

GBP/JPY daily chart

The daily chart shows that the price will first need to get beyond the order block between 150.69 and 151.91 first.

This puts the daily 61.8% ratio, located at 151.06 onto the radar following a break of the order block highs.

GBP/JPY H1 chart

We are also seeing an M-formation on the hourly time frame. The neckline at 150.66 has a correlation with the 61.8% ratio also near the order block lows. This makes for a near term target of between 150.65/70 within the day's range of between 149.67/151.44 so far.

However, there could be some stalling between the 38.2% Fib located at 150.27 and then the 10-hour EMA first. As the price rises, so too will the EMA and drift in near to a 50% retracement near 150.50.

- The S&P 500 has eroded most of its gains and is now just 0.4% higher on the day.

- The index is back to the 4580s, having traded as high as 4650 after the open.

- Sentiment seemingly deteriorated in tandem with a pick-up in the newsflow surrounding the global Omicron outbreak.

US equity markets have been on the back foot over the last few hours and have relinquished much of their pre-market gains. The S&P 500 index has dropped back under 4600 and is now just 0.4% higher on the day having been as much as 1.9% higher earlier in the session. The Nasdaq 100, meanwhile, has pared back on gains that had been as much as 1.8% at the start of the session to just 0.2%. The Dow is up by the same amount.

Omicron worries

Sentiment seemingly deteriorated in tandem with a pick-up in the newsflow surrounding the global Omicron outbreak. The number of Covid-19 infections reported in South Africa doubled on Wednesday vs a day earlier and there were separate reports that hospitalisations had also started picking up as infections spread more to the elderly. Moreover, the South African National Institute For Communicable Diseases (NICD) said that the Omicron variant would be able to get around prior immune protection. However, WHO scientists earlier in the day were out saying they believed that the existing vaccines would still provide substantial protection.

More recently, the first Omicron variant infection was reported in the US. The individual, who is fully vaccinated, is only experiencing mild symptoms at the moment and had traveled to South Africa. The detection of further US infections in the days ahead seems inevitable.

Data, Fedspeak & other themes

Aside from Omicron, equity investors have also had to juggle a number of other themes, including tier one US data releases and further Fed speak. Starting with the former; the November ISM manufacturing PMI survey was stronger than expected, with the employment and new orders subindices both picking up and prices paid moderating slightly amid early indications that supply chain disruptions are easing. Whilst this is good news, investors fear that any Omicron-related global travel/trade restrictions could quickly reverse any progress made supply chains.

The November ADP national employment estimate was also released and will solidify expectations that Friday’s headline official NFP number should be strong. The Fed’s Beige Book was released as well on Wednesday and also alluded to underlying US economic strength, early signs of easing supply chain pressures (which is helping costs fall back). The report pointed to the continued difficulties companies are having finding workers, which supports the idea that the labour market remained tight in the first half of November.

Speaking of the Fed; Chairman Jerome Powell appeared before Congress for a second day and reiterated the same hawkish message he offered on Tuesday (retire “transitory”, inflation risks rising, appropriate to discuss faster QE taper). NY Fed President and influential FOMC member John Williams was also on the wires earlier in the session and largely stuck to the script established by Powell, emphasising rising inflation risks/uncertainty. Meanwhile, in Washington, talks to avoid a government shutdown after Friday are ongoing, a theme that will be worth paying attention to on Thursday and Friday.

What you need to know on Thursday, December 2:

Fears cooled down on Wednesday, resulting in major pairs holding into familiar levels. The greenback ended the day mixed, firmer against commodity-linked rivals but down against other safe-haven currencies.

The cautious optimism came from the World Health Organization, as it said that current vaccines could still offer protection against the new Omicron coronavirus variant, preventing severe illness. Also, the WHO reported that so far, the new strain seems to be causing milder symptoms and illness.

US Federal Reserve chief Jerome Powell testified again before a different Senate Commission and repeated that inflation has spread more broadly and that the risk of persistent inflation has risen. However, he also said that, while they need to remove the world “transitory,” he still believes inflation will come down “meaningfully” in the second half of 2022.

Asian and European indexes closed in the green, while Wall Street opened with a positive tone but trimmed most of its intraday gains ahead of the close. Meanwhile, US Treasury yields ticked modestly higher, with the 10-year note yielding 1.44% at the time being.

The EUR/USD pair trades around 1.1320, while GBP/USD stands at 1.3280, both at risk of falling further. The AUD/USD pair trades at around 0.7110, while USD/CAD is pressuring daily highs in the 1.2830 price zone.

Gold remains under pressure, currently trading at $1,780 a troy ounce. Crude oil prices edged lower, with WTI now at around $65.75 a barrel.

The focus now shifts to US employment figures ahead of the Nonfarm Payrolls report to be out next Friday. The country is expected to have added 550K new jobs in November, quite a healthy reading in terms of monetary policy.

Ethereum price builds the momentum to hit new all-time highs

Like this article? Help us with some feedback by answering this survey:

>

- XAG/USD slides for the fourth consecutive day, down 1.67% as Fed’s Chair Powell testifies on the Congress.

- The market sentiment is upbeat, dampening the risk appetite of safe-haven assets like silver.

- XAG/USD: A break below $22.00 would expose the YTD low at $21.33.

Silver (XAG/USD) continues falling for the fourth day In a row, down trading at $22.40 at the time of writing. in the overnight session, the white metal peaked at $23.01. However, it retreated the move as risk appetite improved, as investors dumped safe-haven assets, turning towards riskier ones, as portrayed by US equity indices rising between 0.48% and 0.50%. Contrarily safe-have currencies like the JPY and the USD are the main gainers in the FX market, with risk-sensitive currencies dropping except for the NZD, advancing 0.10%.

That said, the XAG/USD silver bottomed around $22.30, reached a seven-week fresh low amid an uptick in US 10-year T-bond yields, rising one basis point, sitting at 1.46%. Amid those plays, the US Dollar Index, which measures the greenback’s value against a basket of its peers, is barely flat, at 95.98, as investors start to price in a Fed’s faster bond taper, that could move forward the possibility of hiking rates, sooner than expected.

In the meantime, one of the catalysts of gold, US Real Yields, as of November 30, rose by 1.66%.

Fed’s Chair Powell commented that inflation is no longer “transitory,” expects it will moderate in 2022

Summarizing some of Powell’s remarks, he said that “[Fed] don’t see wages moving up at a troubling rate that would spark inflation.”. He reiterated that it is time to move from the word transitory from inflation and expects that the abovementioned will moderate in 2022, despite not being sure of the forecast. Powell added that “It is appropriate we consider speeding taper at next meeting to wrap it up earlier.”

XAG/USD Price Forecast: Technical outlook

The XAGU/USD daily chart depicts the non-yielding metal has a downward bias. The daily moving averages (DMA’s) with a flat slope but above the spot price confirmed the abovementioned. In the outcome of continuing trending lower, the first support would be the $22.00 figure. A break of the latter would expose the September 30 low at 21.33

On the flip side, the first resistance would be December 1 high at $23.00. A break above that level could pave the way for further gains. The following resistance would be the 50-DMA at $23.52, and then the 100-DMA at $23.80, as the price would close towards $24.00.

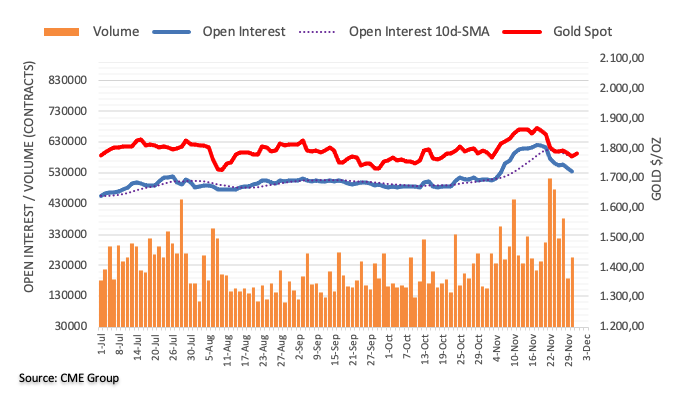

- Gold bulls taking on the counter-trendline resistance and eye the 38.2% Fibo near $1,810.

- Beyond $1,810, there is then air to $1,850 resistance. All eyes are on the central banks, EUR and greenback.

- Safe havens are also in play considering the uncertainty surrounding covid variants.

The price of gold is trading at $1,782 and higher by some 0.5% on the day after rising from a low of $1,772.30 and reaching a high of $1,794.62. The Fed's decision to retire the term 'transitory' has failed to boost the greenback which is arguable overbought in terms of positioning. This has led to a bid in the commodities and has underpinned gold as a perfect hedge for inflation risks.

Federal Reserve Jerome Powell, who testified to the Senate on Tuesday said, "we are actually at our next meeting in a couple of weeks going to have a discussion about accelerating that taper by a few months." He also pledged to bury the term “transitory” and instead recommends Fed policymakers to consider explaining more clearly what the Fed thinks/means when it is talking about inflation.

''The decision helped to clarify that the Fed will look past the omicron threat, for the time being, reversing the shift in pricing catalyzed by the omicron variant in favour of an accelerated tapering process, which opens the door to a faster hiking cycle if necessary as markets had predicted,'' analysts at TD Securities argued.

''Nonetheless, the threshold for another whipsaw for CTAs in gold is razor-thin. In fact, gold prices could surprise the hawks by looking to the upside, as CTA trend followers are set to cover their shorts in gold above $1785/oz,'' the analysts added.

Safe havens up, US dollar down

Meanwhile, trades are also weighing what the new Omicron variant of the coronavirus might do to plans that Federal Reserve Chair Jerome Powell signalled on Tuesday to move more quickly to raise US interest rates. Safe havens are leading the way with the yen and CHF taking the top spot on the Currency Strength Indicator.

The euro is in third place as traders ponder as to whether the latest data will challenge the ECB’s ‘transitory’ story come to the December meeting? In doing so, the US dollar could be starting to lose its edge with regard to central bank divergence. The dollar index DXY, which measures the greenback against major currencies was down on the day at 95.670 the low at one point, supporting gold prices.

Gold technical analysis

Meanwhile, however, the daily outlook is arguable bearish from a technical perspective. The price is retesting the counter trendline. If this holds, then the bias will be to the downside for the coming days. With that being said, a break back above the counter-trendline will leave prospects of a bullish continuation instead.

Bulls will need to get above the 38.2% Fibonacci ratio resistance near $1,810 for a run to the neckline of the M-formation near $1,850 for the days ahead.

According to the Fed's Beige Book, which was prepared by the Chicago Fed based on information collected on or before 19 November, said that economic activity grew at a modest to moderate pace in most Federal Reserve districts during October and early November.

Additional Takeaways:

"The outlook for overall activity remained positive in most districts, but some noted uncertainty about when supply chain and labor supply challenges would ease."

"Employment growth ranged from modest to strong across Federal Reserve districts."

"Prices rose at a moderate to robust pace, with price hikes widespread across sectors of the economy."

"There were wide-ranging input cost increases stemming from strong demand for raw materials, logistical challenges, and labor market tightness."

"Wider availability of some inputs, notably semiconductors and certain steel products, led to easing of some price pressures."

"Strong demand generally allowed firms to raise prices with little pushback, though contractual obligations held back some firms from increasing prices."

"Leisure and hospitality and manufacturing contacts reported an uptick in employment, but many were still limiting operating hours due to a lack of workers."

"Contacts in several other sectors also noted labor-related constraints on meeting demand."

"Childcare, retirements, and Covid-19 safety concerns were widely cited as sources that limited labor supply."

"Loan demand increased in almost all districts."

"Many districts noted concerns that the federal vaccination mandate could exacerbate existing hiring difficulties."

"Nearly all districts reported robust wage growth."

"Hiring struggles and elevated turnover rates led businesses to raise wages and offer other incentives, such as bonuses and more flexible working arrangements."

- GBP/USD holds near the 2021 low with risks tilted to the downside.

- Central bank themes are driving risk and weighing on the pound.

At the time of writing, GBP/USD is trading at 1.3311 and higher by some 0.12% on the day so far. The pair has recovered from a low of 1.3276 and has reached a high of 1.3352 so far.

The US dollar is stuck in the mud after yesterday's whipsaw when the greenback failed to capitalise on hawkish comments from the US Federal Reserve Chair Jerome Powell. DXY, an index that measures the US dollar vs a basket of currencies spiked around 40 points during his testimony to the Senate on Tuesday.

Powell said, "we are actually at our next meeting in a couple of weeks going to have a discussion about accelerating that taper by a few months." He also pledged to bury the term “transitory” and instead recommends Fed policymakers to consider explaining more clearly what the Fed thinks/means when it is talking about inflation.

His comments follow those of a number of Fed officials who in recent weeks have advocated for ending asset purchases sometime in the spring to allow for an earlier start of interest rate increases should they be needed to rein in inflation.

However, the US dollar fell back to the start again due to a relatively strong euro. Data from yesterday came in hot for both the German Unemployment Rate and EZ inflation. Additionally, the market has been very long of the US dollar and it couldn't rally as a safe haven on the covid risks nor on the back of a uber hawkish sounding Fed.

The Eurozone preliminary estimate jumped by a hefty 0.8%-points to 4.9%, making this one of the biggest upside surprises in recent history. This is also more than twice the central bank’s long-term target. The core estimate rose by no less than 0.6%-points. The market is now wondering if this challenge the ECB’s ‘transitory’ story as well come the December meeting? In doing so, the dollar could be starting to lose its edge with regard to central bank divergence.

As for central banks, the British pound holds near the 2021 low versus the greenback as doubts grew on whether the Bank of England will raise interest rates at a policy meeting this month. The BoE said in November it would probably have to raise rates from an all-time low of 0.1% "over the coming months".

However, there are mixed feelings in the market because but policymakers have sounded increasingly divided on this prospect, especially after the new coronavirus variant was detected. Money markets were pricing in only 9 bps of rate hikes by the next meeting on Dec. 16 compared to 8 bps on Tuesday.

GBP/USD technical analysis

From a weekly perspective, the price is moving into a demand area between the low 1.30s and 1.3300. There is room for further declines within this bracket for the coming days as traders take on bullish commitments near the 1.32 figure and recent lows.

- USD/CAD is picking up amid a pullback in crude oil prices from earlier lows.

- The pair is now just under 1.2800, having previously been as low as the 1.2710s.

- USD/CAD seems to be moving higher within a bullish trend channel.

USD/CAD has shifted higher over the last few hours and now trades near 1.2800, up from prior session lows in the 1.2710s, in tandem with a pullback in crude oil prices from earlier session peaks. On the day, the pair is now trading 0.1% higher, having previously been as much as 0.5% lower though, for the most part, has stuck to this week’s intraday ranges.

USD/CAD’s price action on Wednesday suggests that, for the time being, the pair is likely to continue moving higher within the confines of a short-term bullish trendline. Meanwhile, the fact that the 21-day moving average recently crossed to the north of both the 50 and 200DMAs (with the 50 above the 200) suggests the bullish trend has some decent momentum. Should this technical trend persist, a test of resistance at 1.2900 seems likely.

As global oil markets and risk appetite remains on the ropes amid ongoing fears about the impact of the new, highly transmissible Omicron variant, the above technical trend makes sense. This is especially the case if a bad Omicron outbreak delay’s the Bank of Canada’s monetary policy normalisation plans.

Canadian data, meanwhile, was ignored on Wednesday. For reference, Markit Manufacturing PMI in November remained strong at 57.2 (slightly down from 57.7 in October) and Building Permits growth in October was stronger than expected at 1.3% MoM (versus forecasts for a 1.0% MoM drop). US data in the form of a strong November ISM Manufacturing PMI survey and a solid November ADP national employment change estimate got more attention but broadly failed to support the dollar, with the DXY broadly flat.

Fed Chair Jerome Powell’s hawkish tone this week on the economy means that strong ISM services PMI numbers on Friday and a good jobs report on Friday likely won’t have too much of an impact on the dollar’s broader fortunes. Of course, the November US jobs report will still be closely scrutinised, as will the November Canadian jobs report released at the same time.

- The USD recovers some of Tuesday’s losses, as the shared currency finished in the green, amid Fed’s Powell hawkish comments.

- EUR/USD found dynamic support at the 50-hour simple moving average (SMA).

- Fed’s Powell favors a faster taper and expects inflation to moderate by 2022.

During the New York session, the EUR/USD moderately falls, down some 0.20%, trading at 1.1320 at the time of writing. The market sentiment is upbeat, as portrayed by US equity indices rising between 1.06% and 1.50%. At press time, the Federal Reserve Chairman Jerome Powell testifies on the US Congress.

Summarizing some of Powell’s remarks, he said that “[Fed] don’t see wages moving up at a troubling rate that would spark inflation.”. He reiterated that it is time to move from the word transitory from inflation and expects that the abovementioned will moderate in 2022, despite not being sure of the forecast. Powell added that “It is appropriate we consider speeding taper at next meeting to wrap it up earlier.”

EUR/USD Price Forecast: Technical outlook.

As Fed’s Chair Powell testifies at the Congress in the last hour, the EUR/USD pair has remained subdued in a 40-pip range, between 1.1318-58 without swinging violently as on Tuesday’s session. At press time, the pair is testing the 50-hour SMA at 1.1318 for the third time in the day, coinciding with the daily central pivot point, indicating that robust support might deter USD bulls from pushing the pair downwards. In the outcome of a break of the latter, the first support would be the 100-hour SMA at 1.1289, followed by the 200-hour at 1.1267.

On the flip side, if the 50-hour SMA holds, the first resistance would be Wednesday’s cycle high at 1.1359. A break of that level would expose the November 30 swing high at 1.1382, followed by the R1 daily pivot at 1.1401.

-637739764385964751.png)

- WTI has pulled back from earlier highs above $69.00 to trade closer to $67.00, nearly back to flat.

- Prices are still about $2.50 above Tuesday’s lows, but more than $10.00 above last Thursday’s levels.

Oil prices have been pulling back from earlier highs in recent trade. WTI was above $69.00 earlier in the session but now trades in the $67.00s. But WTI is still up more than $2.50 from Tuesday’s sub-$65.00 lows, though amid the recent pullback, prices are only slightly north of neutral on the day.

The presence of the 200-day moving average at close to the $70.00 level seems to have encouraged some selling pressure. Oil prices continue to trade more than $10.00 below last Thursday’s pre-Omicron Covid-19 variant sell-off levels.

Omicron

Uncertainty regarding the new virus strain remains high, but commentary from most global public health officials and vaccine makers (excluding the Moderna CEO on Tuesday) is optimistic that existing vaccines will offer reasonable protection. WHO Chief Scientist Dr Soumya Swaminathan said on Wednesday that she thinks the existing Covid-19 vaccines will still protect against severe disease. Further data on the efficacy of vaccines versus Omicron, its transmissibility and the severity of symptoms will trickle in over the coming days and will remain the major driver of crude oil price action.

OPEC+

Elsewhere, there has been lots of newsflow pertaining to OPEC+; OPEC met on Wednesday ahead of a meeting of the full OPEC+ group on Thursday and, as expected, made no decision on output policy. That decision will come on Thursday and analysts expect the cartel to halt the recent run of output hikes which had been proceeding at a pace of 400K barrels per day per month. Reuters, citing an OPEC+ document, reported on Wednesday that the cartel sees a worsening oil surplus in Q1 2022, with supply outstripping demand by 3.8M barrels per day by March.

Note also smaller OPEC+ oil producers have struggled to keep up with recent output hikes over the last few months; a Reuters survey showed compliance to the output quotas hitting 120% in November. Even in the absence of further output hikes, then, OPEC+ output will still rise in the coming months. In other oil market related news, as signalled by the private weekly inventory data on Tuesday, Wednesday’s official EIA inventory report was bearish, with big buils seen in gasoline and distillate stocks.

US Deputy Energy Secretary David Turk said on Wednesday that the timing of the strategic crude oil stockpile release could be adjusted if prices drop, according to Reuters. He added that the US "metric of success" is affordable consumer fuel prices, not how quickly oil stockpiles can be released. China, other countries could also time their releases based on oil prices, he said, before adding that the Biden administration will continue to consider other tools to manage energy prices including a potential oil export ban.

The ISM Manufacturing Index showed an improvement in November, in line with market expectations. According to analysts at Wells Fargo, the report is the first sign of a thaw in the supply chain crisis. They warn that it is way too early to say that things are materially improving, but it is a welcome sign that 2021 could bring with it a return toward stability.

Key Quotes:

“We are not out of the woods by any means, but wait times for supplier deliveries and prices both fell by more than three points in November. The fact that this occurred alongside an improvement in orders and employment makes this ISM manufacturing release the best report card for the manufacturing sector that we have seen in months—a welcome indication that the choke points in the supply chain are clearing, if only incrementally.”

“Today’s ISM manufacturing index for November came in at 61.1 and lands in the center of a week defined by increased financial market volatility surrounding the Fed’s inclination to accelerate its tapering plans. Financial markets are struggling to determine whether the economy is actually overheating or if activity is already moderating somewhat, a task made more difficult by the latest variant of the virus that has set the timetable for the economy for nearly two years.”

“Some manufacturers are starting to find the help they need. The employment component rose to 53.3 in November. That is the highest reading since April and suggests that this Friday's jobs report could see a hiring boost in the manufacturing sector.”

- The Australian dollar retreated from a daily high at 0.7172 down to 0.7146 as Fed Chair Powell testifies on Congress.

- Positive market sentiment weighed on the greenback, as the US Dollar Index falls 0.09%.

- US ADP Employment Change rose to 534K more than the 525K foreseen by analysts, Nonfarm Payrolls eyed.

The AUD/USD cuts Tuesday’s losses during the New York session, up some 0.27%, trading at 0.7147 at the time of writing. Positive market sentiment in the financial markets favors risk-sensitive currencies like the AUD, the NZD, and the CAD. Also, US equity indices are rising, after on Tuesday, the Omicron COVID-19 variant woes and hawkish commentary of Fed’s Chairman Jerome Powell dampened the market mood.

In the overnight session, the AUD/USD pair recovered most of Tuesday’s losses, peaking at around 0.7172. However, as the European session got underway, it retested the 50-hour simple moving average around 0.7140 but bounced off that level, printing another leg-up, ahead of the testimony of Fed’s Chair Jerome Powell and Treasury Secretary Janet Yellen, before the Congress.

Summarizing some Fed’s Powell remarks, he said that wages have moved up “significantly.” He reiterated that inflation is connected to the pandemic, and elevated prices have been stubbornly persistent. Further noted that “we need to move on from the word transitory” and reinforced that the economy is very strong.

In the Asian session, the Australian economic docket featured the Real Gross Domestic Product for the Q3, quarterly and yearly figures. The quarterly reading shrank 1.9% less than the 2.7% contraction expected, whereas the annual number rose by 3.9%, higher than the 3.0% estimated. According to sources cited by the Guardian, “given the backdrop of lockdowns in NSW, Victoria and the ACT, this is an impressively strong performance.”

On the US economic front, the US ADP Employment Change for November showed that private payrolls rose by 534K, more than the 525K foreseen by analysts. Meanwhile, the US ISM Manufacturing PMI rose by increased to 61.1, a tenth higher than the 61.0 estimated. According to Timothy Fiore, Chair of the ISM survey committee, “the US manufacturing sector remains in a demand-driven, supply chain-constrained environment, with some indications of slight labor and supplier delivery improvement.”

That said, and the ongoing testify on Congress of Fed’s Chair Powell and US Treasury Secretary Yellen, amid market sentiment, would be the catalysts for AUD/USD traders. Any hawkish comments made by Powell would favor USD bulls, though it seems at press time that Tuesday’s appearance at the Senate, priced in any statements that he would make today.

- US dollar holds negative tone after economic data.

- Improvement in market sentiment supports the kiwi.

- NZD/USD holds far from the one-year low it hit on Tuesday.

The NZD/USD printed a fresh six-day high during the American session at 0.6867 and then pulled back as the US dollar attempted a bounce during Powell’s testimony. The pair dropped to 0.6840. It is modestly higher for the day, which could be seen as positive considering it bottomed on Tuesday, at 0.6772, the lowest in a year.

US data, Powell, USD

The greenback remained mostly unaffected by economic data and more recently rose marginally, during Fed Chair Powell comments. He reiterated the need to move on from the word “transitory” and warned that the risk of higher inflation has move up.

US yields are rising moderately on Wednesday offering only a small support to the dollar across the board. The 10-year stands at 1.48%. In Wall Street, stocks are rising sharply. The Dow Jones gains 1.45% and the Nasdaq by 1.75%.

The ADP report showed private payroll rose by 534K in November, in line with expectations. The ISM Manufacturing Index showed an acceleration in November from 60.8 to 61.1, also near market consensus. Later, the Fed will release the Beige Book and on Friday will be the turn of the NFP report.

Still bearish but…

The primary trend in NZD/USD is bearish. The area around 0.6770 is a key support: horizontal levels and the convergence of the 100 and 200-week moving average. If it remains above, the kiwi could stage a rebound. A weekly close below, should point to more losses over the medium term.

In the very short-term, a firm break above 0.6860 would be a positive development for the kiwi while under 0.6830, the intraday bias would change from positive/neutral to negative.

Technical levels

Fed Chair Jerome Powell is currently testifying before the House Financial Services Committee alongside US Treasury Secretary Janet Yellen.

Key takeaways:

"The taper need not be a disruptive event in markets; do not expect it will be."

"Highly accommodative policy we have, even after the taper, means it is appropriate we taper."

"It's appropriate that we taper and that we consider at next meeting to taper faster."

"It is appropriate we consider speeding taper at next meeting to wrap it up earlier."

Fed Chair Jerome Powell is currently testifying before the House Financial Services Committee alongside US Treasury Secretary Janet Yellen.

Key takeaways:

"Our forecast is for inflation to come down meaningfully in the second half of next year."

"I think it is likely inflation will come down then."

"But we can't act like we are sure that will happen with inflation next year."

"We are not at all sure of inflation forecast."

"We have to use our policy tools to tackle range of possible inflation outcomes."

"We are assuming that some form of build back better plan will pass."

Fed Chair Jerome Powell is currently testifying before the House Financial Services Committee alongside US Treasury Secretary Janet Yellen.

Key takeaways:

"We need to move on from the word transitory."

"The risks of higher inflation have moved up."

"Demand is very, very strong from fiscal policy and a quickly rebounding economy."

"The economy is very strong now."

"Price stability and job are in tension; we'll use tools to make sure high inflation does not become entrenched."

"Fed's two goals are in tension now, need to balance them."

Fed Chair Jerome Powell is currently testifying before the House Financial Services Committee alongside US Treasury Secretary Janet Yellen.

Key takeaways:

"Wages have moved up significantly."

"We don't see them moving up at a troubling rate that would spark inflation."

"Inflation we are seeing is still clearly connected to pandemic."

"But inflation has spread more broadly."

"Risk of persistent inflation has risen."

- Mexican peso rises for the third consecutive day against the US dollar.

- While under 21.30, the Mexican peso to remain strong.

- Technical indicators keep moving south, supporting MXN.

The USD/MXN is falling again on Wednesday but the Mexican peso is offering some signs of exhaustion. Still, while under 21.30, the pair could drop further to the 20.90 area, where the next strong support is seen.

A recovery back above 21.30 should give an indication that the bearish correction could have run its course, suggesting some consolidation between 21.30 and 21.65. On the contrary, a break under 20.90 should strengthen the outlook for the MXN, exposing the next critical support located at 20.50.

The primary trend still favor the upside in USD/MXN. The sharp rally of last week looks exaggerated so the pullback taking place at the moment seems normal so far. Price is hovering around the 50% Fibonacci retracement of the latest rally.

A rally back above 22.00 needs volatility across financial markets and a much stronger dollar. Before that level, resistance is seen at 21.60, 21.75 and 21.90.

USD/MXN daily chart

-637739694384806639.png)

Commercial crude oil inventories in the US fell by 0.910 million barrels in the week ending November 26, a weekly report published by the US Energy Information Administration (EIA) revealed on Wednesday. This was smaller than the expected draw of 1.273 million barrels.

Distillate stocks saw a larger than expected build of 2.16M barrels (forecasts were for a 0.462M barrel build). Gasoline stocks also saw a larger than expected build of 4.029M barrels (forecasts were for a 0.029M barrel build).

Market Reaction

WTI fell slightly in wake of the bearish inventory numbers, with WTI now trading just above $68.00 versus pre-data levels above $68.50.

- The USD/JPY slides for the fifth consecutive day, down more than 0.05%.

- An upbeat market sentiment weighed on the greenback as the DXY falls below the 96.00 handle.

- USD/JPY crucial support to be found at the November 9 low at 112.72.

The USD/JPY slumps for the fifth consecutive day, down 0.10%, trading at 112.84 during the New York session at the time of writing. Market sentiment is upbeat after a volatile Tuesday’s session, headed for the Omicron COVID-19 variant and Federal Reserve Chief Jerome Powell’s hawkish comments that dented investors mood.

During the overnight session, the USD/JPY peaked around 113.66, 20 pips above the 50-hour simple moving average (SMA) but, in the last couple of hours, as Wall Street opens, the USD/JPY has dropped beneath 113.00, on no apparent news, despite the upward move in the US 10-year Treasury yield, up to four basis points, sitting at 1.48%.

In the meantime, the US Dollar Index, which tracks the greenback’s value against six rivals, is down 0.19%, at 95.81, below the 96.00 figure reclaimed on Tuesday, as market sentiment dampened.

On Tuesday, hawkish commentary of Jerome Powell, which signaled that inflation is no longer “transitory” and favors a faster bond taper, spurred volatility around the markets. Short-term US bond yields heightened as the curve flattened the most since March of the last year. Also, on Wednesday at 1500 GMT, Powell will appear before the House of Representatives, finishing his appearance on the Congress. Any meaningful words that he says would be intensely scrutinized by investors.

According to ADP Research Institute, before Wall Street opened, the US ADP Employment Change for November showed that private payrolls rose by 534K, more than the 525K foreseen by analysts. According to Nela Richardson, ADP’s chief economist, “the labor market recovery continued to power through its challenges last month.” Further, she added that “service providers, which are more vulnerable to the pandemic, have dominated job gains this year. It’s too early to tell if the omicron variant could potentially slow the jobs recovery in coming months.”

That said, USD/JPY traders’ focus turns to Fed’s Chief Jerome Powell’s appearance on the Congress, and Friday’s Nonfarm Payrolls report.

USD/JPY Price Forecast: Technical outlook

The USD/JPY daily chart depicts that the pair has a near-term downward bias, though on Tuesday, despite breaking the 50-day moving average (DMA) to the downside, it bounced off the November 9 low at 112.72 reclaimed the 113.00 figure. Additionally, on November 10, a 130 pip upward move, which formed a large bullish engulfing candle pattern, boosts confidence for USD bulls and reinforces that 112.72 would be problematic support to overcome for USD bears.

Further, the 100 and the 200-DMA’s with an upslope, residing below the spot price, support the upward bias, which coupled with current fundamentals of the USD/JPY with the Fed looking for a faster taper would cap any downward moves.

However, in the outcome of moving lower, the first support would be the November 9 low at 1112.72. Breach of the latter would expose the September 30 low high at 112.07 previous resistance-turned-support, followed by the 100-DMA at 111.56.

On the flip side, the 50-DMA at 113.30 would be the first resistance. A break of the former would expose the November 10 high at 114.00, followed by the October 20 cycle high at 114.70.

- ISM Manufacturing PMI rose to 61.1 in November from 60.8 in October.

- There were "some indications of slight labor and supplier delivery improvement".

According to a survey compiled by the Institute of Supply Management, US Manufacturing PMI rose to 61.1 in November from 60.8 in October. That was slightly above the expected reading of 61.0 and above October's 60.8.

In terms of the subindices; the employment index rose to 53.3 from 52.0, the new orders index rose to 61.5 from 59.8 and the prices paid index fell more than expected to 82.4 from 85.7, versus an expected decline to 85.5.

According to Timothy Fiore, Chair of the ISM survey committee, “the US manufacturing sector remains in a demand-driven, supply chain-constrained environment, with some indications of slight labor and supplier delivery improvement." "Manufacturing performed well for the 18th straight month", he continued, "with demand and consumption registering month-over-month growth, in spite of continuing obstacles". Finally, "meeting demand remains a challenge, due to hiring difficulties and a clear cycle of labor turnover at all tiers" he added.

Market Reaction

There wasn't much of a reaction to the latest US PMI data, which contained promising signs of an easing of supply chain gridlock.

EUR/USD fell sharply to mid-1.1200s late Tuesday. The pair has climbed back above 1.1300 but economists at Nomura believe it is just a matter of time for a move towards 1.10.

A global slowdown typically benefits USD

"We find more compelling macro and flow reasons for a move towards 1.10 to be on the horizon, it’s just a matter of time."

"Rate spreads suggest EUR/USD should be much lower (sub 1.10) and FX is still playing catch up.”

“A global slowdown typically benefits USD. German new orders are in decline and with China slowing too it’s difficult to see why European growth should outperform.”

“In addition, there is the added uncertainty over rising covid cases, a new variant and restrictions.”

The final estimate of the IHS Markit Manufacturing PMI edged lower to 58.3 in November from the flash estimate of 59.1. That left it slightly below October's 58.4 reading.

According to Chris Williamson, Chief Business Economist at IHS Markit, “broad swathes of US manufacturing remain hamstrung by supply chain bottlenecks and difficulties filling staff vacancies". "Although November brought some signs of supply chain problems easing slightly to the lowest recorded for six months," he added, "widespread shortages of inputs meant production growth was again severely constrained to the extent that the survey is so far consistent with manufacturing acting as a drag on the economy during the fourth quarter."

Market Reaction

The dollar has not reacted to the latest Markit PMI numbers, but may be choppy after ISM releases their Manufacturing PMI survey at 1500GMT.

According to IHS Markit, Canadian Manufacturing PMI fell slightly to 57.2 in November from 57.7 in October. That was slightly more than the expected decline to 57.4.

Commenting on the latest survey results, Shreeya Patel, Economist at IHS Markit, said: "The penultimate month of 2021 continued to indicate strong growth in Canada's manufacturing sector. Overall, Canada’s manufacturing sector performed well in November. Growth has certainly been hindered by transportation bottlenecks, material scarcity and intense cost pressures, but firms remain confident that such issues will subside in 2022."

Market Reaction

The loonie has not seen any reaction to the latest PMI numbers, which showed the manufacturing sector remaining in robust health.

USD/CAD once again failed to close above 1.28 during Tuesday’s session after two separate moves above the figure. Economists at Scotiabank believe the pair could decline toward the 1.26 level.

Initial support awaits at 1.2730/20

“While the broader technical trend suggests further USD gains, a failure to break past the 1.28 level points to a possible reversal toward the 1.26 mark, near the 100-day MA of 1.2574.”

“From a shorter-run perspective, support is relatively firm in the 1.2720/30 zone that has marked the bottom for the week, to be followed by the figure.”

“After the 1.28 area, Tuesday’s peak of 1.2837 marks resistance followed by the mid-figure zone.”

GBP/USD is marginally stronger. The pair is currently trading in the positive territory around 1.3330. However, economists at Scotiabank expect cable to retest the 1.32 level.

GBP/USD faces resistance at 1.3360/70

“Cable staged a solid recovery from yesterday’s test of 1.32 (a new low since December) but still closed just below the 1.33 figure. Setting aside yesterday’s sharp drop, the GBP’s decline has lost steam near the figure as it neared oversold but continued downward pressure points to a firm break of the level to another (more sustained) test of 1.32; 1.3150 and 1.3135 follow as support.”

“The GBP/USD faces resistance at 1.3360/70 followed by 1.3390/400.”

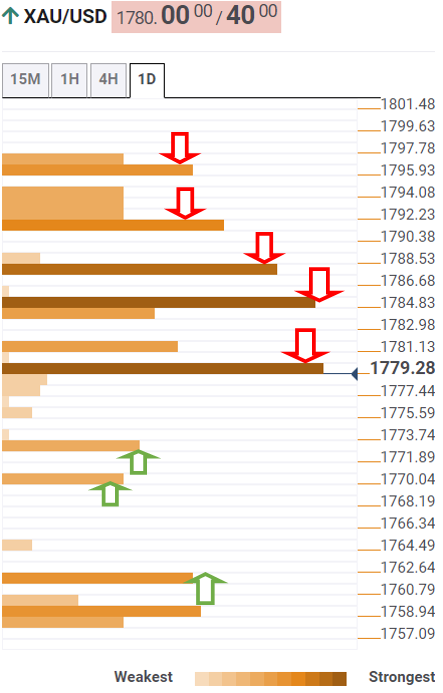

- Spot gold has recovered back to close to its 50 and 200DMAs after a brief dip to $1770 on Tuesday.

- Prices were weighed on Tuesday by Powell’s hawkishness and traders will be watching day 2 of his testimony on Wednesday.

Spot gold (XAU/USD) prices have recovered off of Tuesday lows on Wednesday and currently trade with gains of about 0.75% on the session and just under $1790. That means spot prices are currently trading just to the south of the 50 and 200-day moving averages, both of which reside close to $1792, and are trading close to the middle of recent $1770-$1810ish ranges.

Recent Price Action

To recap recent price action, spot gold prices on Tuesday reversed from as high $1810 to print session lows at $1770, in line with last week’s lows. Hawkish commentary from Fed Chair Jerome Powell, who essentially signaled intent to press on with monetary normalisation plans despite Omicron-related economic risks, spurred the downside at the time. Gold traders look to further comments from Fed Chair Jerome Powell at day two of his testimony before Congress, which will begin from 1500GMT after the release of the November ISM Manufacturing PMI survey. The survey is expected to point to continued underlying strength in the US manufacturing sector and economy, though also to high inflationary pressures and the impact of shortages.

Gold prices did not see any reaction to the release of a slightly stronger than expected ADP national employment estimate for Friday, which ought to solidify expectations that the official labour market survey will show strong employment growth in November. Markets suspect that this week’s heavy slate of US data should validate Powell’s bullish tone on the state of the economy and should support the argument for a quickening of the Fed’s QE taper plans.

Omicron uncertainty

High levels of uncertainty about how the Omicron Covid-19 variant will impact the global economy is keeping spot gold prices subdued close to its 50 and 200DMAs for now. But should the new variant turn out to be “super mild” as early (anecdotal doctor) reports have suggested, markets could become very risk on once more and Fed tightening expectations for 2022 could come surging back. This could be a bearish catalyst for gold and send it below recent lows in the $1770 area. In a bearish scenario, the $1760 level would be the next in sight and a break below that would open the door to a run lower to $1720, the September lows.

FOMC Chairman Jerome Powell will be testifying before the House Financial Services Committee alongside US Treasury Secretary Janet Yellen on Wednesday, December 1, at 1500 GMT.

The hearing is entitled "Oversight of the Treasury Department's and Federal Reserve's Pandemic Response."

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Gold still has considerable upside left in the early part of 2022, in the view of strategists at TD Securities. Jerome Powell is no hawk and will keep rates low for longer to achieve full employment, with economic data driving decisions.

XAU/USD to jump into the $1,875/oz territory in the first half of 2022

If data is lackluster, which looks likely due to less liquidity and the waning positive fiscal stimulus impact, Fed Chair Powell most likely will continue signaling a dovish policy tilt for much of 2022. This is a positive for gold.”

“Post-COVID normalization may well increase the labor participation rate over time. The hope is that the resulting higher potential growth, and the lower non-accelerating inflation rate of unemployment, may all leave the US central bank comfortable keeping the economy running hot for longer. The best case for gold is high, but decelerating inflation.”

“Political risks associated with the pending US mid-term elections, US fiscal drag, fairly steadfast central bank gold purchases, and a significantly slower pace of US and global recovery, are additional factors which may see investors rekindle their interest in gold. These factors should help lift gold into the $1,875/oz territory in the first half of 2022, as per our projections.”

- EUR/USD trades within a volatile session around 1.1340.

- Next on the upside targets the weekly high at 1.1464.

EUR/USD trims losses to the 1.1300 neighbourhood and now manages to return to the 1.1340 region on Wednesday.

In case the recovery picks up further impulse, then the pair is forecast to revisit the weekly high at 1.1464 (November 15). The surpass of this area is seen targeting the round level at 1.1500 ahead of the 55-day SMA, today at 1.1535.

The probability of further losses remains unchanged as long as EUR/USD trades below the 2-month resistance line (off September’s peak) near 1.1560. In the longer run, the offered stance in spot is expected to persist while below the 200-day SMA at 1.1823.

EUR/USD daily chart

- DXY gives away initial gains and now struggles around 95.90.

- There is still scope for another move to the mid-95.00s.

DXY’s bullish attempt seems to have met initial resistance in the 96.10/15 band midweek.

The inability of the dollar to regain upside traction on a sustainable fashion in the very near term could spark another bout of weakness and the subsequent visit to the area of recent lows around 95.50.

In the meantime, while above the 2-month support line (off September’s low) near 94.10, extra gains in DXY remain well on the table. In addition, the broader constructive stance remains underpinned by the 200-day SMA at 92.50.

DXY daily chart

EUR/JPY has again held key channel support from early June, now seen at 127.45. With daily RSI momentum holding a bullish divergence, analysts at Credit Suisse look for a base to be established for a recovery back to 129.54/61.

Key support remains at 127.49/45

“Resistance moves to 128.96 initially, above which should see resistance next at the 13-day exponential average at 129.18. A close above here is needed to add weight to a basing story with resistance seen next at the late November reaction high at 129.54/61, with the 38.2% retracement of the October/November fall just above at 129.78.”

“Support moves to 128.36 initially, with a break below 128.19 needed to warn of a fresh move back into the 127.93/45 zone, but with a fresh floor expected here. A closing break below here though would mark a large and important top to mark a more significant change of trend lower.”

US ISM Manufacturing PMI overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result, also known as the ISM Manufacturing PMI at 15:00 GMT this Wednesday. The index is anticipated to edge higher to 61 in November from 60.8 in the previous month. Given that the Fed looks more at the labour market and inflation than growth, investors will keep a close eye on the Employment and Prices Paid sub-component.

How could it affect EUR/USD?

Ahead of the key release, the US dollar was seen consolidating the previous day's volatile move and failed to provide any meaningful impetus to the EUR/USD pair. That said, a strong rally in the US Treasury bond yields, bolstered by rising bets for a more aggressive policy tightening by the Fed, acted as a tailwind for the greenback. A stronger headline print will reaffirm hawkish Fed expectations and help revive the USD demand. Conversely, a weaker reading might do little to derail the Fed's expected policy path. This, in turn, suggests that the path of least resistance for the greenback is to the upside and down for the EUR/USD pair.

Key Notes

• US Manufacturing Purchasing Managers Index November Preview: Businesses are watching the consumer

• EUR/USD Forecast: Euro needs to claim 1.1360 to extend recovery

• EUR/USD: The possibility of a break lower to 1.10 during 2022 has increased – Rabobank

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

- USD/CAD witnessed some selling on Wednesday and dropped back closer to the weekly low.

- Rallying oil prices underpinned the loonie and exerted pressure amid a subdued USD demand.

- Rising Fed rate hike bets acted as a tailwind for the USD and helped limit losses for the major.

The USD/CAD pair remained on the defensive through the early European session, albeit has managed to recover a few pips from the daily swing low, around the 1.2725 region. The pair held steady around mid-1.2700s and had a rather muted reaction to the US ADP report.

Crude oil prices rallied nearly 4% on Wednesday and recovered a major part of the previous day's downfall to the lowest level since August 23. This, in turn, boosted demand for the commodity-linked loonie and prompted fresh selling around the USD/CAD pair amid a subdued US dollar price action.

A sharp turnaround in the global risk sentiment turned out to be a key factor that acted as a headwind for the safe-haven greenback and further contributed to the selling bias surrounding the USD/CAD pair. Investors now seem convinced that the latest COVID-19 variant would not derail the economic recovery.

Further supporting the upbeat market mood were comments by the World Health Organization (WHO) official, saying that some of the early indications are that most Omicron cases are mild. That said, increasing bets for a more aggressive policy tightening by the Fed helped limit any meaningful USD slide.

In fact, the money markets indicate the possibility of at least a 50 bps rate hike by the end of 2022. This was reinforced by a strong rally in the US Treasury bond yields, which further extended some support to the USD and assisted the USD/CAD pair to attract some buying ahead of the weekly low.

On the economic data front, the Automatic Data Processing (ADP) Research Institute reported that the US private-sector employers added 534K jobs in November. This marked a modest slowdown from the previous month's downward revised reading of 570K, though was better than the 525K anticipated.

The data failed to provide any impetus as the focus remains on Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen's joint testimony before the House Financial Services Committee. Apart from this, the US ISM Manufacturing PMI could influence the greenback and the USD/CAD pair.

Technical levels to watch

Although economists at Rabobank think too long USD may curtail further gains for the greenback, they highlight the possibility of the EUR/USD pair breaking below the 1.10 through 2022.

Long USD position may inhibit further gains for the greenback in the coming month or so